Stem Cell Manufacturing Market by Product (Consumables, Instruments, Stem Cell Lines), Application (Research, Clinical, Cell Tissue & Banking), End User, Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2028

Market Growth Outlook Summary

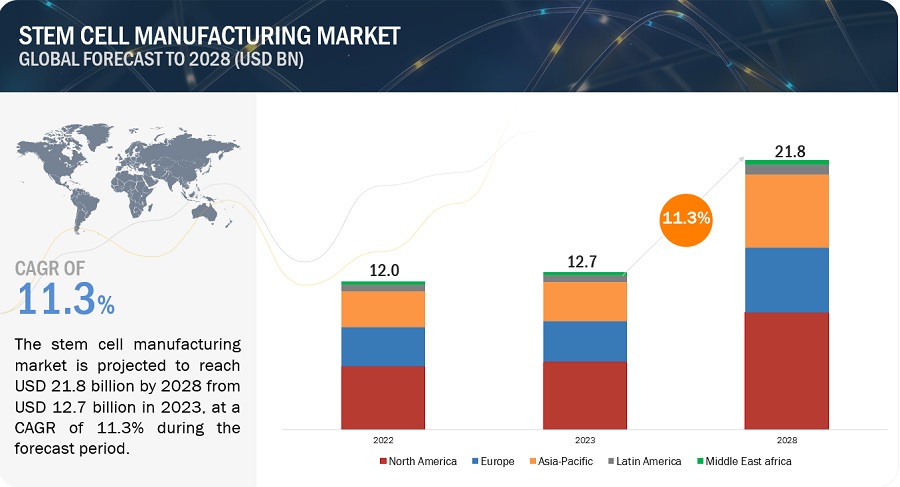

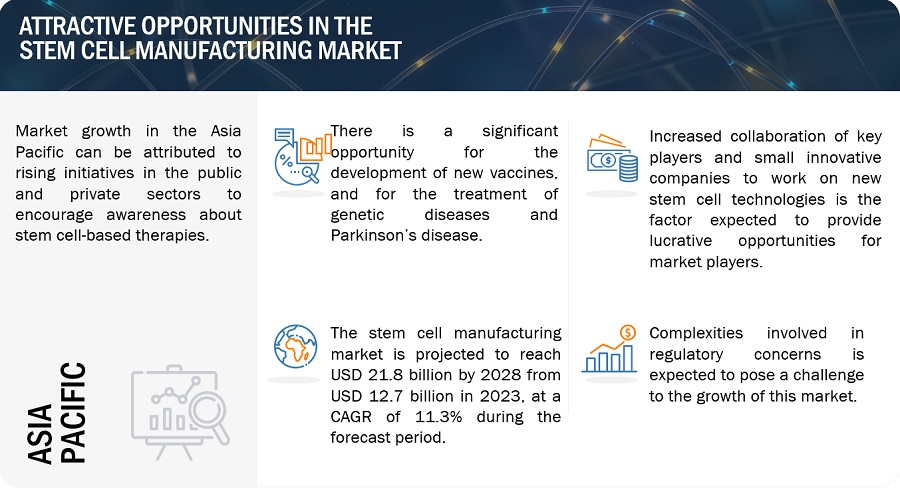

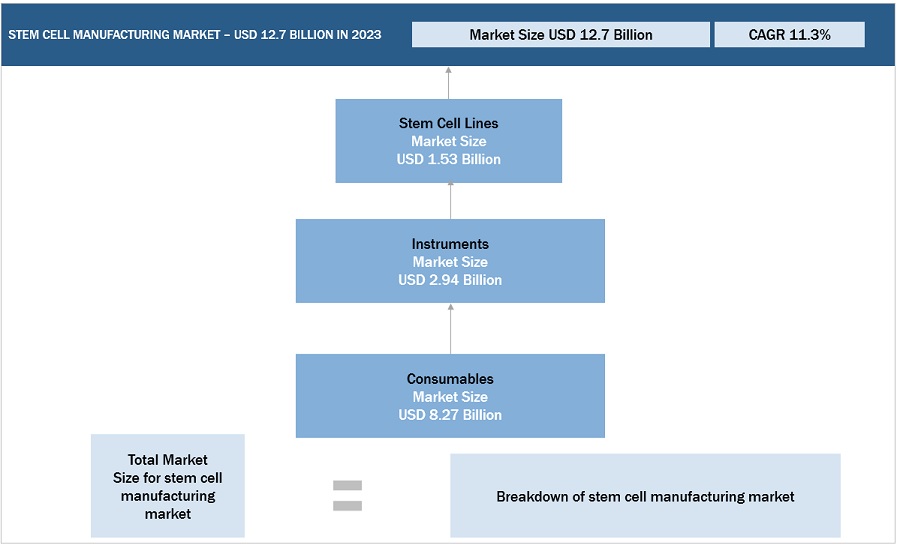

The global stem cell manufacturing market, valued at US$12.0 billion in 2022, stood at US$12.7 billion in 2023 and is projected to advance at a resilient CAGR of 11.3% from 2023 to 2028, culminating in a forecasted valuation of US$21.8 billion by the end of the period. The major factors driving the growth of this market are technological advancements in stem cell manufacturing and the rising prevalence of genetic disorders, both of which are expected to propel market growth. However, the high operational costs of stem cell manufacturing and cell banking are anticipated to restrain market growth to some extent.

Stem Cell Manufacturing Market – Global Forecast and Growth Insights to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Stem Cell Manufacturing Market – Global Forecast and Key Opportunities to 2028

Stem Cell Manufacturing Market Dynamics to 2028

DRIVER: Growing venture capital investment in stem cell research

Venture capital investment in stem cell research has been growing in recent years as investors see the potential for this field to revolutionize healthcare. Venture capital investment in stem cell research has experienced significant growth, reflecting the increasing recognition of its potential in revolutionizing healthcare and regenerative medicine. Stem cells possess the remarkable ability to differentiate into various cell types, making them a promising tool for treating a wide range of diseases and injuries. With the potential to address conditions such as neurodegenerative disorders, heart disease, and organ failure, the field of stem cell research has captured the attention of venture capitalists looking to support groundbreaking scientific advancements.

RESTRAINT: Significant operational costs associated with stem cell manufacturing and banking

Significant operational costs are associated with stem cell manufacturing and banking due to the complex and intricate processes involved. Firstly, the acquisition and maintenance of specialized laboratory equipment and facilities contribute to a substantial portion of the expenses. These facilities need to maintain strict standards for maintaining sterility, ensuring optimal growth conditions, and conducting quality control tests. Additionally, the costs of sourcing and maintaining a skilled workforce, including scientists, technicians, and quality assurance personnel, are considerable.

OPPORTUNITY: Government initiatives to boost the biotechnology and biopharmaceutical industries

Governments recognize the significant potential of the biotechnology and biopharmaceutical industries and have implemented various initiatives to foster their growth. These initiatives aim to promote research and development, attract investment, and accelerate the translation of scientific discoveries into innovative therapies and treatments. Governments provide funding through grants, tax incentives, and subsidies to support biotech and biopharma companies, especially startups and small enterprises.

CHALLENGE: Technical limitations associated with manufacturing scale-up

A major challenge in stem cell manufacturing is the requirement for large-scale expansion of stem cells while maintaining their unique characteristics and functionality. This necessitates the development of robust and standardized cell culture systems, which must be optimized to ensure consistent and reproducible outcomes on a larger scale. Additionally, the complex and delicate nature of stem cells demands stringent control over environmental factors such as temperature, pH, and oxygen levels throughout the manufacturing process. Achieving these conditions on a larger scale can be technically demanding and may require specialized equipment and infrastructure.

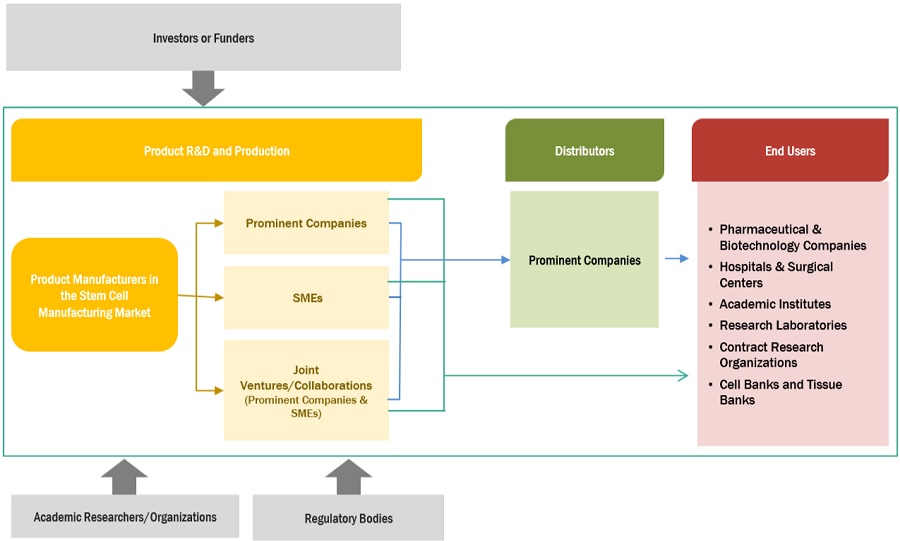

Stem Cell Manufacturing Market Map & Ecosystem Overview

Prominent companies in the market include well-established, financially stable manufacturers of stem cell manufacturing products. These companies have been active in the market for several years and boast diversified, state-of-the-art technologies, extensive product portfolios, and robust global sales and marketing networks.

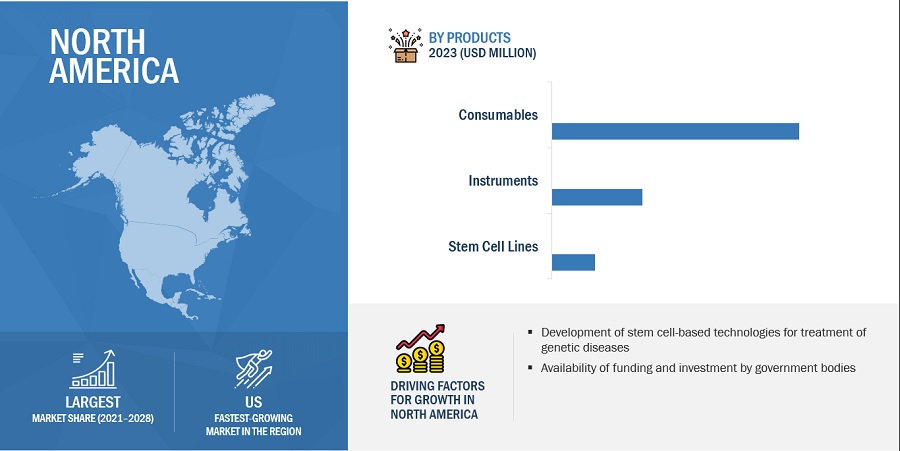

The consumables segment accounted for the largest share of the product segment in the stem cell manufacturing industry in 2023.

Based on products, the stem cell manufacturing market is categorized into consumables, instruments, and stem cell lines. In 2023, the consumables segment accounted for the largest share of the stem cell manufacturing market. The major driver propelling the increasing demand for regenerative therapies, advancements in stem cell research, and increasing potential in treating various diseases, driving the need for efficient and reliable manufacturing processes.

The pharmaceutical & biotechnology companies segment dominated the end-user segment in the stem cell manufacturing industry in 2023.

Based on the end user, the segment of the stem cell manufacturing market is categorized into hospitals & surgical centers; pharmaceutical & biotechnology companies; cell & tissue banks; academic institutes, research laboratories, and CROs; and other end users. In 2023, the pharmaceutical & biotechnology companies segment dominated the end-user segment with the highest revenue share. The growing demand for regenerative medicine and increasing strategic collaborations to accelerate the development and commercialization of stem cell-based therapies.

North America was the largest market for stem cell manufacturing industry in 2023

Geographically, the stem cell manufacturing market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East Africa. The stem cell manufacturing market is dominated by North America in 2023, and this dominance is anticipated to continue throughout the forecast period. The established research infrastructure, technological advancements, demand for precision medicine, supportive regulatory environment, robust biotechnology and healthcare industry, and availability of funding and investment drive the growth of the stem cell manufacturing market in North America. However, the high cost associated with research and products, which can limit the adoption of these products for some end users, especially smaller research institutions with limited budgets, are negatively impacting the market growth.

Stem Cell Manufacturing Market by Region – Forecast to 2028

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the stem cell manufacturing market are Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Lonza Group (Switzerland), Danaher Corporation (US), Sartorius AG (Germany), Becton, Dickinson, and Company (US), Eppendorf AG (Germany), Corning Inc. (US), Bio-Rad Laboratories (US), Takara Bio Group (Japan), Fujifilm Holdings Corporation (Japan), Getinge AB (Sweden), Terumo Corporation (Japan), Bio-Techne Corporation (US), HiMedia Laboratories (India), StemCell Technologies, Inc. (Canada), Miltenyi Biotec GmbH (Germany), PromoCell (Germany), Anterogen Co. Ltd. (South Korea), CellGenix GmbH (Germany), Pluristem Therapeutics Inc. (Israel), Daiichi Sankyo (Japan), Organogenesis Holdings Inc. (US), Vericel Corporation (US), and American CryoStem Corporation (US).

Stem Cell Manufacturing Market Report Scope and Insights

| Report Metric | Details |

|---|---|

| Market Revenue in 2023 | US$ 12.7 billion |

| Projected Revenue by 2028 | US$ 21.8 billion |

| Revenue Rate | Poised to Grow at a CAGR of 11.3% |

| Market Driver | Growing venture capital investment in stem cell research |

| Market Opportunity | Government initiatives to boost the biotechnology and biopharmaceutical industries |

Stem Cell Manufacturing Market Segmentation and Analysis

By Product

-

Consumables

- Culture Media

- Other Consumables

-

Instruments

- Bioreactors and Incubators

- Cell Sorters

- Other Instruments

-

Stem Cell Lines

- Hematopoietic stem cells (HSC)

- Mesenchymal stem cells (MSC)

- Induced Pluripotent Stem cells (iPSC)

- Embryonic stem cells (ESC)

- Neural Stem cells (NSC)

- Multipotent adult progenitor stem cells

By Application

-

Research Applications

- Life science research

- Drug discovery and development

-

Clinical Application

- Allogenic stem cell therapy

- Autologous stem cell therapy

- Cell & Tissue Banking Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Academic institutes, Research laboratories & contract research organizations

- Hospitals & surgical centers

- Cell & tissue banks

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- India

- China

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East Africa

Stem Cell Manufacturing Market Recent Developments and Insights

- In April 2023, U.S. Food and Drug Administration approved Omisirge (omidubicel), a substantially modified allogeneic (donor) cord blood-based cell therapy to quicken the recovery of neutrophils (a subset of white blood cells) in the body and reduce the risk of infection. Developments like this are increasing the demand for stem cell therapies and culture media.

- In October 2022, Froilabo (France) announced the launch of a new range of fully automated lab-scale bioreactors. The bioreactor offers a great range of application possibilities suited to academia, research, process development and optimization, scale-up, and production.

- In January 2023, the life science group Sartorius extended a strategic collaboration partnership agreement with RoosterBio Inc. (RoosterBio) to address purification challenges and establish scalable downstream manufacturing processes for exosome-based therapies.

- In November 2021, GenScript announced today that it had launched the GenWand Double-Stranded DNA (dsDNA) Service for the manufacture of STEM CELL MANUFACTURING knock-in homology-directed repair (HDR) templates in T cell engineering.

Frequently Asked Questions (FAQ):

What is the projected growth and market value of the global stem cell manufacturing market?

The global stem cell manufacturing market is projected to grow from US$ 12.7 billion in 2023 to US$ 21.8 billion by 2028, demonstrating a robust CAGR of 11.3%.

What are the key factors driving the stem cell manufacturing market?

The market is driven by growing investments in stem cell research, rising awareness of stem cell therapies' therapeutic potential, technological advancements in manufacturing processes, and increasing prevalence of genetic disorders.

What are the main challenges faced by the stem cell manufacturing market?

The market faces challenges such as high operational costs associated with manufacturing and cell banking, stringent regulatory requirements, and the complexity of scaling up production while maintaining quality and safety standards.

Which product segments dominate the stem cell manufacturing market?

The product segments include consumables, instruments, and stem cell lines. Stem cell lines are expected to exhibit the highest growth due to their therapeutic applications, while consumables, particularly culture media, hold the largest market share in 2023.

What are the key applications of stem cell manufacturing?

The applications include research, clinical, and cell and tissue banking. Research applications, particularly life science research, dominate due to increased funding and advancements in stem cell technologies, while clinical applications like allogeneic and autologous therapies are also growing rapidly.

Which end-user segments are prominent in the stem cell manufacturing market?

Key end users include pharmaceutical and biotechnology companies, hospitals, and academic research institutions. Pharmaceutical and biotechnology companies dominate the market due to increasing regulatory approvals and advanced technologies for stem cell therapies.

Which regions are leading in the stem cell manufacturing market?

North America leads the market, with the US holding the largest share due to strong public-private initiatives, advanced healthcare infrastructure, and high awareness about stem cell therapies. Europe and Asia-Pacific are also witnessing significant growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing venture capital investments in stem cell research- Increasing awareness about therapeutic potency of stem cell products- Technological advancements in stem cell manufacturingRESTRAINTS- Significant operational costs associated with stem cell manufacturing and bankingOPPORTUNITIES- Supportive regulatory framework across developing economies- Government initiatives to boost biotechnology and biopharmaceutical industries- Increased market focus on mesenchymal stem cells and induced pluripotent stem cellsCHALLENGES- Technical limitations associated with manufacturing scale-up- Socio-ethical concerns related to use of allogeneic and human embryonic stem cells

- 5.3 TECHNOLOGY ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 REGULATORY ANALYSISFDA APPROVALSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSSTEM CELL MANUFACTURING MARKET: BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 CONSUMABLESCULTURE MEDIA- Rising stem cell research and increasing demand for stem cell therapies to boost adoption of culture mediaOTHER CONSUMABLES

-

6.3 INSTRUMENTSBIOREACTORS & INCUBATORS- Introduction of advanced bioreactors and incubators to contribute to market growthCELL SORTERS- Development of novel cell sorting technologies such as microfluidics to drive marketOTHER INSTRUMENTS

-

6.4 STEM CELL LINESHEMATOPOIETIC STEM CELLS- Increasing adoption of cord blood banking to boost marketMESENCHYMAL STEM CELLS- Ease of cell harvesting, processing, and preservation to drive adoption of MSCsINDUCED PLURIPOTENT STEM CELLS- Increased adoption of iPSCs in research on cell therapies & regenerative medicine to fuel growthEMBRYONIC STEM CELLS- Rising research activity in cancer precision medicine to contribute to segmental growthNEURAL STEM CELLS- Introduction of novel isolation and expansion techniques for NSCs to drive marketMULTIPOTENT ADULT PROGENITOR STEM CELLS- Rising awareness of role of MAPCs in research to propel market

- 7.1 INTRODUCTION

-

7.2 RESEARCH APPLICATIONSLIFE SCIENCE RESEARCH- Increasing research focus on stem cell cytology & pathology to boost marketDRUG DISCOVERY & DEVELOPMENT- Increasing research expenditure by pharma and biotech companies to contribute to market growth

-

7.3 CLINICAL APPLICATIONSALLOGENEIC STEM CELL THERAPY- Wide therapeutic applications of stem cell lines to drive growthAUTOLOGOUS STEM CELL THERAPY- Increasing patient preference for autologous stem cell therapy to drive segmental growth

-

7.4 CELL & TISSUE BANKING APPLICATIONSRISING DEMAND FOR CORD BLOOD STEM CELL BANKING TO FAVOR MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING PRIVATE INVESTMENTS FOR STEM CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

-

8.3 ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CONTRACT RESEARCH ORGANIZATIONSINCREASED PUBLIC FUNDING FOR RESEARCH ACTIVITIES TO BOOST MARKET

-

8.4 HOSPITALS & SURGICAL CENTERSIMPROVED HEALTHCARE INFRASTRUCTURE TO PROPEL GROWTH

-

8.5 CELL & TISSUE BANKSGROWING APPLICATION OF STEM CELLS IN DISEASE TREATMENT TO FAVOR MARKET GROWTH

- 8.6 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Continued focus to strengthen R&D to drive market in USCANADA- Rising government investments to drive market in CanadaNORTH AMERICA: IMPACT OF RECESSION

-

9.3 EUROPEGERMANY- Strong growth in biotechnology industry to drive marketFRANCE- Government support in stem cell manufacturing to drive marketUK- Growing focus on innovation to increase demand for stem cell-based therapeuticsITALY- Initiatives encouraging development of cell & gene therapy to boost demand for stem cell manufacturingSPAIN- Increasing demand for precision medicine to drive growthREST OF EUROPEEUROPE: IMPACT OF RECESSION

-

9.4 ASIA PACIFICCHINA- Increasing clinical trials for stem cells and innovations to drive marketJAPAN- Growing collaborations for stem cell research to drive growthINDIA- Increasing prevalence of genetic disorders to support growthREST OF ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSION

-

9.5 LATIN AMERICAGROWING PHARMACEUTICAL INDUSTRY IN REGION TO DRIVE MARKET GROWTHLATIN AMERICA: IMPACT OF RECESSION

-

9.6 MIDDLE EAST & AFRICAINCREASING FUNDING AND COLLABORATIONS TO DRIVE MARKET GROWTHMIDDLE EAST & AFRICA: IMPACT OF RECESSION

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS

- 10.4 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

-

10.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

10.7 COMPETITIVE BENCHMARKINGSTEM CELL MANUFACTURING MARKET: DETAILED LIST OF START-UPS/SMES

- 10.8 STEM CELL MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 10.9 COMPETITIVE SCENARIO AND TRENDS

-

11.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewLONZA GROUP- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- MnM viewSARTORIUS AG- Business overview- Products offered- Recent developmentsBECTON, DICKINSON AND COMPANY- Business overview- Products offeredEPPENDORF SE- Business overview- Products offered- Recent developmentsCORNING INCORPORATED- Business overview- Products offeredBIO-RAD LABORATORIES, INC.- Business overview- Products offeredTAKARA BIO INC.- Business overview- Products offered- Recent developmentsFUJIFILM HOLDINGS CORPORATION- Business overview- Products offered- Recent developmentsGETINGE AB- Business overview- Products offeredTERUMO CORPORATION- Business overview- Products offeredBIO-TECHNE CORPORATION- Business overview- Products offeredHIMEDIA LABORATORIES PVT. LTD.- Business overview- Products offered

-

11.2 OTHER PLAYERSSTEMCELL TECHNOLOGIES, INC.MILTENYI BIOTEC GMBHPROMOCELLANTEROGEN CO. LTD.CELLGENIX GMBHPLURISTEM THERAPEUTICS INC.DAIICHI SANKYOORGANOGENESIS HOLDINGS INC.VERICEL CORP.AMERICAN CRYOSTEM CORP.

- 12.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 STEM CELL MANUFACTURING MARKET: IMPACT ANALYSIS

- TABLE 5 SINGLE-USE BIOREACTORS VS. STAINLESS STEEL BIOREACTORS

- TABLE 6 STEM CELL MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS

- TABLE 13 TOP OWNERS OF STEM CELL MANUFACTURING PATENTS

- TABLE 14 STEM CELL MANUFACTURING CONFERENCES (2023–2024)

- TABLE 15 STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 16 STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 EUROPE: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 30 STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 EUROPE: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 EUROPE: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 EUROPE: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 STEM CELL MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 US: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 138 US: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 US: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 US: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 US: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 US: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 US: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 US: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 CANADA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 146 CANADA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 CANADA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 CANADA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 CANADA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 150 CANADA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 CANADA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 CANADA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 EUROPE: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 EUROPE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 155 EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 EUROPE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 159 EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 EUROPE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 162 GERMANY: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 163 GERMANY: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 GERMANY: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 GERMANY: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 GERMANY: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 167 GERMANY: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 GERMANY: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 GERMANY: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 170 FRANCE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 171 FRANCE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 FRANCE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 FRANCE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 FRANCE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 175 FRANCE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 FRANCE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 FRANCE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 UK: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 179 UK: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 UK: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 UK: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 UK: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 183 UK: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 UK: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 UK: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 186 ITALY: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 187 ITALY: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 ITALY: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 ITALY: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 ITALY: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 191 ITALY: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 ITALY: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 ITALY: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 SPAIN: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 195 SPAIN: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 SPAIN: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 SPAIN: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 SPAIN: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 199 SPAIN: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 SPAIN: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 SPAIN: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 207 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 219 CHINA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 220 CHINA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 CHINA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 CHINA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 CHINA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 224 CHINA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 CHINA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 CHINA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 227 JAPAN: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 228 JAPAN: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 JAPAN: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 JAPAN: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 JAPAN: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 232 JAPAN: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 JAPAN: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 JAPAN: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 235 INDIA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 236 INDIA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 INDIA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 INDIA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 INDIA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 240 INDIA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 INDIA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 INDIA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 267 STEM CELL MANUFACTURING MARKET: DETAILED LIST OF START-UPS/SMES

- TABLE 268 STEM CELL MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 269 STEM CELL MANUFACTURING MARKET: PRODUCT LAUNCHES (2021–2023)

- TABLE 270 STEM CELL MANUFACTURING MARKET: DEALS (2021–2023)

- TABLE 271 STEM CELL MANUFACTURING MARKET: OTHER DEVELOPMENTS (2021–2023)

- TABLE 272 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 273 MERCK KGAA: COMPANY OVERVIEW

- TABLE 274 LONZA GROUP: COMPANY OVERVIEW

- TABLE 275 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 276 SARTORIUS AG: COMPANY OVERVIEW

- TABLE 277 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 278 EPPENDORF SE: COMPANY OVERVIEW

- TABLE 279 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 280 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 281 TAKARA BIO INC.: COMPANY OVERVIEW

- TABLE 282 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 283 GETINGE AB: COMPANY OVERVIEW

- TABLE 284 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 285 BIO-TECHNE CORPORATION: COMPANY OVERVIEW

- TABLE 286 HIMEDIA LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- FIGURE 1 STEM CELL MANUFACTURING MARKET: RESEARCH DESIGN

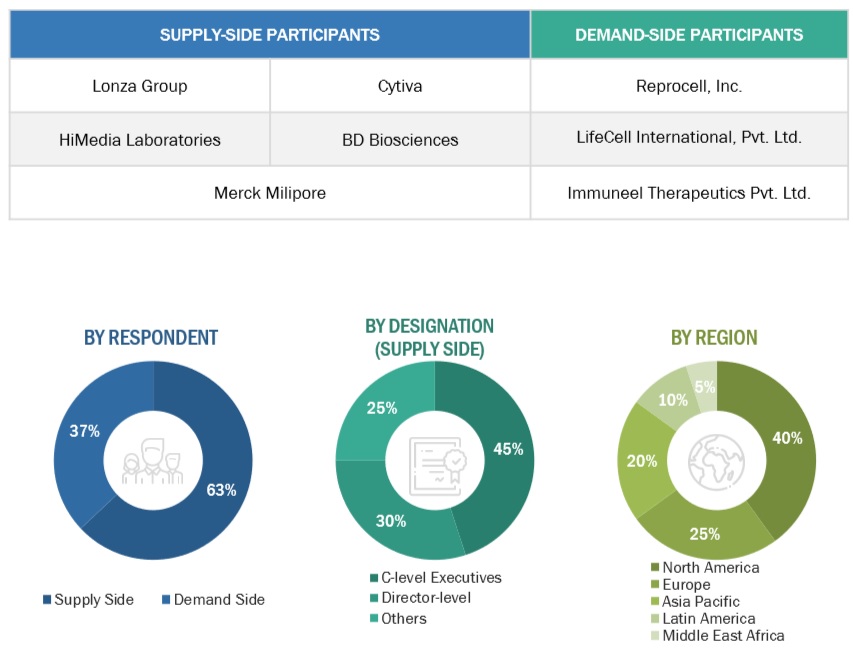

- FIGURE 2 STEM CELL MANUFACTURING MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 4 STEM CELL MANUFACTURING MARKET SIZE (2022)

- FIGURE 5 STEM CELL MANUFACTURING MARKET: FINAL CAGR PROJECTIONS (2023−2028)

- FIGURE 6 STEM CELL MANUFACTURING MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 STEM CELL MANUFACTURING MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 11 GROWING INVESTMENTS IN STEM CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

- FIGURE 12 CONSUMABLES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 PHARMACEUTICAL & BIOTECH COMPANIES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 STEM CELL MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 16 STEM CELL MANUFACTURING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 17 STEM CELL MANUFACTURING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 STEM CELL MANUFACTURING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 19 GRANTED PATENTS FOR STEM CELL MANUFACTURING, 2011–2023*

- FIGURE 20 STEM CELL MANUFACTURING MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

- FIGURE 22 NORTH AMERICA: STEM CELL MANUFACTURING MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET SNAPSHOT

- FIGURE 24 STEM CELL MANUFACTURING MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 25 REVENUE SHARE ANALYSIS FOR TOP 5 COMPANIES (2020−2022)

- FIGURE 26 STEM CELL MANUFACTURING MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS (2022)

- FIGURE 27 STEM CELL MANUFACTURING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 28 STEM CELL MANUFACTURING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 29 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 30 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 31 LONZA GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 32 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 33 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- FIGURE 34 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 35 EPPENDORF SE: COMPANY SNAPSHOT (2022)

- FIGURE 36 CORNING INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 37 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 TAKARA BIO INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 40 GETINGE AB: COMPANY SNAPSHOT (2022)

- FIGURE 41 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 42 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the stem cell manufacturing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the stem cell manufacturing market. The secondary sources used for this study include some of the key secondary sources referred to for this study include International Society for Stem Cell Research (ISSCR), International Stem Cell Forum (ISCF), International Society for Cellular Therapy (ISCT), Council for International Organizations of Medical Sciences (CIOMS), International Consortium of Stem Cell Networks (ICSCN), United States Food and Drug Administration (US FDA), National Institutes of Health (US), EuroStemCell, European Medicines Agency (EMA), Clinical Trials Registry, Pharmaceuticals and Medical Devices Agency (Japan), Ministry of Food and Drug Safety (South Korea), China Food and Drug Administration (China), and Ministry of Health & Family Welfare (India), ClinicalTrials.gov, Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Interviews with Experts, and MarketsandMarkets Analysis. Secondary sources include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess the prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the stem cell manufacturing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the stem cell manufacturing business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global stem cell manufacturing Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global stem cell manufacturing Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Stem cell manufacturing is the process of producing stem cells in a laboratory setting. This process involves isolating stem cells from a source, such as an embryo or adult tissue, and then culturing them in a controlled environment. The goal of stem cell manufacturing is to produce large quantities of high-quality stem cells that can be used for research or therapeutic purposes. The market is driven by the increasing demand for stem cells for research, clinical applications, and cell and tissue banking.

Key Stakeholders

- Manufacturers and distributors of stem cell manufacturing products

- Pharmaceutical and biotechnology companies

- Market research and consulting firms

- R&D centers

- Researchers and scientists

- Academic & research institutes

Report Objectives

- To define, describe, and forecast the stem cell manufacturing market based on products, Applications, and end users.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall stem cell manufacturing market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the stem cell manufacturing market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Twenty-five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stem Cell Manufacturing Market

Which segment accounted for the largest market share for the stem cell manufacturing market?

I want to know about the key players in stem cell manufacturing.