Methyl Ester Ethoxylates Market by Type (C16-C18 & C12-C14), Application (Domestic Cleaning, Industrial Cleaning, Personal Care & Others), and Region - Global Forecast to 2021

[154 Pages Report] The Methyl Ester Ethoxylate Market is projected to reach USD 139.8 Million by 2021, at a CAGR of 3.4% between 2016 and 2021.

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

For the companies profiled in the report, 2015 has been considered as the base year. Wherein information is unavailable for the base year, the years prior to it have been considered.

The objectives of this study are:

- To define, describe, and forecast the methyl ester ethoxylate market based on type, application and region

- To analyze and forecast the methyl ester ethoxylate market size in terms of volume (kilotons) and value (USD million)

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions made to the overall market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of the market

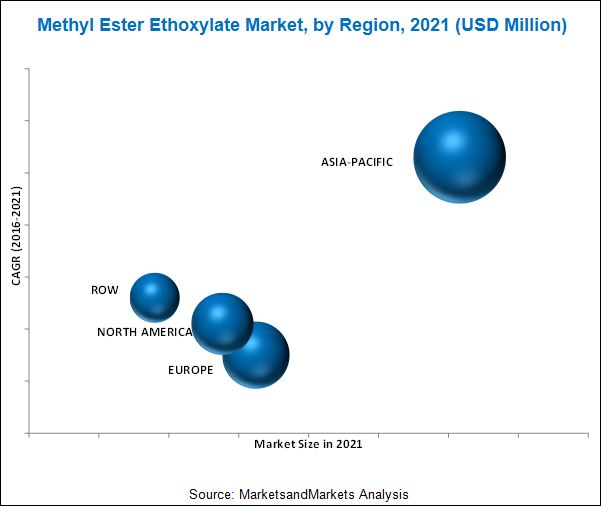

- To forecast the market size, in terms of value, with respect to four main regions (along with countries), namely, Asia-Pacific, North America, Europe, and RoW

- To strategically profile key players and comprehensively analyze their core competencies and market share

- To analyze competitive developments, such as expansions, mergers & acquisitions, and new product developments in the methyl ester ethoxylate market

Research Methodology:

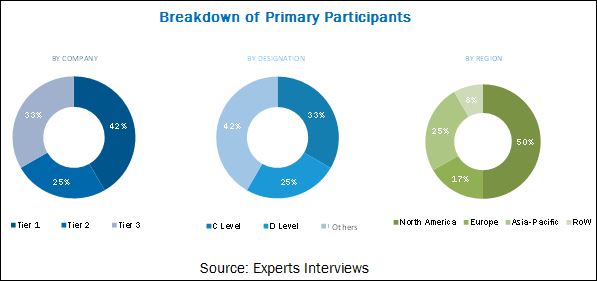

The research methodology used to estimate and forecast the methyl ester ethoxylate market involves obtaining data on key vendor revenues through secondary research (annual reports, press releases & investor presentations of companies, white papers, solvent journals, certified publications & articles from recognized authors, authenticated directories, and databases). Vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall size of the methyl ester ethoxylate market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The methyl ester ethoxylate market has a diversified ecosystem, including raw material suppliers, along with vendors, end users, and government organizations. Key players in this market are Huntsman Corporation (U.S.), KLK OLEO (Malaysia), Lion Corporation (Japan), Ineos Group Limited (Switzerland), and Jet Technologies (Australia), among others. Government & research organizations, raw material suppliers & distributors, construction companies, and industry associations have been considered as critical stakeholders in this study.

Target Audience

- Methyl Ester Ethoxylate Producers

- Methyl Ester Ethoxylate Traders, Distributors, and Suppliers

- Manufacturers in End-use Industries

- Associations and Industry Bodies

Scope of the Report: This research report categorizes the methyl ester ethoxylate market based on type, application, and region, forecasting volumes and revenues as well as analyzing trends in each of these submarkets.

- Based on Type, the methyl ester ethoxylate market is segmented into:

- C16-C18

- C12-C14

- Based on Application, the methyl ester ethoxylate market is segmented into:

- Industrial Cleaning

- Domestic Cleaning

- Personal Care

- Others (Agrochemicals and Emulsifiers)

- Based on Region, the methyl ester ethoxylate market is segmented into:

- Asia-Pacific

- North America

- Europe

- RoW

The following customization options are available for the report:

- Further breakdown of Asia-Pacific & Europe methyl ester ethoxylate markets

- Company information

- Detailed analysis and profiling of additional market players (up to three)

The methyl ester ethoxylate market was valued at USD 114.7 Million in 2015 and is projected to reach USD 139.8 Million by 2021, at a CAGR of 3.4% between 2016 and 2021. This growth can be attributed to the rising demand from end-use industries, shift in consumer lifestyles, and increasing demand for ecofriendly surfactants and low-rinse detergents.

Among types, the C16-C18 segment of the methyl ester ethoxylate market is expected to grow at the highest CAGR from 2016 to 2021, owing to the availability of feedstock from palm oil, especially from the Southeast Asia region. The demand for C16-C18 methyl ester ethoxylate is rising especially from the concentrated liquid detergent segment. They are eco-friendly as they are derived from natural feedstock. Subsidies are given by the governments of European and Southeast Asian countries to produce C16-C18 methyl ester which makes it cheaper and more competitive in comparison to its major substitute alcohol ethoxylate.

Among applications, the domestic cleaning segment is expected to grow at the highest CAGR from 2016 to 2021 in the methyl ester ethoxylate market, in terms of value. Rising awareness about low-foam, low-rinse, and single wash detergents have resulted in rising demand from this application segment. Methyl ester ethoxylate is a concentrated liquid detergent that can be used in a variety of detergents for the domestic cleaning segment. Changing lifestyles in the developing countries such as China and India will further increase the demand of methyl ester ethoxylate from the domestic cleaning segment.

The Asia-Pacific region accounted for the largest share of the methyl ester ethoxylate market in 2015. The demand for low-rinse detergents is increasing significantly in various applications in the region. The reason behind the increasing popularity of low-rinse detergents is that they do not ionize in solution and have no electrical charge, as a result they are resistant to hardness and clean well most soils. This has led to the increasing demand of methyl ester ethoxylate in this region.

Factors inhibiting the growth of the methyl ester ethoxylate market include low potential in developed countries, falling petrochemical prices, and complicated production process.

Huntsman Corporation (U.S.), KLK OLEO (Malaysia), Lion Corporation (Japan), Ineos Group Limited (Switzerland), and Jet Technologies (Australia) are the key players in the methyl ester ethoxylate market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Methyl Ester Ethoxylate Market: Segmentation & Coverage

1.3 Stakeholders

1.4 Market Definition

2 Research Methodology

2.1 Methyl Ester Ethoxylate Market: Research Design

2.2 Research Methodology

2.3 Arriving at the Global Methyl Ester Ethoxylate Market

2.4 Top Down Approach

2.5 Bottom-Up Approach

2.6 Key Data From Secondary Sources

2.7 Key Data From Primary Sources

2.8 Assumptions

3 Executive Summary

3.1 Key Insights: Methyl Ester Ethoxylate Market

3.2 Market Snapshot, 2015

3.3 Market: Geographical Matrix

3.4 Emerging Markets

3.5 Asia-Pacific Market Snapshot: By Country & Application, 2015

4 Market Overview

4.1 Methyl Ester Ethoxylate : History

4.2 Methyl Ester Ethoxylate: Introduction

4.3 Methyl Ester Ethoxylate: Properties

4.4 Alcohol Ethoxylate: Introduction

4.5 Methyl Ester Ethoxylate: Feedstock

4.6 Methyl Ester Ethoxylate: Methods of Production

4.7 Methyl Ester Ethoxylate: Production Process

4.8 Methyl Ester Ethoxylate: Catalysts

4.9 Methyl Ester Ethoxylate: Advantages

4.10 Methyl Ester Ethoxylate: Reasons for Slow Adoption

4.11 Methyl Ester Ethoxylate as A Replacement of Alcohol Ethoxylate

4.12 Production Facilities

4.13 Methyl Ester Ethoxylate Market: Drocs Analysis

4.13.1 By Market: Drivers

4.13.2 By Market: Restraints

4.13.3 By Market: Opportunities

4.13.4 By Market: Challenges

4.14 Methyl Ester Ethoxylate : Porter’s Five Forces Analysis

5 Methyl Ester Ethoxylate Market, By Application

5.1 Methyl Ester Ethoxylate Market, By Application

5.2 By Market in Domestic Cleaning

5.3 By Market in Industrial Cleaning

5.4 By Market in Personal Care

5.5 By Market in Others

6 Methyl Ester Ethoxylate Market, By Type

6.1 Methyl Ester Ethoxylate Market, By Type

6.2 C16-C18 Methyl Ester Ethoxylate Market

6.3 C12-C14 Methyl Ester Ethoxylate Market

7 Adhesion Promoters Market, By Region

7.1 Methyl Ester Ethoxylate Market, By Region

7.2 Asia-Pacific

7.2.1 Asia-Pacific Market Snapshot

7.2.2 Asia-Pacific Market, By Application

7.2.3 Asia-Pacific Market, By Type

7.2.4 Asia-Pacific Market, By Country

7.2.5 Asia-Pacific Market Size, By Country

7.2.6 China Market, By Application

7.2.7 China Market, By Type

7.2.8 India Market, By Application

7.2.9 India Market, By Type

7.2.10 Japan Market, By Application

7.2.11 Japan Market, By Type

7.2.12 Malaysia Market, By Application

7.2.13 Malaysia Market, By Type

7.2.14 Rest of Asia-Pacific Market, By Application

7.2.15 Rest of Asia-Pacific Market, By Type

7.3 Europe

7.3.1 Europe Market Snapshot

7.3.2 Europe Market, By Application

7.3.3 Europe Market, By Type

7.3.4 Europe Market, By Country

7.3.5 Europe Market Size, By Country

7.3.6 Germany Market, By Application

7.3.7 Germany Market, By Type

7.3.8 France Market, By Application

7.3.9 France Market, By Type

7.3.10 U.K. Market, By Application

7.3.11 U.K. Market, By Type

7.3.12 Russia Market, By Application

7.3.13 Russia Market, By Type

7.3.14 Rest of Europe Market, By Application

7.3.15 Rest of Europe Market, By Type

7.4 North America

7.4.1 North America Market Snapshot

7.4.2 North America Market, By Application

7.4.3 North America Market, By Type

7.4.4 North America Market, By Country

7.4.5 North America Market Size, By Country

7.4.6 U.S. Market, By Application

7.4.7 U.S. Market, By Type

7.4.8 Canada Market, By Application

7.4.9 Canada Market, By Type

7.4.10 Mexico Market, By Application

7.4.11 Mexico Market, By Application

7.5 RoW

7.5.1 RoW Market Snapshot

7.5.2 RoW Market, By Application

7.5.3 RoW Market, By Type

7.5.4 RoW Market Size, By Country

7.5.5 Brazil Market, By Application

7.5.6 Brazil Market, By Type

7.5.7 Saudi Arabia Market, By Application

7.5.8 Saudi Arabia Market, By Type

7.5.9 Others Market, By Application

7.5.10 Others Market, By Type

7.5.11 RoW Market, By Type

7.5.12 RoW Market, By Type

8 Competitive Landscape

8.1 Recent Developments

8.2 Company Share Analysis

9 Company Profiles

9.1 Introduction

9.2 Huntsman Corporation

9.2.1 Financial Overview

9.2.2 Overview

9.2.3 Products Offered

9.2.4 SWOT Analysis

9.2.5 MnM View

9.3 KLK Oleo

9.3.1 General Information

9.3.2 Overview

9.3.3 Products Offered

9.3.4 SWOT Analysis

9.3.5 MnM View

9.4 Lion Corporation

9.4.1 Financial Overview

9.4.2 Overview

9.4.3 Products Offered

9.4.4 Recent Development

9.4.5 SWOT Analysis

9.4.6 MnM View

9.5 Ineos Group Limited

9.5.1 General Information

9.5.2 Overview

9.5.3 Products Offered

9.5.4 SWOT Analysis

9.5.5 MnM View

9.6 Jet Technologies

9.6.1 General Information

9.6.2 Overview

9.6.3 Products Offered

9.6.4 MnM View

9.6.5 MnM View

10 Appendix

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Technical Analysis

10.1.4 Low-Cost Sourcing Locations

10.1.5 Technical Analysis

10.2 Related Reports

List of Tables (106 Tables)

Table 1 Methyl Ester Ethoxylate Market Size, By Application, 2014-2021 (Kilotons)

Table 2 Market Size, By Application, 2014-2021 (USD Million)

Table 3 Market in Domestic Cleaning, By Region, 2014-2021 (Kilotons)

Table 4 Market in Domestic Cleaning, By Region, 2014-2021 (USD Million)

Table 5 Market in Industrial Cleaning, By Region, 2014-2021 (Kilotons)

Table 6 Market in Industrial Cleaning, By Region, 2014-2021 (USD Million)

Table 7 Market in Personal Care, By Region, 2014-2021 (Kilotons)

Table 8 Market in Personal Care, By Region, 2014-2021 (USD Million)

Table 9 Market in Others, By Region, 2016-2021 (Kilotons)

Table 10 Market in Others, By Region, 2016-2021 (USD Million)

Table 11 Market Size, By Type 2014-2021 (Kilotons)

Table 12 Market Size, By Type, 2014-2021 (USD Million)

Table 13 C16-C18 Market, By Region, 2014-2021 (Kilotons)

Table 14 C16-C18 Market, By Region, 2014-2021 (USD Million)

Table 15 C12-C14 Market, By Region, 2014-2021 (Kilotons)

Table 16 C12-C14 Market, By Region, 2014-2021 (USD Million)

Table 17 Market Size, By Region, 2014-2021 (Kilotons)

Table 18 Market Size, By Region, 2014-2021 (USD Million)

Table 19 Asia-Pacific Market Size, By Application, 2014-2021 (Kilotons)

Table 20 Asia-Pacific Market Size, By Application, 2014-2021 (USD Million)

Table 21 Asia-Pacific Market Size, By Type, 2014-2021 (Kilotons)

Table 22 Asia-Pacific Market Size, By Type, 2014-2021 (USD Million)

Table 23 Asia-Pacific Market Size, By Country, 2014-2021 (Kilotons)

Table 24 Asia-Pacific Market Size, By Country, 2014-2021 (USD Million)

Table 25 China Market Size, By Application, 2014-2021 (Kilotons)

Table 26 China Market Size, By Application, 2014-2021 (USD Million)

Table 27 China Market Size, By Type, 2014-2021 (Kilotons)

Table 28 China Market Size, By Type, 2014-2021 (USD Million)

Table 29 India Market Size, By Application, 2014-2021 (Kilotons)

Table 30 India Market Size, By Application, 2014-2021 (USD Million)

Table 31 India Market Size, By Type, 2014-2021 (Kilotons)

Table 32 India Market Size, By Type, 2014-2021 (USD Million)

Table 33 Japan Market Size, By Application, 2014-2021 (Kilotons)

Table 34 Japan Market Size, By Application, 2014-2021 (USD Million)

Table 35 Japan Market Size, By Type, 2014-2021 (Kilotons)

Table 36 Japan Market Size, By Type, 2014-2021 (USD Million)

Table 37 Malaysia Market Size, By Application, 2014-2021 (Kilotons)

Table 38 Malaysia Market Size, By Application, 2014-2021 (USD Million)

Table 39 Malaysia Market Size, By Type, 2014-2021 (Kilotons)

Table 40 Malaysia Market Size, By Type, 2014-2021 (USD Million)

Table 41 Rest of Asia-Pacific Market Size, By Application, 2014-2021 (Kilotons)

Table 42 Rest of Asia-Pacific Market Size, By Application, 2014-2021 (USD Million)

Table 43 Rest of Asia-Pacific Market Size, By Type, 2014-2021 (Kilotons)

Table 44 Rest of Asia-Pacific Market Size, By Type, 2014-2021 (USD Million)

Table 45 Europe Market Size, By Application, 2014-2021 (Kilotons)

Table 46 Europe Market Size, By Application, 2014-2021 (USD Million)

Table 47 Europe Market Size, By Type, 2014-2021 (Kilotons)

Table 48 Europe Market Size, By Type, 2014-2021 (USD Million)

Table 49 Europe Market Size, By Application, 2014-2021 (Kilotons)

Table 50 Europe Market Size, By Application, 2014-2021 (USD Million)

Table 51 Germany Market Size, By Application, 2014-2021 (Kilotons)

Table 52 Germany Market Size, By Application, 2014-2021 (USD Million)

Table 53 Germany Market Size, By Type, 2014-2021 (Kilotons)

Table 54 Germany Market Size, By Type, 2014-2021 (USD Million)

Table 55 France Market Size, By Application, 2014-2021 (Kilotons)

Table 56 France Market Size, By Application, 2014-2021 (USD Million)

Table 57 France Market Size, By Type, 2014-2021 (Kilotons)

Table 58 France Market Size, By Type, 2014-2021 (USD Million)

Table 59 U.K. Market Size, By Application, 2014-2021 (Kilotons)

Table 60 U.K. Market Size, By Application, 2014-2021 (USD Million)

Table 61 U.K. Market Size, By Type, 2014-2021 (Kilotons)

Table 62 U.K. Market Size, By Type, 2014-2021 (USD Million)

Table 63 Russia Market Size, By Application, 2014-2021 (Kilotons)

Table 64 Russia Market Size, By Application, 2014-2021 (USD Million)

Table 65 Russia Market Size, By Type, 2014-2021 (Kilotons)

Table 66 Russia Market Size, By Type, 2014-2021 (USD Million)

Table 67 Rest of Europe Market Size, By Application, 2014-2021 (Kilotons)

Table 68 Rest of Europe Market Size, By Application, 2014-2021 (USD Million)

Table 69 Rest of Europe Market Size, By Type, 2014-2021 (Kilotons)

Table 70 Rest of Europe Market Size, By Type, 2014-2021 (USD Million)

Table 71 North America Market Size, By Application, 2014-2021 (Kilotons)

Table 72 North America Market Size, By Application, 2014-2021 (USD Million)

Table 73 North America Market Size, By Type, 2014-2021 (Kilotons)

Table 74 North America Market Size, By Type, 2014-2021 (USD Million)

Table 75 North America Market Size, By Country, 2014-2021 (Kilotons)

Table 76 North America Market Size, By Country, 2014-2021 (USD Million)

Table 77 U.S. Market Size, By Application, 2014-2021 (Kilotons)

Table 78 U.S. Market Size, By Application, 2014-2021 (USD Million)

Table 79 U.S. Market Size, By Type, 2014-2021 (Kilotons)

Table 80 U.S. Market Size, By Type, 2014-2021 (USD Million)

Table 81 Canada Market Size, By Application, 2014-2021 (Kilotons)

Table 82 Canada Market Size, By Application, 2014-2021 (USD Million)

Table 83 Canada Market Size, By Type, 2014-2021 (Kilotons)

Table 84 Canada Market Size, By Type, 2014-2021 (USD Million)

Table 85 Mexico Market Size, By Application, 2014-2021 (Kilotons)

Table 86 Mexico Market Size, By Application, 2014-2021 (USD Million)

Table 87 Mexico Market Size, By Type, 2014-2021 (Kilotons)

Table 88 Mexico Market Size, By Type, 2014-2021 (USD Million)

Table 89 RoW Market Size, By Application, 2014-2021 (Kilotons)

Table 90 RoW Market Size, By Application, 2014-2021 (USD Million)

Table 91 RoW Market Size, By Type, 2014-2021 (Kilotons)

Table 92 RoW Market Size, By Type, 2014-2021 (USD Million)

Table 93 RoW Market Size, By Country, 2014-2021 (Kilotons)

Table 94 RoW Market Size, By Country, 2014-2021 (USD Million)

Table 95 Brazil Market Size, By Application, 2014-2021 (Kilotons)

Table 96 Brazil Market Size, By Application, 2014-2021 (USD Million)

Table 97 Brazil Market Size, By Type, 2014-2021 (Kilotons)

Table 98 Brazil Market Size, By Type, 2014-2021 (USD Million)

Table 99 Saudi Arabia Market Size, By Application, 2014-2021 (Kilotons)

Table 100 Saudi Arabia Market Size, By Application, 2014-2021 (USD Million)

Table 101 Saudi Arabia Market Size, By Type, 2014-2021 (Kilotons)

Table 102 Saudi Arabia Market Size, By Type, 2014-2021 (USD Million)

Table 103 Others Market Size, By Application, 2014-2021 (Kilotons)

Table 104 Others Market Size, By Application, 2014-2021 (USD Million)

Table 105 Others Market Size, By Type, 2014-2021 (Kilotons)

Table 106 Others Market Size, By Type, 2014-2021 (USD Million)

List of Figures (24 Figures)

Figure 1 Methyl Ester Ethoxylate Market: Segmentation & Coverage

Figure 2 Value Chain

Figure 3 Data Triangulation

Figure 4 Methyl Ester Ethoxylate - Top Down Approach

Figure 5 Methyl Ester Ethoxylate - Bottom-Up Approach

Figure 6 Methyl Ester Ethoxylate Application Market Overview, 2016 & 2021 (%)

Figure 7 Methyl Ester Ethoxylate Market, By Application, 2016-2021 (Kilotons)

Figure 8 Market of Methyl Ester Ethoxylate in Domestic Cleaning, By Region, 2016 & 2021

Figure 9 Market of Methyl Ester Ethoxylate in Industrial Cleaning, By Region, 2016 & 2021

Figure 10 Market of Methyl Ester Ethoxylate in Personal Care, By Region, 2016 & 2021

Figure 11 Market of Methyl Ester Ethoxylate in Others, By Region, 2016 & 2021

Figure 12 Market of Methyl Ester Ethoxylate Overview, 2016 & 2021 (%)

Figure 13 Market, By Type, 2016-2021 (Kilotons)

Figure 14 C16-C18 Market of Methyl Ester Ethoxylate, By Region, 2016 & 2021

Figure 15 C12-C14 Market of Methyl Ester Ethoxylate, By Region, 2016 & 2021

Figure 16 Market of Methyl Ester Ethoxylate: Growth Analysis, By Region, 2016-2021 (Kilotons)

Figure 17 Asia-Pacific Market of Methyl Ester Ethoxylate, Growth Analysis, By Country, 2016-2021

Figure 18 Asia-Pacific Market of Methyl Ester Ethoxylate Overview, 2016 & 2021

Figure 19 Europe Market of Methyl Ester Ethoxylate, Growth Analysis, By Country, 2016-2021

Figure 20 Europe Market of Methyl Ester Ethoxylate Overview, 2016 & 2021

Figure 21 Market of Methyl Ester Ethoxylate, Growth Analysis, By Country, 2016-2021

Figure 22 North America Market Overview, 2016 & 2021

Figure 23 Market of Methyl Ester Ethoxylate, Growth Analysis, By Country, 2016-2021

Figure 24 RoW Market Overview, 2016 & 2021

Growth opportunities and latent adjacency in Methyl Ester Ethoxylates Market