Creatinine Assay Kits Market by Type (Jaffe's Kinetic Test, Creatinine-PAP, and ELISA), Sample (Blood, Serum, Urine, Saliva, CSF, Tissue Homogenate, Sweat) and Region (North America, Europe, Asia and RoW) - Global Forecast to 2022

[192 Pages Report] The global creatinine assay kits market is valued at USD 182.7 Million in 2016 and is projected to reach USD 245.4 Million by 2022, at a CAGR of 5.3%. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

The objectives of this study are as follows:

- To define, describe, and forecast the global creatinine assay kits on the basis of type, type of sample, and region

- To estimate the total number of Creatinine Measurement tests conducted by type and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To forecast the size of the market with respect to five regions: North America, Europe, Asia, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments in the creatinine assay kits industry, such as acquisitions, agreements, product launches & upgrades, expansions, and R&D activities

Research Methodology

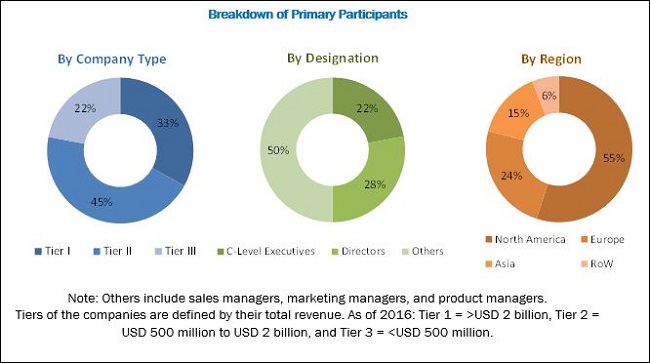

The study estimates the market size for 2017 and projects its demand till 2022. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include physicians/doctors, healthcare professionals, clinical laboratory executives, lab managers, laboratory assistants, and biochemistry consultants.

For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the creatinine assay kits market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. Secondary sources such as directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies were referred.

To know about the assumptions considered for the study, download the pdf brochure

The market is highly fragmented with the presence of several small and big players. Prominent players in this market include Thermo Fisher Scientific (US), Merck (Germany), Abbott Laboratories (US), Abcam (UK), Quidel (US), Enzo Life Sciences (US), Cayman Chemical (US), Cell Biolabs (US), Genway Biotech (US), BioAssay Systems (US), Wako Pure Chemical Industries (Japan), Tulip Diagnostics (India), BioVision (US), and Arbor Assays (US).

Target Audience for this Report:

- Creatinine assay kit manufacturers

- Creatinine assay kit distributors

- Hospitals

- Research and consulting firms

- Venture capitalists

- Regulatory bodies

- Academic centers

- Teaching hospitals and academic medical centers (AMCs)

- Contract manufacturing organizations (CMOs)

- Contract research organizations (CROs)

Scope of the Report

This report categorizes the market into following segments and subsegments:

Creatinine Assay Kits Market, by Type

- Jaffe’s Kinetic Test Kits

- Creatinine-PAP Test Kits

- ELISA Test Kits

Creatinine Assay Kits Market, by Type of Sample

- Blood/Serum

- Urine

- Other Samples

Creatinine Assay Kits Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- RoE

- Asia

- Japan

- China

- India

- Indonesia

- RoA

- Rest of the World (RoW)

- Brazil

- Other RoW Countries

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The global creatinine assay kits market is expected to reach USD 245.4 Million by 2022 from USD 189.6 Million in 2017, at a CAGR of 5.3%. The growth of this market is mainly driven by the increasing incidence of renal disorders, growing incidence of other chronic disorders impacting renal function, growing awareness and adoption of preventive healthcare, favourable government initiatives to promote renal health, rapid growth in the geriatric population, and advancements in biomedical research pertaining to kidney disorders and availability of funding.

This report segments the market on the basis of type, type of sample, and region. By type, the market is segmented into Jaffe’s kinetic test kits, Creatinine-PAP test kits, and ELISA test kits. In 2017, the Jaffe’s kinetic test kits segment accounted for the largest share of the market, since it is the oldest and most conventional method for creatinine measurement. Additionally, wide product availability and cost-effectiveness of these kits are some of the other major factors responsible for the large share of this segment.

Based on type of sample, the market is segmented into blood/serum, urine, and other samples. The urine samples segment accounted for the largest share of the market in 2017, owing to ease of sample availability and non-invasive method of sample collection. The blood/serum segment is expected to witness the fastest growth over the forecast period, as it ensures greater result accuracy.

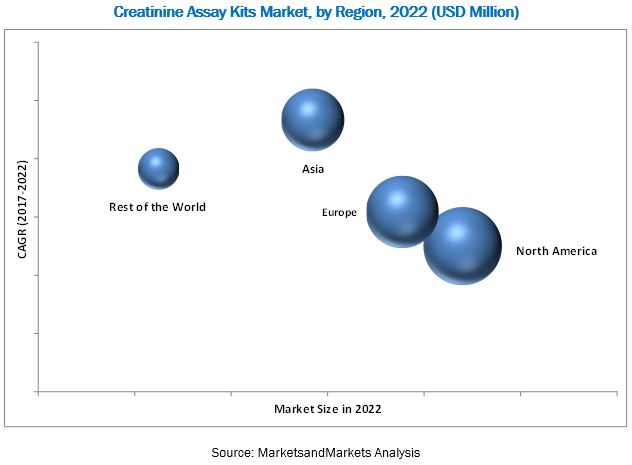

In 2017, North America dominated the market followed by Europe. Asia is expected to grow at the highest CAGR during the forecast period. This can be attributed to factors such as the large population base in Asian countries, growing geriatric population, growing prevalence of CKD, rising awareness towards preventive healthcare, improving healthcare infrastructure, and growing focus of market players on addressing demands in these countries. The increasing prevalence of infectious diseases and metabolic syndromes in this region is resulting in the high and regular prescription for metabolic tests.

On the other hand, limited usage of creatinine assay kits in IVD, identification of novel renal dysfunction biomarkers, and frequently changing regulatory policies are expected to restrain the growth of this market to a certain extent.

The creatinine assay kits market is highly fragmented with the presence of several small and big players. Prominent players in this market include Thermo Fisher Scientific (US), Merck (Germany), Abbott Laboratories (US), Abcam (UK), Quidel (US), Enzo Life Sciences (US), Cayman Chemical (US), Cell Biolabs (US), Genway Biotech (US), BioAssay Systems (US), Wako Pure Chemical Industries (Japan), Tulip Diagnostics (India), BioVision (US), and Arbor Assays (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Tables of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Limitations

1.5 Stakeholders

2 Research Methodology

2.1 Introduction

2.2 Research Data

2.3 Market Size Estimation: Creatinine Assay Kits Market

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Apporach

2.4 Breakdown of Primaries: Market

2.5 Market Breakdown and Data Triangulation: Market

2.6 Epidemiology-Based Model: Number of Creatinine Measurement Tests Performed

2.7 Breakdown of Primaries: Number of Creatinine Measurement Tests Performed

2.8 Market Breakdown and Data Triangulation: Number of Creatinine Measurement Tests Performed

2.9 Secondary Data

2.9.1 Key Data From Secondary Sources

2.10 Primary Data

2.10.1 Key Data From Primary Sources

2.11 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Drivers

5.2.1 Increasing Incidence of Renal Disorders

5.2.2 Growing Incidence of Other Chronic Disorders Impacting Renal Function

5.2.3 Growing Awareness and Adoption of Preventive Healthcare

5.2.4 Favorable Government Initiatives to Promote Renal Health

5.2.5 Rapid Growth in the Geriatric Population

5.2.6 Advancements in Biomedical Research Pertaining to Kidney Disorders and Availability of Funding

5.3 Market Restraints/Challenges

5.3.1 Limited Usage of Creatinine Assay Kits in IVD

5.3.2 Identification of Novel Renal Dysfunction Biomarkers

5.3.3 Frequently Changing Regulatory Policies

5.4 Market Opportunities

5.4.1 High Growth Potential in Emerging Economies

6 Number of Creatinine Tests Performed

6.1 Introduction

6.2 Number of Creatinine Tests Performed, By Region

6.3 Number of Creatinine Tests Performed, By Type

7 Creatinine Assay Kits Market, By Type

7.1 Introduction

7.2 Jaffe’s Kinetic Test Kits

7.3 Creatinine-Pap Test Kits

7.4 Elisa Test Kits

8 Creatinine Assay Kits Market, By Sample Type

8.1 Introduction

8.2 Blood/Serum

8.3 Urine

8.4 Other Samples

9 Creatinine Assay Kits Market, By Region

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of the Europe

9.4 Asia

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Indonesia

9.4.5 Rest of the Asia

9.5 Rest of the World

9.5.1 Brazil

9.5.2 Other Rest of the World

10 Competitive Landscape

10.1 Creatinine Assay Kits Market: Competitive Intelligence (2016)

10.2 Market Share Analysis

10.3 Competetive Situation & Trends

11 Company Profiles

11.1 Introduction

11.2 Thermo Fisher Scientific Inc.

11.3 Merck KGaA

11.4 Abcam PLC

11.5 Abbott Laboratories

11.6 Quidel Corporation

11.7 Enzo Life Sciences, Inc.

11.8 Cayman Chemical

11.9 Crystal Chem Inc.

11.10 Cell Biolabs Inc.

11.11 Genway Biotech

11.12 Bioassay Systems LLC

11.13 Wako Pure Chemical Industries, Ltd

11.14 Tulip Diagnostics Private Limited

11.15 Biovision Inc.

11.16 Arbor Assays LLC

12 Appendix

12.1 Key Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Marketsandmarkets Knowledge Store: Snapshot

12.5 Introducing RT: Real Time Market Intelligence

12.6 Related Reports

12.7 Author Details

List of Tables (84 Tables)

Table 1 Number of Creatinine Measurement Tests Performed, By Region 2016 (Million Units)

Table 2 Jaffe’s Kinetic Test: Number of Creatinine Measurement Tests Performed, By Region 2016 (Million Units)

Table 3 Creatinine-Pap Test: Number of Creatinine Measurement Tests Performed, By Region 2016 (Million Units)

Table 4 Creatinine Assay Kits Market, By Type, 2015–2022 (USD Million)

Table 5 Jaffe’s Kinetic Test Kits Market, By Region, 2015–2022 (USD Million)

Table 6 North America: Jaffe’s Kinetic Test Kits Market, By Country, 2015–2022 (USD Million)

Table 7 Europe: Jaffe’s Kinetic Test Kits Market, By Country, 2015–2022 (USD Million)

Table 8 Asia: Jaffe’s Kinetic Test Kits Market, By Country, 2015–2022 (USD Million)

Table 9 RoW: Jaffe’s Kinetic Test Kits Market, By Country, 2015–2022 (USD Million)

Table 10 Creatinine-Pap Test Kits Market, By Region, 2015–2022 (USD Million)

Table 11 North America: Creatinine-Pap Test Kits Market, By Country, 2015–2022 (USD Million)

Table 12 Europe: Creatinine-Pap Test Kits Market, By Country, 2015–2022 (USD Million)

Table 13 Asia: Creatinine-Pap Test Kits Market, By Country, 2015–2022 (USD Million)

Table 14 RoW: Creatinine-Pap Test Kits Market, By Country, 2015–2022 (USD Million)

Table 15 Elisa Test Kits Market, By Region, 2015–2022 (USD Million)

Table 16 North America: Elisa Test Kits Market, By Country, 2015–2022 (USD Million)

Table 17 Europe: Elisa Test Kits Market, By Country, 2015–2022 (USD Million)

Table 18 Asia: Elisa Test Kits Market, By Country, 2015–2022 (USD Thousand)

Table 19 RoW: Elisa Test Kits Market, By Country, 2015–2022 (USD Thousand)

Table 20 Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Million)

Table 21 Blood/Serum Samples Market, By Region, 2015–2022 (USD Million)

Table 22 North America: Blood/Serum Samples Market, By Country, 2015–2022 (USD Million)

Table 23 Europe: Blood/Serum Samples Market, By Country, 2015–2022 (USD Million)

Table 24 Asia: Blood/Serum Samples Market, By Country, 2015–2022 (USD Million)

Table 25 RoW: Blood/Serum Samples Market, By Country, 2015–2022 (USD Million)

Table 26 Urine Samples Market, By Region, 2015–2022 (USD Million)

Table 27 North America: Urine Samples Market, By Country, 2015–2022 (USD Million)

Table 28 Europe: Urine Samples Market, By Country, 2015–2022 (USD Million)

Table 29 Asia: Urine Samples Market, By Country, 2015–2022 (USD Million)

Table 30 RoW: Urine Samples Market, By Country, 2015–2022 (USD Million)

Table 31 Other Samples Market, By Region, 2015–2022 (USD Million)

Table 32 North America: Other Samples Market, By Country, 2015–2022 (USD Million)

Table 33 Europe: Other Samples Market, By Country, 2015–2022 (USD Million)

Table 34 Asia: Other Samples Market, By Country, 2015–2022 (USD Million)

Table 35 RoW: Other Samples Market, By Country, 2015–2022 (USD Thousand)

Table 36 Creatinine Assay Kits Market, By Region, 2015–2022 (USD Million)

Table 37 Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 38 North America: Market, By Country, 2015–2022 (USD Million)

Table 39 North America: Market, By Type, 2015–2022 (USD Million)

Table 40 North America: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Million)

Table 41 US: Market, By Type, 2015–2022 (USD Million)

Table 42 US: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Million)

Table 43 US: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 44 Canada: Market, By Type, 2015–2022 (USD Million)

Table 45 Canada: Market, By Sample Type, 2015–2022 (USD Million)

Table 46 Canada: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 47 Europe: Creatinine Assay Kits Market, By Type, 2015–2022 (USD Million)

Table 48 Europe: s Market, By Sample Type, 2015–2022 (USD Million)

Table 49 Europe: Number of Creatinine Measurement Tests Performed, By Type 2016 (Million Units)

Table 50 Germany: Market, By Type, 2015–2022 (USD Million)

Table 51 Germany: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Million)

Table 52 UK: Market, By Type, 2015–2022 (USD Million)

Table 53 UK: Market, By Sample Type, 2015–2022 (USD Million)

Table 54 France: Market, By Type, 2015–2022 (USD Million)

Table 55 France: Market, By Sample Type, 2015–2022 (USD Million)

Table 56 RoE: Market, By Type, 2015–2022 (USD Million)

Table 57 RoE: Market, By Sample Type, 2015–2022 (USD Million)

Table 58 Asia: Market, By Country, 2015–2022 (USD Million)

Table 59 Asia: Market, By Type, 2015–2022 (USD Million)

Table 60 Asia: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Million)

Table 61 Japan: Market, By Type, 2015–2022 (USD Million)

Table 62 Japan: Market, By Sample Type, 2015–2022 (USD Million)

Table 63 Japan: Number of Creatinine Measurement Tests Performed, By Type 2016 (Million Units)

Table 64 China: Market, By Type, 2015–2022 (USD Million)

Table 65 China: Market, By Sample Type, 2015–2022 (USD Million)

Table 66 China: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 67 India: Creatinine Assay Kits Market, By Type, 2015–2022 (USD Million)

Table 68 India: Market, By Sample Type, 2015–2022 (USD Million)

Table 69 India: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 70 Indonesia: Market, By Type, 2015–2022 (USD Thousand)

Table 71 Indonesia: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Thousand)

Table 72 Indonesia: Number of Creatinine Measurement Tests Performed, By Type 2016 (Million Units)

Table 73 RoA: Market, By Type, 2015–2022 (USD Million)

Table 74 RoA: Market, By Sample Type, 2015–2022 (USD Million)

Table 75 RoA: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 76 Rest of the World: Creatinine Assay Kits Market, By Country, 2015–2022 (USD Million)

Table 77 Rest of the World: Market, By Type, 2015–2022 (USD Million)

Table 78 RoW: Market, By Sample Type, 2015–2022 (USD Million)

Table 79 RoW: Number of Creatinine Measurement Tests Performed, By Type, 2016 (Million Units)

Table 80 Brazil: Market, By Type, 2015–2022 (USD Thousand)

Table 81 Other RoW Countries: Market, By Type, 2015–2022 (USD Million)

Table 82 Brazil: Creatinine Assay Kits Market, By Sample Type, 2015–2022 (USD Thousand)

Table 83 Brazil: Number of Creatinine Measurement Tests Performed, By Type 2016 (Million Units)

Table 84 Other RoW Countries: Market, By Sample Type, 2015–2022 (USD Million)

List of Figures (22 Figures)

Figure 1 Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Research Design

Figure 4 Creatinine Assay Kits Market: Bottom-Up Approach

Figure 5 Market: Top-Down Approach

Figure 6 Breakdown of Supply-Side Primary Interviews: By Company Type, Designation, and Region

Figure 7 Data Triangulation Methodology: Creatinine Assay Kits Market

Figure 8 Epidemiology-Based Model: Number of Creatinine Measurement Tests Performed

Figure 9 Breakdown of Primary Interviews: By Region

Figure 10 Data Triangulation Methodology: Number of Creatinine Measurement Tests Performed

Figure 11 Creatinine Assay Kits Market, By Type, 2017 vs 2022

Figure 12 Market, By Type of Sample, 2017 vs 2022

Figure 13 Geographic Snapshot of the Market: Asia to Witness the Highest Growth During the Forecast Period

Figure 14 Increasing Incidence of Renal Disorders: Major Factor Driving the Growth of the Market

Figure 15 Jaffe’s Kinetic Test Kits Segment to Dominate the Market in 2017

Figure 16 Urine Samples Segment to Dominate the Market in 2017

Figure 17 Geographic Growth Opportunities: Asia to Witness the Highest Growth During the Forecast Period

Figure 18 Creatinine Assay Kits Market: Drivers, Restraints/Challenges, and Opportunities

Figure 19 Pricing Analysis: Creatinine Test Market

Figure 20 Key Developments in the Market, 2013–2017

Figure 21 Agreements Accounted for the Largest Share of the Total Developments in the Market (2013–2017)

Figure 22 Insights From Industry Experts

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Creatinine Assay Kits Market