Lined Valve Market by Type (Ball Valve, Butterfly Valve, Globe Valve, Plug Valve, Gate Valve), Material (Polytetrafluoroethylene (PTFE), Perfluoroalkoxy (PFA), Polychlorotrifluoroethylene(PCTFE) ), Industry and Region - Global Forecast to 2028

Updated on : October 23, 2024

Lined Valve Market Size

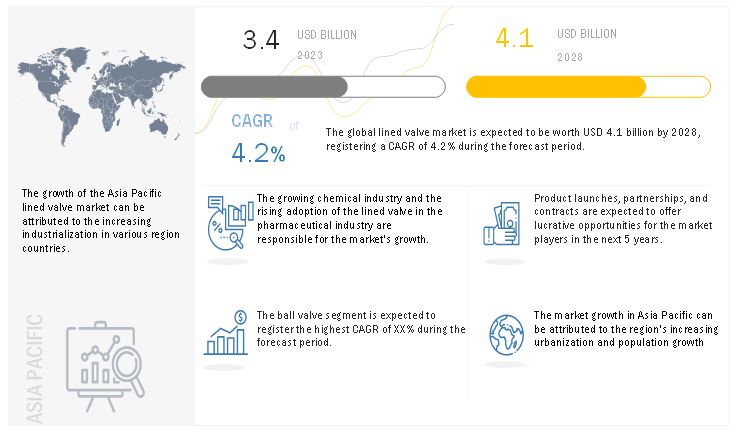

The global lined valve market size is estimated to be USD 3.4 billion in 2023 and is projected to reach USD 4.1 billion by 2028, growing at a CAGR of 4.2% during the forecast period from 2023 to 2028.

The increasing potential of the chemical industry and the rising necessity for a sterile environment and purity in the pharmaceutical industry processes are the major factors driving the growth of the lined valve market.

The lined valve market is witnessing strong growth due to increasing demand across industries such as chemicals, pharmaceuticals, oil and gas, and water treatment, where handling corrosive and abrasive fluids is essential. Lined valves, typically featuring protective linings made from materials like PTFE, offer superior corrosion resistance and leak prevention, making them ideal for managing hazardous and aggressive substances. Key trends driving the market include the growing focus on safety, operational efficiency, and the rising need for durable valves in chemical processing plants and other industrial applications. Additionally, advancements in valve technology, stringent environmental regulations, and the push for energy-efficient systems are further boosting market demand, as industries prioritize both safety and long-term cost savings.

Lined Valve Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Latest technological Trends in the Lined Valve Market

Rising adoption of AI

Artificial intelligence (AI) is one of the most emerging technologies providing end users various benefits. The world is adopting machine learning (ML) technology, which is becoming a fundamental part of various fields for solving multiple problem statements and making better decisions and predictions. Predictive analytics is an area of focus for the valves industry to reduce downtime, predict process failures due to valve malfunctioning, avoid breakdown of processes, and take preventive measures for enhancing plant efficiency. AI is used to create generative design-based software to help design multi-objective optimized valves. The software uses AI to instantly generate a valve design for a desired flow performance requirement. Such features would enable the manufacturers to design and provide products according to customer's requirements within a stipulated time.

Lined Valve Market Trends and Dynamics

DRIVERS: Growing demand for a sterile environment and purity in the process in the pharmaceutical industry

The pharmaceutical industry has been growing quickly in the past few years. Hence, the pharmaceutical industry's primary requirement is the highest quality, chemical resistance and cavity-free processes. With this industry's growth, the demand for production processes and plant components such as valves is also increasing. Further, the purity in the processes, a sterile environment, and no contamination are the major requirements currently. Moreover, in the pharmaceutical industry, high-quality materials such as PTFE and TFM are mainly used to ensure chemical resistance or contamination in the valves. Hence, growing pharmaceuticals will drive the growth of the lined valve industry.

RESTRAINT: Lack of standardized policies

Valve manufacturers must adhere to the different certifications and policies of different regions regarding valves. This factor creates diversity in product specifications due to the widespread applicability of valves in various end-user industries. However, this diversity is hindering the growth of the lined valve market, as industry players have to amend the same product according to regional policies, making it difficult for valve manufacturers to achieve an ideal installation cost. To resolve this issue, they must set up manufacturing facilities across regions, resulting in additional capital investments.

OPPORTUNITIES: Growth in automatic valve demand

The lined valve manufacturers continuously focus on automation technology to produce valves based on this technology. At present, valves with embedded processors and networking capabilities are receiving huge traction in the lined valve market. These valves help the industrial plants control the flow from a central control station. In addition, the smart or automatic valves help prevent blockage and damage to the pipeline network. Further, lined ball valves are considered reliable and durable and perform well after many cycles. Hence, they are a great choice for shutoff and control applications.

CHALLENGES: Unplanned downtime due to malfunctioning or failure of valves

Malfunctioning or failure of valves results in unplanned downtime or shutdown of a plant. In this scenario, replacing or repairing the valves are the only options. Unplanned downtimes can result in considerable losses in terms of loss of production, emergency repair costs paid to technicians, wastage of raw materials, customer dissatisfaction due to delayed delivery or poor product quality, etc. However, industry players are trying to overcome this issue by adopting monitoring, predictive maintenance, connected infrastructure, or condition monitoring solutions. Smart valve monitoring is another development through which manufacturers can overcome the issue of downtime and help customers improve process efficiency.

Lined Valve Market Segmentation

Ball valves held the largest share of the lined valve market in 2022

The lined ball valves are considered a cost-effective solution for chemical and severe corrosive applications because these applications require long-term sealing and reliability. In addition, the lined ball valves are reliable and durable and perform very well even after many cycles. Owing to this, these valves are considered a great choice for shutoff and control applications.

Polytetrafluoroethylene (PTFE) held the larger share of the lined valve market in 2022

PTFE has exceptional chemical stability and electrical insulation for strong alkalis, acids, and oxidants. Lined valves with polytetrafluoroethylene ensure longevity and are cost-effective. Hence are widely used in high-grade alloys in corrosive applications in various industries such as pharmaceutical, chemical, petrochemical, pulp and paper, fertilizer, and metallurgical.

The chemical industry held the largest share of the lined valve market in 2022

PFA-lined butterfly valves, lined ball valves, and diaphragm valves are mainly used in the chemical industry for brine preparation and caustic soda production to protect from corrosion. Manufacturers in this industry focus on enhancing business processes by implementing lined valves. Because in chemical plants, hazardous reactions may occur if chemicals come in contact with reactive materials. Therefore, lined valves are used in plants to reduce emissions, increase plant safety, and protect the environment.

Lined Valve Industry Regional Analysis

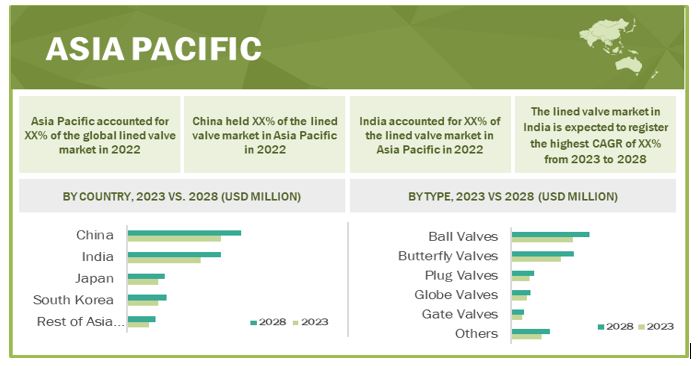

Asia Pacific held the largest share of the lined valve market in 2022

The lined valve market in Asia Pacific for the semiconductor industry is growing significantly; a similar trend will likely be observed in the coming years. Further, dense population, high per capita income, large-scale industrialization, and rapid urbanization are the major factors fueling the growth of the market in the region. China is considered the second largest pharmaceutical market worldwide, which is the key factor for the growth opportunities of lined valves in this country. South Korea is a leading manufacturer of semiconductors, wherein large amounts of ultrapure water are used during the manufacturing process. The demand for lined valves for ultrapure, hygienic, and cryogenic applications promotes the growth of the lined valve market.

Lined Valve Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Lined Valve Companies - Key Market Players

The lined valve companies is dominated by a few globally established players such as

- Emerson (US),

- Flowserve Corporation (US),

- Crane Co. (Sweden),

- Neles (Finland),

- KITZ Corporation (Japan).

Lined Valve Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 3.4 billion in 2023 |

|

Expected Value |

USD 4.1 billion by 2028 |

|

Growth Rate |

CAGR of 4.2% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Material, and Industry |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Emerson (US), Flowserve Corporation (US), Crane Co. (Sweden), Neles (Finland), KITZ Corporation (Japan), Entegris (US), Samson (Germany), Bray International (US), ChemValve-Schmid AG (Switzerland), and EBRO ARMATUREN Gebr. Bröer GmbH (Germany), among others – A total of 25 players have been covered. |

Lined Valve Market Highlights

This research report segments the lined valve market share based on offering, technique, workflow, and region.

|

Aspect |

Details |

|

By Type: |

|

|

By Material: |

|

|

By Industry: |

|

|

By Region: |

|

Recent Developments in Lined Valve Industry

- In November 2022, Neles, a global provider of flow control solutions, completed the acquisition of the valve and pump businesses of the Finland-based technology company, Flowrox. Through this acquisition, Neles aims to expand its product portfolio and exposure to the metals and mining industry.

- In May 2022, Flowserve Corporation, a leading global provider of comprehensive flow control solutions, announced that they received a contract from OMV Aktiengesellschaft (OMV) for providing control and ball valves to OMV’s chemical recycling demonstration plant in Schwechat, Austria. The company, through this deal, aims to expand its diversification, decarbonization, and digitization strategy.

- In December 2020, ChemValve-Schmid AG, a leading manufacturer of valves, introduced their new product line of ChemBall CSB Lined Ball Valves, which feature an additional set of chevrons for minimizing leakage and optimizing operational safety. The new valves also feature the TrueFloat technology, in which a one-piece PFA jacket encloses the movable metallic connection between the shaft and the ball core.

- In December 2020, GEMÜ Group, a leading manufacturer of valves, introduced the GEMÜ R563 eSyStep lined globe valve, which is suitable for control applications with low flow rates. They feature a motorized actuator and offer Kv values from 63 I/h to 3,300 I/h.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the lined valve market size from 2023 to 2028?

The global lined valve market is expected to record a CAGR of 4.2% from 2023–2028.

What are the driving factors for the lined valve market share?

The rising demand for a sterile environment, purity in the process in the pharmaceutical industry, and the growing potential of the chemical industry are key driving factors.

Which are the significant players operating in the lined valve market share?

Emerson (US), Flowserve Corporation (US), Crane Co. (Sweden), Neles (Finland), and KITZ Corporation (Japan) are some of the major companies operating in the lined valve market.

Which region will lead the lined valve market in the future?

Asia Pacific is expected to lead the lined valve market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

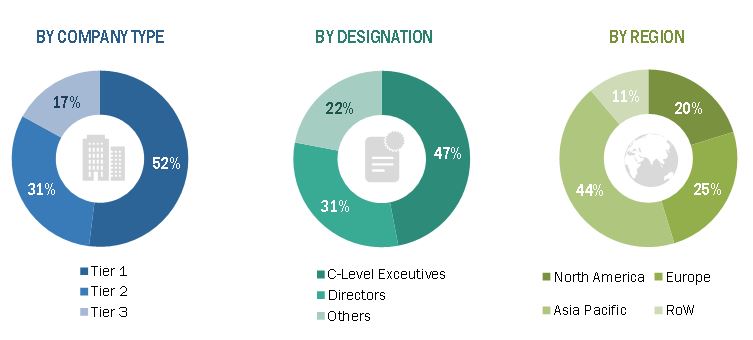

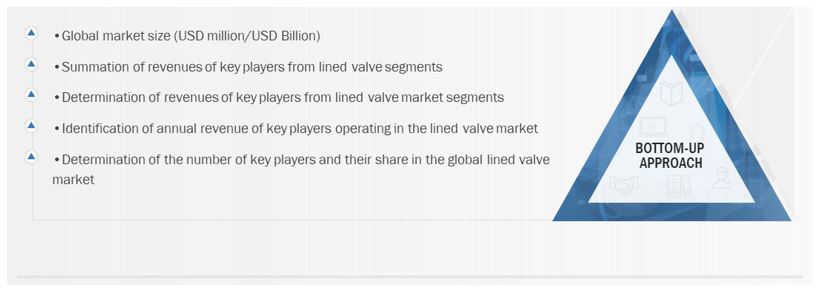

The study involved four major activities in estimating the current size of the lined valve market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been conducted mainly to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends, geographic markets, and key developments from market and technology oriented perspectives.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the lined valve ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the overall lined valve market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the lined valve market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the lined valve market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, split, and breakdowns, have been determined through secondary sources, which are further verified through primary sources.

Global lined valve market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the lined valve market, in terms of value, based on offering, technique, and workflow

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the lined valve ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the lined valve market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lined Valve Market