Low GWP Refrigerants Market by Type (Inorganics, Hydrocarbons, Fluorocarbons), Application (Commercial Refrigeration, Industrial Refrigeration, Domestic Refrigeration), and Region (Asia Pacific, Europe, North America) - Global Forecast to 2023

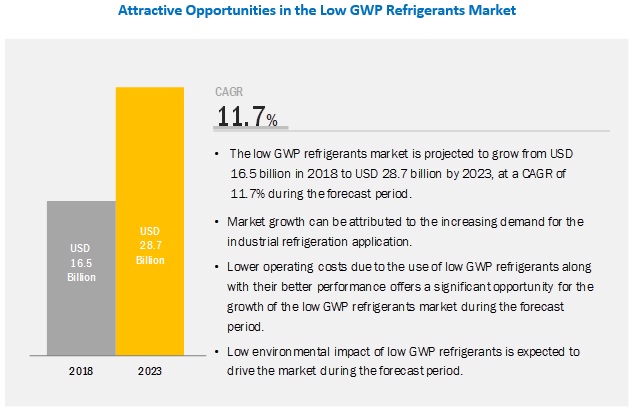

[158 Pages Report] The low GWP refrigerants market is projected to grow from USD 16.5 billion in 2018 to USD 28.7 billion by 2023, at a CAGR of 11.7%. The major factors driving the low GWP refrigerants market are the low environmental impact of low GWP refrigerants, phasing out of CFC, HCFC, and HFC refrigerants, and the increasing demand for refrigerants and air conditioners across the globe.

Hydrocarbon type segment expected to grow at the highest CAGR due to the increasing demand from the industrial refrigeration sector

Hydrocarbon refrigerants have excellent thermodynamic properties, and refrigerating and air-conditioning systems operating using these substances are highly energy-efficient. Hydrocarbon refrigerants are miscible with conventional refrigerating oils and have a relatively high critical temperature.

Hydrocarbon refrigerants are flammable in nature and can be explosive as well; this is a major safety concern associated with the use of hydrocarbon refrigerants and therefore requires hermetically sealed systems with explosion protection for electric components.

Commercial refrigeration application segment is projected to be the largest segment due to the increasing demand from the retail sector

The Montreal Protocol and Kyoto Protocol have led to reductions in the use of environmentally harmful refrigerants, especially in commercial refrigeration plants. Plug-in equipment, such as vending machines used in small stores and supermarkets that rely on hydrocarbons and CO2 have been available for a few years. In large supermarkets, refrigeration (centralized systems) CO2 cascade systems are an alternative to common HFC systems in cold and moderate climates. Hydrocarbons have also proven to be highly efficient alternatives in most applications under high ambient temperatures, except for larger condensing units.

Europe is expected to lead the market during the forecast period

The low GWP refrigerants market in Europe is projected to witness high growth during the forecast period on account of the recent F-gas regulations/HFC phase out plan which dictates the reduction of use of HFC refrigerants by almost half by 2025. The region also enjoys the highest number of end users who have already switched to refrigeration systems based on low GWP refrigerants.

Key Market Players

Key players in the market include Linde Group (Germany), Honeywell (US), Sinochem Group (China), Airgas Inc. (US), Engas Australasia (Australia), A-Gas (UK), Puyang Zhongwei Fine Chemical (China), Harp International (UK), Tazzetti (Italy), Shandong Yueon Chemical Industry (China), HyChill Australia (Australia), GTS (Italy), Chemours (US), Mexichem (Mexico), Daikin (Japan), and Arkema (France). These players have expanded their geographical presence through new product launches & developments, partnerships & contracts, expansions, and acquisitions & mergers. The Linde Group, the market leader in the low GWP refrigerants market, invested USD 33.70 million to expand production capacity and meet growing customer demands in Malaysia. This is expected to enable Linde to meet the forecast growth in demand in the Malaysian region. Such acts of expansion can be followed by other players to strengthen their positions in the low GWP refrigerants market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) and Volume (KT) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe Middle East & Africa, and South America |

|

Companies covered |

Linde Group (Germany), Honeywell (US), Sinochem Group (China), Airgas Inc. (US), Engas Australasia (Australia), A-Gas (UK), Puyang Zhongwei Fine Chemical (China), Harp International (UK), Tazzetti (Italy), Shandong Yueon Chemical Industry (China), HyChill Australia (Australia), GTS (Italy), Chemours (US), Mexichem (Mexico), Daikin (Japan), and Arkema (France) |

This research report categorizes the low GWP refrigerants market based on type, application, and region, forecasting volumes and revenues as well as analyzing trends in each of these submarkets.

Based on type the low GWP refrigerants market is segmented into:

- Inorganics

- Ammonia

- Carbon dioxide

- Others (Air, and Water)

- Hydrocarbons

- Isobutane

- Propane

- Others (Butane, Propylene, Ethylene, and Ethane)

- Fluorocarbons

- HFCs

- HFOs

Based on application the low GWP refrigerants market is segmented into:

- Commercial Refrigeration

- Industrial Refrigeration

- Domestic Refrigeration

- Stationary Air-conditioning

- Mobile Air-conditioning

- Others (Chillers and Water Heat Pumps)

Based on region the low GWP refrigerants market is segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In June 2018, A-Gas launched a new total solutions packet which includes fire extinguishing agents and expert consulting services in the Australian market. The impact of launching agile services is expected to strengthen the companys position in the Australian market.

- In November 2018, The Linde Group, along with NLMK Group, signed an agreement for the long-term supply of industrial gases to the Novolipetsk Steel site in Russia. This contract is expected to embark upon a strategic partnership between Linde and NLMK and is an opportunity for Linde to expand business in Russia.

Key Questions addressed by the report

- How will all these developments affect the industry in the mid to long term?

- What are the upcoming industry applications for low GWP refrigerants?

- What is the impact of the change in the environmental policy globally on the low GWP refrigerant market?

- When will emerging countries adopt the CO2 refrigeration technology?

- What is the phase-out status of HCFC and HFC refrigerants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Low Environmental Impact of Low GWP Refrigerants

5.2.1.2 Phasing Out of CFC, CFC, and HFC Refrigerants

5.2.1.3 Long-Term Viability of Low GWP Refrigerants

5.2.1.4 Increasing Demand for Refrigeration and Air-Conditioning Application

5.2.2 Restraints

5.2.2.1 Higher Initial Capital Cost Requirement

5.2.2.2 Flammability and Toxicity Issues

5.2.3 Opportunities

5.2.3.1 Effects of Global Warming

5.2.3.2 Lower Operating Cost With Higher Performance

5.2.3.3 Technological Advancement for Increasing Performance

5.2.4 Challenges

5.2.4.1 Few Purification Companies

5.2.4.2 Lack of Education and Awareness in Hvac Contractors and Technicians

5.3 R&D in Low GWP Refrigerants

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Policies and Regulations

5.5.1 Europe

5.5.1.1 Eu F-Gas Regulations

5.5.1.2 Montreal Protocol

5.5.1.3 Mac Directive

5.5.2 North America

5.5.2.1 Significant New Alternative Policy (SNAP) By EPA

5.5.3 Asia-Pacific

5.5.3.1 Japan: Revised F-Gas Law

5.5.4 South America

5.5.4.1 Brazil: Label for Commercial Refrigeration Under Discussion

6 Low GWP Refrigerants Market, By Type

6.1 Introduction

6.2 Inorganics

6.2.1 Ammonia

6.2.2 Carbon Di-Oxide

6.2.3 Others

6.3 Fluorocarbons

6.3.1 HFOC

6.3.2 HFCS

6.4 Hydrocarbons

6.4.1 Propane

6.4.2 Isobutane

6.4.3 Others

*Note: Only Qualitative Data Will Be Provided for the Highlighted in Italics

7 Low GWP Refrigerants Market, By Application

7.1 Introduction

7.2 Commercial Refrigeration

7.3 Industrial Refrigeration

7.4 Domestic Refrigeration

7.5 Stationary Air-Conditioning

7.6 Mobile Air-Conditioning

7.7 Others

8 Regional Analysis

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 India

8.2.4 Malaysia

8.2.5 Singapore

8.2.6 South Korea

8.2.7 Thailand

8.2.8 Indonesia

8.2.9 Rest of Asia-Pacific

8.3 North America

8.3.1 Canada

8.3.2 Mexico

8.3.3 US

8.4 Europe

8.4.1 France

8.4.2 Germany

8.4.3 Italy

8.4.4 Spain

8.4.5 UK

8.4.6 Rest of Europe

8.5 South America

8.5.1 Argentina

8.5.2 Brazil

8.5.3 Chile

8.5.4 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 South Africa

8.6.3 Turkey

8.6.4 Rest of Middle East & Africa

9 Competitive Landscape

9.1 Introduction

9.2 Market Share Analysis

9.3 Competitive Situation & Trends

9.4 Micro Quadrant

10 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 A.S. Trust & Holdings

10.2 A-Gas

10.3 Airgas Inc.

10.4 Arkema

10.5 Brothers Gas

10.6 Chemours

10.7 Daikin

10.8 Deepfreeze Refrigerants

10.9 Ecofreeze International

10.10 Engas Australasia

10.11 GTS

10.12 Harp International

10.13 Honeywell

10.14 Hychill Australia

10.15 Intergas

10.16 Linde Group

10.17 Mexichem

10.18 MK Chemical

10.19 Puyang Zhongwei Fine Chemical

10.20 Shandong Yueon Chemical Industry

10.21 Sinochem Group

10.22 SOL Spa

10.23 Tazzetti

10.24 The Natural Refrigerants Company

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix

11.1 Discussion Guides

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (110 Tables)

Table 1 Annual GDP Growth of Major Economies, 2012 to 2016

Table 2 Low GWP Refrigerants Market, By Type, 20162023 (USD Million)

Table 1 Market, By Type, 20162023 (Kilotons)

Table 2 Refrigeration Market Size, By Region, 20162023 (USD Million)

Table 3 Refrigeration Market Size, By Region, 20162023 (Kilotons)

Table 8 Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 9 Market, By Application, 20162023 (Kilotons)

Table 10 Commercial Refrigeration Market Size, By Region, 20162023 (USD Million)

Table 11 Commercial Refrigeration Market Size, By Region, 20162023 (Kilotons)

Table 12 Industrial Refrigeration Market Size, By Region, 20162023 (USD Million)

Table 13 Industrial Refrigeration Market Size, By Region, 20162023 (Kilotons)

Table 14 Domestic Refrigeration Market Size, By Region, 20162023 (USD Million)

Table 15 Domestic Refrigeration Market Size, By Region, 20162023 (Kilotons)

Table 20 Low GWP Refrigerant Market, By Region, 20162023 (USD Million)

Table 21 Low GWP Refrigerant Market, By Region, 20162023 (Kilotons)

Table 22 Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 23 Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 24 Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 25 Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 26 Europe Low GWP Refrigerant Market, By Country, 20162023 (USD Million)

Table 27 Europe Low GWP Refrigerant Market, By Country, 20162023 (Kilotons)

Table 28 Europe Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 29 Europe Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 30 Europe Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 31 Europe Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 32 Germany Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 33 Germany Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 34 Norway Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 35 Norway Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 36 Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 37 Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 38 Denmark Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 39 Denmark Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 40 Switzerland Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 41 Switzerland Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 42 Sweden Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 43 Sweden Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 44 Rest of Europe Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 45 Rest of Europe Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 46 Asia Pacific Low GWP Refrigerant Market, By Country, 20162023 (USD Million)

Table 47 Asia Pacific Low GWP Refrigerant Market, By Country, 20162023 (Kilotons)

Table 48 Asia Pacific Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 49 Asia Pacific Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 50 Asia Pacific Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 51 Asia Pacific Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 52 Japan Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 53 Japan Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 54 China Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 55 China Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 56 New Zealand Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 57 New Zealand Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 58 Indonesia Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 59 Indonesia Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 60 Australia Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 61 Australia Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 62 Taiwan Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 63 Taiwan Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 64 Malaysia Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 65 Malaysia Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 67 North America Low GWP Refrigerant Market, By Country, 20162023 (USD Million)

Table 68 North America Low GWP Refrigerant Market, By Country, 20162023 (Kilotons)

Table 69 North America Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 71 North America Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 73 North America Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 74 North America Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 75 US Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 76 US Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 77 Canada Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 79 Canada Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 80 Mexico Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 81 Mexico Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 82 Middle East & Africa Low GWP Refrigerant Market, By Country, 20162023 (USD Million)

Table 83 Middle East & Africa Low GWP Refrigerant Market, By Country, 20162023 (Kilotons)

Table 84 Middle East & Africa Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 85 Middle East & Africa Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 86 Middle East & Africa Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 87 Middle East & Africa Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 88 South Africa Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 89 South Africa Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 90 Jordan Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 91 Jordan Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 92 South America Low GWP Refrigerant Market, By Country, 20162023 (USD Million)

Table 93 South America Low GWP Refrigerant Market, By Country, 20162023 (Kilotons)

Table 94 South America Low GWP Refrigerant Market, By Type, 20162023 (USD Million)

Table 95 South America Low GWP Refrigerant Market, By Type, 20162023 (Kilotons)

Table 96 South America Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 97 South America Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 98 Argentina Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 99 Argentina Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 100 Chile Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 101 Chile Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 102 Brazil Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 103 Brazil Low GWP Refrigerant Market, By Application, 20162023 (Kilotons)

Table 104 Colombia Low GWP Refrigerant Market, By Application, 20162023 (USD Million)

Table 106 New Product Launches, 20132018

Table 107 Expansions, 20132018

Table 108 Partnerships & Joint Ventures, 20132018

Table 109 Agreements & Contracts, 20132018

Table 110 Mergers & Acquisitions, 20132018

List of Figures (18 Figures)

Figure 1 Low GWP Refrigerants Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Low GWP Refrigerant Market: Data Triangulation

Figure 5 Refrigeration Segment to Lead Low GWP Refrigerant Market Between 2018 and 2023

Figure 6 Commercial Refrigeration Segment to Lead Low GWP Refrigerant Market During Forecast Period

Figure 7 Europe Estimated to Lead Low GWP Refrigerant Market in 2018

Figure 8 Drivers, Restraints, Opportunities, and Challenges in the Transcritical Co₂ Systems Market

Figure 9 Refrigeration Type Segment Projected to Lead Low GWP Refrigerant Market During Forecast Period

Figure 10 Commercial Refrigeration Application Segment Projected to Lead Low GWP Refrigerant Market During Forecast Period

Figure 11 Regional Snapshot

Figure 12 Europe Low GWP Refrigerant Market Snapshot

Figure 13 Asia Pacific Low GWP Refrigerant Market Snapshot

Figure 14 North America Low GWP Refrigerant Market Snapshot

Figure 15 Middle East & Africa Low GWP Refrigerant Market Snapshot

Figure 16 South America Low GWP Refrigerant Market Snapshot

Figure 17 Companies Have Adopted Organic Growth Strategies Between 2013 and 2018 to Strengthen their Position in Market

Figure 18 Low GWP Refrigerants Market Ranking, By Company, 2018

The study involved 4 major activities to estimate the current market size of low GWP refrigerants. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

As a part of the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the industrys supply chain, markets monetary chain, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

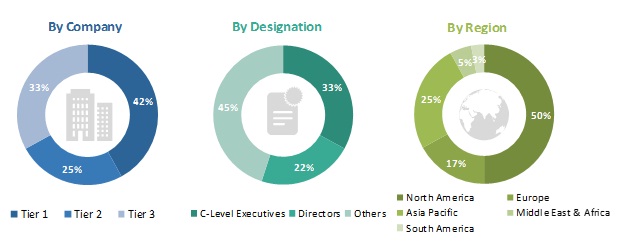

As a part of the primary research process, various primary sources from both, supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the low GWP refrigerants market. Primary sources from the demand side included directors, marketing heads, and purchase managers from end-use industries. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the low GWP refrigerants market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of volume and value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process, and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition to this, the market was validated using both, top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global low GWP refrigerants market based on type, application, and region

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape of the market

- To forecast the market size in terms of value with respect to the main regions (along with countries), namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and Research & Development (R&D) activities in the global low GWP refrigerants market

The following customization options are available for the report:

- Further breakdown of Asia Pacific and Europe low GWP refrigerants markets

- Company information

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Low GWP Refrigerants Market