Military Communications Market by System (Satcom System, Radio System, Security System, Communication Management System), Platform (Land, Naval, Airborne, Unmanned Vehicles), Point of Sale (New Installation, Upgrade), Application and Region - Global Forecast to 2028

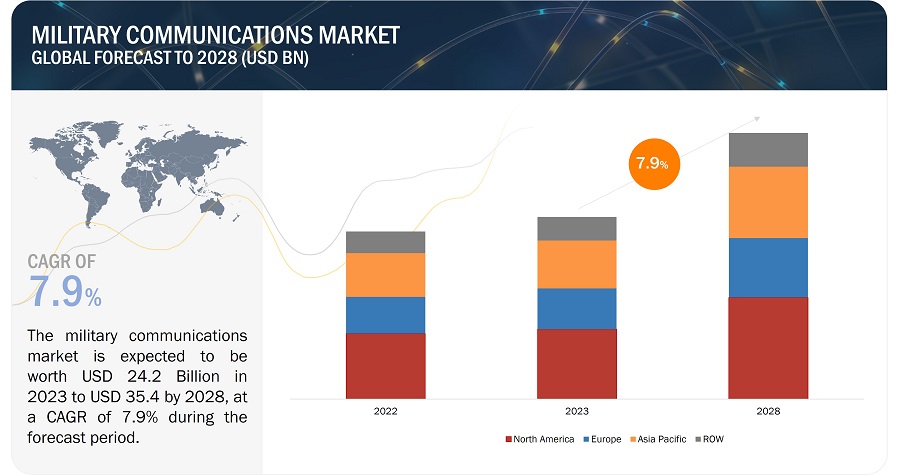

The Global Military Communications Market Size is estimated to be USD 24.2 Billion in 2023 to USD 35.4 Billion by 2028, at a CAGR of 7.9% from 2023 to 2028. Rapid advancements in communication technologies, including satellite communication, secure data encryption, high-frequency radio systems, and advanced networking protocols, have significantly improved the capabilities of military communication systems. These advancements enable faster and more reliable communication in complex and challenging environments. Modern military operations rely heavily on real-time data exchange, intelligence sharing, and situational awareness. Robust communication systems are essential for transmitting large amounts of data, including high-resolution imagery, sensor data, video feeds, and tactical information, to decision-makers and troops in the field. Military forces often operate in joint and coalition environments, requiring seamless communication between different branches of the armed forces and allied nations. Interoperable communication systems enable efficient coordination and synergy among diverse units.

Military Communications Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military Communications Market Dynamics:

Drivers: Rising adoption of new technologies for military communication Systems

Ongoing technological advancements, such as 5G networks, software-defined radios, AI, and Internet of Things (IoT) capabilities, are set to transform military communications systems. These advancements will enable faster data transmission, improved bandwidth capacity, enhanced encryption and cybersecurity measures, and the integration of emerging technologies into communication platforms. Encryption techniques are used to protect military comms from being intercepted and read by the enemy. Quantum cryptography and other new encryption techniques are providing militaries with new levels of security for their communications. AI is being used to develop more intelligent and adaptive military communications systems. For example, AI can be used to improve the accuracy of target identification and to optimize the routing of communications traffic. In modern warfare, the ability to make rapid and informed decisions and situational awareness is crucial. Communications systems that enable real-time data transmission, quick information sharing, and seamless collaboration contribute to faster decision-making processes. Advanced communications systems provide real-time information, sensor data, and intelligence feeds, enabling commanders to maintain a comprehensive understanding of the operational environment. New technologies are making military communications systems more interoperable and secure. This will allow different military communications systems to work together more effectively, which is essential for joint operations.

Restraints: Increasing cost of developing and deploying new technologies

Developing cutting-edge communication technologies involves substantial investment in research and development. As technology becomes more sophisticated, the R&D phase can become longer and more expensive, which may hinder rapid advancements. Also, integrating new technologies into existing military infrastructure can be a complex task. Sometimes, this integration can require overhauling entire systems, incurring significant costs. Introducing new communication technologies demands training for personnel. This training, especially for highly specialized systems, can be cost-intensive and time-consuming. Protecting advanced communication systems from cyber threats requires substantial investments in security infrastructure, software, and continuous monitoring.

In essence, while advanced communication technologies offer substantial benefits to military operations, their high development and integration costs can be a deterrent. This restraint is particularly pronounced for countries with limited defense budgets or for those prioritizing other areas of defense expenditure.

Military Comms Opportunities: Use of Cloud-based solutions

The integration of cloud-based solutions in military communications is an evolving paradigm that offers multiple advantages, albeit with certain challenges to address. Here's a look at the use of cloud solutions in Military communication systems:

Data Centralization: Cloud solutions can centralize vast amounts of data from disparate sources, facilitating easier data management and more efficient access for authorized personnel from anywhere.

Scalability: Cloud infrastructures can easily scale based on the requirements. This means that military organizations can adjust their data storage and processing capabilities without massive capital expenses.

Cost-Effectiveness: Over time, cloud solutions can lead to cost savings, as they reduce the need for extensive on-premises infrastructure, maintenance, and manual upgrades.

Flexibility and Agility: Military units can rapidly deploy, modify, or scale applications hosted on cloud platforms, ensuring agility in response to changing operational requirements.

Disaster Recovery and Redundancy: Cloud providers often have multiple data centers in various locations, ensuring data redundancy and quicker disaster recovery.

Collaboration and Real-time Updates: Cloud platforms can enhance collaboration by providing real-time data access to multiple units or even allied forces, ensuring everyone operates with the latest information.

Military Comms Challenges: Complexity and data management

The complexity of military communications refers to the challenges associated with collecting and analysing the large amounts of data generated by these systems. Military communication systems capture information across multiple platforms and wavelengths, resulting in a wealth of information that must be analysed and interpreted to be useful. The challenge lies in extracting meaningful insights from this data, which can be time-consuming and difficult. Given the sensitive, diverse, and voluminous nature of data in military settings, managing it efficiently becomes both crucial and challenging. For example, military data, depending on its type and relevance, might have different lifecycles. Determining how long to store data, when to archive or delete it, and ensuring compliance with regulations can be complicated.

The complexity of military communication systems presents a significant challenge to their adoption and use. However, by investing in user-friendly software and other solutions, companies can simplify the process of data analysis and make military communications more accessible to users across a variety of industries.

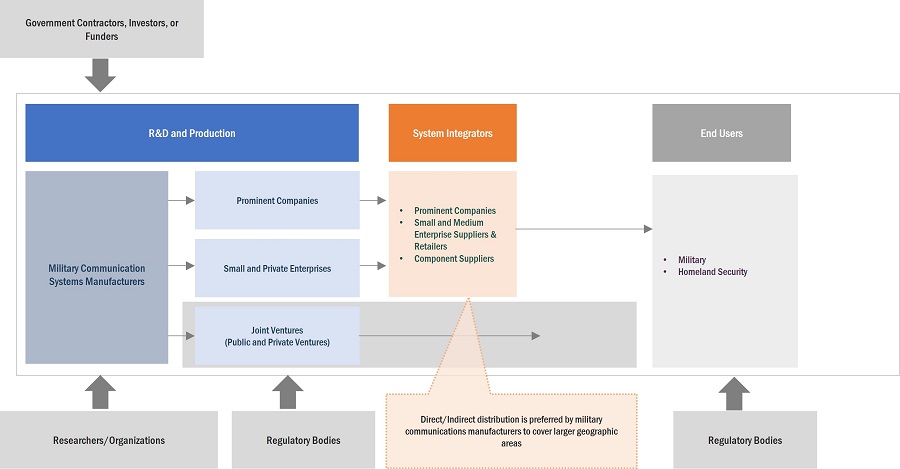

Military Communications Market Ecosystem

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S. (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US), are some of the leading companies in the military communications market.

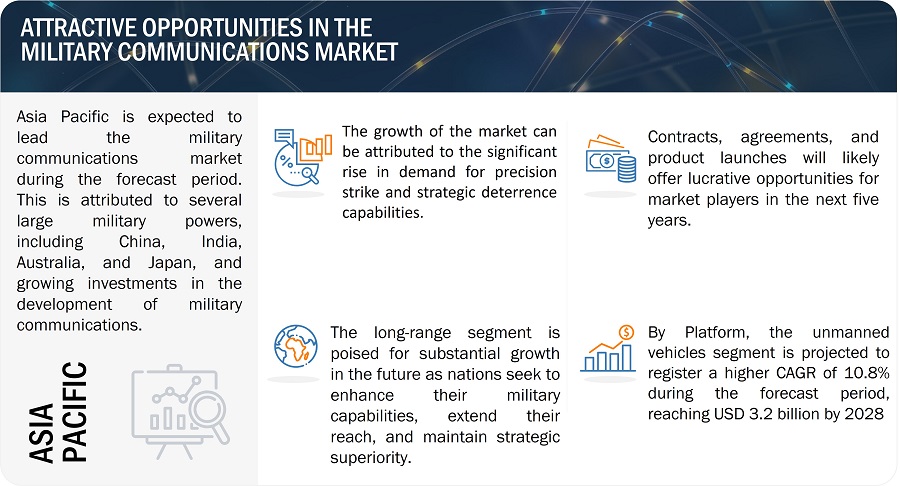

Based on platform, the unmanned vehicles segment is projected to grow at the highest CAGR in the military communications market during the forecast period

Military communication systems in unmanned vehicles (UVs) are experiencing significant growth due to several factors. UAVs can be used to relay communications between ground troops and command centers. This can be useful in areas where there is no line-of-sight communication, such as in mountainous terrain or urban areas. Also, UGVs can be equipped with sensors that can provide commanders with a better understanding of the battlefield. This can help commanders to make better decisions and to avoid surprises. UUVs can be used to lay communications cables or conduct underwater surveillance. They can also be used to collect intelligence on enemy ships or submarines. UVs offer a number of advantages over manned vehicles in military communications applications. They are less expensive to operate and maintain, and they do not put human lives at risk. They are also more agile and can operate in more difficult environments.

UVs are also used in agriculture for tasks such as crop monitoring, pest control, and precision farming. UVs are used in agriculture for tasks such as crop monitoring, pest control, and precision farming. UVs are used in search and rescue for tasks such as locating missing persons and assessing disaster damage. UVs are used in environmental monitoring for tasks such as tracking pollution levels, surveying wildlife, and assessing natural disasters. The use of UVs is growing rapidly in many different fields. UVs offer a number of advantages over manned vehicles, including lower cost, greater flexibility, and the ability to operate in dangerous or difficult-to-reach areas. As UV technology continues to develop, it is likely that we will see even more uses for UVs in the future.

Based on Application, the ISR segment is highest market share the military communication systems during the forecast period

Military communication systems in ISR applications are witnessing rapid growth due to their ability to enhance situational awareness and improve operational capabilities. Defense forces require comprehensive and accurate information about their surroundings to effectively monitor and respond to threats. military communications offer an advantage by capturing images, real-time data and gathers information. Moreover, military communication systems provide crucial data for target acquisition, tracking, and intelligence gathering. The sheer volume of data collected by ISR operations necessitates advanced data management solutions, ensuring relevant intelligence is easily accessible and actionable. With the digital realm becoming a significant battleground, ISR also encompasses cyber operations, monitoring, and analyzing digital traffic for threats, patterns, and intelligence.

Given the sensitive nature of ISR data, these systems often incorporate advanced encryption measures to protect against interception and cyber threats. ISR missions can be carried out using a variety of platforms, from satellites in space to drones (UAVs), manned aircraft, ground vehicles, and naval vessels. Modern ISR systems often incorporate real-time data analysis tools, allowing for instantaneous decision-making based on current data.

In essence, ISR is an evolving field, adapting and growing in response to technological advancements and the changing dynamics of global security challenges. It remains a cornerstone of modern military and intelligence operations.

Based on System, the Military Satcom System segment has highest market share in the military communications market during the forecast period

Military communications are seeing considerable market share increase in miltary satcom systems. A military satellite communications (milsatcom) system is a network of satellites that are used to provide secure and reliable communications for military applications. Milsatcom systems are used for a variety of purposes, including command and control, intelligence gathering, and logistics. Milsatcom systems are designed to be secure, and they use a variety of encryption techniques to protect communications from unauthorized interception. In June 2023, The U.S. Air Force has granted L3Harris Technologies a contract valued at $81 million to provide a new satellite communications (SATCOM) solution capable of functioning across multiple orbits and waveforms.

There are a number of different milsatcom systems in use today, each with its own strengths and weaknesses. Some of the most commonly used milsatcom systems include: Wideband Global SATCOM (WGS) a U.S. military satellite communications system that provides secure, reliable, and high-bandwidth communications. Skynet: a British military satellite communications system that provides secure, reliable, and high-bandwidth communications . Iridium is another commercial satellite communications system that is also used by the military. Iridium provides global coverage and a variety of services, including voice, data, and video.

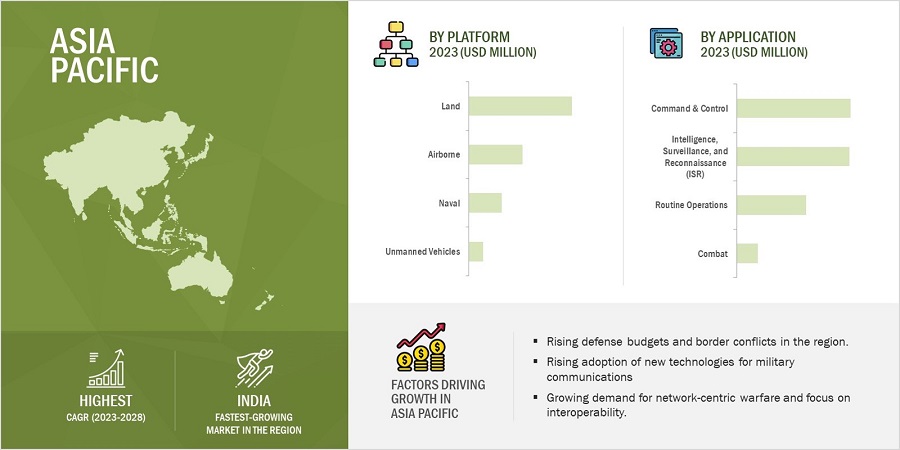

Asia Pacific is expected to account for the highest CAGR in the forecasted period .

Military communication systems in the Asia-Pacific region are experiencing significant growth due to several key factors. Firstly, the region has a diverse range of industries, including agriculture, environmental monitoring, forestry, and urban planning, which can benefit from the capabilities ofmilitary communication systems. military comms provide valuable data for crop monitoring, disease detection, land cover analysis, and environmental assessments. Secondly, the rapid technological advancements in the region have led to increased availability and affordability of military communications systems. This has made them more accessible to industries and organizations of varying sizes, including small and medium enterprises, research institutions, and government agencies.

Military Communications Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Military Comms Key Market Players

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US), are some of the leading companies in the military communications companies. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

By Platform, By Application, By System, By Point of sale |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

like Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US) . (25 companies) |

Military Communications Market Highlights

This research report categorizes military communications based on By Platform, By Application, By System, By Point of sale & Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Application |

|

|

By System |

|

|

By Point of Sale |

|

|

By Region |

|

Recent Developments

- In August 2023, Ukraine announced that Rheinmetall will supply Ukraine with new Luna NG (next generation) reconnaissance unmanned aircraft systems (UASs). This provision is a segment of a USD 765 million military assistance package committed by the German government for Ukraine, as announced at the NATO summit in Vilnius, Lithuania.

- In May 2023, L3Harris Technologies has disclosed contracts amounting to USD 160 million from the Marine Corps, encompassing multi-channel handheld and vehicular radio systems. This development raises the cumulative program orders to USD 336 million. All U.S. military branches, Special Operations Command, and many key allies have widely embraced the Falcon IV radio family's software-defined framework. This offers adaptability for ongoing updates and effortless incorporation of new technologies for future requirements.

- In June 2023, Raytheon Technologies received a USD 625 million contract from the U.S. Air Force Nuclear Weapons Center to manufacture satellite communication terminals that are resistant to nuclear effects.

- In May 2022, the U.S. Defense Advanced Research Projects Agency (DARPA) awarded BAE Systems a USD 24 million contract. Under the Mission-Integrated Network Control (MINC) program, BAE Systems will create software that automatically sets up tactical networks for essential communications.

Frequently Asked Questions (FAQ):

What is the current size of the military communications market?

The Military Communications Market is estimated to be USD 24.2 Billion in 2023 to USD 35.4 by 2028, at a CAGR of 7.9% during the forecast period.

What are the key sustainability strategies adopted by leading players operating in the military Military communications market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the military communications. Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US), are some of the leading companies in the military communications market.

What new emerging technologies and use cases disrupt the military communications

Response: Some of the major emerging technologies and use cases disrupting the market include the development of unmanned system for battlefield management, survey & mapping, remote sensing, military ISR activity.

Who are the key players and innovators in the ecosystem of the military communications market?

Response: . Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), BAE Systems(UK), Saab AB (Sweden).

Which region is expected to hold the highest market share in the military communications market?

Response: In 2023, Asia Pacific held the greatest market share for military communications , and during the forecast period, India is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing complexity of warfare driving advancements in military communications systems- Rising adoption of new technologies for military communications- Growing demand for network-centric warfare and focus on interoperability- Increasing cyber threats driving development of military communications- Rise in global defense spendingRESTRAINTS- Increasing cost of developing and deploying new technologies- Regulatory and certification requirements and lack of standardized communication protocolsOPPORTUNITIES- Use of unmanned systems and autonomous communications- Cloud-based solutionsCHALLENGES- Training and user adoption- Operating reliably in harsh and remote environments

-

5.3 TRENDS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS IN MILITARY COMMUNICATIONS MARKET

- 5.4 RECESSION IMPACT ANALYSIS

-

5.5 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SYSTEMINDICATIVE PRICING ANALYSIS

- 5.6 VOLUME DATA ANALYSIS

-

5.7 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.8 VALUE CHAIN ANALYSISPARTS SUPPLIERS

- 5.9 TRADE ANALYSIS

-

5.10 USE CASE ANALYSISUSE CASE 1: MILITARY COMMUNICATION UNMANNED SYSTEM (MCUS)USE CASE 2: MILITARY CLOUD COMMUNICATIONS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.14 KEY CONFERENCES AND EVENTS

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN MILITARY COMMUNICATIONS MARKETINTEGRATION OF ADVANCED TECHNOLOGIESWIRELESS COMMUNICATION ADVANCEMENTSSHIFT TO SOFTWARE-DEFINED NETWORKING (SDN)GROWING IMPORTANCE OF CYBERSECURITYSATCOMCLOUD COMPUTING5GCOGNITIVE RADIO

-

6.3 IMPACT OF MEGATRENDSNETWORK-CENTRIC OPERATIONSRAPID DEVELOPMENT OF UNMANNED SYSTEMSSATCOM-ON-THE-MOVEINTELLIGENT OPTICAL SATELLITE COMMUNICATION

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 LANDCOMMAND & CONTROL/GROUND STATIONARMORED VEHICLESCOMBAT VEHICLESCOMBAT SUPPORT VEHICLESSOLDIERS

-

7.3 NAVALSHIPSDESTROYERSFRIGATESCORVETTESAMPHIBIOUS VESSELSSURVEY VESSELSPATROL & MINE COUNTERMEASURE VESSELSOFFSHORE SUPPORT VESSELS (OSVS)OTHER SUPPORTING VESSELSSUBMARINES

-

7.4 AIRBORNEFIXED WING- Fighter aircraft- Transport aircraft- Special mission aircraftROTARY WING- Attack helicopters- Maritime helicopters- Multi-role helicopters

-

7.5 UNMANNEDUNMANNED AERIAL VEHICLES (UAVS)UNMANNED GROUND VEHICLES (UGVS)UNMANNED UNDERWATER VEHICLES (UUVS)

- 8.1 INTRODUCTION

-

8.2 COMMAND & CONTROLENABLING INFORMED DECISIONS AS DECENTRALIZED APPROACH TO DRIVE MARKET

-

8.3 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)RISE IN CYBER THREATS TO DRIVE MARKET

-

8.4 ROUTINE OPERATIONSADVANCEMENT IN TECHNOLOGY TO DRIVE MARKET

-

8.5 COMBATTREND IN MODERN COMBAT SYSTEMS PROGRESSING TOWARD GREATER INTEGRATION AND AUTOMATION TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 MILITARY SATCOM SYSTEMSATELLITE-ON-THE-MOVE- Advantages over traditional satellite communications systems to drive marketSATTELITE-ON-THE-PAUSE- Development of robust and reliable communication links in stationary situations to drive market

-

9.3 MILITARY RADIO SYSTEMANALOG RADIO SYSTEM- Resistance to certain types of jamming compared to digital signals to drive marketDIGITAL RADIO SYSTEM- Range of advanced features to drive market

-

9.4 MILITARY SECURITY SYSTEMDATA ENCRYPTION SYSTEM- Proper encryption key management to drive market

-

9.5 COMMUNICATION MANAGEMENT SYSTEMDYNAMIC SPECTRUM MANAGEMENT AND BATTLEFIELD MANAGEMENT SYSTEM TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NEW INSTALLATIONDEVELOPMENT OF NEW MISSILES TO DRIVE MARKET.

-

10.3 UPGRADEMODERNIZATION OF MILITARY COMMUNICATIONS SYSTEMS TO DRIVE MARKET

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICAPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSISUS- To dominate North American military communications marketCANADA- Increasing demand for secure and reliable communications systems to drive market

-

11.4 EUROPEPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSISUK- Development of next-generation communications systems to drive marketFRANCE- Increasing investments in military communication R&D to drive marketGERMANY- Continuous focus on upgrading battle management and communications systems to drive marketPOLAND- Deployment and modernization of armed forces to drive marketITALY- Increasing development of secure communications systems to drive marketREST OF EUROPE

-

11.5 ASIA PACIFICPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSISCHINA- Military modernization and increase in defense budget to drive marketJAPAN- Enhancement of defense and surveillance capabilities to drive marketINDIA- Territorial disputes and border tensions to drive marketSINGAPORE- Modernization of defense capabilities to drive marketAUSTRALIA- Defense Joint Project to drive marketREST OF ASIA PACIFIC

-

11.6 REST OF THE WORLDRECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Border tensions and geopolitical competition to drive marketLATIN AMERICA- Increasing demand for military UAVs to drive market

- 12.1 INTRODUCTION

- 12.2 COMPETITIVE OVERVIEW

- 12.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- 12.4 MARKET SHARE OF KEY PLAYERS, 2022

- 12.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- 12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.8 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsASELSAN A.S.- Business overview- Products/Solutions/Services offered- Recent developmentsELBIT SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsVIASAT INC.- Business overview- Products/Solutions/Services offeredRHEINMETALL AG- Business overview- Products/Solutions/Services offeredLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- Recent developmentsCOBHAM LIMITED- Business overview- Products/Solutions/Services offeredISRAEL AEROSPACE INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSROLTA INDIA LTDKONGSBERGJAPAN RADIO COMPANYDATA LINK SOLUTIONSVANTAGE ROBOTICSRAFAEL ADVANCED DEFENCE SYSTEMS LTDFORTEM TECHNOLOGIESSHIELD AIANDURIL INDUSTRIES

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN MILITARY COMMUNICATIONS MARKET

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 4 MILITARY COMMUNICATIONS MARKET: NAVAL DELIVERIES IN UNITS

- TABLE 5 MILITARY COMMUNICATIONS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 END USERS

- TABLE 7 RADAR APPARATUS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

- TABLE 8 RADAR APPARATUS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

- TABLE 9 MILITARY COMMUNICATIONS MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 4 PLATFORMS (%)

- TABLE 11 KEY BUYING CRITERIA FOR 4 PLATFORMS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 17 MILITARY COMMUNICATIONS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 18 MARKET: KEY PATENTS

- TABLE 19 MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 20 MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 21 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 24 MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY POINT OF SALE, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY POINT OF SALE, 2023–2028 (USD MILLION)

- TABLE 27 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 28 MILITARY COMMUNICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 38 US: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 39 US: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 40 US: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 CANADA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 43 CANADA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 44 CANADA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: MILITARY COMMUNICATION MARKET, COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 EUROPE: MILITARY COMMUNICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 EUROPE: MILITARY COMMUNICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 EUROPE: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 51 EUROPE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 53 EUROPE: MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 54 UK: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 55 UK: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 56 UK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 FRANCE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 59 FRANCE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 60 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 GERMANY: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 63 GERMANY: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 64 GERMANY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 GERMANY: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 POLAND: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 67 POLAND: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 POLAND: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 POLAND: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 ITALY: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 71 ITALY: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 72 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 REST OF EUROPE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 75 REST OF EUROPE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MARKET, COUNTRY, 2019–2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 86 CHINA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 87 CHINA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 88 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 JAPAN: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 91 JAPAN: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 92 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 INDIA: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 95 INDIA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 96 INDIA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 99 SINGAPORE: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 100 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 SINGAPORE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 AUSTRALIA: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 103 AUSTRALIA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 104 AUSTRALIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 116 REST OF THE WORLD: MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 117 REST OF THE WORLD: MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 123 LATIN AMERICA: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 KEY DEVELOPMENTS BY LEADING PLAYERS IN MILITARY COMMUNICATIONS MARKET BETWEEN 2019 AND 2023

- TABLE 127 COMPANY PRODUCT FOOTPRINT

- TABLE 128 COMPANY REGION FOOTPRINT

- TABLE 129 MILITARY COMMUNICATIONS MARKET: PRODUCT LAUNCHES, MARCH 2020– NOVEMBER 2021

- TABLE 130 MILITARY COMMUNICATIONS MARKET: DEALS, FEBRUARY 2020–JUNE 2023

- TABLE 131 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 132 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 134 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 135 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 136 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 137 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 138 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 139 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 140 NORTHROP GRUMMAN COOPERATION: DEALS

- TABLE 141 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 142 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 144 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 145 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 146 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BAE SYSTEMS: DEALS

- TABLE 148 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 149 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 151 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 SAAB AB: DEALS

- TABLE 153 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 154 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 ASELSAN A.S.: DEALS

- TABLE 156 ELBIT SYSTEMS: COMPANY OVERVIEW

- TABLE 157 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 ELBIT SYSTEMS: DEALS

- TABLE 159 THALES GROUP: COMPANY OVERVIEW

- TABLE 160 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 THALES GROUP: PRODUCT LAUNCHES

- TABLE 162 THALES GROUP: DEALS

- TABLE 163 VIASAT INC.: COMPANY OVERVIEW

- TABLE 164 VIASAT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 166 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 168 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 170 LEONARDO S.P.A.: DEALS

- TABLE 171 COBHAM LIMITED: COMPANY OVERVIEW

- TABLE 172 COBHAM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 174 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ISRAEL AEROSPACE INDUSTRIES: DEALS

- TABLE 176 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 177 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 179 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 180 ROLTA INDIA LTD: COMPANY OVERVIEW

- TABLE 181 KONGSBERG: COMPANY OVERVIEW

- TABLE 182 JAPAN RADIO COMPANY: COMPANY OVERVIEW

- TABLE 183 DATA LINK SOLUTIONS: COMPANY OVERVIEW

- TABLE 184 VANTAGE ROBOTICS: COMPANY OVERVIEW

- TABLE 185 RAFAEL ADVANCED DEFENCE SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 186 FORTEM TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 187 SHIELD AI: COMPANY OVERVIEW

- TABLE 188 ANDURIL INDUSTRIES: COMPANY OVERVIEW

- FIGURE 1 MILITARY COMMUNICATIONS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 MILITARY COMMUNICATIONS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 LAND PLATFORM TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 11 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 MILITARY SATCOM SYSTEM TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 UPGRADE SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 RISE IN DEMAND FOR REAL-TIME INFORMATION SHARING TO DRIVE MARKET

- FIGURE 16 LAND SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 COMMAND & CONTROL TO BE LEADING SEGMENT OF MARKET DURING FORECAST PERIOD

- FIGURE 18 MILITARY SATCOM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE MARKET DURING FORECAST PERIOD

- FIGURE 19 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 MILITARY COMMUNICATIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 DEFENSE EXPENDITURE OF MAJOR COUNTRIES IN PERCENTAGE, 2021–2022

- FIGURE 23 REVENUE SHIFT IN MILITARY COMMUNICATIONS MARKET

- FIGURE 24 MILITARY COMMUNICATIONS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 25 MARKET: AVERAGE SELLING PRICE ANALYSIS

- FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 MILITARY COMMUNICATIONS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 4 PLATFORMS

- FIGURE 30 KEY BUYING CRITERIA FOR 4 PLATFORMS

- FIGURE 31 EVOLUTION OF MILITARY COMMUNICATIONS TECHNOLOGY: A ROADMAP FROM 1980 TO 2050

- FIGURE 32 MILITARY COMMUNICATIONS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 MARKET, BY PLATFORM, 2023–2028

- FIGURE 34 MARKET, BY APPLICATION, 2023–2028

- FIGURE 35 MARKET, BY SYSTEM, 2023–2028

- FIGURE 36 MARKET, BY POINT OF SALE, 2023–2028

- FIGURE 37 MILITARY COMMUNICATIONS MARKET, BY REGION, 2023–2028

- FIGURE 38 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET SNAPSHOT

- FIGURE 39 EUROPE: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET SNAPSHOT

- FIGURE 41 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 MILITARY COMMUNICATIONS MARKET: START-UP/SME COMPANY EVALUATION MATRIX, 2022

- FIGURE 43 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 48 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- FIGURE 50 ELBIT SYSTEMS: COMPANY SNAPSHOT

- FIGURE 51 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 52 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 53 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

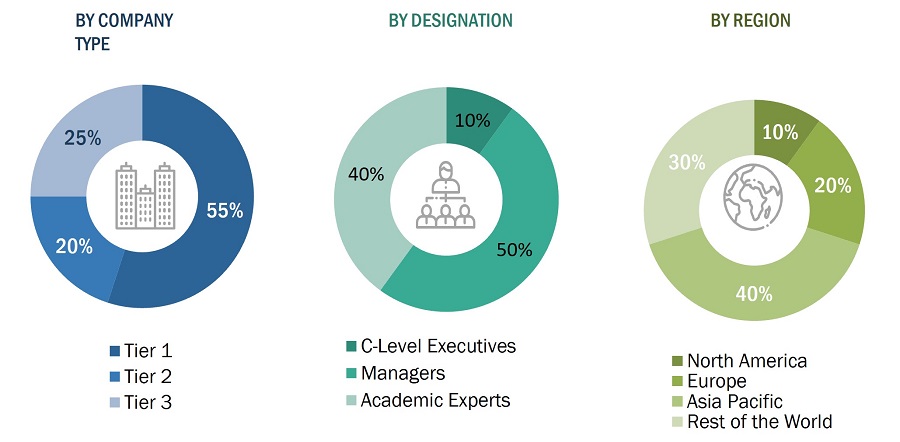

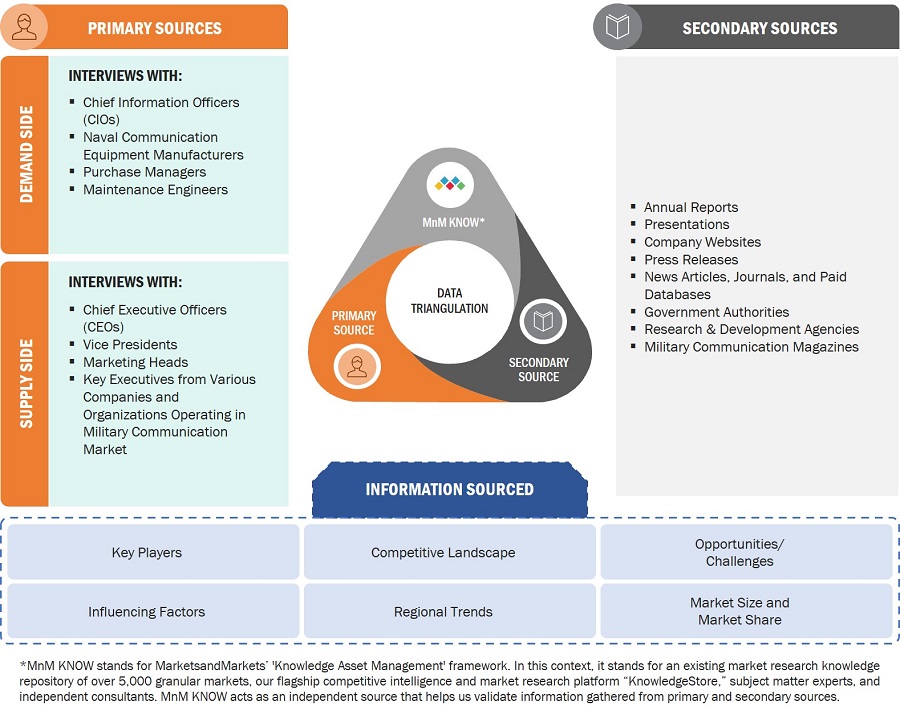

The research study conducted on the military communications market involved extensive use of secondary sources, including directories, databases of articles, journals on military communications, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the military communications market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the military communications market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the military communications market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the military communications industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the military comms market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the military communications market.

To know about the assumptions considered for the study, download the pdf brochure

Military Comms Market Size Estimation

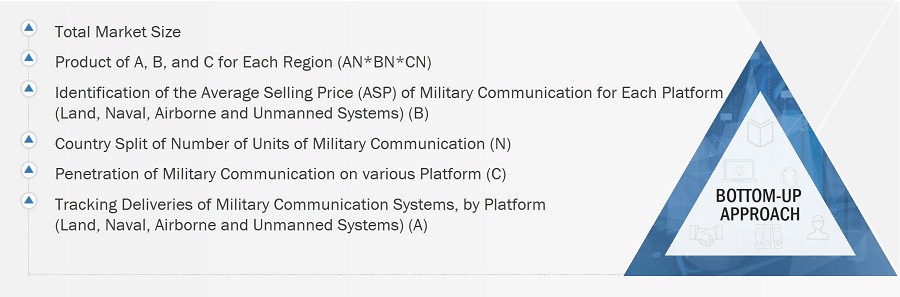

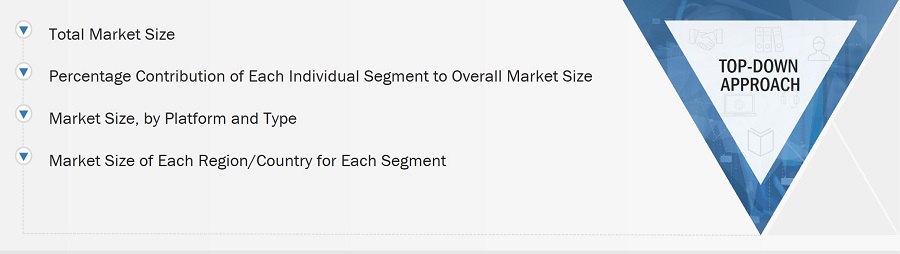

Both the top-down and bottom-up approaches were used to estimate and validate the size of the military communications market. The following figure represents the overall market size estimation process employed for this study on the market.

The research methodology used to estimate the market size included the following details:

- Secondary research identified key players in the military comms market, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the military communications market.

- This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Military Comms Market size estimation methodology: Top-Down Approach

In the top-down approach, the overall size of the military communications market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. The size of the most appropriate, immediate parent market was used to implement the top-down approach to calculate the sizes of specific market segments. The approach was also implemented to validate the revenues obtained for various market segments.

Market share was estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primary, this study determined and confirmed the overall size of the parent market and each market segment. The following figure shows the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Militray Comms Market Definition

The military communications systems refers to the aggregate of products, services, technologies, and systems designed to facilitate communication within and between military entities. This market encompasses the entire spectrum of tools and technologies used by defense forces to transmit and receive information securely, rapidly, and reliably. The military communication market's growth is influenced by geopolitical dynamics, technological advancements, defense budgets, emerging threats, and evolving nature of warfare. Companies, researchers, and defense establishments operating within this market work towards providing the military with state-of-the-art communication solutions that cater to its multifaceted requirements.

The military communication market plays a pivotal role in the modern defense sector, underpinning a vast array of applications essential for operational success. At its core, military communication ensures seamless command and control, enabling leaders to make informed decisions based on real-time data from diverse sources such as intelligence, surveillance, and reconnaissance (ISR) systems. Furthermore, it's instrumental in coordinating joint and multinational operations, ensuring that different military branches and allied forces can collaborate effectively. The growth of the unmanned vehicles segment, from drones to autonomous ground vehicles, further underscores the need for robust military communication systems to remotely control and retrieve data from these assets. Additionally, with the evolving threat landscape, especially in cyber warfare, there's an increasing emphasis on secure and encrypted communication to thwart potential adversaries.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Ministry of Defense

- Regulatory Bodies

- R&D Companies

- Providers of military communications Systems

- Providers of military communications Components and Sub-components

- Armed Forces

Report Objectives

- To define, describe, and forecast the size of the military communications market based on cooling technology, application, end use, spectrum, and region from 2023 to 2028.

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa, Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the military communications market across the globe.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the military communications market.

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the military communications market.

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2.

1. Micro markets refer to further segments and subsegments of the military communications market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Military Communications Market

Interested in militaryradio industry for South American, Asian, and African markets.

Market sizing of military headsets market.

Evaluation of military telecommunication industry

Understanding the military communication market.

Interested in military communication using private communications market.

Understanding the market sizing and market trends of tactical headset.

Interested in Land Mobile Radio market projections

Interested in C4ISR, Syunthetic Systems Deployment, Organic Computing industries.