IT BFSI Market by Component (Technology Type (ECM, CRM, HCM, ERP, Artificial Intelligence, Business Intelligence, Unified Communications), and Services), Organization Size, Deployment Type (Cloud and On-Premises), and Region - Global Forecast to 2022

[119 Pages Report] MarketsandMarkets forecasts the global IT BFSI market to grow from USD 73.81 Billion in 2016 to 149.74 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period. The forecast period has been considered from 2017 to 2022, while 2016 is considered as the base year for estimating the market size.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the IT BFSI market by segments component, organization size, deployment, and vertical. The report provides detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth. The report forecasts the market size with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America. The report profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities in the market.

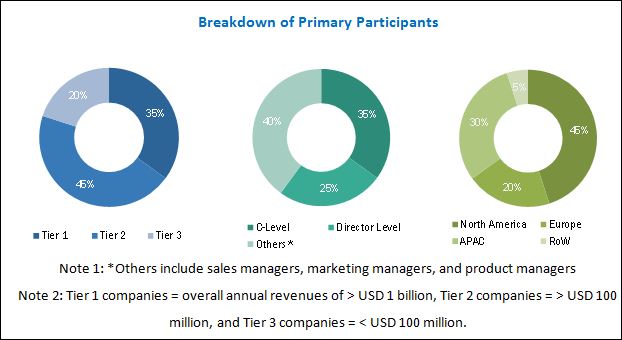

The research methodology used to estimate and forecast the IT BFSI market begins with the collection and analysis of data on key vendors product offerings and business strategies from secondary sources, such as IT service providers, technology providers, press releases and investor presentations of companies, white papers, technology journals, certified publications, and articles from recognized authors, directories, and databases. Vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global IT BFSI market from the revenue of the key market IT solution and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives.

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

Major vendors offering IT solutions and services in the BFSI vertical include IBM (US), Microsoft (US), Accenture (Ireland), Micro Focus (UK), CA Technologies (US), Adobe Systems (US), SAP (Germany), Salesforce (US), Oracle (US), and Cognizant (US).

Key Target Audience For IT BFSI Market

- IT solution and service providers

- System integrators

- Application developers

- Hardware vendors

- Consulting firms

- Research organizations

- Resellers and distributors

Scope of the IT BFSI Market Report

|

Report Metrics |

Details |

|

Market size available for years |

20162022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Organization Size, Deployment Type and Region |

|

Geographies covered |

North America, Europe, MEA, APAC and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Accenture (Ireland), Micro Focus (UK), CA Technologies (US), Adobe Systems (US), SAP (Germany), Salesforce (US), Oracle (US), and Cognizant (US). |

The research report categorizes the market to forecast revenues and analyze the trends in each of the following submarkets:

IT BFSI Market By Component

- Technology Types

- CRM

- HCM

- ERP

- ECM

- Cyber Security

- Unified Communication

- Artificial Intelligence

- Business Intelligence

- Services

- Managed Services

- Professional Services

- Consulting

- System Integration

- Support and Maintenance

By Organization Size

- SMEs

- Large Enterprises

By Deployment Type

- Cloud

- On-premises

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American IT BFSI market into countries

- Further breakdown of the European market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

The IT BFSI market is expected to grow from USD 82.06 Billion in 2017 to USD 149.74 Billion by 2022, at a CAGR of 12.8% during the forecast period, owing to the rapid growth in data generated from multiple sources across various applications. Furthermore, the rising pressure on BFSI organizations to enhance customer experience, increasing focus on digital marketing activities, and customized advanced IT solutions launched by IT vendors to cater to specific needs of BFSI drive the adoption of IT technologies and services in the BFSI vertical. However, security and privacy concerns are a major restraint that would affect the adoption of advanced IT technologies in the BFSI vertical.

The on-premises deployment model is expected to account for a major share of the IT BFSI market by deployment type. The BFSI vertical holds high value sensitive data including financial, customer, and employee information. In order to maintain authenticity and secrecy of the data, BFSI organizations prefer to store and manage their sensitive data on-premises than over cloud. Also, governments and concerned authorities have deployed stringent regulations that mandate BFSI organizations to store and manage their sensitive data within the private cloud or on-premises.

The Artificial Intelligence (AI) technology type is projected to gain traction in the IT BFSI market. AI is a trending technology that is witnessing increasing demand across applications. AI is expected play a vital role in streamlining business operations and enhancing customer experience. Automating operational processes by implementing the AI technology is expected to reduce the operational costs and speed up the banking operations. As a result, BFSI organizations are expected to witness profit margin expansion.

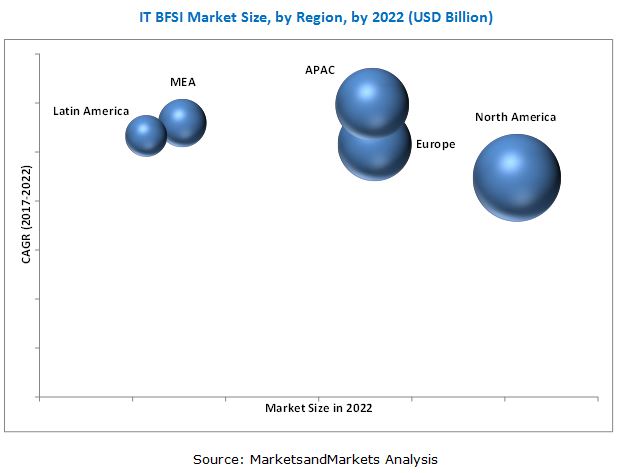

North America is expected to hold the largest market share and dominate the IT BFSI market from 2017 to 2022. The region has a high concentration of major BFSI organizations. This is one of the main factors that contribute to the dominance of North America in the IT BFSI market. However, the APAC region is considered to provide high growth opportunities for IT vendors catering to the needs of BFSI companies. This can be majorly attributed to the rapid technological developments and the increasing presence of BFSI companies in the developing countries.

Major IT vendors in the IT BFSI market include IBM (US), Microsoft (US), Accenture (Ireland), Micro Focus (UK), CA Technologies (US), Adobe Systems (US), SAP (Germany), Salesforce (US), Oracle (US), and Cognizant (US). These players have adopted various strategies, such as new product launches, product upgradations, and partnerships with technology companies to cater to the dynamic and specific needs of the BFSI organizations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Research Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the IT BFSI Market

4.2 Market By Technology Type and Region

4.3 Market By Deployment Type

4.4 Market By Component

4.5 Market By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Innovation Spotlight

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need to Enhance and Improve Customer Experience

5.3.1.2 Customized IT Solutions for Specific Banking Needs

5.3.1.3 Exploration of Digital Channels to Roll Out New Services at A Faster Pace

5.3.2 Restraints

5.3.2.1 Security and Privacy Concerns, Due to Advanced Cybersecurity Attacks

5.3.3 Opportunities

5.3.3.1 Intelligent Applications are Expected to Aid Operations of the Banking Industry

5.3.4 Challenges

5.3.4.1 Constantly Changing Technology Landscape

5.4 Use Cases

5.4.1 IBM

5.4.2 Qlik

5.5 Major Technology Deals in the BFSI Sector

6 IT BFSI Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Technology Types

6.2.1 Customer Relationship Management

6.2.2 Human Capital Management (HCM)

6.2.3 Enterprise Content Management (ECM)

6.2.4 Cybersecurity

6.2.5 Enterprise Resource Planning (ERP)

6.2.6 Unified Communication

6.2.7 Artificial Intelligence (AI)

6.2.8 Business Intelligence (BI)

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

6.3.2.1 Consulting

6.3.2.2 Support and Maintenance

6.3.2.3 System Integration

7 By Organization Size (Page No. - 47)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 By Deployment Type (Page No. - 51)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 IT BFSI Market, By Region (Page No. - 54)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 72)

10.1 Overview

10.2 Competitive Scenario

10.2.1 New Product Launches, 20152017

10.2.2 Expansions, 20152017

10.2.3 Mergers and Acquisitions, 20152017

10.2.4 Partnerships and Collaborations, 20152017

11 Company Profiles (Page No. - 77)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 IBM

11.2 Micro Focus

11.3 Microsoft

11.4 CA Technologies

11.5 Accenture

11.6 Adobe Systems

11.7 SAP

11.8 Salesforce

11.9 Oracle

11.10 Cognizant

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 110)

12.1 Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (55 Tables)

Table 1 USD Exchange Rate, 20142016

Table 2 IT BFSI Market Size and Growth Rate, 20152022 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Component, 20152022 (USD Billion)

Table 4 Technology Types: Market Size, By Type, 20152022 (USD Billion)

Table 5 CRM Market Size, By Region, 20152022 (USD Billion)

Table 6 HCM Market Size, By Region, 20152022 (USD Billion)

Table 7 ECM Market Size, By Region, 20152022 (USD Billion)

Table 8 Cybersecurity Market Size, By Region, 20152022 (USD Billion)

Table 9 ERP Market Size, By Region, 20152022 (USD Billion)

Table 10 Unified Communication Market Size, By Region, 20152022 (USD Billion)

Table 11 AI Market Size, By Region, 20152022 (USD Billion)

Table 12 BI Market Size, By Region, 20152022 (USD Billion)

Table 13 Services: IT BFSI Market Size, By Type, 20152022 (USD Billion)

Table 14 Managed Services Market Size, By Region, 20152022 (USD Billion)

Table 15 Professional Services Market Size, By Region, 20152022 (USD Billion)

Table 16 Consulting Market Size, By Region, 20152022 (USD Billion)

Table 17 Support and Maintenance Market Size, By Region, 20152022 (USD Billion)

Table 18 System Integration Market Size, By Region, 20152022 (USD Billion)

Table 19 Market Size, By Organization Size, 20152022 (USD Billion)

Table 20 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Billion)

Table 21 Large Enterprises: Market Size, By Region, 20152022 (USD Billion)

Table 22 Market Size, By Deployment Type, 20152022 (USD Billion)

Table 23 Cloud: Market Size, By Region, 20152022 (USD Billion)

Table 24 On-Premises: IT BFSI Market Size, By Region, 20152022 (USD Billion)

Table 25 Market Size, By Region, 20152022 (USD Billion)

Table 26 North America: Market Size, By Component, 20152022 (USD Billion)

Table 27 North America: Market Size, By Technology Type, 20152022 (USD Billion)

Table 28 North America: Market Size, By Service, 20152022 (USD Billion)

Table 29 North America: Market Size, By Professional Service, 20152022 (USD Billion)

Table 30 North America: Market Size, By Deployment Type, 20152022 (USD Billion)

Table 31 North America: Market Size, By Organization Size, 20152022 (USD Billion)

Table 32 Europe: Market Size, By Component, 20152022 (USD Billion)

Table 33 Europe: Market Size, By Technology Type, 20152022 (USD Billion)

Table 34 Europe: Market Size, By Service, 20152022 (USD Billion)

Table 35 Europe: IT BFSI Market Size, By Professional Service, 20152022 (USD Billion)

Table 36 Europe: Market Size, By Deployment Type, 20152022 (USD Billion)

Table 37 Europe: Market Size, By Organization Size, 20152022 (USD Billion)

Table 38 Asia Pacific: Market Size, By Component, 20152022 (USD Billion)

Table 39 Asia Pacific: Market Size, By Technology Type, 20152022 (USD Billion)

Table 40 Asia Pacific: Market Size, By Service, 20152022 (USD Billion)

Table 41 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Billion)

Table 42 Asia Pacific: Market Size, By Deployment-Type, 20152022 (USD Billion)

Table 43 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Billion)

Table 44 Middle East and Africa: Market Size, By Component, 20152022 (USD Billion)

Table 45 Middle East and Africa: IT BFSI Market Size, By Technology Type, 20152022 (USD Billion)

Table 46 Middle East and Africa: Market Size, By Service, 20152022 (USD Billion)

Table 47 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Billion)

Table 48 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Billion)

Table 49 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Billion)

Table 50 Latin America: Market Size, By Component, 20152022 (USD Billion)

Table 51 Latin America: Market Size, By Technology Type, 20152022 (USD Billion)

Table 52 Latin America: Market Size, By Service, 20152022 (USD Billion)

Table 53 Latin America: Market Size, By Professional Service, 20152022 (USD Billion)

Table 54 Latin America: Market Size, By Deployment Type, 20152022 (USD Billion)

Table 55 Latin America: IT BFSI Market Size, By Organization Size, 20152022 (USD Billion)

List of Figures (40 Figures)

Figure 1 IT BFSI Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 IT BFSI Market: Assumptions

Figure 8 Top Three Categories With the Largest Market Shares in the Market in 2017

Figure 9 Market By Region, 20172022

Figure 10 Increasing Pressure to Enhance Customer Experience is A Major Driver for Growth of the Market

Figure 11 Cybersecurity and North America are Estimated to Have the Largest Market Shares in 2017

Figure 12 Cloud Deployment Type is Expected to Grow at A Higher CAGR in the Market During the Forecast Period

Figure 13 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 IT BFSI Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 AI Technology Type is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Regional Snapshot: Asia Pacific is Expected to Grow at the Highest CAGR in the IT BFSI Market During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By Leading Players in the IT BFSI Market During 20142017

Figure 26 IBM: Company Snapshot

Figure 27 IBM: SWOT Analysis

Figure 28 Micro Focus: Company Snapshot

Figure 29 Micro Focus: SWOT Analysis

Figure 30 Microsoft: Company Snapshot

Figure 31 Microsoft: SWOT Analysis

Figure 32 CA Technologies: Company Snapshot

Figure 33 Accenture: Company Snapshot

Figure 34 Accenture: SWOT Analysis

Figure 35 Adobe Systems: Company Snapshot

Figure 36 SAP: Company Snapshot

Figure 37 SAP: SWOT Analysis

Figure 38 Salesforce: Company Snapshot

Figure 39 Oracle: Company Snapshot

Figure 40 Cognizant: Company Snapshot

Growth opportunities and latent adjacency in IT BFSI Market