Kidney/Renal Function Test Market by Product (Dipsticks, Reagents, Disposables), Type (Urine Test (Urine Protein, Microalbumin, Creatinine Clearance), Blood Test (Serum Creatinine, BUN)), End User & Geography - Global Forecast to 2022

The global kidney function test market is projected to grow at a CAGR of 6.1%. Growth in the kidney function test market can primarily be attributed to factors such as the rising prevalence of kidney disease, growing prevalence of diabetes and hypertension, rapid growth in the geriatric population, and the rise in alcohol consumption are driving the growth of the market.

Objectives of the Study:

- To define, describe, segment, and forecast the global kidney function test market by product, type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their product portfolios, market shares, and core competencies in the global kidney function test market

- To forecast the size of the market segments with respect to four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To track and analyze competitive developments such as expansions, product launches, agreements, acquisitions, and regulatory approvals.

Research Methodology:

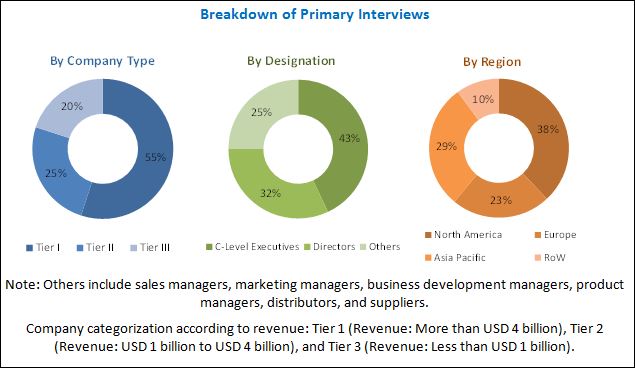

Top-down and bottom-up approaches were used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall kidney function test market. Various secondary sources such as associations like the American Academy of Family Physicians (AAFP), University of Utah, European Renal Care Providers Association (ERCPA), Association of Clinical Biochemists in Ireland (ACBI), Association of Physicians of India (API), American Urological Association (AUA), Centers for Disease Control and Prevention (CDC), National Kidney Foundation, World Health Organization (WHO), directories, industry journals, databases, and annual reports of the companies have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

In 2017, the key players in the global kidney function/renal function test market are Beckman Coulter (US), Siemens (Germany), Nova Biomedical (US), Roche (Switzerland), Abbott (US), URIT Medical (China), ARKRAY (Japan), OPTI Medical (US), ACON Laboratories (US), Sysmex (Japan), 77 Elektronika (Hungary), and Randox Laboratories (UK).

Target Audience:

- Kidney function test product manufacturers and distributors

- Healthcare institutions (hospitals, academic medical centers, and outpatient clinics)

- Diagnostic laboratories

- Health insurance players

- Research and consulting firms

- Regulatory bodies

- Venture capitalists

Scope of the Report:

This research report categorizes the global market into the following segments:

Kidney Function Test Market, by Product

- Dipsticks

- Reagents

- Disposables

Kidney Function Test Market, by Type

-

Urine Tests

- Urine Protein Tests

- Creatinine Clearance Tests

- Microalbumin Tests

-

Blood Tests

- Serum Creatinine Tests

- Glomerular Filtration Rate Tests

- Blood Urea Nitrogen Tests

Kidney Function Test Market, by End User

- Hospitals

- Diagnostics Laboratories

- Research Laboratories and Institutes

Kidney Function Test Market, by Region

-

North America

- US

- Canada

-

Europe

- EU-5

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization option is available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5).

Growth in the kidney function test market can primarily be attributed to factors such as the rising prevalence of kidney disease, growing prevalence of diabetes and hypertension, and the rise in alcohol consumption are driving the growth of the market.

Based on product, the market is categorized into dipsticks, reagents, and disposables. The dipsticks segment is expected to account for the largest share of the market in 2017 and is also estimated to grow at the highest CAGR during the forecast period. Factors contributing to the large share of the market include the cost-effectiveness of dipstick testing, which also accounts for its widespread application across the globe.

Based on type, the market is segmented into urine tests and blood tests. Urine tests are further categorized into urine protein, creatinine clearance, and microalbumin tests. Similarly, blood tests are categorized into serum creatinine, glomerular filtration rate (GFR), and blood urea nitrogen (BUN) tests. The urine tests segment is expected to hold the largest share of the market in 2017. This segment is also expected to grow at the highest CAGR during the forecast period. The large share and high growth rate of the urine test segment can be attributed to the increasing usage of urine dipsticks analysis, the ease in sample collection compared to blood tests that can cause discomfort and swelling, and very low risk of infection due to sample collection.

On the basis of end users, the market is segmented into hospitals, diagnostics laboratory, and research laboratories & institutes. The hospitals segment is the largest and fastest growing segment of the market. Factors contributing to the large share and high growth rate of this segment include the increasing number of awareness campaigns about kidney function tests and the growing focus of emerging economies on increasing the number of hospitals in these regions.

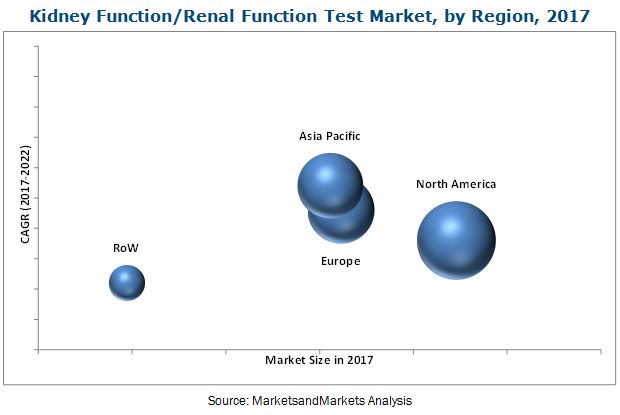

In 2017, North America is estimated to account for the largest share of the market, followed by Europe. This large share can be attributed to factors such as the increasing incidence of chronic diseases, rising prevalence of hypertension, growing incidence of diabetes in the US, and increasing initiatives by the Canadian government for the awareness and treatment of kidney diseases. However, the Asia Pacific region is expected to register the highest CAGR during the forecast period.

The prominent players in the global kidney function/renal function test market are Siemens (Germany), Beckman Coulter (US), Sysmex (Japan), Roche (Switzerland), Abbott(US), Nova Biomedical (US), URIT Medical (China), ARKRAY (Japan), OPTI Medical (US), ACON Laboratories (US), 77 Elektronika (Hungary), and Randox Laboratories (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Kidney Function Tests: Market Overview

4.2 Kidney Function Tests Market Share, By Product and Region

4.3 Kidney Function Tests Market, By Type

4.4 Kidney Function Tests Market, By End User

4.5 Geographic Snapshot of the Kidney Function Tests Market

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Prevalence of Kidney Disease

5.2.1.2 Growing Prevalence of Diabetes and Hypertension

5.2.1.3 Rapid Growth in Geriatric Population

5.2.1.4 Rise in Consumption of Alcohol

5.2.2 Restraints

5.2.2.1 Unfavorable Healthcare Reforms in the Us

5.2.3 Opportunities

5.2.3.1 Emerging Markets

6 Kidney Function Tests Market, By Product (Page No. - 38)

6.1 Introduction

6.2 Dipsticks

6.3 Disposables

6.4 Reagents

7 Kidney Function Tests Market, By Type (Page No. - 43)

7.1 Introduction

7.2 Urine Tests

7.2.1 Urine Protein Tests

7.2.2 Creatinine Clearance Tests

7.2.3 Microalbumin Tests

7.3 Blood Tests

7.3.1 Serum Creatinine Tests

7.3.2 Glomerular Filtration Rate Tests

7.3.3 Blood Urea Nitrogen Tests

8 Kidney Function Tests Market, By End User (Page No. - 52)

8.1 Introduction

8.2 Hospitals

8.3 Diagnostic Laboratories

8.4 Research Laboratories and Institutes

9 Kidney Function Tests Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 EU-5

9.3.2 Rest of Europe

9.4 Asia Pacific

9.4.1 Conferences & Campaigns to Create Awareness of Kidney Diseases

9.4.2 China

9.4.3 Japan

9.4.4 India

9.4.5 Rest of Asia Pacific (RoAPAC)

9.5 Rest of the World (RoW)

9.5.1 Latin America

9.5.2 Middle East

10 Competitive Landscape (Page No. - 93)

10.1 Introduction

10.2 Market Overview

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 Product Launches

10.3.3 Acquisitions

10.3.4 Agreements

10.3.5 Regulatory Approvals

11 Company Profiles (Page No. - 97)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Siemens

11.2 Beckman Coulter

11.3 Roche

11.4 Abbott

11.5 Sysmex

11.6 Nova Biomedical

11.7 Urit Medical

11.8 Arkray

11.9 Opti Medical

11.10 Acon Laboratories

11.11 77 Elektronika

11.12 Randox Laboratories

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 116)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (90 Tables)

Table 1 Top 5 Countries With the Highest Number of Diabetics (20–79 Years), 2015 vs 2040

Table 2 Forecast Increase in Population Aged 60 and Above (Millions)

Table 3 Global Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 4 Kidney Function Tests Market for Dipsticks, By Country, 2015–2022 (USD Million)

Table 5 Kidney Function Tests Market for Disposables, By Country, 2015–2022 (USD Million)

Table 6 Kidney Function Tests Market for Reagents, By Country, 2015–2022 (USD Million)

Table 7 Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 8 Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 9 Urine Protein Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 10 Creatinine Clearance Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 11 Microalbumin Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 12 Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 13 Serum Creatinine Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 14 Stages of Chronic Kidney Disease

Table 15 Glomerular Filtration Rate Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 16 Blood Urea Nitrogen Tests Market, By Country/Region, 2015–2022 (USD Million)

Table 17 Global Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 18 Kidney Function Tests Market for Hospitals, By Country/Region, 2015–2022 (USD Million)

Table 19 Kidney Function Tests Market for Diagnostic Laboratories, By Country/Region, 2015–2022 (USD Million)

Table 20 Kidney Function Tests Market for Research Laboratories and Institutes, By Country/Region, 2015–2022 (USD Million)

Table 21 Kidney Function Tests Market Size, By Region, 2015–2022 (USD Million)

Table 22 North America: Kidney Function Tests Market, By Country, 2015–2022 (USD Million)

Table 23 North America: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 24 North America: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 25 North America: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 26 North America: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 27 North America: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 28 US: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 29 US: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 30 US: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 31 US: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 32 US: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 33 Canada: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 34 Canada: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 35 Canada: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 36 Canada: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 37 Canada: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 38 Europe: Kidney Function Tests Market, By Region, 2015–2022 (USD Million)

Table 39 Europe: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 40 Europe: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 41 Europe: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 42 Europe: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 43 Europe: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 44 EU-5: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 45 EU-5: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 46 EU-5: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 47 EU-5: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 48 EU-5: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 49 RoE: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 50 RoE: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 51 RoE: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 52 RoE: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 53 RoE: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 54 Aging Demographics in Asia Pacific Countries

Table 55 Asia Pacific: Kidney Function Tests Market, By Country, 2015–2022 (USD Million)

Table 56 Asia Pacific: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 57 Asia Pacific: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 58 Asia Pacific: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 59 Asia Pacific: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 60 Asia Pacific: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 61 China: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 62 China: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 63 China: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 64 China: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 65 China: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 66 Japan: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 67 Japan: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 68 Japan: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 69 Japan: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 70 Japan: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 71 India: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 72 India: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 73 India: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 74 India: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 75 India: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 76 RoAPAC: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 77 RoAPAC: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 78 RoAPAC: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 79 RoAPAC: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 80 RoAPAC: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 81 RoW: Kidney Function Tests Market, By Product, 2015–2022 (USD Million)

Table 82 RoW: Kidney Function Tests Market, By Type, 2015–2022 (USD Million)

Table 83 RoW: Urine Tests Market, By Type, 2015–2022 (USD Million)

Table 84 RoW: Blood Tests Market, By Type, 2015–2022 (USD Million)

Table 85 RoW: Kidney Function Tests Market, By End User, 2015–2022 (USD Million)

Table 86 Expansions (2014–2017)

Table 87 Product Launches (2014–2017)

Table 88 Acquisitions (2014–2017)

Table 89 Agreements (2014–2017)

Table 90 Regulatory Approvals (2014–2017)

List of Figures (33 Figures)

Figure 1 Research Methodology: Global Kidney Function Tests Market

Figure 2 Research Design: Kidney Function Tests Market

Figure 3 Break Down of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Sampling Frame: Primary Research

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Global Kidney Function Tests Market, By Product (2017)

Figure 9 Global Kidney Function Tests Market, By Type, 2017 vs 2022

Figure 10 Global Kidney Function Tests Market, By End User, 2017 vs 2022

Figure 11 Asia Pacific to Register the Highest Growth During the Forecast Period

Figure 12 Rising Prevalence of Kidney Diseases is A Major Factor Driving the Growth of the Kidney Function Tests Market

Figure 13 China is Expected to Account for the Largest Share of the Asia Pacific Kidney Function Tests Market in 2017

Figure 14 Urine Tests Segment to Continue to Dominate the Kidney Function Tests Market Between 2017 and 2022

Figure 15 Hospital Segment to Continue to Dominate the Kidney Function Tests Market Between 2017 and 2022

Figure 16 China to Register the Highest CAGR During the Forecast Period

Figure 17 Drivers, Restraints, and Opportunities

Figure 18 Global Kidney Function Tests Market, By Product, 2017–2022

Figure 19 Urine Tests Segment to Dominate the Kidney Function Tests Market in 2017

Figure 20 Global Kidney Function Tests Market, By End User, 2017–2022

Figure 21 North America to Command the Largest Share of the Market in 2017

Figure 22 North America: Kidney Function Tests Market Snapshot

Figure 23 Causes of Kidney Failure in the Us

Figure 24 Europe: Kidney Function Tests Market Snapshot

Figure 25 Rest of Europe: Number of Diabetics, By Country, 2015 (Million Cases)

Figure 26 Asia Pacific: Kidney Function Tests Market Snapshot

Figure 27 RoW: Kidney Function Tests Market Snapshot

Figure 28 Key Developments of the Prominent Players in the Kidney Function Tests Market (2014–2017)

Figure 29 Siemens: Company Snapshot

Figure 30 Danaher Corporation: Company Snapshot

Figure 31 Roche: Company Snapshot

Figure 32 Abbott: Company Snapshot

Figure 33 Sysmex: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Kidney/Renal Function Test Market