Commercial Refrigeration Equipment Market by Product Type, Refrigerant Type (Fluorocarbons, Hydrocarbons, Inorganics), Application (Hotels & Restaurants, Supermarkets & Hypermarkets), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Commercial Refrigeration Equipment Market

The global commercial refrigeration equipment market was valued at USD 32.0 billion in 2021 and is projected to reach USD 43.3 billion by 2026, growing at 6.2% cagr from 2021 to 2026. The market is expected to shift towards natural refrigerant-based systems because of the potential for large energy savings, and implementation of stringent regulations worldwide for phasing out ozone-depleting substances, such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs). The demand for NH3/CO2 cascade systems is also slated to go up gradually due to the advantages they offer for food processing and low-temperature distribution facilities. These benefits include low operating costs (as they use less energy per ton of refrigeration compared to other systems), lower capital and compliance costs, optimal food quality, and increased throughput.

Commercial Refrigeration Equipment Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global commercial refrigeration equipment market

The pandemic is estimated to have an impact on various factors of the value chain of the commercial refrigeration equipment market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

COVID-19 had a significant economic impact on various financial as well as industrial sectors, such as travel & tourism, manufacturing, construction, and aviation. The end-use sectors of commercial refrigeration equipment, such as hotels & restaurants, supermarkets & hypermarkets, convenience store, and bakeries have been impacted. Hotels & restaurants and bakeries was one of the severely impacted sectors due to strict lockdowns and curfew in most countries to prevent the spread of coronavirus.

Commercial Refrigeration Equipment Market Dynamics

Driver: Growing demand for frozen and processed food across word

The food processing sector requires equipment and solutions to produce, process, and distribute food to billions of households across the world as it services a multi-faceted value chain from farming to logistics. This sector has become increasingly important as the world’s population is on the rise, and dietary preferences are evolving, reflecting higher incomes and a shift to value-added products. The global demand for fresh and processed fruits and vegetables is increasing because of the changing food consumption habits of the urban population. The rise in disposable incomes in emerging economies has led to an increase in demand for fresh and processed fruits and vegetables. Frozen food products are increasingly becoming an integral part of daily diet across the world. Also, rapid urbanization in developing countries and rising living standards are fueling the demand for processed and packaged food, thereby leading to higher commercial refrigeration equipment sales, which is expected to propel the demand for commercial refrigeration equipment market during the forecast period.

Restraints: Stringent regulations against the use of fluorocarbon refrigerants

Fluorocarbon refrigerants adversely affect the ozone layer. In regard to this, governments of several countries worldwide are imposing regulations to limit the use of fluorocarbon refrigerants. They have agreed to phase out the use of HCFCs and HFCs by imposing limits on their consumption.

Regulations imposed on certain refrigerants such as R22 under the Montreal Protocol are hampering the growth of the commercial refrigerant equipment market. The main aim of this protocol is to minimize the damage caused to the ozone layer due to the use of refrigerant gases. Under this protocol, countries have agreed to phase out the use of ozone-depleting fluorinated refrigerant gases

Opportunity: Improvements in the efficiency of refrigeration systems with the use of natural refrigerants

Several government agencies and R&D companies are focused on improving the coefficient of performance, efficiency, lifetime, and total ownership cost of commercial refrigeration systems. With the Kyoto Protocol and the recent EU F-Gas regulations, manufacturers are trying to develop natural refrigerant technologies that can boost the energy efficiency of commercial refrigeration systems. Companies such as Carnot Refrigeration, Danfoss, and Carrier Commercial Refrigeration are introducing ammonia and CO2 refrigerant technologies. Earlier, cascade refrigeration systems using CO2 and ammonia as refrigerants were confined to limited refrigeration applications. However, with the increasing awareness regarding eco-friendly refrigerants, cascade refrigeration systems are preferred for a wide range of refrigeration applications. The Clean Development Mechanism (CDM) defined in article 12 of the Kyoto Protocol encourages the use of natural refrigerants. The CDM allows a country with an emission-reduction commitment under the Kyoto Protocol to implement an emission-reduction project. Such projects can earn saleable Certified Emission Reduction (CER) credits, each equivalent to one ton of CO2, which can be counted toward meeting the Kyoto targets. These projects include the installation of energy-efficient equipment in industries.

Challenge: Few purification companies

There are different grades of ammonia and CO2 that can be used as refrigerants in commercial refrigeration equipment. These grades need to be of very high purity. Refrigerant grade ammonia is 99.95% pure, with a water content within 33 parts per million (ppm) and oil content within 2 ppm. Preserving the purity of ammonia is essential to ensure the proper functioning of refrigeration systems. The cost of purifying natural refrigerants is high, and the process is quite complex. Therefore, there are limited companies that produce refrigerant grade ammonia. Similarly, for refrigerant grade CO2, the water content has to be less than 10 ppm. However, there are very few companies that provide this grade of CO2. Thus, the presence of a few purification companies is acting as a challenge to the growth of the commercial refrigeration equipment market.

By application, supermarkets & hypermarkets segment is expected to account for the largest share for commercial refrigeration equipment market during the forecast period

By application, supermarkets & hypermarkets segment is projected to be the largest application segment of the commercial refrigeration equipment market from 2021 to 2026. The advanced commercial refrigerators provide for practical designs to capture the attention of customers at any such point of sale. Also, Changing food consumption trends and rising international food trade are additional factors contributing to the growth of the market.

By refrigerant type, fluorocarbons segment is expected to lead the commercial refrigeration equipment market during the forecast period

The fluorocarbons segment is estimated to be the largest refrigerant type segment of the commercial refrigeration equipment market in 2021. Fluorocarbons are chemical compounds comprising carbon, hydrogen, chlorine, and fluorine as their major constituents. However, not all fluorocarbons may consist of both chlorine and fluorine atoms. The applications of these refrigerants are in refrigerators (domestic, transport, and commercial) and large-scale refrigerators (supermarket/ hypermarket). Fluorocarbons are further sub-divided into three types – HFCs, HCFCs, and HFOs.

By product type, transportation refrigeration segment is expected to lead the commercial refrigeration equipment market during the forecast period

Countries such as Asia Pacific has large consumer base and offer lucrative opportunities for chilled and frozen food products such as dairy products, beverages, ice creams, frozen dairy products, processed meat, and fish & seafood products, among others. Such products have a very less shelf life if kept at normal temperature. Thus, transportation refrigeration is required to transport the products from one place to other, creating a demand for commercial refrigeration equipment.

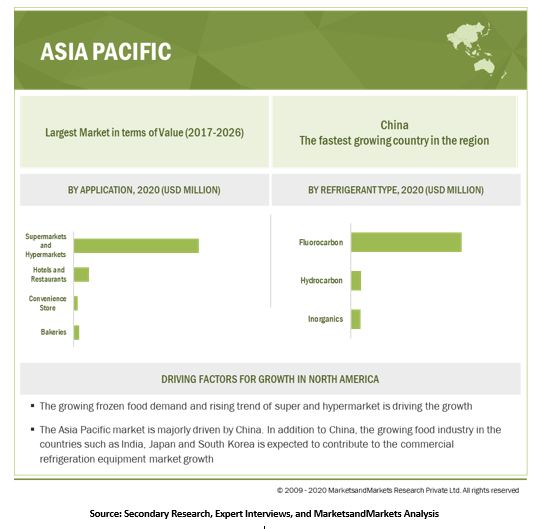

Asia Pacific dominated the global commercial refrigeration equipment market, in terms of value, in 2020

The Asia Pacific is expected to be the largest market of commercial refrigeration equipment during the forecast period. The increasing population in the region, improving economic conditions, such as rising GDP & disposable incomes, and a booming consumer appliances sector have led to growth in the commercial refrigeration equipment in the region. In addition, the growth of the commercial refrigeration equipment market in this region is fueled by growth in the manufacturing sector; increase in spending on private & public infrastructure development; and rapid urbanization.

Commercial Refrigeration Equipment Market Players

The key market players include Carrier (US), Emerson Electric Company (US), Daikin (Japan), Danfoss (Denmark), and GEA Group (Germany). These players have adopted product launches, acquisitions, expansions, partnerships as their growth strategies.

Commercial Refrigeration Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 32.0 billion |

|

Revenue Forecast in 2026 |

USD 43.3 billion |

|

CAGR |

6.2% |

|

Market Size Available for Years |

2017–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2025 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Product Type, Refrigerant Type, Application, and Regions |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

Carrier (US), Emerson Electric Company (US), Daikin (Japan), Danfoss (Denmark) and GEA Group (Germany), among others (Other small companies and start-ups). Total 25 major players covered. |

This research report categorizes the commercial refrigeration equipment market based on product type, refrigerant type, application, and region and forecasts revenues as well as analyzes trends in each of these submarkets.”

On the basis of Product Type

- Refrigerator & Freezer

- Transportation Refrigeration

- Refrigerated Display Cases

- Beverage Refrigeration

- Ice Cream Merchandiser

- Refrigerated Vending Machine

On the basis of Refrigerant Type

- Fluorocarbons

- Hydrocarbons

- Inorganics

On the basis of Application:

- Hotels & Restaurants

- Supermarkets & Hypermarkets

- Convenience Stores

- Bakeries

On the basis of Region:

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In July 2021, BITZER has launched gas coolers for carbon dioxide (CO2) applications in commercial and light industry refrigeration. These coolers provide resistance to pressure and thermal efficiency. They offer advantage for systems with medium or large capacity of more than 250 kW

- In May 2021, Danfoss launches multi-refrigerant, A2L-ready condensing units for ultra-low GWP installations. It comes with high energy efficiency and reduces consumption of energy and indirect emissions.

- In December 2020, Danfoss has launched an upgraded version of Optyma cold room controller. The upgraded version helps cold room contractors protect equipment, maintain safe temperatures, and reduce consumption of energy.

Frequently Asked Questions (FAQ):

Which region is expected to be the most beneficial for Commercial Refrigeration Equipment Market growth?

According to MarketsandMarkets APAC to be one of the key regions for the Commercial Refrigeration Equipment Market.

What is the current size of the global commercial refrigeration equipments market?

The global market size for commercial refrigeration equipment is estimated at USD 32.0 billion in 2021 and is projected to reach USD 43.3 billion by 2026, at a CAGR of 6.2% between 2021 and 2026.

Who are the leading players in the global commercial refrigeration equipments market?

The leading companies in the commercial refrigeration equipments market include Carrier (US), Emerson Electric Company (US), Daikin (Japan), Danfoss (Denmark), and GEA Group (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVE OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

1.8.1 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 COMMERCIAL REFRIGERATION EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING THE DEMAND FOR COMMERCIAL REFRIGERATION EQUIPMENT

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF COMMERCIAL REFRIGERATION EQUIPMENT MARKET

2.3.2.1 Calculations for supply-side analysis

2.4 DATA TRIANGULATION METHODOLOGY

FIGURE 6 COMMERCIAL REFRIGERATION EQUIPMENT MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 7 SUPERMARKETS & HYPERMARKETS APPLICATION TO LEAD THE COMMERCIAL REFRIGERATION MARKET DURING THE FORECAST PERIOD

FIGURE 8 REFRIGERATED VENDING MACHINE AND REFRIGERANT DISPLAY CASE SEGMENTS TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 9 HYDROCARBONS REFRIGERANT TYPE TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 10 APAC TO LEAD THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET

FIGURE 11 INCREASING USE OF COMMERCIAL REFRIGERATION IN SUPERMARKETS & HYPERMARKETS SEGMENT EXPECTED TO DRIVE COMMERCIAL REFRIGERATION EQUIPMENT MARKET FROM 2021 TO 2026

4.2 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION

FIGURE 12 THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN SOUTH AMERICA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC COMMERCIAL REFRIGERATION EQUIPMENT MARKET

FIGURE 13 T TRANSPORTATION REFRIGERATION PRODUCT TYPE ACCOUNTS FOR THE LARGEST SHARE

4.4 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY APPLICATION

FIGURE 14 SUPERMARKETS & HYPERMARKETS SEGMENT TO LEAD THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET DURING THE FORECAST PERIOD

4.5 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REFRIGERANT TYPE

FIGURE 15 HYDROCARBONS SEGMENT TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Improving consumer lifestyle and flourishing food and healthcare industries

5.2.1.2 Growing cold chain market

5.2.1.3 Increasing use of advanced technologies such as magnetic refrigeration

5.2.1.4 Growing demand for frozen and processed food across the world

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations against the use of fluorocarbon refrigerants

TABLE 1 SCHEDULE FOR ELIMINATING HCFC: NON-ARTICLE 5 PARTIES

TABLE 2 SCHEDULE FOR ELIMINATING HCFC: ARTICLE 5 PARTIES

5.2.3 OPPORTUNITIES

5.2.3.1 Potential demand for Carbon Dioxide/Ammonia (CO2/NH3) cascade refrigeration systems

5.2.3.2 Improvements in the efficiency of refrigeration systems with the use of natural refrigerants

5.2.4 CHALLENGES

5.2.4.1 Few purification companies

5.2.4.2 Impact of covid-19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS OF THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ADJACENT AND INTERCONNECTED MARKETS

TABLE 3 ADJACENT AND NTERCONNECTED MARKETS (USD MILLION)

6 COMMERCIAL REFRIGERATION EQUIPMENT PATENT ANALYSIS (Page No. - 64)

6.1 INTRODUCTION:

6.2 METHODOLOGY

6.3 DOCUMENT TYPE

FIGURE 18 NUMBER OF PATENTS REGISTERED

FIGURE 19 PATENT PUBLICATION TREND

6.4 INSIGHT

6.5 JURISDICTION ANALYSIS

6.6 TOP COMPANIES/APPLICANTS

FIGURE 20 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 4 LIST OF PATENTS BY HEFEI HUALING CO. LTD

TABLE 5 LIST OF PATENTS BY CARRIER CORP.

TABLE 6 LIST OF PATENTS BY HONEYWELL INT INC.

TABLE 7 LIST OF PATENTS BY QINGDAO HAIER CO LTD

TABLE 8 TOP 10 PATENT OWNERS (US) IN LAST 10 Y EARS

6.7 POLICIES AND REGULATIONS

6.7.1 EUROPE

6.7.1.1 EU F-Gas regulations

6.7.1.2 Montreal protocol

6.7.1.3 Denmark

6.7.1.4 Austria

6.7.2 NORTH AMERICA

6.7.2.1 Significant New Alternative Policy (SNAP) by EPA

6.7.3 ASIA PACIFIC

6.7.3.1 Japan: Revised F-Gas law

6.7.3.2 China - FECO: First catalogue of recommended substitutes for HCFCs

7 IMPACT OF COVID-19 ON THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET (Page No. - 72)

7.1 INTRODUCTION

7.1.1 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

7.1.2 ECONOMIC OUTLOOK

7.2 IMPACT OF COVID-19: CUSTOMER ANALYSIS

7.3 IMPACT OF COVID-19 ON REGIONS

7.3.1 APAC

7.3.2 NORTH AMERICA

7.3.3 EUROPE

7.3.4 MIDDLE EAST & AFRICA

7.3.5 SOUTH AMERICA

8 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE (Page No. - 75)

8.1 INTRODUCTION

FIGURE 21 TRANSPORTATION REFRIGERATION SEGMENT TO ACCOUNT FOR THE LARGEST SHARE

TABLE 9 COMMERCIAL REFRIGERATION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2017-2019 (USD MILLION)

TABLE 10 COMMERCIAL REFRIGERATION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2020-2026 (USD MILLION)

8.2 TRANSPORTATION REFRIGERATION

8.2.1 INCREASING DEMAND FOR TEMPERATURE-CONTROLLED FOOD SYSTEMS AND CONTAINERS ACROSS THE GLOBE IS DRIVING THE GROWTH

8.2.2 TRANSPORTATION REFRIGERATION TYPES

8.2.2.1 Shipping Container

8.2.2.2 Trailer

8.2.2.3 Truck

TABLE 11 TRANSPORTATION REFRIGERATION MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 12 TRANSPORTATION REFRIGERATION MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

8.3 REFRIGERATOR & FREEZER

8.3.1 DEVELOPMENT OF ADVANCED COMMERCIAL REFRIGERATION SYSTEMS IS ADDING TO THE GROWTH

8.3.2 REFRIGERATOR & FREEZER TYPES

8.3.2.1 Walk-in

8.3.2.2 Reach-in

8.3.2.3 Chest

TABLE 13 REFRIGERATOR & FREEZER MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 14 REFRIGERATOR & FREEZER MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

8.4 REFRIGERATED DISPLAY CASE

8.4.1 GROWING NUMBER OF SUPERMARKETS, GROCERY STORES, AND OTHER FOOD RETAIL OUTLETS WORLDWIDE IS DRIVING THE GROWTH OF THE MARKET

TABLE 15 REFRIGERATED DISPLAY CASE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 16 REFRIGERATED DISPLAY CASE MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

8.5 BEVERAGE REFRIGERATION

8.5.1 INCREASING DEMAND FOR CHILLED PACKAGED DRINKS (ALCOHOLIC AND NON- ALCOHOLIC) IS DRIVING THE GROWTH

TABLE 17 BEVERAGE REFRIGERATION MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 18 BEVERAGE REFRIGERATION MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

8.6 ICE CREAM MERCHANDISER

8.6.1 THE STEADILY RISING ICE CREAM INDUSTRY IS PROPELLING THE GROWTH

TABLE 19 ICE CREAM MERCHANDISER MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 20 ICE CREAM MERCHANDISER MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

8.7 REFRIGERATED VENDING MACHINE

8.7.1 LOW OPERATIONAL AND FUNCTIONAL COSTS AND GROWING DEMAND FOR HEALTHY FOODS ARE DRIVING THE GROWTH

TABLE 21 REFRIGERATED VENDING MACHINE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 22 REFRIGERATED VENDING MACHINE MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

9 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REFRIGERANT TYPE (Page No. - 84)

9.1 INTRODUCTION

FIGURE 22 FLUOROCARBONS SEGMENT TO LEAD THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET DURING THE FORECAST PERIOD

TABLE 23 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REFRIGERANT TYPE, 2017–2019 (USD MILLION)

TABLE 24 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

9.2 FLUOROCARBONS

9.2.1 GROWING DEMAND FOR HFCS WILL ENHANCE THE DEMAND FOR FLUOROCARBONS

9.2.2 HYDROCHLOROFLUOROCARBONS (HCFCS)

9.2.3 HYDROFLUOROCARBONS (HFCS)

9.2.4 HYDROFLUOROOLEFINS (HFOS)

TABLE 25 FLUOROCARBONS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 FLUOROCARBONS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2020–2026 (USD MILLION)

9.3 HYDROCARBONS

9.3.1 NATURAL AND NON-TOXIC PROPERTIES OF REFRIGERANTS ARE EXPECTED TO ENHANCE THE DEMAND

TABLE 27 HYDROCARBONS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 HYDROCARBONS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2020–2026 (USD MILLION)

9.3.2 ISOBUTANE

9.3.3 PROPANE

9.3.4 OTHERS

9.4 INORGANICS

9.4.1 ENVIRONMENTALLY FRIENDLY PROPERTIES AND LOW PRICE TO ENHANCE THE DEMAND

TABLE 29 INORGANICS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 30 INORGANICS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2020–2026 (USD MILLION)

9.4.2 AMMONIA

9.4.3 CO2

9.4.4 OTHERS

10 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY APPLICATION (Page No. - 92)

10.1 INTRODUCTION

10.2 MARKET SIZE & PROJECTION

FIGURE 23 SUPERMARKETS & HYPERMARKETS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 31 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2016–2023 (USD MILLION)

10.3 HOTELS & RESTAURANTS

10.3.1 GROWING MIDDLE-CLASS POPULATION IN EMERGING COUNTRIES TO PROPEL THE DEMAND

TABLE 33 HOTELS & RESTAURANTS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 HOTELS & RESTAURANTS: MARKET, BY REGION, 2020–2026 (USD MILLION)

10.4 SUPERMARKETS & HYPERMARKETS

10.4.1 AIM TO INCREASE EFFICIENCY AND REDUCE COSTS TO ENHANCE THE DEMAND

TABLE 35 SUPERMARKETS & HYPERMARKETS: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 SUPERMARKETS & HYPERMARKETS: MARKET, BY REGION, 2020–2026 (USD MILLION)

10.5 CONVENIENCE STORES

10.5.1 INCREASING PREFERENCE FOR PACKAGED FOOD ITEMS WILL PROPEL THE DEMAND IN CONVENIENCE STORES

TABLE 37 CONVENIENCE STORES: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 CONVENIENCE STORES: MARKET, BY REGION, 2020–2026 (USD MILLION)

10.6 BAKERIES

10.6.1 ADOPTION OF COMMERCIAL REFRIGERATION EQUIPMENT TO STORE NATURAL BAKERY PRODUCTS FOR INCREASING THEIR SHELF LIFE WILL PROPEL THE DEMAND

TABLE 39 BAKERIES: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 BAKERIES: MARKET, BY REGION, 2020–2026 (USD MILLION)

11 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION (Page No. - 99)

11.1 INTRODUCTION

TABLE 41 COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 MARKET, BY REGION, 2020–2026 (USD MILLION)

11.2 APAC

FIGURE 24 APAC: COMMERCIAL REFRIGERATION EQUIPMENT MARKET SNAPSHOT

TABLE 43 APAC: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 44 APAC: MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 45 APAC: MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 46 APAC: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 47 APAC: MARKET,

TABLE 48 APAC: MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

TABLE 49 APAC: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 50 APAC: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.1 CHINA

11.2.1.1 The increasing consumption of packaged and frozen food in China is driving the growth

TABLE 51 CHINA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 52 CHINA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 53 CHINA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 54 CHINA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 High presence of refrigeration equipment manufacturers in Japan is fueling the growth

TABLE 55 JAPAN: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 56 JAPAN: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 57 JAPAN: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 58 JAPAN: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Government support for setting up of cold storage facilities to drive market growth

TABLE 59 INDIA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 60 INDIA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 61 INDIA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 62 INDIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.4 SOUTH KOREA

11.2.4.1 Growing trend of supermarkets & hypermarkets is driving the market growth

TABLE 63 SOUTH KOREA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 64 SOUTH KOREA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 65 SOUTH KOREA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 66 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.5 THAILAND

11.2.5.1 The growth in end-use industries, such as cold storage, to boost the market

TABLE 67 THAILAND: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 68 THAILAND: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 69 THAILAND: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 70 THAILAND: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.6 MALAYSIA

11.2.6.1 High penetration of refrigeration appliances in the country is propelling the demand for refrigeration equipment

TABLE 71 MALAYSIA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 72 MALAYSIA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 73 MALAYSIA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 74 MALAYSIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.7 SINGAPORE

11.2.7.1 High demand for advanced refrigeration equipment from convenience stores is driving the growth

TABLE 75 SINGAPORE: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 76 SINGAPORE: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 77 SINGAPORE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 78 SINGAPORE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.8 INDONESIA

11.2.8.1 The growing cold storage construction market to drive the commercial refrigeration equipment market

TABLE 79 INDONESIA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 80 INDONESIA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 81 INDONESIA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 82 INDONESIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.2.9 REST OF APAC

TABLE 83 REST OF APAC: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 84 REST OF APAC: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 85 REST OF APAC: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 86 REST OF APAC: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 25 NORTH AMERICA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET SNAPSHOT

TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2017–2019 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Construction of cold storage and ice manufacturing facilities will drive the demand

TABLE 95 US: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 96 US: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 97 US: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 98 US: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increase in demand from supermarkets and convenience stores to enhance the demand

TABLE 99 CANADA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 100 CANADA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 101 CANADA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 102 CANADA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Growing packaged food industry has increased the demand for commercial refrigeration equipment in Mexico

TABLE 103 MEXICO: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 104 MEXICO: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 105 MEXICO: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 106 MEXICO: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4 EUROPE

FIGURE 26 EUROPE: COMMERCIAL REFRIGERATION EQUIPMENT MARKET SNAPSHOT

TABLE 107 EUROPE: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY REFRIGERANT TYPE, 2017–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Hotels & restaurants application to lead the commercial refrigeration equipment market in Germany

TABLE 115 GERMANY: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.2 UK

11.4.2.1 The supermarkets & hypermarkets application is estimated to fuel the growth

TABLE 119 UK: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 120 UK: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 121 UK: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 122 UK: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 Growing demand for refrigerated vending machines and display cases in retail stores and supermarkets to fuel growth

TABLE 123 FRANCE: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Growing use of vending machines across various applications to propel the demand

TABLE 127 ITALY: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 128 ITALY: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 129 ITALY: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 130 ITALY: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.5 SPAIN

11.4.5.1 Increasing shift of preference toward packaged food products to enhance market growth

TABLE 131 SPAIN: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 132 SPAIN: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 134 SPAIN: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.4.6 REST OF EUROPE

TABLE 135 REST OF EUROPE: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

TABLE 139 MIDDLE EAST & AFRICA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2017–2019 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.5.1 SAUDI ARABIA

11.5.1.1 Growing demand for commercial refrigeration from the country’s hotels & restaurants and retail stores will drive the market

TABLE 147 SAUDI ARABIA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 148 SAUDI ARABIA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 149 SAUDI ARABIA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.5.2 TURKEY

11.5.2.1 Increase in demand from the packaged food industry to propel the demand for commercial refrigeration equipment

TABLE 151 TURKEY: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 152 TURKEY: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 153 TURKEY: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 154 TURKEY: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.5.3 EGYPT

11.5.3.1 Emerging economy to propel the demand for commercial refrigeration equipment

TABLE 155 EGYPT: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 156 EGYPT: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 157 EGYPT: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 158 EGYPT: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 159 REST OF MIDDLE EAST & AFRICA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 162 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2017–2019 (USD MILLION)

TABLE 168 SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2020–2026 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Increase in infrastructural development activities such as commercial sites and hospitals will drive the demand

TABLE 171 BRAZIL: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 172 BRAZIL: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 173 BRAZIL: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Growing white goods industry will drive the demand

TABLE 175 ARGENTINA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 176 ARGENTINA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 177 ARGENTINA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 178 ARGENTINA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.6.3 CHILE

11.6.3.1 Increase in the demand for frozen food products will drive the demand

TABLE 179 CHILE: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 180 CHILE: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 181 CHILE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 182 CHILE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11.6.4 REST OF SOUTH AMERICA

TABLE 183 REST OF SOUTH AMERICA: COMMERCIAL REFRIGERATION EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 184 REST OF SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 186 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 164)

12.1 KEY PLAYERS’ STRATEGIES

TABLE 187 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018-2021

12.2 REVENUE ANALYSIS

FIGURE 27 REVENUE SHARE ANALYSIS IN THE COMMERCIAL REFRIGERATION EQUIPMENT MARKET

12.3 MARKET SHARE ANALYSIS

FIGURE 28 COMMERCIAL REFRIGERATION EQUIPMENT: MARKET SHARE ANALYSIS

TABLE 188 MARKET: DEGREE OF COMPETITION

TABLE 189 MARKET: APPLICATION FOOTPRINT

TABLE 190 MARKET: REGION FOOTPRINT

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 29 COMMERCIAL REFRIGERATION EQUIPMENT MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 STARTING BLOCKS

12.5.4 DYNAMIC COMPANIES

FIGURE 30 OTHER ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR COMMERCIAL REFRIGERATION EQUIPMENT MARKET

12.6 COMPETITIVE SCENARIO

TABLE 191 COMMERCIAL REFRIGERATION EQUIPMENT MARKET: PRODUCT LAUNCHES, 2018–2021

TABLE 192 MARKET: DEALS, 2018–2021

TABLE 193 MARKET: OTHER DEVELOPMENTS, 2018–2021

13 COMPANY PROFILES (Page No. - 181)

13.1 DAIKIN

(Business overview, Products offered, Recent developments, MNM view)*

TABLE 194 DAIKIN: COMPANY OVERVIEW

FIGURE 31 DAIKIN: COMPANY SNAPSHOT

TABLE 195 DAIKIN: PRODUCT OFFERINGS

TABLE 196 DAIKIN: PRODUCT LAUNCHES

TABLE 197 DAIKIN: DEALS

TABLE 198 DAIKIN: OTHERS

13.2 DANFOSS

TABLE 199 DANFOSS: COMPANY OVERVIEW

FIGURE 32 DANFOSS: COMPANY SNAPSHOT

TABLE 200 DANFOSS: PRODUCT OFFERINGS

TABLE 201 DANFOSS: PRODUCT LAUNCHES

TABLE 202 DANFOSS: OTHERS

13.3 GEA GROUP

TABLE 203 GEA GROUP: COMPANY OVERVIEW

FIGURE 33 GEA GROUP: COMPANY SNAPSHOT

TABLE 204 GEA GROUP: PRODUCT OFFERINGS

TABLE 205 GEA GROUP: PRODUCT LAUNCHES

TABLE 206 GEA GROUP: DEALS

TABLE 207 GEA GROUP: OTHERS

13.4 JOHNSON CONTROLS

TABLE 208 JOHNSON CONTROLS: COMPANY OVERVIEW

FIGURE 34 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 209 JOHNSON CONTROLS: PRODUCT OFFERINGS

13.5 BITZER

TABLE 210 BITZER: COMPANY OVERVIEW

TABLE 211 BITZER: SOLUTION/ PRODUCT OFFERINGS

TABLE 212 BITZER: PRODUCT LAUNCHES

TABLE 213 BITZER: DEALS

TABLE 214 BITZER: OTHERS

13.6 HILLPHOENIX

TABLE 215 HILLPHOENIX: COMPANY OVERVIEW

TABLE 216 HILLPHOENIX: PRODUCT OFFERINGS

13.7 SCM FRIGO S.P.A.

TABLE 217 SCM FRIGO: COMPANY OVERVIEW

TABLE 218 SCM FRIGO S.P.A.: PRODUCT OFFERINGS

TABLE 219 SCM FRIGO S.P.A.: PRODUCT LAUNCHES

13.8 EMERSON ELECTRIC CO.

TABLE 220 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

FIGURE 35 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 221 EMERSON ELECTRIC CO.: PRODUCT OFFERINGS

TABLE 222 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

TABLE 223 EMERSON ELECTRIC CO.: OTHERS

13.9 CARRIER

TABLE 224 CARRIER: COMPANY OVERVIEW

TABLE 225 CARRIER: PRODUCT OFFERINGS

TABLE 226 CARRIER: PRODUCT LAUNCHES

TABLE 227 CARRIER: DEALS

13.10 HENRY TECHNOLOGIES

TABLE 228 HENRY TECHNOLOGIES: COMPANY OVERVIEW

TABLE 229 HENRY TECHNOLOGIES: PRODUCT OFFERINGS

13.11 HEATCRAFT WORLDWIDE REFRIGERATION

TABLE 230 HEATCRAFT WORLDWIDE REFRIGERATION: COMPANY OVERVIEW

TABLE 231 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT OFFERINGS

TABLE 232 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT LAUNCHES

13.12 PANASONIC CORPORATION

TABLE 233 PANASONIC CORPORATION: COMPANY OVERVIEW

FIGURE 36 PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 234 PANASONIC CORPORATION: PRODUCT OFFERINGS

13.13 IMBERA

TABLE 235 IMBERA: COMPANY OVERVIEW

TABLE 236 IMBERA: PRODUCT OFFERINGS

13.14 MINUS FORTY

TABLE 237 MINUS FORTY: COMPANY OVERVIEW

TABLE 238 MINUS FORTY: PRODUCT OFFERINGS

13.15 METALFRIO

TABLE 239 METALFRIO: COMPANY OVERVIEW

FIGURE 37 METALFRIO: COMPANY SNAPSHOT

TABLE 240 METALFRIO: PRODUCT OFFERINGS

13.16 EXCELLENCE INDUSTRIES

TABLE 241 EXCELLENCE INDUSTRIES: COMPANY OVERVIEW

TABLE 242 EXCELLENCE INDUSTRIES: PRODUCT OFFERINGS

13.17 ILLINOIS TOOL WORKS INC.

TABLE 243 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

FIGURE 38 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

TABLE 244 ILLINOIS TOOL WORKS INC.: PRODUCT OFFERINGS

13.18 BALTIMORE AIRCOIL COMPANY

TABLE 245 BALTIMORE AIRCOIL COMPANY: COMPANY OVERVIEW

TABLE 246 BALTIMORE AIRCOIL COMPANY: PRODUCT OFFERINGS

TABLE 247 BALTIMORE AIRCOIL COMPANY: PRODUCT LAUNCHES

13.19 LG ELECTRONICS

TABLE 248 LG ELECTRONICS: COMPANY OVERVIEW

FIGURE 39 LG ELECTRONICS: COMPANY SNAPSHOT

TABLE 249 LG ELECTRONICS: PRODUCT OFFERINGS

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

13.20 OTHER PLAYERS

13.20.1 CARNOT REFRIGERATION

TABLE 250 CARNOT REFRIGERATION: COMPANY OVERVIEW

13.20.2 GREEN & COOL

TABLE 251 GREEN & COOL: COMPANY OVERVIEW

13.20.3 EVAPCO, INC.

TABLE 252 EVAPCO, INC.: COMPANY OVERVIEW

13.20.4 ROCKWELL INDUSTRIES LIMITED

TABLE 253 ROCKWELL INDUSTRIES LIMITED: COMPANY OVERVIEW

13.20.5 ICE MAKE REFRIGERATION LIMITED

TABLE 254 ICE MAKE REFRIGERATION LIMITED: COMPANY OVERVIEW

13.20.6 WESTERN REFRIGERATION PRIVATE LIMITED

TABLE 255 WESTERN REFRIGERATION PRIVATE LIMITED: COMPANY OVERVIEW

13.20.7 MAYEKAWA MFG. CO., LTD.

TABLE 256 MAYEKAWA MFG. CO., LTD.: COMPANY OVERVIEW

14 ADJACENT AND RELATED MARKETS (Page No. - 242)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 COMMERCIAL REFRIGERATION EQUIPMENT INTERCONNECTED MARKETS

14.4 REFRIGERANT MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

14.4.3 REFRIGERANTS MARKET, BY APPLICATION

14.4.3.1 Refrigeration systems

14.4.3.2 Chillers

14.4.3.3 Air conditioning systems

14.4.3.4 Mobile Air Conditioning (MAC)

TABLE 257 REFRIGERANTS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 258 REFRIGERANTS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

14.5 INDUSTRIAL REFRIGERATION SYSTEM MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

14.5.3 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY REFRIGERANT TYPE

14.5.3.1 Ammonia

14.5.3.2 CO2

14.5.3.3 Others

TABLE 259 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY RE FRIGERANT TYPE, 2016-2025 (USD BILLION)

15 APPENDIX (Page No. - 248)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

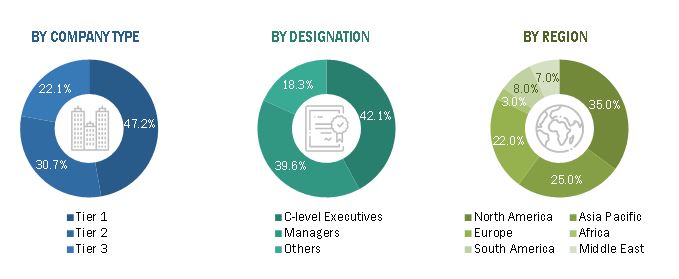

The study involved four major activities in estimating the current size of the commercial refrigeration equipment market. Exhaustive secondary research was undertaken to collect information on the commercial refrigeration equipment market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the commercial refrigeration equipment value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the commercial refrigeration equipment market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study on the commercial refrigeration equipment market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, a monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology-oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the commercial refrigeration equipment market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the commercial refrigeration equipment market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the commercial refrigeration equipment market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the commercial refrigeration equipment market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

Global commercial refrigeration equipment market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the commercial refrigeration equipment market based on product type, refrigerant type, application, and region

- To analyze and forecast the value (USD million) of the global commercial refrigeration equipment market

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the market size in terms of value with respect to five main regions (along with countries), namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America.

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze recent market developments and competitive strategies in the commercial refrigeration equipment market, such as agreements, collaborations, acquisitions, new product developments, and expansions in the global commercial refrigeration equipment market.

Competitive Intelligence

- To identify and profile key players in the commercial refrigeration equipment market

- To determine the market share of key players operating in the market

-

To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North America commercial refrigeration equipment market, with respect to major countries in this region

- Further breakdown of the Europe commercial refrigeration equipment market, with respect to major countries in this region

- Further breakdown of the Asia-Pacific commercial refrigeration equipment market, with respect to major countries in this region

- Further breakdown of the RoW commercial refrigeration equipment market

Company Information

- Detailed analysis and profiling of the additional market players (up to three)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Commercial Refrigeration Equipment Market