Change and Configuration Management Market by Components (Software and Services), Deployment (Cloud and On-premise), Organization Size (SME and Enterprises), Vertical, and Region - Global Forecast to 2021

[140 Pages Report] The overall change and configuration management market is expected to grow from USD 1.29 billion in 2016 to USD 2.04 billion by 2021, at a CAGR of 11.0% from 2016 to 2021. The benefits of configuration management include establishing a reliable repository of accurate information regarding IT components; understanding relationships between configuration items; and determining what components impact which services. Configuration management solutions aim at providing accurate configuration information to assist decision-making and to help resolve incidents and problems faster, which, in turn, help in the growth of the market. The change and configuration management market is expanding as the organizations deploys change and configuration Management solutions to establish effective ground rules which can reduce system downtimes, enhance compliance with guidelines, improve flexibility of the infrastructure and automate this entire process to a certain extent enabling them to concentrate on their core business functions. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Simplification and synchronization of IT resources

- Automated management of IT resources

- Digital technologies driving the need for scalable and flexible systems

Restraints

- Diverse application in an enterprise

Opportunities

- Potential combination of configuration management tools with the DevOPs approach

- Increased demand for agile systems

Challenges

- Third party integrations, acquisitions and collaborations

- GUI development problem for large amounts of data

Simplification and synchronization of IT resources drives the global change and configuration management market

Configuration management refers to maintain consistent state of IT resources throughout the infrastructure. The process involves storage of Configuration Items (CIs), which hold data regarding versions, patches upgrades, system downtimes, documentation, and other in a central repository called Configuration Management Database (CMDB).

Storage of CIs in CMDB leads to the creation of a single unified repository for your system related information. This makes it easier for IT administrators to control status of system components, monitor requirement changes at the infrastructural as well as individual level, and ensure system availability by troubleshooting system issues in real time. Establish effective ground rules with which they can reduce system downtimes, enhanced compliance with guidelines, improved flexibility of the infrastructure, and automation of the process to a certain extent enabling them to concentrate on their core business functions are some of the major motivation factor for organizations to use change and configuration management.

The following are the major objectives of the study.

- To define, describe, and forecast the global change and configuration management market on the basis of software, services, organization sizes, deployment types, verticals, and regions

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To strategically analyze sub segments with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the market size of various market segments with respect to five main regions, namely, North America, Europe, Latin America, Asia-Pacific (APAC), and Middle East and Africa (MEA)

- To analyze opportunities in the market for stakeholders, to provide strategic profiles of the key players in the market to comprehensively analyze the core competencies and to draw the competitive landscape of the market

- To track and analyze competitive developments such as mergers & acquisitions, partnerships & agreements, new product developments, and Research and Development (R&D) activities in the market

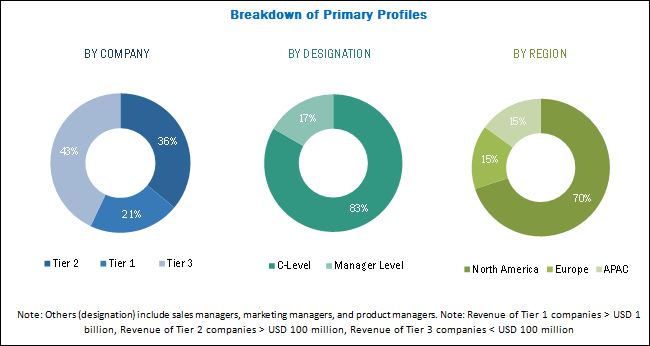

During this research study, major players operating in the change and configuration management market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

The change and configuration management ecosystem comprises of software providers such as IBM (U.S.), Microsoft (U.S.), HP (U.S.), CA Technologies (U.S.), ServiceNow (U.S.), BMC Software (U.S.), AWS (U.S.), Chef Software Inc (U.S.), Ansible (U.S.) and Codenvy (U.S.) among others; solution providers such as Puppet (U.S.); service providers such as IBM (U.S.), HP (U.S.) and AWS (U.S.) among others who offers their software, solution and services to end users to cater to their unique business requirements.

Major Market Developments

- In November 2016, Chef has announced to releases chefdk 1.0.3, an enhanced version of chefdk with advanced features.

- In October 2016, Microsoft has launched new platform for documentation of system center configuration manager. Previous to its launch documents were configured on TechNet. This new documentation is logically arranged in seven groups namely core infrastructure. Application management, device compliance, mobile device management, operating system deployment, protect data & infrastructure, and software update management

- In October 2016, HP Enterprise has launched version 10.30 of configuration management system. This release has linked users to cloud and container environment with real time event based discovery thereby increasing performance and scalability of management system.

- In September 2016, Codenvy entered into partnership with Bitnami for simplifying the setup and configuration process for development environments in the cloud. This will lead developers to download, install and create a workspace with just one click, and share it with a single URL.

- In December 2016, AWS expands its business in regions of Canada of North American zone. This expansion will benefit in fast delivery of cloud environment.

- In September 2015, IBM acquired StrongLoop, a leading provider of application development software provider. This acquisition has helped to extend the enterprise reach using IBM Cloud.

Target Audience

- Implementation service providers

- Consultants/consultancies/advisory firms

- Enterprise service management vendors

- Support and maintenance service providers

- Value-added resellers

- System design and development vendors

- Cloud service providers

- IT service desk solution vendors

- Small and medium/large enterprise users

Report Scope

By Component:

- Software

- Services

By Deployment Type:

- On Premise

- Cloud based

By Organization Size:

- SMEs

- Large Enterprises

By Industry Type:

- BFSI (Banking, Financial Services and Insurance)

- Healthcare and Life Science

- Education

- Government and Public Sector

- Telecom and IT

- Retail and Consumer Packaged Goods

- Others

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- Key geographical regions offering lucrative opportunity for the adoption of change and configuration management solution and services?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North Americas Change and Configuration Management Market

- Further breakdown of the Europe Change and Configuration Management Market

- Further breakdown of the MEA Change and Configuration Management Market

- Further breakdown of the APAC Change and Configuration Management Market

- Further breakdown of the Latin America Change and Configuration Management Market

Company Information

- Detailed analysis and profiling of market players

The Change and Configuration Management market is expected to grow from USD 1.21 billion in 2016 to USD 2.04 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. Factors like the increasing demand for Agile systems driven by the emergence of digital technologies and possibilities which can be realized by combining the DevOps approach with configuration management tools are driving the Change and Configuration management market. Verticals such as healthcare, banking, defense, Telecom and IT, and many more have boosted the change and configuration management market.

The Change and Configuration Management market is segmented by component, deployment type, organization size, industry verticals and regions. The services market for change and configuration management is expected to grow at the highest CAGR, due to the fact that, more and more organizations are now outsourcing their IT operations to third party vendors.

Currently, the rapid increase in initiatives undertaken by organizations to undergo digital transformation is creating a need for change and configuration management practices and tools, as a result cloud based deployment is expected to grow. However, due to reliability and other security issues of the cloud based deployment, the on-premise deployment of change and configuration management expected to hold the largest market share in 2016.

There is always a strain on resources for SMEs, in such a scenario the extent of flexibility and automation allowed for by CM tools can be highly beneficial. Effective Change and Configuration Management policies can also be beneficial when partnering with larger organizations, as they might expect such practices to be in place while considering companies to partner with to reduce their overheads. As a result, the SME market for change and configuration management is expected to grow at the highest CAGR in the organizations segment.

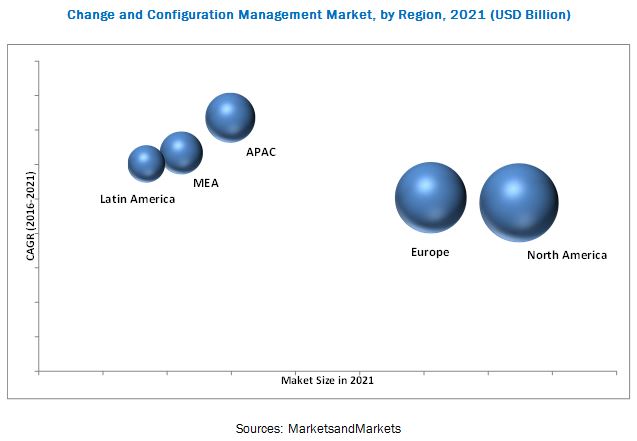

The global market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and Latin America to provide a region-specific analysis in the report. North America is expected to have the largest market share and is expected to dominate the market from 2016 to 2021. This is mainly because in the developed economies of the U.S. and Canada, there is a high focus on innovations obtained from research and development and technology.

Change and configuration management helps organizations to standardize their IT governance aligned with overall corporate strategy, which further drive the business performance.

Telecom and IT

Both IT as well as telecom industries experience rapid innovations and new technologies on a daily basis. Due to the pace of these innovations, IT infrastructures in both the industries require a high level of scalability and flexibility to be able to incorporate these new applications and solutions. Thus, it becomes a difficult task for organizations in these industries to maintain a balance between staying up-to-date and optimizing their expenditure, this is where change and configuration management practices come into the picture.

BFSI

Banks and other financial institutes are being forced to change their IT strategies with technology penetrating the length and breadth of BFSI as an industry. The emergence of mobility technologies, has given greater power to BFSI institutions to improve the service experience for their customers. The functioning of the industry is sure to change in the longer run with multiple technological trends emerging offering an opportunity for change and configuration management solution and services vendors.

Retail and consumer packaging goods

E-commerce and analytics has changed the face of retail industry, leading to changes in how customers buy their product. Companies can now track data in real time and influence the customers buying decision at any point of the decision-making process due to improved accessibility. Due to globalization, technology more than ever before, impacts and dictates the way the retail industry operates. Change and configuration management enables backward as well as forward compatibilities, reducing operational overheads for the end users of retail industry. Additionally, it leads to the creation of a reliable and flexible infrastructure, which can withstand the rapid pace of technological innovations.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry adopting changing and configuration management solutions and services?

Organizations structures are rapidly transforming to remain competitive in the global market, leading to change in the traditional business processes. To enable this transformation organizations need to make use of several applications and solutions. This leads to increased complexity in management of configuration due to the diversity of applications in the organization. This is one of the restraints impacting the long term growth of the change and configuration management market. Puppet, Chef and CA Technologies are a few of the key players leading innovation in the Change and Configuration Management market These players have adopted various growth strategies such as new product launches, partnerships, contracts, collaborations, acquisitions, and expansions to expand their global presence and increase their market shares in the global market.

The change and configuration management ecosystem comprises the major vendors such as IBM Corporation (U.S.), Microsoft Corporation (U.S.), HP Enterprises (U.S.), CA technologies (U.S.), ServiceNow (U.S.), BMC Software (U.S.), AWS (U.S.), Chef Software (U.S.), Puppet (U.S.), Ansible by Red Hat (U.S.) and Codenvy (U.S.). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Report

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Vendor Dive Matrix

2.4.1 Quadrant Description

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Component

4.3 Change and Configuration Management Market Potential

4.4 Market By Region and Vertical

4.5 Market By Region

4.6 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Deployment Type

5.2.3 By Organization Size

5.2.4 By Vertical

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Simplification and Synchronization of IT Resources

5.3.1.2 Automated Management of IT Processes and Policies

5.3.1.3 Digital Technologies Driving the Need for Scalable and Flexible Systems

5.3.2 Restraint

5.3.2.1 Diverse Applications in an Enterprise

5.3.3 Opportunity

5.3.3.1 Potential Combination of Configuration Management Tools With the Devops Approach

5.3.3.2 Increased Demand for Agile Systems

5.3.4 Challenges:

5.3.4.1 Third-Party Integrations, Acquisitions, and Collaborations

5.3.4.2 Gui Development Problem for Large Amounts of Data

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Ecosystem

6.4 Strategic Benchmarking

6.5 Evolution

7 Change and Configuration Management Market Analysis, By Component (Page No. - 46)

7.1 Introduction

7.2 Software

7.3 Services

7.3.1 Professional Services

7.3.1.1 Training and Consulting

7.3.1.2 Integration Services

7.3.1.3 Support and Maintenance

7.3.2 Managed Services

8 Market Analysis, By Deployment Type (Page No. - 55)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Change and Configuration Management Market Analysis, By Organization Size (Page No. - 59)

9.1 Introduction

9.2 Small and Medium Size Enterprises (SMES)

9.3 Large Enterprises

10 Change and Configuration Management Market Analysis, By Vertical (Page No. - 63)

10.1 Introduction

10.2 BFSI (Banking, Financial Services, and Insurance)

10.3 Healthcare and Life Science

10.4 Education

10.5 Government and Public Sector

10.6 Telecom and IT

10.7 Retail and Consumer Packaged Goods

10.8 Others

11 Change and Configuration Management Market Analysis, By Region (Page No. - 71)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 94)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 Partnerships, Agreements, and Collaborations

12.2.3 Mergers and Acquisitions

12.2.4 Expansions

12.3 MnM Dive: Change and Configuration Management Vendor Scorecard

12.3.1 Change and Configuration Management: MnM Dive-Vendor Comparison

13 Company Profiles (Page No. - 103)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 IBM Corporation

13.3 Microsoft Corporation

13.4 Hewlett-Packard Enterprise Company

13.5 CA Technologies

13.6 Servicenow

13.7 BMC Software

13.8 Amazon Web Services

13.9 Chef Software, Inc.

13.10 Puppet

13.11 Ansible

13.12 Codenvy, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 131)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (67 Tables)

Table 1 Global Change and Configuration Management Market Size, By Component, 20142021 (USD Million)

Table 2 Market Size, By Component, 20142021 (USD Million)

Table 3 Software: Market Size, By Region, 20142021 (USD Million)

Table 4 Services: Market Size, By Region, 20142021 (USD Million)

Table 5 Services: Market Size, By Type, 20142021 (USD Million)

Table 6 Professional Services Market Size, By Region, 20142021 (USD Million)

Table 7 Professional Services Market Size, By Type, 20142021 (USD Million)

Table 8 Training and Consulting Market Size, By Region, 20142021 (USD Million)

Table 9 Integration Services Market Size, By Region, 20142021 (USD Million)

Table 10 Support and Maintenance Services Market Size, By Region, 20142021 (USD Million)

Table 11 Managed Services Market Size, By Region, 20142021 (USD Million)

Table 12 Change and Configuration Management Market Size, By Deployment Type, 20142021 (USD Million)

Table 13 Cloud: Market Size, By Region, 20142021 (USD Million)

Table 14 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 15 Market Size, By Organization Size, 20142021 (USD Million)

Table 16 Small and Medium Size Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 17 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 18 Market Size, By Vertical, 20142021 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 20 Healthcare and Life Science: Market Size, By Region, 20142021 (USD Million)

Table 21 Education: Market Size, By Region, 20142021 (USD Million)

Table 22 Government and Public Sector: Market Size, By Region, 20142021 (USD Million)

Table 23 Telecom and IT: Market Size, By Region, 20142021 (USD Million)

Table 24 Retail and Consumer Packaged Goods: Market Size, By Region, 20142021 (USD Million)

Table 25 Others: Market Size, By Region, 20142021 (USD Million)

Table 26 Change and Configuration Management Market Size, By Region, 20142021 (USD Million)

Table 27 North America: Market Size, By Country, 20142021 (USD Million)

Table 28 North America: Market Size, By Component, 20142021 (USD Million)

Table 29 North America: Market Size, By Service, 20142021 (USD Million)

Table 30 Professional Services Market Size, By Type, 20142021 (USD Million)

Table 31 North America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 32 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 33 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 34 U.S.: Market Size, By Component, 20142021 (USD Million)

Table 35 U.S.: Market Size, By Service, 20142021 (USD Million)

Table 36 U.S.: Professional Services Market Size, By Type, 20142021 (USD Million)

Table 37 U.S.: Market Size, By Deployment Type, 20142021 (USD Million)

Table 38 U.S.: Market Size, By Organization Size, 20142021 (USD Million)

Table 39 U.S.: Market Size, By Vertical, 20142021 (USD Million)

Table 40 Europe: Market Size, By Component, 20142021 (USD Million)

Table 41 Europe: Market Size, By Service, 20142021 (USD Million)

Table 42 Europe: Professional Services Market Size, By Type, 20142021 (USD Million)

Table 43 Europe: Market Size, By Deployment Type, 20142021 (USD Million)

Table 44 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 46 Asia-Pacific: Market Size, By Component, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 48 Asia-Pacific: Professional Services Market Size, By Type, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Deployment Type, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 51 Asia- Pacific : Market Size, By Vertical, 20142021 (USD Million)

Table 52 Middle East and Africa: Market Size, By Component, 20142021 (USD Million)

Table 53 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 54 Middle East and Africa: Professional Services Market Size, By Type, 20142021 (USD Million)

Table 55 Middle East and Africa: Market Size, By Deployment Type, 20142021 (USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 58 Latin America: Market Size, By Component, 20142021 (USD Million)

Table 59 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 60 Latin America: Professional Services Market Size, By Type, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 63 Latin America: Change and Configuration Management Market Size, By Vertical,20142021 (USD Million)

Table 64 New Product Launches, 2016

Table 65 Partnerships, Agreements, and Collaborations, 2016

Table 66 Mergers and Acquisitions, 20152016

Table 67 Expansions, 2016

List of Figures (46 Figures)

Figure 1 Global Change and Configuration Management Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Vendor Dive Matrix: Criteria Weightage

Figure 6 Vendor Dive Matrix

Figure 7 Service Model Snapshot: Market for Managed Services is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 8 North America is Estimated to Hold the Largest Market Share in 2016

Figure 9 Improved Flexibility of Systems is Driving the Market

Figure 10 The Services Market for Change and Configuration Management is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 On-Premises Deployment is Expected to Dominate the Market During the Forecast Period

Figure 12 Government and Public Sector Vertical is Expected to Hold the Largest Market Share in the Market, in 2016

Figure 13 North America is Expected to Hold the Largest Market Size in Change and Configuration Management Market During the Forecast Period

Figure 14 Regional Lifecycle: Asia-Pacific is Estimated to Be in the Growth Phase in 2016

Figure 15 Market Segmentation By Component

Figure 16 Market Segmentation By Deployment Type

Figure 17 Market Segmentation By Organization Size

Figure 18 Market Segmentation By Vertical

Figure 19 Market Segmentation By Region

Figure 20 Market Drivers, Restraints, Opportunities, and Challenges

Figure 21 Market Value Chain

Figure 22 Market Ecosystem

Figure 23 Services Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Cloud-Based Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Large Enterprises Segment is Expected to Hold the Largest Market Share During Forecast Period

Figure 26 Telecom and IT is Expected to Grow With Highest CAGR During 2016- 2021

Figure 27 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Geographic Snapshot (20162021): Asia-Pacific and Middle East and Africa Offers Lucrative Opportunities in the Change and Configuration Management Market

Figure 29 North America Market Snapshot

Figure 30 Asia-Pacific Market Snapshot

Figure 31 Companies Adopted New Product Launch as the Key Growth Strategy Between 2014 and 2016

Figure 32 Market Evaluation Framework

Figure 33 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 34 Evaluation Overview: Service Offerings

Figure 35 Evaluation Overview: Business Strategy

Figure 36 Geographic Revenue Mix of Top 5 Market Players

Figure 37 IBM Corporation: Company Snapshot

Figure 38 IBM Corporation: SWOT Analysis

Figure 39 Microsoft Corporation: Company Snapshot

Figure 40 Microsoft Corporation: SWOT Analysis

Figure 41 Hewlett-Packard Enterprise Company: Company Snapshot

Figure 42 Hewlett-Packard Enterprise Company: SWOT Analysis

Figure 43 CA Technologies : Company Snapshot

Figure 44 CA Technologies: SWOT Analysis

Figure 45 Servicenow: Company Snapshot

Figure 46 Servicenow: SWOT Analysis

Growth opportunities and latent adjacency in Change and Configuration Management Market