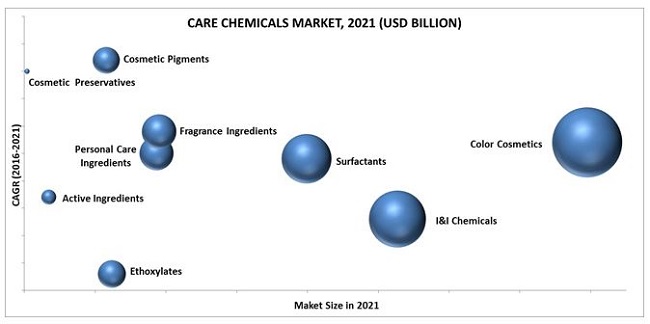

Top 10 Care Chemicals Market (Color Cosmetics, Personal Care Ingredients, Active Ingredients, Fragrance Ingredients, I&I Cleaning Chemicals, Surfactants, Emollient Esters, Cosmetic Pigments, Cosmetic Preservatives, Ethoxylates) - Global Forecast to 2021

Care chemicals are products that are used for homecare, personal care and industrial and institutional cleaning. The care chemicals such as cosmetic products, cosmetic pigments, personal care ingredients, surfactants, and much more are used for skin care, hair care, cleanliness, and hygiene at home and workplace. The report analyzes the key parameters that help in the growth of various care chemicals market. In addition, the companies functioning in the market have been profiled with major focus on their product offerings.

In this study, the years considered to estimate the market size of various care chemical markets are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Years – 2021

2015 has been considered the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To analyze and forecast the market size of the various care chemicals market, in terms of value

- To identify significant trends and factors driving or inhibiting the market growth

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments

- To define, describe, and forecast each market type on the basis of various segments and subsegments, and region

- To forecast the size of the market and submarkets by five regions, namely, Europe, Asia-Pacific, North America, and Rest of World (RoW)

- To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

The care chemicals supply chain starts with the procurement of raw materials required in the manufacturing of raw materials. Large numbers of chemicals with distinct functions go in the manufacturing of personal care chemicals. Raw materials for these chemicals are procured from different sources such as crude oil, natural gas, palm oil, and coconut oil. For instance, the raw materials for some emollients and conditioning polymers have to be procured from the farmers, while synthetic surfactants are synthesized from petroleum products that act as a base chemical in the production of the final product.

Base chemicals are supplied by the raw material supplier or sometimes the company itself manufactures the base chemicals that it needs. Since there are a large number of suppliers, procuring base chemicals is easy and cost-effective. On the other hand, in the case of feedstock, the procuring process is comparatively complicated, as the supplier procures materials from a limited number of farmers. However, in the case of a shortage or untimely delivery, may result in a delay in the production which many times lead to increased costs.

The chemical manufacturers such as BASF SE (Germany), Clariant AG (Switzerland), Akzo Nobel N.V. (Netherlands), and others process these raw materials to make the final product and are delivered to the personal care product manufacturing companies. There are many suppliers who have a global market reach, such as Brenntag Group (Germany), Nexeo Solutions (U.S.), IMCD Group (Netherlands), etc., these companies act as an intermediary in supplying the ingredients to the personal care products manufacturers such as Revlon (U.S.), L'Oréal Group (France), and Procter & Gamble Co. (U.S.). Some companies have their own distribution network, and thus they supply the ingredients directly to the product manufacturers. “This study answers several questions for stakeholders, primarily which market segments to focus upon during the next two to five years to prioritize their efforts and investments”

Target audience:

- Care Chemicals manufacturers

- Raw material suppliers

- Government bodies

- Cosmetic product manufacturers

To know about the assumptions considered for the study, download the pdf brochure

The Scope of the Report:

The report analyzes various care chemicals market. It provides a forecast of the market size, in terms of value and volume, and an analysis of trends in each of the markets.

The various markets covered in this report are

- Color Cosmetics (By Target market, Applications, and Region)

- Personal Care Ingredients (By Type, Application, and Region)

- Fragrance Ingredients (By Type, Application, and Region)

- Cosmetic Pigments (By Elemental Composition, Type, Application, and Region)

- Active Ingredients for Cosmetics (By Functionality, Application, and Region)

- Cosmetic Preservatives (By Type, Application, and Region)

- Emollient Esters (By Product, End-User, and Region)

- Surfactants (By Type, Substrate, Application, and Region)

- Industrial Cleaning Chemicals (By Ingredient type, Product type, Application, and Region)

- Ethoxylates (By Type, End-Use industry, and Region)

Available Customizations: The following customization options are available for this report:

-

Company information

Analysis and profiles of additional global as well as regional market players (Up to three)

-

Country-level information

Market analysis for additional countries

-

Pricing analysis

Detailed pricing analysis for each type of care chemicals market

Care chemicals are used in various homecare, personal care, cosmetics and industrial cleaning chemicals. The care chemicals market has been segmented into various markets such as personal care ingredients, active ingredients for cosmetics, cosmetic pigments, and much more.

Personal care ingredients are used in personal care products, which are broadly classified into hair care, skin care, oral care, toiletries, and cosmetics. The skin care segment is the largest application for personal care chemicals. The increasing demand for sun care products, anti-aging products, fairness products, and moisturizing creams is one of the major reasons for the growth in the skin care products industry. Hair care is the second-largest market for personal care chemicals and is used in shampoos, conditioners, and hair gels.

Active ingredients for cosmetics are those components in the cosmetic product formulation that imparts pharmacological properties or other direct effects in the cure, diagnosis treatment, mitigation, or prevention of disease. They are used in the cosmetics to provide functional properties when applied to the skin. The rising concerns regarding the aging skin and need for an even skin-tone are contributing towards the use of cosmetic active ingredients. Additionally, the temperature variations and rising heat levels are the factors contributing to the growth of sun care active ingredients.

Cosmetic pigments are used in the production of cosmetic colors, along with various other ingredients. Most of the color cosmetic manufacturers use inorganic or organic colors based on requirements. The cosmetic pigments market is classified on the basis of the elemental composition into organic and inorganic. Inorganic pigments dominate the cosmetic pigments market, as the demand for metal oxides is increasing. By application, the market is segmented into nail products, lip products, eye makeup, facial makeup, hair color products, special effect & special purpose, and other cosmetic products.

Stringent regulations governing the chemical market is the major factor restraining the growth of the care chemicals market. These regulations may be troublesome as they delay or prevent the launch of new products and may lead to product recalls. Implementation of new regulations or modifications to applicable regulations will have a negative effect on the growth of the market.

Some of the key players of the care chemicals market are AkzoNobel N.V. (Netherlands), BASF SE (Germany), Evonik Industries AG (Germany), Clariant AG (Switzerland), and Lonza Group Ltd (Switzerland). These players compete with each other, in terms of prices, and offer a wide range of products to meet the market requirements. The companies are primarily focused on research & development of new products for the market and this can be seen as there are lots of new product launches.

Please visit 360Quadrants to see the vendor listing of Top 20 Personal Care Ingredients Companies, Worldwide 2023

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Executive Summary (Page No. - 21)

3 Market Overview (Page No. - 23)

3.1 Market Dynamics

3.1.1 Drivers

3.1.1.1 Changing Lifestyle and Rise in Spending Capacity in Apac

3.1.1.2 Increasing Demand for Multi-Functional Ingredients

3.1.1.3 Workplace Hygiene Initiatives

3.1.2 Restraints

3.1.2.1 Stringent Government Regulations

3.1.3 Opportunities

3.1.3.1 Emerging Economies Present Huge Potential

3.1.3.2 Increasing Demand for Bio-Based Ingredients

4 Industry Trends (Page No. - 28)

4.1 Introduction

4.2 Supply Chain Analysis

4.3 Porter’s Five Forces Analysis

4.3.1 Threat From New Entrants

4.3.2 Bargaining Power of Suppliers

4.3.3 Threat of Substitutes

4.3.4 Bargaining Power of Buyers

4.3.5 Intensity of Competitive Rivalry

5 Care Chemicals Market (Page No. - 32)

5.1 Color Cosmetics

5.1.1 By Target Market

5.1.1.1 Prestige Products

5.1.1.2 Mass Products

5.1.2 By Application

5.1.2.1 Nail Products

5.1.2.2 Lip Products

5.1.2.3 Eye Make-Up

5.1.2.4 Facial Make-Up

5.1.2.5 Hair Color Products

5.1.2.6 Special Effect & Special Purpose Products

5.1.2.7 Others

5.1.3 By Region

5.1.3.1 North America

5.1.3.2 Europe

5.1.3.3 Asia-Pacific

5.1.3.4 RoW

5.2 Personal Care Ingredients

5.2.1 By Type

5.2.1.1 Surfactants

5.2.1.2 Conditioning Polymers

5.2.1.3 Emollients

5.2.1.4 Rheology Modifiers

5.2.1.5 Others

5.2.2 By Application

5.2.2.1 Skin Care

5.2.2.2 Hair Care

5.2.2.3 Oral Care

5.2.2.4 Others

5.2.3 By Region

5.2.3.1 North America

5.2.3.2 Europe

5.2.3.3 Asia-Pacific

5.2.3.4 RoW

5.3 Fragrance Ingredients

5.3.1 By Type

5.3.1.1 Essential Oils

5.3.1.2 Aroma Chemicals

5.3.2 By Application

5.3.2.1 Cosmetics & Toiletries

5.3.2.2 Fine Fragrances

5.3.2.3 Soaps & Detergents

5.3.2.4 Others

5.3.3 By Region

5.3.3.1 North America

5.3.3.2 Europe

5.3.3.3 Asia-Pacific

5.3.3.4 RoW

5.4 Cosmetic Pigments

5.4.1 By Elemental Composition

5.4.1.1 Organic Pigments

5.4.1.1.1 Lakes

5.4.1.1.2 Toners

5.4.1.1.3 True Pigments

5.4.1.2 Inorganic Pigments

5.4.1.2.1 Titanium Dioxide

5.4.1.2.2 Iron Oxide

5.4.1.2.3 Chromium Dioxide

5.4.1.2.4 Zinc Oxide

5.4.1.2.5 MICA

5.4.1.2.6 Ultramarines

5.4.1.2.7 Other Metal Oxides

5.4.2 By Type

5.4.2.1 Special Effect Pigments

5.4.2.1.1 Pearlescents

5.4.2.1.2 Organic Pearls

5.4.2.1.2.1 Inorganic Pearls

5.4.2.1.2.2 Silver Pearls

5.4.2.1.2.3 Colored Interference Pearls

5.4.2.1.3 Metallic

5.4.2.2 Surface Treated Pigments

5.4.2.2.1 Methicone & Dimethicone Treated

5.4.2.2.2 Alkyl Silane Treated

5.4.2.2.3 Organo Titanate Treated

5.4.2.2.4 Cross Polymer Treated

5.4.2.3 Nano Pigments

5.4.2.3.1 Titanium Dioxide

5.4.2.3.2 Zinc Oxide

5.4.2.3.3 Carbon Black

5.4.2.4 Natural Colorants

5.4.2.4.1 Alkanet Root

5.4.2.4.2 Henna

5.4.2.4.3 Phycobiliproteins

5.4.3 By Application

5.4.3.1 Facial Makeup

5.4.3.1.1 Powder

5.4.3.1.2 Foundation

5.4.3.1.3 Blushers

5.4.3.2 Eye Makeup

5.4.3.2.1 Eye Liner

5.4.3.2.2 Eye-Shadow

5.4.3.2.3 Mascara

5.4.3.3 Lip Products

5.4.3.3.1 Lip stick

5.4.3.3.2 Lip Gloss

5.4.3.3.3 Lip Liner

5.4.3.4 Nail Products

5.4.3.4.1 Nail Polish

5.4.3.4.2 Nail Treatment

5.4.3.5 Hair Color Products

5.4.3.6 Special Effect & Special Purpose Products

5.4.3.7 Others

5.4.3.7.1 Toothpaste

5.4.3.7.2 Hair Shampoo & Conditioner

5.4.3.7.3 Sunless Tanning Products

5.4.4 By Region

5.4.4.1 North America

5.4.4.2 Europe

5.4.4.3 Asia-Pacific

5.4.4.4 RoW

5.5 Active Ingredients for Cosmetics

5.5.1 By Functionality

5.5.1.1 Conditioning Agent

5.5.1.2 UV Filters

5.5.1.3 Anti-Ageing Agents

5.5.1.4 Skin Lightening Agents

5.5.2 By Application

5.5.2.1 Skin Care

5.5.2.1.1 Body Care

5.5.2.1.2 Face Care

5.5.2.1.3 Sun Care

5.5.2.2 Hair Care

5.5.2.2.1 Shampoos

5.5.2.2.2 Dyes

5.5.3 By Region

5.5.3.1 North America

5.5.3.2 Europe

5.5.3.3 Asia-Pacific

5.5.3.4 RoW

5.6 Cosmetic Preservatives

5.6.1 By Type

5.6.1.1 Paraben Esters

5.6.1.2 Formaldehyde Donors

5.6.1.3 Phenol Derivatives

5.6.1.4 Alcohols

5.6.1.5 Inorganics

5.6.1.6 Quaternary Compounds

5.6.1.7 Organic Acids and Their Salts

5.6.1.8 Others

5.6.2 By Application

5.6.2.1 Lotions. Facemasks, Sunscreens & Scrubs

5.6.2.2 Shampoos & Conditioners

5.6.2.3 Soaps, Shower Cleansers & Shaving Gels

5.6.2.4 Face Powder & Powder Compacts

5.6.2.5 Mouthwash & Toothpaste

5.6.2.6 Others

5.6.3 By Region

5.6.3.1 Americas

5.6.3.2 Europe

5.6.3.3 Asia-Pacific

5.6.3.4 RoW

5.7 Emollient Esters

5.7.1 By Product

5.7.1.1 Isopropyl Myristate

5.7.1.2 C12-15 Alkyl Benzoate

5.7.1.3 Caprylic/Capric Triglyceride

5.7.1.4 Cetyl Palmitate

5.7.1.5 Myristyl Myristate

5.7.2 By Application

5.7.2.1 Skin Care

5.7.2.2 Hair Care

5.7.2.3 Cosmetics

5.7.2.4 Oral Care

5.7.2.5 Others

5.7.3 By Region

5.7.3.1 Europe

5.7.3.2 North America

5.7.3.3 Asia-Pacific

5.7.3.4 RoW

5.8 Surfactants

5.8.1 By Type

5.8.1.1 Anionic Surfactants

5.8.1.1.1 Linear Alkylbenzene Sulfonate (LAS)

5.8.1.1.2 Secondary Alkane Sulfonate (SAS)

5.8.1.1.3 Alpha Olefin Sulfonates (AOS)

5.8.1.1.4 Methyl Ester Sulfonates (Mes)

5.8.1.2 Non-Ionic Surfactants

5.8.1.2.1 Alcohol Ethoxylates (AE)

5.8.1.2.2 Amine Oxides

5.8.1.3 Cationic Surfactants

5.8.1.4 Amphoteric Surfactants

5.8.2 By Substrate

5.8.2.1 Synthetic Surfactants

5.8.2.2 Bio-Based Surfactants

5.8.2.2.1 Chemically Synthesized Bio-Based Surfactants

5.8.2.2.1.1 Sucrose Esters

5.8.2.2.1.2 Fatty Acid Glucamides

5.8.2.2.1.3 Sorbitan Esters

5.8.2.2.2 Bio Surfactants

5.8.2.2.2.1 Low Molecular Weight Biosurfactants

5.8.2.2.2.2 High Molecular Weight Biosurfactants

5.8.3 By Application

5.8.3.1 Detergents

5.8.3.2 Personal Care

5.8.3.3 Textile

5.8.3.4 Industrial & Institutional Cleaning

5.8.3.5 Elastomers & Plastics

5.8.3.6 Oilfield Chemicals

5.8.3.7 Crop Protection

5.8.3.8 Food & Beverage

5.8.3.9 Others

5.8.4 By Region

5.8.4.1 North America

5.8.4.2 Europe

5.8.4.3 Asia-Pacific

5.8.4.4 RoW

5.9 Industrial Cleaning Market

5.9.1 By Ingredient Type

5.9.1.1 Chelating Agents

5.9.1.2 Ph Regulators

5.9.1.3 Solubilizers/Hydrotropes

5.9.1.4 Solvents

5.9.1.5 Surfactants

5.9.1.5.1 Anionic Surfactants

5.9.1.5.2 Nonionic Surfactants

5.9.1.5.3 Cationic Surfactants

5.9.1.6 Amphoteric Surfactants

5.9.1.7 Others

5.9.2 By Application

5.9.2.1 Manufacturing and Commercial Offices

5.9.2.2 Healthcare

5.9.2.3 Retail & Food Service

5.9.2.4 Hospitality

5.9.2.5 Automotive & Aerospace

5.9.2.6 Food Processing

5.9.2.7 Others

5.9.3 By Product Type

5.9.3.1 Metal Cleaners

5.9.3.2 General Cleaners

5.9.3.3 Dishwashing

5.9.3.4 Oven & Grills

5.9.3.5 Food Processing Industry Cleaners

5.9.3.6 Dairy Industry Cleaners

5.9.4 By Region

5.9.4.1 Europe

5.9.4.2 North America

5.9.4.3 Asia-Pacific

5.9.4.4 RoW

5.10 Ethoxylates Market

5.10.1 By Type

5.10.1.1 Alcohol Ethoxylates (AE)

5.10.1.1.1 Natural Alcohol Ethoxylates

5.10.1.1.2 Synthetic Alcohol Ethoxylates

5.10.1.2 Fatty Amine Ethoxylates

5.10.1.3 Fatty Acid Ethoxylates

5.10.1.4 Methyl Ester Ethoxylates (MEE)

5.10.1.5 Glyceride Ethoxylates

5.10.2 By Application

5.10.2.1 Household & Personal Care

5.10.2.1.1 Laundry and Dishwashing Detergent

5.10.2.1.2 I&I Cleaning

5.10.2.1.3 Personal Care

5.10.2.2 Pharmaceutical

5.10.2.2.1 Ointments & Emulsions

5.10.2.3 Agrochemicals

5.10.2.3.1 Herbicides

5.10.2.3.2 Insecticides

5.10.2.3.3 Fungicides

5.10.2.4 Oilfield Chemicals

5.10.2.4.1 Foam Control and Wetting Agents

5.10.2.4.2 Lubricants & Emulsifiers

5.10.2.4.3 Automotive & Aerospace

5.10.2.4.4 Food Processing

5.10.2.5 Oilfield Chemicals

5.10.2.5.1 Foam Control and Wetting Agents

5.10.2.5.2 Lubricants & Emulsifiers

5.10.2.6 Oilfield Chemicals

5.10.3 By Region

5.10.3.1 Europe

5.10.3.2 North America

5.10.3.3 Asia-Pacific

5.10.3.4 RoW

6 Competitive Landscape (Page No. - 117)

6.1 Overview

6.2 Competitive Situation and Trends

6.2.1 New Product Launches

6.2.1 Expansions

6.2.2 Acquisitions

6.2.3 Research & Development

6.2.4 Others

7 Company Profiles (Page No. - 122)

(Overview, Financial*, Products & Services, Strategy, and Developments)

7.1 AkzoNobel N.V.

7.2 BASF SE

7.3 Clariant AG

7.4 Evonik Industries AG

7.5 Gattefossé

7.6 Lonza Group Ltd.

7.7 Lucas Meyer Cosmetics

7.8 Sensient Cosmetic Technologies

7.9 Stepan Company

7.1 Sun Chemical Corporation (DIC Corp.)

7.11 The DOW Chemical Company

7.12 Other Players

7.12.1 Ashland Inc.

7.12.2 Croda International PLC

7.12.3 AAK AB

7.12.4 Sederma Inc.

7.12.5 Solvay SA

7.12.6 Seppic SA

7.12.7 Unilever N.V.

7.12.8 L’oréal Group

7.12.9 Lanxess AG

7.12.10 Huntsman Corporation

7.12.11 Kobo Products Inc.

7.12.12 EMD Performance Materials (MERCK)

7.12.13 Wacker Chemie AG

7.12.14 Geotech International B.V.

7.12.15 Symrise AG

7.12.16 Miyoshi Kasei, Inc.

*Details Might Not Be Captured in Case of Unlisted Companies.

8 Appendix (Page No. - 153)

8.1 Knowledge Store: Marketsandmarkets Subscription Portal

8.2 Introducing RT: Real Time Market Intelligence

8.3 Available Customizations

8.4 Related Reports

List of Tables (54 Tables)

Table 1 Major Trends in Personal Care for Active Agents

Table 2 Care Chemicals: Regulations By Country

Table 3 10 Largest Economies, By GDP in Ppp Terms, 2010 & 2020

Table 4 Green Care Chemicals

Table 5 Color Cosmetics Market Size, By Target Market, 2014–2021 (USD Billion)

Table 6 Color Cosmetics Market Size, By Application, 2014–2021 (USD Billion)

Table 7 Color Cosmetics Market Size, By Region, 2014–2021 (USD Billion)

Table 8 Personal Care Ingredients Market Size, By Type, 2014–2021 (USD Million)

Table 9 Personal Ingredients Market Size, By Application, 2014–2021 (USD Million)

Table 10 Personal Care Ingredients Market Size, By Region, 2014–2021 (USD Million)

Table 11 Fragrance Ingredients Market Size, By Type, 2014–2021 (USD Million)

Table 12 Plant Parts as Source of Essential Oils

Table 13 Plant-Producing Regions

Table 14 Fragrance Ingredients Market Size, By Application, 2014–2021 (USD Million)

Table 15 Fragrance Ingredients Market Size, By Region, 2014–2021 (USD Million)

Table 16 Cosmetic Pigments Market Size, By Elemental Composition, 2014–2021 (USD Million)

Table 17 Cosmetic Pigments Market Size, By Elemental Composition, 2014–2021 (Kiloton)

Table 18 Inorganic Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 19 Cosmetic Pigments Market Size, By Type, 2014–2021 (USD Million)

Table 20 Cosmetic Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 21 Cosmetic Pigments Market Size, By Application, 2014–2021 (USD Million)

Table 22 Cosmetic Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 23 Cosmetic Pigments Market Size, By Region, 2014–2021 (USD Million)

Table 24 Cosmetic Pigments Market Size, By Region, 2014–2021 (Kiloton)

Table 25 Active Ingredient for Cosmetics Market Size, By Functionality, 2014–2021 (USD Million)

Table 26 Active Ingredient for Cosmetics Market Size, By Application, 2014–2021 (USD Million)

Table 27 Active Ingredients for Cosmetics Market Size, By Region, 2014–2021 (USD Million)

Table 28 Cosmetic Preservatives Market Size, By Type, 2014–2021(USD Million)

Table 29 Cosmetic Preservatives Market, By Type, 2014-2021 (Ton)

Table 30 Cosmetic Preservatives Market Size, By Application, 2014–2021 (USD Million)

Table 31 Cosmetic Preservatives Market Size, By Application, 2014–2021 (Ton)

Table 32 Cosmetic Preservatives Market Size, By Region, 2014–2021 (USD Million)

Table 33 Cosmetic Preservatives Market Size, By Region, 2014–2021 (Ton)

Table 34 Emollient Esters Market Size, By Product, 2014–2021 (Ton)

Table 35 Emollient Esters Market Size, By Application, 2014–2021 (Ton)

Table 36 Emollient Esters Market Size, By Region, 2014–2021 (Ton)

Table 37 Surfactants Market Size, By Type, 2014–2021 (Kiloton)

Table 38 Surfactants Market Size, By Type, 2014–2021 (USD Million)

Table 39 Surfactants Market Size, By Substrate, 2014–2021 (Kiloton)

Table 40 Surfactants Market Size, By Substrate, 2014–2021 (USD Million)

Table 41 Surfactants: Breakdown of Application

Table 42 Surfactants Market Size, By Application, 2014–2021 (Kiloton)

Table 43 Surfactants Market Size, By Application, 2014–2021 (USD Million)

Table 44 Surfactants Market Size, By Region, 2014–2021 (USD Million)

Table 45 Surfactants Market Size, By Region, 2014–2021 (Kilotons)

Table 46 I&I Cleaning Chemicals Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 47 I&I Cleaning Chemicals Market Size, By Application, 2014-2021 (USD Million)

Table 48 I&I Cleaning Chemicals Market Size, By Product Type, 2014-2021 (USD Million)

Table 49 I&I Cleaning Chemicals Market Size, Region, 2014-2021 (USD Million)

Table 50 Ethoxylates Market Size, By Type, 2014 – 2021 (Kiloton)

Table 51 Ethoxylates Market Size, By End-Use Industry, 2014-2021 (Kiloton)

Table 52 Ethoxylates Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 53 Ethoxylates Market Size, By Region, 2014–2021 (Kiloton)

Table 54 Ethoxylates Market Size, By Region, 2014–2021 (USD Million)

List of Figures (18 Figures)

Figure 1 Care Chemicals Market Segmentation

Figure 2 Cosmetic Pigments to Be Fastest Growing Market

Figure 3 Changing Lifestyle and Increasing Disposable Income to Drive the Care Chemicals Market in Future

Figure 4 Porter’s Five Forces Analysis

Figure 5 Personal Care Ingredients Market Snapshot

Figure 6 Essential Oil to Lead the Fragrance Ingredients Market Snapshot

Figure 7 New Product Launches Was the Key Growth Strategy Adopted By Leading Companies

Figure 8 Battle for Market Share: New Product Launches is the Key Strategy Adopted By Market Players

Figure 9 AkzoNobel N.V.: Company at A Glance

Figure 10 AkzoNobel N.V. : SWOT Analysis

Figure 11 BASF SE: Company at A Glance

Figure 12 BASF SE: SWOT Analysis

Figure 13 Clariant AG: Company at A Glance

Figure 14 Clariant AG: SWOT Analysis

Figure 15 Evonik Industries AG: Company Snapshot

Figure 16 Lonza Group Ltd: Company Snapshot

Figure 17 Stepan Company: Company at A Glance

Figure 18 The DOW Chemical Company: Company at A Glance

Growth opportunities and latent adjacency in Top 10 Care Chemicals Market