Creatinine Measurement Market by Product (Kits, Reagents), Test Type (Jaffe method, Enzymatic creatinine method), Sample (Serum Creatinine, Urine) and End User (Hospitals, Diagnostic Laboratories), Region (North America, Europe) - Global Forecasts to 2023

The global creatinine measurement market is projected to reach USD 564.5 Million by 2023, at a CAGR of 8.4%.

The objectives of this study are as follows:

- To define, describe, and forecast the global creatinine measurement on the basis of type, type of sample, end user, product and region

- To estimate the total number of creatinine measurement tests conducted by type and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To forecast the size of the market with respect to five regions: North America, Europe, Asia, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments in the creatinine measurement market, such as acquisitions, agreements, product launches & upgrades, expansions, and R&D activities

Research Methodology

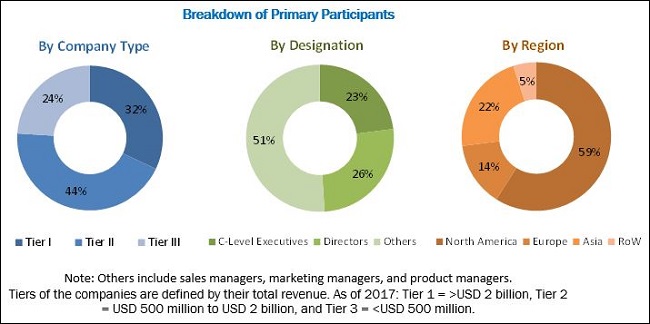

The study estimates the creatinine measurement market size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include physicians/doctors, healthcare professionals, clinical laboratory executives, lab managers, laboratory assistants, and biochemistry consultants.

For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the creatinine measurement market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. Secondary sources such as directories; databases such as D&B Hoovers, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies were referred.

To know about the assumptions considered for the study, download the pdf brochure

The creatinine measurement market is highly fragmented with the presence of several small and big players. The prominent players in this market include F. Hoffmann-la Roche ltd. (Switzerland), Abbott Laboratories (US), Danaher Corporation (US), Thermo Fisher Scientific (US), Siemens Healthineers (Germany), Randox Laboratories (UK), Pointe Scientific (US), Sentinel Ch. Spa. (Italy), Diasys Diagnostic Systems GmbH (Germany), Dialab GmbH (Vienna), Diazyme Laboratories (US), Wako Pure Chemical Industries, Ltd. (Japan), Ortho Clinical Diagnostics (US), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China).

Target Audience for this Report:

- Creatinine test kits and reagents manufacturers

- Creatinine test kits and reagents distributors

- Hospitals

- Research and consulting firms

- Venture capitalists

- Regulatory bodies

- Academic centers

- Teaching hospitals and academic medical centers (AMCs)

- Contract manufacturing organizations (CMOs)

- Contract research organizations (CROs)

Creatinine Measurement Market Scope

This report categorizes the creatinine measurement market into following segments and subsegments:

By Type

- Jaffe’s kinetic method

- Enzymatic method

By Type of Sample

- Blood/serum

- Urine

By End user

- Hospitals

- Diagnostic Laboratories

By Product

- Reagents

- Kits

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia

- Japan

- China

- India

- Indonesia

- RoA

-

Rest of the World (RoW)

- Brazil

- Other Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The growth of this market is mainly driven by increasing incidence of renal disorders, growing incidence of other chronic disorders impacting renal function, rising awareness and adoption of preventive healthcare approaches, implementation of favorable government initiatives to promote renal health, rapid growth in the geriatric population, and increasing number of drug development initiatives.

This report segments the creatinine measurement market on the basis of type, type of sample, end user, product, and region. By type, the market is segmented into Jaffe’s kinetic method and enzymatic method. In 2018, the Jaffe’s kinetic method segment is estimated to account for the largest share of the creatinine measurement market, as it is the oldest and most conventional method for creatinine measurement in clinical samples. Additionally, the widespread availability and cost-effectiveness of kits and reagents used in Jaffe’s kinetic method is another major factor responsible for the large share of this segment.

Based on type of sample, the market is segmented into blood/serum and urine samples. The blood sample segment accounted for the largest share of the creatinine measurement market in 2017 due to the increased accuracy and low risk of contamination. This segment is also expected to witness the highest growth over the forecast period, as it is the most preferred sample type for accurate measurement of creatinine levels.

Based on end user, the creatinine measurement market is segmented into hospitals and diagnostic laboratories. In 2018, the hospitals segment is expected to account for the largest share of the creatinine measurement owing to established infrastructures with an advanced diagnostic assembly for better diagnostic results within shorter time spans. The diagnostic laboratories segment is expected to witness the highest growth over the forecast period as various market players are entering into long-term collaborations with diagnostic laboratories in order to increase their presence in the creatinine measurement market.

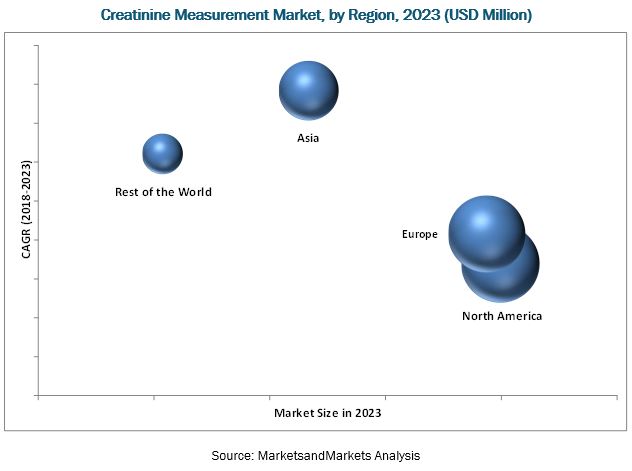

In 2017, North America dominated the market followed by Europe. Asia is expected to grow at the highest CAGR during the forecast period. This can be attributed to factors such as the growing prevalence of CKD, rising awareness about preventive healthcare, improving healthcare infrastructure, and growing focus of market players on addressing the demands in several Asian countries. Also, as developed markets are reaching saturation levels, Asia is expected to become a hotspot for creatinine kits and reagents providers However, identification of novel renal dysfunction Biomarkers and frequently changing regulatory policies are expected to challenge market growth in the coming years.

The creatinine measurement market is highly fragmented with the presence of several small and big players. The prominent players in this market include F. Hoffmann-la Roche Ltd (Switzerland), Abbott Laboratories (US), Danaher Corporation (US), Thermo Fisher Scientific (US), Siemens Healthineers (Germany), Randox Laboratories (UK), Pointe Scientific (US), Sentinel Ch. Spa. (Italy), Diasys Diagnostic Systems GmbH (Germany), Dialab GmbH (Vienna), Diazyme Laboratories (US), Wako Pure Chemical Industries, Ltd. (Japan), Ortho Clinical Diagnostics (US), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Limitations

1.5 Stakeholders

2 Research Methodology

2.1 Introduction

2.2 Research Data

2.3 Market Size Estimation: Creatinine Test Kits and Reagents Market

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Apporach

2.4 Breakdown of Primaries: Creatinine Test Kits and Reagents Market

2.5 Market Breakdown and Data Triangulation: Creatinine Test Kits and Reagents Market

2.6 Secondary Data

2.6.1 Key Data From Secondary Sources

2.7 Primary Data

2.7.1 Key Data From Primary Sources

2.8 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Drivers

5.2.1 Increasing Incidence of Renal Disorders

5.2.2 Growing Incidence of Other Chronic Disorders Impacting Renal Function

5.2.3 Growing Awareness and Adoption of Preventive Healthcare

5.2.4 Favorable Government Initiatives to Promote Renal Health

5.2.5 Rapid Growth in the Geriatric Population

5.2.6 Increasing Number of Drug Development Initiatives

5.3 Market Restraints/Challenges

5.3.1 Identification of Novel Renal Dysfunction Biomarkers

5.3.2 Frequently Changing Regulatory Policies

5.4 Market Opportunities

5.4.1 High Growth Potential in Emerging Economies

5.4.2 Commercialization of Advanced Testing Methods

6 Creatinine Test Kits and Reagents Market, By Product

6.1 Introduction

6.2 Reagents

6.3 Kits

7 Creatinine Test Kits and Reagents Market, By Type

7.1 Introduction

7.2 Jaffe’s Kinetic Method

7.3 Enzymatic Method

8 Creatinine Test Kits and Reagents Market, By Sample Type

8.1 Introduction

8.2 Blood/Serum

8.3 Urine

9 Creatinine Test Kits and Reagents Market, By End User

9.1 Introduction

9.2 Hospitals

9.3 Diagnostic Laboratories

10 Creatinine Test Kits and Reagents Market, By Region

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of the Europe

10.4 Asia

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Indonesia

10.4.5 Rest of the Asia

10.5 Rest of the World

10.5.1 Brazil

10.5.2 Other RoW Countries

11 Competitive Landscape

11.1 Creatinine Test Kits and Reagents Market: Competitive Intelligence (2017)

11.2 Creatinine Test Kits and Reagents Market: Market Share Analysis (2017)

11.3 Creatinine Test Kits and Reagents Market: Competetive Situation & Trends

12 Company Profiles

12.1 Introduction

12.2 Siemens Healthineers (A Division of Siemens AG)

12.3 F. Hoffmann-La Roche Ltd.

12.4 Abbott Laboratories

12.5 Danaher Corporation (Beckman Coulter)

12.6 Thermo Fisher Scientific Inc.

12.7 Randox Laboratories

12.8 Wako Pure Chemical Industries, Ltd

12.9 Pointe Scientific, Inc (A Part of Medtest Holdings)

12.10 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

12.11 Ortho Clinical Diagnostics

12.12 Diazyme Laboratories, Inc

12.13 Dialab GmbH

12.14 Sentinel Ch. SPA

12.15 Diasys Diagnostic Systems GmbH

13 Appendix

13.1 Key Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Marketsandmarkets Knowledge Store: Snapshot

13.5 Introducing RT: Real Time Market Intelligence

13.6 Related Reports

13.7 Author Details

List of Tables (96 Tables)

Table 1 Creatinine Test Kits and Reagents Market, By Product, 2016–2023 (USD Million)

Table 2 Reagents Market, By Region, 2016–2023 (USD Million)

Table 3 Kits Market, By Region, 2016–2023 (USD Million)

Table 4 Creatinine Test Kits and Reagents Market, By Test Type, 2016–2023 (USD Million)

Table 5 Jaffe’s Kinetic Method Market, By Region, 2016–2023 (USD Million)

Table 6 North America: Jaffe’s Kinetic Method Market, By Country, 2016–2023 (USD Million)

Table 7 Europe: Jaffe’s Kinetic Method Market, By Country, 2016–2023 (USD Million)

Table 8 Asia: Jaffe’s Kinetic Method Market, By Country, 2016–2023 (USD Million)

Table 9 RoW: Jaffe’s Kinetic Method Market, By Country, 2016–2023 (USD Million)

Table 10 Enzymatic Method Market, By Region, 2016–2023 (USD Million)

Table 11 North America: Enzymatic Method Market, By Country, 2016–2023 (USD Million)

Table 12 Europe: Enzymatic Method Market, By Country, 2016–2023 (USD Million)

Table 13 Asia: Enzymatic Method Market, By Country, 2016–2023 (USD Million)

Table 14 RoW: Enzymatic Method Market, By Country, 2016–2023 (USD Million)

Table 15 Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 16 Blood/Serum Samples Market, By Region, 2016–2023 (USD Million)

Table 17 North America: Blood/Serum Samples Market, By Country, 2016–2023 (USD Million)

Table 18 Europe: Blood/Serum Samples Market, By Country, 2016–2023 (USD Million)

Table 19 Asia: Blood/Serum Samples Market, By Country, 2016–2023 (USD Million)

Table 20 RoW: Blood/Serum Samples Market, By Country, 2016–2023 (USD Million)

Table 21 Urine Samples Market, By Region, 2016–2023 (USD Million)

Table 22 North America: Urine Samples Market, By Country, 2016–2023 (USD Million)

Table 23 Europe: Urine Samples Market, By Country, 2016–2023 (USD Million)

Table 24 Asia: Urine Samples Market, By Country, 2016–2023 (USD Million)

Table 25 RoW: Urine Samples Market, By Country, 2016–2023 (USD Million)

Table 26 Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 27 Creatinine Test Kits and Reagents Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 28 North America: Creatinine Test Kits and Reagents Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 29 Europe: Creatinine Test Kits and Reagents Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 30 Asia: Creatinine Test Kits and Reagents Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 31 RoW: Creatinine Test Kits and Reagents Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 32 Creatinine Test Kits and Reagents Market for Diagnostic Laboratories, By Region, 2016–2023 (USD Million)

Table 33 North America: Creatinine Test Kits and Reagents Market for Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 34 Europe: Creatinine Test Kits and Reagents Market for Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 35 Asia: Creatinine Test Kits and Reagents Market for Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 36 RoW: Creatinine Test Kits and Reagents Market for Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 37 Creatinine Test Kits and Reagents Market, By Region, 2016–2023 (USD Million)

Table 38 North America: Creatinine Test Kits and Reagents Market, By Country, 2016–2023 (USD Million)

Table 39 North America: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 40 North America: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 41 North America: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 42 North America: Creatinine Test Kits and Reagents Market, By Product, 2016–2023 (USD Million)

Table 43 US: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 44 US: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 45 US: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 46 Canada: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 47 Canada: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 48 Canada: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 49 Europe: Creatinine Test Kits and Reagents Market, By Country, 2016–2023 (USD Million)

Table 50 Europe: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 51 Europe: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 52 Europe: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 53 Europe: Creatinine Test Kits and Reagents Market, By Product, 2016–2023 (USD Million)

Table 54 Germany: Creatinine Test Kits Market, By Type, 2016–2023 (USD Million)

Table 55 Germany: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 56 Germany: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 57 UK: Creatinine Test Kits Market, By Type, 2016–2023 (USD Million)

Table 58 UK: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 59 UK: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 60 France: Creatinine Test Kits Market, By Type, 2016–2023 (USD Million)

Table 61 France: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 62 France: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 63 RoE: Creatinine Test Kits Market, By Type, 2016–2023 (USD Million)

Table 64 RoE: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 65 RoE: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 66 Asia: Creatinine Test Kits and Reagents Market, By Country, 2016–2023 (USD Million)

Table 67 Asia: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 68 Asia: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 69 Asia: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 70 Asia: Creatinine Test Kits and Reagents Market, By Product, 2016–2023 (USD Million)

Table 71 Japan: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 72 Japan: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 73 Japan: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 74 China: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 75 China: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 76 China: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 77 India: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 78 India: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 79 India: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 80 Indonesia: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 81 Indonesia: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 82 Indonesia: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 83 RoA: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 84 RoA: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 85 RoA: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 86 Rest of the World: Creatinine Test Kits and Reagents Market, By Country, 2016–2023 (USD Million)

Table 87 Rest of the World: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 88 Rest of the World: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 89 Rest of the World: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 90 Rest of the World: Creatinine Test Kits and Reagents Market, By Product, 2016–2023 (USD Million)

Table 91 Brazil: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 92 Other RoW Countries: Creatinine Test Kits and Reagents Market, By Type, 2016–2023 (USD Million)

Table 93 Brazil: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 94 Other RoW Countries: Creatinine Test Kits and Reagents Market, By Sample Type, 2016–2023 (USD Million)

Table 95 Brazil: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

Table 96 Other RoW Countries: Creatinine Test Kits and Reagents Market, By End User, 2016–2023 (USD Million)

List of Figures (21 Figures)

Figure 1 Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Research Design

Figure 4 Creatinine Test Kits and Reagents Market: Bottom-Up Approach

Figure 5 Creatinine Test Kits and Reagents Market: Top-Down Approach

Figure 6 Breakdown of Supply-Side Primary Interviews: By Company Type, Designation, and Region

Figure 7 Data Triangulation Methodology: Creatinine Test Kits and Reagents Market

Figure 8 Creatinine Test Kits & Reagents Market, By Product, 2018 vs 2023

Figure 9 Creatinine Test Kits & Reagents Market, By Test Type, 2018 vs 2023

Figure 10 Creatinine Test Kits & Reagents Market, By Sample Type, 2018 vs 2023

Figure 11 Creatinine Test Kits & Reagents Kits Market, By End User, 2018 vs 2023

Figure 12 Geographic Snapshot of the Creatinine Test Kits & Reagents Market: Asia to Witness the Highest Growth During the Forecast Period

Figure 13 Increasing Incidence of Renal Disorders, A Major Factor Driving the Growth of the Creatinine Test Kits & Reagents Market

Figure 14 The Enzymatic Method to Register Highest CAGR Over the Forecast Perod (2018–2023)

Figure 15 Blood/Serum Samples to Dominate the Market in 2018

Figure 16 Hospitals to Dominate the Market During the Forecast Period

Figure 17 Geographic Growth Opportunities: Asia to Witness the Highest Growth During the Forecast Period

Figure 18 Creatinine Test Kits and Reagents Market: Drivers, Restraints/Challenges, and Opportunities

Figure 19 Key Developments in the Creatinine Test Kits Market, 2015–2018

Figure 20 Expansion Accounted for the Largest Share of the Total Developments in the Creatinine Test Kits Market (2013–2017)

Figure 21 Insights From Industry Experts

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Creatinine Measurement Market