Ethoxylates Market by Type (Alcohol, Fatty Amine, Fatty Acid, Methyl Ester, Glyceride), Application (Agrochemicals, Household & Personal Care, Pharmaceutical, Oilfield Chemicals), Region - Global Forecast to 2021

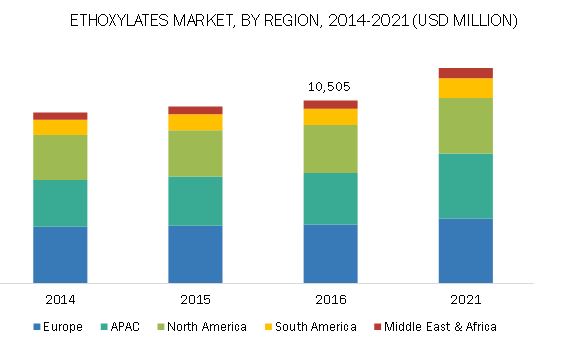

[138 Pages Report] MarketsandMarkets forecasts the Ethoxylates Market to grow from USD 10.5 billion in 2016 to USD 12.3 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 3.33% during the forecast period. The growing demand from major end-use industries such as household & personal care, and pharmaceutical is expected to drive the market in the future. The harmful environmental effects of the some of the ethoxylates is a major restraint for the market.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

By end use industry, household and personal care segment accounts for the largest market of ethoxylates market

By end use industry, the household and personal care segment is expected to lead the market during the forecast period. The demand for ethoxylates in the pharmaceutical industry is projected to grow at the highest CAGR during the forecast period. The growth in this industry is driven by the growing healthcare sector in developed and emerging economies.

By product type, Alcohol ethoxylates type to record the highest CAGR during the forecast period

By product type, the alcohol ethoxylates type of the ethoxylates market is projected to grow at the highest during the forecast period, in terms of value. Alcohol ethoxylates are the most widely used type of non-ionic surfactants. Alcohol ethoxylates are composed of an alkyl chain, which is combined with ethylene oxide. These are surface active agents, substances that are used to change the surface tension of water to assist in applications such as cleansing, wetting surfaces, foaming, and emulsifying. Being non-ionic surfactants, alcohol ethoxylates can remove grease effectively, which makes them suitable to be used in laundry products, household cleaners, and hand & dishwashing liquids. Alcohol ethoxylates have many other desirable properties such as moderate foaming ability, superior cleaning of fibers, and high tolerance to water hardness. They are widely used in the manufacture of domestic detergents, household & personal care products, and I&I cleaning products.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

APAC to grow at the highest CAGR during the forecast period.

The Asia-Pacific region is projected to be the fastest-growing ethoxylates market due to the growing household & personal care, and pharmaceutical industries in the region. The Middle East & African ethoxylates market is also expected to grow at a high rate due to growing demand for ethoxylates in the oilfield industry. North America is a significant market for ethoxylates, though is witnessing a moderate growth. Among regions, the Asia Pacific ethoxylates market is projected to grow at the highest CAGR between 2016 and 2021, in terms of value.

Market Dynamics

Drivers: Increased demand of low-rinse detergents

The demand for low-rinse detergents is increasing significantly, in various applications. According to various studies, the level of foam produced does not correlate with the cleaning power of detergents, but it is proved that low-foaming detergents can be strong cleaners than the high-foaming detergents. The reason behind the increasing popularity of low-rinse detergents is that they do not ionize in solution and thus have no electrical charge, they are resistant to hardness. Companies are focusing on developing low-rinse products such as methyl ester ethoxylates, as these products produce low foam which also helps in reducing water usage. These low-foaming detergents are preferred for front-loading washing machines, automatic dishwashing machines, and rinse aids. Ethoxylates are mainly non-ionic surfactants, so with increasing demand of non-rinse detergents the demand of ethoxylates is also increasing.

Opportunity: Development of Eco-friendly products

Environmental concerns regarding the toxicity issues of some of the ethoxylates are rising. The manufacturers, especially, should focus on the development of eco-friendly ethoxylates products. Alcohol ethoxylates (AEs) is the main substitute for these toxic ethoxylates. AEs are a class of non-ionic surfactants produced and used globally. The human health risk assessment has proved that the use of AE in laundry and cleaning detergents is safe. AE possess good performance characteristics in variety of applications. They are readily biodegradable unlike NPEs, which makes them a preferred choice for manufacturers. Many countries have imposed strict regulations on the usage of toxic ethoxylates. Alcohol ethoxylates have an opportunity to capture market in such nations.

Restraints: Low potential of ethoxylates in developed countries

There are many household and personal care products, which are manufactured by using alternatives of ethoxylates. At present, ethoxylates are showing a moderate growth rate in developed nations. With the increasing usage of substitute products in household & personal care products, the demand for ethoxylates will also decrease. Some of the ethoxylates for instance, Nonylphenol are toxic in nature, due to which they are banned in many countries. The major substitutes of ethoxylates are sodium lauryl sulfate, sodium laureth sulfate, and ammonium laurel sulfate. The market share of these substitute products are increasing, which is a barrier to the growth of ethoxylates in developed nations. Hence, the ethoxylates market has less potential in developed countries although they have high penetration in household & personal care products.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016–2021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type (Alcohol ethoxylates, Fatty amine ethoxylates, Fatty acid ethoxylates, Methyl esters, Glycerides), End-use Industry (Household & personal care, Pharmaceutical, Agrochemical, Oilfield, Others) |

|

Geographies covered |

APAC, North America, Europe, MEA, and South America |

|

Companies covered |

BASF SE (Germany), Royal Dutch Shell Plc (Netherlands), Huntsman International LLC (U.S.), Stepan Company (U.S.), Clariant AG (Switzerland), The Dow Chemical Company (U.S.), Sasol Ltd (South Africa), India Glycols Ltd. (India), Ineos Group Ltd. (Switzerland), and Solvay (Belgium). |

The research report categorizes the Ethoxylates Market to forecast the revenues and analyze the trends in each of the following sub-segments:

Ethoxylates Market, By Type

- Alcohol ethoxylates

- Fatty amine ethoxylates

- Fatty acid ethoxylates

- Methyl esters

- Glycerides

Ethoxylates Market, By End-Use Industry

- Household & personal care

- Pharmaceutical

- Agrochemical

- Oilfield

- Others

Ethoxylates Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- Middle East and Africa (MEA)

- South America

Key Market Players

BASF SE (Germany), Royal Dutch Shell Plc (Netherlands), Huntsman International LLC (U.S.), Stepan Company (U.S.), Clariant AG (Switzerland), The Dow Chemical Company (U.S.), Sasol Ltd (South Africa), India Glycols Ltd. (India), Ineos Group Ltd. (Switzerland), and Solvay (Belgium).

Recent Developments

- In September 2015, Royal Dutch Shell PLC announced to double its production capacity of high-purity ethylene oxide and ethoxylates at its Jurong Island site (Singapore). This plant will have an ethoxylates production capacity of 140,000 tonnes per annum.

- In March 2014, BASF SE, inaugurated a new surfactant plant in Dahej (India). This helped the company to meet the rising demand of ethoxylates in the region.

- In June 2015, Sovay inaugurated its new alkoxylation plant in Singapore, to expand its specialty surfactants business in the region. This plant also complemented its existing facilities in China, and India.

- In July 2014, Stepan Company completed its front-end engineering and design work for a potential USD 60 million to USD 70 million chemical production facility in the Ascension Parish’s industrial corridor. This plant is expected to produce intermediate chemicals for Stepan’s global surfactants and polymer production sites.

- In January 2014, Clariant expanded its ethoxylation plant in Daya Bay, Huizhou (China). In 2011, the initial capacity of the plant was of 50,000 MT/year. After completion of the expansion, the total capacity of the plant reached 100,000 MT/year.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the ethoxylates market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Scope of the Report, By Region

1.3.2 Years Considered for the Study

1.3.3 Currency

1.3.4 Limitation

1.4 Stakeholder

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities

4.2 Rapid Growth in Ethoxylates Market Due to High Demand in Developing Regions

4.3 Ethoxylates Market, By Type

4.4 Ethoxylates Market in Europe, By Type and Country

4.5 Ethoxylates Market Attractiveness

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Ethoxylates Market Segmentation, By Type

5.2.2 Ethoxylates Market Segmentation, By End-Use Industry

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Demand from End-Use Industries

5.3.1.2 Increasing Demand of Low-Rinse Detergents

5.3.1.3 Shift in Consumer Lifestyles

5.3.2 Restraints

5.3.2.1 Low Potential of Ethoxylates in Developed Countries

5.3.2.2 Environmental Concerns Regarding Toxicity Issues

5.3.3 Opportunities

5.3.3.1 Development of Eco-Friendly Products

5.3.4 Impact Analysis of Dros for Short, Medium, and Long Term

5.4 Revenue Pocket Matrix

5.4.1 Revenue Pocket Matrix for Ethoxylates, By Type

5.4.2 Revenue Pocket Matrix for Ethoxylates, By End-Use Industry

5.5 Value Chain Analysis

5.6 Porter’s Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

5.7 Economic Indicators

5.7.1 Industry Outlook

5.7.1.1 Oil & Gas Industry

6 Ethoxylates Market, By Type (Page No. - 46)

6.1 Introduction

6.1.1 Ethoxylates Market Size, By Type, 2014 – 2021 (Kiloton)

6.1.2 Ethoxylates Market Size, By Type, 2014 – 2021 (USD Million)

6.2 Alcohol Ethoxylates (Ae)

6.2.1 Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (Kiloton)

6.2.2 Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

6.2.3 Natural Alcohol Ethoxylates

6.2.4 Synthetic Alcohol Ethoxylates

6.2.5 Global Alcohol Ethoxylate Market, By Production Type, 2014–2021, (Kiloton)

6.2.6 Global Alcohol Ethoxylate Market, By Production Type, 2014–2021, (USD Million)

6.3 Fatty Amine Ethoxylates

6.3.1 Fatty Amine Ethoxylates Market Size, By Region, 2014–2021 (Kiloton)

6.3.2 Fatty Amine Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

6.4 Fatty Acid Ethoxylates

6.4.1 Fatty Acid Ethoxylates Market Size, By Region, 2014–2021 (Kiloton)

6.4.2 Fatty Acid Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

6.5 Methyl Ester Ethoxylates (Mee)

6.5.1 Methyl Ester Ethoxylates Market Size, By Region, 2014–2021 (Kiloton)

6.5.2 Methyl Ester Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

6.6 Glyceride Ethoxylates

6.6.1 Glyceride Ethoxylates Market Size, By Region, 2014–2021 (Kiloton)

6.6.2 Glyceride Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

7 Ethoxylates Market, By End-Use Industry (Page No. - 54)

7.1 Introduction

7.1.1 Ethoxylates Market Size, By End-Use Industry, 2014 – 2021 (Kiloton)

7.1.2 Ethoxylates Market Size, By End-Use Industry, 2014 – 2021 (USD Million)

7.2 Household & Personal Care

7.2.1 Laundry and Dishwashing Detergent

7.2.2 I&I Cleaning

7.2.3 Personal Care

7.2.4 Household & Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (Kiloton)

7.2.5 Household & Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

7.3 Pharmaceutical

7.3.1 Ointments & Emulsions

7.3.2 Pharmaceutical: Ethoxylates Market Size, By Type, 2014–2021 (Kiloton)

7.3.3 Pharmaceutical: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

7.4 Agrochemicals

7.4.1 Herbicides

7.4.2 Insecticides

7.4.3 Fungicides

7.4.4 Agrochemicals: Ethoxylates Market Size, By Type, 2014–2021 (Kiloton)

7.4.5 Agrochemicals: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

7.5 Oilfield Chemicals

7.5.1 Foam Control and Wetting Agents

7.5.2 Lubricants & Emulsifiers

7.5.3 Oilfield Chemicals: Ethoxylates Market Size, By Type, 2014–2021 (Kiloton)

7.5.4 Oilfield Chemicals: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

7.6 Other End-Use Industries

7.6.1 Other End-Use Industries: Ethoxylates Market Size, By Type, 2014–2021 (Kiloton)

7.6.2 Other End-Use Industries: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

8 Regional Analysis (Page No. - 63)

8.1 Introduction

8.1.1 Ethoxylates Market Size, By Region, 2014 – 2021 (Kiloton)

8.1.2 Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

8.2 Europe

8.2.1 Europe Ethoxylates: Market Size, By Country, 2014–2021 (Kiloton)

8.2.2 Europe Ethoxylates: Market Size, By Country, 2014–2021 (USD Million)

8.2.3 Europe Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.4 Europe Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.5 Germany

8.2.5.1 Germany Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.5.2 Germany Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.6 U.K.

8.2.6.1 U.K. Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.6.2 U.K. Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.7 France

8.2.7.1 France Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.7.2 France Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.8 Italy

8.2.8.1 Italy Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.8.2 Italy Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.9 Russia

8.2.9.1 Russia Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.9.2 Russia Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.10 Spain

8.2.10.1 Spain Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.10.2 Spain Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.11 Poland

8.2.11.1 Poland Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.11.2 Poland Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.2.12 Rest of Europe

8.2.12.1 Rest of Europe Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.2.12.2 Rest of Europe Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3 Asia-Pacific

8.3.1 Asia Pacific Ethoxylates: Market Size, By Country, 2014–2021 (Kiloton)

8.3.2 Asia Pacific Ethoxylates: Market Size, By Country, 2014–2021 (USD Million)

8.3.3 Asia Pacific Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.4 Asia Pacific Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.5 China

8.3.5.1 China Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.5.2 China Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.6 India

8.3.6.1 India Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.6.2 India Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.7 Japan

8.3.7.1 Japan Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.7.2 Japan Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.8 South Korea

8.3.8.1 South Korea Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.8.2 South Korea Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.9 Taiwan

8.3.9.1 Taiwan Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.9.2 Taiwan Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.10 Thailand

8.3.10.1 Thailand Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.10.2 Thailand Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.11 Malaysia

8.3.11.1 Malaysia Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.11.2 Malaysia Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.3.12 Others

8.3.12.1 Others Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.3.12.2 Others Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.4 North America

8.4.1 North America Ethoxylates: Market Size, By Country, 2014–2021 (Kiloton)

8.4.2 North America Ethoxylates: Market Size, By Country, 2014–2021 (USD Million)

8.4.3 North America Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.4.4 North America Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.4.5 U.S.

8.4.5.1 U.S. Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.4.5.2 U.S. Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.4.6 Canada

8.4.6.1 Canada Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.4.6.2 Canada Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.4.7 Others

8.4.7.1 Others Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.4.7.2 Others Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.5 Latin America

8.5.1 Latin America Ethoxylates: Market Size, By Country, 2014–2021 (Kiloton)

8.5.2 Latin America Ethoxylates: Market Size, By Country, 2014–2021 (USD Million)

8.5.3 Latin America Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.5.4 Latin America Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.5.5 Brazil

8.5.5.1 Brazil Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.5.5.2 Brazil Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.5.6 Argentina

8.5.6.1 Argentina Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.5.6.2 Argentina Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.6 The Middle East & Africa

8.6.1 The Middle East & Africa Ethoxylates: Market Size, By Country, 2014–2021 (Kiloton)

8.6.2 The Middle East & Africa Ethoxylates: Market Size, By Country, 2014–2021 (USD Million)

8.6.3 The Middle East & Africa Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.6.4 The Middle East & Africa Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.6.5 The Middle East

8.6.5.1 The Middle East Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.6.5.2 The Middle East Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

8.6.6 Africa

8.6.6.1 Africa Ethoxylates: Market Size, By Type, 2014–2021 (Kiloton)

8.6.6.2 Africa Ethoxylates: Market Size, By Type, 2014–2021 (USD Million)

9 Competitive Landscape (Page No. - 102)

9.1 Overview

9.2 Major Players

9.2.1 Market Share Analysis

9.2.2 Competitive Benchmarking

9.3 Expansion: the Most Popular Growth Strategy

9.4 Competitive Situation and Trends

9.4.1 Expansions

9.4.2 Acquisitions

9.4.3 Others

10 Company Profiles (Page No. - 108)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 The Dow Chemical Company

10.1.1 Business Overview

10.1.2 Recent Developments

10.1.3 Swot Analysis

10.1.4 MNM View

10.2 BASF S.E.

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 Swot Analysis

10.2.5 MNM View

10.3 Royal Dutch Shell Plc

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 Swot Analysis

10.3.5 MNM View

10.4 Huntsman International Llc

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 Swot Analysis

10.4.5 MNM View

10.5 Stepan Company

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 Swot Analysis

10.5.5 MNM View

10.6 Clariant Ag

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 MNM View

10.7 Sasol Limited

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Recent Developments

10.7.4 MNM View

10.8 India Glycols Limited (Igl)

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 MNM View

10.9 Ineos Group Limited

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 MNM View

10.10 Solvay

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 Recent Developments

10.10.4 MNM View

10.11 Galaxy Surfactants Ltd.

10.11.1 Business Overview

10.11.2 Products Offered

10.12 Kao Corporation

10.12.1 Business Overview

10.12.2 Products Offered

10.13 Croda International Plc

10.13.1 Business Overview

10.13.2 Products Offered

10.14 Lion Speciality Chemicals Co., Ltd.

10.14.1 Business Overview

10.14.2 Products Offered

10.15 Procter & Gamble

10.15.1 Business Overview

10.15.2 Products Offered

10.16 KLK Oleo

10.16.1 Business Overview

10.16.2 Products Offered

10.17 Sertling Auxiliaries Pvt. Ltd

10.17.1 Business Overview

10.17.2 Products Offered

10.18 Norchem

10.18.1 Business Overview

10.18.2 Products Offered

10.19 Pt Polychem Indonesia Tbk

10.19.1 Business Overview

10.19.2 Products Offered

10.20 Ecogreen Oleochemicals

10.20.1 Business Overview

10.20.2 Products Offered

*Details Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 131)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing Rt: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (123 Tables)

Table 1 Total GDP of 10 Largest Global Economies in Terms of Ppp, 2020

Table 2 Oil Production, By Region and Country, 2010–2014 (Million Ton)

Table 3 Ethoxylates Market Size, By Type, 2014 – 2021 (Kilotons)

Table 4 Ethoxylates Market Size, By Type, 2014 – 2021 (USD Million)

Table 5 Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 6 Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 7 Natural Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 8 Natural Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 9 Synthetic Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 10 Synthetic Alcohol Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 11 Global Alcohol Ethoxylate Market, By Production Type, 2014 – 2021, (Kilotons)

Table 12 Global Alcohol Ethoxylate Market, By Production Type, 2014 – 2021, (USD Million)

Table 13 Fatty Amine Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 14 Fatty Amine Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 15 Fatty Acid Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 16 Fatty Acid Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 17 Methyl Ester Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 18 Methyl Ester Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 19 Glyceride Ethoxylates Market Size, By Region, 2014 – 2021 (Kilotons)

Table 20 Glyceride Ethoxylates Market Size, By Region, 2014 – 2021 (USD Million)

Table 21 Ethoxylates: End-Use Industries

Table 22 Ethoxylates Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 23 Ethoxylates Market, By End-Use Industry, 2014-2021 (USD Million)

Table 24 Laundry and Dishwashing Detergent: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 25 Laundry and Dishwashing Detergent: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 26 I&I Cleaning: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 27 I&I Cleaning: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 28 Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 29 Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 30 Household & Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 31 Household & Personal Care: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 32 Ointments & Emulsions: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 33 Ointments & Emulsions: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 34 Pharmaceuticals: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 35 Pharmaceuticals: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 36 Herbicides: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 37 Herbicides: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 38 Insecticides: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 39 Insecticides: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 40 Fungicides: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 41 Fungicides: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 42 Agrochemicals: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 43 Agrochemicals: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 44 Foam Control and Wetting Agents: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 45 Foam Control and Wetting Agents: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 46 Lubricants & Emulsifiers: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 47 Lubricants & Emulsifiers: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 48 Oilfield Chemicals: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 49 Oilfield Chemicals: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 50 Other End-Use Industry: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 51 Other End-Use Industry: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 52 Ethoxylates Market Size, By Region, 2014–2021 (Kilotons)

Table 53 Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

Table 54 Europe Ethoxylates: Market Size, By Country, 2014-2021 (Kilotons)

Table 55 Europe Ethoxylates: Market Size, By Country, 2014-2021(USD Million)

Table 56 Europe Ethoxylates: Market Size, By Type, 2014 -2021 (Kilotons)

Table 57 Europe Ethoxylates: Market Size, By Type, 2014 -2021 (USD Million)

Table 58 Germany Ethoxylates: Market Size, By Type, 2014 -2021 (Kilotons)

Table 59 Germany Ethoxylates: Market Size, By Type, 2014 -2021 (USD Million)

Table 60 U.K.: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 61 U.K.: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 62 France: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 63 France: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 64 Italy: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 65 Italy: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 66 Russia: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 67 Russia: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 68 Spain: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 69 Spain: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 70 Poland: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 71 Poland: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 72 Rest of Europe: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 73 Rest of Europe: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 74 Asia Pacific Ethoxylates: Market Size, By Country, 2014-2021 (Kilotons)

Table 75 Asia Pacific Ethoxylates: Market Size, By Country, 2014-2021 (USD Million)

Table 76 Asia Pacific Ethoxylates: Market Size, By Type, 2014-2021 (Kilotons)

Table 77 Asia Pacific Ethoxylates: Market Size, By Type, 2014-2021 (USD Million)

Table 78 China Ethoxylates: Market Size, By Type, 2014-2021 (Kilotons)

Table 79 China: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 80 India Ethoxylates: Market Size, By Type, 2014-2021 (Kilotons)

Table 81 India: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 82 Japan Ethoxylates: Market Size, By Type, 2014-2021 (Kilotons)

Table 83 Japan: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 84 South Korea: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 85 South Korea: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 86 Taiwan: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 87 Taiwan: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 88 Thailand: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 89 Thailand: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 90 Malaysia: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 91 Malaysia: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 92 Others: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 93 Others: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 94 North America Ethoxylates: Market Size, By Country, 2014-2021 (Kilotons)

Table 95 North America Ethoxylates: Market Size, By Country, 2014-2021(USD Million)

Table 96 North America: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 97 North America: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 98 U.S.: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 99 U.S.: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 100 Canada: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 101 Canada: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 102 Others: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 103 Others: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 104 Latin America Ethoxylates: Market Size, By Country, 2014-2021 (Kilotons)

Table 105 Latin America Ethoxylates: Market Size, By Country, 2014-2021(USD Million)

Table 106 Latin America: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 107 Latin America: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 108 Brazil: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 109 Brazil: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 110 Argentina: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 111 Argentina: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 112 Middle East & Africa Ethoxylates: Market Size, By Country, 2014-2021 (Kilotons)

Table 113 Middle East & Africa Ethoxylates: Market Size, By Country, 2014-2021(USD Million)

Table 114 Middle East & Africa: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 115 Middle East & Africa: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 116 Middle East: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 117 Middle East: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 118 Africa: Ethoxylates Market Size, By Type, 2014–2021 (Kilotons)

Table 119 Africa: Ethoxylates Market Size, By Type, 2014–2021 (USD Million)

Table 120 Ethoxylates Market Players

Table 121 Expansions, 2012–2016

Table 122 Acquisitions, 2012–2016

Table 123 Others, 2012–2016

List of Figures (42 Figures)

Figure 1 Ethoxylates Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Ethoxylates Market: Data Triangulation

Figure 5 Alcohol Ethoxylate to Dominate the Ethoxylates Market During the Forecast Period

Figure 6 Household & Personal Care to be the Largest End-Use Indsutry Between 2016 and 2021

Figure 7 Asia-Pacific to be the Fastest-Growing Market Between 2016 and 2021

Figure 8 Attractive Opportunities in the Ethoxylates Market Between 2016 and 2021

Figure 9 Asia-Pacific Ethoxylates Market to Witness Rapid Growth Between 2016 and 2021

Figure 10 Alcohol Ethoxylates Dominates Ethoxylates Market, 2016 (USD Million)

Figure 11 Germany Accounted for Major Share of the Europe Ethoxylates Market in 2015

Figure 12 Asia-Pacific and the Middle East & Africa to Experience Increased Demand for Ethoxylates Between 2016 and 2021

Figure 13 Ethoxylates Market, By Region

Figure 14 Drivers, Restraints, Opprtunities, and Challenges in the Ethoxylates Market

Figure 15 Overview of Factors Governing the Ethoxylates Market

Figure 16 Revenue Pocket Matrix: Type

Figure 17 Revenue Pocket Matrix: End-Use Industry

Figure 18 Value Chain Analysis for Ethoxylates

Figure 19 Porter’s Five Forces Analysis (2014) – High Feedstock Prices and Narrow Profit Margins are Impacting the Industry

Figure 20 Oil Production, By Region, 2013–2014

Figure 21 Alcohol Ethoxylate Is Estimated to Dominate the Overall Ethoxylates Market

Figure 22 Alcohol Ethoxylates, By Production Type, 2015

Figure 23 Household & Personal Care Industry to Dominate the Ethoxylates Market

Figure 24 Asia-Pacific to Dominate the Ethoxylates Market By 2021

Figure 25 Regional Snapshot of the Ethoxylates Market: China Driving the Global Market

Figure 26 Germany Is Expected to Dominate the European Ethoxylates Market During the Forecast Period

Figure 27 Asia-Pacific Ethoxylates Market Snapshot—China: Most Lucrative Market

Figure 28 China Will Dominate the Asia-Pacific Ethoxylates Market During the Forecast Period

Figure 29 North America Ethoxylates Market Snapshot: Canada to Witness Highest Cagr During the Forecast Period

Figure 30 U.S. Is the Largest Ethoxylates Market in North America During the Forecast Period

Figure 31 Brazil Will Continue to Dominate the Latin American Ethoxylates Market During the Forecast Period

Figure 32 Middle East Is the Largets Market of Ethoxyaltes Due to the Presence of Strong Oil & Gas Industry

Figure 33 Expansion Is the Major Growth Strategy Adopted Between 2012 and 2016

Figure 34 the Dow Chemical Company: Company Snapshot

Figure 35 BASF Se: Company Snapshot

Figure 36 Royal Dutch Shell Plc: Company Snapshot

Figure 37 Huntsman International Llc: Company Snapshot

Figure 38 Stepan Company: Company Snapshot

Figure 39 Clariant Ag: Company Snapshot

Figure 40 Sasol Limited: Company Snapshot

Figure 41 India Glycols Limited.: Company Snapshot

Figure 42 Solvay: Company Snapshot

Growth opportunities and latent adjacency in Ethoxylates Market

Require sample of market driver, value chain and by type for ethoxylate market report

Client is interested in research reports on Ethylene Oxide/ Ethylene Glycol, Ethanolamines, Ethoxylates

General information on market estimation at regional level, growth trends, application of C16-C18 ethoxylates market

General information on prosuction capacities of Butyl glycol ether and PEG, major manufacturers associated in the market

market size/demand for ethoxylates and potential future growth