3D Food Printing Market by Vertical (Government, Commercial, and Residential), Technique (Extrusion Based Printing, Selective Laser Sintering, Binder Jetting and Inkjet Printing), Ingredient and Geography - Global Forecast to 2027

3D Food Printing Market Research Report, 2027

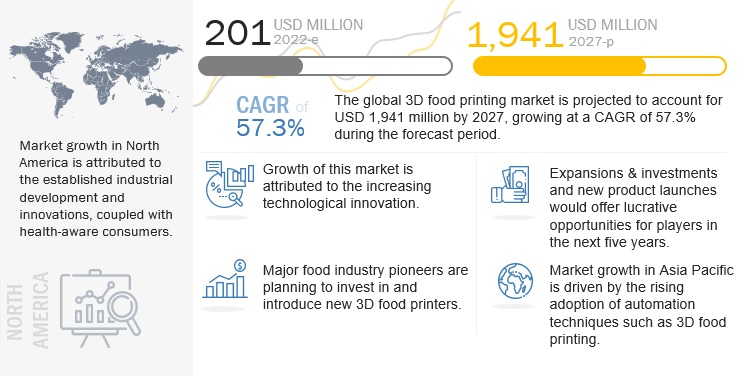

The global 3D food printing market size was reasonably estimated to be approximately $201 million in 2022 and is poised to generate revenue over $1,941 million by 2027, growing at a CAGR of 57.3% from 2022 to 2027

The global market is highly impacted by innovations, as manufacturers are always introducing new processing techniques to produce complex food products of different shapes and sizes, thereby focusing on catering to the increasing demand from the processed food industry and consumers.

Development of new machinery and enhancement of the existing ones are the key strategies adopted by many players in the market. In addition, increasing focus on the expansion of facilities, marketing schemes, and information exchange programs to create awareness and enhance the applications of 3D food printer is projected to contribute to the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 outbreak jeopardizes food security and nutrition from a variety of perspectives, including food chain disruption, food shortages, reduced purchasing power, unhealthy eating habits, increased food loss, and an increase in unemployment and underemployment. Furthermore, the lack of socializing with friends, colleagues, parents, and others while eating has resulted in stress, anxiety, fear, anguish, and worry, which has exacerbated the negative effects of COVID-19 on the health status of all people, particularly vulnerable consumers such as the elderly and hospitalized patients. 3D food printing has unrivaled and unique potential, allowing for personalized food manufacture, social distancing, decentralization of food manufacturing, people participation in food co-creation, socializing the process, and creating new businesses and jobs. These new ideas should assist in considerably reducing the spread of COVID-19, as well as the threats to people’s health and negative consequences for food security and society.

To begin with, 3D food printing maintains social distancing as required by regulations in the food site area due to its nature as a computer-aided technology. When generating, sculpting, testing, validating, and manufacturing food products, 3D food printing may reduce the number of people touching food before consumption, as well as inter-human contact. Furthermore, 3D food printing significantly supports food decentralization, allowing for a reduction in the number of persons participating in the food chain and thus a reduction in food contact. Lean manufacturing and just-in-time production, distribution, and storage strategies have formulated a low-cost food system, but the unusual and widely dispersed stresses of the pandemic economy unfolded the inability of this kind of system to respond quickly to disruptions that are far outside the normal range.

Market Dynamics

Drivers: Bourgeoning demand for gourmet food

3D food printing provides the ability to personalize food according to individual needs. The increasing market for customized food is a major reason for the growth of the 3D food printing market. The advancement in technology has made people busier with their work, and they often fail to experience their favorite food due to the shortage of time. This gives rise to the market for customized food; however, the customized food items need to be mixed with appropriate preservatives to keep them fresh. Frequent consumption of preservatives is not good for health in the long run. Thus, 3D food printing technology provides an option to have homemade freshly cooked food for the users.

The 3D food printer can print food in different complex designs, which is not possible manually. A 3D food printer comprises a food-grade syringe or cartridge that holds material, a real food item, and deposits exact fractional layers through a food-grade nozzle directly onto a plate or other surface in a layer-by-layer additive manner. This food can be a source of a healthy diet for children and adults who want to indulge in food such as chocolate, pizza, and pancakes in unique shapes and designs.

Restraints: Slow processing time involved

Processing time is one of the major restraints that the 3D food printing industry faces. The food that is printed using the 3D food printer takes much more time compared to traditional methods of preparation. The main reason for this slow printing time is that the printer has to maintain a high level of precision while printing food; the printed food needs to cool down first to be solid enough to eat. To print a small design of chocolate, the 3D food printer can take 30–45 minutes, and a consumer would not prefer wasting time on chocolate just for its unique design. Consumers would not prefer to wait for a long time to eat unique-shaped chocolate. Thus, the slow processing time of 3D food printers is a restraint to market growth

Opportunities: Growth in demand from the hospitality industry

The hospitality industry has shown huge interest in 3D food printing technology. The capability of the 3D food printers to print food in various complex designs, which is not possible manually, has gained the attention of many famous chefs around the world. According to the companies offering 3D food printers, it would provide chefs an opportunity to present food with various complex designs, which was not possible through the traditional preparation methods. Although the idea of the companies offering 3D food printers to replace microwaves with 3D food printers for household uses is far from reality, the users are likely to prefer to have food in various designs sometimes for fun. Thus, the hospitality industry is expected to provide ample opportunities for the 3D food printing market.

Challenges: limitations in processing different ingredients hamper usage of 3D printers

Limited availability of food ingredients is the major challenge that 3D food printer companies face. The 3D food printer cannot be commercialized on a large scale due to the unavailability of all the necessary food ingredients. The big market players such as Barilla (Italy) and Nestlé (Switzerland) associated with the food industry are working with 3D food printer manufacturing companies in developing ingredients of different nutrients composition for 3D food printers. This is not an easy task as the companies have to extract polymers from the food items that need to be printed, which are not easy to extract and require extensive research in this area. Thus, although the companies seem positive and excited about this new technology of 3D food printing, the prospects of the market depend on how soon the companies come up with various options for consumers.

Different countries across the globe have different food cuisines, and consumers in these countries prefer different food products made up of different ingredients. 3D food printers are highly specific in terms of food processing, ingredients, and final products. This is a challenge for players in the market as they need to develop 3D printers that cater to consumers’ needs in regions such as Asia and Africa. Similarly, there is also a need for the production and availability of ingredients that can be used to produce these different cuisines. Another similar challenge is that not every type of food can be food-printed. Food that is not strong enough to be filed is not appropriate for 3D printing. Food printers should go beyond the printing of shapes to printing food textures, both existing and new.

The carbohydrate segment is estimated to dominate the global 3D food printing market in 2022

By ingredient, the carbohydrate segment is estimated to dominate the global market in 2022. The carbohydrate segment is projected to witness significant growth due to the structural property of carbohydrates and increasing demand for customized carbohydrate-based products like 3D chocolates. Proteins are second largest segment followed by carbohydrate estimated acquire largest market during forecast period. The protein segment is projected to witness significant growth due to major demand of protein based products particularly plant based proteins.

The commercial segment is estimated to account for the largest share in the global market in 2021

By vertical, the commercial segment is estimated to account for the largest share in the market in 2022. Commercial segment is estimated to witness growth due to major demand of 3D printed food can be served through baking industry, restaurants, confectionaries and retail store. The companies are working on their products to make them more efficient so that they would be able to provide more options for customized food to the customers. For a instance, BeeHex, the company manufacturing the 3D pizza printers, has demonstrated the use of their Chef3D food printer to print pizzas in various shapes. Thus, the ability of 3D food printers to print food in complex designs to provide customized food would drive the market for 3D food printers in coming years with the developments in technology.

To know about the assumptions considered for the study, download the pdf brochure

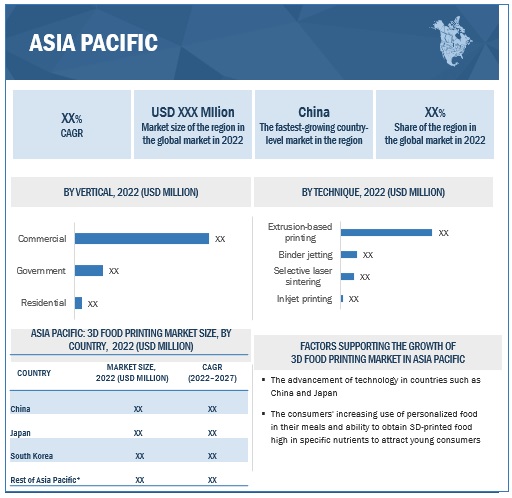

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period

The market in Asia Pacific is projected to grow at the highest rate with the reducing cost of the technology in the coming year. Countries such as China, South Korea, and Japan are working actively in the 3D food printing market, signifying the promising future for 3D food printing technology in the coming years

Leading Oraganizations Outlined:

Key players in this market include 3D systems (US), TNO (Netherlands), NATURAL MACHINES (Spain), Choc edge (UK), Systems & Materials Research Corporation (US), byFlow B.V. (Netherlands), beehex (US), CandyFab (US), ZMORPH S.A (Poland) and Wiiboox (China)

Target Audience:

- Government organizations

- Service providing company officials

- Government and research organizations

- Research officers

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

- Manufacturing and marketing companies

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 201 million |

|

Revenue forecast in 2026 |

USD 1941 million |

|

Growth Rate |

CAGR of 57.3 % From 2021-2026 |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2018-2027 |

|

Historical Base Year |

2021 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

North America |

|

Key companies profiled |

|

3D Food Printing Market Highlights

In this report, the overall 3D food printing market has been segmented based on offering, component, end user and region.

|

Aspect |

Details |

|

By Ingredient |

|

|

By Vertical |

|

|

By Technology |

|

|

By Region |

|

Recent Developments

- In September 2021, Zmorph announced a new collaboration with the Spanish company, Sicnova, to make its products available in Spain, Portugal, and Latin America (excluding Brazil) through Sicnova’s distributor network. The company was founded in 2007 and has specialized in additive manufacturing for many years. Its expertise is a valuable addition to the portfolio of Zmorph resellers

- In August 2021, SavorEat signed an agreement with Sodexo Operations, the American subsidiary of Paris-based food services and facilities management conglomerate Sodexo, to launch a pilot project in the US that would offer the startup’s kosher, vegan, gluten-free, allergen-free burger patties.

- In October 2020, Indukern’s food division announced a partnership with Natural Machines to offer ingredients and products designed specifically for Foodini, a kitchen appliance with 3D printing technology.

- In December 2019, Brill Inc., in partnership with 3D Systems, announced a new and innovative full-color, professional-grade culinary 3D printing system. The result of a multi-year collaboration, the new technology provided chefs the control over producing custom, cutting-edge culinary creations, limited only by their imagination.

- In May 2019, byFlow announced a collaboration with VDL Groep, making VDL Apparatenbouw responsible for the manufacturing and assembly of their 3D Food Printers. VDL Apparatenbouw, a subsidiary of VDL Groep, delved into precision engineering and subcontracting, with a global reputation in manufacturing high-specification products and materials.

Frequently Asked Questions (FAQ):

What is the projected market value of the global 3D food printing market?

The global 3D food printing market is poised to reach $1,941 million by 2027, growing at a CAGR of 57.3% from 2022 to 2027

What is the estimated growth rate (CAGR) of the global 3D food printing market for the next five years?

The global 3D food printing market is expected to grow at a CAGR of 6.0% during forecast year.

What are the major revenue pockets in the 3D food printing market currently?

The market in Asia Pacific is projected to grow at the highest rate with the reducing cost of the technology in the coming year. Countries such as China, South Korea, and Japan are working actively in the 3D food printing market, signifying the promising future for 3D food printing technology in the coming years

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.1.1 MARKET DEFINITION

1.2 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: 3D FOOD PRINTING MARKET

TABLE 1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 GEOGRAPHIC SCOPE

1.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN: 3D FOOD PRINTING MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 DEMAND-SIDE ASPECTS OF MARKET SIZING

2.2.2 BOTTOM-UP APPROACH

2.2.3 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 6 ASSUMPTIONS OF THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID–19 HEALTH ASSESSMENT

FIGURE 7 COVID–19: GLOBAL PROPAGATION

FIGURE 8 COVID–19 PROPAGATION: SELECT COUNTRIES

2.8 COVID–19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 12 3D FOOD PRINTING MARKET SIZE, BY INGREDIENT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SIZE, BY VERTICAL, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET SIZE, BY TECHNIQUE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 16 INCREASE IN DEMAND FOR CUSTOMIZED FOOD TO PROPEL THE MARKET

4.2 NORTH AMERICA: 3D FOOD PRINTING MARKET, BY INGREDIENT & COUNTRY

FIGURE 17 CARBOHYDRATES AND THE US TO ACCOUNT FOR THE LARGEST SHARES IN THE NORTH AMERICAN MARKET IN 2022

4.3 3D FOOD PRINTING MARKET, BY INGREDIENT

FIGURE 18 3D CARBOHYDRATE PRINTING TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY VERTICAL & REGION

FIGURE 19 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET, BY VERTICAL

FIGURE 20 COMMERCIAL USE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY TECHNIQUE

FIGURE 21 EXTRUSION-BASED PRINTING SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 3D FOOD PRINTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Bourgeoning demand for gourmet food

5.2.1.2 Higher focus on the development of nutritionally customized foods for enhanced health benefits

5.2.1.3 Rise in use of 3D printers in plant-based meat alternatives

5.2.1.4 Increase in adoption of 3D food printing to reduce food wastage

5.2.2 RESTRAINTS

5.2.2.1 Slow processing time involved

5.2.2.2 Lack of original flavor and texture

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in demand from the hospitality industry

5.2.3.2 Strong rise in innovations and developments in bioprinting for printing meat and seafood products

5.2.3.3 Increase in research initiatives for development of newer innovative 3D food printing models

5.2.4 CHALLENGES

5.2.4.1 Limitations in processing different ingredients hamper usage of 3D printers

5.2.4.2 Ongoing research & development of this technology indicates a low current market use

5.3 COVID-19 IMPACT ANALYSIS

6 INDUSTRY TRENDS (Page No. - 57)

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 23 3D FOOD PRINTING MARKET: VALUE CHAIN

6.2.1 RESEARCH & PRODUCT DEVELOPMENT

6.2.2 PROCESSING AND SOFTWARE IMPLEMENTATION

6.2.3 PRODUCT MANUFACTURING

6.2.4 DISTRIBUTION, MANUFACTURING, AND POST-SALES

6.3 MARKET ECOSYSTEM AND SUPPLY CHAIN

FIGURE 24 3D FOOD PRINTING MARKET: MARKET ECOSYSTEM

FIGURE 25 PRODUCT R&D AND PRODUCTION ARE VITAL COMPONENTS OF THE SUPPLY CHAIN

TABLE 3 3D FOOD PRINTING MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 26 3D FOOD PRINTING: MARKET MAP

6.4 TECHNOLOGY ANALYSIS

6.4.1 FOOD 3D BIOPRINTING

6.5 KEY CONFERENCES & EVENTS

TABLE 4 3D FOOD PRINTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS IN 2022

6.6 TRADE DATA

6.6.1 IMPORT SCENARIO

TABLE 5 IMPORT DATA FOR HS CODE 8443, BY COUNTRY, 2016–2020 (USD BILLION)

FIGURE 28 POTENTIAL IMPORTS OF 3D PRINTERS, BY COUNTRY, 2019

6.6.2 EXPORT SCENARIO

FIGURE 29 EXPORT DATA FOR HS CODE 8443, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 6 EXPORT DATA FOR HS CODE 8443, BY COUNTRY, 2016–2020 (USD BILLION)

FIGURE 30 POTENTIAL EXPORTS OF 3D PRINTERS, BY COUNTRY, 2019

6.7 AVERAGE SELLING PRICE (ASP) ANALYSIS

FIGURE 31 ASP ANALYSIS OF 3D PRINTERS, 2018–2027 (USD)

TABLE 7 ESTIMATED PRICE FOR KEY 3D FOOD PRINTER BRANDS

6.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 32 REVENUE SHIFT FOR THE 3D FOOD PRINTING MARKET

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 3D FOOD PRINTING MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 PATENT ANALYSIS

FIGURE 33 INCREASE IN PATENT GRANTS FOR 3D FOOD PRINTERS, 2010–2021

FIGURE 34 KEY APPLICANTS FOR 3D FOOD PRINTER PATENTS IN THE MARKET, 2019–2021

FIGURE 35 3D FOOD PRINTER PATENTS, BY KEY JURISDICTION, 2015–2022

TABLE 9 LIST OF IMPORTANT PATENTS FOR 3D FOOD PRINTER EQUIPMENT, 2019–2021

6.11 CASE STUDIES

TABLE 10 BYFLOW: INCREASING DEMAND FOR PERSONALIZED CHOCOLATES

TABLE 11 DOVETAILED: INCREASING DEMAND FOR LIQUID-BASED 3D FOOD PRINTER

6.12 REGULATORY AFFAIRS

6.12.1 EUROPE

6.12.1.1 Status of printed food

6.12.1.2 Marketing requirements

6.12.2 GLOBAL

6.12.3 THE DIFFERENT STANDARDS PERTAINING TO INDUSTRIAL 3D PRINTERS

6.12.3.1 ASTM International

TABLE 12 ASTM STANDARDS

7 3D FOOD PRINTING MARKET, BY INGREDIENT (Page No. - 80)

7.1 INTRODUCTION

FIGURE 36 THE CARBOHYDRATES SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 14 MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

7.2 COVID-19 IMPACT ON THE 3D FOOD PRINTING MARKET, BY INGREDIENT

7.2.1 OPTIMISTIC SCENARIO

TABLE 15 OPTIMISTIC SCENARIO: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

7.2.2 REALISTIC SCENARIO

TABLE 16 REALISTIC SCENARIO: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

7.2.3 PESSIMISTIC SCENARIO

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

7.3 DOUGH

7.3.1 RHEOLOGY OF DOUGH IS A DRIVER FOR 3D PRINTING

TABLE 18 3D DOUGH PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 3D DOUGH PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 FRUITS & VEGETABLES

7.4.1 FRUITS AND VEGETABLES ARE MAJOR SOURCES OF NUTRIENTS

TABLE 20 3D FRUIT & VEGETABLE PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 3D FRUIT & VEGETABLE PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 PROTEINS

7.5.1 DAILY NEED FOR PROTEIN AND EASY-TO-PRINT TEXTURE DRIVE THE SEGMENT

TABLE 22 3D PROTEIN PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 3D PROTEIN PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 SAUCES

7.6.1 INCREASE IN DEMAND FOR READY-TO-COOK FOOD DRIVES THE GROWTH OF SAUCES

TABLE 24 3D SAUCES PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 3D SAUCES PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 DAIRY PRODUCTS

7.7.1 CONSISTENCY AND MELTING PROPERTIES OF MILK AND MILK PRODUCTS ARE KEY FACTORS

TABLE 26 3D DAIRY PRODUCT PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 3D DAIRY PRODUCT PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.8 CARBOHYDRATES

7.8.1 CARBOHYDRATES ARE LARGELY USED DUE TO THEIR STRUCTURE

TABLE 28 3D CARBOHYDRATE PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 3D CARBOHYDRATE PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.9 OTHER INGREDIENTS

TABLE 30 3D OTHER FOOD INGREDIENT PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 3D OTHER FOOD INGREDIENT PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 3D FOOD PRINTING MARKET, BY VERTICAL (Page No. - 92)

8.1 INTRODUCTION

FIGURE 37 THE COMMERCIAL SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 33 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 COVID-19 IMPACT ON THE 3D FOOD PRINTING MARKET, BY VERTICAL

TABLE 34 OPTIMISTIC SCENARIO: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

8.2.1 REALISTIC SCENARIO

TABLE 35 REALISTIC SCENARIO: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

8.2.2 PESSIMISTIC SCENARIO

TABLE 36 PESSIMISTIC SCENARIO: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

8.3 GOVERNMENT

8.3.1 DEFENSE

8.3.1.1 3D printing may expect high demand from the defense sector for personalized meals

8.3.2 EDUCATION

8.3.2.1 Adulteration and malnutrition in public schools can drive the market in the education sector

8.3.3 EMERGENCY SERVICES

8.3.3.1 Emergency services fulfill the demand for food and nutrition insecurity

TABLE 37 3D FOOD PRINTING MARKET SIZE FOR GOVERNMENT VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 GOVERNMENT: 3D FOOD PRINTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 COMMERCIAL

8.4.1 RETAIL STORES

8.4.1.1 Improved logistics and increased modern retail stores help acquire 3D food printing

8.4.2 BAKERIES

8.4.2.1 Demand for fresh and artisan bread may increase the market for 3D food

8.4.3 CONFECTIONERIES

8.4.3.1 Popularity of chocolate in Europe fuels the growth and innovation of 3D confectioneries

8.4.4 RESTAURANTS

8.4.4.1 Consumer preference for quick-service restaurants is a driving factor for 3D printed food

TABLE 39 MARKET SIZE FOR COMMERCIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET SIZE FOR COMMERCIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

8.5 RESIDENTIAL

8.5.1 INNOVATIONS IN THIS SECTOR DRIVE THE GROWTH OF THE MARKET

TABLE 41 MARKET SIZE FOR RESIDENTIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET SIZE FOR RESIDENTIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

9 3D FOOD PRINTING MARKET, BY TECHNIQUE (Page No. - 101)

9.1 INTRODUCTION

FIGURE 38 THE EXTRUSION-BASED PRINTING SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 44 MARKET SIZE, BY TECHNIQUE, 2022–2027 (USD MILLION)

9.2 EXTRUSION-BASED PRINTING

9.2.1 EXTRUSION WOULD BE THE MOST AFFORDABLE TECHNIQUE BECAUSE OF ITS LOW COST

TABLE 45 EXTRUSION-BASED 3D FOOD PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 BINDER JETTING

9.3.1 CAKES AND OTHER BAKERY PRODUCTS TO DRIVE THE MARKET FOR BINDER JETTING

TABLE 47 BINDER JET 3D FOOD PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 SELECTIVE LASER SINTERING (SLS)/HOT-AIR SINTERING (HAS)

9.4.1 GROWTH OF YOUNG POPULATION DRIVES DEMAND FOR SELECTIVE LASER SINTERING (SLS) TECHNIQUE

TABLE 49 SELECTIVE LASER SINTERING 3D FOOD PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 INKJET PRINTING

9.5.1 HIGHER DEMAND FOR CUSTOMIZED FOOD DRIVES THE MARKET FOR INKJET PRINTING

TABLE 51 INKJET 3D FOOD PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 3D FOOD PRINTING MARKET, BY REGION (Page No. - 108)

10.1 INTRODUCTION

FIGURE 39 MARKET: GEOGRAPHIC SNAPSHOT OF MARKET SHARE PERCENTAGE, 2021

TABLE 53 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 COVID-19 IMPACT ON THE GLOBAL MARKET, BY REGION

10.2.1 OPTIMISTIC SCENARIO

TABLE 55 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 56 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 57 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: 3D FOOD PRINTING MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY TECHNIQUE, 2022–2027 (USD MILLION)

10.3.1 US

10.3.1.1 Industrial developments and innovations are leading the market growth

TABLE 66 US: 3D FOOD PRINTING MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 67 US: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Growth of the bakery industry is a key factor in Canada

TABLE 68 CANADA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Rise in adoption of customized foods and technology in restaurants driving the market growth

TABLE 70 MEXICO: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 71 MEXICO: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 EUROPE

FIGURE 41 SHARE OF COMPANIES IN THE FOOD AND DRINK INDUSTRY SECTOR (2018)

TABLE 72 EUROPE: 3D FOOD PRINTING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY TECHNIQUE, 2022–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Germany is a major contributor to the European food sector in terms of turnover

FIGURE 42 TURNOVER OF MAJOR EUROPEAN COUNTRIES FOOD & DRINK SECTOR, 2019

TABLE 80 GERMANY: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.2 UK

10.4.2.1 Innovative ideas propel the market for 3D-printed food in the UK

TABLE 82 UK: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 83 UK: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.3 NETHERLANDS

10.4.3.1 Presence of major 3D food printing companies leads to major market share

TABLE 84 NETHERLANDS: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 85 NETHERLANDS: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 Adoption of digital technologies drives the use of 3D food printing in Spain

TABLE 86 SPAIN: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 87 SPAIN: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 REST OF EUROPE

TABLE 88 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: 3D FOOD PRINTING MARKET SNAPSHOT

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY TECHNIQUE, 2022–2027 (USD MILLION)

10.5.1 CHINA

10.5.1.1 Advancements in technology fuel the growth of the 3D food printing market

TABLE 98 CHINA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 99 CHINA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.2 JAPAN

10.5.2.1 Aging population in the labor force adopts automation techniques such as 3D food printing

FIGURE 44 COUNTRIES WITH THE LARGEST SHARE OF THE POPULATION AGED 65 OR OVER, 2019

TABLE 100 JAPAN: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 101 JAPAN: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.3 SOUTH KOREA

10.5.3.1 Evolving landscape in South Korea’s 3D printing to drive the market

TABLE 102 SOUTH KOREA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 103 SOUTH KOREA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.4 REST OF ASIA PACIFIC

TABLE 104 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 106 ROW: 3D FOOD PRINTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 ROW: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 108 ROW: MARKET SIZE, BY INGREDIENT, 2018–2021 (USD THOUSAND)

TABLE 109 ROW: MARKET SIZE, BY INGREDIENT, 2022–2027 (USD THOUSAND)

TABLE 110 ROW: MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 111 ROW: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

TABLE 112 ROW: MARKET SIZE, BY TECHNIQUE, 2018–2021 (USD THOUSAND)

TABLE 113 ROW: MARKET SIZE, BY TECHNIQUE, 2022–2027 (USD THOUSAND)

10.6.1 SOUTH AMERICA

TABLE 114 SOUTH AMERICA: MARKET SIZE FOR 3D FOOD PRINTING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 SOUTH AMERICA MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 117 SOUTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

10.6.1.1 Brazil

10.6.1.1.1 Brazilian researchers focus on advancing the 3D food printing technology

TABLE 118 BRAZIL: MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 119 BRAZIL: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

10.6.1.2 Rest of South America

TABLE 120 REST OF SOUTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 121 REST OF SOUTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

10.6.2 MIDDLE EAST

10.6.2.1 Startups and innovations fuel the growth of the market

TABLE 122 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 123 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

10.6.3 AFRICA

10.6.3.1 South Africa projected to dominate Africa’s 3D food printing market

TABLE 124 AFRICA: MARKET SIZE, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 125 AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 145)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 126 OVERVIEW OF STRATEGIES DEVELOPED BY KEY PLAYERS

11.3 COVID-19-SPECIFIC COMPANY RESPONSE

11.3.1 3D SYSTEMS (US)

11.3.2 TNO (NETHERLANDS)

11.4 RANKING ANALYSIS

FIGURE 45 MARKET FOR 3D FOOD PRINTING: COMPANY RANKING ANALYSIS

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 46 3D FOOD PRINTING MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.5.5 PRODUCT FOOTPRINT

TABLE 127 COMPANY BY INGREDIENT FOOTPRINT

TABLE 128 COMPANY BY VERTICLE FOOTPRINT

TABLE 129 COMPANY REGIONAL FOOTPRINT

TABLE 130 OVERALL COMPANY FOOTPRINT

11.5.6 COMPETITIVE BENCHMARKING

TABLE 131 MARKET FOR 3D FOOD PRINTING: DETAILED LIST OF KEY MANUFACTURERS

11.6 COMPANY EVALUATION QUADRANT (END USERS)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 47 3D FOOD PRINTING MARKET: COMPANY EVALUATION QUADRANT, 2022 (END USERS)

11.7 DEALS AND OTHER DEVELOPMENTS

11.7.1 DEALS

TABLE 132 DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 157)

(Business overview, Products offered, Recent Developments, MNM view)*

12.1 3D FOOD PRINTER MANUFACTURERS

12.1.1 BYFLOW

TABLE 133 BYFLOW: BUSINESS OVERVIEW

TABLE 134 BYFLOW: PRODUCTS OFFERED

TABLE 135 BYFLOW DEALS: DEALS, 2019

12.1.2 TNO

TABLE 136 TNO: BUSINESS OVERVIEW

FIGURE 48 TNO: COMPANY SNAPSHOT

TABLE 137 TNO: PRODUCTS OFFERED

12.1.3 NATURAL MACHINES

TABLE 138 NATURAL MACHINES: BUSINESS OVERVIEW

TABLE 139 NATURAL MACHINES: PRODUCTS OFFERED

TABLE 140 NATURAL MACHINES: DEALS, 2019–2021

12.1.4 CHOC EDGE

TABLE 141 CHOC EDGE: BUSINESS OVERVIEW

TABLE 142 CHOC EDGE: PRODUCTS OFFERED

12.1.5 3D SYSTEMS

TABLE 143 3D SYSTEMS: BUSINESS OVERVIEW

FIGURE 49 3D SYSTEMS: COMPANY SNAPSHOT

TABLE 144 3D SYSTEMS: PRODUCTS OFFERED

TABLE 145 3D SYSTEMS: DEALS

12.1.6 SYSTEMS & MATERIALS RESEARCH CORPORATION

TABLE 146 SYSTEMS & MATERIALS RESEARCH CORPORATION: BUSINESS OVERVIEW

TABLE 147 SYSTEMS & MATERIALS RESEARCH CORPORATION: PRODUCTS OFFERED

12.1.7 PROCUSINI

TABLE 148 PROCUSINI: BUSINESS OVERVIEW

TABLE 149 PROCUSINI: PRODUCTS OFFERED

12.1.8 BEEHEX

TABLE 150 BEEHEX: BUSINESS OVERVIEW

TABLE 151 BEEHEX: PRODUCTS OFFERED

12.1.9 CANDYFAB

TABLE 152 CANDYFAB: BUSINESS OVERVIEW

TABLE 153 CANDYFAB: PRODUCTS OFFERED

12.1.10 ZMORPH

TABLE 154 ZMORPH: BUSINESS OVERVIEW

TABLE 155 ZMORPH: PRODUCTS OFFERED

TABLE 156 ZMORPH: DEALS

12.1.11 MYCUSINI

TABLE 157 MYCUSINI: BUSINESS OVERVIEW

TABLE 158 MYCUSINI: PRODUCTS OFFERED

12.1.12 WIIBOOX

TABLE 159 WIIBOOX: BUSINESS OVERVIEW

TABLE 160 WIIBOOX: PRODUCTS OFFERED

12.1.13 SAVOUREAT LTD

TABLE 161 SAVOUREAT LTD: BUSINESS OVERVIEW

TABLE 162 SAVOUREAT LTD: PRODUCTS OFFERED

TABLE 163 SAVOUREAT LTD: DEALS

12.1.14 3DESSERTS GRAPHIQUES

TABLE 164 3DESSERTS GRAPHIQUES: BUSINESS OVERVIEW

TABLE 165 3DESSERTS GRAPHIQUES: PRODUCTS OFFERED

12.2 3D FOOD PRINTING END USERS

12.2.1 BARILLA

TABLE 166 BARILLA: BUSINESS OVERVIEW

FIGURE 50 BARILLA: COMPANY SNAPSHOT

TABLE 167 BARILLA: PRODUCTS OFFERED

12.2.2 REDEFINE MEAT LTD

TABLE 168 REDEFINE MEAT LTD: BUSINESS OVERVIEW

TABLE 169 REDEFINE MEAT LTD: PRODUCTS OFFERED

12.2.3 THE SUGAR LAB

TABLE 170 THE SUGAR LAB: BUSINESS OVERVIEW

TABLE 171 THE SUGAR LAB: PRODUCTS OFFERED

12.2.4 NOVAMEAT

TABLE 172 NOVAMEAT: BUSINESS OVERVIEW

TABLE 173 NOVAMEAT: PRODUCTS OFFERED

12.2.5 OPEN MEALS

TABLE 174 OPEN MEALS: BUSINESS OVERVIEW

TABLE 175 OPEN MEALS: PRODUCTS OFFERED

12.2.6 FOOD INK

TABLE 176 FOOD INK: BUSINESS OVERVIEW

TABLE 177 FOOD INK: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 197)

13.1 INTRODUCTION

TABLE 178 ADJACENT MARKETS TO 3D FOOD PRINTING

13.2 LIMITATIONS

13.3 INDUSTRIAL 3D PRINTING MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 179 INDUSTRIAL 3D PRINTING MARKET SIZE, BY OFFERING, 2017–2026 (USD MILLION)

13.4 3D PRINTING MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 180 3D PRINTING MARKET SIZE, BY OFFERING, 2017–2026 (USD MILLION)

14 APPENDIX (Page No. - 200)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

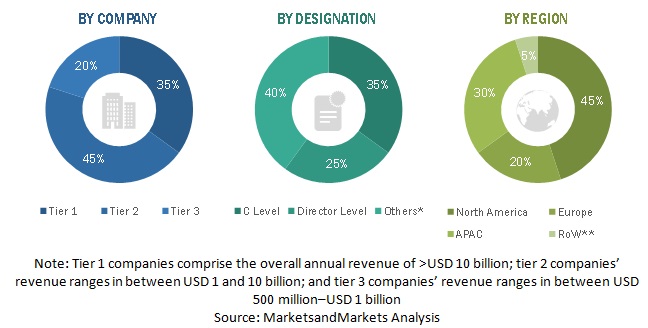

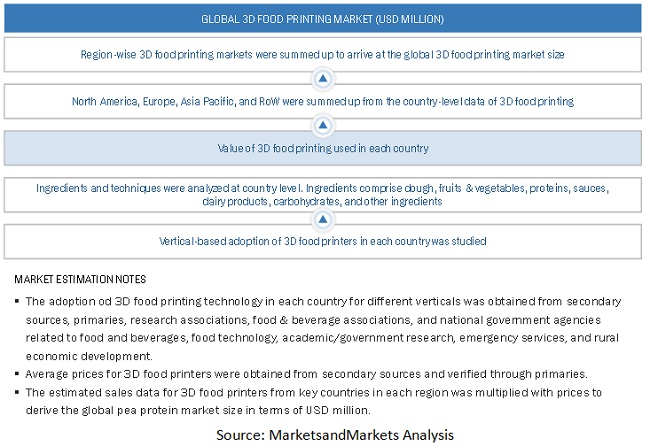

The study involves four major activities to estimate the current 3D food printing market size. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to in order to identify and collect information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, patent databases, gold & silver standard websites, food & beverage organizations, news articles, regulatory bodies, trade directories, and databases. The secondary research was used mainly to obtain key information about the industry’s supply chain, distribution channels, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The 3D food printing market comprises several stakeholders in the supply chain, which include product and solution providers, service providers, materials, and accessories provider. Extensive primary research was conducted after obtaining information about the market scenario through secondary research. Several primary interviews have been conducted with experts from the demand side (manufacturing companies, food processing companies, and government organizations) and supply side (suppliers and distributors, contractors, and supply chain vendors) across five major regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Approximately 70% and 30% of the primary interviews were conducted from the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the 3D food printing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size, which includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the 3D food processing market. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To define, segment, and project the global market size for 3D food printing market

- To understand the structure of the 3D food printing market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the four regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions & investments, new product launches, mergers & acquisitions, collaborations, and agreements

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Food Printing Market