Aerospace 3D Printing Market by Offerings(Printers, Materials, Services, Software), Technology, Platform(Aircraft, UAVs, Spacecraft), Application(Prototyping, Tooling, Functional Parts), End Product, End User(OEM, MRO), & Region (2021-2026)

Updated on : Oct 22, 2024

The Aerospace 3D Printing Market is experiencing rapid growth, driven by increasing demand for lightweight, cost-effective components and the ability to create complex, customized parts with greater precision. Technological advancements in additive manufacturing, including improved materials and faster printing speeds, are transforming the aerospace industry by enhancing production efficiency and reducing lead times. The adoption of 3D printing in aerospace allows for reduced material waste and optimized designs that contribute to fuel efficiency and overall performance. As the industry continues to innovate, the integration of 3D printing is expected to expand further, offering significant opportunities for manufacturers and suppliers.

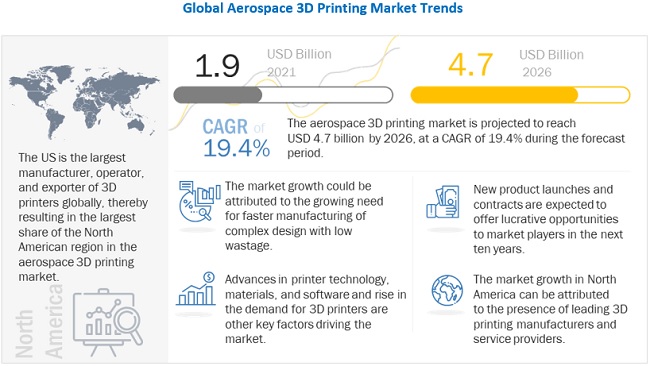

The Aerospace 3D Printing Market projected to reach USD 4.7 billion by 2026, it is expected to grow at a CAGR of 19.4% during the forecast period. The demand for aerospace 3D printing is projected to be driven by the low volume production of aircraft components in the aerospace industry, rising demand for lightweight components, the need to reduce the production time of components, and the requirement for cost-efficient and sustainable products. The requirement for rapid prototyping is expected to fuel the growth of the aerospace 3D printing market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Electric Aircraft Market

COVID-19 has affected almost every industry, especially aerospace. The immediate drop in the demand to manufacture aircraft and disruptions in raw materials have adversely affected the industry. Limitations in cross-border movements, disruptions in manufacturing and transportation, constrained supply chains triggering supply delays, and massive slowdowns in production over the first quarter of 2020 have also affected the industry.

In commercial aviation, companies are experiencing disruptions in production and a slump in demand due to the lack of laborers, less travel by passengers, and customers postponing the delivery of new aircraft. Demand for spare parts is also down as less maintenance is required. According to the Boeing 2019 Q2 report, the revenues for the first half (H1) 2019 vs. H1 2018 were down 19% and commercial aircraft deliveries for the same time were down 37%.

Aerospace 3D Printing Market Dynamics

Drivers: Demand for lightweight parts and components from aerospace industry

Aircraft, rockets, satellites, and their relative components are considerably heavy, which mainly increases the cost of their operations. A heavy aircraft consumes more fuel and incurs additional costs in terms of environmental pollution through high carbon dioxide emissions. It has been observed that fuel costs comprise around 35% of the total costs of airline operators. 3D printing can be used to manufacture engine parts, fuselage parts, and other relative parts used in an aircraft. For instance, Airbus Group uses DMLS 3D printing technology to create improved nacelle hinge brackets fitted in the Airbus A320. This has reduced the weight of the aircraft’s parts by 30% to 50% while keeping their strength and performance intact. The use of this technology has reduced the weight of the aircraft by 10 kilograms.

Satellites with less physical weight are given higher preference in space missions as their weight directly affects the costs involved in manufacturing components. For instance, if the weight of a satellite component is 1 kilogram, it would cost the satellite manufacturer around USD 21,000 to put it into orbit. Materialise NV (Belgium) manufactured titanium components, which are 66% lighter using 3D printing, rather than conventional manufacturing. On May 2021, NASA announced a partnership of its Robotic Deposition Technology (RDT) team with Aerojet Rocketdyne, an American rocket and missile propulsion manufacturer, to advance its 3D printing, specifically metal additive manufacturing, technologies.

Opportunities: Development of advanced 3D printing technologies requiring less production time

The traditional processes employed for the manufacturing of aerospace components take more time as compared to 3D printing. The development of new 3D printing technologies allows quicker production of parts and components, which may otherwise take months or years to be manufactured, thereby reducing their production time. CLIP (Continuous Liquid Interface Production) is one of the recent 3D printing technologies used for manufacturing parts and objects through continuous production. It eliminates layer by layer processes, unlike other 3D printing technologies, such as SLA and SLS. Another technology is DMLS, which uses powdered metals instead of powdered thermoplastics for creating metal components. These technologies can develop products at a rate hundred times faster than other 3D printing technologies.

Challenges: High volume production of aerospace components is slower as compared to traditional manufacturing

In traditional manufacturing of aerospace components, an increase in production volume results in reduced manufacturing costs, while the speed at which the production is carried out remains intact. However, in 3D printing technology, the manufacturing costs increase along with an increase in the production scale, thus making the technology more suitable for low production volume. The costs involved in running and procuring 3D printing machines and the cost of raw materials used in 3D printing are higher compared to those in the case of conventional manufacturing. This factor poses a challenge to the growth of the aerospace 3D printing market, although it can be overcome by reducing the costs of raw materials used for 3D printing.

The need for cost-efficient custom printing and manufacturing would be one of the factors leading to the growth of the offerings segment.

The printer segment is expected to dominate the segment in the initial years of the forecasted period. The service segment is expected to lead the market by 2026 over the printer segment. The need for cost-efficient custom printing and manufacturing would be one of the factors leading to the growth of the segment. Most companies would outsource additively manufactured parts to 3D printing companies and need extensive after-sales service once the demand for 3D printed parts increases. These factors would lead to the growth of the service segment in the market.

The Material Extrusion or Fusion Deposition Modeling (FDM) segment is projected to witness the highest CAGR during the forecast period.

Based on technology, the Material Extrusion or Fusion Deposition Modeling (FDM) segment is expected to dominate the aerospace 3D printing market The extrusion process is fast and efficient at producing large volumes of continuous shapes in varying lengths with minimum wastage. The ability to manufacture complex shapes with varying thickness, textures, and colors is a major advantage of this process.

The Aircraft Segment is projected to witness the highest CAGR during the forecast period.

Based on platform, The aircraft segment is projected to dominate the aerospace 3D printing market, by platform, during the forecast period. The maximum number of developments would occur on an aircraft. The need for lightweight, cost-efficient aircraft and the need for fast manufacturing of complex parts would drive the adoption of 3D printers in aircraft manufacturing.

The engine component segment is projected to witness the highest market share during the forecast period

Based on the end products, the engine components segment is witnessing the highest market share for the aerospace 3D printing market during the forecast period. Ease of designing, improved strength, lightweight, and durability of the components manufactured, as well as their cost-effectiveness, contribute to the growth of end products

The functional parts is projected to witness the highest CAGR during the forecast period

Based on application, The prototyping segment is projected to lead the aerospace 3D printing market from 2021 to 2026. However, the functional parts segment is expected to grow at the largest CAGR during the forecast period. The growth of the functional parts segment can be attributed to the advancements in 3D printing technology and the increasing adoption of 3D printers into manufacturing processes across industries.

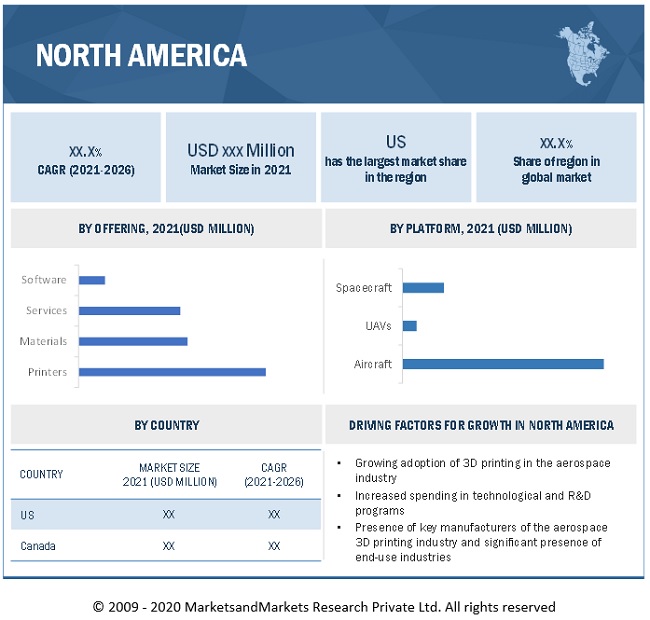

The North American market is projected to contribute the largest share from 2021 to 2026

The North American region is estimated to account for the largest share of 47.7% of the global aerospace 3D printing market in 2021. It is projected to record a CAGR of 18.6% during the forecast period, driven by the increasing adoption of 3D printing technology for manufacturing complex 3D components that are light in weight. Moreover, manufacturers of aircraft components and aircraft are switching to 3D printing technology to produce low-volume parts, thus fueling the growth of the aerospace 3D printing market.

To know about the assumptions considered for the study, download the pdf brochure

The key manufacturers in the aerospace 3D printing market include Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), EOS GmbH (Germany), Norsk Titanium AS (Norway), Ultimaker B.V. (Netherlands), and EnvisionTec GmbH (Germany), etc.

Aerospace 3D Printing Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 1.9 Billion |

| Revenue Forecast in 2030 | USD 4.7 Billion |

| Growth Rate | 19.4% |

|

Forecast period |

2021-2030 |

|

Market size available for years |

2017–2030 |

|

Base year considered |

2020 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Offerings, By Platform, By Technology, By Application, By End Product, By End User, |

|

Geographies covered |

|

|

Companies covered |

Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), EOS GmbH (Germany), Norsk Titanium AS (Norway), Ultimaker B.V. (Netherlands), and EnvisionTec GmbH (Germany), |

The study categorizes the aerospace 3D printing market based on Type, System, Aircraft Type, End User, and Region.

By Offerings

- Printers

- Materials

- Services

- Software

By Technology

- Polymerization

- Powder Bed Fusion

- Material Extrusion Or Fusion Deposition Modeling (Fdm)

- Others

By Platform

- Aircraft

- UAVs

- Spacecraft

By End Product

- Engine Components

- Structural Components

- Others

By End User

- OEM

- MRO

By Application

- Prototyping

- Tooling

- Functional Parts

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In May 2021, Materialise announced its qualification by Airbus to manufacture flight-ready parts using laser sintering technology. The material used in the process, produced by EOS, is a flame-retardant polyamide (PA 2241 FR). With this development, Materialise, and EOS became the first suppliers to be qualified by Airbus to produce laser sintered parts under the Airbus Process Specification AIPS 03-07-022. Materialise now offers two 3D printing technologies approved by Airbus for flight-ready parts.

- In December 2020, Norsk Titanium announced production deliveries of new Boeing 787 Dreamliner components to Leonardo’s Grottaglie Plant, based in South Italy and part of Leonardo’s Aerostructures Division. This delivery adds a third production customer to Norsk’s growing commercial aerostructures customer base and represents Norsk’s first recurring production order from a European Union-based Aerospace company.

- In June 2019, Stratasys entered into a seven-year agreement with Boom Supersonic, a Colorado-based company that builds the fastest supersonic airliner, to accelerate the adoption of additive manufacturing for 3D-printed flight hardware.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aerospace 3D printing market?

The aerospace 3D printing market is expected to grow substantially. The demand for aerospace 3D printing is projected to be driven by the low volume production of aircraft components in the aerospace industry, rising demand for lightweight components, the need to reduce the production time of components, and the requirement for cost-efficient and sustainable products.

What are the key sustainability strategies adopted by leading players operating in the aerospace 3D printing market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aerospace 3D printing market. The key manufacturers in the aerospace 3D printing market include Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), EOS GmbH (Germany), Norsk Titanium AS (Norway), Ultimaker B.V. (Netherlands), and EnvisionTec GmbH (Germany), etc. These players have adopted various strategies, such as acquisitions, contracts, new product launches, and partnerships & agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aerospace 3D printing market?

Aerospace 3D printing has come a long way since it was introduced for the first time in 1980. The technology is witnessing rapid changes in the development of complex aerospace components and aerostructures. The applications of 3D printing range right from printing prosthetics for jaws, kidneys, and legs to printing UAVs, cars, and aircraft components. In the aerospace industry, the emphasis is currently on reducing the weight of aircraft by using 3D printing to print complex niche and low volume parts.

For decades, aerospace 3D printing has been evolving significantly to cater to mass customization requirements, thereby resulting in the reduction of assembling time. The technology serves as a cost-effective low-volume production process, which offers designing flexibility. In the near future, printing entire wings of aircraft or even printing an entire aircraft will be possible using 3D printing technologies.

Who are the key players and innovators in the ecosystem of the aerospace 3D printing market?

The key players in the aircraft pumps market include Airbus SE (Netherlands), Elbit Systems Ltd. (Israel), and AeroVironment, Inc (US). The key manufacturers in the aerospace 3D printing market include Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), EOS GmbH (Germany), Norsk Titanium AS (Norway), Ultimaker B.V. (Netherlands), and EnvisionTec GmbH (Germany), etc.

Which region is expected to hold the highest market share in the aerospace 3D printing market?

The North American region is estimated to account for the largest share of 47.7% of the global aerospace 3D printing market in 2021. It is projected to record a CAGR of 18.6% during the forecast period, driven by the increasing adoption of 3D printing technology for manufacturing complex 3D components that are light in weight. Moreover, manufacturers of aircraft components and aircraft are switching to 3D printing technology to produce low-volume parts, thus fueling the growth of the aerospace 3D printing market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AEROSPACE 3D PRINTING MARKET SEGMENTATION

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AEROSPACE 3D PRINTING MARKET

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY & PRICING

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

FIGURE 2 AEROSPACE 3D PRINTING MARKET TO GROW FASTER THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market Size Estimation

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE & SUPPLY SIDE)

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE FACTORS

2.6 RISKS

2.7 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 PRINTERS SEGMENT TO DOMINATE AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2021–2026 (USD MILLION)

FIGURE 9 FDM SEGMENT TO LEAD AEROSPACE 3D PRINTING MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 10 AIRCRAFT SEGMENT TO COMMAND LARGEST SHARE, BY PLATFORM, 2021–2026 (USD MILLION)

FIGURE 11 NORTH AMERICA TO LEAD AEROSPACE 3D PRINTING MARKET, 2021-2026

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE AEROSPACE 3D PRINTING MARKET

FIGURE 12 FASTER MANUFACTURING OF COMPLEX DESIGNS AND LOW WASTAGE DRIVE MARKET, 2O21-2026

4.2 MARKET, BY OFFERING

FIGURE 13 SERVICE SEGMENT PROJECTED TO LEAD MARKET, 2021-2026

4.3 AEROSPACE 3D PRINTING MARKET, BY APPLICATION

FIGURE 14 FUNCTIONAL PARTS TO DOMINATE MARKET, 2021-2026

4.4 MARKET, BY END PRODUCT

FIGURE 15 ENGINE COMPONENTS TO LEAD PRODUCT MARKET, 2021-2026

4.5 AEROSPACE 3D PRINTING MARKET, BY END USER

FIGURE 16 OEM SEGMENT PROJECTED TO DOMINATE MARKET, 2021-2026

4.6 MARKET, BY TOP COUNTRIES

FIGURE 17 HIGHEST CAGR PROJECTED IN JAPANESE AEROSPACE 3D PRINTING MARKET, 2021-2026

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 AEROSPACE 3D PRINTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Short supply chain of aerospace components

5.2.1.2 Demand for lightweight parts and components from aerospace industry

5.2.1.3 Aerospace 3D printing technologies to manufacture complex aerospace parts

5.2.1.4 Need for low volume production from aerospace industry

5.2.2 RESTRAINTS

5.2.2.1 Limited types of raw materials for 3D printing

5.2.2.2 Stringent industry certifications

5.2.3 OPPORTUNITIES

5.2.3.1 Development of advanced 3D printing technologies requiring less production time

FIGURE 19 CLIP VS. OTHER 3D PRINTING TECHNOLOGIES

5.2.3.2 3D printing as a service

5.2.4 CHALLENGES

5.2.4.1 High volume production of aerospace components is slower as compared to traditional manufacturing

5.2.4.2 Ensuring product quality

5.2.4.3 Threat of copyright infringement

5.3 IMPACT OF COVID 19 ON AEROSPACE 3D PRINTING

5.4 RANGE AND SCENARIOS

5.5 TECHNOLOGY TRENDS

5.5.1 SHIFT TOWARD SERVICE PROVIDERS FOR FUNCTIONAL PARTS

5.5.2 ENTRY OF PRINTING GIANTS INTO THE AEROSPACE 3D PRINTING MARKET

5.5.3 LARGE SCALE AEROSPACE 3D PRINTING

5.6 AEROSPACE 3D PRINTING MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

5.6.4 AFTER SALE SERVICE PROVIDERS

FIGURE 20 AEROSPACE 3D PRINTING MARKET ECOSYSTEM

TABLE 2 MARKET ECOSYSTEM

5.7 DISRUPTION IMPACTING CUSTOMER BUSINESSES

FIGURE 21 AEROSPACE 3D PRINTING MARKET ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS OF AEROSPACE 3D PRINTING ECOSYSTEM

5.8.1 RESEARCH & DEVELOPMENT

5.8.2 MATERIAL & SOFTWARE PLAYERS

5.8.3 MANUFACTURING

5.8.4 SERVICE PROVIDER

5.8.5 END USERS

5.8.6 AFTER-SALE SERVICE

5.9 CASE STUDY ANALYSIS

5.9.1 BOOM SUPERSONIC USES 3D PRINTED PARTS IN ITS COMMERCIAL AIRCRAFT

5.9.2 TRUMPF USES 3D PRINTING FOR SATELLITE & AIRCRAFT PRODUCTION

5.9.3 UTC AEROSPACE 3D PRINTING

5.9.4 DLR (GERMAN SPACE AGENCY) INCORPORATING ADDITIVE MANUFACTURING TO OPTIMIZE FLUID DYNAMICS

5.9.5 ASTROBOTIC USES 3D PRINTING FOR LUNAR AND SPACE APPLICATIONS

5.10 TRADE DATA ANALYSIS

TABLE 3 IMPORTS DATA FOR HS CODE 8443, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 4 EXPORTS DATA FOR HS CODE 8443, BY COUNTRY, 2016–2020 (USD BILLION)

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES IMPACT ON THE AEROSPACE 3D PRINTING MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 COMPETITIVE RIVALRY IN INDUSTRY

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 SAE STANDARDS

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

6.2.1 3D PRINTING IN SPACE EXPLORATION MISSIONS

6.2.2 INNOVATIONS IN MATERIALS USED FOR 3D PRINTING

6.2.3 INNOVATION IN 3D PRINTING TECHNOLOGIES

6.2.4 4D PRINTING

6.2.5 ARTIFICIAL INTELLIGENCE

6.3 INNOVATIONS & PATENT REGISTRATIONS

TABLE 6 INNOVATIONS & PATENT REGISTRATIONS

6.4 IMPACT OF MEGATRENDS

7 AEROSPACE 3D PRINTING MARKET, BY OFFERING (Page No. - 82)

7.1 INTRODUCTION

FIGURE 24 SERVICES SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 7 AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 8 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 PRINTERS

FIGURE 25 DESKTOP PRINTER SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 9 AEROSPACE 3D PRINTER MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 AEROSPACE 3D PRINTER MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2.1 DESKTOP PRINTERS

7.2.1.1 Increased use in designing and prototyping in aerospace industry will drive this segment

7.2.2 INDUSTRIAL PRINTERS

7.2.2.1 Industrial printers are used to generate concept models, precision and functional prototypes, master patterns and molds for tooling, and real end-use parts

7.3 MATERIALS

FIGURE 26 PLASTIC SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 AEROSPACE 3D PRINTING MATERIALS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 12 AEROSPACE 3D PRINTING MATERIALS MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.3.1 TITANIUM

7.3.1.1 Titanium powder is sintered together by a laser to produce end-use metal parts that are as good as machined models

7.3.2 STEEL

7.3.2.1 Steel provides a significant level of strengthening to the 3D printed model

7.3.3 ALUMINUM

7.3.3.1 Alumide is commonly used to build complex, small series, and functional models

7.3.4 NICKEL

7.3.4.1 Growth is driven by the rising adoption of 3D printing in the aerospace & defense industry

7.3.5 PLASTIC

7.3.5.1 Plastics are used either in powdered or filament forms for prototyping and printing

7.3.6 CERAMIC

7.3.6.1 Versatile physical properties of ceramics allow them to be used across applications

7.3.7 OTHERS

7.3.7.1 Ability to withstand heat and corrosion along with the capability of creating complex designs to drive the segment

7.4 SOFTWARE

FIGURE 27 PRINTING SEGMENT PROJECTED TO LEAD MARKET FOR AEROSPACE 3D PRINTING SOFTWARE DURING FORECAST PERIOD

TABLE 13 AEROSPACE 3D PRINTING SOFTWARE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 AEROSPACE 3D PRINTING SOFTWARE MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.4.1 DESIGN

7.4.1.1 Design software is used to create drawings of parts and assemblies

7.4.2 INSPECTION

7.4.2.1 Inspection software is developed to inspect prototypes to ensure their compliance with required specifications

7.4.3 PRINTING

7.4.3.1 Printing software includes tools to ensure precision with the functioning of printers

7.4.4 SCANNING

7.4.4.1 Scanning software allows users to scan physical objects and create digital models or designs

7.5 SERVICES

FIGURE 28 CUSTOM DESIGN & MANUFACTURING SEGMENT PROJECTED TO LEAD MARKET FOR AEROSPACE 3D PRINTING SERVICES DURING FORECAST PERIOD

TABLE 15 AEROSPACE 3D PRINTING SERVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 AEROSPACE 3D PRINTING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.5.1 CUSTOM DESIGN & MANUFACTURING

7.5.1.1 Requirements for complex custom designs to drive this segment

7.5.2 AFTER-SALES

7.5.2.1 Increasing demand for 3D printers to drive the need for aftersales services

8 AEROSPACE 3D PRINTING MARKET, BY TECHNOLOGY (Page No. - 93)

8.1 INTRODUCTION

FIGURE 29 MATERIAL EXTRUSION SEGMENT IS PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 17 AEROSPACE 3D PRINTING MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 18 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 POLYMERIZATION

8.2.1 HIGH-QUALITY SURFACE FINISH MAKES POLYMERIZATION IDEAL FOR CONCEPT MODELS, FORM AND FIT STUDIES, AND INVESTMENT CASTING PATTERNS

8.3 POWDER BED FUSION

8.3.1 USE OF POWDER BED FUSION DOES NOT REQUIRE SUPPORT FOR MATERIALS AND PRODUCE HIGH-DENSITY PARTS WITH RELATIVELY GOOD MECHANICAL PROPERTIES

8.4 MATERIAL EXTRUSION

8.4.1 A CLEAN, SIMPLE-TO-USE, AND OFFICE-FRIENDLY 3D PRINTING TECHNOLOGY

8.5 OTHERS

8.5.1 OTHER TECHNOLOGIES ARE USED TO DEVELOP HIGHLY ACCURATE MODELS WITH INTRICATE DETAILS AND COMPLEX GEOMETRIES

9 AEROSPACE 3D PRINTING MARKET, BY PLATFORM (Page No. - 97)

9.1 INTRODUCTION

FIGURE 30 AIRCRAFT SEGMENT PROJECTED TO LEAD AEROSPACE 3D PRINTING MARKET DURING FORECAST PERIOD

TABLE 19 AEROSPACE 3D PRINTING MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 20 MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2 AIRCRAFT

9.2.1 USAGE OF 3D PRINTING TO MANUFACTURE AIRCRAFT PARTS RESULTS IN SHORTER PRODUCTION TIME, ELIMINATION OF ADDITIONAL TOOLS, AND HIGHER COST-EFFICIENCY

9.3 UAVS

9.3.1 USE OF 3D PRINTING CAPABILITIES MAKES IT POSSIBLE TO MANUFACTURE UAVS FOR BEYOND MILITARY USE

9.4 SPACECRAFT

9.4.1 AEROSPACE 3D PRINTING USED TO MANUFACTURE ROCKET COMPONENTS

10 AEROSPACE 3D PRINTING MARKET, BY END PRODUCT (Page No. - 101)

10.1 INTRODUCTION

FIGURE 31 ENGINE COMPONENTS SEGMENT PROJECTED TO LEAD AEROSPACE 3D PRINTING MARKET DURING FORECAST PERIOD

TABLE 21 AEROSPACE 3D PRINTING MARKET, BY END PRODUCT, 2017–2020 (USD MILLION)

TABLE 22 MARKET, BY END PRODUCT, 2021–2026 (USD MILLION)

10.2 ENGINE COMPONENTS

10.2.1 3D PRINTED ENGINE COMPONENTS ARE INCREASINGLY USED FOR EFFICIENCY AND REDUCE WEIGHT

10.3 STRUCTURAL COMPONENTS

10.3.1 USE OF ADVANCED MATERIALS IN STRUCTURAL COMPONENTS REDUCES THEIR COST AND WEIGHT

10.4 OTHERS

10.4.1 INCREASING USAGE OF 3D PRINTED COMPONENTS IN SPACECRAFT AND HYPERSONICS WILL DRIVE THIS SEGMENT

11 AEROSPACE 3D PRINTING MARKET, BY APPLICATION (Page No. - 105)

11.1 INTRODUCTION

FIGURE 32 FUNCTIONAL PARTS SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 AEROSPACE 3D PRINTING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 PROTOTYPING

11.2.1 INCREASING USAGE OF 3D PRINTING FOR PROTOTYPING AS IT ENABLES QUICK PRODUCTION AND COST-EFFECTIVE PROTOTYPES

11.3 TOOLING

11.3.1 INCREASING USE OF 3D PRINTING FOR CREATING COMLEX DESIGN TOOL MOLDS TO HELP THE MASS PRODUCTION OF THESE TOOLS THROUGH CONVENTIONAL MANUFACTURING

11.4 FUNCTIONAL PARTS

11.4.1 INCREASING USE OF 3D PRINTERS TO MANUFACTURE FUNCTIONAL PARTS AS THEY HAVE THE ABILITY TO PRODUCE COMPLEX DESIGN AND DEFINED AERODYNAMIC PROPERTIES

12 AEROSPACE 3D PRINTING MARKET, BY END USER (Page No. - 108)

12.1 INTRODUCTION

FIGURE 33 OEM SEGMENT PROJECTED TO LEAD AEROSPACE 3D PRINTING MARKET DURING FORECAST PERIOD

TABLE 25 MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 26 MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2 OEM

12.2.1 OEMS ADOPTS 3D PRINTING TO ACHIEVE LIGHTWEIGHT HIGH COMPLEX DESIGNS, REDUCE LEAD TIME & INCREASE AIRCRAFT’S EFFICIENCY

12.3 MRO

12.3.1 3D PRINTING USED IN LARGE MILITARY AIRCRAFT PARTS, TURBINE BLADES, AND OTHER EQUIPMENT WILL DRIVE THIS SEGMENT

13 REGIONAL ANALYSIS (Page No. - 111)

13.1 INTRODUCTION

FIGURE 34 NORTH AMERICA ESTIMATED TO HOLD LARGEST SHARE OF AEROSPACE 3D PRINTING MARKET IN 2021

TABLE 27 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY REGION, 2021–2026 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA AEROSPACE 3D PRINTING MARKET SNAPSHOT

13.2.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 29 NORTH AMERICA: AEROSPACE 3D PRINTING MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.2.2 US

13.2.2.1 Presence of major players drive market in the US

TABLE 35 US: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 36 US: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 37 US: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 38 US: AEROSPACE 3D PRINTING MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Increased developments in 3D printing undertaken by players expected to fuel market

TABLE 39 CANADA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 40 CANADA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 41 CANADA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 42 CANADA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.3 EUROPE

FIGURE 36 EUROPE AEROSPACE 3D PRINTING MARKET SNAPSHOT

13.3.1 PESTLE ANALYSIS: EUROPE

TABLE 43 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 46 EUROPE: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 47 EUROPE: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 48 EUROPE AEROSPACE 3D PRINTING MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Supplying and manufacturing engine parts for aerospace companies

TABLE 49 GERMANY: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 50 GERMANY: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 51 GERMANY: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 52 GERMANY: AEROSPACE 3D PRINTING MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.3.3 UK

13.3.3.1 Acquaintances and collaborations for aerospace 3d printed parts

TABLE 53 UK: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 54 UK: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 55 UK: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 56 UK: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 OEMS such as Airbus and Safran investing in advanced 3d printing solutions propel the market in France

TABLE 57 FRANCE: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 58 FRANCE: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 59 FRANCE: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 60 FRANCE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Developments undertaken by players operating in Italy to drive the market

TABLE 61 ITALY: AEROSPACE 3D PRINTING MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 62 ITALY: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 63 ITALY: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 64 ITALY: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.6 RUSSIA

13.3.6.1 Increasing government investments into 3D printing technologies fueling growth of the market

TABLE 65 RUSSIA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 66 RUSSIA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 67 RUSSIA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 68 RUSSIA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.3.7 REST OF EUROPE

13.3.7.1 Increasing adoption of 3D printing solutions in military applications and MRO services drive the market in this region

TABLE 69 REST OF EUROPE: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 70 REST OF EUROPE: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 72 REST OF EUROPE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4 ASIA PACIFIC (APAC)

FIGURE 37 APAC AEROSPACE 3D PRINTING MARKET SNAPSHOT

13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 73 APAC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 74 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 75 APAC: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 76 APAC: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 77 APAC: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 78 APAC: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Advancements in 3D printing technology will fuel the market

TABLE 79 CHINA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 80 CHINA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 81 CHINA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 82 CHINA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Increased use of 3D printing to manufacture satellite engines will drive the market

TABLE 83 JAPAN: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 84 JAPAN: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 85 JAPAN: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 86 JAPAN: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4.4 INDIA

13.4.4.1 Strategic collaborations between 3D printing service providers in the country to drive market

TABLE 87 INDIA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 88 INDIA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 89 INDIA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 90 INDIA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4.5 SOUTH KOREA

13.4.5.1 Advancements in 3D printing propel the market

TABLE 91 SOUTH KOREA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 92 SOUTH KOREA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 93 SOUTH KOREA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 94 SOUTH KOREA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4.6 AUSTRALIA

13.4.6.1 Increased investments to adopt 3D printing solutions for aerospace applications fuel the market

TABLE 95 AUSTRALIA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 96 AUSTRALIA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 98 AUSTRALIA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.4.7 REST OF APAC

13.4.7.1 Emergence of startups is boosting the aerospace 3D printing market in the region

TABLE 99 REST OF APAC: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 100 REST OF APAC: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 101 REST OF APAC: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 102 REST OF APAC: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.5 REST OF THE WORLD (ROW)

FIGURE 38 ROW: AEROSPACE 3D PRINTING MARKET SNAPSHOT

TABLE 103 ROW: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 ROW: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 105 ROW: MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 106 ROW: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 107 ROW: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 108 ROW: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.5.1 LATIN AMERICA

13.5.1.1 Increasing use of 3D printing in space and military applications will drive the market

TABLE 109 LATIN AMERICA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 110 LATIN AMERICA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.5.2 MIDDLE EAST

13.5.2.1 Presence of key aerospace 3D printing solution providers to drive the market in this region

TABLE 113 MIDDLE EAST: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 114 MIDDLE EAST: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 115 MIDDLE EAST: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 116 MIDDLE EAST: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

13.5.3 AFRICA

13.5.3.1 Increasing investments in 3D printing technology propel the market in this region

TABLE 117 AFRICA: AEROSPACE 3D PRINTING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 118 AFRICA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 119 AFRICA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 120 AFRICA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 151)

14.1 INTRODUCTION

14.2 MARKET SHARE ANALYSIS, 2020

TABLE 121 DEGREE OF COMPETITION

FIGURE 39 MARKET SHARE OF TOP PLAYERS IN THE AEROSPACE 3D PRINTING MARKET, 2020 (%)

14.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STAR

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE

14.4.4 PARTICIPANT

FIGURE 40 AEROSPACE 3D PRINTING MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

14.5 STARTUP EVALUATION QUADRANT

14.5.1 PROGRESSIVE COMPANIES

14.5.2 RESPONSIVE COMPANIES

14.5.3 DYNAMIC COMPANIES

14.5.4 STARTING BLOCKS

FIGURE 41 AEROSPACE 3D PRINTING MARKET STARTUPS/SME COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 122 COMPANY PRODUCT FOOTPRINT

TABLE 123 COMPANY FOOTPRINT BY OFFERINGS

TABLE 124 COMPANY FOOTPRINT BY PLATFORM

TABLE 125 COMPANY REGION FOOTPRINT

14.6 COMPETITIVE SCENARIO

14.6.1 DEALS

TABLE 126 DEALS, 2017–2021

14.6.2 PRODUCT LAUNCHES

TABLE 127 PRODUCT LAUNCHES, 2017–2021

14.6.3 OTHERS

TABLE 128 OTHERS, 2017–2021

15 COMPANY PROFILES (Page No. - 169)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1 KEY PLAYERS

15.1.1 STRATASYS LTD.

TABLE 129 STRATASYS LTD.: BUSINESS OVERVIEW

FIGURE 42 STRATASYS LTD.: COMPANY SNAPSHOT

TABLE 130 STRATASYS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 131 STRATASYS: PRODUCT LAUNCHES

TABLE 132 STRATASYS: DEALS

15.1.2 3D SYSTEMS, INC.

TABLE 133 3D SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 43 3D SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 134 3D SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 135 3D SYSTEMS, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 136 3D SYSTEMS, INC.: DEALS

15.1.3 GE ADDITIVE

TABLE 137 GE ADDITIVE: BUSINESS OVERVIEW

TABLE 138 GE ADDITIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 GE ADDITIVE: PRODUCT LAUNCHES

TABLE 140 GE ADDITIVE: DEALS

TABLE 141 GE ADDITIVE: OTHERS

15.1.4 EOS GMBH

TABLE 142 EOS GMBH: BUSINESS OVERVIEW

FIGURE 44 EOS GMBH: COMPANY SNAPSHOT

TABLE 143 EOS GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

15.1.5 MATERIALISE NV

TABLE 144 MATERIALISE NV: BUSINESS OVERVIEW

FIGURE 45 MATERIALISE NV: COMPANY SNAPSHOT

TABLE 145 EMBRAER SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 MATERIALISE NV: DEALS

15.1.6 RENISHAW PLC

TABLE 147 RENISHAW PLC: BUSINESS OVERVIEW

FIGURE 46 RENISHAW PLC: COMPANY SNAPSHOT

TABLE 148 RENISHAW PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.7 TRUMPF

TABLE 149 TRUMPF: BUSINESS OVERVIEW

FIGURE 47 TRUMPF: COMPANY SNAPSHOT

TABLE 150 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.8 NORSK TITANIUM

TABLE 151 NORSK TITANIUM: BUSINESS OVERVIEW

FIGURE 48 NORSK TITANIUM: COMPANY SNAPSHOT

TABLE 152 NORSK TITANIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 153 NORSK TITANIUM: DEALS

15.1.9 OC OERLIKON MANAGEMENT AG

TABLE 154 OC OERLIKON MANAGEMENT AG : BUSINESS OVERVIEW

FIGURE 49 OC OERLIKON MANAGEMENT AG: COMPANY SNAPSHOT

TABLE 155 OC OERLIKON MANAGEMENT AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 156 OC OERLIKON MANAGEMENT AG: DEALS

15.1.10 ULTIMAKER BV

TABLE 157 ULTIMAKER BV: BUSINESS OVERVIEW

TABLE 158 ULTIMAKER BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 159 ULTIMAKER BV: DEALS

15.1.11 HÖGANÄS AB

TABLE 160 HÖGANÄS AB: BUSINESS OVERVIEW

TABLE 161 HÖGANÄS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.12 MARKFORGED

TABLE 162 MARKFORGED: BUSINESS OVERVIEW

TABLE 163 MARKFORGED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 MARKFORGED: DEALS

15.1.13 SLM SOLUTIONS

TABLE 165 SLM SOLUTIONS BUSINESS OVERVIEW

FIGURE 50 SLM SOLUTIONS: COMPANY SNAPSHOT

TABLE 166 SLM SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.14 VOXELJET

TABLE 167 VOXELJET: BUSINESS OVERVIEW

FIGURE 51 VOXELJET: COMPANY SNAPSHOT

TABLE 168 VOXELJET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.15 PRODWAYS

TABLE 169 PRODWAYS: BUSINESS OVERVIEW

FIGURE 52 PRODWAYS : COMPANY SNAPSHOT

TABLE 170 PRODWAYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 PRODWAYS: DEALS

15.1.16 NANO DIMENSION

TABLE 172 NANO DIMENSION: BUSINESS OVERVIEW

FIGURE 53 NANO DIMENSION: COMPANY SNAPSHOT

TABLE 173 VERTICAL AEROSPACE GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.2 OTHER PLAYERS

15.2.1 MOOG INC

TABLE 174 MOOG INC: COMPANY OVERVIEW

15.2.2 PROTOLABS

TABLE 175 PROTOLABS: COMPANY OVERVIEW

15.2.3 SHAPEWAYS

TABLE 176 SHAPEWAYS: COMPANY OVERVIEW

15.2.4 ST ENGINEERING

TABLE 177 DELOREAN AEROSPACE: COMPANY OVERVIEW

15.2.5 FIT AG

TABLE 178 FIT AG: COMPANY OVERVIEW

15.2.6 ZORTRAX

TABLE 179 ZORTRAX: COMPANY OVERVIEW

15.2.7 JAVELIN TECHNOLOGIES

TABLE 180 JAVELIN TECHNOLOGIES: COMPANY OVERVIEW

15.2.8 ENVISIONTEC, INC.

TABLE 181 ENVISIONTEC, INC.: COMPANY OVERVIEW

15.2.9 ESSENTIUM, INC.

TABLE 182 ESSENTIUM, INC. COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 227)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

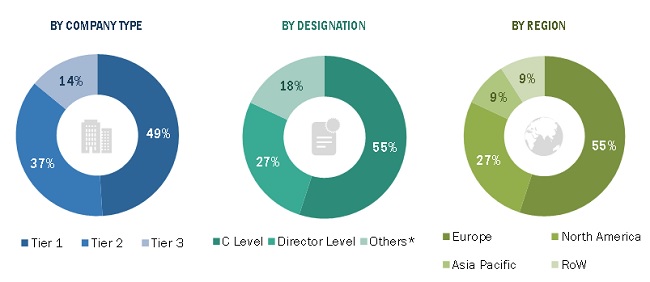

The research study involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg, and Factiva to identify and collect information relevant to the aerospace 3D printing market. Primary sources include industry experts from the aerospace 3D printing market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the aerospace 3D printing market as well as to assess the growth prospects of the market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); 3D Printing Association (3DPA); Association of 3D Printing; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from 3D printing vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using 3D printers were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of 3D printers and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

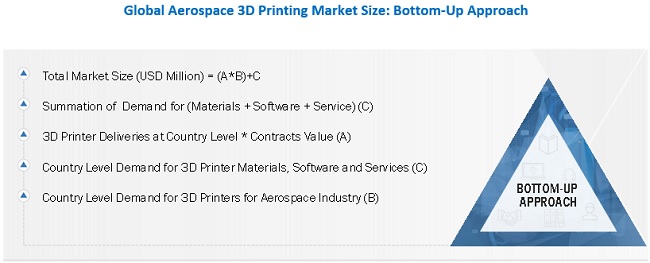

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace 3D printing market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aerospace 3D printing market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the aerospace 3D printing market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the aerospace 3D printing market on the basis of offerings, platform, technology, application, end user, end product and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerospace 3D printing market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aerospace 3D printing market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aerospace 3D printing Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerospace 3D Printing Market