Medical Adhesive Tapes Market by Type (Acrylic, Silicone, Rubber), Backing Material (Paper, Fabric, Plastic), Application (Surgeries, Wound Dressings, Secure IV Lines, Splints, Ostomy Seals) and Region - Global Forecast to 2026

Updated on : August 25, 2025

Medical Adhesive Tapes Market

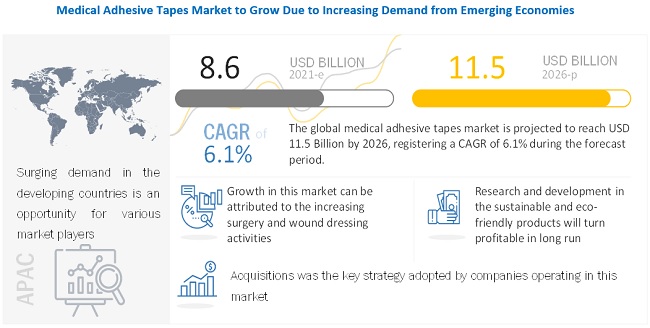

The global medical adhesive tapes market was valued at USD 8.6 billion in 2021 and is projected to reach USD 11.5 billion by 2026, growing at 6.1% cagr from 2021 to 2026. The drivers of market growth are identified as the rising number of surgeries, increasing incidence of diabetes, and the growing number of ambulatory surgery centers.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Medical Adhesive tapes Market

The value chain of medical adhesive tapes has witnessed various disruptions owing to the outbreak of COVID-19. The major disruption in the value chain has been the lack of suppliers due to various industries' shutdown, including raw material manufacturers. This was aggravated by international and regional road restrictions imposed across the globe to curb the spread of the pandemic. As a result, the prices of various raw materials, including PVC and paper, increased by between 10% to 50% for a brief period.

Apart from those mentioned above, the outbreak of COVID-19 significantly disrupted the healthcare industry. This pandemic put healthcare infrastructure to the test across the globe. Various countries underwent shortages in healthcare facilities. This led to a significant increase in demand for medical adhesive tapes since the outbreak

Medical Adhesive Tapes Market Dynamics

Driver: Growth in surgical procedures/operations

Surgeries involve incisions and amputations and thus are a major cause of wounds. Most pre-or post-surgery cases require the placement of catheters and infusions in patients. As medical adhesive tapes are used to secure wound dressings and infusion lines and treat wounds, their demand is expected to increase with the growth in the volume of surgeries performed across the globe.

There are several factors responsible for the growth in the number of surgical procedures across the globe, and these factors vary based on the type of surgery. According to data collected from 150 countries, the rate of C-section surgery was the highest in Latin America and the Caribbean—40.5% of total births. This figure was 32.3% in Northern America, 25.0% in Europe, 19.2% in Asia, and 7.3% in Africa (the lowest globally). Other than Africa and Asia, these statistics are considered significantly high in most regions across the globe as the WHO estimates that ideally, only 15% of cases require C-sections. C-section procedures are increasing with the growing focus on minimizing pain during childbirth. This trend, in turn, has created a potential growth area for the medical adhesive tapes market.

Restraint: Volatility in prices of raw materials

Prices and the availability of raw materials are the key factors that need to be considered by medical adhesive tape manufacturers to decide the cost structure of their products. Rubber, acrylic, silicone, paper, adhesives, and release liners are the raw materials used to manufacture medical adhesive tapes. Most of these raw materials are petroleum-based derivatives which are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile due to the increasing global demand and unrest in the Middle East. The uncertainty and fluctuations in the cost and availability of feedstock impact the market's growth.

The adhesives industry has been affected due to the increased energy costs in higher manufacturing costs. The consistently increasing global demand for chemicals and the capacity constraints in the supply of these primary chemicals and resin feedstock have fueled the increase in raw materials prices. These supply shortages of monomers such as piperylene and C9 monomers used to make adhesive raw materials have increased the costs of raw materials.

All these factors are restraining the growth of the market.

Opportunity: Healthcare sector in emerging markets

Emerging markets such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities to players operating in the medical adhesive tapes market. This can primarily be attributed to the improved healthcare sector in these emerging countries. The availability of high-quality surgical treatments at lower costs is the key factor enabling patients to shift to these countries for undergoing elective surgeries.

The increasing number of cosmetic surgeries and developing healthcare infrastructure in emerging countries are the other major factors expected to offer growth opportunities to the market players. To leverage the high growth opportunities for medical adhesive tapes in the emerging markets, manufacturers are strategically focusing on expanding their presence in China, India, Brazil, and Mexico.

Regulatory policies in the Asia-Pacific region are more adaptive and business-friendly due to the less stringent regulations and data requirements. The increasing competition in the mature markets will further compel the manufacturers of medical adhesive tapes to focus on emerging markets.

Challenge: Implementation of stringent regulatory policies

The chemical industry in Europe and North America is facing challenges from regulatory authorities such as the Control of Substances Hazardous to Health (COSHH), the European Union (EU), the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), the Globally Harmonized System (GHS), and the Environmental Protection Agency (EPA). Manufacturers in these regions are required to follow regulations regarding the production and usage of adhesive tapes for various applications to reduce the emissions of VOCs. These regulations require manufacturers to change their technologies from solvent-based to water-based, which is a major challenge for manufacturers because solvent-based adhesive tapes offer durability and can withstand a high range of temperatures, making them suitable for a wide range of applications, unlike water-based adhesive tapes. Owing to these regulations, the production of solvent-based adhesive tapes has decreased.

Acrylic to be the largest segment of medical adhesive tapes market

The acrylic-based medical adhesive tapes segment accounts for a major proportion of the overall global medical adhesive tapes market due to ease of use, low cost, and wide acceptability in applications such as surgery, wound dressing, and splints. Acrylic-based medical adhesive tapes are suitable in solvent- and water-based technologies as they offer higher resistance to other solvents, chemicals, and water. Water-based acrylic medical adhesives are the least expensive among all the resins used in the medical adhesive tapes industry.

Fabric backing segment to lead overall medical adhesive tapes market

An increase in awareness about healthcare among the older population has led to a surge in the sale of medical products in matured markets, which has led to a higher demand for fabric medical adhesive tapes. The aging population, rising chronic diseases, and high demand in Europe, Asia Pacific, and North America are expected to drive the fabric medical adhesive tapes market globally. These tapes have high strength, flexibility, and elasticity, making them durable. Owing to their strength, these tapes are used for securing dressings, catheters, tubing, and other medical purposes. Their strength and elasticity make them useable on body areas such as the biceps, which expand and contract with movement. Owing to their fabric backing, doctors or surgeons can mark them with pens to tag surgical scrubs and other equipment.

Wound dressing to be the fastest-growing application of medical adhesive tapes

Wound dressing is projected to be the fastest-growing application for medical adhesive tapes mainly because of its low infection probability and ease of use. The wound dressing application accounted for the second-largest share during the forecast period due to the factors such as better cosmetic effect, faster wound healing period, and preference by doctors.

To know about the assumptions considered for the study, download the pdf brochure

Medical Adhesive Tapes Market Players

The key players of adhesive tapes include 3M company (US), Medtronic PLC (US), Medline Industries (US), Avery Dennison Corporation (US), Johnson & Johnson (US), Smith & Nephew plc (United Kingdom), Nichiban (Japan), Paul Hartmann AG (Germany), Nitto Denko Corporation (Japan) and Scapa Group PLC (United Kingdom). 3M Company (US) is one of the largest medical adhesive tapes companies. This company has a strong global presence. It has a diversified product portfolio to cater to applications according to their requirements. To sustain its dominating position, the company may enter into new industries and target new markets.

Medical Adhesive Tapes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 8.6 billion |

|

Revenue Forecast in 2026 |

USD 11.5 billion |

|

CAGR |

6.1% |

|

Years considered for the study |

2017–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Million Square Meter) |

|

Segments |

Resin, Backing Material, Application, and Region |

|

Regions |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

3M company (US), Medtronic PLC (US), Medline Industries (US), Avery Dennison Corporation (US), Johnson & Johnson (US), Smith & Nephew plc (United Kingdom), Nichiban (Japan), Paul Hartmann AG (Germany), Nitto Denko Corporation (Japan) and Scapa Group PLC (United Kingdom) |

This research report categorizes the adhesive tapes market based on resin, backing material, application, and region.

On the basis of resin type, the medical adhesive tapes market is segmented as follows:

- Acrylic

- Silicone

- Rubber

- Others

On the basis of backing material, the medical adhesive tapes market is segmented as follows:

- Paper

- Fabric

- Plastic

- Others

On the basis of application, the medical adhesive tapes market is segmented as follows:

- Surgery

- Wound Dressing

- Splints

- Secure IV lines

- Ostomy Seals

- Others

On the basis of region, the medical adhesive tapes market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Recent Developments

- In August 2021, Medtronic Plc., the global leader in medical technology, announced that it has entered into a definitive agreement with Intersect ENT, a global ear, nose, and throat (ENT) medical technology leader dedicated to transforming patient care, under which Medtronic will acquire all outstanding shares of Intersect ENT for USD 28.25 per share in an all-cash transaction with an enterprise value of approximately USD 1.1 billion.

- In June-2021, Medline finalized the acquisition of a large portion of Teleflex's Hudson RCI brand of respiratory consumables.

- In May-2021, With a USD 1.5 billion investment, Medline enhances the domestic healthcare supply chain.

- In September-2021, Johnson & Johnson's manufacturing facility in Ringaskiddy, Ireland, continues to expand. After completing a USD 354 million expansion in 2019, the corporation intends to increase the site's capacity even more.

- In November 2020, Medtronic Plc. acquired France-based Medicrea International, a leader in the development of spine surgery with artificial intelligence (AI), predictive modeling, and patient-specific implants.

- In October-2020, Johnson & Johnson finalized its all-cash acquisition of Momenta Pharmaceuticals, Inc., a firm that discovers and develops innovative medicines for immune-mediated disorders, for about USD 6.5 billion.

Frequently Asked Questions (FAQ):

What is the mid-to-long term impact of the developments undertaken in the industry?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launches/developments, mergers & acquisitions, and investments & expansions are some of the key strategies adopted by the players to achieve growth in the medical adhesive tapes market.

What are the upcoming technologies used in medical adhesive tapes industry?

Medical adhesive tape manufacturers use three technologies to manufacture medical adhesive tapes, namely, hot-melt, water-based, and solvent-based. During the manufacture of medical adhesive tapes, technologies that do not release VOC fumes are preferred. Some of the preferred technologies are hot-melt-based, water-based, and solvent-free acrylic-based.

Which segment has the potential to register the highest market share?

Surgery to register the highest market share of medical adhesive tapes market. The high number of surgical procedures conducted across the globe is the major factor driving the market. This has also enabled the surgical wounds segment to dominate the medical adhesive tapes market by the application.

What is the current competitive landscape in the adhesive tapes market in terms of new technologies, production, and sales?

The competitive landscape of the adhesive tapes market includes the important growth strategies adopted by the key players between 2016 and 2021. 3M company (US), Medtronic PLC (US), Medline Industries (US), Avery Dennison Corporation (US), Johnson & Johnson (US), Smith & Nephew plc (United Kingdom), Nichiban (Japan), Paul Hartmann AG (Germany), Nitto Denko Corporation (Japan) and Scapa Group PLC (United Kingdom) are the leading players in the adhesive tapes market.

What will be the growth prospects of the medical adhesive tapes market?

The drivers of market growth are identified as the rising number of surgeries, increasing incidence of diabetes, and the growing number of ambulatory surgery centers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS AND EXCLUSIONS

1.2.1.1 Market inclusions

1.2.1.2 Market exclusions

1.3 MARKET SCOPE

FIGURE 1 MEDICAL ADHESIVE TAPES: MARKET SEGMENTATION

1.3.1 BY REGION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DESIGN

FIGURE 2 MEDICAL ADHESIVE TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 MEDICAL ADHESIVE TAPES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 4 MEDICAL ADHESIVE TAPES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MEDICAL ADHESIVE TAPES MARKET SIZE ESTIMATION, BY REGION

FIGURE 6 MEDICAL ADHESIVE TAPES MARKET SIZE ESTIMATION, BY APPLICATION

FIGURE 7 MEDICAL ADHESIVE TAPES MARKET SIZE ESTIMATION, BY RESIN TYPE

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST

2.3.2 DEMAND-SIDE FORECAST

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MEDICAL ADHESIVE TAPES MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 MEDICAL ADHESIVE TAPES: MARKET SNAPSHOT

FIGURE 9 NORTH AMERICA TO DOMINATE MEDICAL ADHESIVE TAPES MARKET, 2021–2026

FIGURE 10 ACRYLIC TO BE LARGEST SEGMENT OF MEDICAL ADHESIVE TAPES MARKET, 2021–2026

FIGURE 11 WOUND DRESSING TO BE FASTEST-GROWING APPLICATION OF MEDICAL ADHESIVE TAPES, 2021–2026

FIGURE 12 FABRIC BACKING MATERIAL TO DOMINATE MEDICAL ADHESIVE TAPES, 2021–2026

FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MEDICAL ADHESIVE TAPES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MEDICAL ADHESIVE TAPES MARKET

FIGURE 14 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES TO MARKET PLAYERS

4.2 MEDICAL ADHESIVE TAPES MARKET, BY RESIN TYPE

FIGURE 15 ACRYLIC SEGMENT TO DOMINATE MEDICAL ADHESIVE TAPES MARKET BETWEEN 2021 AND 2026

4.3 MEDICAL ADHESIVE TAPES MARKET, BY APPLICATION AND COUNTRY IN ASIA PACIFIC

FIGURE 16 SURGERY APPLICATION ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

4.4 ASIA PACIFIC MEDICAL ADHESIVE TAPES MARKET

FIGURE 17 INDIA TO BE FASTEST-GROWING MARKET FOR MEDICAL ADHESIVE TAPES

4.5 MEDICAL ADHESIVE TAPES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 18 MARKET IN DEVELOPING COUNTRIES TO GROW FASTER THAN IN DEVELOPED COUNTRIES, 2021–2026

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF MEDICAL ADHESIVE TAPES MARKET

TABLE 2 MEDICAL ADHESIVE TAPES MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.1 IMPACT OF COVID-19 ON VALUE CHAIN

5.2.1.1 Action plan against current vulnerability

5.3 SUPPLY CHAIN CRISES

5.4 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MEDICAL ADHESIVE TAPES MARKET

5.4.1 DRIVERS

5.4.1.1 Growth in surgical procedures/operations

5.4.1.2 Increasing aging population

5.4.1.3 High demand for medical adhesive tapes in Asia Pacific

5.4.1.4 Increased government relief packages for strengthening healthcare systems to handle COVID-19 boosted demand

5.4.2 RESTRAINTS

5.4.2.1 Volatility in prices of raw materials

5.4.3 OPPORTUNITIES

5.4.3.1 Healthcare sector in emerging markets

5.4.3.2 Improvements in healthcare systems

5.4.4 CHALLENGES

5.4.4.1 Increasing price pressure on market players

5.4.4.2 Increasing awareness about advanced wound care products

5.4.4.3 Implementation of stringent regulatory policies

5.5 PORTER'S FIVE FORCES ANALYSIS

FIGURE 21 MEDICAL ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 3 MEDICAL ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 BARGAINING POWER OF BUYERS

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 THREAT OF SUBSTITUTES

5.5.5 THREAT OF NEW ENTRANTS

5.6 MACROECONOMIC INDICATORS

5.6.1 INTRODUCTION

5.6.2 TRENDS AND FORECAST OF GDP

TABLE 4 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

5.7 ENVIRONMENTAL REGULATIONS & ROLE OF GOVERNMENT

5.8 COVID-19 IMPACT ANALYSIS

5.8.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.8.2 ECONOMIC IMPACT OF COVID-19 – SCENARIO ASSESSMENT

FIGURE 23 FACTORS IMPACTING ECONOMIES OF SELECT G20 COUNTRIES IN 2020

5.9 PRICING ANALYSIS

FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN MEDICAL ADHESIVE TAPES MARKET, BY REGION

5.9.1 PRICING ASSUMPTIONS

5.10 ADHESIVE TAPES ECOSYSTEM

FIGURE 25 ADHESIVE TAPES ECOSYSTEM

5.10.1 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTIONS ON MANUFACTURERS OF MEDICAL ADHESIVE TAPES: YC AND YCC SHIFT

FIGURE 26 MEDICAL ADHESIVE TAPES INDUSTRY: YC AND YCC SHIFT

5.10.1.1 Healthcare

5.10.1.1.1 Wearable medical devices

5.10.1.1.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.11 GLOBAL SCENARIOS

5.11.1 CHINA

5.11.1.1 Economic Meltdown

5.11.1.2 Australia-China trade war

5.11.1.3 Environmental commitments

5.11.2 EUROPE

5.11.2.1 Energy crisis in Europe

5.11.2.2 Manpower issues in UK

5.12 TRADE SCENARIO: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 5 INTENSITY OF TRADE, BY KEY COUNTRY

5.12.1 MAJOR IMPORTERS

TABLE 6 MAJOR IMPORTERS OF SELF-MEDICAL ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES MADE OF PLASTICS (2018–2020) (USD THOUSAND)

TABLE 7 MAJOR IMPORTERS OF SELF-MEDICAL ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS AND IMPACT OF COVID-19 ON TRADE (USD THOUSAND)

5.12.2 MAJOR EXPORTERS

TABLE 8 MAJOR EXPORTERS OF SELF-MEDICAL ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS (2018–2020) (USD THOUSAND)

TABLE 9 MAJOR EXPORTERS OF SELF-MEDICAL ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS AND IMPACT OF COVID-19 ON TRADE (USD THOUSAND)

5.13 PATENT ANALYSIS

FIGURE 27 NUMBER OF GRANTED PATENTS FROM 2016 TO OCTOBER 2021

FIGURE 28 SHARE OF GRANTED PATENTS, BY KEY PLAYERS

FIGURE 29 GRANTED PATENTS SHARE, BY JURISDICTION

5.14 CASE STUDY

5.15 TECHNOLOGY ANALYSIS

6 MEDICAL ADHESIVE TAPES MARKET, BY BACKING MATERIAL (Page No. - 83)

6.1 INTRODUCTION

FIGURE 30 FABRIC BACKING SEGMENT TO LEAD OVERALL MEDICAL ADHESIVE TAPES MARKET

TABLE 10 MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 11 MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 12 MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METER)

TABLE 13 MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METER)

6.2 PAPER

6.2.1 REPULPABLE NATURE OF PAPER EXPECTED TO DRIVE MARKET FOR THIS SEGMENT

TABLE 14 PAPER MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 15 PAPER MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 PAPER MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 17 PAPER MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

6.3 FABRIC TAPES

6.3.1 STRENGTH AND ELASTICITY OF FABRIC TAPES EXPECTED TO DRIVE DEMAND FOR FABRIC MEDICAL ADHESIVE TAPES

TABLE 18 FABRIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 19 FABRIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 FABRIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 21 FABRIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

6.4 PLASTIC TAPES

6.4.1 GROWING NUMBER OF MEDICAL PROCEDURES DRIVING CONSUMPTION OF PLASTIC MEDICAL ADHESIVE TAPES

TABLE 22 PLASTIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 23 PLASTIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 PLASTIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 25 PLASTIC MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

6.5 OTHERS

TABLE 26 OTHER BACKING MATERIAL MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 27 OTHER BACKING MATERIAL MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 OTHER BACKING MATERIAL MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 29 OTHER BACKING MATERIAL MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

7 MEDICAL ADHESIVE TAPES MARKET, BY RESIN TYPE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 31 ACRYLIC TO BE LEADING RESIN TYPE IN OVERALL MEDICAL ADHESIVE TAPES MARKET

TABLE 30 MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 31 MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 32 MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METER)

TABLE 33 MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METER)

7.2 ACRYLIC-BASED MEDICAL ADHESIVE TAPES

7.2.1 HIGH DURABILITY BOOSTING DEMAND FOR ACRYLIC-BASED MEDICAL ADHESIVE TAPES

TABLE 34 ACRYLIC-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 35 ACRYLIC-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 ACRYLIC-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 37 ACRYLIC-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

7.3 SILICONE-BASED MEDICAL ADHESIVE TAPES

7.3.1 DEMAND FOR SILICONE MEDICAL ADHESIVE TAPES INCREASING IN STICK-TO-SKIN MARKET OF MEDICAL SECTOR

TABLE 38 SILICONE-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 39 SILICONE-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 SILICONE-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 41 SILICONE-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

7.4 RUBBER-BASED MEDICAL ADHESIVE TAPES

7.4.1 HIGH ADHESION TO PLASTICS, NON-POLAR, AND LOW-ENERGY SURFACES FUELING DEMAND FOR RUBBER-BASED MEDICAL ADHESIVE TAPES

TABLE 42 RUBBER-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 43 RUBBER-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 RUBBER-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 45 RUBBER-BASED MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

7.5 OTHER RESIN TYPES

TABLE 46 OTHER RESIN TYPES MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 47 OTHER RESIN TYPE MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 OTHER RESIN TYPE MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 49 OTHER RESIN TYPE MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

8 MEDICAL ADHESIVES MARKET, BY APPLICATION (Page No. - 103)

8.1 INTRODUCTION

TABLE 50 MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 51 MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 52 MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METER)

TABLE 53 MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

FIGURE 32 SURGERY TO BE LARGEST APPLICATION OF MEDICAL ADHESIVE TAPES

8.2 SURGERY

8.2.1 SURGICAL PROCEDURES CONDUCTED ACROSS THE GLOBE IS MAJOR FACTOR DRIVING MARKET

TABLE 54 MEDICAL ADHESIVE TAPES MARKET SIZE IN SURGERY APPLICATION, BY REGION, 2015–2018 (USD MILLION)

TABLE 55 MEDICAL ADHESIVE TAPES MARKET SIZE IN SURGERY APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 MEDICAL ADHESIVE TAPES MARKET SIZE IN SURGERY APPLICATION, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 57 MEDICAL ADHESIVE TAPES MARKET SIZE IN SURGERY APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.3 WOUND DRESSING

8.3.1 RISING INCIDENCES OF WOUND INFECTIONS AND INCREASING AWARENESS OF ADVANCED TECHNOLOGIES TO DRIVE MARKET

TABLE 58 MEDICAL ADHESIVE TAPES MARKET SIZE IN WOUND DRESSING APPLICATION, BY REGION, 2015–2018 (USD MILLION)

TABLE 59 MEDICAL ADHESIVE TAPES MARKET SIZE IN WOUND DRESSING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 MEDICAL ADHESIVE TAPES MARKET SIZE IN WOUND DRESSING APPLICATION, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 61 MEDICAL ADHESIVE TAPES MARKET SIZE IN WOUND DRESSING APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.4 SPLINTS

8.4.1 ASIA PACIFIC IS FASTEST-GROWING MARKET IN SPLINTS APPLICATION

TABLE 62 MEDICAL ADHESIVE TAPES MARKET SIZE IN SPLINTS APPLICATION, BY REGION, 2015–2018 (USD MILLION)

TABLE 63 MEDICAL ADHESIVE TAPES MARKET SIZE IN SPLINTS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 MEDICAL ADHESIVE TAPES MARKET SIZE IN SPLINTS APPLICATION, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 65 MEDICAL ADHESIVE TAPES MARKET SIZE IN SPLINTS APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.5 SECURE IV LINES

8.5.1 SECURE IV LINES ARE USEFUL DUE TO DECREASED RISK OF INFECTION

TABLE 66 MEDICAL ADHESIVE TAPES MARKET SIZE IN SECURE IV LINES APPLICATION, BY REGION, 2015–2018 (USD MILLION)

TABLE 67 MEDICAL ADHESIVE TAPES MARKET SIZE IN SECURE IV LINES APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 MEDICAL ADHESIVE TAPES MARKET SIZE IN SECURE IV LINES APPLICATION, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 69 MEDICAL ADHESIVE TAPES MARKET SIZE IN SECURE IV LINES APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.6 OSTOMY SEALS

8.6.1 OSTOMY SEALS DESIGNED TO WITHSTAND MOISTURE WHILE WORKING WITH BODY'S NATURAL SWEAT COMPONENTS

TABLE 70 MEDICAL ADHESIVE TAPES MARKET SIZE IN OSTOMY SEALS APPLICATION, BY REGION, 2015–2018 (USD MILLION)

TABLE 71 MEDICAL ADHESIVE TAPES MARKET SIZE IN OSTOMY SEALS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 72 MEDICAL ADHESIVE TAPES MARKET SIZE IN OSTOMY SEALS APPLICATION, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 73 MEDICAL ADHESIVE TAPES MARKET SIZE IN OSTOMY SEALS APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.7 OTHER APPLICATIONS

TABLE 74 MEDICAL ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2015–2018 (USD MILLION)

TABLE 75 MEDICAL ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 76 MEDICAL ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 77 MEDICAL ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.7.1 BURN INJURY TREATMENT

8.7.2 SPORT-RELATED FATALITIES

9 MEDICAL ADHESIVE TAPES MARKET, BY REGION (Page No. - 116)

9.1 INTRODUCTION

FIGURE 33 MEDICAL ADHESIVE TAPES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE

TABLE 78 MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 79 MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 80 MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2015–2018 (MILLION SQUARE METER)

TABLE 81 MEDICAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 34 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 83 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (MILLION SQUARE METER)

TABLE 85 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 86 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 87 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METER)

TABLE 89 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 90 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 91 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METER)

TABLE 93 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 94 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 95 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METER)

TABLE 97 NORTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

9.2.2 US

9.2.2.1 Increase in demand for medical adhesive tapes due to rising incidence of chronic wounds

9.2.3 CANADA

9.2.3.1 Significant growth is expected in technology-intensive areas

9.2.4 MEXICO

9.2.4.1 Country has witnessed a dynamic and sustained growth

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 35 EUROPE: MEDICAL ADHESIVE TAPES MARKET SNAPSHOT

TABLE 98 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 99 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (MILLION SQUARE METER)

TABLE 101 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 102 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 103 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METER)

TABLE 105 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 106 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 107 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 108 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METER)

TABLE 109 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 110 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 111 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METER)

TABLE 113 EUROPE: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

9.3.2 GERMANY

9.3.2.1 Innovations and product differentiation drive medical adhesives tapes market in Germany

9.3.3 ITALY

9.3.3.1 High growth in healthcare industry to bolster medical adhesive tapes market

9.3.4 UK

9.3.4.1 Advanced technological infrastructure and increased R&D investments attract companies globally to invest in the country

9.3.5 BENELUX

9.3.5.1 Leading manufacturers coming up with VOC-free products

9.3.6 FRANCE

9.3.6.1 Healthcare expenditure expected to increase

9.3.7 SPAIN

9.3.7.1 Increasing aging population a major driver for medical adhesive tapes market

9.3.8 POLAND

9.3.8.1 Health awareness to drive the medical adhesive tapes market in Poland

9.3.9 REST OF EUROPE

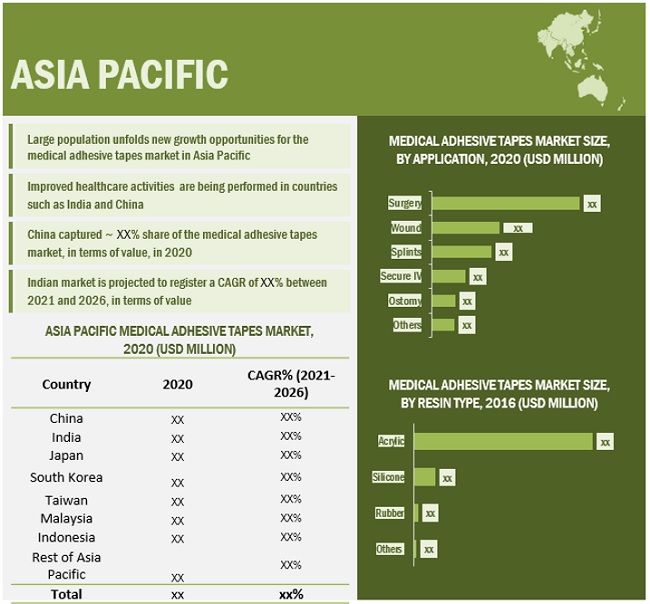

9.4 ASIA PACIFIC

9.4.1 IMPACT OF COVID-19 ON ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SNAPSHOT

TABLE 114 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 115 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (MILLION SQUARE METERS)

TABLE 117 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 118 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 119 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METERS)

TABLE 121 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METERS)

TABLE 122 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 123 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METERS)

TABLE 125 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METERS)

TABLE 126 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 127 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 128 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METERS)

TABLE 129 ASIA PACIFIC: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METERS)

9.4.2 CHINA

9.4.2.1 Government supporting domestic players supporting growth of market

9.4.3 INDIA

9.4.3.1 Rapidly growing healthcare sector to drive market

9.4.4 JAPAN

9.4.4.1 Japan is third-largest medical adhesive tapes consumer in Asia Pacific

9.4.5 SOUTH KOREA

9.4.5.1 Stringent environmental regulations to reduce use of high VOC content tapes

9.4.6 TAIWAN

9.4.6.1 Taiwan witnessing higher exports of medical adhesive tapes than domestic sales

9.4.7 MALAYSIA

9.4.7.1 Growing wound care manufacturing to provide opportunities for medical adhesive tapes market

9.4.8 INDONESIA

9.4.8.1 Availability of cheap labor and raw materials to propel growth of market

9.4.9 REST OF ASIA PACIFIC

9.5 SOUTH AMERICA

9.5.1 IMPACT OF COVID-19 ON SOUTH AMERICA

FIGURE 37 INCREASING DEMAND FOR MEDICAL ADHESIVE TAPES FROM HEALTHCARE INDUSTRY TO DRIVE MARKET IN SOUTH AMERICA

TABLE 130 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 131 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 132 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (MILLION SQUARE METERS)

TABLE 133 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 134 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 135 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 136 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METERS)

TABLE 137 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METERS)

TABLE 138 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 139 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 140 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METERS)

TABLE 141 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METERS)

TABLE 142 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 143 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 144 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METERS)

TABLE 145 SOUTH AMERICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METERS)

9.5.2 BRAZIL

9.5.2.1 Surgery and wound dressing applications offering high growth potential for medical adhesive tape manufacturers

9.5.3 ARGENTINA

9.5.3.1 Increase in population and improved economic conditions to increase demand for medical adhesive tapes

9.5.4 COLOMBIA

9.5.4.1 Columbia is fastest-growing market in South America

9.5.5 REST OF SOUTH AMERICA

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

FIGURE 38 WOUND DRESSING TO BE FASTEST-GROWING END-USE INDUSTRY OF MEDICAL ADHESIVE TAPES

TABLE 146 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2015–2018 (MILLION SQUARE METERS)

TABLE 149 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 150 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2015–2018 (MILLION SQUARE METERS)

TABLE 153 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION SQUARE METERS)

TABLE 154 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2015–2018 (MILLION SQUARE METERS)

TABLE 157 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2026 (MILLION SQUARE METERS)

TABLE 158 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2015–2018 (MILLION SQUARE METERS)

TABLE 161 MIDDLE EAST & AFRICA: MEDICAL ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METERS)

9.6.2 SOUTH AFRICA

9.6.2.1 Low production costs and access to new markets favor market growth

9.6.3 UAE

9.6.3.1 UAE government working on policies to develop various industries

9.6.4 SAUDI ARABIA

9.6.4.1 Saudi Arabia taking steps to improve healthcare sector

9.6.5 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE (Page No. - 162)

10.1 OVERVIEW

TABLE 162 LEADING PLAYERS FAVOR INVESTMENT & EXPANSION STRATEGY BETWEEN 2016 AND 2021

10.2 MARKET SHARE ANALYSIS

TABLE 163 MEDICAL ADHESIVE TAPES MARKET: DEGREE OF COMPETITION

FIGURE 39 MEDICAL ADHESIVE TAPES MARKET: MARKET SHARE ANALYSIS (2020)

10.2.1 MARKET RANKING ANALYSIS

TABLE 164 MARKET RANKING OF KEY PLAYERS (2021)

FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN LAST FIVE YEARS

10.3 COMPANY EVALUATION QUADRANT MATRIX, 2020

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 PARTICIPANTS

FIGURE 41 MEDICAL ADHESIVE TAPES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.4 SME MATRIX, 2020

10.4.1 PROGRESSIVE COMPANIES

10.4.2 DYNAMIC COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 RESPONSIVE COMPANIES

FIGURE 42 MEDICAL ADHESIVE TAPES MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 STRENGTH OF PRODUCT PORTFOLIO

10.6 BUSINESS STRATEGY EXCELLENCE

10.7 COMPETITIVE SCENARIO

10.7.1 MARKET EVALUATION FRAMEWORK

TABLE 165 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 166 MOST FOLLOWED STRATEGY

TABLE 167 GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

10.7.2 MARKET EVALUATION MATRIX

TABLE 168 COMPANY PRODUCT FOOTPRINT

TABLE 169 COMPANY REGION FOOTPRINT

TABLE 170 COMPANY INDUSTRY FOOTPRINT

10.8 STRATEGIC DEVELOPMENTS

10.8.1 MERGERS & ACQUISITIONS

TABLE 171 MERGER & ACQUISITION, 2016–2021

10.8.2 INVESTMENTS & EXPANSIONS

TABLE 172 INVESTMENTS & EXPANSIONS, 2016–2021

10.8.3 NEW PRODUCT LAUNCHES

TABLE 173 NEW PRODUCT LAUNCHES, 2016–2021

11 COMPANY PROFILES (Page No. - 178)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 3M COMPANY

TABLE 174 3M COMPANY: COMPANY OVERVIEW

FIGURE 43 3M COMPANY: COMPANY SNAPSHOT

TABLE 175 3M COMPANY: NEW PRODUCT LAUNCHES

TABLE 176 3M COMPANY: DEALS

TABLE 177 3M COMPANY: OTHER DEVELOPMENTS

11.1.2 MEDTRONIC PLC.

TABLE 178 MEDTRONIC PLC.: COMPANY OVERVIEW

FIGURE 44 MEDTRONIC PLC.: COMPANY SNAPSHOT

TABLE 179 MEDTRONIC PLC: DEALS

TABLE 180 MEDTRONIC PLC.: OTHER DEVELOPMENTS

11.1.3 MEDLINE INDUSTRIES, INC.

TABLE 181 MEDLINE INDUSTRIES, INC.: COMPANY OVERVIEW

TABLE 182 MEDLINE INDUSTRIES, INC.: DEALS

TABLE 183 MEDLINE INDUSTRIES, INC.: OTHER DEVELOPMENTS

11.1.4 NITTO DENKO CORPORATION

TABLE 184 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 45 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 185 NITTO DENKO CORPORATION: NEW PRODUCT LAUNCHES

TABLE 186 NITTO DENKO CORPORATION: DEALS

TABLE 187 NITTO DENKO CORPORATION: OTHER DEVELOPMENTS

11.1.5 JOHNSON & JOHNSON

TABLE 188 JOHNSON & JOHNSON: COMPANY OVERVIEW

FIGURE 46 JOHNSON & JOHNSON: COMPANY SNAPSHOT

TABLE 189 JOHNSON & JOHNSON: DEALS

TABLE 190 JOHNSON & JOHNSON: OTHER DEVELOPMENTS

11.1.6 SMITH & NEPHEW PLC

TABLE 191 SMITH & NEPHEW PLC: COMPANY OVERVIEW

FIGURE 47 SMITH & NEPHEW PLC: COMPANY SNAPSHOT

TABLE 192 SMITH & NEPHEW PLC: DEALS

11.1.7 NICHIBAN CO. LTD.

TABLE 193 NICHIBAN CO. LTD.: COMPANY OVERVIEW

FIGURE 48 NICHIBAN CO. LTD.: COMPANY SNAPSHOT

11.1.8 SCAPA GROUP PLC

TABLE 194 SCAPA GROUP PLC: COMPANY OVERVIEW

FIGURE 49 SCAPA GROUP: COMPANY SNAPSHOT

TABLE 195 SCAPA GROUP PLC: DEALS

11.1.9 PAUL HARTMANN AG

TABLE 196 PAUL HARTMANN AG: COMPANY OVERVIEW

FIGURE 50 PAUL HARTMANN AG: COMPANY SNAPSHOT

11.1.10 AVERY DENNISON CORPORATION

TABLE 197 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

FIGURE 51 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 198 AVERY DENNISON CORPORATION: NEW PRODUCT LAUNCHES

TABLE 199 AVERY DENNISON CORPORATION: DEALS

Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY COMPANIES

11.2.1 LOHMANN GMBH & CO. KG

TABLE 200 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

11.2.2 MACTAC LLC

TABLE 201 MACTAC LLC: COMPANY OVERVIEW

11.2.3 ADCHEM CORPORATION

TABLE 202 ADCHEM CORPORATION: COMPANY OVERVIEW

11.2.4 MERCATOR MEDICAL S.A.

TABLE 203 MERCATOR MEDICAL S.A.: COMPANY OVERVIEW

11.2.5 JIANGSU NANFANG MEDICAL CO., LTD.

TABLE 204 JIANGSU NANFANG MEDICAL CO., LTD.: COMPANY OVERVIEW

11.2.6 DERMAMED COATINGS COMPANY LLC

TABLE 205 DERMAMED COATINGS COMPANY, LLC.: COMPANY OVERVIEW

11.2.7 LIBATAPE PHARMACEUTICAL CO., LTD.

TABLE 206 LIBATAPE PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

11.2.8 CCT TAPES

TABLE 207 CCT TAPES: COMPANY OVERVIEW

11.2.9 SEYITLER KIMYA SAN. INC.

TABLE 208 SEYITLER KIMYA SANAYI AS: COMPANY OVERVIEW

11.2.10 GERGONNE INDUSTRIE

TABLE 209 GERGONNE INDUSTRIE: COMPANY OVERVIEW

11.2.11 DERMARITE INDUSTRIES, LLC.

TABLE 210 DERMARITE INDUSTRIES, LLC: COMPANY OVERVIEW

11.2.12 A.M.G. MEDICAL INC.

TABLE 211 A.M.G. MEDICAL INC.: COMPANY OVERVIEW

11.2.13 STERIMED MEDICAL DEVICES PVT. LTD.

TABLE 212 STERIMED MEDICAL DEVICES PRIVATE LTD.: COMPANY OVERVIEW

11.2.14 PINNACLE TECHNOLOGIES

TABLE 213 PINNACLE TECHNOLOGIES: COMPANY OVERVIEW

11.2.15 WUXI BEYON MEDICAL PRODUCTS CO., LTD.

TABLE 214 WUXI BEYON MEDICAL PRODUCTS CO., LTD.: COMPANY OVERVIEW

12 ADJACENT/RELATED MARKETS (Page No. - 216)

12.1 INTRODUCTION

12.2 ADHESIVE TAPES MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 ADHESIVE TAPES MARKET, BY RESIN TYPE

12.2.3.1 Introduction

TABLE 215 ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2018–2026 (USD MILLION)

TABLE 216 ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2018–2026 (MILLION SQUARE METER)

12.2.3.2 Acrylic

12.2.3.3 Silicone

12.2.3.4 Rubber

12.2.3.5 Others

12.2.4 ADHESIVE TAPES MARKET, BY TECHNOLOGY

12.2.4.1 Introduction

TABLE 217 ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 218 ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2018–2026 (MILLION SQUARE METERS)

12.2.4.2 Solvent-Based

12.2.4.3 Hot-Melt

12.2.4.4 Water-Based

12.2.5 ADHESIVE TAPES MARKET, BY BACKING MATERIAL

12.2.5.1 Introduction

TABLE 219 ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2018–2026 (USD MILLION)

TABLE 220 ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2018–2026 (MILLION SQUARE METERS)

12.2.5.2 PolyPropylene (PP)

12.2.5.3 Paper

12.2.5.4 Polyvinyl Chloride (PVC)

12.2.5.5 Others

12.2.6 ADHESIVE TAPES MARKET, BY CATEGORY

12.2.6.1 Introduction

TABLE 221 ADHESIVE TAPES MARKET SIZE, BY CATEGORY, 2018–2026 (USD MILLION)

TABLE 222 ADHESIVE TAPES MARKET SIZE, BY CATEGORY, 2018–2026 (MILLION SQUARE METERS)

12.2.6.2 Commodity adhesive tapes

12.2.6.3 Specialty adhesive tapes

12.2.7 ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

12.2.7.1 Introduction

12.2.7.2 Commodity adhesive tapes

TABLE 223 COMMODITY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 224 COMMODITY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (MILLION SQUARE METERS)

12.2.7.2.1 Packaging

12.2.7.2.2 Masking

12.2.7.2.3 Consumer & Office

12.2.7.3 Specialty adhesive tapes

TABLE 225 SPECIALTY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 226 SPECIALTY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (MILLION SQUARE METERS)

12.2.7.3.1 Electrical & electronics

12.2.7.3.2 Healthcare

12.2.7.3.3 Automotive

12.2.7.3.4 White goods

12.2.7.3.5 Paper & printing

12.2.7.3.6 Building & construction

12.2.7.3.7 Retail

12.2.7.3.8 Other end-use industries

12.2.8 ADHESIVE TAPES MARKET, BY REGION

12.2.8.1 Introduction

TABLE 227 ADHESIVE TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 228 ADHESIVE TAPES MARKET SIZE, BY REGION, 2018–2026 (MILLION SQUARE METERS)

12.2.8.2 North America

12.2.8.3 Europe

12.2.8.4 Asia Pacific

12.2.8.5 South America

12.2.8.6 Middle East & Africa

13 APPENDIX (Page No. - 229)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

Overview on Medical Tapes Market

The medical tapes market refers to the market for tapes used in medical applications such as wound management, surgical procedures, and diagnostic procedures. Medical tapes are designed to provide secure adhesion to skin or other surfaces, while also being gentle to sensitive skin and easy to remove without causing damage.

Medical tapes are a subset of the larger medical adhesive tapes market, which includes tapes, films, and dressings used in medical applications. Medical tapes are differentiated from other medical adhesives by their use of a backing material, which provides additional strength and durability.

The medical tapes market is expected to grow in the coming years due to an increasing demand for advanced wound care products, a growing number of surgical procedures, and an aging population. This growth is likely to have a positive impact on the larger medical adhesive tapes market, as companies expand their product offerings to meet the needs of the growing market.

Futuristic Growth Use-Cases

One potential growth use-case for medical tapes is the development of smart medical tapes that can monitor and transmit information about a patient's vital signs, such as heart rate and respiration. Another growth area is the development of tapes that can release medication or other therapeutic agents to the site of a wound or other medical application.

Top Players in Medical Tapes Market

Some of the top players in the medical tapes market include 3M Company, Johnson & Johnson, Nitto Denko Corporation, Smith & Nephew plc, and Scapa Group plc.

Impact on Other Industries

The growth of the medical tapes market is expected to have a positive impact on other industries, such as the medical device industry and the healthcare industry as a whole. As new and advanced medical tapes are developed, they can be incorporated into a range of medical devices and procedures, improving patient outcomes and driving growth in these industries.

Speak to our Analyst today to know more about Medical Tapes Market!

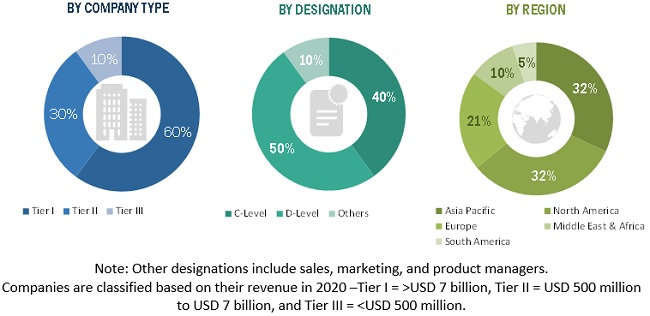

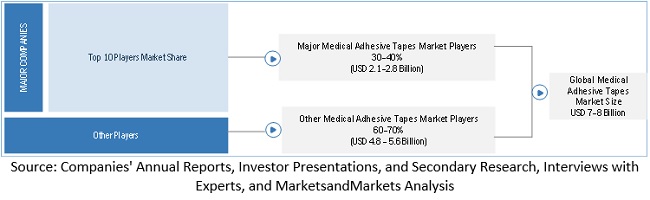

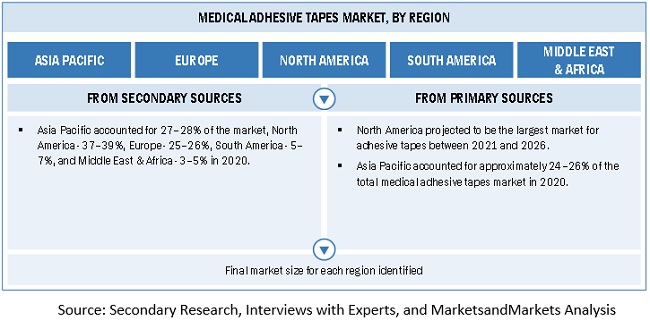

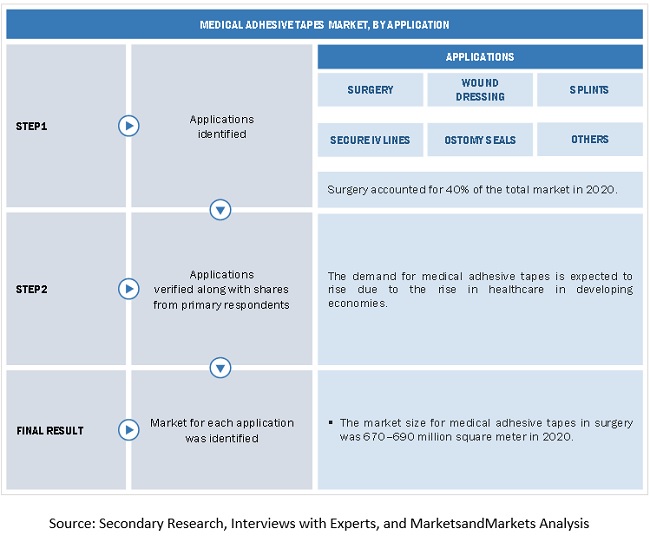

The study involved four major activities in estimating the current market size of medical adhesive tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of the segments and the sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg, and BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The medical adhesive tapes market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. In the primary research process, different primary sources from the supply & demand sides were interviewed to obtain qualitative and quantitative information. The primary sources included industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the medical adhesive tapes market.:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the market sizes of medical adhesive tapes for various sub-markets in each region. The research methodology used to estimate the market size included the following steps:

- The key players in the market were identified through secondary research and their market shares in the respective regions were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis and presented in this report.

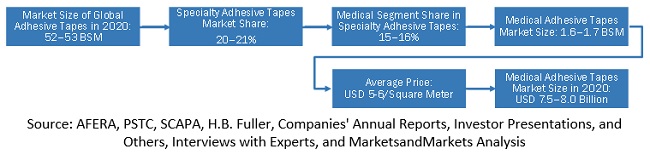

Top-Down Approach

The top-down approach, one of the approaches, used to estimate the market size included the following steps:

- During the course of the study, we have collected information from various secondary and primary sources. We collectively analyzed all the sources both from the demand and supply side and evaluated the parent reports information (MnM repository) for adhesive tapes. In this approach, the market size was assessed from the supply side. Firstly, the overall adhesive tapes market size was evaluated, and then its consumption as specialty adhesive tapes was ascertained, and then as medical adhesive tapes. This helped quantify the overall medical adhesive taps market in the global adhesive tapes market. The penetration in different regions was determined through secondary research and by interacting with industry experts.

- Ascertaining the share of various segments in the overall medical adhesive tapes market led to the market size in terms of volume (Kiloton).

- The share of the medical adhesive tapes market in the overall adhesive tapes was ascertained based on the insights provided by the industry experts and data obtained from the secondary research. The overall market size of medical adhesive tapes was then estimated from the overall adhesive tapes market in terms of volume. Then, by multiplying the market size (by value) with the average price of the medical adhesive tapes, the value of the market was estimated.

- There were a number of secondary sources (companies' annual reports, investor presentations, Afera, PSTC, SCAPA, H.B. Fuller, and others), and also, the regional association articles and papers were considered to identify the regional market size such as Europe (Afera), North America (PSTC), and APAC (JATMA, CATIA, and Korean Association).

- After estimating the market size/share and growth rate through secondary sources, we validate and authentic the market estimation and projection through our industry experts from suppliers' side, and validated the information with global associations across different regions and countries to share their suggestions and verification of the estimated market size.

- Accordingly, we have finalized the market size estimation and growth projections for all the regions and finally arrived at the global market size/share in terms of both value and volume.

- Similarly, the market for all other segments was derived and verified.

Medical Adhesive Tapes Market Size Estimation: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the medical adhesive tapes market from the revenue of key players (companies) and their shares in the market. The supply-side approach was also used for the data extracted from secondary research to validate the market sizes of the segments obtained in terms of value. Market shares were estimated for each company to verify the revenue shares used earlier in the supply-side approach. With the data triangulation procedure and data validation through primaries, the exact values of the market sizes were estimated and verified in this study. The data triangulation procedure implemented for this study is explained in the next section.

Medical Adhesive Tapes Market Size Estimation: Bottom-Up Approach

Medical Adhesive Tapes Market Size Estimation, By Region

Medical Adhesive Tapes Market Size Estimation, By Application

Medical Adhesive Tapes Market Size Estimation, By Resin Type

Data Triangulation

After arriving at the overall market size, the market was split into several segments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the medical adhesive tapes market, in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on resin type, technology, backing material, category, and end-use industry

- To analyze and forecast the market size, with respect to five main regions, namely, Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America along with their respective key countries

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as new product launch, merger & acquisition, and investment & expansion in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the metallized film market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Adhesive Tapes Market