Cloud Communication Platform Market by Solution and Service (UCC/UCaaS, WebRTC, VoIP, IVR, API, Reporting and Analytics, and Training and Consulting, Support and Maintenance Service, and Managed Service) - Global Forecast to 2021

[164 Pages Report] The cloud communication platform market is estimated to grow from USD 1.36 billion by 2016 to USD 4.45 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 26.8% from 2016 to 2021. 2014 has been considered as the historical year and 2015 as the base year for performing the market estimation and forecasting. The tremendous growth of Business Process Outsourcing (BPO) sectors has increased the demand for cloud communication platform solutions and services. Along with this, the seismic shift in communication market, the increasing demand for BYOD, and the cost effectiveness of cloud-based communication platform solutions have contributed significantly towards the growth of the cloud communication platform market. The organizations are adopting advanced cloud-based communication solutions to eliminate the pitfalls of traditional PBX (Private Branch Exchange) systems. Nowadays, organizations are experiencing a significant need for the adoption of cloud communication platform solutions to keep themselves updated with the technological advancements in the communication market. The cloud communication platform market is segmented into various application types across regions such as North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market has also been segmented on the basis of verticals into Banking, Financial Services, and Insurance (BFSI), healthcare, telecommunication and IT-Enabled Services (ITES), government, retail, travel and hospitality, education, manufacturing, and other verticals.

Market Dynamics

Drivers

- Increased mobility and growing trend of bring your own device

- Increased savings, and workforce productivity

Restraints

- Lack of security

- High dependency on Internet

Opportunities

- Lower capital and operating expenditure

- High adoption rate in small and medium enterprises

Challenges

- Stiff Competition among vendors

- Redesigning the network for cloud involves cost

Increased savings and workforce productivity drives the cloud communication platform market

Nowadays, most of the organizations are offering flexible working conditions such as work from home for their employees to increase productivity. Cloud collaboration has enabled the enterprises to save significant costs and ensure updated communication with the employees working in remote locations. As multiple users can edit, comment, share, upload, and perform numerous tasks at the same time, the enterprises can save significant amount of time and costs which was incurred in the on-premises model. These solutions enable employees to reply via telephony, video conferencing, instant messaging, and others even while travelling, further improving the productivity. As the communication and collaboration has become easier among employees, the enterprises have become more agile, productive, and innovative. Thus, productive workforce generates positive results and help in quick business decision making. Factor such as increased productivity and reduced costs has enabled the enterprises to adopt the cloud collaboration solutions for better outcome. This has provided the service providers to focus on the cloud-based communication and collaboration solutions and drive this market in long-run.

The following are the major objectives of the study.

- To define and segment the global cloud collaboration market

- To describe and forecast the global cloud collaboration market on the basis of solutions, services, deployment models, organization size, verticals, and regions

- To forecast the market size of the five main regional segments, namely North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA),and Latin America

- To strategically analyze sub-segments with respect to individual growth trends, future prospects, and contribution to the total market

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and to provide details of competitive landscape for major players

- To strategically profile key players and comprehensively analyze their core competencies1 and positioning

- To track and analyze competitive developments such as Mergers & Acquisitions (M&A), new product developments, and partnerships & collaborations in the market

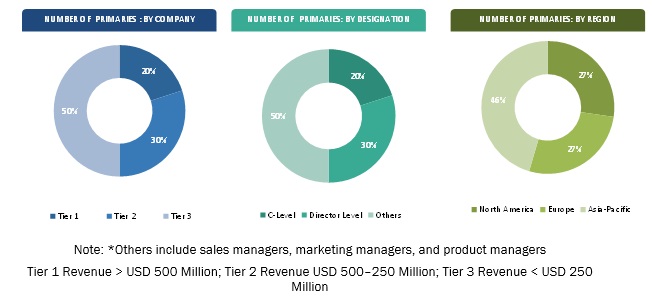

The research methodology used to estimate and forecast the cloud communication platform market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud communication platform market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud communication platform market ecosystem comprises cloud communication platform solution and service vendors, such as 8x8, Inc.; Avaya, Inc.; Cisco Systems, Inc.; Twilio, Inc.; NetFortris, Inc.; West IP Communications, Inc.; Telestax, Inc., Plivo, Inc.; CallFire, Inc.; and Nexmo, Inc. A few other major vendors such as IBM Corporation, Alcatel-Lucent, Mitel Networks Corporation, and Genesys Telecommunication offer comparatively narrower, yet locally-effective solutions and distribution networks in the cloud communication platform market ecosystem. These vendors offer strategically innovated cloud communication platform solutions and services to the end users in various industrial verticals.

Major Market Developments

- In May 2016, Intralinks announced new integration and security capabilities to enhance its content collaboration network, which would solve three major challenges for its customers: global regulatory compliance, data privacy, and acceleration of business beyond geographical boundaries

- In April 2016, Mitel announced the availability of Mitel MiTeam, a mobile-first team and social collaboration application with real-time integration. It provides a highly collaborative workspace for team-based communication, meetings, content collaboration, and project management.

- In December 2015, Salesforce and Box entered into a partnership to introduce Salesforce Files Connect for Box. It is a powerful solution that would help businesses become more collaborative, productive, and connected. This partnership would allow box users to seamlessly search, browse, share, and collaborate on Box files via any device.

Stake Holders

- Cloud solution providers

- Government agencies

- System integrators

- Investors and venture capitalists

- Cloud service providers

- Internet application developers and service providers

- Teleconferencing hardware and software suppliers and service providers

- Telecommunication service providers

Scope of the Report

The cloud communication platform market report is broadly segmented into the following solutions, services, organization size, verticals, and regions.

Global Cloud Communication Platform Market, by Solution

- Unified Communication and Collaboration (UCC/UCaaS)

- Web Real-Time Communication (WebRTC)

- Interactive Voice Response (IVR)

- Voice over Internet Protocol (VoIP)

- Application Programming Interface (API)

- Reporting and Analytics

Global Cloud Communication Platform Market, by Service

- Training and consulting

- Support and maintenance

- Managed services

Global Cloud Communication Platform Market, by Organization Size

- Large enterprises

- Small and Medium Enterprises (SME)

Global Cloud Communication Platform Market, by Vertical

- BFSI

- Healthcare

- Telecommunication and ITES

- Government

- Retail

- Travel and hospitality

- Education

- Manufacturing

- Others

Global Cloud Communication Platform Market, by Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are new application areas which the cloud communication platform companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the rest of Asia-Pacific cloud communication platform market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Latin American cloud communication market into Brazil, Argentina, and the rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The tremendous growth of the Business Process Outsourcing (BPO) sector and the significant requirements of business organizations for greater flexibility/scalability have increased the adoption rate of cloud communication platform solutions and services, thereby providing immense opportunities to the vendors. These vendors are providing advanced and scalable cloud communication platform solutions and services to various organizations across the globe, thereby leveraging the benefits of cloud-based communication. The cloud communication platform market is estimated to reach USD 4.45 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 26.8% from 2016 to 2021. Factors such as the seismic shift in communication market, cost effectiveness of cloud communication platform solutions, growing inclination of organizations to provide flexible work options, increasing demand for Bring Your Own Device (BYOD) trend, and growing demand for more customer satisfied solutions and services are driving the growth of the cloud communication platform market.

The global cloud communication platform market report quantifies the market for solutions, services, organization size, verticals, and regions. The reporting and analytics solution is expected to grow at the highest CAGR during the forecast period, as it is helping the organizations to get real-time statistics and Key Performance Indicators (KPI) to monitor, manage, and accelerate business communications. The Unified Communication and Collaboration (UCC/UCaaS) solution is expected to have the largest market size because this solution enables seamless and unparalleled communication among the employees irrespective of their location or device, further eliminating the communications complexities. In terms of services, managed services show great opportunities and the segment is projected to grow at the highest CAGR by 2021.

The research report is based on extensive research on and around the cloud communication market and the related submarkets within the ecosystem. The cloud communication market by training and consulting service is estimated to have the largest market size as this service educates the enterprises with respect to strategic transformation, rapid business assessment, solution assessment, investment assurance, and executive workshop.

The cloud communication platform market is thriving, and in the next five years it will present a huge opportunity for cloud communication platform vendors. The report provides detailed insights into the global cloud communication platform market, which is segmented by solution, service, organization size, vertical, and region. The market has been segmented into diverse industry verticals, including BFSI, healthcare, telecommunication and Information Technology-Enabled Services (ITES), government, retail, travel and hospitality, education, manufacturing, and others.

Cloud communication applications in BFSI, Consumer Goods and Retail, Education to drive the growth of cloud communication platform market

BFSI

The cloud collaboration solutions allow investment banks, private equity, venture capital, asset managers, and insurance firms to securely exchange business information with the partners, clients, and customers. In addition, the cloud-based collaborative solutions provide workflow and content governance processes to power banks, insurance firms, and investment and advisory firms. The financial sector is undergoing huge transformation and it has become the need of an hour to be more agile, innovative, collaborative, and customer centric. The cloud collaboration vendors such as Jive Software, Box, HighQ, and others enable the BFSI industry to deliver high end customer experience, reduce operating costs, and meet the regulatory and compliance requirements. Cloud collaboration can improve customer service offerings for this sector via enhanced online customer care and improved customer self-service.

Consumer Goods and Retail

The consumer goods and retail industry are facing the challenge of managing fluctuating and seasonal demand for various products. The retailers are looking for ways to reduce cost through inventory and supply chain management optimization. The cloud collaboration solution has enabled this industry to achieve key initiatives such as customer retention, customer relationship management, brand awareness, and brand loyalty. The scalability feature of the cloud collaboration solution assists the retailers to optimize their supply chain cost by enabling cost-effective cloud collaboration solution within the store, with the wholesalers, and with the manufacturers. Furthermore, the retailers can provide real-time responses by using enterprise social collaboration solution to build customer loyalty and brand perception. The cloud collaboration solution also supports retailers in providing personalized shopping experiences to their users via instant messaging, mobility, customer self-service, and various other channels. The major vendors catering this industry vertical comprises Box, Cisco, IBM, and others.

Education

The educational institutions are witnessing the need to facilitate communication and collaboration among students, researchers, teachers, professors, and others to make learning easy from any remote area. Online and distance learning, e-textbooks, video, and social media are the latest concepts in the education industry. The cloud collaboration solutions provide a variety of tools such as instant messaging, web conferencing, telepresence, virtual classrooms, and others to help manage distance learning programs. The students can participate in multiple projects with the help of cloud collaboration solutions irrespective of location. The cloud-based collaboration solutions also enable the educational institutions in reducing the capital and operating expenditure thereby using the capital for some other useful requirements. The key players offering cloud collaboration solutions and services to this vertical includes Cisco, Box, HyperOffice, and others.

Government and Public Sector

The cloud collaboration solutions enable team collaboration among central governments, federal governments, local authorities, and other public bodies. These solutions offer numerous benefits such as streamlining communications, reducing costs, conducting investigations and inspections, security, monitoring and controlling capabilities. The cloud-based communication and collaboration solutions allow the public sector organization to save infrastructure cost and provide flexibility to the employees, teams, partners, and vendors on any device irrespective of location. Government organizations have to ensure that they provide all the services to the citizens as early as possible, and it has been made possible due to the availability of cloud collaboration solutions. The major companies catering to this industry vertical comprises HyperOffice, Jive Software, Box, and others.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for cloud communication platform?

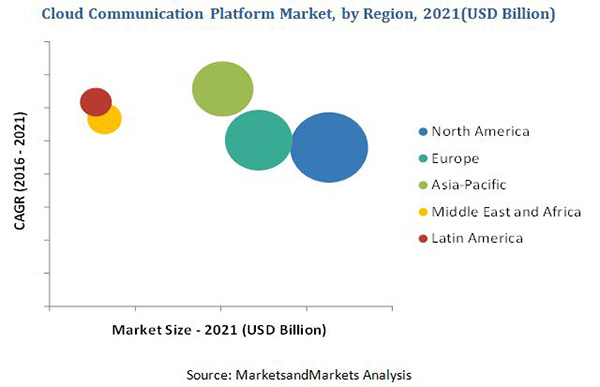

The report covers all the major aspects of the cloud communication platform market and provides an in-depth analysis across the regions of North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is expected to hold the largest market share, whereas the APAC region is projected to have great opportunities in this market, growing at the highest CAGR by 2021. The primary reason for the high growth rate in APAC region is the tremendous growth of the BPO sector, which in turn is elevating the demand for UCC/UCaaS solutions.

The huge investment associated with the initial setup and the security and privacy concerns are a few of the restraints acting as a hindrance for the growth of the cloud communication platform market. The primary vendors in the cloud communication platform market are 8x8, Inc.; Avaya, Inc.; Cisco Systems, Inc.; Twilio, Inc.; NetFortris; West IP Communication; Telestax; Plivo; CallFire; and Nexmo. This research report includes the strategic alliances and lucrative acquisitions between the major players in the ecosystem. Technological developments include inventing new robust and sophisticated solutions which can leverage the company’s Return-on-Investment (ROI) scenario.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in Cloud Communication Platform Market

4.2 Market CAGR of Top Three Soltuions and Verticals

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Service

5.2.3 By Organization Size

5.2.4 By Vertical

5.2.5 By Region

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Seismic Shifts in Communication Market

5.4.1.2 Cost Effectiveness of Cloud Communication Platform Solutions

5.4.1.3 Growing Inclination of Organizations to Provide Flexible Work Options

5.4.1.4 Increasing Demand for Byod

5.4.1.5 Increasing Demand for Customer-Centric Solutions and Services

5.4.2 Restraints

5.4.2.1 The Huge Investment Associated With Initial Setup

5.4.2.2 Security and Privacy Concerns

5.4.3 Opportunities

5.4.3.1 The Tremendous Growth of Bpo Sector and Its Inclination Towards Cloud-Based Solutions

5.4.3.2 The Significant Requirements of Business Organizations for Greater Flexibility/Scalability

5.4.4 Challenges

5.4.4.1 The Need for Technology to Keep Pace With Changing Customer Behaviour

5.4.4.2 Challenge in Developing the Required Skill Set Among the Workforce

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Strategic Benchmarking

7 Cloud Communication Platform Market Analysis, By Solution (Page No. - 49)

7.1 Introduction

7.2 Unified Communication and Collaboration (UCC/UCaaS)

7.3 Web Real-Time Communication (WebRTC)

7.4 Interactive Voice Response (IVR)

7.5 Voice Over Internet Protocol (VoIP)

7.6 Application Programming Interface (API)

7.7 Reporting and Analytics

8 Market Analysis, By Service (Page No. - 59)

8.1 Introduction

8.2 Training and Consulting

8.3 Support and Maintenance

8.4 Managed Service

9 Market Analysis, By Organization Size (Page No. - 66)

9.1 Introduction

9.2 Small- and Medium-Sized Enterprises

9.3 Large Enterprises

10 Cloud Communication Platform Market Analysis, By Vertical (Page No. - 71)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Healthcare

10.4 Telecommunication and Ites

10.5 Government

10.6 Retail

10.7 Travel and Hospitality

10.8 Education

10.9 Manufacturing

10.10 Others

11 Geographic Analysis (Page No. - 94)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 112)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 Partnerships, Collaborations, and Agreements

12.2.3 Acquisitions

12.2.4 Venture Funding

13 Company Profiles (Page No. - 125)

13.1 Introduction

13.2 8x8, Inc.

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 MnM Views

13.2.4.1 Key Strategies

13.2.4.2 SWOT Analysis

13.3 Avaya, Inc.

13.3.1 Business Overview

13.3.2 Solutions Offered

13.3.3 Recent Developments

13.3.4 MnM Views

13.3.4.1 Key Strategies

13.3.4.2 SWOT Analysis

13.4 Cisco System, Inc. (Cisco)

13.4.1 Business Overview

13.4.2 Products and Services Offered

13.4.3 Recent Developments

13.4.4 MnM Views

13.4.4.1 Key Strategies

13.4.4.2 SWOT Analysis

13.5 Twilio, Inc.

13.5.1 Business Overview

13.5.2 Solutions Offerd

13.5.3 Recent Developments

13.5.4 MnM Views

13.5.4.1 Key Strategies

13.6 Netfortris, Inc. (Netfortris)

13.6.1 Business Overview

13.6.2 Solutions Offerd

13.6.3 Recent Developments

13.6.4 MnM Views

13.6.4.1 Key Strategies

13.7 West IP Communications, Inc.

13.7.1 Business Overview

13.7.2 Solutions Offered

13.7.3 Recent Developments

13.8 Telestax, Inc.

13.8.1 Business Overview

13.8.2 Products, Solutions, and Services Offered

13.8.3 Recent Developments

13.9 Plivo, Inc.

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.10 Callfire

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.11 Nexmo, Inc.

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

13.12 Other Major Vendors

13.12.1 IBM Corporation

13.12.2 Alcatel-Lucent

13.12.3 Mitel Networks Corporation (Mitel)

13.12.4 Genesys Telecommunications Laboratories, Inc.

13.12.5 Intelepeer

14 Appendix (Page No. - 152)

14.1 Key Insights

14.2 Recent Developments

14.3 Discussion Guide

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (69 Tables)

Table 1 Cloud Communication Platform Market: Assumptions

Table 2 Market Size and Growth Rate, 2014–2021 (USD Million, Y-O-Y %)

Table 3 Market Size, By Solution, 2014–2021 (USD Million)

Table 4 UCC/UCaaS: Market Size, By Vertical, 2014–2021 (USD Million)

Table 5 WebRTC: Market Size, By Vertical, 2014–2021 (USD Million)

Table 6 IVR: Market Size, By Vertical, 2014–2021 (USD Million)

Table 7 VoIP: Market Size, By Vertical, 2014–2021 (USD Million)

Table 8 API: Market Size, By Vertical, 2014–2021 (USD Million)

Table 9 Reporting and Analytics: Market Size, By Vertical, 2014-2021 (USD Million)

Table 10 Cloud Communication Platform Market Size, By Service, 2014-2021 (USD Million)

Table 11 Training and Consulting: Market Size, By Vertical, 2014-2021 (USD Million)

Table 12 Support and Maintenance: Market Size, By Vertical, 2014-2021 (USD Million)

Table 13 Managed Service: Market Size, By Vertical, 2014-2021 (USD Million)

Table 14 Market Size, By Organization Size 2014-2021 (USD Million)

Table 15 SMES: Market Size, By Region, 2014-2021 (USD Million)

Table 16 Large Enterprises: Market Size, By Region, 2014-2021 (USD Million)

Table 17 Cloud Communication Platform Market Size, By Vertical, 2014-2021 (USD Million)

Table 18 BFSI: Market Size, By Region, 2014-2021 (USD Million)

Table 19 BFSI: Market Size, By Solution, 2014-2021 (USD Million)

Table 20 BFSI: Market Size, By Service, 2014-2021 (USD Million)

Table 21 Healthcare: Market Size, By Region, 2014-2021 (USD Million)

Table 22 Healthcare: Market Size, By Solution, 2014-2021 (USD Million)

Table 23 Healthcare: Market Size, By Service, 2014-2021 (USD Million)

Table 24 Telecommunication and ITES: Cloud Communication Platform Market Size, By Region, 2014-2021 (USD Million)

Table 25 Telecommunication and ITES: Market Size, By Solution, 2014-2021 (USD Million)

Table 26 Telecommunication and ITES: Market Size, By Service, 2014-2021 (USD Million)

Table 27 Government: Market Size, By Region, 2014-2021 (USD Million)

Table 28 Government: Market Size, By Solution, 2014-2021 (USD Million)

Table 29 Government: Market Size, By Service, 2014-2021 (USD Million)

Table 30 Retail: Market Size, By Region, 2014-2021 (USD Million)

Table 31 Retail: Market Size, By Solution, 2014-2021 (USD Million)

Table 32 Retail: Market Size, By Service, 2014-2021 (USD Million)

Table 33 Travel and Hospitality: Market Size, By Region, 2014-2021 (USD Million)

Table 34 Travel and Hospitality: Market Size, By Solution, 2014-2021 (USD Million)

Table 35 Travel and Hospitality: Market Size, By Service, 2014-2021 (USD Million)

Table 36 Education: Cloud Communication Platform Market Size, By Region, 2014-2021 (USD Million)

Table 37 Education: Market Size, By Solution, 2014-2021 (USD Million)

Table 38 Education: Market Size, By Service, 2014-2021 (USD Million)

Table 39 Manufacturing: Market Size, By Region, 2014-2021 (USD Million)

Table 40 Manufacturing: Market Size, By Solution, 2014-2021 (USD Million)

Table 41 Manufacturing: Market Size, By Service, 2014-2021 (USD Million)

Table 42 Others: Market Size, By Region, 2014-2021 (USD Million)

Table 43 Others: Market Size, By Solution, 2014-2021 (USD Million)

Table 44 Others: Market Size, By Service, 2014-2021 (USD Million)

Table 45 Cloud Communication Platform Market Size, By Region, 2014-2021 (USD Million)

Table 46 North America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 47 North America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 48 North America: Market Size, By Solution, 2014-2021 (USD Million)

Table 49 North America: Market Size, By Service, 2014-2021 (USD Million)

Table 50 Europe: Market Size, By Vertical, 2014-2021 (USD Million)

Table 51 Europe: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 52 Europe: Market Size, By Solution, 2014-2021 (USD Million)

Table 53 Europe: Market Size, By Service, 2014-2021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Vertical, 2014-2021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Solution, 2014-2021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Service, 2014-2021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Vertical, 2014-2021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Solution, 2014-2021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Service, 2014-2021 (USD Million)

Table 62 Latin America: Cloud Communication Platform Market Size, By Vertical, 2014-2021 (USD Million)

Table 63 Latin America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 64 Latin America: Market Size, By Solution, 2014-2021 (USD Million)

Table 65 Latin America: Market Size, By Service, 2014-2021 (USD Million)

Table 66 New Product Launches, 2012-2015 (USD Million)

Table 67 Partnerships, Collaborations and Agreements, 2012-2016 (USD Million)

Table 68 Acquistions, 2013-2015 (USD Million)

Table 69 Venture Capital Funding, 2012–2015

List of Figures (48 Figures)

Figure 1 Cloud Communication Platform Market: Market Segmentation

Figure 2 Market: Years Considered

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Na Holds the Highest Market Share for 2015

Figure 9 Top Three Segments for Cloud Communication Market 2016-2021

Figure 10 Growth Trend of Cloud Communication Platform Market (2016–2021)

Figure 11 Geographic Lifecycle Analysis (2016): Apac Market is Increasing With the Highest Growth Rate

Figure 12 Market Investment Scenario: Apac Rise as the Best Opportunity Market for Investment in the Next Five Years

Figure 13 Market, By Solutions

Figure 14 Market, By Services

Figure 15 Market, By Organization Size

Figure 16 Market, By Verticals

Figure 17 Market , By Region

Figure 18 The Evolution of Cloud Communication Platform Market

Figure 19 The Seismic Shift in Communication Market is the Key Drivers in This Market

Figure 20 Value Chain Analysis

Figure 21 Porter’s Five Forces Analysis

Figure 22 Strategic Benchmarking: Cloud Communication Platform Market

Figure 23 UCC/UCaaS Solution is Expected to Hold the Largest Market Size in 2016

Figure 24 Training and Consulting Service is Expected to Hold the Largest Market Share in 2016

Figure 25 Large Enterprises Segment is Expected to Hold the Largest Market Share in 2016

Figure 26 BFSI Vertical Expected to Hold the Largest Market Share Among Verticals in the Cloud Communication Platform Market in 2016

Figure 27 North America Expected to Hold the Largest Market Share in 2016

Figure 28 North America Market: Snapshot

Figure 29 Asia-Pacific Market: Snapshot

Figure 30 Companies Adopted Partnership, Agreements and Collaborations as the Key Growth Strategy Over the Period of 2012–2016

Figure 31 Market Evaluation Framework

Figure 32 Battle for Market Share: Partnership, Agreements and Collaborations is the Key Strategy

Figure 33 Geographic Revenue Mix of Top Market Players

Figure 34 8x8, Inc.: Business Overview

Figure 35 8x8, Inc.: SWOT Analysis

Figure 36 Avaya, Inc. : Business Overview

Figure 37 Avaya, Inc. : SWOT Analysis

Figure 38 Cisco Systems, Inc. : Business Overview

Figure 39 Cisco Systems, Inc. : SWOT Analysis

Figure 40 Twilio, Inc. : Business Overview

Figure 41 Netfortis, Inc. : Business Overview

Figure 42 West IP Communicati0ns, Inc.: Business Overview

Figure 43 Telestax, Inc. : Business Overview

Figure 44 Plivo, Inc.: Business Overview

Figure 45 Callfire, Inc. : Business Overview

Figure 46 Nexmo, Inc. : Business Overview

Figure 47 New Product Launches, 2011–2015

Figure 48 Partnerships, Collaborations, and Agreements, 2011–2015

Growth opportunities and latent adjacency in Cloud Communication Platform Market