Industrial 3D Printing Market by Offering (Printers, Materials, Software, Services), Application, Process, Technology, Industry (Aerospace & Defense, Automotive) and Geography (2024-2029)

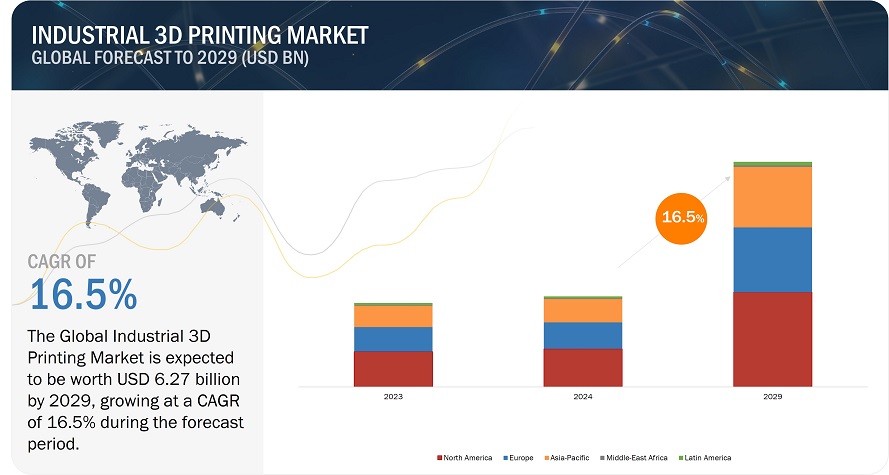

The global industrial 3D printing market is projected to reach USD 6.27 billion by 2029 from USD 2.92 billion in 2024, growing at a CAGR of 16.5%. The rapid growth in industrial 3D printing is because it can resolve key manufacturing challenges while creating new opportunities. This technology provides superior design by allowing users to create geometries that may be difficult to do with traditional methods. It offers efficiency through less material waste, optimized supply chains because of on-demand and local production, and accelerated prototyping and production cycles. Advanced materials such as high-performance polymers, metals, and composites further broaden the application base to aerospace, healthcare, automotive, and energy industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

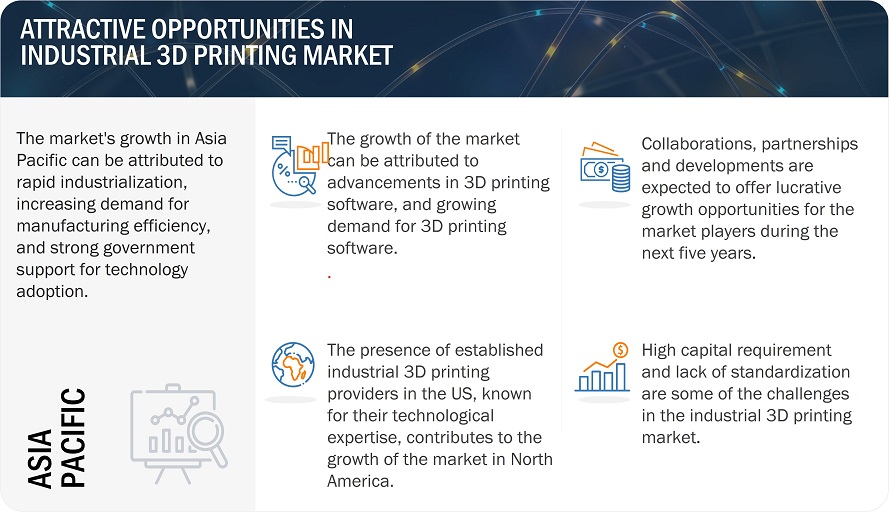

Driver: Advancements in 3D printing software

The major advancement fueling growth in industrial 3D printing is the improvement of the software. These enable high precision, efficiency, and easy access to manufacturing processes. Modern 3D printing software provides sophisticated design tools for optimization, such as topology optimization and generative design. These enable engineers to come up with lightweight yet strong structures. They minimize material usage besides offering better performance of the product. This ability is also instrumental in industries such as aerospace and automotive, where every unit of weight reduction impacts fuel efficiency and cost savings. Furthermore, enhanced simulation and analysis tools ensure that parts will meet stringent performance criteria before production, thus limiting costly iterations.

Apart from the above, software developments facilitate and simplify workflow integration of 3D printing into larger manufacturing operations. Tools for integrating, such as slicing, print management, and post-processing planning, allow manufacturers to streamline manufacturing production processes. It has enabled collaborative real-time engagement and remote and scalable monitoring; this allows further accessibility to dispersed teams or small businesses into 3D printing. Another advantage relates to the creation of applications related to multi-material and multi-process workflows to allow for a wider range of parts produced, such as complex, functional pieces.

Restraint: Lack of Standardization

The lack of standardization represents a significant restraint for the industrial application of 3D printing, which is, therefore, not yet widely adopted by industries. Compared to traditional manufacturing processes, which are defined by well-established standards of materials, processes, and quality assurance, 3D printing lacks consistent standards for these critical elements. This makes it difficult to meet repeatability, reliability, and interoperability, especially in industries such as aerospace, healthcare, and automotive sectors, where strict quality and safety regulations must be fulfilled.

For example, tensile strength, thermal conductivity, or resistance to chemicals are often dependent on the supplier or sometimes batch-to-batch; consequently, manufacturers cannot predict performance consistently. Similarly, machine configuration software and process parameters might differ from manufacturer to manufacturer, resulting in product variations at the end.

Opportunity: Increasing investments in core printing technologies and specialized software

The industrial 3D printing sector is growing significantly as more investment in core 3D printing technologies and specialized software increases the effectiveness of its approach toward solving complex manufacturing needs. Meanwhile, investments in application-specific 3D printing software transform design and production workflow. Modern software tools are designed with features that include topology optimization, generative design, and even real-time process simulation; manufacturers can thus create very optimized parts using minimal material waste. AI platforms add to this improved efficiency through failure prediction, optimization of print parameters, and guarantee of consistency in quality.

In other words, the synergy in hardware and software innovation offers the ability to enable multi-material and multi-process capabilities, thus opening up many applications for additive manufacturing. Venture capital and corporate R&D focused on these developments are making the industrial 3D printing ecosystem become more robust, driving the pace of adoption across industries and accelerating the shift toward digital, sustainable manufacturing.

Challenge: Ensuring consistant quality of final 3D product with repeatable and stable production process

The main challenge, however, in industrial 3D printing is in keeping the consistent quality of end products along with repeatable stability in the process. Unlike regular manufacturing, quality controls and repeatable, predictable outcomes from traditional approaches have not established controls here. It's especially sensitive to the differences in both materials and in settings on 3D machine environments, even some design file conditions. Small changes in the speed of print, layer height, temperature, or material properties lead to drastic deviations in product quality, and thus, it is rather challenging to ensure consistent output results, especially for more critical applications in industries like aerospace, healthcare, automotive, etc. Additionally, the nature of 3D printing processes, for example, layering in additive manufacturing, introduces structural weaknesses and defects such as warping or delamination and inconsistent material properties across parts of the same print. Lack of standardized processes also makes repeatability difficult because each printer, software, and material combination behaves differently.

Based on offering, printers segment is expected to dominate throughout forecast period

Printers are expected to dominate the industrial 3D printing market, as 3D printers basically form the basis of how additive manufacturing is carried out within most industries. Printers are at the core of this process, taking digital designs and turning them into reality in the physical world through precision, which is imperative for industries such as aerospace, automotive, healthcare, and manufacturing. As technology advances, industrial printers can handle a wide range of materials, including metals, polymers, ceramics, and composites, and produce high-quality, complex parts at higher speeds and with greater accuracy.

The demand for high-performance printers is highly influenced by rapid prototyping, customized production, and low-volume manufacturing that would be more difficult and costly to carry out through traditional methods. Additionally, printer capabilities are advancing to large build volumes, multi-material printing, and resolution in which industries aim to innovate and reduce cost in production processes. Industrial 3D printing further becomes an integral part of the smart manufacturing ecosystem. The demand rises with Industry 4.0 and automation to produce on demand, with locally sourced goods, while fitting smoothly into digital workflows.

Based on the industry, aerospace & Defense segment to to dominate throughout forecast period

Aerospace and defense is likely to capture the largest share of industrial 3D printing due to the industry's strong need for lightweight, complex, and high-performance parts, which are difficult to make through traditional manufacturing. Three-dimensional printing allows for internal geometries such as lattices and complex inner channels that reduce weight with the strength required in an aerospace application. This capability allows for more effective aircraft designs and results in lighter, stronger parts. That is particularly important for the aerospace market.

The defense industry also needs specialized, low-run, high-precision parts that are unique to applications, such as UAVs and military-grade components, but also critical spare parts. 3D printing provides a cost-effective and flexible solution to these needs: it enables rapid prototyping, on-demand production, and quick iteration in design. Another important factor is that 3D printing can support rapid prototyping and low-volume production of complex parts, reducing lead times and overall production costs. Such is critical in aerospace and defense industries, which conduct operations very rapidly and are very competitive. Stringent regulations of the aerospace and defense industries also embrace additive manufacturing. The 3D printed parts meet rigorous safety and certification standards, further driving the sector's share of the industrial 3D printing market.

Based on region, North America is expected to dominate during forecast period

North America is expected to emerge as a dominant player in the industrial 3D printing market in the coming years. The reasons driving its success are many in number and strong, such as robust innovation, substantial investments, and an already developed manufacturing base. The region experiences extensive research and development activity. Huge investments are done towards finding new 3D printing technologies and its possible applications. Specifically, the United States government supports innovation in these sectors through research grants, incentives, and public-private partnerships in defense, aerospace, and healthcare, which support the adoption of industrial 3D printing. The growing interest in customized production and low-volume production for areas of healthcare, automotive, and aerospace industries has enabled the use of 3D printing for prototype development, product designing, and manufacture of spare parts.

North America is one of the major players globally in 3D printing. Due to its highly developed infrastructure, it has plays major role in global 3D printing. The integration of IoT and Industry 4.0 initiatives through smart manufacturing practices has furthered its hold on industrial 3D printing. These factors are fueling the growth in the region.

Key Market Players

The industrial 3D Printing market is dominated by a few globally established players, such as Stratasys (US), 3D Systems (US), Materialise (Belgium), EOS (Germany), GE Additive (US), Exone (US), Voxeljet (Germany), SLM Solutions (Germany), Envisiontec (Germany), HP (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017—2026 |

|

Base year |

2020 |

|

Forecast period |

2021—2026 |

|

Units |

Value (USD Billion/Million), Volume (Units) |

|

Segments covered |

Offering, Process, Technology, Application, Industry, and Geography |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Stratasys (US), 3D Systems (US), Materialise (Belgium), EOS (Germany), GE Additive (US), ExOne (US), voxeljet (Germany), HP (US), SLM Solutions (Germany), Renishaw (UK), Protolabs (US), CleenGreen3D (Ireland), Optomec (US), Groupe Gorgé (France), Ultimaker (The Netherlands), Beijing Tiertime (China) XYZprinting (Taiwan), Höganäs (Sweden), Covestro (Royal DSM) (Germany), Desktop Metal (US), Nano Dimension (Israel), Formlabs (US), Carbon (US), TRUMPF (Germany), and Markforged (US) |

This report categorizes the industrial 3D printing market based on offering, process, technology, application, industry, and geography.

Industrial 3D Printing Market, by Offering:

- Printers

- Materials

- Software

- Services

- Impact Of COVID-19 On 3D Printer Offerings

Industrial 3D Printing Market Market, by Process:

- Binder Jetting

- Direct Energy Deposition

- Material Extrusion

- Material Jetting

- Powder Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

Industrial 3D Printing Market Market, by Technology:

- Sterorlithography

- Fused Modelling Deposition (FDM)

- Selective Laser Sintering (SLS)

- Direct Metal Laser Sintering (DMLS)

- Polyjet Printing

- Inkjet Printing

- Electron Beam Melting (EBM)

- Laser Metal Deposition (LMD)

- Digital Light Processing (DLP)

- Laminated Object Manufacturing (LOM)

- Others

Industrial 3D Printing Market Market, by Application:

- Prototyping

- Manufactruing

- High Voltage

Industrial 3D Printing Market Market, by Industry:

- Automotive

- Aerospace & Defense

- Food & Culinary

- Printed Electronics

- Foundry & Forging

- Healthcare

- Jewelry

- Oil & Gas

- Consumer Goods

- Others

- Impact of COVID-19 on various industries

Industrial 3D Printing Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

Recent Developments

- In April 2024, HP and DyeMansion have established a strategic collaboration, combining HP’s 3D printing technology with DyeMansion’s postprocessing workflows. Under this partnership, HP will promote DyeMansion’s postprocessing solutions as the preferred choice for customers seeking large-scale production of end-use parts.

- In January 2024, ABB Robotics has partnered with Simpliforge Creations, an additive manufacturing solutions company, to enhance and accelerate the development of 3D printing technologies for the Indian construction industry.

- In June 2023, Nuburu, a leader in industrial blue laser technology, has entered into a joint technology agreement with GE Additive to investigate the speed, precision, and commercial advantages of blue laser-based metal 3D printing.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of industrial 3D printing based on application?

Market for prototyping is expected to hold a larger share of the industrial 3D printing market during the forecast period. Although large corporations have been utilizing 3D printers to prototype products for years, they have also become an open prototyping tool for smaller businesses as their costs have declined substantially. However, the market for manufacturing application is expected to grow at a higher CAGR during the forecast period. Advancements in 3D printing technology, equipment, and materials have consequently reduced their costs, making them a more feasible option for general manufacturing applications.

Which 3D printing materials is expected to have high market value by 2029?

3D printing materials have been the focal point of advancements. In the thermoplastics market, high-performance polymers such as polyether ether ketone (PEEK), polyetherketoneketone (PEKK), and ULTEM are being adopted for their unique properties. On the other hand, metal powder production process is expensive for the AM process. However, it is essential for the industrialization of metal 3D printing and the manufacturing of certified parts.

How will 3D printing software developments in change the market landscape in the future?

The software used for designing and product development are becoming highly advanced, enabling generative design and topology optimization. Although design and simulation solutions are dominating the software space, workflow software as a subcategory has emerged in the past 5 years. In the past 2 years, end users have shown a high interest in software used in 3D printing.

How will 3D printing technologies assist hybrid manufacturing?

Hybrid manufacturing machines are equipped with manufacturing technologies and are integrated with a directed energy deposition (DED) head for depositing metal powder or substrate. These allow manufacturers to produce highly accurate finished parts and reduce errors followed by additive manufacturing. Apart from this, the powder bed fusion (PBF) additive manufacturing process is integrated with CNC machining to process polymers in hybrid manufacturing.

What are the key factors influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The industrial 3D printing market is expanding beyond the development of 3D printer hardware. Investments in core printing technologies and specialized software, advanced materials, and application development have renewed interest in the technology and led to the emergence of several startups. Thus, the strategic and financial venture capital investments in 3D printing offerings have increased dramatically in recent years, especially for materials and software development in 3D printing. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

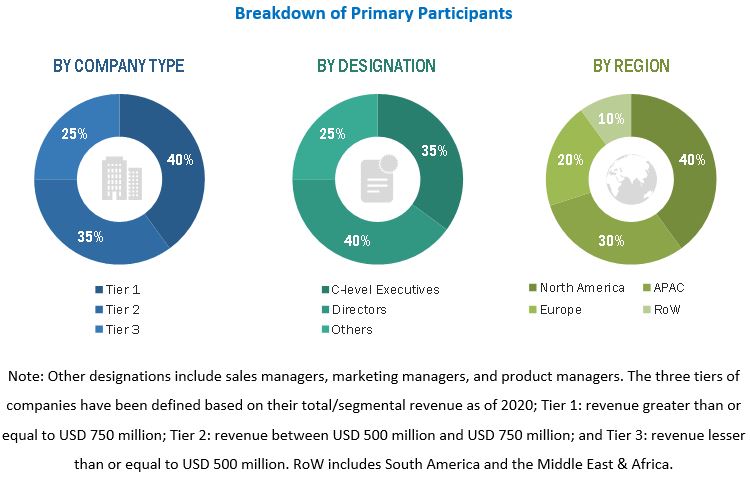

The study involved four major activities in estimating the size for the industrial 3D printing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, related journals, and certified publications; articles by recognized authors; gold and silver standard websites; directories; and databases like Factiva.

Secondary research was mainly conducted to obtain key information about the industry supply chain, the market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the industrial 3D printing market.

Extensive primary research was conducted after obtaining information about the industrial 3D printing market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides. Primary data has been mainly collected through telephonic interviews, which constitute approximately 80% of the overall primary interviews. Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods for estimating and forecasting the size of the industrial 3D printing market and its segments and subsegments listed in this report. The key players in the market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews of the industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Industrial 3D Printing Market: Bottom-Up Approach

Data Triangulation:

After arriving at the overall size of the industrial 3D printing market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the industrial 3D printing market, in terms of value, segmented by offering, process, technology, application, industry, and region

- To describe and forecast the market size, in terms of value, for four major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the value chain, market and technology trends, product pricing, patents, use cases, and impact of COVID-19 on the industrial 3D printing market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the industrial 3D printing market

- To benchmark market players using the competitive leadership mapping framework, which analyzes market players based on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, expansions, partnerships, agreements, and collaborations, in the industrial 3D printing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial 3D Printing Market

We are researching the expected growth in industrial 3D printing as we are building our business model for future years. I would like to understand the trends in the industries such as automotive and aerospace applications.

We are a company which do graphics and 3D work for national and international clients. For expansion we need to understand the geographic locations where we can expand our business and the growth in next 5-6 years. How industrial 3D printing can explore the market for the same? Apart from this, which are the major target industries for 3D printing?

I am currently pursuing a master’s degree in Management & Technology in Germany. In the course of a project my team and me are working within the area of additive manufacturing of high performance polymers with a special focus on medical applications. I was hoping to speak to you as an expert in the field. I am specifically interested in experience you have with market dynamics and trends of medical additive manufacturing. I would be very happy if I would get the chance to discuss this topic with you or one of your colleagues. I’d like to set up a brief call (~15 min) during the next week. I am flexible in date and time. If you're interested, please let me know how and when I can best reach you.

The customers (including their Industries/Verticals) that are served by Industrial 3D Printer Manufacturers. Also, the current methods Industrial 3D Printer Manufacturers are currently using to market their products to these customers. Does this affect the major applications for this market?

Hi, I'm looking into starting my own 3D printing material supply company and would like to study the industry dynamics and understand the strong demand zones by country, by industry and by material requirement. Any help and guidance in this regard will be really appreciated.