Food Testing Kits Market by Target Tested (Pathogens, Meat Species, GMOs, Allergens, Mycotoxins), Technology (PCR, Immunoassay, and Enzyme Substrate based), Sample (Meat, Packaged Food, Cereals, Grains, Dairy & Nuts), and Region - Global Forecast to 2022

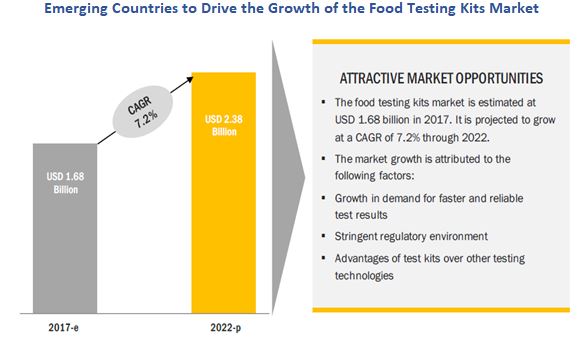

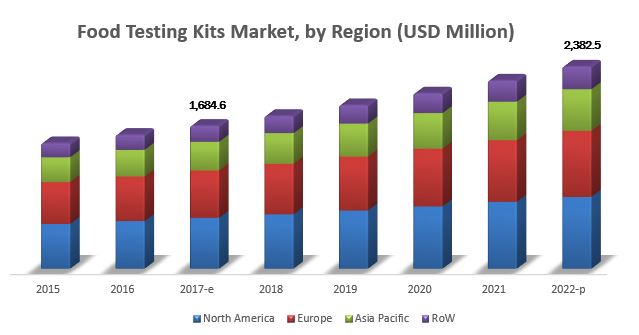

[201 Pages Report] The food testing kits market was valued at USD 1.58 Billion in 2016. It is projected to reach USD 2.38 Billion by 2022, growing at a CAGR of 7.2% from 2017. Food testing kits include the kits for testing and detection of pathogens, meat species, GMOs, allergen, mycotoxin, and others (which include pesticides and other residues in food). Technologies used for testing are PCR-based, immunoassay-based, and enzyme substrate-based. Market players are tapping new opportunities by engaging in organic strategies such as the expansion of their global presence and product offerings through new product launches.

For More details on this research, Request Free Sample Report

The objectives of the study are as follows:

- To define, segment, and forecast the size of this market with respect to target tested, technology, sample, and region

- To analyze the market structure by identifying various subsegments of the food testing kits market

- To forecast the size of the global market and its various submarkets with respect to four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as new product & technology launches expansions, acquisitions, agreements, collaborations, and mergers & partnerships in this market

The years considered for the study are periodized as follows:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017-2022 |

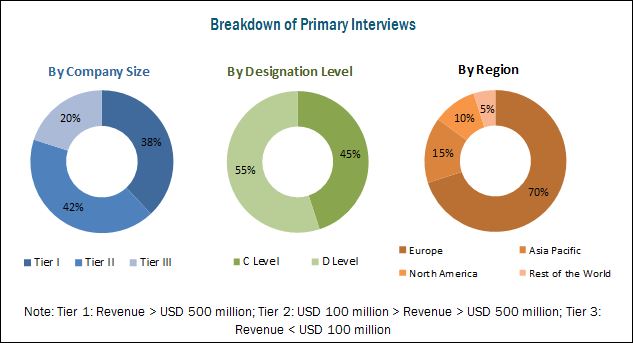

This report includes estimations of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the food testing kits market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research through various sources such as the Centers for Disease Control and Prevention (CDC), The European Federation of National Associations of Measurement, Testing and Analytical Laboratories (EUROLAB), The World Health Organization (WHO), I.E. Canada (Canadian Association of Importers and Exporters), Environmental Protection Agency (EPA), Food and Agricultural Organization (FAO), Food Safety Council (FSC), and Statistics Canada, and their market ranking in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience:

- R&D institutes

- Technology providers

- Food testing kits products providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the report

Based on Target Tested, the food testing kits market has been segmented as follows:

- Pathogens

- Meat species

- GMOs

- Allergens

- Mycotoxins

- Others (which include pesticides and other residues in food)

Based on Technology, the market has been segmented as follows:

- PCR-based

- Immunoassay-based

- Enzyme substrate-based

Based on Sample, the market has been segmented as follows:

- Meat, poultry, and seafood

- Dairy products

- Packaged food

- Fruits & vegetables

- Cereals, grains, and pulses

- Nuts, seeds, and spices

- Others (which include dietary supplements and food additives)

Based on Region, the food testing kits market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (which includes South Africa, Brazil, and Argentina)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Segmental Analysis

- Further breakdown of food testing kits market by target tested such as pathogens, meat species, GMOs, allergens, and mycotoxins.

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific food testing kits market, by country

- Further breakdown of Rest of Europe food testing kits market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The growth of this market can be attributed to the inclination of customers toward faster and reliable test results, growth in incidences of foodborne illnesses, globalization of food trade, increase in preference for on-site testing, and stringent international food safety regulations.

For More details on this research, Request Free Sample Report

The global market, based on target tested, is segmented into pathogens, meat species, GMOs, allergens, and mycotoxins. The pathogens segment is estimated to dominate the market with the largest share in 2017, due to global occurrences of incidences such as foodborne illnesses caused by pathogens. In developed countries, millions of cases of infectious gastrointestinal diseases are reported each year due to foodborne pathogens, costing them billions of dollars in medical care and lost productivity.

The food testing kits market, on the basis of technology, is segmented into PCR-based, immunoassay-based, enzyme substrate-based, and others. The immunoassay-based segment is estimated to dominate the market in 2017. Immunoassay-based technology has several advantages such as cost-effectiveness, rapid test results, and ability to carry out screening of multiple targets such as pathogens, meat speciation, GMOs, allergens, pesticides, mycotoxins, and other residues.

The global market, based on sample, is segmented into meat, poultry, and seafood; dairy products; packaged food; fruits & vegetables; cereals, grains, and pulses; and nuts, seeds, and spices. The meat, poultry, and seafood segment is estimated to dominate the market in 2017 and is projected to grow at the highest CAGR through 2022. The reason for the large market share of this segment can be attributed to the strict regulatory mandates provided by leading authority to ensure food safety and prevent meat and meat product contamination.

The North American region is projected to dominate this market by 2022. The Asia Pacific region is projected to be the fastest-growing market during the forecast period. The market in this region is driven by the increasing export activities, which need onsite testing and faster test results to meet the standards & regulations enforced by different countries and regions.

The market for food testing kits in developing countries lacks food control infrastructure and resources; also, there is lack of support from international agencies such as FAO, the WHO, and the World Bank. There is also lack of harmonization of food safety regulations and implementation of heavy duty on import of test kits in various regions, which is also restraining market growth. These are few restraining factors that affect the growth of food testing kits market, globally.

New product & technology launches, expansions, acquisitions, agreements, collaborations, and mergers & partnerships are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as Thermo Fisher (US), Agilent (US), Eurofins (Luxembourg), bioMérieux (France), and Neogen (US). Other major players in the market include PerkinElmer (US), Bio-Rad (US), QIAGEN (Germany), EnviroLogix (US), IFP Institut Für Produktqualität (Germany), Romer Labs (Austria), and Millipore Sigma (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Research Assumptions

2.4.2 Limitation

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Oppurtunities

4.2 Food Testing Kits Market: Key Country

4.3 Market, Technology, By Target Testing

4.4 Developed vs Developing Markets for Food Testing Kits

4.5 Market for Food Testing Kits, By Target Tested & Region

4.6 North America: Market, By Target Tested & Country, 2016

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Faster and Reliable Test Results

5.2.1.1.1 Advantages of Test Kits Over Other Testing Technologies

5.2.1.2 Growing Preferences for Onsite Testing

5.2.1.3 Growing Competition Leading to Increased R&D Activities

5.2.1.3.1 Investments By the Biotech Industry to Develop Molecular-Based Technologies

5.2.1.3.2 Increased Innovation and Acceptance of PCR & Immunoassay-Based Technologies

5.2.1.4 Globalization of Food Trade

5.2.1.4.1 Increase in Food Processing Necessitates Safety Testing With Faster Results

5.2.1.5 Implementation of Stringent Food Safety Regulations in Developed Countries

5.2.1.6 Growing Number of Foodborne Illnesses

5.2.1.6.1 Increase in Number of Food Recalls

5.2.2 Restraints

5.2.2.1 Lack of Food Control Infrastructure & Resources in Developing Countries

5.2.2.2 Lack of Harmonization of Food Safety Regulations

5.2.2.2.1 Heavy Duty on Test Kits

5.2.3 Opportunities

5.2.3.1 Development of Multi-Contaminant Analyzing Technology

5.2.3.2 Growing Consumer Awareness and Inclination to Test Food Samples Directly

5.2.3.2.1 Dependency on Allergen Test Kits By Consumers

5.2.3.3 Huge Potential in Emerging Markets of Asian, African, and Other Developing Countries

5.2.3.3.1 Indian Food Industry to Lay Emphasis on Food Safety

5.2.3.3.2 Government Initiatives and A Favorable Regulatory Scenario

5.2.3.4 Budget Allocation and Spending on Food Safety

5.2.4 Challenges

5.2.4.1 Complexity in Quantification of Test Results

5.2.4.1.1 Varying Results With Different Test Methods

5.3 Industry Trends

5.3.1 Real-Time PCR Technique

5.3.2 Immunoassay-Based

5.3.3 Substrate Technology

6 Regulations (Page No. - 63)

6.1 Introduction

6.2 International Body for Food Safety Standards and Regulations

6.2.1 Codex Alimentarius Commission (CAC)

6.3 Global Food Safety Initiative (GFSI)

6.4 North America

6.4.1 US Regulations

6.4.1.1 Federal Legislation

6.4.1.1.1 State Legislation

6.4.1.1.2 Food Safety in Retail Food

6.4.1.1.3 Food Safety in Trade

6.4.1.1.4 Haccp Regulation in the US

6.4.1.1.5 US Regulation for Foodborne Pathogens in Poultry

6.4.1.1.6 Food Safety Regulations for Fruit & Vegetable Growers

6.4.1.1.7 GMOs Regulation in the US

6.4.1.1.8 FDA Food Safety Modernization Act (FSMA)

6.4.1.1.9 Labeling of GM Foods

6.4.1.1.10 Regulatory Guidance By FDA for Aflatoxins

6.4.1.1.11 Pesticide Regulation in the US

6.4.2 Canada

6.4.3 Mexico

6.5 Europe

6.5.1 European Union Regulations

6.5.1.1 Microbiological Criteria Regulation

6.5.1.2 Melamine Legislation

6.5.1.3 General Food Law for Food Safety

6.5.1.4 Toxins Regulation

6.5.1.4.1 Ochratoxin A

6.5.1.4.2 Dioxin and PBCS

6.5.1.4.3 Fusarium Toxins

6.5.1.4.4 Aflatoxins

6.5.1.4.5 Polycyclic Aromatic Hydrocarbons (Pah)

6.5.2 Germany

6.5.3 UK

6.5.4 France

6.5.5 Italy

6.5.6 Poland

6.6 Asia Pacific

6.6.1 China

6.6.1.1 The Regulating Bodies for Food Safety in China Are:

6.6.1.2 Major Efforts of China to Standardize Its Food Safety System

6.6.2 Japan

6.6.3 India

6.6.3.1 Food Safety Standards Amendment Regulations, 2012

6.6.3.2 Food Safety Standards Amendment Regulations, 2011

6.6.3.3 Food Safety and Standards Act, 2006

6.6.4 Australia

6.6.4.1 Food Standards Australia New Zealand

6.6.5 New Zealand

6.6.5.1 GMOs Labeling Regulation in the Asia Pacific

6.6.6 Indonesia

6.6.6.1 General Law for Food Safety

6.6.7 Regulation on Pesticides

6.6.8 Regulations on Mycotoxins in Food

6.6.9 Chemical Contaminants

6.6.10 Genetically Engineered Foods

6.6.11 Allergen: Regulation on Allergen Labeling in Food

6.7 Rest of the World

6.7.1 South Africa

6.7.1.1 International vs Local Standards & Legislations

6.7.1.2 Private Standards in South Africa & the Requirements for Product Testing

6.7.2 Brazil

6.7.2.1 The Ministry of Agriculture, Livestock, and Food Supply (MAPA)

6.7.2.2 Ministry of Health (MS)

6.7.3 Argentina

7 Food Testing Kits Market, By Sample (Page No. - 88)

7.1 Introduction

7.2 Meat, Poultry, and Seafood Products

7.3 Dairy Products

7.4 Packaged Food

7.5 Fruits & Vegetables

7.6 Cereals, Grains & Pulses

7.7 Nuts, Seeds, and Spices

7.8 Others

8 Food Testing Kits Market, By Technology (Page No. - 97)

8.1 Introduction

8.2 PCR-Based

8.3 Immunoassay-Based

8.4 Enzyme Substrate-Based & Others

9 Food Testing Kits Market, By Target Tested (Page No. - 103)

9.1 Introduction

9.2 Allergens

9.3 Mycotoxins

9.4 Pathogens

9.5 GMOs

9.6 Meat Species

9.7 Others

10 Food Testing Kits Market, By Region (Page No. - 118)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 South Africa

10.5.3 Others in RoW

11 Competitive Landscape (Page No. - 146)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 New Product & Technology Launches

11.3.2 Expansions

11.3.3 Acquisitions

11.3.4 Agreements, Collaborations, Mergers & Partnerships

12 Company Profiles (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Thermo Fisher

12.2 Agilent

12.3 Eurofins

12.4 Biomérieux

12.5 Perkinelmer

12.6 Bio-Rad

12.7 Qiagen

12.8 Neogen

12.9 Envirologix

12.10 IFP Institut Fur Produktqualität

12.11 Romer Labs

12.12 Millipore Sigma

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 185)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (90 Tables)

Table 1 US Dollar Exchange Rates Considered for the Study, 2014–2016

Table 2 Chemical Outbreaks in the World, 2011–2015

Table 3 Regulatory Bodies That Actively Participate in Food Protection and Monitoring

Table 4 Reagents & Test Kits Market for Microbial Contamination in Drinking & Bottled Water, By Region, 2015-2022 (USD Million)

Table 5 Food Recalls in Australia & New Zealand, 2010–2015

Table 6 Food Products From the US Banned in Other Countries

Table 7 Food Production in India and Global Share Percentage, 2015

Table 8 USDa Grants for Food Safety Research

Table 9 International Regulatory Chart on Food Allergens

Table 10 Federal Food, Drug, and Cosmetic Act, By Tolerances of Raw & Processed Food

Table 11 Maximum Level for Melamine & Its Structural Analogs

Table 12 Gmos: Labeling Requirement

Table 13 Commission Regulation for Ochratoxin A

Table 14 Maximum Levels of Various Types of Mycotoxins in Different Foods

Table 15 Gmos Labeling in Asia Pacific Countries

Table 16 List of Genetically Engineered Crops Developed in Indonesia

Table 17 Market Size for Food Testing Kits, By Sample, 2015–2022 (USD Million)

Table 18 Meat, Poultry, and Seafood Products: Market Size for Food Testing Kits, By Region, 2015–2022 (USD Million)

Table 19 Dairy Products: Market Size, By Region, 2015–2022 (USD Million)

Table 20 Processed Food: Market Size, By Region, 2015–2022 (USD Million)

Table 21 Fruits & Vegetables: Market Size, By Region, 2015–2022 (USD Million)

Table 22 Cereals & Grains: Market Size, By Region, 2015–2022 (USD Million)

Table 23 Nuts, Seeds, and Spices: Market Size for Food Testing Kits, By Region, 2015–2022 (USD Million)

Table 24 Others: Market Size for Food Testing Kits, By Region, 2015–2022 (USD Million)

Table 25 Market Size for Food Testing Kits, By Technology, 2015–2022 (USD Million)

Table 26 PCR-Based Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 27 Immunoassay-Based Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 28 Enzyme Substrate-Based & Other Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 29 Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 30 Allergen: Market Size for Food Testing Kits, By Region, 2015–2022 (USD Million)

Table 31 Allergen Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 32 Mycotoxins: Occurrence, Source, and Health Effects

Table 33 Mycotoxin Testing Kits Market Size, By Region, 2015–2022 (USD Million)

Table 34 Mycotoxin Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 35 Pathogens Contributing to Foodborne Illnesses and Foodborne Illnesses Resulting in Hospitalization and Death Annually in the Us

Table 36 Foodborne Disease-Causing Organisms

Table 37 Food Pathogens: Inspection Rate & Incidence of Foodborne Illness, 2013 (Per 100,000 People)

Table 38 Pathogen Testing Kits Market Size, By Region, 2015–2022 (USD Million)

Table 39 Pathogen Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 40 Gmo Testing Kits Market Size, By Region, 2015–2022 (USD Million)

Table 41 Gmo Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 42 Meat Species Testing Kits Market Size, By Region, 2015–2022 (USD Million)

Table 43 Meat Species Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 44 Other Target Testing Kits Market Size, By Region, 2015–2022 (USD Million)

Table 45 Other Target Testing Kits Market Size, By Technology, 2015–2022 (USD Million)

Table 46 Market Size for Food Testing Kits, By Region, 2015–2022 (USD Million)

Table 47 North America: Food Testing Kits Market Size, By Country, 2015–2022 (USD Million)

Table 48 North America: Market Size, By Target Tested, 2015–2022 (USD Million)

Table 49 US: Food Fraud Details

Table 50 US: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 51 Canada: Food Fraud Details

Table 52 Canada: Market Size, By Target Tested, 2015–2022 (USD Million)

Table 53 Mexico: Market Size, By Target Tested, 2015–2022 (USD Million)

Table 54 Europe: Market Size for Food Testing Kits, By Country, 2015–2022 (USD Million)

Table 55 Europe: Market Size, By Target Tested, 2015–2022 (USD Million)

Table 56 Germany: Food Fraud Details

Table 57 Germany: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 58 UK: Food Fraud Details

Table 59 UK: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 60 France: Food Fraud Details

Table 61 France: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 62 Italy: Food Fraud Details

Table 63 Italy: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 64 Spain: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 65 Rest of Europe: Food Fraud Details

Table 66 Rest of Europe: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 67 Asia Pacific: Market Size for Food Testing Kits, By Country, 2015–2022 (USD Million)

Table 68 Asia Pacific: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 69 China: Food Fraud Details

Table 70 China: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 71 Japan: Market Size for Food Testing Kits, By Target Tested, 2015–2022 (USD Million)

Table 72 India: Food Fraud Details

Table 73 India: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 74 Australia & New Zealand: Food Fraud Details

Table 75 Australia & New Zealand: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 76 Rest of Asia Pacific: Food Fraud Details

Table 77 Rest of Asia Pacific: Food Testing Kits Market Size, By Target Tested, 2015–2022 (USD Million)

Table 78 RoW: Food Testing Kits Market Size, By Country, 2015–2022 (USD Million)

Table 79 RoW: Market Size, By Target Tested, 2015–2022 (USD Million)

Table 80 Brazil: Food Fraud Details

Table 81 Brazil: Food Testing Kits Market Size, By Target Testing, 2015–2022 (USD Million)

Table 82 Argentina: Market Size, By Target Testing, 2015–2022 (USD Million)

Table 83 South Africa: Market Size, By Target Testing, 2015–2022 (USD Million)

Table 84 Others in RoW: Food Fraud Details

Table 85 Others in RoW: Food Testing Kits Market Size, By Target Testing, 2015–2022 (USD Million)

Table 86 Top Five Companies in the Food Testing Kits Market, 2016

Table 87 New Product & Technology Launches, 2014–2017

Table 88 Expansions, 2012–2017

Table 89 Acquisitions, 2014–2017

Table 90 Agreements, Collaborations, Mergers & Partnerships, 2012–2017

List of Figures (65 Figures)

Figure 1 Market Segmentation

Figure 2 Food Testing Kits Market: Geographic Segmentation

Figure 3 Research Design: Food Testing Kits

Figure 4 Breakdown of Primaries

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Food Testing Kits Market Snapshot, By Target Tested, 2017 vs 2022

Figure 9 Market Size, By Technology, 2017–2022

Figure 10 Market Size, By Sample, 2017–2022

Figure 11 Market, By Region and Ranking, 2017–2022

Figure 12 Market Share, By Region

Figure 13 Emerging Countries to Drive the Growth of this Market

Figure 14 China to Be the Fastest-Growing Country in this Market By 2022

Figure 15 Immunoassay Based Technology Dominated the Food Testing Kits Market in 2016

Figure 16 Developing Countries to Emerge at the Highest Growth Rates During the Forecast Period

Figure 17 North America Dominated the Global Market Across All Target Tested in 2016

Figure 18 US Accounted for the Largest Share in 2016

Figure 19 Market Dynamics: Food Testing Kits Market

Figure 20 Global Microbiological Test Volume

Figure 21 US Federal R&D Expenditure Across All Major Agencies, 2016

Figure 22 US Agricultural Imports, 2010–2015

Figure 23 Processed Food & Related Products Export From India, 2011–2015, USD Billion

Figure 24 Trend of Food Processing Projects in Us, 2011–2015

Figure 25 Number of Subsectors of Food Processing Projects in Us, 2011–2015

Figure 26 US Processed Food Export, 2009 vs 2013, USD Billion

Figure 27 Major Export Markets of US, 2009 vs 2013, USD Billion

Figure 28 US: Estimated Annual Cost of Foodborne Illness Caused By Salmonella, 2013 (USD Million)

Figure 29 US: Estimated Annual Cost of Foodborne Illness Caused By Listeria, 2013 (USD Million)

Figure 30 Increase in Foodborne Outbreaks in Us

Figure 31 US: Share of Pathogens in Foodborne Illness - Economic Burden of USD 15.5 Billion, 2015

Figure 32 Growth in US Food Recalls, 2004 vs 2014

Figure 33 Food Allergy Prevalence Among Children of All Ages (0-18 Years), 2013

Figure 34 Fund Allocation for Food Processing Industry Development in India, USD Million

Figure 35 Australian Government Investment in R&D, 2015–2016 (USD Billion)

Figure 36 Food Safety Improvements & Increased Budget Allocation By the Fda, 2015

Figure 37 Legislation Process in the EU

Figure 38 Role of EFSA to Reduce Campylobacteriosis

Figure 39 Food Commodities Associated With Salmonella Outbreaks, 2004–2008

Figure 40 Food Testing Kits Market Size, By Sample, 2017 vs 2022

Figure 41 Meat, Poultry, and Seafood Products: Food Testing Kits Market Size, By Region, 2017 vs 2022

Figure 42 Market Size for Food Testing Kits, By Technology, 2017 vs 2022

Figure 43 PCR-Based Food Testing Kits Market Size, By Target Tested, 2017 vs 2022

Figure 44 Market Size for Food Testing Kits, By Target Tested, 2017 vs 2022

Figure 45 Allergen Testing Kits Market Size, By Region, 2017 vs 2022

Figure 46 Global Mycotoxin Testing Market Size in Food & Feed, By Region, 2015–2022 (Thousand Tests)

Figure 47 US Held the Largest Share of the Food Testing Kits Market, 2016

Figure 48 North American Market Snapshot

Figure 49 US: Number of Cases, Hospitalizations, and Deaths Caused By Pathogens, 2015

Figure 50 Number of Expansions of Food Processing Projects in the Us, 2011-2015

Figure 51 Food Allergen Recalls in the EU

Figure 52 Europe: Market Snapshot

Figure 53 Asia Pacific: Market Snapshot

Figure 54 Major Importing Countries of Processed Food and Agricultural Commodities From India, 2016

Figure 55 Fund Allocation for Food Project Development in 12th Five-Year Plan

Figure 56 Key Developments of the Leading Players in the Food Testing Kits Market for 2012-2017

Figure 57 Market Evaluation Framework

Figure 58 Thermo Fisher: Company Snapshot

Figure 59 Agilent: Company Snapshot

Figure 60 Eurofins: Company Snapshot

Figure 61 Biomérieux: Company Snapshot

Figure 62 Perkinelmer: Company Snapshot

Figure 63 Bio-Rad: Company Snapshot

Figure 64 Qiagen: Company Snapshot

Figure 65 Neogen: Company Snapshot

Growth opportunities and latent adjacency in Food Testing Kits Market