Liquid Roofing Market by Type (PU/Acrylic Hybrids, Polyurethane, Acrylic, Bituminous, and Silicone Coatings), Application (Residential Buildings, Commercial Buildings, Public Infrastructure, and Industrial Facilities) - Global Forecast to 2021

[139 Pages Report] Liquid Roofing Market size of liquid roofing was USD 4.97 Billion in 2015, and is projected to register a CAGR of 7.1% between 2016 and 2021. The market size was 2,333.0 Million square meter in 2015; it is projected to register a CAGR of 6.7% during the forecast period. In this study, 2015 has been considered as the base year and 2021 as the forecast year for estimating market size of liquid roofing between 2016 and 2021.

The Objectives of the Study are:

- To define and segment the global liquid roofing market by type, application, and region

- To estimate and forecast the liquid roofing market, , in terms of value (USD million), and volume (million square meter), by type, and application at country-level in different regions, namely, North America, Asia-Pacific, Europe, South America, and the Middle East & Africa

- To identify and analyze the key growth drivers, restraints, opportunities, and challenges influencing the liquid roofing market

- To analyze recent market developments and competitive strategies, such expansion, product launch/development, agreement/collaboration, and merger & acquisition to draw the competitive landscape in the liquid roofing market

- To strategically identify and profile the key market players and analyze their core competencies in each type and application of the liquid roofing market

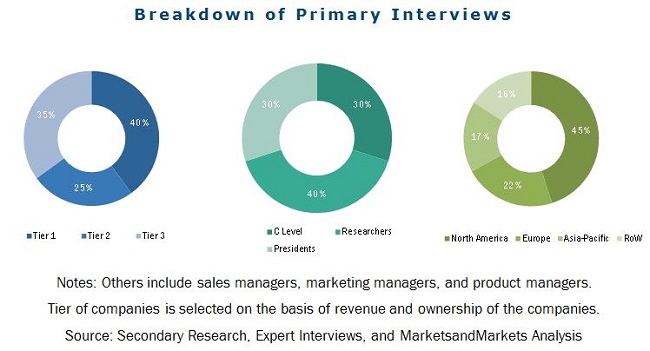

Different secondary sources such as company websites, encyclopedia, directories, and database have been used to identify and collect information useful for this extensive commercial study of the global liquid roofing market. The primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess the future prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The liquid roofing market has a diversified and established ecosystem of its upstream players such as raw material suppliers, including BASF (Germany), Dow Chemical (U.S.), Saint-Gobain (France), 3M (Minnesota), and AkzoNobel N.V. (Netherlands), Bergquist Company (U.S.), Indium Corporation (U.S.), and Parker Hannifin (U.S.), among others. The products manufactured by these companies are used in roofing applications of residential buildings, commercial buildings, industrial facilities, and public infrastructure.

Key Target Audience:

- Regional manufacturer associations and general liquid roofing associations

- Raw material manufacturers of liquid roofing

- Traders, distributors, and suppliers of liquid roofing

- Government and regional agencies and research organizations

This study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing efforts, and investments and competitive landscape of the market.

Scope of the Report:

This research report categorizes the liquid roofing market based on type, application, and region, and forecasts revenue growth and analysis of trends in each of the submarkets.

On the basis of Type:

- Polyurethane coatings

- Acrylic coatings

- PU/Acrylic hybrids

- Bituminous coatings

- Silicone coatings

- Modified Silane polymer

- EPDM rubbers

- Elastomeric membranes

- Cementitous membranes

- Epoxy coatings

Each type is described in detail in the report with value forecasts until 2021.

On the basis of Application:

- Residential buildings

- Commercial buildings

- Public infrastructure

- Industrial facilities

Each application segment is described in detail in the report with value forecasts until 2021.

On the basis of Region:

- Europe

- North America

- Asia-Pacific

- South America

- Middle East & Africa

Each region of liquid roofing is further segmented into key countries such as the U.S., Mexico, Canada, China, Japan, South Korea, India, Indonesia, Germany, the U.K., France, Turkey, Russia, the Middle East & Africa, Argentina, and Brazil.

Available Customizations: The following customization options are available for the report:

- Company information

Analysis and profiling of additional global as well as regional market players (Up to three)

The market size of liquid roofing is projected to reach USD 7.48 Billion by 2021, at a CAGR of 7.1%. It is projected to be 3,439.3 million square meters by 2021, registering a CAGR of 6.7% between 2016 and 2021. The growing construction industry, increasing demand for energy-efficient buildings, and continuous new product launch/development, agreement/collaboration, expansion, and merger & acquisition activities undertaken by companies are the key factors driving the global liquid roofing market.

Elastomeric membranes are projected to register the fastest growth in comparison to other types of liquid roofing, followed by silicone coatings in the global liquid roofing market. The demand for elastomeric membranes is mainly driven by their extensive use in the construction industry for waterproofing and protecting surfaces against abrasion and chemicals.

Residential buildings are the fastest-growing application segment in the global liquid roofing market. Liquid roofing is largely used in residential building application owing to increased urbanization across emerging economies such as India, Brazil, Indonesia, and Turkey.

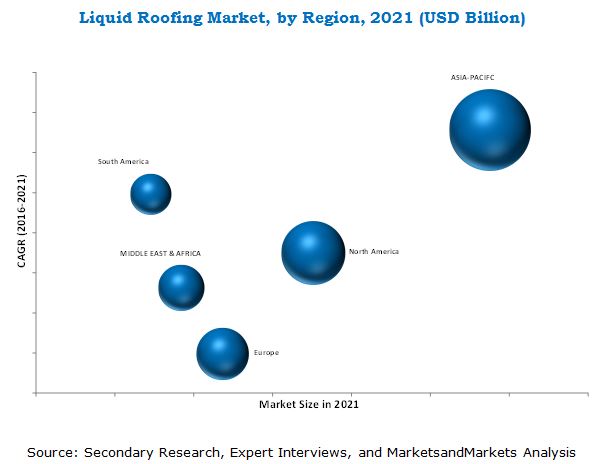

Asia-Pacific was the largest as well as the fastest-growing market for liquid roofing, in terms of value and volume, in 2015. Rising investments by foreign companies, growing production facilities, strong industrial base for construction, and rise in standard of living are the major factors contributing to the growth of the liquid roofing market in this region.

Although the liquid roofing market is gaining importance rapidly, few factors restraint its growth. Elastomeric membranes is projected to be the fastest-growing segment during the forecast period. However, higher cost of these membranes compared to their alternatives is one the major factors restraining the market growth of liquid roofing. Difficulty in applying elastomeric membranes with higher film thickness to achieve proper benefits such as crack bridging ability, high flexibility, and resistance to dirt, waterproofing, and weatherproofing is another concern for the liquid roofing market. The crack bridging capability is related to the film thickness applied. The necessity for high thickness of elastomeric membranes makes it expensive than other alternative membranes.

The cost of elastomeric membranes is similar or marginally more than single-ply membranes. However, the application cost is much higher. Elastomeric membranes are very expensive, as their application requires more skilled labor and material than a standard sheet membrane. Elastomeric membranes are especially designed by paint manufacturers to stretch beyond 300% of its original strength. They are expensive also because they provide more longevity and stretch properties.

Companies such as BASF (Germany), Dow Chemical (U.S.), Saint-Gobain (France), 3M (Minnesota), AkzoNobel N.V. (Netherlands), Bergquist Company (U.S.), Indium Corporation (U.S.), and Parker Hannifin (U.S.) are the key market players of the liquid roofing. The diverse product portfolio, strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are some of the factors that strengthen the market position of these companies in the liquid roofing market. They have been adopting various organic and inorganic growth strategies to enhance the current market scenario of liquid roofing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Liquid Roofing Market

4.2 Liquid Roofing Market Growth, By Type

4.3 Liquid Roofing Market in Asia-Pacific, By Country and Application, 2015

4.4 Liquid Roofing Market Share, By Region

4.5 Liquid Roofing Market: Developed vs Developing Nations

4.6 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Cost-Effectiveness of Liquid Roofing

5.3.1.2 Rising Demand for Energy-Efficient Buildings

5.3.2 Restraints

5.3.2.1 Higher Cost of Elastomeric Membranes

5.3.3 Opportunities

5.3.3.1 Government Policies Advancing Infrastructure Growth

5.3.3.2 Growing Requirement for Water Management Activities in Asia-Pacific

5.3.4 Challenges

5.3.4.1 Fluctuating Raw Material Prices

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Liquid Roofing Market, By Type (Page No. - 45)

7.1 Introduction

7.2 Polyurethane Coatings

7.3 Acrylic Coatings

7.4 PU/Acrylic Hybrids

7.5 Bituminous Coatings

7.6 Silicone Coatings

7.7 Modified Silane Polymers

7.8 EPDM Rubbers

7.9 Elastomeric Membranes

7.10 Cementitious Membranes

7.11 Epoxy Coatings

8 Liquid Roofing Market, By Application (Page No. - 63)

8.1 Introduction

8.2 Residential Buildings

8.3 Commercial Buildings

8.4 Public Infrastructure

8.5 Industrial Facilities

9 Liquid Roofing Market, By Region (Page No. - 72)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Western Europe

9.4.1.1 Germany

9.4.1.2 U.K.

9.4.1.3 France

9.4.1.4 Rest of Western Europe

9.4.2 Central & Eastern Europe

9.4.2.1 Russia

9.4.2.2 Turkey

9.4.2.3 Rest of Central & Eastern Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 100)

10.1 Overview

10.2 Market Share Analysis

10.3 Expansion: the Most Popular Growth Strategy

10.4 Competitive Situations and Trends

10.4.1 Expansion

10.4.2 New Product Launch

10.4.3 Acquisition

10.4.4 Joint Venture & Agreement

11 Company Profiles (Page No. - 107)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 The DOW Chemical Company

11.3 Saint-Gobain S.A.

11.4 3M Company

11.5 Akzonobel N.V.

11.6 Sika AG

11.7 Kraton Performance Polymers Inc.

11.8 GAF Materials

11.9 Johns Manville Corporation

11.10 Kemper System Inc.

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 130)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Available Customizations

12.6 Related Reports

List of Tables (72 Tables)

Table 1 Liquid Roofing Market, By Type

Table 2 Liquid Roofing Market, By Application

Table 3 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 4 Liquid Roofing Market Size, By Type, 20142021 (Million Square Meter)

Table 5 Polyurethane Coatings Market Size, By Region, 20142021 (USD Million)

Table 6 Polyurethane Coatings Market Size, By Region, 20142021 (Million Square Meter)

Table 7 Acrylic Coatings Market Size, By Region, 20142021 (USD Million)

Table 8 Acrylic Coatings Market Size, By Region, 20142021 (Million Square Meter)

Table 9 PU/Acrylic Hybrids Market Size, By Region, 20142021 (USD Million)

Table 10 PU/Acrylic Hybrids Market Size, By Region, 20142021 (Million Square Meter)

Table 11 Bituminous Coating Market Size, By Region, 20142021 (USD Million)

Table 12 Bituminous Coating Market Size, By Region, 20142021 (Million Square Meter)

Table 13 Silicone Coating Market Size, By Region, 20142021 (USD Million)

Table 14 Silicone Coating Market Size, By Region, 20142021 (Million Square Meter)

Table 15 Modified Silane Polymers Market Size, By Region, 20142021 (USD Million)

Table 16 Modified Silane Polymers Market Size, By Region, 20142021 (Million Square Meter)

Table 17 EPDM Rubbers Market Size, By Region, 20142021 (USD Million)

Table 18 EPDM Rubbers Market Size, By Region, 20142021 (Million Square Meter)

Table 19 Elastomeric Membranes Market Size, By Region, 20142021 (USD Million)

Table 20 Elastomeric Membranes Market Size, By Region, 20142021 (Million Square Meter)

Table 21 Cementitious Membranes Market Size, By Region, 20142021 (USD Million)

Table 22 Cementitious Membranes Market Size, By Region, 20142021 (Million Square Meter)

Table 23 Epoxy Coatings Market Size, By Region, 20142021 (USD Million)

Table 24 Epoxy Coatings Market Size, By Region, 20142021 (Million Square Meter)

Table 25 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 26 Liquid Roofing Market Size, By Type, 20142021 (Million Square Meter)

Table 27 Liquid Roofing Market Size in Residential Buildings, By Region, 20142021 (USD Million)

Table 28 Liquid Roofing Market Size in Residential Buildings, By Region, 20142021 (Million Square Meter)

Table 29 Liquid Roofing Market Size in Commercial Buildings, By Region, 20142021 (USD Million)

Table 30 Liquid Roofing Market Size in Commercial Buildings, By Region, 20142021 (Million Square Meter)

Table 31 Liquid Roofing Market Size in Public Infrastructure, By Region, 20142021 (USD Million)

Table 32 Liquid Roofing Market Size in Public Infrastructure, By Region, 20142021 (Million Square Meter)

Table 33 Liquid Roofing Market Size in Industrial Facilities, By Region, 20142021 (USD Million)

Table 34 Liquid Roofing Market Size in Industrial Facilities, By Region, 20142021 (Million Square Meter)

Table 35 Liquid Roofing Market Size, By Region, 20142021 (USD Million)

Table 36 Liquid Roofing Market Size, By Region, 20142021 (Million Square Meter)

Table 37 Liquid Roofing Market Size, By Country, 20142021 (USD Million)

Table 38 Liquid Roofing Market Size, By Country, 20142021 (Million Square Meter)

Table 39 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 40 Liquid Roofing Market Size, By Type, 20142021 (Million Square Meter)

Table 41 Liquid Roofing Market Size, By Application, 20142021 (USD Million)

Table 42 Size, By Application, 20142021 (Million Square Meter)

Table 43 Liquid Roofing Market Size, By Country, 20142021 (USD Million)

Table 44 Size, By Country, 20142021 (Million Square Meter)

Table 45 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 46 Size, By Type, 20142021 (Million Square Meter)

Table 47 Liquid Roofing Market Size, By Application, 20142021 (USD Million)

Table 48 Size, By Application, 20142021 (Million Square Meter)

Table 49 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 50 Size, By Type, 20142021 (Million Square Meter)

Table 51 Liquid Roofing Market Size, By Application, 20142021 (USD Million)

Table 52 Size, By Application, 20142021 (Million Square Meter)

Table 53 Liquid Roofing Market Size, By Country, 20142021 (USD Million)

Table 54 Size, By Country, 20142021 (Million Square Meter)

Table 55 Size, By Country, 20142021 (USD Million)

Table 56 Size, By Country, 20142021 (Million Square Meter)

Table 57 Size, By Country, 20142021 (USD Million)

Table 58 Size, By Country, 20142021 (Million Square Meter)

Table 59 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 60 Size, By Type, 20142021 (Million Square Meter)

Table 61 Liquid Roofing Market Size, By Application, 20142021 (USD Million)

Table 62 Size, By Application, 20142021 (Million Square Meter)

Table 63 Liquid Roofing Market Size, By Country, 20142021 (USD Million)

Table 64 Size, By Country, 20142021 (Million Square Meter)

Table 65 Liquid Roofing Market Size, By Type, 20142021 (USD Million)

Table 66 Size, By Type, 20142021 (Million Square Meter)

Table 67 Liquid Roofing Market Size, By Application, 20142021 (USD Million)

Table 68 Size, By Application, 20142021 (Million Square Meter)

Table 69 Expansion, 20132016

Table 70 New Product Launch, 20132015

Table 71 Acquisition, 20142016

Table 72 Joint Venture& Agreement, 20132014

List of Figures (63 Figures)

Figure 1 Liquid Roofing: Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Liquid Roofing Market: Research Design

Figure 4 Key Data From Secondary Sources

Figure 5 Key Data From Primary Sources

Figure 6 Key Industry Insights

Figure 7 Breakdown of Primary Interviews

Figure 8 Market Size Estimation: Top-Down Approach

Figure 9 Market Size Estimation: Bottom-Up Approach

Figure 10 Data Triangulation

Figure 11 Research Assumptions

Figure 12 Asia-Pacific Dominated the Liquid Roofing Regional Market in 2015

Figure 13 Silicone Coatings to Dominate the Liquid Roofing Market During the Forecast Period

Figure 14 Residential Buildings Application to Witness Fastest Growth During Forecast Period

Figure 15 Residential Buildings Application Dominated the Market in 2015

Figure 16 Significant Growth in the Liquid Roofing Market

Figure 17 Silicone Coatings to Be the Fastest-Growing Type of Liquid Roofing Between 2016 and 2021

Figure 18 Residential Buildings Accounted for the Largest Share in the Liquid Roofing Market

Figure 19 Asia-Pacific to Register the Highest Growth in the Liquid Roofing Market

Figure 20 Developing Nations to Emerge as A Lucrative Market in the Liquid Roofing

Figure 21 High Growth Potential in the Asia-Pacific Liquid Roofing Market

Figure 22 Drivers, Restraints, Opportunities, and Challenges for the Liquid Roofing Market

Figure 23 Value Chain Analysis of the Liquid Roofing Market

Figure 24 Porters Five Forces Analysis

Figure 25 Elastomeric Membranes to Drive the Liquid Roofing Market Between 2016 and 2021

Figure 26 Asia-Pacific to Be the Largest Polyurethane Coatings Market

Figure 27 Asia-Pacific to Be the Fastest-Growing Acrylic Coatings Market

Figure 28 Asia-Pacific to Be the Largest PU/Acrylic Hybrids Market

Figure 29 Asia-Pacific to Be the Largest Bituminous Coating Market

Figure 30 Asia-Pacific to Be the Fastest-Growing Silicone Coatings Market

Figure 31 Middle East & Africa is the Fastest-Growing Modified Silane Polymers Market

Figure 32 Asia-Pacific to Be the Fastest-Growing EPDM Rubbers Market

Figure 33 North America to Be the Second-Largest Elastomeric Membranes Market

Figure 34 Asia-Pacific to Be the Largest Cementitious Membranes Market

Figure 35 Asia-Pacific to Be the Fastest-Growing Epoxy Coatings Market

Figure 36 Residential Buildings to Drive the Liquid Roofing Market

Figure 37 Asia-Pacific to Be the Largest Liquid Roofing Market

Figure 38 Asia-Pacific to Be the Fastest-Growing Liquid Roofing Market

Figure 39 Asia-Pacific to Be the Largest Market for Liquid Roofing in Public Infrastructure

Figure 40 Asia-Pacific to Be the Fastest-Growing Liquid Roofing Market in Industrial Facilities

Figure 41 Regional Snapshot: India to Emerge as A New Strategic Destination

Figure 42 Asia-Pacific to Be an Attractive Destination for the Liquid Roofing Market

Figure 43 Asia-Pacific Market Snapshot: China is the Largest and India to Be the Fastest-Growing Markets for Liquid Roofing

Figure 44 North America Market Snapshot: the U.S. is the Largest and Mexico to Be the Fastest-Growing Markets

Figure 45 Europe Market Snapshot: Germany to Be the Largest and Fastest-Growing Market

Figure 46 South America Market Snapshot: Brazil to Be the Largest and Fastest-Growing Market

Figure 47 Middle East & Africa Market Snapshot: Saudi Arabia to Be the Largest and Fastest-Growing Market

Figure 48 Companies Adopted New Product Launch as the Key Growth Strategy, 20112016

Figure 49 BASF SE is the Largest Market Player in Terms of R&D Expenditure, 20132015 (USD Million)

Figure 50 Saint Gobain, BASF SE, and DOW Chemical are Major Market Players in the Liquid Roofing

Figure 51 Key Growth Strategies in the Liquid Roofing Market, 20112016

Figure 52 BASF SE: Company Snapshot

Figure 53 BASF SE: SWOT Analysis

Figure 54 The DOW Chemical Company: Company Snapshot

Figure 55 The DOW Chemical Company: SWOT Analysis

Figure 56 Saint Gobain S. A.: Company Snapshot

Figure 57 Saint Gobain S. A.: SWOT Analysis

Figure 58 3M Company.: Company Snapshot

Figure 59 3M Company: SWOT Analysis

Figure 60 Akzonobel N.V.: Company Snapshot

Figure 61 Akzonobel N.V.: SWOT Analysis

Figure 62 SikaAG: Company Snapshot

Figure 63 Kraton Performance Polymers Inc.: Company Snapshot

Growth opportunities and latent adjacency in Liquid Roofing Market