Albumin & Creatinine Tests Market by Product (Analyzers, Cartridges (PoC, Tabletop), Dipsticks, Kits, Reagents), Type (Blood & Urine Creatinine, Urine Albumin, Glycated Albumin), Enduser (Hospital, Diagnostic & Research Labs) - Global Forecast to 2025

Market Growth Outlook Summary

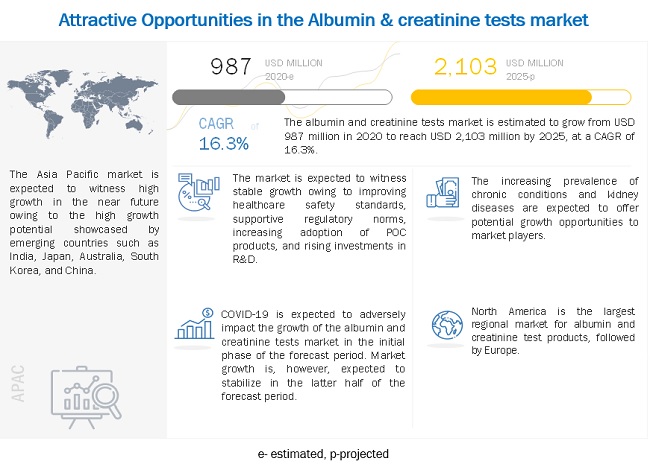

The global albumin & creatinine tests market growth forecasted to transform from $987 million in 2020 to $2,103 million by 2025, driven by a CAGR of 16.3%. The growth of this market is driven by the growing prevalence of kidney disorders and diseases, the rising adoption of POC diagnostics, and the increasing prevalence of chronic conditions.

To know about the assumptions considered for the study, Request for Free Sample Report

Albumin & Creatinine Tests Market Dynamics

Driver: Rising prevalence of kidney disorders

Kidney disease is one of the leading causes of death across the globe. Such cases—involving multiple kidney treatments—require the regular monitoring of components like creatinine and albumin and their ratios, for which multiple urine analysis products and techniques are used. Urine analysis has widespread applications in the diagnosis and management of kidney diseases. Biochemical urine analysis enables clinicians to assess the level of chemical compounds (such as creatinine, urobilinogen, bilirubin, ketones, and glucose) in the urine. Abnormal levels of these compounds in the urine indicate chronic kidney diseases, acute kidney injuries, and acute renal failure. Thus, the growing incidence of kidney diseases will be the primary growth driver for this market, as it will ensure sustained demand for albumin and creatinine tests.

Opportunity: Integrated and automated systems for overall urine analysis

The integration of automated urine sediment and urine biochemical analysis in one system allows rapid and easy urine analysis. At present, standalone automated urine sediment analyzers help standardize sediment & biochemical analysis with minimum operator interference and enable the rapid analysis of urine samples. Such integrated systems have a huge potential in the automated devices market and can help large hospitals and diagnostic labs to manage their workloads efficiently. As a result, this area has been identified as an opportunity in the market.

Challenge: High cost of automated analyzers

Most small hospitals and clinics with lower workloads still prefer semi-automated devices or manual analysis. Automated devices are primarily used by large hospitals with higher workloads; thus, the revenue generation can justify the costs incurred in installing automated analyzers. This makes it difficult for automated analyzers to penetrate the market, specifically in developing economies, which is a major challenge to market growth.

The dipsticks and kits product segment accounted for the largest share of the albumin and creatinine tests market, by product and service, in 2019.

The market is segmented into dipsticks & kits, analyzers, cartridges, and reagents & other consumables. In 2019, the dipsticks & kits segment accounted for the largest share in this market. The frequent purchase of these products compared to instruments like analyzers and cartridges and the increasing use of kit-based rapid techniques for albumin & creatinine tests drive market growth.

Urine tests accounted for the largest share of the albumin and creatinine tests market by type in 2019.

Based on type, the market is segmented into urine tests, and blood & serum creatinine tests. In 2019, urine tests accounted for the largest share in this market. Factors such as the rapid growth in the diagnostics segment and the increasing demand for rapid and easy-to-use urine tests drive the growth of this segment.

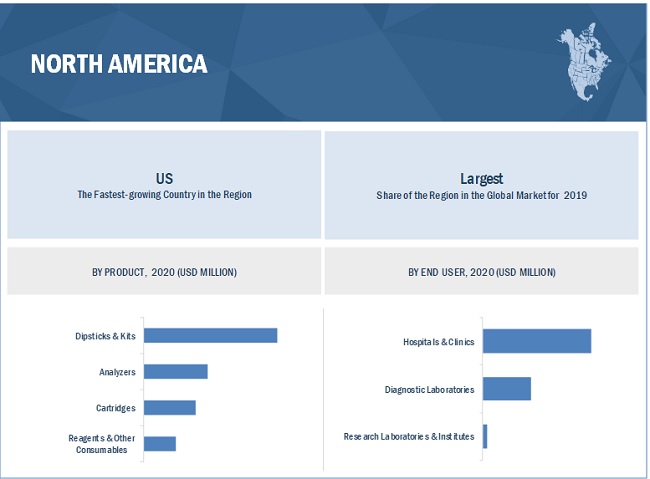

North America is the largest region of the albumin and creatinine test market.

The market is segmented into North America, Europe, the Asia Pacific, Latin America and Middle East & Africa. In 2019, North America accounted for the largest share of the global albumin & creatinine tests market. The large share of this regional segment can primarily be attributed to the growth in demand for rapid urine tests, increasing prevalence of chronic conditions leading to various kidney diseases, rising government initiatives, and growing geriatric population.

To know about the assumptions considered for the study, download the pdf brochure

Some key players in the albumin & creatinine tests market are:

- Roche Diagnostics

- Abbott laboratories

- Danaher Corporation

Albumin & Creatinine Tests Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$987 million |

|

Estimated Value by 2025 |

$2,103 million |

|

Growth Rate |

Poised to grow at a CAGR of 16.3% |

|

Segments covered |

Product, type, end user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, & Middle East & Africa |

This report categorizes the albumin & creatinine tests market into the following segments and subsegments:

By Product

- Dipsticks & Kits

- Analyzers

-

Cartridges

- Cartridges for POC Analyzers

- Cartridges for Table-Top Analyzers

- Reagents & Other Consumables

By Type

-

Urine Tests

- Urine Albumin Tests

- Urine Creatinine Tests

- Glycated Albumin

- Blood & Serum Creatinine Tests

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Research Laboratories & Institutes

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

-

Asia Pacific

- Japan

- China

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In 2018, Danaher launched iQ Urinalysis Workcell.

- In 2017, Abbott Laboratories acquired Alere to enter the overall urine analysis market.

- In 2020, Siemens Healthineers acquired Sysmex Corporation to enter the overall urine analysis market.

Frequently Asked Questions (FAQs):

What is the projected market value of the global albumin & creatinine tests market?

The global market of albumin & creatinine tests is projected to reach USD 2,103 million.

What is the estimated growth rate (CAGR) of the global albumin & creatinine tests market for the next five years?

The global albumin & creatinine tests market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.3% from 2020 to 2025.

What are the major revenue pockets in the albumin & creatinine tests market currently?

The global market is segmented into North America, Europe, the Asia Pacific, Latin America and Middle East & Africa. In 2019, North America accounted for the largest share of the global albumin & creatinine tests market. The large share of this regional segment can primarily be attributed to the growth in demand for rapid urine tests, increasing prevalence of chronic conditions leading to various kidney diseases, rising government initiatives, and growing geriatric population.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 INCLUSIONS & EXCLUSIONS

1.2.1 MARKETS COVERED

FIGURE 2 ALBUMIN & CREATININE TESTS MARKET SEGMENTATION

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

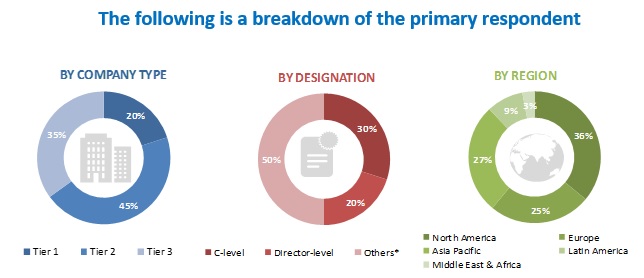

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 ALBUMIN & CREATININE TESTS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 ALBUMIN & CREATININE TESTS MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 8 ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 9 ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 11 ALBUMIN & CREATININE TESTS MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ALBUMIN & CREATININE TESTS MARKET OVERVIEW

FIGURE 12 RISING ADOPTION OF POC PRODUCTS TO DRIVE MARKET GROWTH

4.2 ALBUMIN & CREATININE TESTS MARKET, BY CARTRIDGE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 13 POC ANALYZER CARTRIDGES SEGMENT TO COMMAND THE LARGEST MARKET SHARE IN 2019

4.3 URINE TESTS MARKET, BY TYPE, 2020 VS. 2025

FIGURE 14 URINE ALBUMIN TESTS TO HOLD THE LARGEST MARKET SHARE

4.4 ALBUMIN & CREATININE TESTS MARKET, BY REGION, 2020 VS. 2025

FIGURE 15 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 ALBUMIN & CREATININE TESTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of kidney disorders

5.2.1.2 Increasing adoption of point-of-care (POC) diagnostics

5.2.1.3 Growing global prevalence of chronic conditions leading to kidney diseases

5.2.2 RESTRAINTS

5.2.2.1 Unfavorable healthcare reforms in the US

5.2.3 OPPORTUNITIES

5.2.3.1 Integrated and automated systems for overall urine analysis

5.2.3.2 Emerging economies to provide significant opportunities

5.2.4 CHALLENGES

5.2.4.1 High cost of automated analyzers

5.2.4.2 High degree of consolidation acts as an entry barrier for new entrants

5.3 IMPACT OF COVID-19 ON THE ALBUMIN & CREATININE TESTS MARKET

5.4 ECOSYSTEM ANALYSIS

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS OF THE ALBUMIN & CREATININE TESTS MARKET

FIGURE 18 RESTRAINTS IN THE VALUE CHAIN FOR POC DIAGNOSTICS, BY STAGE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN ANALYSIS OF THE ALBUMIN & CREATININE TESTS MARKET

5.7 PESTLE ANALYSIS

FIGURE 20 PESTLE ANALYSIS OF THE ALBUMIN & CREATININE TESTS MARKET

6 ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT (Page No. - 49)

6.1 INTRODUCTION

TABLE 1 AVERAGE SELLING PRICES OF PRODUCTS (USD)

TABLE 2 ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 DIPSTICKS & KITS

6.2.1 COST-EFFECTIVENESS AND EASE OF USE TO DRIVE MARKET GROWTH

TABLE 3 DIPSTICKS & KITS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 ANALYZERS

6.3.1 ADOPTION OF POC ANALYZERS HAS INCREASED IN RECENT YEARS

TABLE 4 ANALYZERS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 CARTRIDGES

TABLE 5 CARTRIDGES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.4.1 POC ANALYZER CARTRIDGES

6.4.1.1 Increasing adoption of POC technologies to drive market growth

TABLE 7 POC ANALYZER CARTRIDGES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4.2 TABLE-TOP ANALYZER CARTRIDGES

6.4.2.1 Table-top analyzers and cartridges are used in hospitals, labs, and research

TABLE 8 TABLE-TOP ANALYZER CARTRIDGES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.5 REAGENTS & OTHER CONSUMABLES

6.5.1 INCREASING USE OF CONTROLS AND CALIBRATORS TO DRIVE MARKET GROWTH

TABLE 9 REAGENTS & OTHER CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7 ALBUMIN & CREATININE TESTS MARKET, BY TYPE (Page No. - 57)

7.1 INTRODUCTION

TABLE 10 ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

7.2 URINE TESTS

TABLE 11 URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 URINE TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1 URINE ALBUMIN TESTS

7.2.1.1 Increasing prevalence of hypertension to drive market growth

TABLE 13 URINE ALBUMIN TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.2 URINE CREATININE TESTS

7.2.2.1 Increasing prevalence of drug nephrotoxicity to drive market growth

TABLE 14 URINE CREATININE TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.3 GLYCATED ALBUMIN TESTS

7.2.3.1 Increasing prevalence of diabetes to drive market growth

TABLE 15 GLYCATED ALBUMIN TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 BLOOD & SERUM CREATININE TESTS

7.3.1 INCREASING PREVALENCE OF CHRONIC CONDITIONS TO DRIVE MARKET GROWTH

TABLE 16 BLOOD & SERUM CREATININE TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

8 ALBUMIN & CREATININE TESTS MARKET, BY END USER (Page No. - 63)

8.1 INTRODUCTION

TABLE 17 ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 HOSPITALS & CLINICS

8.2.1 RISING NUMBER OF HOSPITALS TO DRIVE MARKET GROWTH

TABLE 18 ALBUMIN & CREATININE TESTS MARKET FOR HOSPITALS & CLINICS, BY REGION, 2018–2025 (USD MILLION)

8.3 DIAGNOSTIC LABORATORIES

8.3.1 INCREASING OUTSOURCING BY HOSPITALS IS SUPPORTING THE GROWTH OF THIS END-USER SEGMENT

TABLE 19 ALBUMIN & CREATININE TESTS MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2018–2025 (USD MILLION)

8.4 RESEARCH LABORATORIES & INSTITUTES

8.4.1 INCREASING INVESTMENTS IN RESEARCH IS THE MAJOR FACTOR CONTRIBUTING TO MARKET GROWTH

TABLE 20 ALBUMIN & CREATININE TESTS MARKET FOR RESEARCH LABORATORIES & INSTITUTES, BY REGION, 2018–2025 (USD MILLION

9 ALBUMIN & CREATININE TESTS MARKET, BY REGION (Page No. - 68)

9.1 INTRODUCTION

TABLE 21 ALBUMIN & CREATININE TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: ALBUMIN & CREATININE TESTS MARKET SNAPSHOT

TABLE 22 NORTH AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 NORTH AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 24 NORTH AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 25 NORTH AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing geriatric population to drive market growth in the US

TABLE 26 US: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 27 US: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 28 US: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 29 US: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 US: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising prevalence of diabetes to drive market growth

TABLE 31 CANADA: INCIDENCE OF DIABETES, 2019 VS. 2029

TABLE 32 CANADA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 33 CANADA: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 CANADA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 35 CANADA: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 CANADA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 37 EUROPE: PREVALENCE OF DIABETES (20–79 YEARS), 2019 VS. 2045

TABLE 38 EUROPE: ALBUMIN & CREATININE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 EUROPE: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 UK

9.3.1.1 Rising incidence of chronic kidney disorders to drive market growth

TABLE 42 UK: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 43 UK: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 UK: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 UK: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 46 UK: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Increasing healthcare expenditure to drive market growth

TABLE 47 GERMANY: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 48 GERMANY: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 GERMANY: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 GERMANY: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Rising R&D expenditure to drive market growth

TABLE 52 FRANCE: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 53 FRANCE: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 FRANCE: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 FRANCE: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 FRANCE: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Large geriatric population to drive the growth of the albumin & creatinine tests market in Italy

TABLE 57 ITALY: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 58 ITALY: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 ITALY: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 ITALY: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 ITALY: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Rising prevalence of CKD in Spain to drive market growth

TABLE 62 SPAIN: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 63 SPAIN: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 SPAIN: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 SPAIN: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 SPAIN: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.6 RUSSIA

9.3.6.1 Government focus on increasing diabetes awareness will favor market growth in Russia

TABLE 67 RUSSIA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 68 RUSSIA: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 RUSSIA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 RUSSIA: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 RUSSIA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 72 ROE: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 73 ROE: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 ROE: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 ROE: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 ROE: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 22 APAC: ALBUMIN & CREATININE TESTS MARKET SNAPSHOT

TABLE 77 APAC: ALBUMIN & CREATININE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 78 APAC: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 79 APAC: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 APAC: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China accounts for the largest share of the APAC market

TABLE 81 CHINA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 82 CHINA: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 CHINA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 CHINA: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 CHINA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Favorable regulatory framework to drive market growth

TABLE 86 JAPAN: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 87 JAPAN: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 JAPAN: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 JAPAN: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 JAPAN: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 AUSTRALIA

9.4.3.1 Increasing incidence of diabetes is driving market growth

TABLE 91 AUSTRALIA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 92 AUSTRALIA: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 AUSTRALIA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 AUSTRALIA: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 AUSTRALIA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Rising geriatric population to drive market growth

TABLE 96 SOUTH KOREA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 97 SOUTH KOREA: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 SOUTH KOREA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 SOUTH KOREA: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 SOUTH KOREA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 101 ROAPAC: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 102 ROAPAC: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 ROAPAC: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 ROAPAC: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 ROAPAC: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 106 LATIN AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 107 LATIN AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 108 LATIN AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 LATIN AMERICA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 High prevalence of chronic conditions to promote market growth

TABLE 110 BRAZIL: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 111 BRAZIL: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 BRAZIL: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 BRAZIL: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 BRAZIL: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Rising prevalence of diabetes to drive market growth in Mexico

TABLE 115 MEXICO: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 116 MEXICO: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 MEXICO: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 MEXICO: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 MEXICO: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 120 ROLATAM: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 121 ROLATAM: ALBUMIN & CREATININE TEST CARTRIDGES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 ROLATAM: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 ROLATAM: URINE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 ROLATAM: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 INCREASING HEALTHCARE EXPENDITURE TO DRIVE MARKET GROWTH IN THE MIDDLE EAST AND AFRICA

TABLE 125 MEA: ALBUMIN & CREATININE TESTS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 126 MEA: ALBUMIN & CREATININE TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 MEA: ALBUMIN & CREATININE TESTS MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 115)

10.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE ALBUMIN & CREATININE TESTS MARKET (JANUARY 2017–NOVEMBER 2020)

10.2 ALBUMIN & CREATININE TESTS MARKET SHARE ANALYSIS

FIGURE 24 ALBUMIN & CREATININE TESTS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

10.3 COMPANY EVALUATION QUADRANT

10.3.1 DEFINITION AND METHODOLOGY

10.3.2 VENDOR DIVE OVERVIEW

10.3.2.1 Stars

10.3.2.2 Emerging leaders

10.3.2.3 Pervasive

10.3.2.4 Participants

FIGURE 25 ALBUMIN & CREATININE TESTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 COMPANY EVALUATION MATRIX FOR START-UPS (2019)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 RESPONSIVE COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 DYNAMIC COMPANIES

FIGURE 26 ALBUMIN & CREATININE TESTS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS, 2019

10.5 COMPETITIVE SCENARIO

10.5.1 PRODUCT LAUNCHES & REGULATORY APPROVALS

TABLE 128 PRODUCT LAUNCHES & REGULATORY APPROVALS (JANUARY 2017–NOVEMBER 2020)

10.5.2 PARTNERSHIPS & AGREEMENTS

TABLE 129 PARTNERSHIPS & AGREEMENTS (JANUARY 2017–NOVEMBER 2020)

10.5.3 ACQUISITIONS

TABLE 130 ACQUISITIONS (JANUARY 2017–NOVEMBER 2020)

10.5.4 EXPANSIONS

TABLE 131 EXPANSIONS (JANUARY 2017–NOVEMBER 2020)

11 COMPANY PROFILES (Page No. - 123)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1.1 ABBOTT LABORATORIES

FIGURE 27 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

11.1.2 ROCHE DIAGNOSTICS (A DIVISION OF F. HOFFMAN-LA ROCHE AG)

FIGURE 28 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT (2019)

11.1.3 SIEMENS HEALTHINEERS AG

FIGURE 29 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2019)

11.1.4 DANAHER CORPORATION

FIGURE 30 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

11.1.5 THERMO FISHER SCIENTIFIC, INC.

FIGURE 31 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

11.1.6 SYSMEX CORPORATION

FIGURE 32 SYSMEX CORPORATION: COMPANY SNAPSHOT (2019)

11.1.7 ORTHO CLINICAL DIAGNOSTICS

11.1.8 PROMOCELL GMBH

11.1.9 RANDOX LABORATORIES

11.1.10 FUJIFILM WAKO PURE CHEMICAL CORPORATION

11.2 OTHER PLAYERS

11.2.1 ABBEXA LTD.

11.2.2 ACON LABORATORIES, INC.

11.2.3 ARBOR ASSAYS, INC.

11.2.4 ARKRAY GLOBAL BUSINESS, INC.

11.2.5 AVIVA SYSTEMS BIOLOGY

11.2.6 AXXORA, LLC

11.2.7 BIOASSAY SYSTEMS

11.2.8 NOVA BIOMEDICAL CORPORATION

11.2.9 QUANTIMETRIX CORPORATION

11.2.10 RAYBIOTECH, INC.

11.2.11 SEKISUI DIAGNOSTICS PEI INC.

11.2.12 TECO DIAGNOSTICS

11.2.13 TULIP DIAGNOSTICS LTD.

11.2.14 ULTI MED PRODUCTS GMBH

11.2.15 URIT MEDICAL ELECTRONIC CO., LTD.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 154)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

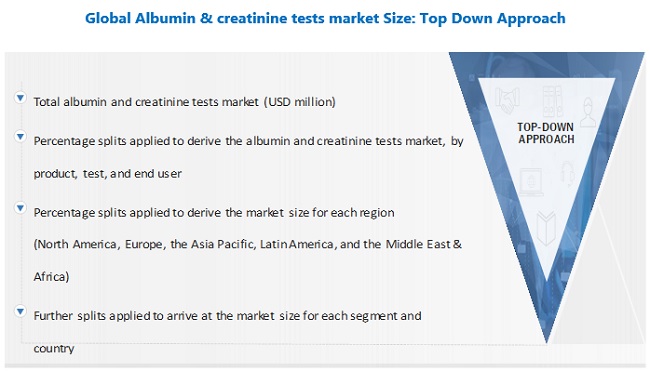

This study involved four major activities in estimating the current size of the albumin & creatinine tests market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information and assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the albumin & creatinine tests market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the albumin & creatinine tests market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global albumin and creatinine tests market on the basis of product, test, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global albumin and creatinine tests market with respect to five main regions (along with countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global albumin and creatinine tests market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as agreements, partnerships, acquisitions, product launches, and expansions in the global albumin and creatinine tests market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Albumin & creatinine tests market size and growth rate estimates for counties in Rest of Europe, the Rest of Asia Pacific and Rest of the World

Company profiles

Additional five company profiles of players operating in the albumin & creatinine tests market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Albumin & Creatinine Tests Market

Which approaches are adopted for the market size estimation for the global Albumin Tests Market?

What is the growth rate in the Global as well as geographical Albumin Tests Market?

I need the detailed information about the leading companies of the Albumin Tests Market across the globe