Valve Driver Market Size, Share, Statistics, Industry Growth Analysis with COVID-19 Impact, by Function (Solenoid, Proportional), Valve Type (Conventional Control Valve, Expansion Valve), End-User (Commercial & Residential, Industrial, and Motion Equipment), Region - Global Forecast to 2025

Updated on : April 07, 2024

The global valve driver market size is expected to grow from USD 421 million in 2020 to USD 519 million by 2025, at a CAGR of 4.3%. Increase in government regulations and policies for saving energy and increase in focus on enhancing efficiency and power consumption are the critical factors driving the growth of the valve driver market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the valve driver market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. This is mainly due to the disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production across industries has been limited due to the pandemic resulting in the shortage of raw material, the decline in exports, and the disruptions in the supply chain are the major factors contributing to the decline in the production. Most of the revenue generated in the valve driver market is from the commercial & residential and industrial end users. As the valve drivers are directly proportional to commercial & manufacturing activities, the valve driver industry is thus getting affected by COVID-19. This has resulted in a lower estimated year-on-year growth rate for 2020 as compared with 2019.

Market Dynamics

DRIVERS: Increase in Government Regulations and Policies for Saving Energy

With the new performance requirements by government and category associations for saving energy, end users, such as residential & commercial, industrial, and motion equipment, would require energy-efficient systems for their processes, which, in turn, increases the demand for valve drivers due to its energy-efficient nature. Carbon emission is a significant challenge for energy & power vertical. CO2 levels influence air quality, and according to many experts, they contribute to global warming. These concerns are encouraging a shift from coal to gas renewables, and now to electricity. The introduction of environment, health, and safety regulations in the chemicals vertical regarding volatile organic compounds (VOCs) require end-user industries to adopt new, better, and innovative valve driver. These new regulations are encouraging consumers to deploy the valve driver to adhere to stringent standards being imposed.

RESTRAINT: Lack of standardized certifications and government policies

Key problems of many industrial devices and equipment are the lack of standardization in equipment and protocols being used. Due to this, there are cases of mismatch occurring in many of the existing databases. Valve driver manufacturers need to adhere to several norms and regulations. To implement proper standardization and certification for ensuring authenticity, which is creating issues for backward and forward integration with field devices. This creates heterogeneity in demand due to the wide applicability of valve drivers in industries, such as commercial & residential, oil & gas, food & beverage, pharmaceuticals, energy & power, water & wastewater treatment, construction, chemicals, and pulp & paper. This heterogeneity acts as a restraining factor as industry players have to amend the same product based on regional policies.

OPPORTUNITIES: Rise in demand for valve drivers in commercial & residential applications

Valve drivers offer lower costs and minimize efficiency losses. They provide a sustainable solution to increase concerns about the growing demand for energy efficiency, particularly in commercial & residential applications. Moreover, it allows refrigeration systems to operate more efficiently and accurately, which is a major factor that drives the demand for valve drivers. Further, in the current scenario, with the increase in the number of commercial and residential spaces, such as hotels, office spaces, airports, educational institutions, and hospitals, the sales of expansion valve drivers are most likely to increase at a rapid pace, as HVAC/R systems are increasingly employed in the commercial sector, creating new growth avenues for expansion valve driver manufacturers.

CHALLENGES: Lockdown and social distancing may restrict commercial trade growth in the coming months

Social distancing is a precautionary and mandatory measure that is followed to contain the outbreak. Social distancing implies that people should remain at home in isolation and avoid gathering in a group to prevent community spread. End users are also following these measures to retain customer loyalty. These measures restrict the presence of workers on the shop floor of the plant, thereby limiting the manufacturing operations. Some companies have completely stopped the manufacturing operations, which has disrupted the supply chain. Social distancing is also being observed in other parts of the manufacturing ecosystem, including transportation. Supplying essential manufacturing components and raw materials to regions that have been completely locked has become difficult. This further brings the commercial activities to a standstill, thereby negatively affecting the growth of the market, particularly in the manufacturing sector.

“Commercial & residential end user to grow at the fastest rate during the forecast period”

Residential and commercial include apartments, homes, offices, industrial facilities, and others. The increased adoption of HVAC/R systems in the residential segment has led to the growth of the valve drivers market. In situations where the government has set new performance norms to save energy as there focus is to make the machineries or operations more efficient, manufacturers of HVAC/R systems are encouraged to manufacture new versions of those systems, which will increase the demand for the HVAC/R systems. Thus, driving the growth of the market for valve drivers in residential and commercial end users.

“Proportional valve driver to hold the largest share of valve driver market by 2025”

The proportional valve drivers find applications in several end uses, such as commercial & residential, motion equipment, and industries, which include oil & gas, pharmaceuticals, metals & mining, energy & power, chemicals, water & wastewater, and food & beverages. Due to its more advanced features and wide usage across many industries, the market for proportional valve drivers will see a significant increase.

To know about the assumptions considered for the study, download the pdf brochure

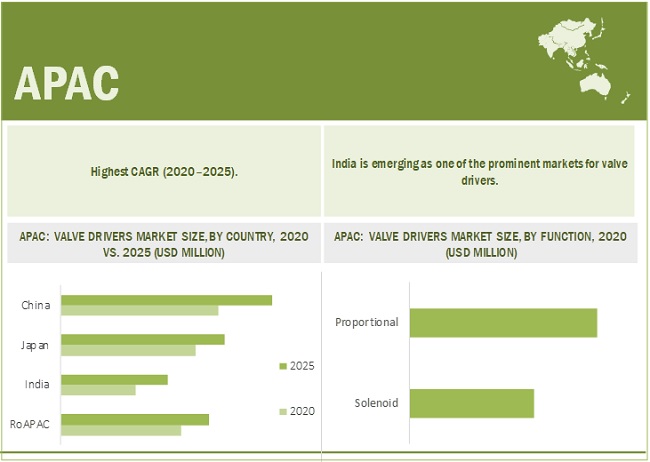

“Valve driver market in APAC to grow at the highest CAGR”

The rapid urbanization and industrialization in developing countries, such as China, Japan, and India, growing construction activities, and rising population are the major factors driving the growth of the valve driver market in the region. This, in turn, has led to an increase in demand for valve drivers until 2019. However, COVID-19, a global health emergency and an economic crisis, which has impacted the growth of the valve driver market in 2020 adversely. The valve driver market is projected to witness a significant decline as a few of the major end-users are adopting valve drivers. These end users are non-operational due to stringent measures, which include lockdown, restrictions on foreign trade, and a halt in the supply of non-essential products and services taken by several governments across the world as precautionary measures for the safety of people. There is also a huge supply-demand gap due to the decline in global demand.

Top Valve Driver Companies - Key Market Players:

Danfoss (Europe), Parker Hannifin (US), Emerson Electric Co. (US), Eliwell Controls (Europe), Carel Industries (Europe), MKS Instruments (US), Hydraforce Inc. (US), Hussmann Corporation (US), Sanhua (Spain), and Fujikoki Corporation (Japan) are a few major players in valve driver market.

Valve Driver Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 421 million in 2020 |

| Projected Market Size | USD 519 million by 2025 |

| Growth Rate | At CAGR of 4.3% |

|

Market Size Available for Years |

2016–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Units |

Value (USD Thousand/Million) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

Major Players: Danfoss (Europe), Parker Hannifin (US), Emerson Electric Co. (US), Eliwell Controls (Europe), Carel Industries (Europe), MKS Instruments (US), Hydraforce Inc. (US), Hussmann Corporation (US), Sanhua (Spain), and Fujikoki Corporation (Japan)- total 25 players have been covered |

This research report categorizes the valve driver market by function, valve type, end-user, and region.

Valve driver market , By Function:

- Solenoid

- Proportional

Valve driver market ,By Valve Type:

- Conventional control valve

- Expansion valve

Valve driver market ,By End-User:

- Commercial & residential

- Industrial

- Motion Equipment

Valve driver market ,By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Valve Driver Industry :

- In January 2020, Danfoss acquired Eaton’s hydraulics business. Through this acquisition, Eaton would focus on strengthening its core business segment.

- In September 2019, The subsidiary Carel USA LLC took over the entire share capital of Enersol Inc, a historical Canadian distributor of Carel humidification products based in Montreal, Quebec. This transaction is part of the group’s strategy to expand its direct sales network, aimed at strengthening its relationship with end customers in order to consolidate its market leadership.

- In February 2019, MKS Instruments acquired Electro Scientific Industries, Inc. This acquisition has broadened the product portfolios of key industrial end markets.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the valve driver market during 2020-2025?

The valve driver market is expected to record the CAGR of 4.3% from 2020–2025.

Does this report include the impact of COVID-19 on the valve driver market?

Yes, the report includes the impact of COVID-19 on the valve driver market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the valve driver market?

Increase in government regulations and policies for saving energy and increase in focus on enhancing efficiency and power consumption are the critical factors driving the growth of the valve driver market.

Which are the significant players operating in the valve driver market?

Danfoss (Europe), Parker Hannifin (US), Emerson Electric Co. (US), Eliwell Controls (Europe), Carel Industries (Europe), MKS Instruments (US), Hydraforce Inc. (US), Hussmann Corporation (US), Sanhua (Spain), and Fujikoki Corporation (Japan), are some of the major companies operating in the valve driver market.

Which region will lead the valve driver market in the future?

APAC is expected to lead the valve driver market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VALVE DRIVER MARKET: MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

FIGURE 2 VALVE DRIVER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE)-REVENUE OF PRODUCTS/SOLUTIONS/SERVICES OF THE VALVE DRIVERS MARKET SIZE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY-SIDE)-ILLUSTRATION OF COMPANY VALVE DRIVER REVENUE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at the market share by bottom-up analysis (demand-side)

FIGURE 5 VALVE DRIVERS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share by top-down analysis (supply-side)

FIGURE 6 VALVE DRIVER MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 8 COVID-19 IMPACT ANALYSIS ON THE VALVE DRIVERS MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 9 EXPANSION VALVES ARE PROJECTED TO DOMINATE THE VALVE DRIVERS MARKET DURING FORECAST PERIOD

FIGURE 10 PROPORTIONAL VALVE DRIVERS MARKET TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 COMMERCIAL & RESIDENTIAL IS PROJECTED TO ACCOUNT FOR THE LARGEST SIZE IN THE VALVE DRIVERS MARKET DURING FORECAST PERIOD

FIGURE 12 APAC IS PROJECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE VALVE DRIVERS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN THE VALVE DRIVER MARKET

FIGURE 13 INCREASE IN DEMAND FOR VALVE DRIVER IN COMMERCIAL & RESIDENTIAL APPLICATIONS TO DRIVE THE MARKET GROWTH

4.2 VALVE DRIVERS MARKET, BY VALVE TYPE

FIGURE 14 EXPANSION VALVE DRIVER TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

4.3 VALVE DRIVERS MARKET, BY FUNCTION

FIGURE 15 PROPORTIONAL TO HOLD LARGEST SHARE IN THE VALVE DRIVERS MARKET BY 2025

4.4 MARKET, BY END USER

FIGURE 16 COMMERCIAL & RESIDENTIAL SEGMENT TO DOMINATE THE VALVE DRIVERS MARKET BY 2025

4.5 MARKET, BY REGION

FIGURE 17 APAC TO HOLD THE LARGEST SHARE IN THE VALVE DRIVERS MARKET BY 2025

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: OVERVIEW

5.2.1 DRIVERS

5.2.1.1 Increase in government regulations and policies for saving energy

5.2.1.2 Increase in focus on enhancing efficiency and power consumption

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardized certifications and government policies

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of IIoT technology in industrial valve drivers

5.2.3.2 Rise in demand for valve drivers in commercial & residential applications

5.2.4 CHALLENGES

5.2.4.1 Lockdown and social distancing may restrict commercial trade growth in the coming months

5.3 VALUE CHAIN

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE-ADDED DURING VALVE DRIVER MANUFACTURING AND SYSTEM INTEGRATION STAGES

6 VALVE DRIVERS MARKET, BY FUNCTION (Page No. - 45)

6.1 INTRODUCTION

FIGURE 20 MARKET, BY FUNCTION

TABLE 1 MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 2 MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

FIGURE 21 PROPORTIONAL VALVE DRIVERS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

6.2 SOLENOID

6.2.1 GROWTH IN DEMAND FOR SOLENOID IN THE MOTION EQUIPMENT SEGMENT TO INCREASE THE LIFE CYCLE OF VALVE DRIVERS

TABLE 3 SOLENOID MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 4 SOLENOID VALVE DRIVER MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 6 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 7 SOLENOID VALVE DRIVER MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 9 NORTH AMERICA: SOLENOID MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 10 NORTH AMERICA: SOLENOID MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 11 EUROPE: SOLENOID VALVE DRIVERS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 12 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 13 APAC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 14 APAC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

6.3 PROPORTIONAL

6.3.1 PROPORTIONAL VALVE DRIVERS TO CONTINUE TO ACCOUNT FOR THE LARGER MARKET SIZE

TABLE 15 MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 17 PROPORTIONAL VALVE DRIVER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 18 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 19 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: PROPORTIONAL VALVE DRIVERS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 23 EUROPE: SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 24 EUROPE: PROPORTIONAL VALVE DRIVERS MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 25 APAC: PROPORTIONAL VALVE DRIVERS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 26 APAC: PROPORTIONAL MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 27 ROW: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 28 ROW: PROPORTIONAL VALVE DRIVERS MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

7 VALVE DRIVERS MARKET, BY VALVE TYPE (Page No. - 56)

7.1 INTRODUCTION

FIGURE 22 MARKET, BY VALVE TYPE

TABLE 29 MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 30 MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

7.2 CONVENTIONAL CONTROL VALVES

7.2.1 RAPID GROWTH OF INDUSTRIES WILL INCREASE THE ADOPTION OF CONVENTIONAL CONTROL VALVES

TABLE 31 CONVENTIONAL CONTROL VALVE DRIVERS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 32 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 33 MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 35 CONVENTIONAL CONTROL VALVE DRIVERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 CONVENTIONAL CONTROL VALVE DRIVERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 EXPANSION VALVES

7.3.1 INCREASE IN FOCUS ON SAVING ENERGY AND ENHANCING EFFICIENCY

TABLE 37 EXPANSION VALVE DRIVERS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 38 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 39 MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 40 MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 41 EXPANSION VALVE DRIVERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 EXPANSION VALVE DRIVERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 VALVE DRIVERS MARKET, BY END USER (Page No. - 63)

8.1 INTRODUCTION

FIGURE 23 MARKET, BY END USER

TABLE 43 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 44 VALVE DRIVERS MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

FIGURE 24 THE COMMERCIAL & RESIDENTIAL SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR

8.2 COMMERCIAL & RESIDENTIAL

8.2.1 INCREASED FOCUS ON ENERGY-EFFICIENT OPERATIONS IN THE CONSTRUCTION SECTOR

TABLE 45 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 48 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 49 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 50 MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

8.3 INDUSTRIAL

TABLE 51 MARKET SIZE FOR REGION BY INDUSTRIAL END USERS, 2016–2019 (USD MILLION)

TABLE 52 MARKET SIZE FOR INDUSTRIAL END USERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 MARKET SIZE FOR INDUSTRIAL END USERS, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 54 MARKET SIZE FOR INDUSTRIAL END USERS, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 55 MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 56 MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

8.3.1 OIL & GAS

8.3.1.1 Rapid growth in demand from industries pushing toward mass production

8.3.2 PHARMACEUTICALS

8.3.2.1 Ease in the operations involving the manufacture of drugs

8.3.3 ENERGY & POWER

8.3.3.1 Increased demand from operations involving flow regulation in the energy & power industry

8.3.4 METALS & MINING

8.3.4.1 Increased adoption of automated valve driver in mining

8.3.5 WATER & WASTEWATER

8.3.5.1 Adoption of wastewater treatment in developing countries

8.3.6 FOOD & BEVERAGES

8.3.6.1 Growing adoption of valve drivers for the processed food segment

8.3.7 OTHER INDUSTRIAL END USERS

8.4 MOTION EQUIPMENT

8.4.1 RAPID URBANIZATION CREATES DEMAND FOR MOTION HANDLING EQUIPMENT

TABLE 57 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 59 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 60 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 61 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 62 MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 75)

9.1 INTRODUCTION

FIGURE 25 GEOGRAPHIC SNAPSHOT OF THE MARKET

TABLE 63 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 26 APAC TO DOMINATE THE MARKET DURING FORECAST PERIOD

TABLE 65 EXPANSION VALVE DRIVERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

TABLE 67 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 27 NORTH AMERICA: SNAPSHOT OF THE MARKET

9.2.1 IMPACT OF COVID-19 ON THE MARKET IN NORTH AMERICA

TABLE 69 NORTH AMERICA: MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

9.2.2 US

9.2.2.1 Growth of the construction industry in the US

9.2.3 CANADA

9.2.3.1 Energy-saving initiatives adopted for construction in Canada

9.2.4 MEXICO

9.2.4.1 Growth in the food & beverage industry in Mexico

9.3 EUROPE

FIGURE 28 EUROPE: SNAPSHOT OF THE MARKET

9.3.1 IMPACT OF COVID-19 ON THE MARKET IN EUROPE

TABLE 81 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 84 EUROPE:MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 94 EUROPE VALVE DRIVERS MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Rise in demand for energy-efficient and cost-effective devices in commercial and residential buildings

9.3.3 GERMANY

9.3.3.1 Growth in investments in the oil & gas industry in Germany

9.3.4 FRANCE

9.3.4.1 Greater focus toward reduction in energy and emissions of greenhouse gases in France

9.3.5 REST OF EUROPE

9.4 APAC

FIGURE 29 APAC: SNAPSHOT OF THE MARKET

9.4.1 IMPACT OF COVID-19 ON THE MARKET IN APAC

TABLE 95 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 96 APAC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 97 APAC: MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 98 APAC: VALVE DRIVERS MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 99 APAC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 100 APAC:MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 101 APAC:MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 102 APAC:MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 103 APAC: VALVE DRIVERS MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 104 APAC: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 105 APAC: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 106 APAC: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 107 APAC: MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 108 APAC: MARKET SIZE FOR MOTION EQUIPMENT END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Growing industrialization and urbanization in China

9.4.3 JAPAN

9.4.3.1 Rise in demand for HVAC/R systems to upsurge demand in Japan

9.4.4 INDIA

9.4.4.1 Increase in industrialization due to availability of cheap labor in India

9.4.5 REST OF APAC

9.5 REST OF THE WORLD

FIGURE 30 SOUTH AMERICA TO DOMINATE VALVE DRIVERS MARKET DURING FORECAST PERIOD

9.5.1 IMPACT OF COVID-19 ON THE MARKET IN ROW

TABLE 109 ROW: VALVE DRIVER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 110 ROW: VALVE DRIVER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 111 ROW: VALVE DRIVER MARKET SIZE, BY VALVE TYPE, 2016–2019 (USD MILLION)

TABLE 112 ROW: VALVE DRIVER MARKET SIZE, BY VALVE TYPE, 2020–2025 (USD MILLION)

TABLE 113 ROW: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 114 ROW: VMARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 115 ROW: VALVE DRIVER MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 116 ROW: VALVE DRIVER MARKET SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 117 ROW: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 118 ROW: MARKET SIZE FOR COMMERCIAL & RESIDENTIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 119 ROW: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 120 ROW: MARKET SIZE FOR INDUSTRIAL END USERS, BY FUNCTION, 2020–2025 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Growth in FDI for infrastructure in South America

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Increase in construction activities in Africa and regulations on energy-efficiency in the Middle East

10 COMPETITIVE LANDSCAPE (Page No. - 102)

10.1 OVERVIEW

FIGURE 31 KEY DEVELOPMENTS IN THE VALVE DRIVER MARKET (2018–2020)

10.1.1 MARKET SHARE ANALYSIS OF PLAYERS, 2019

TABLE 121 MARKET SHARE OF TOP FIVE PLAYERS IN THE MARKET IN 2019

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 VISIONARY LEADERS

10.2.2 DYNAMIC DIFFERENTIATORS

10.2.3 INNOVATORS

10.2.4 EMERGING COMPANIES

FIGURE 32 VALVE DRIVER MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

10.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

10.5 COMPETITIVE SCENARIO

10.5.1 ACQUISITIONS

TABLE 122 ACQUISITIONS, 2018–2020

11 COMPANY PROFILES (Page No. - 109)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

11.1 KEY PLAYERS

11.1.1 DANFOSS

FIGURE 35 DANFOSS: COMPANY SNAPSHOT

11.1.2 PARKER HANNIFIN

FIGURE 36 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

11.1.3 EMERSON ELECTRIC CO.

FIGURE 37 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

11.1.4 ELIWELL CONTROLS

11.1.5 CAREL INDUSTRIES

FIGURE 38 CAREL INDUSTRIES: COMPANY SNAPSHOT

11.1.6 MKS INSTRUMENTS

FIGURE 39 MKS INSTRUMENTS: COMPANY SNAPSHOT

11.1.7 HYDRAFORCE INC.

11.1.8 HUSSMANN CORPORATION

11.1.9 SANHUA

11.1.10 FUJIKOKI CORPORATION

11.1.11 WALVOIL

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

11.2 RIGHT TO WIN

11.3 OTHER PLAYERS

11.3.1 CLIPPARD INSTRUMENT LABORATORY, INC.

11.3.2 IQ VALVE CO.

11.3.3 IRS SYSTEMS

11.3.4 PWM CONTROLS INC.

11.3.5 HUMPHREY

11.3.6 KAR TECH

11.3.7 AXIOMATIC TECHNOLOGIES CORPORATION

11.3.8 LYNCH FLUID CONTROLS

11.3.9 IMI PRECISION ENGINEERING

11.3.10 KAHAN CONTROLS

11.3.11 KELLY PNEUMATICS, INC.

11.3.12 BUCHER HYDRAULICS, INC.

11.3.13 OEM CONTROLS

11.3.14 APPLIED PROCESSOR AND MEASUREMENT, INC.

11.3.15 ENFIELD TECHNOLOGIES, LLC

12 ADJACENT & RELATED REPORTS (Page No. - 135)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 GEOGRAPHIC ANALYSIS

12.3.1 INTRODUCTION

TABLE 123 INDUSTRIAL VALVES MARKET SIZE, BY REGION, 2017–2025 (USD BILLION)

12.4 NORTH AMERICA

TABLE 124 NORTH AMERICA: INDUSTRIAL VALVES MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD BILLION)

12.4.1 MNM VIEWPOINT (IMPACT OF COVID-19 & OIL PRICE CRISIS)

TABLE 125 NORTH AMERICA: INDUSTRIAL VALVES MARKET SIZE, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 126 NORTH AMERICA: INDUSTRIAL VALVES MARKET SIZE, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

12.4.2 US

12.4.3 CANADA

12.4.4 MEXICO

12.5 EUROPE

TABLE 127 EUROPE: INDUSTRIAL VALVES MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD BILLION)

12.5.1 MNM VIEWPOINT (IMPACT OF COVID-19 & OIL PRICE CRISIS)

TABLE 128 EUROPE: INDUSTRIAL VALVES MARKET SIZE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 129 EUROPE: INDUSTRIAL VALVES MARKET SIZE, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

12.5.2 UK

12.5.3 GERMANY

12.5.4 FRANCE

12.5.5 ITALY

12.5.6 REST OF EUROPE

12.6 ASIA PACIFIC (APAC)

TABLE 130 APAC: INDUSTRIAL VALVES MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD BILLION)

12.6.1 MNM VIEWPOINT (IMPACT OF COVID-19 & OIL PRICE CRISIS)

TABLE 131 APAC: INDUSTRIAL VALVES MARKET SIZE, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

12.6.2 CHINA

12.6.3 JAPAN

12.6.4 INDIA

12.6.5 SOUTH KOREA

12.6.6 REST OF APAC

12.7 REST OF THE WORLD (ROW)

TABLE 132 ROW: INDUSTRIAL VALVES MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD BILLION)

12.7.1 MNM VIEWPOINT (IMPACT OF COVID-19 & OIL PRICE CRISIS)

12.7.2 MIDDLE EAST

12.7.3 SOUTH AMERICA

12.7.4 AFRICA

13 APPENDIX (Page No. - 148)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

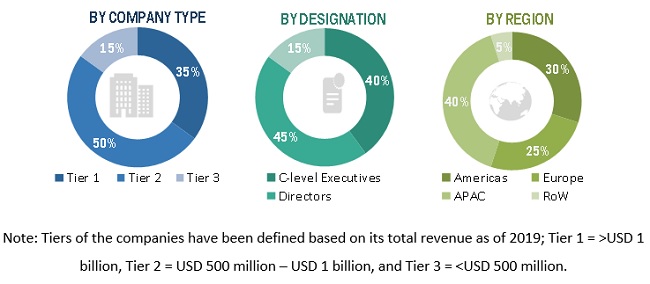

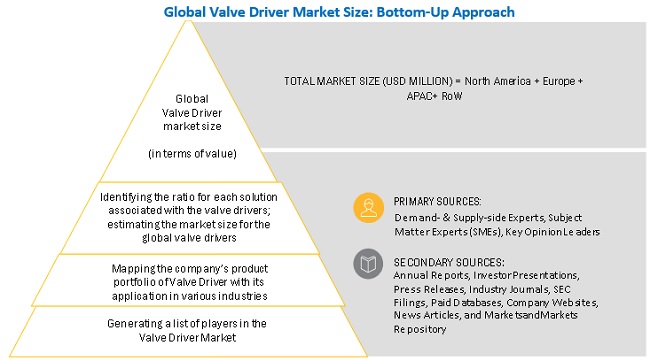

The study involved four major activities in estimating the current size of the valve driver market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the valve driver market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on manufacturing industries, as well as valve driver products, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from valve driver vendors, such as Schneider (Eliwell), Carel, Emerson, Parker Hannifin, and Danfoss; system integrators, professional and managed service providers, industry associations, independent automation consultants and importers, distributors, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the valve driver market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the valve driver market, in terms of value, by function, by valve type, and end-user

- To describe and forecast the market, in terms of value, with regard to 4 main regions: Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To describe and forecast the market, in terms of volume, by end-use industry

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of valve drivers

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the valve driver market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the valve drivers

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, and acquisitions, adopted by key market players in the valve driver market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Valve Driver Market