Nonylphenol Ethoxylates Market by Application (Industrial & Institutional Cleaning, Paints, Agrochemicals, Leather, Textile, Oilfield ChemicalS) and Region - Global Forecast to 2021

[61 Pages Report] The global NPEs market is estimated to decline and reach at USD 607.5 Million by 2021. In this report, 2015 is considered as the base year and the forecast period is between 2016 and 2021.

The objectives of this study are:

- To analyze and forecast the market size of nonylphenol ethoxylates, in terms of both value and volume

- To define, describe, and segment the global nonylphenol ethoxylates market by application

- To forecast the sizes of the market segments based on regions such as Asia-Pacific, North America, Europe, South America, and the Middle East & Africa

- To provide detailed information regarding the important factors (drivers, restraints, and opportunities) influencing the growth of the market along with an analysis of substitutes of nonylphenol ethoxylates market

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market of nonylphenol ethoxylates

- To strategically profile key players and comprehensively analyze their core competencies

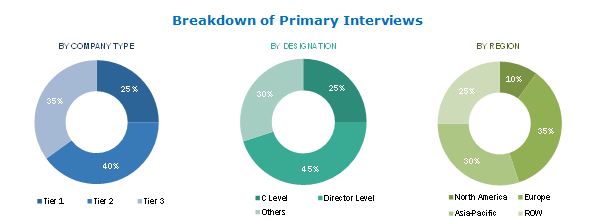

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial study of the NPEs market. The primary sources mainly include several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industry’s supply chain. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the global nonylphenol ethoxylates market are AkzoNobel N.V. (Netherlands), Clariant AG (Switzerland), The DOW Chemical Company (U.S.), Hunstman (U.S.), Stepan Company (U.S.), India Glycols (India), SABIC (Saudi Arabia), PJSC Nizhnekamskneftekhim (Russia), Solvay (Belgium), and PCC Exol SA (Poland). The products manufactured by these companies are used by I&I cleaning, paints, oilfield chemicals, leather, agrochemicals, and textile related companies such as Ineos Group (Japan), Syngeta (Switzerland), and Geelong Leathers Ltd. (Australia).

Target Audience:

- nonylphenol ethoxylates manufacturers

- nonylphenol ethoxylates dealers

- nonylphenol ethoxylates suppliers

- End users

- Raw material suppliers

- Others

Scope of the Report:

This report categorizes the global nonylphenol ethoxylates market market based on application and region.

Market Segmentation, by Application:

The NPEs market has been segmented based on Application:

- I&I cleaning

- Paints

- Agrochemicals

- Leather

- Textile

- Oilfield chemicals

- Others (pulp & paper, plastics, building & construction, and electrical & optical)

Market Segmentation, by Region:

The regional analysis covers:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global market size of nonylphenol ethoxylates (NPEs) is estimated to decline and reach USD 607.5 Million by 2021, in terms of value. The market is segmented based on application and region. Various applications such as industrial & institutional (I&I) cleaning, paints, oilfield chemicals, leather, textiles, and agrochemicals will support the demand of nonylphenol ethoxylates during the forecast period.

The I&I cleaning segment accounted for almost one-third of the market share, in terms of volume, in 2015. The paints segment accounted for the second-largest application, followed by oilfield chemicals. In the paints segment, NPEs function as binder emulsifiers, pigment dispersants, and helps in improving wetting on low-energy substrates by restricting foam formation during applications and processing. In the oilfield chemicals segment, nonylphenol ethoxylates are used to demulsify crude oil and reduce the surface tension in water, thus helping in removal of dirt particles from the surface.

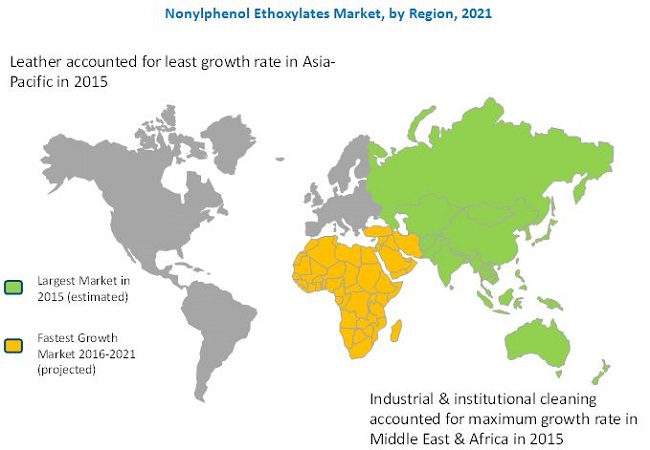

Asia-Pacific accounted for the largest share of the global NPEs market in 2015, in terms of both volume and value. The demand in Asia-Pacific will be supported by growth of applications in the region. The growth of the NPEs market is directly associated with the increasing manufacturing sites, commercial buildings, healthcare facilities, hotels, and others. This is due to several factors such as increasing income and spending on residential establishments as well as the relocation of manufacturing sites to the low-cost markets of Asia-Pacific.

The Middle East & Africa is expected to be the fastest-growing nonylphenol ethoxylates market. The demand is supported by the rising construction of industrial & institutional facilities in the region, especially in countries such as UAE and Qatar. The market is also expected to account for a considerable share in the paints application owing to rise in disposable income and spending in decorative paints. The demand of NPEs from the oilfield chemicals application is significant owing to presence of the established oil & gas industry in the region.

The key restraint of the market is the environmental concerns regarding the use of nonylphenol ethoxylates, which is responsible for the declining trend in its demand. The key opportunity for the market is the emerging markets of the Middle East & Africa and Asia-Pacific. Some of the major players operating in the global NPEs market are AkzoNobel N.V. (Netherlands), Clariant AG (Switzerland), The DOW Chemical Company (U.S.), Hunstman (U.S.), Stepan Company (U.S.), India Glycols (India), SABIC (Saudi Arabia), PJSC Nizhnekamskneftekhim (Russia), Solvay (Belgium), and PCC Exol SA (Poland). Companies in this market compete with each other with respect to prices and product offerings to meet the market requirements of nonylphenol ethoxylates.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Scope of the Market

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.2.3 Currency & Pricing

1.2.4 Package Size

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.1.1 Applications of NPE

4.2 Market Dynamics

4.2.1 Drivers

4.2.1.1 Superior Chemical Properties

4.2.1.2 Growth of End-Use Industries

4.2.2 Restraints

4.2.2.1 Environmental Concerns

4.2.3 Opportunities

4.2.3.1 Emerging Markets of Middle East and Asia-Pacific

4.3 Pricing Analysis

4.4 Substitutes Analysis

4.4.1 NP9 in Household Detergents

4.4.2 NP9 Substitutes in Household Chemicals

4.4.3 Substitutes of NP9 in Household Detergents

4.4.4 Alcohol Ethoxylates the Most Preferred Alternative for NP9

5 Nonylphenol Ethoxylates Market, By Application (Page No. - 31)

5.1 Introduction

5.2 I&I Cleaning

5.3 Paints

5.4 Agrochemicals

5.5 Leather

5.6 Textile

5.7 Oilfield Chemicals

5.8 Others

6 Nonylphenol Ethoxylates, By Region (Page No. - 34)

6.1 Introduction

6.2 North America

6.2.1 By Application

6.2.2 By Country

6.3 Europe

6.3.1 By Application

6.3.2 By Country

6.4 Asia-Pacific

6.4.1 By Application

6.4.2 By Country

6.5 Middle East & Africa

6.5.1 By Application

6.5.2 By Country

6.6 South America

6.6.1 By Application

6.6.2 By Country

7 Company Profiles (Page No. - 46)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

7.1 Akzonobel N.V.

7.2 Clariant AG

7.3 The DOW Chemical Company

7.4 Huntsman Corporation

7.5 Stepan Company

7.6 India Glycols

7.7 Sabic

7.8 PJSC Nizhnekamskneftekhim

7.9 Solvay

7.10 Pcc Exol Sa

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

8 Competitive Landscape (Page No. - 57)

9 Appendix (Page No. - 58)

9.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

List of Tables (33 Tables)

Table 1 Nonylphenol Ethoxylates Price By Region, 2014-2021 (USD/Kg)

Table 2 Alternatives of Nonylphenol Ethoxylates in Various Applications

Table 3 NP9 Market Size in Household Detergents, By Region, 2014–2021 (Kiloton)

Table 4 NP9 Market Size in Household Detergents, By Region, 2014–2021 (USD Million)

Table 5 Commonly Used Ingredients in Household Detergents

Table 6 Substitutes of NP9 in Household Detergents

Table 7 Substitutes of NP9 in Household Detergents By Chinese Players

Table 8 Alcohol Ethoxylates Market Size, By Application, 2014–2021 (Kiloton)

Table 9 Nonylyphenol Ethoxylates Market Analysis, By Application, 2014–2021 (Kiloton)

Table 10 Nonylyphenol Ethoxylates Market Analysis, By Application, 2014–2021 (USD Million)

Table 11 Nonylyphenol Ethoxylates Market Analysis, By Region, 2014–2021 (Kiloton)

Table 12 Nonylyphenol Ethoxylates Market Analysis, By Region, 2014–2021 (USD Million)

Table 13 North America: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (Kiloton)

Table 14 North America: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (USD Million)

Table 15 North America: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (Kiloton)

Table 16 North America: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (USD Million)

Table 17 Europe: Nonylphenol Ethoxylates Market, By Application,2014–2021 (Kiloton)

Table 18 Europe: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (USD Million)

Table 19 Europe: Nonylphenol Ethoxylates Market, By Country,2014–2021 (Kiloton)

Table 20 Europe: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (USD Million)

Table 21 Asia-Pacific: Nonylphenol Ethoxylates, By Application, 2014–2021 (Kiloton)

Table 22 Asia-Pacific: Nonylphenol Ethoxylates, By Application, 2014–2021 (USD Million)

Table 23 Asia-Pacific: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (Kiloton)

Table 24 Asia-Pacific: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (USD Million)

Table 25 Middle East & Africa: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (Kiloton)

Table 26 Middle East & Africa: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (USD Million)

Table 27 Middle East: Nonylphenol Market, By Country, 2014–2021 (Kiloton)

Table 28 Middle East: Nonylphenol Market, By Country, 2014–2021 (USD Million)

Table 29 South America: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (Kiloton)

Table 30 South America: Nonylphenol Ethoxylates Market, By Application, 2014–2021 (USD Million)

Table 31 South America: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (Kiloton)

Table 32 South America: Nonylphenol Ethoxylates Market, By Country, 2014–2021 (USD Million)

Table 33 Nonylphenol Ethoxylates Substitutes Launched By Companies, 2008-2015

List of Figures (17 Figures)

Figure 1 Nonylphenol Ethoxylates Market: Research Design

Figure 2 Nonylphenol Ethoxylates Market Size Estimation: Bottom-Up Approach

Figure 3 Nonylphenol Ethoxylates Market Size Estimation: Top-Down Approach

Figure 4 Nonylphenol Ethoxylates Market Breakdown & Data Triangulation

Figure 5 Nonylphenol Ethoxylates: Application Snapshot (2016 vs 2021)

Figure 6 Nonylphenol Ethoxylates Market Share (Volume), By Region, 2015

Figure 7 I&I Cleaning to Dominate the Nonylphenol Ethoxylates Market, During the Forecast Period

Figure 8 Saudi Arabia, Turkey, and Iran to Register Moderate Growth During the Forecast Period

Figure 9 Akzonobel N.V.: Company Snapshot

Figure 10 Clariant AG: Company Snapshot

Figure 11 The DOW Chemical Company: Company Snapshot

Figure 12 Huntsman Corporation: Company Snapshot

Figure 13 Stepan Company: Company Snapshot

Figure 14 India Glycols: Company Snapshot

Figure 15 Sabic: Company Snapshot

Figure 16 PJSC Nizhnekamskneftekhim: Company Snapshot

Figure 17 Solvay: Company Snapshot

Growth opportunities and latent adjacency in Nonylphenol Ethoxylates Market