Valve Controller Market by Type (Traditional and Digital Valve Controller), Digital Valve Controller Communication Protocol, End-use Industry (Oil & Gas, Energy & Power, Water & Wastewater Treatment), and Geography - Global forecast to 2025

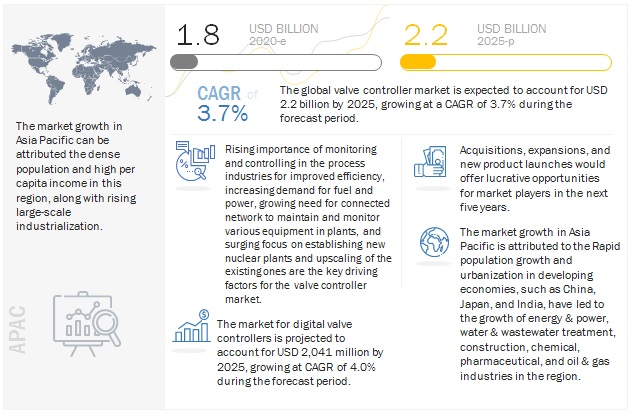

[163 Pages Report] The valve controller market size was USD 1.8 billion in 2020 and is projected to reach USD 2.2 billion by 2025. It is expected to register a CAGR of 3.7% during the forecast period. Rising importance of monitoring and controlling in the process industries for improved efficiency, increasing demand for fuel and power, growing need for connected network to maintain and monitor various equipment in plants, and surging focus on establishing new nuclear plants and upscaling of the existing ones are the key driving factors for the valve controller market. The introduction of IIoT & industry 4.0 and the need for valve replacement and adoption of smart valves to offer improved customer service are among the other factors fueling the valve controller market. However, a rise in collaboration among industry players can hamper the growth of the valve controller market.

Attractive Opportunities in Valve Controller Market

Market Dynamics:

Driver: Rising importance of monitoring & controlling in the process industries for improved efficiency

A process industry undergoes various complex processes until the time it obtains an end-product. These processes are interlinked and interdependent. They need to be synchronized to enable their completion in stipulated time. The overall efficiency of the industry is directly proportional to the timely operation of these processes. To increase efficiency, it is necessary to uniformly monitor and control the processes to avoid shutdowns or accidents. Hence, the importance of process control and monitoring is growing in the process industries to increase profitability. There is also a demand for valve automation solutions that can work in line with this scenario.

The use of control valve assembly in the chemical, pharmaceutical, oil & gas, food & beverage, and water & wastewater treatment industries, helps in keeping a close watch over the flow, temperature, and pressure of fluid or gas. The control valve used in this assembly needs to be accurate and responsive in its operation so that no breakdowns occur. This can be achieved with a valve controller, which controls the position of the control valve as per the input signal and feedback loop signal, thus enhancing the operational efficiency of the control valve. Valve controllers help in faster and more accurate control of the processes. Digital valve controllers help in remote monitoring of the processes as well.

Restraint: Lack of standardized norms and governing policies

The manufacturers of valve controllers need to adhere to certain norms and regulations. Different regions have different certifications and policies with respect to control valves. This factor creates diversity in demand due to the wide applicability of valve controllers in various industries, such as oil & gas, food & beverage, pharmaceutical, energy & power, water & wastewater treatment, building & construction, chemical, and pulp & paper. Such diversity acts as a restraining factor as industry players have to amend the same product based on regional policies. Thus, this makes it difficult for industry players to achieve an ideal cost of installation. To resolve this issue, they have to invest their resources in setting up manufacturing facilities across the world, thus requiring additional capital.

Opportunity: Need for valve replacement and adoption of smart valves

Aging infrastructure in oil & gas and water & wastewater treatment industries is a primary concern in several countries. For instance, the US has a wide network of old pipelines that are used for transporting critical commodities that include natural gas, oil, water, and wastewater. Valves used in old infrastructure are also on the verge of replacement as they have surpassed their operational life. Hence, it is important to replace such valves for improved performance and better worker safety. The need for the replacement or repair of old infrastructure is expected to create a demand for new control valves. End users are focusing on adopting highly reliable, integrated, and cutting-edge solutions to resolve the issue of maintenance. They are adopting valve controllers to efficiently control and monitor the operation of control valves and the processes. Valve controllers make it possible to add on control features for valves that are used to make valve operations more reliable and effective, and their maintenance easier.

Challenge: Rise in collaboration among industry players

The valve controller market is one of the highly fragmented markets. Mergers and acquisitions are expected to help manufacturers enhance their product portfolio and acquire a larger market share. Due to declining oil prices, big industry players are acquiring small companies to ensure sustainable growth and profitability. Hence, this is expected to result in increased competition in the valve controller market.

Digital valve controller projected to account for large size of the valve controller market during the forecast period.

Digital valve controllers are the most widely used valve controllers due to their several applications across all industry verticals. The feedback-based controlling of the valve operation helps in better performance of the complete valve assembly. Digital valve controllers are more accurate and reliable as compared to traditional valve controllers. For example, in China, at one of the worlds largest integrated chemical facilities, instrument engineers faced pipeline vibration that was destroying a steam service valves instrumentation. Since it was not feasible to change the process conditions or piping, the valve positioner had to be replaced about every three months. However, to solve this problem, a DVC6200f (offered by Emerson) was installed to take advantage of the units resistance to high levels of vibration, as well as its FOUNDATION Fieldbus communications capability. The digital valve controller performed accurately and reliably, saving the facility USD 40,000 per year for replacement instruments and also for lost production and labor. Such applications are replacing the valve positioners or traditional valve controllers with digital valve controllers.

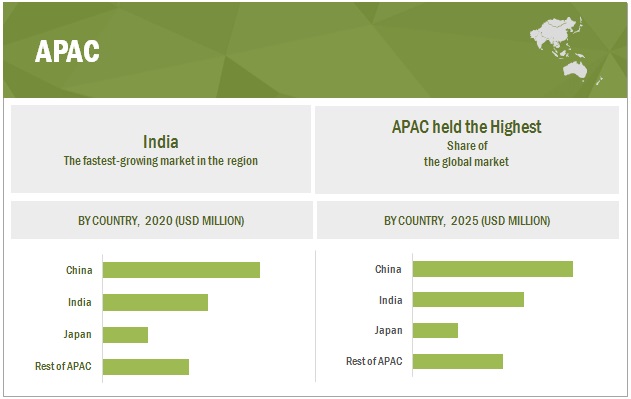

APAC estimated to account for the largest size of the valve controller market in 2020.

Rapid population growth and urbanization in developing economies, such as China, Japan, and India, have led to the growth of energy & power, water & wastewater treatment, construction, chemical, pharmaceutical, and oil & gas industries. This, in turn, increased the demand for control valve assemblies with valve controllers until 2019. However, COVID-19, a global health emergency and also an economic crisis, has hit the valve controller market in 2020 adversely. The valve controller market is expected to witness a significant decline as few of the major industries adopting valves and valve controllers are oil & gas, energy & power, and water & wastewater treatment. These industries are non-operational due to several government implications that include lockdown, foreign trade, and a halt on the supply of non-essentials goods & services as precautionary measures for the safety of people. There is also a huge supply-demand gap due to the decline in global demand.

Key Market Players

Emerson (US), Metso (Finland), CIRCOR (US), ABB (Switzerland), Schneider electric (France), Flowserve Corporation (US), SMC Corporation (Japan), Azbil (Japan), Baker Hughes (US), Rotork (UK), Siemens (Germany), IMI (UK), CLA-VAL (US), Dymax Corporation (US), Tokyo Keiki (Japan), Curtiss Wright Group (US), and Samson Controls (Germany) are few of the major players in the valve controller market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, DVC by communication protocol, end-use industry, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Emerson (US), Metso (Finland), CIRCOR (US), ABB (Switzerland), Schneider electric (France), Flowserve Corporation (US), SMC Corporation (Japan), Azbil (Japan), Baker Hughes (US), Rotork (UK), Siemens (Germany), IMI (UK), CLA-VAL (US), Dymax Corporation (US), Tokyo Keiki (Japan), Curtiss Wright Group (US), Samson Controls (Germany), VRG Controls (US), Power-Genex (South Korea), Akron Brass Company (USA), KSB (Germany), KZ Valve (US), Gefran S.P.A (Italy), Enovation Controls (US), Yeagle Technology Inc. (US), PR Electronics (Europe), Val Controls A/S (Europe), Elkhart Brass Manufacturing Company Inc. (US), and Axiomatic Technologies Corporation (Canada). |

In this research report, the interactive kiosk market has been segmented on the basis of type, DVC by communication protocol, end-use industry, and geography.

Valve Controller Market, by Type

- Traditional

- Digital

Digital Valve Controller Market, by Communication Protocol

- FOUNDATION Fiedlbus

- Highway Addressable Remote Transducer (HART)

- PROFIBUS

- Others

Valve Controller Market, by End-use Industry

- Oil & Gas

- Energy & Power

- Water & Wastwater Treatment

- Pharmaceutical & Healthcare

- Food & Beverage

- Chemical

- Building & Construction

- Pulp & Paper

- Metals & Mining

- Others (Corporate and Education)

Valve Controller Market, by Geography

- North America

- Europe

- APAC

- RoW

Recent Developments

- In December 2019, Metso signed a distributor agreement with Axel Larsson to provide customers across Sweden with its valve offerings, especially in the energy and mining sectors. This will help the company to expand its presence in Sweden and increase the brand value to a substantial extent.

- In December 2019, Metsos valve business, Future Neles Corporation, has established two new service centers in Lisbon, Portugal, and in Mulhouse area, France.

- In September 2019, Emerson acquired Spence and Nicholson Steam Technology Product Lines from Circor International. The acquisition complements Emersons broad portfolio of steam system solutions for process industries and commercial buildings.

- In July 2019, Rotork launched Smart Positioner YT-3700. YT-3700 / 3750 series Smart Valve Positioner that accurately control valve stroke in response to an input signal of 4~20mA from the controller.

- In 2019, Cla-val updated its online valve and other water system assets monitoring software, Link2Valves, to allow asset management of electronic and hydraulic valves. This will enhance the performance of valves as well as valve controllers with the proper support of planning and maintenance (hydraulic function and hydraulic to electronic function modification).

Frequently Asked Questions (FAQ):

Which are the major companies in the valve controller market? What are their major strategies to strengthen their market presence?

The major companies in the valve controller market are - Emerson Electric (US), Flowserve (US), ABB (Switzerland), Metso (Finland), Schneider Electric (France), and Tokyo Keiki (Japan). The players in this market have adopted partnerships, mergers, acquisitions, and agreements growth strategies to enhance and increase their market share.

Which is the potential market for Valve Controllers in terms of region?

APAC is expected to hold the largest share of 39% of the valve controller market in 2020. Rapid population growth and urbanization in developing economies, such as China, Japan, and India, have led to the growth of energy & power, water & wastewater treatment, construction, chemical, pharmaceutical, and oil & gas industries in the region. This, in turn, increased the demand for control valve assemblies with valve controllers until 2019. However, COVID-19, a global health emergency and also an economic crisis, has hit the valve controller market in 2020 adversely. The valve controller market is expected to witness a significant decline as few of the major industries adopting valves and valve controllers are oil & gas, energy & power, and water & wastewater treatment. These industries are non-operational due to several government implications that include lockdown, foreign trade, and a halt on the supply of non-essential goods & services as precautionary measures for the safety of people. There is also a huge supply-demand gap due to the decline in global demand.

What are the opportunities for new market entrants?

There are significant opportunities in the valve controller market such need for valve replacement and adoption of smart valves and introduction of IIoT and Industry 4.0.

Which end-user industries are expected to drive the growth of the market in the next 5 years?

In the energy & power industry, there is a strong need to develop infrastructure to balance the future demand for energy. This trend is creating an opportunity for manufacturers to design and develop their products as per the requirements and standards of the industry. Control valves, specifically with digital valve controllers, are in demand for safety applications and critical operations.

Which type of valve controller is expected to drive the growth of the market in the next 5 years?

Digital valve controllers are the most widely used valve controllers due to their several applications across all industry verticals. The feedback-based controlling of the valve operation helps in better performance of the complete valve assembly. Digital valve controllers are more accurate and reliable as compared to traditional valve controllers. They are available with various communication protocols, such as FOUNDATION Fieldbus, PROFIBUS, HART, and CANopen, among other connectivity options. The use of communication protocols depends on the end-use applications and the facility they are being used at. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

3.1 COVID-19 & OIL PRICE CRISIS IMPACT ON VALVE CONTROLLER MARKET: REALISTIC SCENARIO

3.2 COVID-19 & OIL PRICE CRISIS IMPACT ON VALVE CONTROLLER MARKET: OPTIMISTIC SCENARIO

3.3 COVID-19 & OIL PRICE CRISIS IMPACT ON VALVE CONTROLLER MARKET: PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN VALVE CONTROLLER MARKET

4.2 MARKET, BY TYPE

4.3 DIGITAL VALVE CONTROLLER MARKET, BY COMMUNICATION PROTOCOL

4.4 MARKET IN APAC, BY COUNTRY AND END-USE INDUSTRY, 2025

4.5 MARKET, BY COUNTRY (2025)

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising importance of monitoring & controlling in the process industries for improved efficiency

5.2.1.2 Increasing demand for fuel and power

5.2.1.3 Growing need for connected networks to maintain and monitor various equipment in plants

5.2.1.4 Surging focus on establishing new nuclear power plants and upscaling of existing ones

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardized norms and governing policies

5.2.3 OPPORTUNITIES

5.2.3.1 Need for valve replacement and adoption of smart valves

5.2.3.2 Introduction of IIoT and Industry 4.0

5.2.4 CHALLENGES

5.2.4.1 Rise in collaboration among industry players

5.3 VALUE CHAIN ANALYSIS

5.4 COVID-19 IMPACT ON KEY END-USE INDUSTRIES OF VALVE CONTROLLER

5.4.1 COVID-19 IMPACT ON OIL & GAS INDUSTRY

5.4.2 COVID-19 IMPACT ON ENERGY & POWER INDUSTRY

5.4.3 COVID-19 IMPACT ON WATER & WASTEWATER TREATMENT INDUSTRY

6 VALVE CONTROLLER MARKET, BY TYPE (Page No. - 49)

6.1 INTRODUCTION

6.2 TRADITIONAL VALVE CONTROLLER

6.2.1 TRADITIONAL VALVE CONTROLLERS BEING REPLACED BY DIGITAL VALVE CONTROLLERS

6.3 DIGITAL VALVE CONTROLLER

6.3.1 KEY FEATURES OF DIGITAL VALVE CONTROLLERS MAKE THEM SUITABLE FOR USE ACROSS INDUSTRIES

7 DIGITAL VALVE CONTROLLER MARKET, BY COMMUNICATION PROTOCOL (Page No. - 53)

7.1 INTRODUCTION

7.2 FOUNDATION FIELDBUS

7.2.1 FOUNDATION FIELDBUS TO BE THE FASTEST-GROWING SEGMENT

7.3 HIGHWAY ADDRESSABLE REMOTE TRANSDUCER (HART)

7.3.1 WIDELY USED COMMUNICATION PROTOCOL IN SEVERAL INDUSTRIES

7.4 PROFIBUS (PROCESS FIELD BUS)

7.4.1 PREFERRED IN PROCESS AUTOMATION APPLICATIONS AND FOR DECENTRALIZED EQUIPMENT

7.5 OTHERS

7.5.1 ETHERNET

7.5.2 CANOPEN

7.5.3 MODBUS

7.5.4 BLUETOOTH

8 VALVE CONTROLLER MARKET, BY END-USE INDUSTRY (Page No. - 59)

8.1 INTRODUCTION

8.2 OIL & GAS

8.2.1 OIL & GAS INDUSTRY TO WITNESS A MAJOR SETBACK IN 2020 DUE TO COVID-19 PANDEMIC AND OIL PRICE CRISIS

8.3 WATER & WASTEWATER TREATMENT

8.3.1 RISE IN DEMAND FOR CLEANER WATER AND MODIFICATION IN OLDER WATER INFRASTRUCTURE TO AUGMENT DEMAND FOR VALVE CONTROLLERS

8.4 ENERGY & POWER

8.4.1 INCREASING DEMAND FOR ENERGY IN DEVELOPING COUNTRIES TO BOOST THE MARKET BY 2025

8.5 PHARMACEUTICAL & HEALTHCARE

8.5.1 NORTH AMERICA TO DRIVE THE MARKET IN THIS SEGMENT

8.6 FOOD & BEVERAGE

8.6.1 IMPLEMENTATION OF VALVE CONTROLLERS ALONG WITH CONTROL VALVES INCREASE THE EFFICIENCY OF PROCESSES

8.7 CHEMICAL

8.7.1 VALVE CONTROLLERS MEET THE MOST STRINGENT PROTECTION REQUIREMENTS AND STANDARDS IN THIS INDUSTRY

8.8 BUILDING & CONSTRUCTION

8.8.1 BUILDING & CONSTRUCTION INDUSTRY TO WITNESS SIGNIFICANT DECLINE IN 2020 DUE TO COVID-19 IMPACT ON SMART INFRASTRUCTURE PROJECTS

8.9 PULP & PAPER

8.9.1 VALVE CONTROLLERS HELP IN PREDICTIVE MAINTENANCE OF EQUIPMENT USED IN PULP & PAPER MANUFACTURING

8.10 METALS & MINING

8.10.1 GROWING DEMAND FOR PREDICTIVE MAINTENANCE ENCOURAGING THE USE OF VALVE CONTROLLERS

8.11 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 85)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Aging water & wastewater infrastructure in the US generating demand for valve controllers

9.2.2 CANADA

9.2.2.1 Rise in energy demand to propel the market growth in the next few years

9.2.3 MEXICO

9.2.3.1 An uptrend in the water & wastewater treatment industry to drive the market in Mexico

9.3 EUROPE

9.3.1 UK

9.3.1.1 Water industry to fuel the demand for control valves

9.3.2 GERMANY

9.3.2.1 Growth of process industries encouraging the valve controller market growth in the country

9.3.3 FRANCE

9.3.3.1 Energy & power sector to drive the valve controller market in the country

9.3.4 ITALY

9.3.4.1 Market to be driven by upcoming investments in water & wastewater treatment industry

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC (APAC)

9.4.1 CHINA

9.4.1.1 market in China to be driven by the demand from the energy & power sector

9.4.2 JAPAN

9.4.2.1 Reintegration of nuclear power plants to boost the market in the country

9.4.3 INDIA

9.4.3.1 India to be the fastest-growing country in the APAC valve controller market

9.4.4 REST OF APAC

9.5 REST OF THE WORLD (ROW)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 COVID-19 pandemic to adversely affect the Middle East & African market

9.5.2 SOUTH AMERICA

9.5.2.1 Market projected to register slower growth due to the pandemic

10 COMPETITIVE LANDSCAPE (Page No. - 107)

10.1 COMPETITIVE STRATEGIES

10.2 COMPETITIVE ANALYSIS

10.2.1 RANKING ANALYSIS OF VALVE CONTROLLER MARKET, 2019

10.3 COMPETITIVE SCENARIO

10.3.1 PARTNERSHIPS, MERGERS, ACQUISITIONS, AND AGREEMENTS

10.3.2 PRODUCT DEVELOPMENTS/LAUNCHES

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 VISIONARY LEADERS

10.4.2 DYNAMIC DIFFERENTIATORS

10.4.3 INNOVATORS

10.4.4 EMERGING COMPANIES

11 COMPANY PROFILES (Page No. - 113)

(Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view)*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 EMERSON

11.2.2 METSO

11.2.3 CIRCOR INTERNATIONAL INC.

11.2.4 ABB

11.2.5 SCHNEIDER ELECTRIC

11.2.6 FLOWSERVE CORPORATION

11.2.7 SMC CORPORATION

11.2.8 AZBIL

11.2.9 BAKER HUGHES

11.2.10 ROTORK

11.2.11 SIEMENS

11.2.12 IMI

11.2.13 CLA-VAL

11.2.14 DYMAX CORPORATION

11.2.15 TOKYO KEIKI

11.3 RIGHT TO WIN

11.4 OTHER IMPORTANT PLAYERS

11.4.1 CURTISS-WRIGHT CORPORATION

11.4.2 SAMSON CONTROLS

11.4.3 VRG CONTROLS

11.4.4 POWER-GENEX

11.4.5 DWYER INSTRUMENTS

11.4.6 AKRON BRASS COMPANY

11.4.7 KSB

11.4.8 KZ VALVE

11.4.9 GEFRAN S.P.A

11.4.10 ENOVATION CONTROLS

11.4.11 YEAGLE TECHNOLOGY INC

11.4.12 PR ELECTRONICS

11.4.13 VAL CONTROLS A/S

11.4.14 ELKHART BRASS MANUFACTURING COMPANY, INC.

11.4.15 AXIOMATIC TECHNOLOGIES CORPORATION

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 157)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (78 Tables)

TABLE 1 VALVE CONTROLLER MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 2 DIGITAL VALVE CONTROLLER MARKET, BY COMMUNICATION PROTOCOL, 20172025 (USD MILLION)

TABLE 3 MARKET SIZE, BY END-USE INDUSTRY, 20172025 (USD MILLION)

TABLE 4 MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 5 MARKET SIZE IN OIL & GAS END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 6 MARKET SIZE IN OIL & GAS END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 7 MARKET SIZE IN OIL & GAS END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 8 MARKET SIZE IN OIL & GAS END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 9 MARKET SIZE IN WATER & WASTEWATER TREATMENT END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 10 MARKET SIZE IN WATER & WASTEWATER TREATMENT END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 11 MARKET SIZE IN WATER & WASTEWATER TREATMENT END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 12 MARKET SIZE IN WATER & WASTEWATER TREATMENT END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 13 MARKET SIZE IN WATER & WASTEWATER TREATMENT END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 14 MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 15 MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 16 MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 17 MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 18 MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 19 MARKET SIZE IN PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 20 MARKET SIZE IN PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 21 MARKET SIZE IN PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 22 MARKET SIZE IN PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 23 MARKET SIZE IN PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 24 MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 25 MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 26 MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 27 MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 28 MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 29 MARKET SIZE IN CHEMICAL END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 30 MARKET SIZE IN CHEMICAL END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 31 MARKET SIZE IN CHEMICAL END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 32 VALVE CONTROLLER MARKET SIZE IN CHEMICAL END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 33 MARKET SIZE IN CHEMICAL END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 34 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 35 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 36 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 37 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 38 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 39 MARKET SIZE IN PULP & PAPER END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 40 MARKET SIZE IN PULP & PAPER END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 41 MARKET SIZE IN PULP & PAPER END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 42 MARKET SIZE IN PULP & PAPER END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 43 MARKET SIZE IN PULP & PAPER END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 44 MARKET SIZE IN METALS & MINING END-USE INDUSTRY, BY REGION, 20172025 (USD THOUSAND)

TABLE 45 MARKET SIZE IN METALS & MINING END-USE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 46 MARKET SIZE IN METALS & MINING END-USE INDUSTRY IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 47 MARKET SIZE IN METALS & MINING END-USE INDUSTRY IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 48 MARKET SIZE IN METALS & MINING END-USE INDUSTRY IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 49 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 20172025 (USD THOUSAND)

TABLE 50 VALVE CONTROLLER MARKET SIZE IN OTHER END-USE INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 51 MARKET SIZE IN OTHER END-USE INDUSTRIES IN EUROPE, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 52 MARKET SIZE IN OTHER END-USE INDUSTRIES IN APAC, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 53 VALVE CONTROLLER MARKET SIZE IN OTHER END-USE INDUSTRIES IN ROW, BY REGION, 20172025 (USD THOUSAND)

TABLE 54 MARKET SIZE, BY REGION, 20172025 (USD MILLION)

TABLE 55 MARKET SIZE IN NORTH AMERICA, BY COUNTRY, 20172025 (USD MILLION)

TABLE 56 MARKET SIZE IN NORTH AMERICA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 57 MARKET SIZE IN US, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 58 MARKET SIZE IN CANADA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 59 MARKET SIZE IN MEXICO, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 60 MARKET SIZE IN EUROPE, BY COUNTRY, 20172025 (USD MILLION)

TABLE 61 MARKET SIZE IN EUROPE, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 62 MARKET SIZE IN UK, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 63 MARKET SIZE IN GERMANY, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 64 MARKET SIZE IN FRANCE, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 65 MARKET SIZE IN ITALY, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 66 MARKET SIZE IN REST OF EUROPE, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 67 MARKET SIZE IN APAC, BY COUNTRY, 20172025 (USD MILLION)

TABLE 68 MARKET SIZE IN APAC, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 69 MARKET SIZE IN CHINA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 70 MARKET SIZE IN JAPAN, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 71 MARKET SIZE IN INDIA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 72 MARKET SIZE IN REST OF APAC, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 73 MARKET SIZE IN ROW, BY REGION, 20172025 (USD MILLION)

TABLE 74 MARKET SIZE IN ROW, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 75 MARKET SIZE IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 76 MARKET SIZE IN SOUTH AMERICA, BY END-USE INDUSTRY, 20172025 (USD THOUSAND)

TABLE 77 KEY PARTNERSHIPS, MERGERS, ACQUISITIONS, AND AGREEMENTS (2017 2019)

TABLE 78 KEY PRODUCT DEVELOPMENTS/LAUNCHES (2017 2019)

LIST OF (50 Figures)

FIGURE 1 VALVE CONTROLLER MARKET SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 SUPPLY SIDE ANALYSIS: MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET: DATA TRIANGULATION

FIGURE 7 MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS (20172025)

FIGURE 8 MARKET SIZE (20172025)

FIGURE 9 DIGITAL VALVE CONTROLLER SEGMENT TO HOLD LARGER MARKET SHARE IN 2020

FIGURE 10 HART TO CAPTURE LARGEST SHARE OF DIGITAL VALVE CONTROLLER MARKET, BY COMMUNICATION PROTOCOL IN 2020

FIGURE 11 ENERGY & POWER TO THE BE FASTEST-GROWING END-USE INDUSTRY

FIGURE 12 APAC TO HOLD LARGEST SHARE OF MARKET IN 2020

FIGURE 13 RISING IMPORTANCE OF MONITORING & CONTROLLING IN PROCESS INDUSTRIES IS DRIVING THE MARKET

FIGURE 14 DIGITAL VALVE CONTROLLER TO BE THE LARGER SEGMENT IN 2020

FIGURE 15 HART COMMUNICATION PROTOCOL TO BE THE LARGEST SEGMENT OF THE MARKET

FIGURE 16 CHINA AND ENERGY & POWER SEGMENT TO ACCOUNT FOR THE LARGEST SHARES

FIGURE 17 US TO BE THE LARGEST MARKET

FIGURE 18 MARKET DYNAMICS

FIGURE 19 MARKET DRIVERS AND THEIR IMPACT

FIGURE 20 GLOBAL TREND OF PRIMARY ENERGY CONSUMPTION (IN MTOE)

FIGURE 21 MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 22 MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 23 VALVE CONTROLLER MARKET CHALLENGES AND THEIR IMPACT

FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING RAW MATERIAL AND COMPONENT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURING PHASE

FIGURE 25 MARKET, BY TYPE

FIGURE 26 DIGITAL VALVE CONTROLLER TO DOMINATE THE MARKET DURING 20202025

FIGURE 27 DIGITAL VALVE CONTROLLER MARKET, BY COMMUNICATION PROTOCOL

FIGURE 28 HART COMMUNICATION PROTOCOL TO LEAD THE DIGITAL MARKET DURING 20202025

FIGURE 29 MARKET, BY END-USE INDUSTRY

FIGURE 30 MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 31 APAC TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 32 SNAPSHOT OF MARKET IN NORTH AMERICA

FIGURE 33 SNAPSHOT OF MARKET IN EUROPE

FIGURE 34 SNAPSHOT OF MARKET IN APAC

FIGURE 35 COMPANIES IN MARKET ADOPTED ACQUISITIONS, MERGERS, AND AGREEMENTS AS KEY GROWTH STRATEGIES FROM 2017 TO 2019

FIGURE 36 MARKET RANKING OF TOP 5 PLAYERS IN VALVE CONTROLLER MARKET, 2019

FIGURE 37 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 38 EMERSON: COMPANY SNAPSHOT

FIGURE 39 METSO: COMPANY SNAPSHOT

FIGURE 40 CIRCOR INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 41 ABB: COMPANY SNAPSHOT

FIGURE 42 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 43 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

FIGURE 44 SMC CORPORATION: COMPANY SNAPSHOT

FIGURE 45 AZBIL: COMPANY SNAPSHOT

FIGURE 46 BAKER HUGHES: COMPANY SNAPSHOT

FIGURE 47 ROTORK: COMPANY SNAPSHOT

FIGURE 48 SIEMENS: COMPANY SNAPSHOT

FIGURE 49 IMI: COMPANY SNAPSHOT

FIGURE 50 TOKYO KEIKI: COMPANY SNAPSHOT

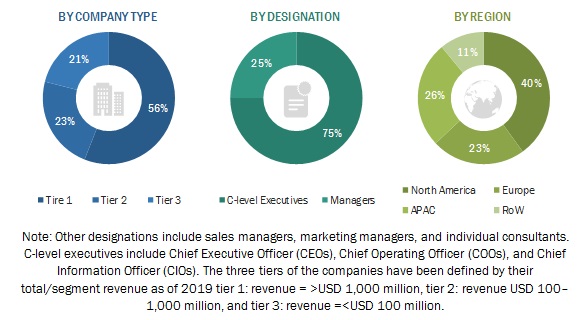

The study involved four major activities for estimating the current size of the valve controller market. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and sub-segments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, valve-related journals, Valve Manufacturers Association of America (VMA0; Valve Magazine; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size estimations, which were further validated through the primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research was conducted after understanding and analyzing the valve controller market through secondary research. Several primary interviews were conducted with the key opinion leaders from both demand and supply side across four regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). RoW comprises the Middle East and Africa and South America. Approximately 25% of the primary interviews were conducted with the demand side, while approximately 75% with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for approximately 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the valve controller market. These methods were also used extensively to estimate the size of the markets based on various segments. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets were identified through extensive secondary research

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and sub-segment. The data was triangulated by studying various factors and trends from demand and supply sides across different end users.

Study Objectives

- To describe and forecast the valve controller market, by type, by communication protocol (digital valve controller), end-use industry, and geography, in terms of value

- To describe and forecast the market for various segments with regard to four main regionsNorth America, Asia Pacific (APAC), Europe, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To study a complete valve controller value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile key players, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches in the market, such as product launches, acquisitions, mergers, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Valve Controller Market