Efficacy Testing Market by Service Type (Antimicrobial/Preservative Efficacy Testing, Disinfectant Efficacy Testing), Application (Pharma, Cosmetics & Personal Care, Medical Devices, Consumer Products) and Region - Global Forecast to 2027

Market Growth Outlook Summary

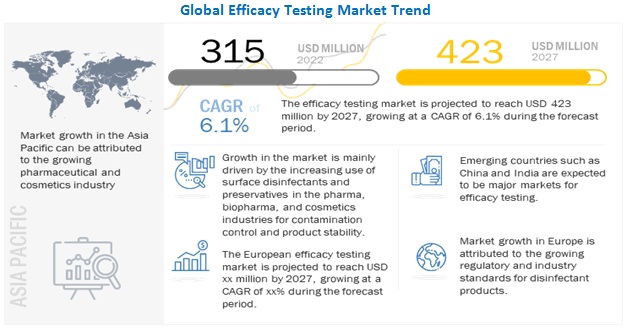

The global efficacy testing market growth forecasted to transform from $315 million in 2022 to $423 million by 2027, driven by a CAGR of 6.1%. Factors such as regulations for pharmaceutical and cosmetic products addressing the safety of the products are expected to drive the growth of the global market for efficacy testing in the coming years. In addition, the efficacy of the active pharmaceutical ingredient (API) is the key concern, the market considers the regulation and validation of pharmaceutical products, and numerous methods of preservative efficacy testing (PET) have been advanced over the decade by standards organizations, regulatory agencies, industry organizations and individual firms such as an international conference on harmonization of technical requirements for registration of pharmaceuticals for human use (ICH) and good clinical practice (GCP). The main purpose of these regulatory bodies is to meet the good documentation standard and scientific soundness.

Efficacy Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Efficacy Testing Market Dynamics

Driver: Rising adoption of quality by design approach

Since the introduction of Quality-by-Design (QbD) concepts, it has been accepted that quality of pharmaceutical products should be designed and built during the manufacturing process. Most of quality problems are related to the way in which a pharmaceutical product was designed. A poor-designed pharmaceutical product will show poor safety and efficacy, no matter how many tests or analyses have been done to verified its quality. Thus, QbD begins with the recognition that quality will not be improved by merely increasing testing of pharmaceutical products. In other words, quality must be built into the product.

Restraint: Adverse effects of chemical disinfectants

Most of the chemical disinfectants currently available in the market have toxic properties. For example, sodium hypochlorite is an effective treatment against blood-borne pathogens but is also highly corrosive and a respiratory irritant, which makes it dangerous for cleaning personnel and building occupants as it causes damage to many surfaces and is toxic when released into the environment. The improper use of these disinfectants can cause environmental hazards and be harmful to patients exposed to them. Disinfectants sold in the US need to be registered with the Environmental Protection Agency (EPA), which classifies these solutions as pesticides; they are regulated under the FIFRA. There is no green certificate currently available for disinfectants in the market.

Due to a growing end-user population demanding greener solutions, the use of disinfectants is becoming limited, with their use being restricted to limited non-critical items and in lower amounts. Manufacturers are now being forced to develop newer and greener alternatives that are less corrosive to the human eyes, such as butyl-free, pH-neutral quaternary, and hydrogen peroxide-based disinfectants. In line with this, in 2021, Clorox Healthcare launched the new Clorox Healthcare Versa-Sure Cleaner Disinfectant Wipes that are alcohol-free.

Opportunity: Emerging countries in Asia Pacific region

Emerging economies, such as India, Brazil, and South Africa, offer significant opportunities for players in the efficacy testing industry. The growing need for advanced healthcare services in these economies is mainly driven by the rapidly increasing aging population and the rising number of patient volumes, growing per capita income, and rising awareness. Also, countries such as India have a huge population base, and these markets are home to a large patient base. Healthcare infrastructural improvements, such as the establishment of new facilities, have been a key trend in emerging markets, alongside rising awareness on the sterilization of medical products.

By service type, the disinfectant efficacy testing segment accounted for the largest share of the efficacy testing industry.

Based on the product, the efficacy testing market is segmented into antimicrobial/preservative efficacy testing (AET/PET) and disinfectant efficacy testing. The disinfectant efficacy testing segment dominated this market in 2021. Rising awareness of environmental & personal hygiene has resulted in the increasing production and use of surface disinfectants. Also, technological advancements and rising R&D investments by key players to deliver novel technologies in the market are factors driving the growth of the segment.

By application, the pharmaceutical manufacturing applications segment accounted for the largest share of the efficacy testing industry.

On the basis of application the efficacy testing market is segmented into pharmaceutical manufacturing applications, cosmetics and personal care product applications, consumer product applications, and medical device applications. The pharmaceutical manufacturing applications segment dominated this market in 2021 and is estimated to grow at the highest CAGR during the forecast period. A tremendous amount of analytical testing is required to support a product from discovery, development, and clinical trials, through manufacturing and marketing. The global competitive environment is compelling these companies to continuously conduct testing—or opt for testing services—throughout the development phases to increase the quality and efficacy of the products. However, the added costs and the time required place a burden on companies, prompting them to outsource testing. Outsourcing analytical testing services as a model and strategy allows companies to maintain the flexibility of internal resources and utilize technical capabilities not available in-house.

North America accounted for the largest share of the efficacy testing industry.

North America accounted for the largest share of the efficacy testing market. The major factors driving the growth of the North American efficacy testing services market include the high R&D expenditure, a strong presence of major service providers, and rising outsourcing of analytical testing (including efficacy testing) by pharmaceuticals and cosmetic companies in the region. Also, most of the world's leading corporations are headquartered in the area or have a strong presence in this market, and others have also concentrated on expanding to improve their scope and capabilities.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are Charles River Laboratories (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), SGS (Switzerland), Intertek Group (UK), Nelson Laboratories, LLC (a Sotera Health company, US), Microbac Laboratories, Inc. (US), Almac Group (UK), North American Science Associates, Inc. (US), Toxikon (US), Pacific Biolabs (US), MSL Solution Providers (UK), Intertek Group PLC (UK), Accugen Laboratories, Inc. (US), Consumer Product Testing Company (US), Lucideon (UK).

Scope of the Efficacy Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$315 million |

|

Projected Revenue Size by 2027 |

$423 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.1% |

|

Market Driver |

Rising adoption of quality by design approach |

|

Market Opportunity |

Emerging countries in Asia Pacific region |

The research report categorizes the efficacy testing market to forecast revenue and analyze trends in each of the following submarkets:

By Service Type

-

Antimicrobial/ Preservative Efficacy Testing

- Traditional test methods

- Rapid test methods

-

Disinfectant Efficacy Testing

- Surface test methods

- Suspension test methods

By Application

- Pharmaceutical Manufacturing Applications

- Cosmetics And Personal Care Product Applications

- Consumer Product Applications

- Medical Device Applications

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments of Efficacy Testing Industry

- In 2021, Eurofins Scientific acquired bioskin GmbH (Germany), a dermatology-specific CRO, to strengthen Eurofins’ leadership position in cosmetic product testing.

- In 2021, Intertek Group plc expanded the company’s Health, Environmental, and Regulatory Consultancy business lines in Spain and Russia.

- In 2020, 3M launched the TB Quat Disinfectant Ready-to-use Cleaner.

- In 2020, Ecolab acquired Holchem Group to strengthen its hygiene and cleaning products and services portfolio for the food & beverage, food service, and hospitality industries.

- In 2019, Diversey Holdings Ltd. announced a strategic alliance in the North American industrial & institutional cleaning market. This partnership is focused on providing solutions for complete facility disinfection, cleaning, and air care for specific applications.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global efficacy testing market?

The global efficacy testing market boasts a total revenue value of $423 million by 2027.

What is the estimated growth rate (CAGR) of the global efficacy testing market?

The global efficacy testing market has an estimated compound annual growth rate (CAGR) of 6.1% and a revenue size in the region of $315 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary sources

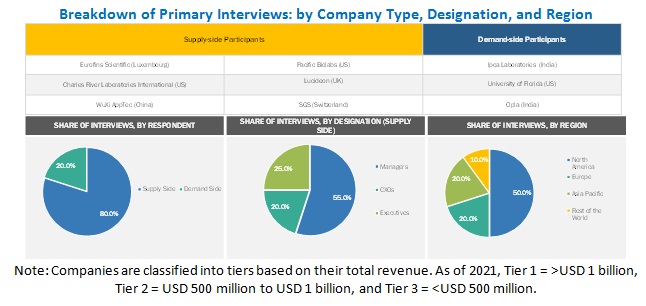

FIGURE 1 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 3 EFFICACY TESTING MARKET: FINAL CAGR PROJECTIONS

FIGURE 4 EFFICACY TESTING INDUSTRY: CAGR PROJECTIONS FROM ANALYSIS OF DEMAND-SIDE DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 5 MARKET: SEGMENTAL ASSESSMENT

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ANALYSIS

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 7 MARKET, BY SERVICE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 EFFICACY TESTING INDUSTRY, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 9 REGIONAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 EFFICACY TESTING MARKET OVERVIEW

FIGURE 10 GROWING PREFERENCE FOR OUTSOURCING EFFICACY TESTING TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 11 PHARMACEUTICAL MANUFACTURING APPLICATIONS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.3 GEOGRAPHICAL SNAPSHOT OF EFFICACY TESTING INDUSTRY

FIGURE 12 CHINA TO WITNESS HIGHEST GROWTH RATE FROM 2022 TO 2027

4.4 MARKET, BY REGION

FIGURE 13 NORTH AMERICA TO DOMINATE MARKET IN 2027

4.5 MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 14 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 EFFICACY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing use of surface disinfectants and preservatives in pharma, biopharma, and cosmetics industries for contamination control and product stability

5.2.1.1.1 Growing focus on contamination control

5.2.1.1.2 Increasing concerns over product stability

5.2.1.2 Growing preference for outsourcing efficacy testing

5.2.1.3 Rising adoption of quality by design approach

5.2.1.4 Stringent regulations for use of surface disinfectants

5.2.1.5 Growing awareness of sanitization and hygiene due to spread of COVID-19

5.2.2 RESTRAINTS

5.2.2.1 Adverse effects of chemical disinfectants

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Time-consuming process

5.3 REGULATORY ANALYSIS

5.3.1 DISINFECTANT EFFICACY TESTING

5.3.2 ANTIMICROBIAL EFFICACY TESTING

5.4 IMPACT OF COVID-19 ON EFFICACY TESTING SERVICES

5.5 PRICING ANALYSIS

TABLE 1 PRICE OF SURFACE DISINFECTANT PRODUCTS (2022)

5.6 PATENT ANALYSIS

5.7 TRADE ANALYSIS

5.7.1 TRADE ANALYSIS FOR DISINFECTANTS

TABLE 2 IMPORT DATA FOR DISINFECTANTS, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 3 EXPORT DATA FOR DISINFECTANTS, BY COUNTRY, 2018–2022 (USD MILLION)

5.8 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS: EFFICACY TESTING INDUSTRY

5.9 ECOSYSTEM ANALYSIS

FIGURE 17 SURFACE DISINFECTANTS MARKET: ECOSYSTEM ANALYSIS

TABLE 4 ROLE IN ECOSYSTEM

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 DEGREE OF COMPETITION

5.11 TECHNOLOGY ANALYSIS

6 EFFICACY TESTING MARKET, BY SERVICE TYPE (Page No. - 57)

6.1 INTRODUCTION

TABLE 6 EFFICACY TESTING INDUSTRY, BY SERVICE TYPE, 2020–2027 (USD MILLION)

6.2 DISINFECTANT EFFICACY TESTING

TABLE 7 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 8 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 9 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 APAC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 ROW: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 MARKET, BY METHOD, 2020–2027 (USD MILLION)

6.2.1 SURFACE TEST METHOD

6.2.1.1 Surface test method segment to account for larger share of disinfectant efficacy testing market

TABLE 13 SURFACE TEST METHOD MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 14 NORTH AMERICA: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 EUROPE: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 16 APAC: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 SUSPENSION TEST METHOD

6.2.2.1 Suspension test method is typically performed by researchers during development stage of disinfectants

TABLE 17 SUSPENSION TEST METHOD MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 NORTH AMERICA: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 EUROPE: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 APAC: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING

TABLE 21 EUROFINS SCIENTIFIC AET TEST PROTOCOL

TABLE 22 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 APAC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 ROW: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 MARKET, BY METHOD, 2020–2027 (USD MILLION)

6.3.1 TRADITIONAL TEST METHOD

6.3.1.1 Traditional test method segment to dominate AET/PET market

TABLE 28 TRADITIONAL TEST METHOD MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 RAPID TEST METHOD

6.3.2.1 Regulatory uncertainties restraining adoption of rapid microbial methods

TABLE 29 RAPID TEST METHOD MARKET, BY REGION, 2020–2027 (USD MILLION)

7 EFFICACY TESTING MARKET, BY APPLICATION (Page No. - 68)

7.1 INTRODUCTION

TABLE 30 EFFICACY TESTING INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 PHARMACEUTICAL MANUFACTURING APPLICATIONS

7.2.1 INCREASING FOCUS ON ENSURING QUALITY OF DRUGS TO DRIVE SEGMENT GROWTH

TABLE 31 MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 EUROPE: MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 APAC: MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS

7.3.1 EFFICACY TESTING IS AN ESSENTIAL PART OF STABILITY TESTING REGIMEN OF COSMETICS

TABLE 35 MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 APAC: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 CONSUMER PRODUCT APPLICATIONS

7.4.1 GROWING FOCUS ON HEALTHY ENVIRONMENT IN HOMES AND INDUSTRIAL FACILITIES TO DRIVE SEGMENT GROWTH

TABLE 39 MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 EUROPE: MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 APAC: MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 MEDICAL DEVICE APPLICATIONS

7.5.1 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS TO DRIVE SEGMENT GROWTH

TABLE 43 MARKET FOR MEDICAL DEVICE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 46 APAC: MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 EFFICACY TESTING MARKET, BY REGION (Page No. - 77)

8.1 INTRODUCTION

TABLE 47 EFFICACY TESTING INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 18 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.1 US

8.2.1.1 US to dominate North American efficacy testing market during forecast period

TABLE 53 US: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 54 US: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 55 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government initiatives to drive market growth in Canada

TABLE 56 CANADA: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 57 CANADA: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 58 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3 EUROPE

TABLE 59 EUROPE: EFFICACY TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Germany to account for largest share in European market

TABLE 64 GERMANY: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 66 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 High demand for cosmetics in France to drive market growth

TABLE 67 FRANCE: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 68 FRANCE: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 69 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.3 UK

8.3.3.1 Market in UK is primarily driven by enforcement of regulatory and industry standards

TABLE 70 UK: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 71 UK: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 72 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Increasing pharmaceutical production in Italy to drive market growth

TABLE 73 ITALY: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 74 ITALY: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 75 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Rising R&D expenditure to boost market growth in Spain

TABLE 76 SPAIN: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 77 SPAIN: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 78 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 79 ROE: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 80 ROE: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 81 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 19 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 82 APAC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 APAC: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 84 APAC: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 85 APAC: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 86 APAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.1 CHINA

8.4.1.1 China to dominate Asia Pacific market

TABLE 87 CHINA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 88 CHINA: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 89 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Rising R&D investments to drive market growth in Japan

TABLE 90 JAPAN: MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 91 JAPAN: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 92 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Growing pharmaceutical industry in India to drive market growth

TABLE 93 INDIA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 94 INDIA: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 95 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC

TABLE 96 ROAPAC: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 97 ROAPAC: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 98 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.5 REST OF THE WORLD

TABLE 99 ROW: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 100 ROW: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 101 ROW: MARKET, BY METHOD, 2020–2027 (USD MILLION)

TABLE 102 ROW: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 ROW: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5.1 LATIN AMERICA

8.5.1.1 Increasing pharmaceutical R&D expenditure to drive market growth in Latin America

TABLE 104 LATAM: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 105 LATAM: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.2 MIDDLE EAST AND AFRICA

8.5.2.1 UAE has emerged as key market in MEA region

TABLE 106 MEA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

TABLE 107 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 104)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 20 KEY DEVELOPMENTS IN EFFICACY TESTING MARKET, 2019–2022

9.3 MARKET SHARE ANALYSIS

FIGURE 21 EFFICACY TESTING INDUSTRY SHARE, BY KEY PLAYER, 2021

TABLE 108 EFFICACY TESTING INDUSTRY: DEGREE OF COMPETITION

9.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STARS

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE PLAYERS

9.5.4 PARTICIPANTS

9.6 COMPANY EVALUATION QUADRANT: START-UPS/SMES

9.6.1 PROGRESSIVE COMPANIES

9.6.2 STARTING BLOCKS

9.6.3 RESPONSIVE COMPANIES

9.6.4 DYNAMIC COMPANIES

9.7 FOOTPRINT ANALYSIS OF COMPANIES

9.7.1 SERVICE FOOTPRINT OF COMPANIES

TABLE 109 SERVICE FOOTPRINT OF COMPANIES: EFFICACY TESTING INDUSTRY (2021)

9.7.2 REGIONAL FOOTPRINT OF COMPANIES

TABLE 110 REGIONAL FOOTPRINT OF COMPANIES: EFFICACY TESTING INDUSTRY (2021)

9.8 COMPETITIVE SCENARIO

TABLE 111 PRODUCT LAUNCHES

TABLE 112 DEALS

TABLE 113 OTHER DEVELOPMENTS

10 COMPANY PROFILES (Page No. - 116)

10.1 EFFICACY TESTING SERVICE PROVIDERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 EUROFINS SCIENTIFIC

TABLE 114 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 25 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2021)

10.1.2 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

TABLE 115 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 26 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.: COMPANY SNAPSHOT (2021)

10.1.3 WUXI APPTEC

TABLE 116 WUXI APPTEC: BUSINESS OVERVIEW

FIGURE 27 WUXI APPTEC: COMPANY SNAPSHOT (2021)

10.1.4 SGS SA

TABLE 117 SGS SA: BUSINESS OVERVIEW

10.1.5 INTERTEK GROUP PLC

TABLE 118 INTERTEK GROUP PLC: BUSINESS OVERVIEW

FIGURE 28 INTERTEK GROUP PLC: COMPANY SNAPSHOT (2021)

10.1.6 MICROCHEM LABORATORY

TABLE 119 MICROCHEM LABORATORY: BUSINESS OVERVIEW

10.1.7 ACCUGEN LABORATORIES, INC.

TABLE 120 ACCUGEN LABORATORIES, INC.: BUSINESS OVERVIEW

10.1.8 PACIFIC BIOLABS

TABLE 121 PACIFIC BIOLABS: BUSINESS OVERVIEW

10.1.9 NORTH AMERICAN SCIENCE ASSOCIATES

TABLE 122 NORTH AMERICAN SCIENCE ASSOCIATES: BUSINESS OVERVIEW

10.1.10 TOXIKON

TABLE 123 TOXIKON: BUSINESS OVERVIEW

10.1.11 BIOSCIENCE LABORATORIES, INC.

TABLE 124 BIOSCIENCE LABORATORIES, INC.: BUSINESS OVERVIEW

10.1.12 CONSUMER PRODUCT TESTING COMPANY (CPTC)

TABLE 125 CONSUMER PRODUCT TESTING COMPANY (CPTC): BUSINESS OVERVIEW

10.1.13 ALMAC GROUP

TABLE 126 ALMAC GROUP: BUSINESS OVERVIEW

10.1.14 MSL SOLUTION PROVIDERS

TABLE 127 MSL SOLUTION PROVIDERS: BUSINESS OVERVIEW

10.1.15 NELSON LABORATORIES, LLC (A SOTERA HEALTH COMPANY)

TABLE 128 NELSON LABORATORIES, LLC: BUSINESS OVERVIEW

10.1.16 ALS LIMITED

TABLE 129 ALS LIMITED: BUSINESS OVERVIEW

10.1.17 ABBOTT ANALYTICAL

TABLE 130 ABBOTT ANALYTICAL: BUSINESS OVERVIEW

10.1.18 BLUTEST LABORATORIES LIMITED

TABLE 131 BLUTEST LABORATORIES LIMITED: BUSINESS OVERVIEW

10.1.19 LUCIDEON

TABLE 132 LUCIDEON: BUSINESS OVERVIEW

10.1.20 HELVIC LABORATORIES (A TENTAMUS COMPANY)

TABLE 133 HELVIC LABORATORIES: BUSINESS OVERVIEW

10.2 MANUFACTURERS OF DISINFECTANTS

10.2.1 PROCTER & GAMBLE

TABLE 134 PROCTER & GAMBLE: BUSINESS OVERVIEW

FIGURE 29 PROCTER & GAMBLE: COMPANY SNAPSHOT (2021)

10.2.2 THE CLOROX COMPANY

TABLE 135 THE CLOROX COMPANY: BUSINESS OVERVIEW

FIGURE 30 THE CLOROX COMPANY: COMPANY SNAPSHOT (2021)

10.2.3 3M

TABLE 136 3M: BUSINESS OVERVIEW

FIGURE 31 3M: COMPANY SNAPSHOT (2021)

10.2.4 RECKITT BENCKISER GROUP PLC

TABLE 137 RECKITT BENCKISER GROUP PLC: BUSINESS OVERVIEW

FIGURE 32 RECKITT BENCKISER GROUP PLC: COMPANY SNAPSHOT (2021)

10.2.5 ECOLAB

TABLE 138 ECOLAB: BUSINESS OVERVIEW

FIGURE 33 ECOLAB: COMPANY SNAPSHOT (2021)

10.2.6 STERIS

TABLE 139 STERIS: BUSINESS OVERVIEW

FIGURE 34 STERIS: COMPANY SNAPSHOT (2021)

10.2.7 CANTEL MEDICAL

TABLE 140 CANTEL MEDICAL: BUSINESS OVERVIEW

FIGURE 35 CANTEL MEDICAL: COMPANY SNAPSHOT (2021)

10.2.8 DIVERSEY HOLDINGS LTD.

TABLE 141 DIVERSEY HOLDINGS LTD.: BUSINESS OVERVIEW

FIGURE 36 DIVERSEY HOLDINGS LTD.: COMPANY SNAPSHOT (2021)

10.2.9 CARROLLCLEAN

TABLE 142 CARROLLCLEAN: BUSINESS OVERVIEW

10.2.10 PAUL HARTMANN AG

TABLE 143 PAUL HARTMANN AG: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 175)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global efficacy testing market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the efficacy testing market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Data

This research study involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies’ house documents, investor presentations, and SEC filings of companies. The secondary sources referred to for this research study include publications from government sources, such as the European Federation of Pharmaceutical Industries and Association, European Trade Association, Environmental Protection Agency, International Journal of Environmental Research and Public Health, Pharmaceutical Research and Manufacturers of America, United States Pharmacopeia, European Pharmacopoeia, World Health Organization, and US Food and Drug Administration. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the efficacy testing market. It was also used to obtain important information about the key players and market classification, segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Data

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report.

Primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of companies providing efficacy testing services, key opinion leaders, and suppliers. Primary sources from the demand side include scientists, researchers, microbiologists, and other related key executives from pharmaceutical and biotechnology companies.

Primary research was used in this report to:

- Validate the market segmentation defined through service portfolio assessment of leading players in the efficacy testing market

- Understand key industry trends and issues defining the strategic growth objectives of market players

- Gather both demand- and supply-side validation of key factors affecting the market growth (such as market drivers, challenges, and opportunities)

- Validate assumptions for the market sizing and forecasting model used for this study

- Understand the market position of leading players in the efficacy testing market and their market share/ranking

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the efficacy testing market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the efficacy testing market

Report Objectives

- To define, describe, and forecast the efficacy testing market by service type, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, collaborations, and expansions in the efficacy testing market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the efficacy testing market into specific countries for the LATAM and MEA regions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Efficacy Testing Market