Live Cell Encapsulation Market by Technique (Dripping (Simple, Electrostatic), Coaxial Airflow, Liquid Jet), Polymer (Alginate, Chitosan, Silica, Cellulose Sulfate), Application (Probiotics, Transplant, Drug Delivery, Research) - Forecast to 2024

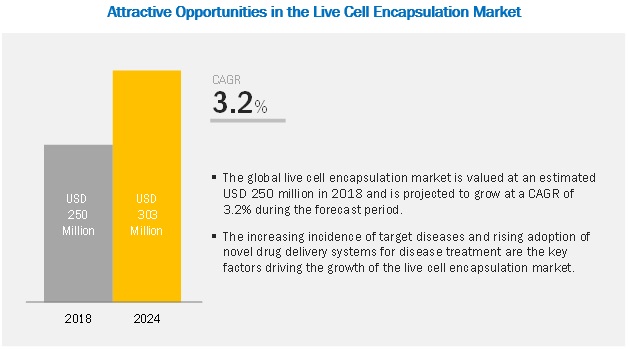

[136 Pages Report] The live cell encapsulation market is projected to grow to USD 303 million by 2024 from USD 250 million in 2018, at a CAGR of 3.2% during the forecast period. Growth in the live cell encapsulation market is primarily driven by factors such as the increasing public-private investments to support product development, increasing research to establish the clinical efficacy of cell encapsulation technologies, and rising public awareness related to the clinical role of encapsulated cells in disease management.

By manufacturing technique, the electrostatic dripping segment is expected to grow at the highest CAGR during the forecast period

Electrostatic dripping is used for droplet generation and enables the acceleration of the normal droplet formation process using electrostatic forces to pull the droplets off the orifice at a considerably faster rate than the normal dripping process. The extruded polymer solution is passed through an electrostatically charged nozzle into a neutral or oppositely charged collecting/hardening solution. The growth of the electrostatic dripping segment is attributed to the procedural benefits such as uniform size distribution and retention of cell viability.

By polymer type, the alginate segment is expected to dominate the live cell encapsulation market till 2024

Alginate is a polysaccharide and the most commonly used polymer for the encapsulation of therapeutic agents. Alginate is extracted from a species of brown seaweed and is produced by two kinds of bacteria—Pseudomonas and Azotobacter. The growth of the alginate segment is attributed to factors such as the high permeability of alginate, uniform cell structures, and high mechanical stability.

By application, drug delivery are expected to be the largest contributor to the live cell encapsulation market

Cell encapsulation is undertaken for the manufacturing of tablets, capsules, and parenteral dosage forms for effective drug delivery. The growth of this segment includes the increasing adoption of cell encapsulation for drug delivery is mainly due to its procedural benefits (such as improved efficacy, reduced toxicity, and improved patient compliance & convenience).

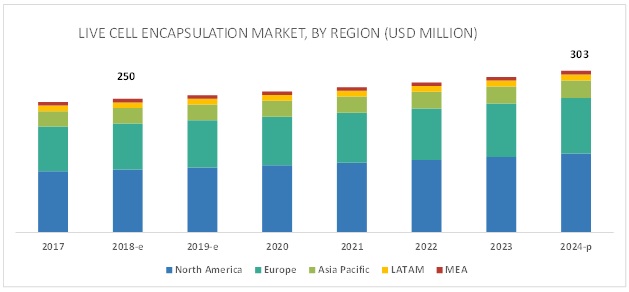

North America is estimated to be the largest regional market for live cell encapsulation during the forecast period

North America is one of the major revenue-generating regions in the live cell encapsulation market. The increasing public-private investments in the live cell encapsulation industry in the US and Canada, ongoing technological advancements in live cell encapsulation, and the presence of major market players in the region are the major factors driving the growth of the live cell encapsulation market in North America.

Key Market Players

BioTime, Inc. (US), Viacyte, Inc. (US), and Living Cell Technologies Ltd. (Australia) were the top three players in the live cell encapsulation market. Other prominent players operating in this market include Sigilon Therapeutics, Inc. (US), Evonik Industries (Germany), BÜCHI Labortechnik AG (Germany), Blacktrace Holdings Ltd (UK), and Sernova Corporation (Canada), among others. Furthermore, the key players in the developmental pipeline products in this market include Neurotech Pharmaceuticals, Inc. (US), Gloriana Therapeutics (US), Kadimastem (Israel), Beta-O2 Technologies, Inc. (Israel), Defymed (France), and Altucell, Inc. (US), among others.

BioTime, Inc. (US) dominated the live cell encapsulation market in 2017. The company has a strong geographic presence across the regions such as US, Australia, New Zealand, Israel, Canada, China, Japan, and Taiwan. BioTime, Inc. mainly focuses on product commercialization to further strengthen its position in the live cell encapsulation market. In line with this, the company commercialized pluripotent cells for research, drug discovery, and Regenerative Medicine therapies. It also focuses on inorganic growth strategies such as distribution agreements to maintain its market position.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Manufacturing Technique, Polymer type, Application, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, the UK, France, and RoE), APAC (Japan, China, India, and the RoAPAC), LATAM, and MEA |

|

Companies Covered |

BioTime, Inc. (US), Viacyte, Inc. (US), Living Cell Technologies Ltd. (Australia), Sigilon Therapeutics, Inc. (US), Evonik Industries (Germany), BÜCHI Labortechnik AG (Germany), Blacktrace Holdings Ltd (UK), Sernova Corporation (Canada), Neurotech Pharmaceuticals, Inc. (US), Gloriana Therapeutics (US), Kadimastem (Israel), Beta-O2 Technologies, Inc. (Israel), Defymed (France), and Altucell, Inc. (US). |

This research report categorizes the live cell encapsulation market based on manufacturing technique, polymer type, application, and region.

Live cell encapsulation market, by Manufacturing Technique

- Simple Dripping

- Electrostatic Dripping

- Liquid Jet Break Up

- Coaxial Airflow

- Vibrating Jet

- Jet Cutting

- Rotating Disk Atomization

Live cell encapsulation market, by Polymer Type

- Alginate

- HEMA-MMA

- Chitosan

- Siliceous Encapsulates

- Cellulose Sulfate

- PAN-PVC

- Other Polymers

Live cell encapsulation market, by Application

- Drug Delivery

- Regenerative medicine

- Cell Transplantation

- Probiotics

- Research

Live cell encapsulation market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia Pacific

- China

- Japan

- India

- RoAPAC

- Latin America

- Middle East and Africa

Recent Developments

- In January 2015, BioTime, Inc. launched the pluripotent cells for research, drug discovery, and regenerative medicine therapies. This helped the company to improve its position in the live cell encapsulation market.

Key questions addressed by the report:

- What is the growth opportunities related to the adoption of live cell encapsulation across major regions in the coming years?

- Emerging countries will offer immense opportunities for the growth and adoption of live cell encapsulation. Will this scenario continue in the coming years?

- Where will all the advancements in products offered by various companies take the industry in the mid-to-long term?

- What is the various research institutes where live cell encapsulation products find a high adoption rate?

- What are the new trends and advancements in the live cell encapsulation market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Major Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources Referred

2.1.2 Primary Data

2.2 Market Estimation Methodology

2.2.1 Procedure-Based Market Estimation

2.2.2 Revenue Mapping-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Live Cell Encapsulation Market Overview

4.2 Europe: Live Cell Encapsulation Market, By Polymer Type

4.3 Global Live Cell Encapsulation Market, By Technique

4.4 Live Cell Encapsulation Market, By Application

4.5 Live Cell Encapsulation Market, By Country

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Incidence of Target Diseases

5.2.1.2 Focus on Novel Drug Delivery Systems for Disease Treatment

5.2.1.3 Technology Advancements

5.2.1.4 Increasing Public-Private Investments to Support Novel Product Development

5.2.1.5 Rising Public Awareness Related to the Clinical Role of Encapsulated Cells in Disease Management

5.2.2 Restraints

5.2.2.1 High Product Manufacturing Costs

5.2.2.2 Limited Market Availability of High-Quality Raw Materials

5.2.3 Opportunities

5.2.3.1 Rising Research Activity

5.2.4 Challenges

5.2.4.1 Adoption of Alternative Therapies

6 Live Cell Encapsulation Market, By Manufacturing Techniques (Page No. - 41)

6.1 Introduction

6.2 Simple Dripping

6.2.1 Global Live Cell Encapsulation Market Split for Simple Dripping Technique, By Application

6.3 Electrostatic Dripping

6.3.1 Global Live Cell Encapsulation Market Split for Electrostatic Dripping Technique, By Application

6.4 Coaxial Airflow

6.4.1 Global Live Cell Encapsulation Market Split for Coaxial Airflow Technique, By Application

6.5 Liquid-Jet Break-Up

6.5.1 Global Live Cell Encapsulation Market Split for Liquid Jet Break Up Technique, By Application

6.6 Vibrating-Jet Technique

6.6.1 Global Live Cell Encapsulation Market Split for Vibrating Jet Technique, By Application

6.7 Jet Cutting

6.7.1 Global Live Cell Encapsulation Market Split for Jet Cutting Technique, By Application

6.8 Rotating Disk Atomization

6.8.1 Global Live Cell Encapsulation Market Split for Rotating Disk Atomization Technique, By Application

7 Live Cell Encapsulation Market, By Polymer Type (Page No. - 54)

7.1 Introduction

7.2 Alginate

7.2.1 Alginate is the Most Widely Adopted Material for the Encapsulation of Living Cells

7.3 Hema-Mma

7.3.1 Hema-Mma-Based Products are Used Mainly for Liver Transplantation Procedures and Diabetes Management

7.4 Chitosan

7.4.1 Inadequate Availability of Natural Chitosan Sources is Expected to Hamper Market Growth

7.5 Siliceous Encapsulates

7.5.1 Procedural Benefits Such as Effective Process Control & Adjustability to Drive Market Growth

7.6 Cellulose Sulfate

7.6.1 Techno-Commercial Benefits Such as High Mechanical Stability & Adjustability to Drive Market Growth

7.7 PAN-PVC

7.7.1 PAN-PVC Polymers have Mechanical Stability, Permeability, and High Biocompatibility

7.8 Other Polymers

8 Live Cell Encapsulation Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Drug Delivery

8.2.1 Drug Delivery Forms the Largest Application Segment of the Live Cell Encapsulation Market

8.3 Regenerative Medicine

8.3.1 Clinical Risk of Hepatic Clogging System is Expected to Hamper the Adoption of Cell Encapsulation

8.4 Cell Transplantation

8.4.1 Technological Advancements in the Field of Cell Transplantation to Support Market Growth

8.5 Probiotics

8.5.1 Probiotics Applications to Register the Highest Growth During the Forecast Period

8.6 Research

8.6.1 Increasing Availability of Public-Private Funding, Investments, & Grants to Drive Market Growth

9 Live Cell Encapsulation Market, By Region (Page No. - 72)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Accounted for the Largest Share Due to Growing Public-Private Investments for Cell Encapsulation Research

9.2.2 Canada

9.2.2.1 Growth in the Live Cell Encapsulation Market in Canada is Driven By the Growing Research Activities Related to Cell Encapsulation

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany to Witness the Highest Growth in the European Live Cell Encapsulation Market During the Forecast Period

9.3.2 UK

9.3.2.1 Growth in This Market is Driven By the Technological Advancements and Efficiency of Cell Encapsulation Techniques

9.3.3 France

9.3.3.1 Increasing Prevalence of Chronic Diseases to Drive Market Growth

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Japan to Register the Highest Growth in the Asia Pacific Live Cell Encapsulation Market

9.4.2 China

9.4.2.1 Supportive Government Regulations for the Expansion and Modernization of Healthcare Facilities are Driving Market Growth

9.4.3 India

9.4.3.1 Increasing Prevalence of Target Chronic Diseases to Support Market Growth

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.6 Middle East & Africa

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Global Market Share Analysis (2017)

10.3 Competitive Scenario (2015 to 2019)

10.4 Competitive Leadership Mapping

10.4.1 Vendor Inclusion Criteria

10.4.1.1 Visionary Leaders

10.4.1.2 Innovators

10.4.1.3 Dynamic Differentiators

10.4.1.4 Emerging Companies

11 Company Profiles (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Introduction

11.2 Biotime, Inc.

11.3 Blacktrace Group

11.4 Büchi Labortechnik AG

11.5 Evonik Industries

11.6 Living Cell Technologies

11.7 Neurotech Holdings, LLC.

11.8 Sernova Corporation

11.9 Sigilon Therapeutics

11.10 Viacyte, Inc.

11.11 Pharmacyte Biotech, Inc.

11.12 Altucell, Inc.

11.13 Beta-O2 Technologies Ltd

11.14 Defymed

11.15 Gloriana Therapeutics

11.16 Kadimastem

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (64 Tables)

Table 1 Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 2 Live Cell Encapsulation Market for Simple Dripping, By Region, 2017–2024 (USD Million)

Table 3 Live Cell Encapsulation Market for Simple Dripping, By Application, 2017–2024 (USD Million)

Table 4 Live Cell Encapsulation Market for Electrostatic Dripping, By Region, 2017–2024 (USD Million)

Table 5 Live Cell Encapsulation Market for Electrostatic Dripping, By Application, 2017–2024 (USD Million)

Table 6 Live Cell Encapsulation Market for Coaxial Airflow, By Region, 2017–2024 (USD Million)

Table 7 Live Cell Encapsulation Market for Coaxial Airflow, By Application, 2017–2024 (USD Million)

Table 8 Live Cell Encapsulation Market for Liquid-Jet Break-Up, By Region, 2017–2024 (USD Million)

Table 9 Live Cell Encapsulation Market for Liquid-Jet Break-Up, By Application, 2017–2024 (USD Million)

Table 10 Live Cell Encapsulation Market for Vibrating-Jet Technique, By Region, 2017–2024 (USD Million)

Table 11 Live Cell Encapsulation Market for Vibrating-Jet Technique, By Application, 2017–2024 (USD Million)

Table 12 Live Cell Encapsulation Market for Jet Cutting, By Region, 2017–2024 (USD Million)

Table 13 Live Cell Encapsulation Market for Jet Cutting, By Application, 2017–2024 (USD Million)

Table 14 Live Cell Encapsulation Market for Rotating Disk Atomization, By Region, 2017–2024 (USD Million)

Table 15 Live Cell Encapsulation Market for Rotating Disk Atomization, By Application, 2017–2024 (USD Million)

Table 16 Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 17 Live Cell Encapsulation Market for Alginate, By Region, 2017–2024 (USD Million)

Table 18 Live Cell Encapsulation Market for Hema-Mma, By Region, 2017–2024 (USD Million)

Table 19 Live Cell Encapsulation Market for Chitosan, By Region, 2017–2024 (USD Million)

Table 20 Live Cell Encapsulation Market for Siliceous Encapsulates, By Region, 2017–2024 (USD Million)

Table 21 Live Cell Encapsulation Market for Cellulose Sulfate, By Region, 2017–2024 (USD Million)

Table 22 Live Cell Encapsulation Market for PAN-PVC, By Region, 2017–2024 (USD Million)

Table 23 Live Cell Encapsulation Market for Other Polymers, By Region, 2017–2024 (USD Million)

Table 24 Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 25 Live Cell Encapsulation Market for Drug Delivery, By Region, 2017–2024 (USD Million)

Table 26 Live Cell Encapsulation Market for Regenerative Medicine, By Region, 2017–2024 (USD Million)

Table 27 Live Cell Encapsulation Market for Cell Transplantation, By Region, 2017–2024 (USD Million)

Table 28 Live Cell Encapsulation Market for Probiotics, By Region, 2017–2024 (USD Million)

Table 29 Live Cell Encapsulation Market for Research, By Region, 2017–2024 (USD Million)

Table 30 Live Cell Encapsulation Market, By Region, 2017–2024 (USD Million)

Table 31 Live Cell Encapsulation Market, By Country, 2017–2024 (USD Million)

Table 32 North America: Live Cell Encapsulation Market, By Country, 2017–2024 (USD Million)

Table 33 North America: Live Cell Encapsulation Market for Simple Dripping, By Country, 2017–2024 (USD Million)

Table 34 North America: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 35 North America: Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 36 North America: Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 37 US: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 38 Canada: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 39 Europe: Live Cell Encapsulation Market, By Country, 2017–2024 (USD Million)

Table 40 Europe: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 41 Europe: Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 42 Europe: Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 43 Germany: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 44 UK: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 45 France: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 46 RoE: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 47 Asia Pacific: Live Cell Encapsulation Market, By Country, 2017–2024 (USD Million)

Table 48 Asia Pacific: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 49 Asia Pacific: Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 50 Asia Pacific: Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 51 Japan: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 52 China: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 53 India: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 54 RoAPAC: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 55 Latin America: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 56 Latin America: Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 57 Latin America: Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 58 MEA: Live Cell Encapsulation Market, By Technique, 2017–2024 (USD Million)

Table 59 MEA: Live Cell Encapsulation Market, By Polymer Type, 2017–2024 (USD Million)

Table 60 MEA: Live Cell Encapsulation Market, By Application, 2017–2024 (USD Million)

Table 61 Key Product Launches

Table 62 Key Expansions

Table 63 Key Acquisitions

Table 64 Key Partnerships, Agreements, and Collaborations

List of Figures (29 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: Live Cell Encapsulation Market

Figure 3 Research Methodology: Hypothesis Building

Figure 4 Market Size Estimation: Live Cell Encapsulation Market

Figure 5 Data Triangulation Methodology

Figure 6 Live Cell Encapsulation Market, By Technique, 2018 vs 2024

Figure 7 Live Cell Encapsulation Market, By Polymer Type, 2018 vs 2024 (USD Million)

Figure 8 Live Cell Encapsulation Market Share, By Application, 2018 vs 2024

Figure 9 Geographic Snapshot: Live Cell Encapsulation Market

Figure 10 Rising Research Activity and Focus on Novel Drug Delivery Systems for Disease Treatment Will Drive Demand for Live Cell Encapsulation

Figure 11 Alginates to Dominate the European Live Cell Encapsulation Market During the Forecast Period

Figure 12 Simple Dripping Segment to Dominate the Live Cell Encapsulation Market During the Forecast Period

Figure 13 North America Will Dominate the Live Cell Encapsulation Application Market in 2018

Figure 14 US and Germany to Be the Fastest-Growing Markets for Live Cell Encapsulation

Figure 15 Live Cell Encapsulation Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Simple Dripping Segment to Dominate the Live Cell Encapsulation Market During the Forecast Period

Figure 17 Alginate Segment to Dominate the Live Cell Encapsulation Market During the Forecast Period

Figure 18 Drug Delivery Segment to Dominate the Live Cell Encapsulation Market During the Forecast Period

Figure 19 North America: Live Cell Encapsulation Market Snapshot

Figure 20 Europe: Live Cell Encapsulation Market Snapshot

Figure 21 Asia Pacific: Live Cell Encapsulation Market Snapshot

Figure 22 Latin America: Live Cell Encapsulation Market Snapshot

Figure 23 MEA: Live Cell Encapsulation Market Snapshot

Figure 24 Key Developments in the Live Cell Encapsulation Market From 2014 to 2019

Figure 25 Biotime, Inc Held the Leading Position in the Live Cell Encapsulation Market in 2017

Figure 26 Competitive Leadership Mapping (2017)

Figure 27 Biotime, Inc.: Company Snapshot (2017)

Figure 28 Evonik Industries: Company Snapshot (2017)

Figure 29 Living Cell Technologies: Company Snapshot (2017)

The study involved four major activities to estimate the current size of the live cell encapsulation market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

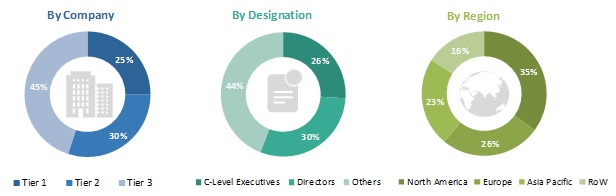

The live cell encapsulation market comprises several stakeholders such as hospitals, surgical centers, government agencies, and research organizations. The demand side of this market is characterized by the the increasing incidence of target diseases and rising adoption of novel drug delivery systems for disease treatment. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the live cell encapsulation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the live cell encapsulation industry.

Report Objectives

- To define, describe, and forecast the live cell encapsulation market by manufacturing technique, polymer type, application, and region

- To provide detailed information about major factors influencing market growth (key drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall live cell encapsulation market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market value of various segments and subsegments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players active in the live cell encapsulation market and comprehensively analyze their global revenue shares and core competencies2

- To track and analyze competitive market-specific developments such as product approvals & commercialization, agreements, partnerships, collaborations, acquisitions, and expansions in the live cell encapsulation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the live cell encapsulation market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players

Product Analysis

- Further breakdown of the Rest of Europe live cell encapsulation market into Poland, Italy, Spain, and other European countries (aggregated)

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Live Cell Encapsulation Market