Managed Wi-Fi Solutions Market by Networking Service (Network Security, Network Planning and Designing, Network Consulting), Infrastructure Service (Survey and Analysis, Installation and Provisioning), Vertical, and Region - Global Forecast to 2022

[141 Pages Report] The managed Wi-Fi solutions market was valued at USD 2.72 Billion in 2016 and is expected to reach USD 6.11 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 14.8% during the forecast period. The base year considered for this study is 2016, and the forecast period is 20172022.

Objectives of the Study:

The main objective of the report is to define, describe, and forecast the managed Wi-Fi solutions market size by component (solutions and services), organization size, vertical, and region. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles key market players and comprehensively analyzes their core competencies. The report also tracks and analyzes competitive developments, such as partnerships, agreements, and collaborations, mergers and acquisitions, and new product developments in the market.

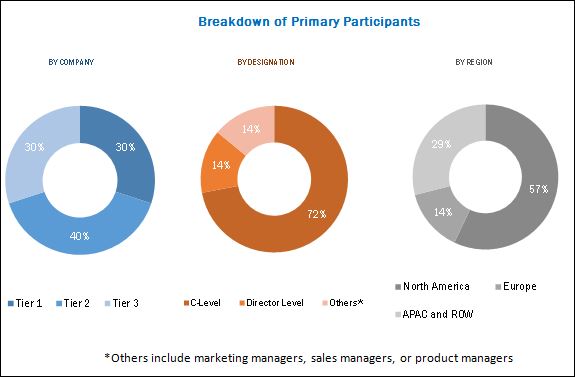

The research methodology used to estimate and forecast the market size begins with the collection and analysis of data on key vendor revenues through secondary sources, including annual reports and press releases, investor presentations of companies; conferences and associations (2017 CWNP WiFiTrek Conference, MSPWorld 2017 Conference and Expo, WLAN Pros EU, IEEE Whitepaper: WiFi White Paper on Convergence), technology journals, and certified publications; and articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The managed Wi-Fi solutions market spending across all regions along with the geographic split in various verticals was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The managed Wi-Fi solutions market consists of vendors providing managed Wi-Fi solutions and associated services including networking services and infrastructure services to commercial clients across the globe. Major vendors, such as Cisco Systems (US), Fujitsu (Japan), Vodafone (UK), Verizon (US), Ruckus Wireless (US), Aruba (US), Mojo Networks (US), and Purple (England), have adopted new product launches and partnerships, agreements, and collaborations as key strategies to improve their offered services and provide better solutions to enterprises and to expand their market reach.

Key Target Audience

- Managed Wi-Fi solution providers

- Governments

- Managed Service Providers (MSPs)

- Information Technology (IT) solution providers

- Cloud solution providers

- System integrators

- Wireless service providers

- Network solution providers

- Telecom and communication service providers

- Training and education service providers

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Managed Wi-Fi Solutions Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

20162022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Networking Service (Network Security, Network Planning and Designing, Network Consulting), Infrastructure Service (Survey and Analysis, Installation and Provisioning), Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

Cisco Systems (US), Fujitsu (Japan), Vodafone (UK), Verizon (US), Ruckus Wireless (US), Aruba (US), Mojo Networks (US), and Purple (England). |

The research report categorizes the Managed Wi-Fi Solutions Market to forecast the revenues and analyze trends in each of the following subsegments:

By Component:

- Solutions

- Services

By Service:

- Networking Services

- Infrastructure Services

By Networking Services:

- Network Security

- Network Auditing and Testing

- Network Planning and Designing

- Network Consulting

- Configuration and Change Management

By Infrastructure Services:

- Survey and Analysis

- System Integration and Upgradation

- Installation and Provisioning

- Wireless Infrastructure Maintenance and Management

- Training and Support

By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

By Vertical:

- IT and Telecommunications

- BFSI

- Retail

- Government and Public Sector

- Healthcare

- Transportation, Logistics, and Hospitality

- Manufacturing

- Education

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

The managed Wi-Fi solutions market is segmented on the basis of components (solutions and services), verticals, organization size, and regions. The market is gaining traction, as managed Wi-Fi solutions and services are instrumental in managing the user access and the entire life cycle of WLAN, from designing, engineering, and installing wireless systems to the entire network management, including infrastructure management. Enterprises are roping in MSPs to manage their widespread and complex Wi-Fi networks, to fulfill the connectivity demand of employees, guests, and commercial users for providing instant, secure, and reliable internet connectivity. The infrastructure services segment is expected to hold the largest market size during the forecast period, as these services act as the backbone of the network, and assist enterprises in installation and provisioning, system integration and upgradation, wireless infrastructure maintenance, and management of the WLAN network, thereby helping them enhance the network efficiency. The infrastructure services segment is categorized as survey and analysis, system integration and upgradation, installation and provisioning, wireless infrastructure maintenance and management, and training and support. The networking services segment includes network security, network auditing and testing, network planning and designing, network consulting, and configuration and change management. The organization size segment is categorized into SMEs and large enterprises. The vertical segment is further categorized into IT and telecommunications, Banking, Financial Services and Insurance (BFSI), retail, government and public sector, healthcare, transportation, logistics, and hospitality, manufacturing, education, and others.

Managed Wi-Fi solutions and associated services offer reliable, fast, and secure Wi-Fi access to guests, employees, students, and customers within premises. In addition, these solutions and services actively manage and provision network access for mobile devices, and enable guests to self-register for securely accessing hotspots and corporate WLANs. Enterprises have been increasingly adopting managed Wi-Fi solutions and services as they provide various benefits, including zero-touch provisioning and configuration, scalability, reliability, and cost-effectiveness.

North America is expected to hold the largest market share and dominate the managed Wi-Fi solutions market during the forecast period. The region has witnessed huge investments in wireless technologies and the rapid adoption of BYOD policies and Wi-Fi-enabled smart devices for enhanced productivity, employee satisfaction, and cost-effectiveness. These factors are expected to drive the market in North America. The market growth in North America is mainly driven by the increasing adoption of integrated enterprise and business solutions for more flexible and agile business processes and operations. The demand for the adoption of wireless hotspots and managed Wi-Fi solutions and services is expected to increase, due to the rise in the wireless technology investments by the major companies in this region. Enterprises in North America are opting for managed Wi-Fi solutions and services to improve their core business with easy and fast deployments, improved performance with limited CAPEX, and minimum OPEX, thereby offering reliable connectivity to their employees.

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and has always been a lucrative region. The managed Wi-Fi solutions market in APAC is expected to grow at the highest CAGR during the forecast period. APAC has witnessed the heavy deployment of wireless hotspots in many cities, and various government initiatives are promoting the adoption of internet and smart devices. A majority of enterprises in this region are adopting managed Wi-Fi solutions and services to provide internet access to their employees and guests, thereby contributing to the overall growth of the market.

Lack of standards for interconnectivity and interoperability is likely to be one of the restraining factors for the growth of managed Wi-Fi solutions market. However, recent developments, new product launches, and acquisitions undertaken by the major market players are expected to boost the market growth.

The study measures and evaluates major offerings and key strategies of the major market vendors, including Cisco Systems (US), Fujitsu (Japan), Vodafone (UK), Verizon (US), Ruckus Wireless (US), Aruba (US), Mojo Networks (US), and Purple (England). These companies offer reliable managed Wi-Fi solutions and associated services to commercial clients across regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Managed Wi-Fi Solutions Market

4.2 Market By Vertical and Region, 2017

4.3 Market Investment Scenario, 20172022

4.4 Market By Organization Size, 2017

4.5 Market By Region, 2017 vs 2022

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of BYOD and CYOD Among Enterprises

5.2.1.2 Low Capex and Tco

5.2.1.3 Rapid Increase in the Deployment of Public Wi-Fi Across Physical Venues

5.2.1.4 Rising Demand for High-Speed and Widespread Network Coverage

5.2.2 Restraints

5.2.2.1 Lack of Standards for Interconnectivity and Interoperability

5.2.3 Opportunities

5.2.3.1 Shift Toward Carrier Wi-Fi

5.2.3.2 Rising Need for Cloud Managed Wi-Fi Services

5.2.4 Challenges

5.2.4.1 Interference From Nearby Wi-Fi APS and Environmental Factors

5.2.4.2 Security and Privacy Concerns

5.3 Managed Wi-Fi Solutions: Subscription Models

5.3.1 Basic

5.3.2 Advanced

5.3.3 Premium

5.3.4 Custom

6 Managed Wi-Fi Solutions Market, By Component (Page No. - 37)

6.1 Introduction

6.2 Solutions

6.2.1 Guest Wi-Fi

6.2.2 Private Wi-Fi

6.3 Services

6.3.1 Networking Services

6.3.2 Infrastructure Services

7 Market By Networking Service (Page No. - 45)

7.1 Introduction

7.2 Network Security

7.3 Network Auditing and Testing

7.4 Network Planning and Designing

7.5 Network Consulting

7.6 Configuration and Change Management

8 Managed Wi-Fi Solutions Market, By Infrastructure Service (Page No. - 53)

8.1 Introduction

8.2 Survey and Analysis

8.3 System Integration and Upgradation

8.4 Installation and Provisioning

8.5 Wireless Infrastructure Maintenance and Management

8.6 Training and Support

9 Market By Organization Size (Page No. - 60)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Managed Wi-Fi Solutions Market, By Vertical (Page No. - 64)

10.1 Introduction

10.2 IT and Telecommunications

10.3 Banking, Financial Services, and Insurance

10.4 Retail

10.5 Government and Public Sector

10.6 Healthcare

10.7 Transportation, Logistics, and Hospitality

10.8 Manufacturing

10.9 Education

10.10 Others

11 Managed Wi-Fi Solutions Market, By Region (Page No. - 74)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 96)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Scenario

12.3.1 New Product Launches

12.3.2 Mergers and Acquisitions

12.3.3 Partnerships, Agreements, and Collaborations

13 Company Profiles (Page No. - 100)

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Cisco Systems

13.2 Aruba

13.3 Vodafone

13.4 Fujitsu

13.5 Comcast Business

13.6 Rogers Communications

13.7 Verizon

13.8 Purple

13.9 Ruckus Wireless

13.10 Mojo Networks

13.11 Megapath

13.12 WiFi Spark

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 130)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (67 Tables)

Table 1 Managed Wi-Fi Solutions Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 2 Market Size, By Component, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Region, 20152022 (USD Million)

Table 4 Services: Market Size, By Type, 20152022 (USD Million)

Table 5 Services: Market Size, By Region, 20152022 (USD Million)

Table 6 Networking Services Market Size, By Region, 20152022 (USD Million)

Table 7 Infrastructure Services Market Size, By Region, 20152022 (USD Million)

Table 8 Managed Wi-Fi Solutions Market Size, By Networking Service, 20152022 (USD Million)

Table 9 Network Security: Market Size, By Region, 20152022 (USD Million)

Table 10 Network Auditing and Testing: Market Size, By Region, 20152022 (USD Million)

Table 11 Network Planning and Designing: Market Size, By Region, 20152022 (USD Million)

Table 12 Network Consulting: Market Size, By Region, 20152022 (USD Million)

Table 13 Configuration and Change Management: Market Size, By Region, 20152022 (USD Million)

Table 14 Managed Wi-Fi Solutions Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 15 Survey and Analysis: Market Size, By Region, 20152022 (USD Million)

Table 16 System Integration and Upgradation: Market Size, By Region, 20152022 (USD Million)

Table 17 Installation and Provisioning: Market Size, By Region, 20152022 (USD Million)

Table 18 Wireless Infrastructure Maintenance and Management: Market Size, By Region, 20152022 (USD Million)

Table 19 Training and Support: Market Size, By Region, 20152022 (USD Million)

Table 20 Market Size, By Organization Size, 20152022 (USD Million)

Table 21 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 22 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 23 Managed Wi-Fi Solutions Market Size, By Vertical, 20152022 (USD Million)

Table 24 IT and Telecommunications: Market Size, By Region, 20152022 (USD Million)

Table 25 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 26 Retail: Market Size, By Region, 20152022 (USD Million)

Table 27 Government and Public Sector: Market Size, By Region, 20152022 (USD Million)

Table 28 Healthcare: Market Size, By Region, 20152022 (USD Million)

Table 29 Transportation, Logistics, and Hospitality: Market Size, By Region, 20152022 (USD Million)

Table 30 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 31 Education: Market Size, By Region, 20152022 (USD Million)

Table 32 Others: Market Size, By Region, 20152022 (USD Million)

Table 33 Managed Wi-Fi Solutions Market Size, By Region, 20152022 (USD Million)

Table 34 North America: Market Size, By Component, 20152022 (USD Million)

Table 35 North America: Market Size, By Service, 20152022 (USD Million)

Table 36 North America: Market Size, By Networking Service, 20152022 (USD Million)

Table 37 North America: Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 38 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 39 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 40 Europe: Managed Wi-Fi Solutions Market Size, By Component, 20152022 (USD Million)

Table 41 Europe: Market Size, By Service, 20152022 (USD Million)

Table 42 Europe: Market Size, By Networking Service, 20152022 (USD Million)

Table 43 Europe: Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 44 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 46 Asia Pacific: Managed Wi-Fi Solutions Market Size, By Component, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Networking Service, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 52 Middle East and Africa: Managed Wi-Fi Solutions Market Size, By Component, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Networking Service, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 58 Latin America: Managed Wi-Fi Solutions Market Size, By Component, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Networking Service, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Infrastructure Service, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 63 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 64 Market Ranking for the Managed Wi-Fi Solutions Market, 2017

Table 65 New Product Launches, 20152017

Table 66 Mergers and Acquisitions, 20152016

Table 67 Partnerships, Agreements, and Collaborations, 20152017

List of Figures (50 Figures)

Figure 1 Managed Wi-Fi Solutions Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market: Assumptions

Figure 7 Market Top 3 Segments, 2017

Figure 8 Market By Component, 2017

Figure 9 Market By Service, 2017

Figure 10 Increasing Adoption of Enterprise Mobility Services and BYOD Trend is Expected to Drive the Managed Wi-Fi Solutions Market Growth

Figure 11 IT and Telecommunications Vertical, and North America are Estimated to Have the Largest Market Shares in 2017

Figure 12 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 13 Large Enterprises Segment is Estimated to Have the Larger Market Share in 2017

Figure 14 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 15 Managed Wi-Fi Solutions Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Solutions Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 17 Networking Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 North America is Expected to Exhibit the Largest Market Size in the Services Segment During the Forecast Period

Figure 19 North America is Expected to Dominate the Networking Services Segment During the Forecast Period

Figure 20 Asia Pacific is Expected to Grow at the Highest CAGR in the Infrastructure Services Segment During the Forecast Period

Figure 21 Network Planning and Designing Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Asia Pacific is Expected to Grow at the Highest CAGR in the Network Auditing and Testing Segment During the Forecast Period

Figure 23 North America is Expected to Dominate the Network Planning and Designing Segment During the Forecast Period

Figure 24 Installation and Provisioning Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 25 North America is Expected to Dominate the Installation and Provisioning Segment During the Forecast Period

Figure 26 Asia Pacific is Expected to Grow at the Highest CAGR in the Wireless Infrastructure Maintenance and Management Segment During the Forecast Period

Figure 27 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 28 North America is Expected to Dominate the Large Enterprises Segment During the Forecast Period

Figure 29 Transportation, Logistics, and Hospitality Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 30 North America is Expected to Dominate the IT and Telecommunications Vertical During the Forecast Period

Figure 31 Asia Pacific is Expected to Witness the Highest CAGR in the Transportation, Logistics, and Hospitality Vertical During the Forecast Period

Figure 32 North America is Expected to Have the Largest Market Size in the Managed Wi-Fi Solutions Market During the Forecast Period

Figure 33 Asia Pacific is Expected to Be an Attractive Destination for Investments in the Market

Figure 34 North America: Market Snapshot

Figure 35 Solutions Component is Expected to Have the Larger Market Size in North America During the Forecast Period

Figure 36 Asia Pacific: Market Snapshot

Figure 37 Key Developments By the Leading Players in the Market for 20152017

Figure 38 Market Evaluation Framework

Figure 39 Cisco Systems: Company Snapshot

Figure 40 Cisco Systems: SWOT Analysis

Figure 41 Aruba: SWOT Analysis

Figure 42 Vodafone: Company Snapshot

Figure 43 Fujitsu: Company Snapshot

Figure 44 Fujitsu: SWOT Analysis

Figure 45 Comcast Business: Company Snapshot

Figure 46 Rogers Communications: Company Snapshot

Figure 47 Rogers Communications: SWOT Analysis

Figure 48 Verizon: Company Snapshot

Figure 49 Verizon: SWOT Analysis

Figure 50 Ruckus Wireless: Company Snapshot

Growth opportunities and latent adjacency in Managed Wi-Fi Solutions Market