Industrial Refrigeration Market by Component (Compressor, Condenser, Evaporator), Application (Fruit & Vegetable Processing, Refrigerated Warehouse), Refrigerant Type, and Region

Updated on : October 23, 2024

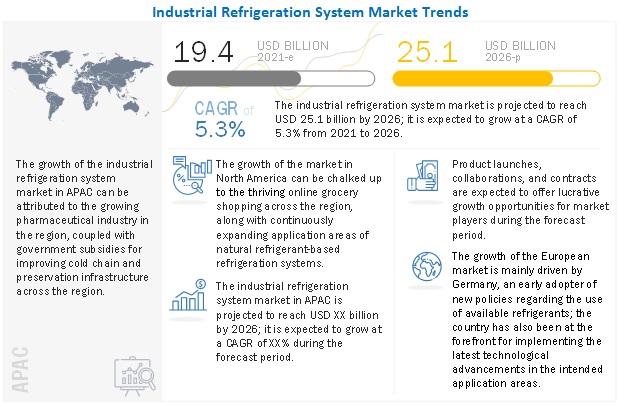

The Industrial Refrigeration Market is expected to grow USD 25.1 billion by 2026 from USD 20.3 billion in 2022, growing at a CAGR of 5.3% during the forecast period from 2022 to 2026. It was observed that the growth rate was 4.3% from 2021 to 2022. CO2 refrigeration type is expected to witness highest CAGR of 7.5%.

The growth of the industrial refrigeration market is driven by factors such as the rising demand for innovative and compact refrigeration systems; increasing government support to strengthen cold chain infrastructure in developing countries; and growing inclination toward eco-friendly refrigerant-based refrigeration systems due to stringent regulatory policies.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Industrial Refrigeration System Technology Trends

Impact of digital transformation and artificial intelligence (AI) in refrigeration

There is a growing demand for applications of Internet of Things (IoT), Big Data and other automation technologies in the refrigeration domain. Similarly, many players in the industrial refrigeration market are shifting their focus towards integrating AI and machine learning (ML) solutions in the industrial refrigeration domain. One of the key factors driving such transition is the need for a solution to optimize energy consumption and utilization.

Currently, AI and ML algorithms are being developed to detect asset health and issues which will help to reduce energy costs and allow implementation of more predictive maintenance programs. Additionally, digital connectivity allows acquisition of information from various processes through sensors or other measurements which offers advantages such as optimal plant operation and reduced down-time.

HYCOOL - Industrial Cooling through a hybrid system based on solar heat

HYCOOL project is an ongoing R&D initiative by Veolia Serveis Catalunya and 16 other partners from 6 European countries. The purpose of the project is to create and validate a system which can enable generation of industrial cold and steam from high-temperature solar panels. This ability makes it one of the most convenient refrigeration technologies in terms of sustainability.

Magnetic Refrigeration technology

One of the highly anticipated trends in the refrigeration domain is magnetic refrigeration technology which on full development will be a completely ecological system. The magnetic refrigeration technology is based on a magnetic solid that acts as a refrigerant through a magnetocaloric effect (MCE). The system is composed of a ferromagnetic material and when the magnetic pairs of the atom manage to align by applying a magnetic field, then the MCE reaches high temperatures. The magnetic refrigeration technology offers several advantages over traditional methods of refrigeration such as high thermodynamic efficiency, low noise, and vibration-free working

Industrial Refrigeration Market Dynamics

DRIVER: Increasing government support to strengthen cold chain infrastructure in developing countries

The lack of efficient cold chain infrastructure is the primary cause of food wastage and food loss. The shelf life of fruits, vegetables, fish, and dairy products decreases dramatically due to factors such as improper handling, insufficient infrastructure, no access to cold chains, a dearth of energy resources to power these cold chain facilities, and so on. Therefore, many developing countries, such as China and India, have started adopting advanced refrigeration systems across cold storage and cold chain infrastructure to ensure uninterrupted temperature-controlled transport and storage of perishable food products, beverages, chemicals, medicines, and pharmaceuticals, among others.In China, strong government initiatives toward developing and improving cold storage warehouses and refrigerated transportation systems, especially in major cities such as Shanghai and Beijing, are driving the industrial refrigeration industry growth.

RESTRAINT: High installation cost and other expenses

Industrial refrigeration systems typically have a high installation cost owing to the high cost of their components, such as compressors, condensers, and evaporators. Also, the control systems used in these refrigeration systems are expensive, which increases the installation cost. Furthermore, refrigerants such as ammonia and certain hydrocarbons are flammable and corrosive. Similarly, exposure to high concentrations of ammonia is toxic and life-threatening if inhaled. Therefore, safety equipment is required when working with ammonia-based refrigeration systems. Along with the installation cost, other expenses such as regular maintenance, staff training, and the high cost of energy also increase the overall operational costs, thereby restraining the industrial refrigeration market growth.

OPPORTUNITY: Growing popularity of carbon dioxide/ammonia (CO2/NH3)-based cascade refrigeration systems

Ammonia and carbon dioxide as refrigerants are simple to use, cost-effective, and available in abundance. Carbon dioxide/ammonia-based cascade refrigeration systems are used in low-temperature applications and are suitable for industrial applications where the required temperature for a product range from -30° C to -50° C. These systems vary in capacity, between 25 and 1,500 tons for applications such as process plate freezers, spiral freezers, refrigerated warehouses, and blast freezers. A cascade system generally comprises two separate one-stage refrigeration cycles, each working with a different refrigerant. Such systems are best suited for applications in which the difference between heat rejection temperature and refrigeration temperature is so drastic that a single refrigerant with suitable properties cannot be found. In CO2/NH3-based cascade refrigeration systems, CO2 refrigerant is used in low-temperature circuits, and ammonia refrigerant is used in high-temperature circuits.

CHALLENGE: Lack of skilled personnel and safety concerns

Natural refrigerant-based systems have been adopted at a significant rate in recent years. Governments worldwide are promoting the use of environmentally friendly refrigeration systems to reduce the impact of synthetic refrigerant-based systems on global warming and ozone layer depletion. However, there is a lack of skilled on-site personnel to handle and manage systems effectively and safely. As natural refrigerant-based systems have gained traction, the demand for ammonia and carbon dioxide as refrigerants has gone up significantly. This increase in demand is because these refrigerants have zero ODP and low GWP. However, ammonia is also regarded as a poisonous gas, and its accidental leakage in facilities can lead to severe industrial accidents. Furthermore, exposure to lower concentrations of ammonia can lead to temporary blindness, eye damage, skin diseases, or pulmonary diseases, while exposure to higher concentration levels can be fatal. Also, the inner leakage of such gases can even contaminate food items kept inside the refrigeration system. Hence, the lack of skilled personnel and safety concerns act as major challenge for the growth of the industrial refrigeration system market.

Compressors held the largest share of industrial refrigeration market during forecast period

Compressors held the largest market share (~41%) of the market in 2020. In industrial refrigeration systems, compressors play a vital role by increasing refrigerant vapor pressure in a condenser to ensure suitable temperature for food storage and preservation applications, thereby propelling the refrigerant compressor market growth. Reciprocating and screw compressors are mainly used in industrial refrigeration systems. However, an increase in the demand for screw compressors has been witnessed owing to various benefits such as high reliability, less frequent maintenance, and compactness offered by them.

Ammonia-based refrigeration systems held the largest share of industrial refrigeration system market during forecast period

Ammonia has a greater cooling capacity than other refrigerants; hence, ammonia-based refrigeration systems are more energy-efficient than those based on other refrigerants. Furthermore, companies are focusing on manufacturing industrial refrigeration equipment compatible with ammonia as HCFC-based refrigeration systems are no longer being manufactured after January 1, 2020.

Refrigerated warehouse applications held the largest share of industrial refrigeration system market during forecast period

The ever-growing population and rising demand for frozen and processed food have resulted in an increase in the number of refrigerated warehouses, globally, with improved capacity in the last few years. According to the Global Cold Chain Alliance (GCCA), the total capacity of refrigerated warehouses worldwide was 616 million cubic meters in 2018. The Indian government is promoting the creation of cold chain facilities through its Scheme for Cold Chain, Value Addition and Preservation Infrastructure, and the Scheme of Mega Food Park. These initiatives toward strengthening cold storage and warehousing infrastructure facilities in developing countries are expected to support the growing use of industrial refrigeration systems in refrigerated warehouse applications during the forecast period.

North America held the largest share of industrial refrigeration market during forecast period

North America held the largest share (~36%) of the global industrial refrigeration market in 2020. The key factor responsible for the growth of the market is various governmentinitiatives such as providing subsidies and implementation of various policies (such as Significant New Alternatives Policy (SNAP)& American Innovation and Manufacturing (AIM) act) to encourage food processing companies to adopt natural refrigerant-based systems. Also, ongoing growth in online grocery shopping across the region, coupled with continuously expanding application areas of natural refrigerant-based refrigeration systems, is expected to drive the industrial refrigeration system market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Refrigeration Market Key Players

The industrial refrigeration companies is dominated by a few globally established players such as Johnson Controls (Ireland), Emerson Electric Co. (US), GEA Group Aktiengesellschaft (Germany), Danfoss (Denmark), and Mayekawa (Japan).

Industrial Refrigeration Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 19.4 Billion |

| Expected Value | USD 25.1 Billion |

| Growth Rate | CAGR of 5.3% |

|

Forecast Period |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Market Size Available for Years |

2017–2026 |

|

CAGR |

5.3% |

|

Segments Covered |

By Component, Refrigerant Type, Application, and Region |

|

Geographic Regions Covered |

APAC, North America, South America, Europe, and RoW (includes South America and the Middle East & Africa) |

| Market Leaders | Johnson Controls (Ireland), GEA Group Aktiengesellschaft (Germany), Danfoss (Denmark), Mayekawa (Japan), Daikin (Japan), Ingersoll Rand (Ireland), BITZER (Germany), LU-VE Group (Italy), MTA S.p.A. (Italy), Frascold (Italy), HITEMA INTERNATIONAL (Italy), Güntner GmbH & Co. KG (Germany), KOBELCO (Japan), Clauger (France), Rivacold (Italy), Dorin S.p.A. (Italy), Star Refrigeration (Scotland), Industrial Frigo (Lombardy), SRM Italy (Italy). |

| Top Companies in North America | Emerson Electric Co. (US), EVAPCO, Inc. (US), Baltimore Aircoil Company (US), Lennox International (US), Hannifin (US), and Innovative Refrigeration Systems (US) |

| Key Market Driver | Increasing government support to strengthen cold chain infrastructure in developing countries |

| Key Market Opportunity | Growing popularity of carbon dioxide/ammonia (CO2/NH3)-based cascade refrigeration systems |

|

Largest Growing Region |

North America |

| Largest Application Market Share | Refrigerated Warehouse Applications |

| Highest CAGR Segment | CO2-based Refrigeration Systems |

This report categorizes the industrial refrigeration market based on component, refrigerant type, application, and region available at the regional and global level

By Component

- Compressor

- Condenser

- Evaporator

- Control

- Vessle, Pump, Valves, and Auxillary Equipment

By Refrigerant Type

- Ammonia

- CO2

- Others (HFC, HCFC, HFO, HC)

By Application

- Refrigerated Warehouses

- Fruit And Vegetable Processing

- Beverage Processing

- Chemical, Petrochemical, and Pharmaceutical

- Dairy And Ice Cream Processing

- Meat, Poultry, and Fish Processing

- Refrigerated Transportation

By Region

- North America

- Europe

- APAC

- RoW

Recent Developments in Industrial Refrigeration Industry

- In June 2021, Johnson Controls added the Quantech QWC4 Water-Cooled Screw Chiller to its product portfolio, which uses variable speed drive technology to reduce carbon emissions and provide flexibility in handling high-lift applications. The Quantech QWC4 chiller also reduces environmental impacts by directly managing refrigerant charges and potential leak points.

- In June 2021, GEA Group Aktiengesellschaft signed an agreement to sell its refrigeration contracting operations in Spain and Italy to Clauger, the French family-owned company, which specializes in industrial refrigeration and air-conditioning systems.

- In May 2021, Johnson Controls selected R-454B, a lower GWP refrigerant, to replace R-410A in its ducted residential and commercial unitary products as well as air-cooled scroll chillers. R-454B is more compatible with existing R-410A equipment designs, requires a lesser or similar refrigerant charge, and can reduce the energy use of HVAC systems and improve system efficiency.

- In May 2021, Johnson Controls announced a partnership with its joint venture company, Johnson Controls-Hitachi Air Conditioning, to offer wide-scale distribution of its industry-recognized line-up of Hitachi horizontal scroll compressors in North America. This offering aligns the innovative Hitachi scroll compressors with the strength of PENN®, an industry-leading brand from Johnson Controls, backed by more than a century of commercial refrigeration expertise.

- In March 2021, Emerson Electric Co. launched a range of two-way and three-way solenoid valves that support original equipment manufacturers’ (OEMs) need to develop more compact machines and equipment without compromising fluid control performance. ASCO™ Series 256/356 offers a smaller footprint, up to 40% reduced power consumption, and up to 30% higher pressure ratings.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the industrial refrigeration market during 2022-2027?

The global industrial refrigeration market is expected to record a CAGR of 5.3% from 2022–2027.

What are the driving factors for the industrial refrigeration?

The growth of the industrial refrigeration market is driven by factors such as the rising demand for innovative and compact refrigeration systems; increasing government support to strengthen cold chain infrastructure in developing countries; and growing inclination toward eco-friendly refrigerant-based refrigeration systems due to stringent regulatory policies.

Which are the significant players operating in the industrial refrigeration market?

Johnson Controls (Ireland), Emerson Electric Co. (US), GEA Group Aktiengesellschaft (Germany), Danfoss (Denmark), and Mayekawa (Japan)are some of the major companies operating in the industrial refrigerationsystem market.

Which region will lead the industrial refrigeration market in the future?

North America is expected to lead the industrial refrigeration market during the forecast period.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

How big is the Industrial Refrigeration Market?

5.3% growth rate is expected and estimated to reach USD 25.1 billion by 2027.

What are the Challenges in Industrial Refrigeration Market?

Industrial refrigeration systems typically have a high installation cost owing to the high cost of their components, such as compressors, condensers, and evaporators.

What Company Leading the Noth America Industrial Refrigeration Market?

Emerson Electric Co. (US), EVAPCO, Inc. (US), Baltimore Aircoil Company (US), Lennox International (US), Hannifin (US), and Innovative Refrigeration Systems (US) are leading players.

What are Opportunities in Industrial Refrigeration Market?

Growing popularity of carbon dioxide/ammonia (CO2/NH3)-based cascade refrigeration systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INDUSTRIAL REFRIGERATION MARKET SEGMENTATION

1.4 INCLUSIONS AND EXCLUSIONS

1.4.1 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW OF INDUSTRIAL REFRIGERATION MARKET SIZE ESTIMATION

FIGURE 3 INDUSTRIAL REFRIGERATION SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key participants in primary processes across value chain of market

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 4 INDUSTRIAL REFRIGERATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: INDUSTRIAL REFRIGERATION MARKET MARKET

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 8 MARKET: POST-COVID-19 SCENARIO ANALYSIS, 2017–2026 (USD BILLION)

3.1 REALISTIC SCENARIO (POST-COVID-19)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 9 COMPRESSORS TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 10 CARBON DIOXIDE REFRIGERANT TO GROW AT HIGHEST CAGR IN INDUSTRIAL REFRIGERANT SYSTEM MARKET DURING FORECAST PERIOD

FIGURE 11 CHEMICAL, PETROCHEMICAL, AND PHARMACEUTICAL APPLICATIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD IN MARKET

FIGURE 12 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL REFRIGERATION MARKET

FIGURE 13 GROWTH IN ONLINE GROCERY SHOPPING AND PHARMACEUTICAL APPLICATIONS ACROSS REGIONS TO DRIVE GROWTH OF MARKET

4.2 MARKET IN APAC, BY APPLICATION AND COUNTRY

FIGURE 14 REFRIGERATED WAREHOUSES AND CHINA HELD LARGEST MARKET SHARE IN APAC, BY APPLICATION AND COUNTRY, RESPECTIVELY, IN 2020

4.3 MARKET, BY COMPONENT

FIGURE 15 COMPRESSORS TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY REFRIGERANT TYPE

FIGURE 16 AMMONIA REFRIGERANT-BASED SYSTEMS TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET, BY APPLICATION

FIGURE 17 REFRIGERATED WAREHOUSES TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.6 REGIONAL ANALYSIS OF MARKET

FIGURE 18 NORTH AMERICA TO BE LARGEST SHAREHOLDER IN INDUSTRIAL REFRIGERATION MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INDUSTRIAL REFRIGERATION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for innovative and compact refrigeration systems

5.2.1.2 Increasing government support to strengthen cold chain infrastructure in developing countries

FIGURE 20 REFRIGERATED WAREHOUSE CAPACITY IN MAJOR COUNTRIES

5.2.1.3 Growing inclination toward eco-friendly refrigerant-based refrigeration systems due to stringent regulatory policies

FIGURE 21 IMPACT OF DRIVERS ON INDUSTRIAL REFRIGERATION SYSTEMS

5.2.2 RESTRAINTS

5.2.2.1 High installation cost and other expenses

FIGURE 22 IMPACT OF RESTRAINTS ON INDUSTRIAL REFRIGERATION MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Growing popularity of carbon dioxide/ammonia (CO2/NH3)-based cascade refrigeration systems

TABLE 2 LARGEST REFRIGERATED WAREHOUSE PROVIDERS ALONG WITH THEIR LOCATIONS AND CAPACITY (MILLION METER CUBE), 2018

5.2.3.2 Rising demand for frozen and processed food worldwide

FIGURE 23 AVERAGE SIZE OF REFRIGERATED WAREHOUSE CAPACITY IN MAJOR COUNTRIES

5.2.3.3 Increasing demand for medicines, drugs, and PPE due to COVID-19 is a key factor fueling growth of cold chain refrigeration systems

FIGURE 24 GLOBAL PHARMACEUTICALS COLD CHAIN SPENDING, 2018–2026 (USD BILLION)

FIGURE 25 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled personnel and safety concerns

FIGURE 26 IMPACT OF CHALLENGES ON INDUSTRIAL REFRIGERATION MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS OF INDUSTRIAL REFRIGERATION SYSTEMS ECOSYSTEM: R&D AND COMPONENT MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

5.4 ECOSYSTEM/MARKET MAP

TABLE 3 INDUSTRIAL REFRIGERATION SYSTEM MARKET: SUPPLY CHAIN

5.5 KEY TECHNOLOGY TRENDS

5.5.1 CASCADE AMMONIA INDUSTRIAL REFRIGERATION SYSTEM

5.5.2 INTELLIGENT PURGING INDUSTRIAL REFRIGERATION SYSTEM

5.5.3 WIRELESS DATA LOGGERS

5.5.4 REAL-TIME DATA MONITORING FOR REFRIGERATED TRANSPORTATION

5.6 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF COMPRESSORS (USD)

TABLE 5 AVERAGE SELLING PRICE OF REFRIGERANTS, BY TYPE (USD/KG)

5.7 LIST OF KEY PATENTS AND INNOVATIONS

FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 11 YEARS

TABLE 6 TOP 10 PATENT OWNERS IN LAST 11 YEARS

FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2010 TO 2020

TABLE 7 KEY PATENTS AND INNOVATIONS IN INDUSTRIAL REFRIGERATION MARKET, 2019–2021

5.8 TRADE DATA

TABLE 8 IMPORTS DATA FOR COMPRESSORS FOR REFRIGERATING EQUIPMENT, HS CODE: 841430 (USD MILLION)

FIGURE 30 COMPRESSORS FOR REFRIGERATING EQUIPMENT – IMPORTS VALUE FOR MAJOR COUNTRIES, 2016–2020

TABLE 9 EXPORTS DATA FOR COMPRESSORS FOR REFRIGERATING EQUIPMENT, HS CODE: 841430 (USD MILLION)

FIGURE 31 COMPRESSORS FOR REFRIGERATING EQUIPMENT – EXPORTS VALUE FOR MAJOR COUNTRIES, 2016–2020

5.9 CASE STUDIES: INDUSTRIAL REFRIGERATION SYSTEM MARKET

5.9.1 GEA GROUP AKTIENGESELLSCHAFT: AURIVO, (IRELAND)

TABLE 10 GEA GROUP AKTIENGESELLSCHAFT: SENS (SUSTAINABLE ENERGY SOLUTIONS)

5.9.2 GEA GROUP AKTIENGESELLSCHAFT: KEZSKY SYRZAVOD CHEESE FACTORY (RUSSIA)

TABLE 11 GEA GROUP AKTIENGESELLSCHAFT: MICROGRID ENERGY MANAGEMENT SYSTEM

5.9.3 JOHN CONTROLS: CRANSWICK COUNTRY FOODS (UK)

TABLE 12 JOHN CONTROLS: SABROE INDUSTRIAL REFRIGERATION SCREW AND HEAT PUMP RECIPROCATING COMPRESSORS

5.9.4 EMERSON ELECTRIC CO.: CIMCO (CANADA)

TABLE 13 EMERSON ELECTRIC CO.: VILTER PACKAGE

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

TABLE 14 INDUSTRIAL REFRIGERATION MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 THREAT OF SUBSTITUTES

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 POLICIES AND REGULATORY LANDSCAPE

5.11.1 EUROPE

5.11.1.1 EU F-gas Regulation

5.11.1.2 Montreal Protocol

5.11.1.3 EcoDesign Directive

5.11.2 NORTH AMERICA

5.11.2.1 Significant New Alternatives Policy (SNAP)

5.11.2.2 American Innovation and Manufacturing (AIM)

5.11.2.3 California Refrigerant Regulations

5.11.3 ASIA PACIFIC

5.11.3.1 Japan

5.11.3.2 Australia

6 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY COMPONENT (Page No. - 86)

6.1 INTRODUCTION

TABLE 15 INDUSTRIAL REFRIGERATION MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

FIGURE 33 COMPRESSORS TO LEAD MARKET DURING FORECAST PERIOD

TABLE 16 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 COMPRESSORS

TABLE 17 MARKET FOR COMPRESSORS, BY TYPE, 2017–2020 (USD MILLION)

FIGURE 34 SCREW COMPRESSORS TO COMMAND MARKET DURING FORECAST PERIOD

TABLE 18 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR COMPRESSORS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR COMPRESSORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 MARKET FOR COMPRESSORS, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR COMPRESSORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR COMPRESSORS, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.1 RECIPROCATING COMPRESSORS

6.2.1.1 Advantages such as low cost and high efficiency of reciprocating compressors to accelerate market growth

TABLE 23 INDUSTRIAL REFRIGERATION RECIPROCATING COMPRESSOR MARKET, BY TYPE, 2017–2020 (USD MILLION)

FIGURE 35 MARKET FOR SEMI-HERMETIC RECIPROCATING COMPRESSORS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 INDUSTRIAL REFRIGERATION RECIPROCATING COMPRESSOR MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2.1.2 Semi-hermetic type

6.2.1.3 Hermetic type

6.2.1.4 Open type

6.2.2 SCREW COMPRESSORS

6.2.2.1 Characteristics such as higher capacity output, larger compression ratios, and smoother control to deliver energy savings to propel growth of screw compressors

6.2.2.2 Single-screw compressors

6.2.2.3 Twin-screw compressors

6.3 CONDENSERS

TABLE 25 INDUSTRIAL REFRIGERATION MARKET FOR CONDENSERS, BY TYPE, 2017–2020 (USD MILLION)

FIGURE 36 MARKET FOR EVAPORATIVE CONDENSERS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET FOR CONDENSERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 27 MARKET FOR CONDENSERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 MARKET FOR CONDENSERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 MARKET FOR CONDENSERS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR CONDENSERS, BY APPLICATION, 2021–2026 (USD MILLION)

6.3.1 AIR-COOLED CONDENSERS

6.3.1.1 Air-cooled condensers offer easy installation and low/less water consumption

6.3.2 WATER-COOLED CONDENSERS

6.3.2.1 Benefits such as higher efficiency and smaller space requirement to propel market growth

6.3.3 EVAPORATIVE CONDENSERS

6.3.3.1 Evaporative condensers to continue to dominate industrial refrigeration condenser market during forecast period

6.4 EVAPORATORS

6.4.1 APAC TO GROW AT HIGHEST CAGR FOR EVAPORATORS DURING FORECAST PERIOD

6.4.2 BY COOLING TYPE

6.4.2.1 Air-cooled evaporators

6.4.3 BY DESIGN TYPE

6.4.3.1 Bare tube evaporators

6.4.3.2 Plate type evaporators

6.4.3.3 Finned evaporators

6.4.3.4 Shell and tube type evaporators

TABLE 31 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR EVAPORATORS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 37 APAC TO RECORD HIGHEST CAGR IN INDUSTRIAL REFRIGERATION MARKET FOR EVAPORATORS DURING FORECAST PERIOD

TABLE 32 MARKET FOR EVAPORATORS, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 MARKET FOR EVAPORATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR EVAPORATORS, BY APPLICATION, 2021–2026 (USD MILLION)

6.5 CONTROLS

6.5.1 CONTROL SYSTEMS HELP REMOTELY MONITOR INDUSTRIAL REFRIGERATION SYSTEMS, THEREBY LOWERING OPERATING & MAINTENANCE COSTS

6.5.2 COMPRESSOR CONTROLS

6.5.3 CONDENSER CONTROLS

6.5.4 EVAPORATOR CONTROLS

TABLE 35 INDUSTRIAL REFRIGERATION MARKET FOR CONTROLS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 38 NORTH AMERICA TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR CONTROLS DURING FORECAST PERIOD

TABLE 36 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR CONTROLS, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR CONTROLS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR CONTROLS, BY APPLICATION, 2021–2026 (USD MILLION)

6.6 VESSELS, PUMPS, VALVES, AND AUXILIARY EQUIPMENT

6.6.1 REFRIGERATED WAREHOUSE & FOOD PROCESSING INDUSTRY TO CREATE NEW MARKET OPPORTUNITIES FOR VESSELS, PUMPS, VALVES, AND AUXILIARY EQUIPMENT

TABLE 39 MARKET FOR VESSELS, PUMPS, VALVES, & AUXILIARY EQUIPMENT, BY REGION, 2017–2020 (USD MILLION)

FIGURE 39 APAC TO WITNESS HIGHEST CAGR IN MARKET FOR VESSELS, PUMPS, VALVES, & AUXILIARY EQUIPMENT DURING FORECAST PERIOD

TABLE 40 MARKET FOR VESSELS, PUMPS, VALVES, & AUXILIARY EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 MARKET FOR VESSELS, PUMPS, VALVES, & AUXILIARY EQUIPMENT, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 42 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR VESSELS, PUMPS, VALVES, & AUXILIARY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

7 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY REFRIGERANT TYPE (Page No. - 110)

7.1 INTRODUCTION

TABLE 43 ENVIRONMENT-FRIENDLY ALTERNATIVES TO HYDROFLUOROCARBONS FOR INDUSTRIAL REFRIGERATION

TABLE 44 INDUSTRIAL REFRIGERATION MARKET, BY REFRIGERANT TYPE, 2017–2020 (USD MILLION)

FIGURE 40 MARKET FOR C02 REFRIGERANT-BASED SYSTEMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 MARKET, BY REFRIGERANT TYPE, 2021–2026 (USD MILLION)

7.2 AMMONIA

7.2.1 CHARACTERISTICS SUCH AS COST-EFFECTIVENESS AND ENERGY EFFICIENCY TO PROPEL GROWTH OF AMMONIA-BASED REFRIGERANTS

7.2.2 AMMONIA REFRIGERATION SYSTEMS

7.2.3 LOW-CHARGE AMMONIA REFRIGERATION SYSTEMS

7.3 CO2

7.3.1 CO2 REFRIGERANTS ARE MOST COMMONLY USED FOR THEIR VARIOUS ADVANTAGES

7.3.2 CO2 REFRIGERATION SYSTEMS

7.3.3 CO2 CASCADE REFRIGERATION SYSTEMS

7.4 OTHERS

7.4.1 HFC

7.4.2 HCFC

7.4.3 HC

7.4.4 HFO

8 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY APPLICATION (Page No. - 117)

8.1 INTRODUCTION

TABLE 46 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 41 REFRIGERATED WAREHOUSE APPLICATION TO LEAD INDUSTRIAL REFRIGERATION MARKET DURING FORECAST PERIOD

TABLE 47 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 REFRIGERATED WAREHOUSES

8.2.1 GROWING DEMAND FOR STORAGE OF PERISHABLE OR SEASONAL FOODS AT STRATEGIC LOCATIONS TO PROPEL MARKET GROWTH

TABLE 48 MARKET FOR REFRIGERATED WAREHOUSE APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 49 MARKET FOR REFRIGERATED WAREHOUSE APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR REFRIGERATED WAREHOUSE APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 42 NORTH AMERICA ACCOUNTED FOR LARGEST SIZE OF MARKET FOR REFRIGERATED WAREHOUSE APPLICATIONS

TABLE 51 MARKET FOR REFRIGERATED WAREHOUSE APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.3 FRUIT & VEGETABLE PROCESSING

8.3.1 STRICT GOVERNMENT REGULATIONS FOR FRUIT & VEGETABLE PROCESSING INDUSTRY PROVIDE OPPORTUNITIES FOR MARKET PLAYERS

TABLE 52 MARKET FOR FRUIT & VEGETABLE PROCESSING APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR FRUIT & VEGETABLE PROCESSING APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR FRUIT & VEGETABLE PROCESSING APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 43 APAC TO RECORD HIGHEST CAGR IN INDUSTRIAL REFRIGERATION MARKET FOR FRUIT & VEGETABLE PROCESSING APPLICATIONS DURING FORECAST PERIOD

TABLE 55 MARKET FOR FRUIT & VEGETABLE PROCESSING APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.4 BEVERAGE PROCESSING

8.4.1 ADOPTION OF AMMONIA-BASED REFRIGERATION SYSTEMS TO ACCELERATE DEMAND FOR INDUSTRIAL REFRIGERATION SYSTEMS IN BEVERAGE APPLICATIONS

TABLE 56 MARKET FOR BEVERAGE PROCESSING APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR BEVERAGE PROCESSING APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR BEVERAGE PROCESSING APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR BEVERAGE PROCESSING APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.5 MEAT, POULTRY, & FISH PROCESSING

8.5.1 INCREASING CONSUMER DEMAND FOR FRESH & PROTEIN-RICH FOOD TO CREATE MARKET OPPORTUNITIES

TABLE 60 INDUSTRIAL REFRIGERATION MARKET FOR MEAT, POULTRY, & FISH PROCESSING APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR MEAT, POULTRY, & FISH PROCESSING APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR MEAT, POULTRY, & FISH PROCESSING APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 44 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET FOR MEAT, POULTRY, & FISH PROCESSING APPLICATIONS DURING FORECAST PERIOD

TABLE 63 MARKET FOR MEAT, POULTRY, & FISH PROCESSING APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.6 DAIRY & ICE CREAM PROCESSING

8.6.1 RISING DEMAND FOR PROCESSED DAIRY PRODUCTS SUCH AS CHEESE, YOGHURT, AND FERMENTED MILK TO DRIVE MARKET

TABLE 64 INDUSTRIAL REFRIGERATION MARKET FOR DAIRY & ICE CREAM PROCESSING APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR DAIRY & ICE CREAM PROCESSING APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 66 MARKET FOR DAIRY & ICE CREAM PROCESSING APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 MARKET FOR DAIRY & ICE CREAM PROCESSING APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.7 CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL

8.7.1 RUNNING CLINICAL TESTING AND RESEARCH IN PHARMACEUTICALS TO HALT OUTBREAK OF COVID-19 PANDEMIC TO AUGMENT MARKET GROWTH

TABLE 68 MARKET FOR CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 45 APAC TO RECORD HIGHEST CAGR IN MARKET FOR CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL APPLICATIONS DURING FORECAST PERIOD

TABLE 71 INDUSTRIAL REFRIGERATION SYSTEM MARKET FOR CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.8 REFRIGERATED TRANSPORTATION

8.8.1 RISING DEMAND FOR FRESH & HIGH-QUALITY FOOD/COMMODITIES TO DRIVE GROWTH OF MARKET

TABLE 72 INDUSTRIAL REFRIGERATION MARKET FOR REFRIGERATED TRANSPORTATION APPLICATIONS, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR REFRIGERATED TRANSPORTATION APPLICATIONS, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 74 MARKET FOR REFRIGERATED TRANSPORTATION APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR REFRIGERATED TRANSPORTATION APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.8.2 REFRIGERATED ROAD TRANSPORT

8.8.3 REFRIGERATED SEA TRANSPORT

8.8.4 REFRIGERATED RAIL TRANSPORT

8.8.5 REFRIGERATED AIR TRANSPORT

9 GEOGRAPHIC ANALYSIS (Page No. - 137)

9.1 INTRODUCTION

FIGURE 46 INDUSTRIAL REFRIGERATION MARKET IN INDIA TO RECORD HIGHEST CAGR FROM 2021 TO 2026

TABLE 76 MARKET, BY REGION, 2017–2020 (USD MILLION)

FIGURE 47 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN APAC TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 77 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 78 MARKET FOR REFRIGERATED WAREHOUSES INSTALLED CAPACITY, BY REGION, 2017–2020 (MILLION CUBIC METERS)

TABLE 79 MARKET FOR REFRIGERATED WAREHOUSES INSTALLED CAPACITY, BY REGION, 2021–2026 (MILLION CUBIC METERS)

9.2 NORTH AMERICA

FIGURE 48 SNAPSHOT: INDUSTRIAL REFRIGERATION MARKET IN NORTH AMERICA

TABLE 80 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 49 CHEMICAL, PETROCHEMICAL, & PHARMACEUTICAL SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 85 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Growing number of refrigerated warehouses due to growth in online grocery shopping to accelerate market growth in US

TABLE 86 TOP TEN PLAYERS IN US REFRIGERATED WAREHOUSE INDUSTRY

TABLE 87 MARKET IN US, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 88 MARKET IN US, BY COMPONENT, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing demand for frozen food products to drive market growth in Canada

TABLE 89 INDUSTRIAL REFRIGERATION MARKET IN CANADA, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN CANADA, BY COMPONENT, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Increasing demand for fresh food products to propel demand for industrial refrigeration systems in Mexico

9.3 EUROPE

FIGURE 50 SNAPSHOT: INDUSTRIAL REFRIGERATION SYSTEM MARKET IN EUROPE

TABLE 91 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN EUROPE, BY COMPONENT, 2017–2020 (USD MILLION)

FIGURE 51 COMPRESSORS SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL REFRIGERATION SYSTEM MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 94 MARKET IN EUROPE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 INDUSTRIAL REFRIGERATION MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.1 UK

9.3.1.1 UK to record highest CAGR in industrial refrigeration system market during 2021–2026

TABLE 97 MARKET IN UK, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN UK, BY COMPONENT, 2021–2026 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Germany to hold largest share of industrial refrigeration system market in Europe during 2021–2026

TABLE 99 MARKET IN GERMANY, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN GERMANY, BY COMPONENT, 2021–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Surging adoption of low-charge ammonia refrigeration systems in food & beverages industry to fuel market growth in France

TABLE 101 MARKET IN FRANCE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN FRANCE, BY COMPONENT, 2021–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Presence of key players to propel market growth in Italy

9.3.5 REST OF EUROPE (ROE)

9.4 ASIA PACIFIC (APAC)

FIGURE 52 APAC: SNAPSHOT OF INDUSTRIAL REFRIGERATION MARKET

TABLE 103 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

FIGURE 53 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 104 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 MARKET IN APAC, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN APAC, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China dominated APAC industrial refrigeration system market in 2020

TABLE 109 INDUSTRIAL REFRIGERATION MARKET IN CHINA, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN CHINA, BY COMPONENT, 2021–2026 (USD MILLION)

9.4.2 INDIA

9.4.2.1 Rising investments and government initiatives for cold chain infrastructure to accelerate market growth

TABLE 111 MARKET IN INDIA, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN INDIA, BY COMPONENT, 2021–2026 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Rising inclination toward implementation of natural refrigerant-based systems to drive market growth in Japan

9.4.4 REST OF APAC (ROAPAC)

9.5 REST OF THE WORLD (ROW)

TABLE 113 INDUSTRIAL REFRIGERATION MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN ROW, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN ROW, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 54 REFRIGERATED WAREHOUSES TO HOLD LARGEST SHARE OF INDUSTRIAL REFRIGERATION SYSTEM MARKET IN ROW DURING FORECAST PERIOD

TABLE 118 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Brazil to be major contributor to growth of industrial refrigeration market in South America

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Growing pharmaceutical industry and increasing consumption of frozen food products and beverages to drive market growth

10 COMPETITIVE LANDSCAPE (Page No. - 170)

10.1 OVERVIEW

TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY INDUSTRIAL REFRIGERATION SYSTEM PROVIDERS

10.2 MARKET SHARE ANALYSIS, 2020

TABLE 120 INDUSTRIAL REFRIGERATION SYSTEM MARKET: DEGREE OF COMPETITION

10.3 REVENUE ANALYSIS

FIGURE 55 REVENUE ANALYSIS: TOP 5 PLAYERS

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 56 INDUSTRIAL REFRIGERATION MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 SME EVALUATION QUADRANT FOR INDUSTRIAL REFRIGERATION SYSTEM MARKET, 2020

10.5.1 PROGRESSIVE COMPANY

10.5.2 RESPONSIVE COMPANY

10.5.3 DYNAMIC COMPANY

10.5.4 STARTING BLOCK

FIGURE 57 INDUSTRIAL REFRIGERATION MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, SME ECOSYSTEM, 2020

10.6 COMPETITIVE BENCHMARKING

TABLE 121 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 122 COMPANY PRODUCT FOOTPRINT

TABLE 123 COMPANY APPLICATION FOOTPRINT

TABLE 124 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 125 MARKET: PRODUCT LAUNCHES, MARCH 2018–JUNE 2021

10.7.2 DEALS

TABLE 126 INDUSTRIAL REFRIGERATION MARKET: DEALS, JANUARY 2018–JUNE 2021

11 COMPANY PROFILES (Page No. - 189)

(Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 JOHNSON CONTROLS

TABLE 127 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 58 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 128 JOHNSON CONTROLS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 129 JOHNSON CONTROLS: PRODUCT LAUNCHES

TABLE 130 JOHNSON CONTROLS: DEALS

TABLE 131 JOHNSON CONTROLS: OTHERS

11.1.2 EMERSON ELECTRIC CO.

TABLE 132 EMERSON: BUSINESS OVERVIEW

FIGURE 59 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 133 EMERSON ELECTRIC CO. : PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 134 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

TABLE 135 EMERSON ELECTRIC CO.: DEALS

TABLE 136 EMERSON ELECTRIC CO.: OTHERS

11.1.3 DANFOSS

TABLE 137 DANFOSS: BUSINESS OVERVIEW

FIGURE 60 DANFOSS: COMPANY SNAPSHOT

TABLE 138 DANFOSS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 139 DANFOSS: PRODUCT LAUNCHES

TABLE 140 DANFOSS: DEALS

11.1.4 GEA GROUP AKTIENGESELLSCHAFT

TABLE 141 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

FIGURE 61 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

TABLE 142 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 143 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

TABLE 144 GEA GROUP AKTIENGESELLSCHAFT: DEALS

TABLE 145 GEA GROUP AKTIENGESELLSCHAFT: OTHERS

11.1.5 MAYEKAWA

TABLE 146 MAYEKAWA: BUSINESS OVERVIEW

TABLE 147 MAYEKAWA MFG. CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 148 MAYEKAWA: PRODUCT LAUNCHES

TABLE 149 MAYEKAWA: DEALS

TABLE 150 MAYEKAWA: OTHERS

11.1.6 BITZER

TABLE 151 BITZER: BUSINESS OVERVIEW

TABLE 152 BITZER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 153 BITZER: PRODUCT LAUNCHES

TABLE 154 BITZER: DEALS

TABLE 155 BITZER: OTHERS

11.1.7 BALTIMORE AIRCOIL COMPANY (AMSTED INDUSTRIES)

TABLE 156 BALTIMORE AIRCOIL COMPANY: BUSINESS OVERVIEW

TABLE 157 BALTIMORE AIRCOIL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 158 BALTIMORE AIRCOIL COMPANY: PRODUCT LAUNCHES

TABLE 159 BALTIMORE AIRCOIL COMPANY: DEALS

11.1.8 LENNOX INTERNATIONAL

TABLE 160 LENNOX INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 62 LENNOX INTERNATIONAL: COMPANY SNAPSHOT

TABLE 161 LENOX INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 162 LENNOX INTERNATIONAL: PRODUCT LAUNCHES

11.1.9 LU-VE GROUP

TABLE 163 LU-VE GROUP: BUSINESS OVERVIEW

FIGURE 63 LU-VE GROUP: COMPANY SNAPSHOT

TABLE 164 LU-VE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 165 LU-VE GROUP: DEALS

TABLE 166 LU-VE GROUP: OTHERS

11.1.10 DAIKIN

TABLE 167 DAIKIN: BUSINESS OVERVIEW

FIGURE 64 DAIKIN: COMPANY SNAPSHOT

TABLE 168 DAIKIN: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 169 DAIKIN: OTHERS

11.2 OTHER PLAYERS

11.2.1 INGERSOLL RAND

11.2.2 HITEMA INTERNATIONAL

11.2.3 SRM ITALY

11.2.4 EVAPCO, INC.

11.2.5 GÜNTNER GMBH & CO. KG

11.2.6 CLAUGER

11.2.7 DORIN S.P.A

11.2.8 KOBELCO

11.2.9 PARKER HANNIFIN

11.2.10 MTA S.P.A.

11.2.11 FRASCOLD

11.2.12 RIVACOLD

11.2.13 STAR REFRIGERATION

11.2.14 INDUSTRIAL FRIGO

11.2.15 INNOVATIVE REFRIGERATION SYSTEMS, INC.

*Details on Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 257)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved four major activities for estimating the size of the industrial refrigeration system market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the industrial refrigeration system market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the industrial refrigeration system market began with the acquisition of data related to the revenues of key vendor in the market through secondary research. The secondary research referred to for this research study involves Food and Agriculture Organization of the United Nations (FAO), International Institute of Refrigeration (IIR), World Food Logistics Organization (WFLO), Global Cold Chain Alliance (GCCA), and Cooling India. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the industrial refrigeration system market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the industrial refrigeration system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and Middle East and Africa (MEA), and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to arrive at the overall size of the industrial refrigeration system market from the revenues of key players in the market.

Approach for capturing market size by bottom-up analysis (demand side)

- Identifying entities offering different industrial refrigeration components in the market

- Analyzing major providers of industrial refrigeration systems, studying their portfolios, and understanding different types of refrigeration systems

- Analyzing trends pertaining to the use of different types of industrial refrigeration systems for different kinds of applications

- Tracking ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, collaborations, and partnerships, as well as forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types and trends of equipment, refrigerant-based systems, industries, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing the revenue of companies generated from each type of industrial refrigeration component and then combining the same to get the market estimate

- Classifying the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

Global Industrial Refrigeration System Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the industrial refrigeration system market by component, refrigerant type, and application in terms of value

- To describe and forecast the market size for various segments for four primary regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding major factors including drivers, restraints, opportunities, and challenges that influence the growth of the industrial refrigeration system market

- To provide a detailed overview of the value chain pertaining to the industrial refrigeration market ecosystem

- To analyze various policies and regulations pertaining to the use of refrigerants in North America, Europe, and APAC

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of revenue and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as collaborations, agreements, partnerships, and product launches in the industrial refrigeration system market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of industrial refrigeration system market

- Estimation of the market size of the segments of the industrial refrigeration system market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Refrigeration Market

Currently, I am preparing for a seminar about industrial refrigeration. Would appreciate it if you could share the brochure for gaining information regarding industrial refrigeration market. The brochure would be used only for education purpose and not for commercial purpose.

I am primarily interested in market size and future trends of Plate Heat Exchangers (semi welded, brazed and plate and shell units) for Industrial Refrigeration.

Does the report break market for equipment (compressors, condensers, evaporators, etc.) into fruit & vegetable, beverage, dairy and ice-cream processing etc.? Would like to see it in the report sample.

Trying to better understand the refrigeration industry and forecasts specifically around Carbon dioxide.

For our sales promotion we are looking for industrial refrigeration system global market and share of components, such as compressors, condensers, etc.

We need to develop understanding about the size and challenges with Ammonia Compressor Systems in the North America Marketplace.

We are more interested in market for refrigerated warehouses specifically in Europe and North America. Who are the leading vendors for this? Is this information covered in the report?