Military 3D Printing Market by Offering (Printer, Material, Software, Service), Application (Functional Part Manufacturing, Tooling, Prototyping), Platform (Airborne, Land, Naval, Space), Process, Technology, and Region - Global Forecast to 2025

The Military 3D Printing Market was valued at USD 623.0 Million in 2017 and is projected to reach USD 4,594.4 Million by 2025, at a CAGR of 28.37% from 2017 to 2025. The objective of this study is to analyze, define, describe, and forecast the military 3D printing market based on offering, process, application, platform, and region. The report also focuses on providing a detailed competitive landscape of the market. It profiles key market players, highlighting their financial positions, product portfolios, and growth strategies, and analyzes their core competencies and market shares to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, acquisitions, new product developments, and funding activities in the military 3D printing market. The base year considered for this study is 2017 and the forecast period is from 2018 to 2025.

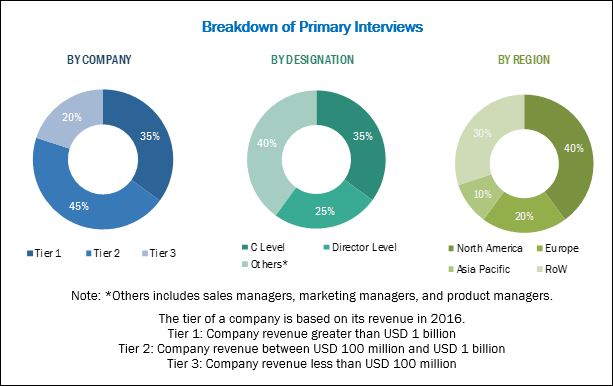

The research methodology used to estimate and forecast the military 3D printing market includes the study of data and revenue of key market players through secondary sources, such as company websites; annual reports; investor presentations; associations such as SME - Additive Manufacturing Community and Additive Manufacturing Association (AMA); and paid databases. The bottom-up procedure was employed to arrive at the overall size of the market by estimating the revenue of key market players. After arriving at the overall market size, the market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. Breakdown of profiles of primaries is showcased in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The military 3D printing market has been segmented on the basis of offering, process, application, platform, and region. Key companies profiled in the report include Stratasys (US), 3D Systems (US), ExOne (France), EOS (Germany), Arcam (Sweden), and Norsk Titanium (Germany). Contracts, new product launches, and partnerships are key growth strategies adopted by leading players in the market.

Target Audience for this Report

- Military 3D Printing Service Providers

- Defense Equipment Manufacturers

- 3D Printing Manufacturers

- Raw Material Suppliers

- Air Forces

- Naval Forces

- Armies

- Ministry of Defense of Various Countries

“This study answers several questions for stakeholders, primarily, which market segments they need to focus on during the next 2 to 5 years to prioritize their efforts and investments.”

Scope of the Report:

Military 3D Printing Market, By Offering

- Printer

- Material

- Software

- Service

By Process

- Binder Jetting

- Direct Energy Deposition

- Material Extrusion

- Material Jetting

- Powder Bed Fusion

- Vat Photopolymerization

- Sheet Lamination

By Application

- Functional Part Manufacturing

- Tooling

- Prototyping

By Platform

- Airborne

- Land

- Naval

- Space

Drone Analytics Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (Latin America and Africa)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for this report:

- Geographic Analysis

- Further breakdown of countries in Latin America

- Company Information

- Detailed analysis and profiles of additional market players (up to 5)

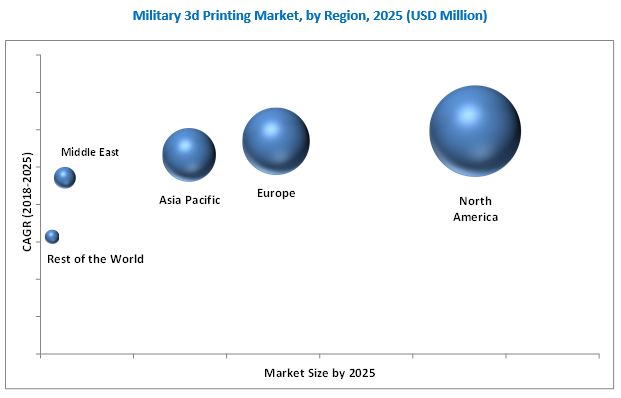

The military 3D printing market is projected to grow from USD 799.8 Million in 2018 to USD 4,594.4 Million by 2025, at a CAGR of 28.37% during the forecast period. The rising demand for lightweight parts and components in the defense industry and increasing investments made by defense entities in 3D printing projects are key factors projected to drive the growth of the market.

The military 3D printing market has been segmented on the basis of offering, process, application, platform, and region. Based on offering, the market has been segmented into printer, material, software, and service. The printer segment is projected to lead the market during the forecast period, owing to the increasing demand for 3D printed components from OEMs in the defense industry.

Based on process, the market has been segmented into binder jetting, direct energy deposition, material extrusion, material jetting, powder bed fusion, vat photopolymerization, and sheet lamination. The direct energy deposition segment is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the requirement for printing small-to-medium sized, and highly-complex functional parts of defense equipment.

Based on application, the market has been segmented into functional part manufacturing, tooling, and prototyping. 3D printing or additive manufacturing helps produce prototypes and models from 3D Computer-aided Design (CAD). OEMs in the defense industry are focused on the adoption of 3D printing technology to develop complex parts with minimum wastage. The need to produce cost-efficient prototypes according to specific customer requirements is one of the most significant factors projected to drive the growth of the prototyping segment.

Based on platform, the market has been segmented into airborne, land, naval, and space. The airborne segment is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing use of 3D printing technology to develop lightweight and durable components of aircraft and drones.

Based on region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East, and Rest of the World (RoW). The North American region led the military 3D printing in 2017. The increasing applicability of 3D printing technology in various industries, such as aerospace, chemicals, and automotive, in North America is one of the most significant factors expected to fuel the growth of the market in this region.

The high cost of 3D printing parts and lack of standard process control act as key challenges to the growth of the military 3D printing market. Key companies profiled in the report include Airware (US), DroneDeploy (US), Delta Drone (France), PrecisionHawk (US), Pix4D (Switzerland), and AeroVironment (US). These players are focused on launching new products and end-to-end military 3D printing solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Growth Opportunities in the Military 3D Printing Market

4.2 By Process

4.3 Europe Market, By Platform & Country

4.4 US Market, By Offering

4.5 Europe Market, By Platform

4.6 Market, By Country

5 Market Overview (Page No. - 39)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Investments By Defense Entities in 3D Printing Projects

5.1.1.2 Reduction in Manufacturing Cost of Parts

5.1.1.3 Demand for Lightweight Parts and Components in the Defense Industry

5.1.2 Restraints

5.1.2.1 Limited Availability of Materials

5.1.2.2 Stringent Military Standards

5.1.3 Opportunities

5.1.3.1 Development of Advanced 3D Printing Technologies

5.1.3.2 3D Printing as A Service

5.1.3.3 Development of Portable Printers

5.1.4 Challenges

5.1.4.1 Not Suitable for High Volume Production

5.1.4.2 Production of Low-Cost 3D Printing Parts

5.1.4.3 Lack of Standard Process Control

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Emerging Trends

6.2.1 Multi-Material 3D Printing in the Defense Industry

6.2.2 3D Printing of Drones & Missiles

6.2.3 3D Printing of Complex Components

6.2.4 3D Printing of Food

6.3 Porter’s Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Patent Analysis

7 Military 3D Printing Market, By Offering (Page No. - 48)

7.1 Introduction

7.2 Printer

7.2.1 Printer, By Type

7.2.1.1 Industrial Printer

7.2.1.2 Portable Printer

7.3 Material

7.3.1 Material, By Type

7.3.1.1 Plastics

7.3.1.1.1 Plastic, By Type

7.3.1.1.1.1 Thermoplastics

7.3.1.1.1.2 Photopolymers

7.3.1.1.2 Plastic, By Form

7.3.1.1.2.1 Powder

7.3.1.1.2.2 Filament/Wire

7.3.1.1.2.3 Liquid

7.3.1.2 Metal

7.3.1.2.1 Metal, By Type

7.3.1.2.1.1 Steel

7.3.1.2.1.2 Aluminum

7.3.1.2.1.3 Titanium

7.3.1.2.1.4 Silver

7.3.1.2.1.5 Others

7.3.1.2.2 Metal, By Form

7.3.1.2.2.1 Powder

7.3.1.2.2.2 Filament/Wire

7.3.1.3 Ceramics

7.3.1.3.1 Ceramics, By Form

7.3.1.3.1.1 Powder

7.3.1.3.1.2 Filament/Wire

7.3.1.3.1.3 Liquid

7.3.1.4 Others

7.4 Software

7.4.1 Software, By Type

7.4.1.1 Printing

7.4.1.2 Design

7.4.1.3 Inspection

7.4.1.4 Scanning

7.5 Service

8 By Platform (Page No. - 60)

8.1 Introduction

8.2 Airborne

8.2.1 Aircraft

8.2.1.1 Engines

8.2.1.2 Aerostructures

8.2.1.3 Cockpit Controls

8.2.1.4 Others

8.2.2 Missiles

8.2.2.1 Rocket Engines

8.2.2.2 Fins

8.2.2.3 Guidance Systems

8.2.2.4 Controls

8.2.2.5 Others

8.2.3 UAV

8.2.3.1 UAV Engines

8.2.3.2 Aerostructures

8.2.3.3 Payloads

8.2.3.4 Others

8.3 Land

8.3.1 Vehicles

8.3.1.1 Engines

8.3.1.2 Structures

8.3.1.3 Others

8.3.2 Soldiers

8.3.2.1 Helmets

8.3.2.2 Vests

8.3.2.3 Communication Devices

8.3.2.4 Food

8.3.2.5 Others

8.3.3 Unmanned Ground Vehicles (UGVS)

8.3.3.1 UGV Engines

8.3.3.2 Structures

8.3.3.3 Others

8.4 Naval

8.4.1 Ships

8.4.2 Unmanned Maritime Vehicles (UMV)

8.5 Space

9 By Application (Page No. - 72)

9.1 Introduction

9.2 Prototyping

9.3 Functional Part Manufacturing

9.4 Tooling

10 By Process (Page No. - 75)

10.1 Introduction

10.2 Powder Bed Fusion

10.3 Material Extrusion

10.4 Vat Photopolymerization

10.5 Material Jetting

10.6 Binder Jetting

10.7 Direct Energy Deposition

10.8 Sheet Lamination

11 By Technology (Page No. - 80)

11.1 Introduction

11.2 Stereolithography

11.3 Fuse Deposition Modeling

11.4 Selective Laser Sintering (SLS)

11.5 Direct Metal Laser Sintering (DMLS)

11.6 Polyjet Printing

11.7 Inkjet Printing

11.8 Electron Beam Melting

11.9 Laser Metal Deposition

11.10 Digital Light Processing

11.11 Laminated Object Manufacturing

12 Regional Analysis (Page No. - 85)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.3 Europe

12.3.1 France

12.3.2 Russia

12.3.3 Germany

12.3.4 UK

12.3.5 Italy

12.3.6 Spain

12.3.7 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 South Korea

12.4.5 Australia

12.4.6 Rest of Asia Pacific

12.5 Middle East

12.5.1 Israel

12.5.2 Saudi Arabia

12.5.3 UAE

12.5.4 Rest of Middle East

12.6 Rest of the World

12.6.1 Latin America

12.6.2 Africa

13 Competitive Landscape (Page No. - 118)

13.1 Introduction

13.2 Competitive Analysis

13.3 Market Ranking Analysis

13.4 Competitive Scenario

13.4.1 Contracts

13.4.2 New Product Launches

13.4.3 Agreements, Acquisitions, Collaborations, Partnerships, and Joint Ventures

14 Company Profiles (Page No. - 122)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 Stratasys

14.2 3D Systems Corporation

14.3 The Exone Company

14.4 EOS GmbH

14.5 Arcam AB

14.6 Norsk Titanium as

14.7 American Elements

14.8 Cimetrix Solutions

14.9 Artec

14.10 3T RPD

14.11 Optomec

14.12 Initial

14.13 Markforged

14.14 Smg3D

14.15 Engineering & Manufacturing Services

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 146)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customization

15.5 Related Reports

15.6 Author Details

List of Tables (82 Tables)

Table 1 Investments in 3D Printing Projects

Table 2 Patents Related to Military 3D Printing, 2013-2018

Table 3 Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 4 Market Size, Printer By Type, 2016-2025 (USD Million)

Table 5 Market Size, Material By Type, 2016-2025 (USD Million)

Table 6 Market Size, Plastic By Type, 2016-2025 (USD Million)

Table 7 Market Size, Plastic By Form, 2016-2025 (USD Million)

Table 8 Market Size, Metal By Type, 2016-2025 (USD Million)

Table 9 Market Size, Metal By Form, 2016-2025 (USD Million)

Table 10 Market Size, Plastic By Form, 2016-2025 (USD Million)

Table 11 Market Size, Software By Type, 2016-2025 (USD Million)

Table 12 Market Size, By Platform, 2016-2025 (USD Million)

Table 13 Market for Airborne, By Type, 2016-2025 (USD Million)

Table 14 Market Size, By Aircraft Component, 2016-2025 (USD Million)

Table 15 Market Size, By Missile Component, 2016-2025 (USD Million)

Table 16 Market Size, By UAV Component, 2016-2025 (USD Million)

Table 17 Market for Land, By Type, 2016-2025 (USD Million)

Table 18 Market Size, By Vehicle Component, 2016-2025 (USD Million)

Table 19 Market for Soldier Equipment and Food, By Type, 2016-2025 (USD Million)

Table 20 Market Size, By UGV Component, 2016-2025 (USD Million)

Table 21 Market for Naval, By Type, 2016-2025 (USD Million)

Table 22 Market Size, By Application, 2016-2025 (USD Million)

Table 23 Market Size, By Process, 2016-2025 (USD Million)

Table 24 Market Size, By Region, 2016-2025 (USD Million)

Table 25 North America: Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 26 North America: Market Size, By Platform, 2016-2025 (USD Million)

Table 27 North America: Market Size, By Country, 2016-2025 (USD Million)

Table 28 US: Market Size, By Offering, 2016-2025 (USD Million)

Table 29 US: Market Size, By Platform, 2016-2025 (USD Million)

Table 30 Canada: Market Size, By Offering, 2016-2025 (USD Million)

Table 31 Canada: Market Size, By Platform, 2016-2025 (USD Million)

Table 32 Europe: Market Size, By Offering, 2016-2025 (USD Million)

Table 33 Europe: Market Size, By Platform, 2016-2025 (USD Million)

Table 34 Europe: Market Size, By Country, 2016-2025 (USD Million)

Table 35 France: Market Size, By Offering, 2016-2025 (USD Million)

Table 36 France: Market Size, By Platform, 2016-2025 (USD Million)

Table 37 Russia: Market Size, By Offering, 2016-2025 (USD Million)

Table 38 Russia: Market Size, By Platform, 2016-2025 (USD Million)

Table 39 Germany: Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 40 Germany: Market Size, By Platform, 2016-2025 (USD Million)

Table 41 UK: Market Size, By Offering, 2016-2025 (USD Million)

Table 42 UK: Market Size, By Platform, 2016-2025 (USD Million)

Table 43 Italy: Market Size, By Offering, 2016-2025 (USD Million)

Table 44 Italy: Market Size, By Platform, 2016-2025 (USD Million)

Table 45 Spain: Market Size, By Offering, 2016-2025 (USD Million)

Table 46 Spain: Market Size, By Platform, 2016-2025 (USD Million)

Table 47 Rest of Europe: Market Size, By Offering, 2016-2025 (USD Million)

Table 48 Rest of Europe: Market Size, By Platform, 2016-2025 (USD Million)

Table 49 Asia Pacific: Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 50 Asia Pacific: Market Size, By Platform, 2016-2025 (USD Million)

Table 51 Asia Pacific: Market Size, By Country, 2016-2025 (USD Million)

Table 52 China: Market Size, By Offering, 2016-2025 (USD Million)

Table 53 China: Market Size, By Platform, 2016-2025 (USD Million)

Table 54 India: Market Size, By Offering, 2016-2025 (USD Million)

Table 55 India: Market Size, By Platform, 2016-2025 (USD Million)

Table 56 Japan: Market Size, By Offering, 2016-2025 (USD Million)

Table 57 Japan: Market Size, By Platform, 2016-2025 (USD Million)

Table 58 South Korea: Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 59 South Korea: Market Size, By Platform, 2016-2025 (USD Million)

Table 60 Australia: Market Size, By Offering, 2016-2025 (USD Million)

Table 61 Australia: Market Size, By Platform, 2016-2025 (USD Million)

Table 62 Rest of Asia Pacific: Market Size, By Offering, 2016-2025 (USD Million)

Table 63 Rest of Asia Pacific: Market Size, By Platform, 2016-2025 (USD Million)

Table 64 Middle East: Market Size, By Offering, 2016-2025 (USD Million)

Table 65 Middle East: Market Size, By Platform, 2016-2025 (USD Million)

Table 66 Middle East: Military 3D Printing Market Size, By Country, 2016-2025 (USD Million)

Table 67 Israel: Market Size, By Offering, 2016-2025 (USD Million)

Table 68 Israel: Market Size, By Platform, 2016-2025 (USD Million)

Table 69 Saudi Arabia: Market Size, By Offering, 2016-2025 (USD Million)

Table 70 Saudi Arabia: Market Size, By Platform, 2016-2025 (USD Million)

Table 71 UAE: Market Size, By Offerings, 2016-2025 (USD Million)

Table 72 UAE: Market Size, By Platform, 2016-2025 (USD Million)

Table 73 Rest of Middle East: Military 3D Printing Market Size, By Offering, 2016-2025 (USD Million)

Table 74 Rest of Middle East: Market Size, By Platform, 2016-2025 (USD Million)

Table 75 Rest of the World: Market Size, By Offering, 2016-2025 (USD Million)

Table 76 Rest of the World: Market Size, By Platform, 2016-2025 (USD Million)

Table 77 Rest of the World: Market Size, By Region, 2016-2025 (USD Million)

Table 78 Latin America: Market Size, By Offering, 2016-2025 (USD Million)

Table 79 Latin America: Military 3D Printing Market Size, By Platform, 2016-2025 (USD Million)

Table 80 Africa: Market Size, By Offering, 2016-2025 (USD Million)

Table 81 Africa: Market Size, By Platform, 2016-2025 (USD Million)

Table 82 Rank Analysis of Key Players in the Market in 2017

List of Figures (37 Figures)

Figure 1 Market Scope: Military 3D Printing Market

Figure 2 Research Process Flow

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Military 3D Printing Market, By Offering, 2018 & 2025 (USD Million)

Figure 9 Airborne Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 10 Functional Part Manufacturing Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Direct Energy Deposition Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 The North American Region Estimated to Lead Market in 2018

Figure 13 Increasing Investments on Military 3D Printing Projects By Government Bodies is Expected to Drive the Military 3D Printing Market From 2018 to 2025

Figure 14 Powder Bed Fusion Segment Projected to Lead the Market From 2018 to 2025

Figure 15 Airborne Segment Platform is Estimated to Lead the European Market in 2018

Figure 16 Service Segment of Market Projected to Grow at the Highest CAGR During Forecast Period

Figure 17 Europe Military 3D Printing Market, By Platform

Figure 18 The US is Expected to Lead Market in 2018

Figure 19 Market: Market Dynamics

Figure 20 Duration of 3D Printing Processes

Figure 21 Porter’s Five Forces Analysis

Figure 22 Service Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 23 Airborne Platform Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Functional Part Manufacturing Segment Expected to Grow at Highest Rate During the Forecast Period

Figure 25 Direct Energy Deposition Segment Expected to Grow at Highest Rate During the Forecast Period

Figure 26 Military 3D Printing Market, By Technology

Figure 27 North America Estimated to Account for the Largest Share of Market in 2018

Figure 28 North America Market Snapshot

Figure 29 Europe Market Snapshot

Figure 30 Asia Pacific Market Snapshot

Figure 31 Middle East Military 3D Printing Market Snapshot

Figure 32 Companies Adopted Supply Contracts & New Product Launches as the Key Growth Strategy Between July 2016 to October 2017

Figure 33 Leading Companies in the Military 3D Printing Market, By Region, 2017

Figure 34 Stratasys: Company Snapshot

Figure 35 3D Systems Corporation: Company Snapshot

Figure 36 The Exone Company: Company Snapshot

Figure 37 Arcam AB: Company Snapshot

Growth opportunities and latent adjacency in Military 3D Printing Market