BFSI Security Market by Information Security (IAM, Encryption, Disaster Recovery, UTM, Firewall, Security and Vulnerability Management, IDS/IPS, Data Loss Protection, Antivirus & Antimalware) & Physical Security - Global Forecast to 2021

[168 Pages Report] The BFSI security market is estimated to grow from USD 30.23 Billion in 2016 to USD 48.95 Billion by 2021, at a CAGR of 10.1% from 2016 to 2021.

Key drivers of this market include the implementation of regulatory security compliance, rising demand for cloud-based security solutions, and the increasing risk of cyber threats against BFSI infrastructure. This report analyzes opportunities in the BFSI security market for stakeholders. It also provides strategic profiles of the key players in the market to comprehensively analyze the core competencies and draw competitive landscape for the market.

Objectives of the Study:

The main objective of this report is to define and measure the global banking, financial services, and insurance (BFSI) security market on the basis of security type, subvertical, and region. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). It aims to strategically analyze subsegments with respect to individual growth trends, future prospects, and contribution to the total market. It also attempts to forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. It also tracks and analyzes competitive developments, such as mergers and acquisitions, new product developments, and research and development (R&D) activities in the market.

The research methodology used to estimate and forecast the BFSI security market began with capturing data on key vendors revenues through secondary research. This was done by referring to annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized associations, and government publishing sources. Insights obtained from key personnel of major players operational in the market were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key market players.

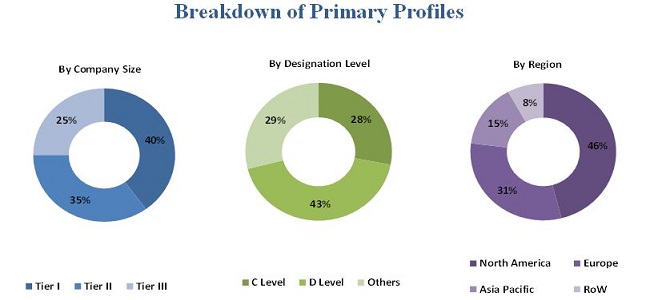

After arriving at the overall market size, the total market was split into several segments and subsegments. These were then verified through primary research by conducting extensive interviews with key people, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations providing BFSI security solutions and services. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Key players operational in the BFSI security market include Cisco Systems, Inc. (U.S.), Computer Sciences Corporation (CSC) (U.S.), EMC Corporation (U.S.), Honeywell International, Inc. (U.S.), IBM Corporation (U.S.), Booz Allen Hamilton, Inc. (U.S.), McAfee, Inc. (Intel Security Group) (U.S.), Sophos Group Plc. (U.S.), Symantec Corporation (U.S.) and Trend Micro Incorporated (U.S.). Other stakeholders of the market include application design and software developers, IT director/consultants, chief compliance officers, cloud service providers system integrators, universities, entertainment broadcasters, sports clubs, research & development centers, music industry, technology consultants, communication services providers, market research and consulting firms.

Target Audience:

- IT Service Providers and Distributors

- Cyber Security Vendors

- BFSI Security Vendors

- Value Added Resellers

- Government Bodies and Departments

- Cloud Service Providers

- System Integrators

- Technology Consultants

This study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing efforts and investments.

Scope of the Report

The research report categorizes the BFSI security market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- Information Security

- Physical Security

By Physical Security

- System & Components

- Service

By Information Security

- System & Components

- Service

By Subvertical

- Banking

- Insurance

- Other Financial Institutions

By Region

- North America

- Europe

- Middle East & Africa

- Asia-Pacific

- Latin America

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America BFSI Security market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The BFSI security market is estimated to grow from USD 30.23 Billion in 2016 to USD 48.95 Billion by 2021, at a CAGR of 10.1% during the forecast period. This growth can be attributed to the enforcement of regulatory security compliances, increasing number of sophisticated threats, and incorporation of the Internet of things (IOT). Hence, the adoption of BFSI Security is increasing in various industries.

The report provides insights on the BFSI security market, which is segmented on the basis of type, physical security, information security, subvertical, and region. Among types, the physical security segment has the largest market share and is expected to grow at a high CAGR, thus leading the overall market during the forecast period. Physical security solutions provide protection against various threats, in terms of malicious software, dishonest insider and external frauds, and natural and man-made disasters.

Based on physical security, the services segment is a more preferred method, as it plays a vital role in enhancing the existing video surveillance system by integrating digital video surveillance with network and IT systems. It is expected to register the highest growth rate during the forecast period. The system & components segment is estimated to account for the largest market share during the forecast period.

On the basis of information security, the BFSI security market is divided into system & components and services. Currently, the system & components segment leads the market with the largest market share and will continue to do so, during the forecast period. This can be attributed to the fact that they form a strong line of defense to tackle a variety of sophisticated threats in a multi-layered fashion for banks, insurance companies, and financial institutions. The service segment is expected to grow at the highest CAGR during the forecast period.

Among verticals, the banking segment is expected to account for the largest market share in the overall BFSI Security market, as banks are seeking to retain and maximize the potential of the pre-existing customers and are moving towards new low-risk financial services products. The insurance segment is expected to grow at the highest CAGR during the forecast period.

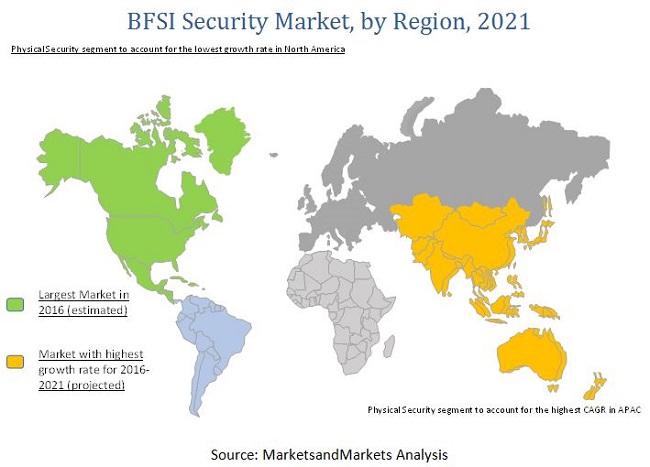

North America is expected to account for a large share of the BFSI security market, during the forecast period owing to the implementation of BFSI security solutions across varied industries in this region. However, the Asia-Pacific region is expected to grow at the highest CAGR by 2021. The growth in this region can be mainly attributed to the increasing adoption of BFSI security solutions across India, China, Japan, and Australia.

BFSI security offers numerous benefits to the users and organization, but at the same time, it accompanies various security risks, which is a restraining factor for the market. It has a wide complexity in security infrastructure. User awareness towards complex threats and system vulnerabilities is very critical. Banks and utilities need to continuously engage customers and educate them about their online security. It lacks interoperability between security products, which restrains the growth of the BFSI security market. Hence, BFSI security vendors are innovating their product portfolio to manage handling complexity.

Cisco Systems, Inc. is a leading supplier of networking products, systems, and associated services. It largely focuses on designing innovative networking solutions for various industries, such as transportation, retail, and manufacturing, among others. Cisco considers security portfolio as its top investment priority and is continuously supporting the R&D against revenue loss, intellectual property deprivation, and reputation diminution in the BFSI industry vertical. For instance, in August 2016, Cisco acquired Cloudlock, a privately-held company based in the U.S., which offers CloudLock and Cisco the industrys broadest cloud security protection for users, applications, and data.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the BFSI Security Market

4.2 Market, By Sub-Vertical

4.3 Market, By Physical Security System and Component Segment and Region

4.4 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 BFSI Physical Security Market, By System & Component

5.2.3 BFSI Physical Security Market, By Services

5.2.4 BFSI Information Security Market, By System & Component

5.2.5 BFSI Information Security Market, By Services

5.2.6 BFSI Security Market, By Sub-Vertical

5.2.7 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Implementation of Regulatory Standards and Acts

5.3.1.2 Rise in Adoption of Cloud-Based Security Solutions

5.3.1.3 Increasing Risk of Data Loss

5.3.2 Restraints

5.3.2.1 Complexity in Security Infrastructure and Lack of Awareness Among Customers

5.3.2.1 Lack of Interoperability Between Security Products

5.3.3 Opportunities

5.3.3.1 Security Solutions Based on Internet of Things (IOT)

5.3.4 Challenges

5.3.4.1 High Implementation Cost of Security Solutions

5.4 Regulatory Implications

5.4.1 Payment Card Industry Data Security Standard (PCIDSS)

5.4.2 Gramm-Leach-Bliley Act (GLB Act)

5.4.3 Sarbanes-Oxley Act (SOX)

5.5 Innovation Spotlight

6 BFSI Security Market, By Security Type (Page No. - 45)

6.1 Introduction

6.2 Physical Security

6.3 Information Security

7 BFSI Physical Security Market, By System & Component, and By Services (Page No. - 49)

7.1 Introduction

7.2 System and Component

7.2.1 Video Surveillance

7.2.2 Access Control

7.2.3 Intrusion & Fire Detection

7.2.4 Physical Security Information Management (PSIM)

7.3 Services

7.3.1 System Integration

7.3.2 Maintenance & Support

7.3.3 Design & Consulting

8 BFSI Security Market for Information Security Solution and Services (Page No. - 59)

8.1 Introduction

8.2 Solution

8.2.1 Identity & Access Management

8.2.2 Risk & Compliance Management

8.2.3 Encryption

8.2.4 Disaster Recovery

8.2.5 Unified Threat Management (UTM)

8.2.6 Firewall

8.2.7 Ddos Mitigation

8.2.8 Security & Vulnerability Management

8.2.9 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

8.2.10 Data Loss Protection (DLP)

8.2.11 Antivirus & Anti-Malware

8.2.12 Web Filtering

8.2.13 Others

8.3 Services

8.3.1 Consulting

8.3.2 Design & Integration

8.3.3 Risk & Threat Assessment

8.3.4 Managed Security Services

8.3.5 Training & Education

9 BFSI Security Market, By Sub-Vertical (Page No. - 77)

9.1 Introduction

9.2 Banking

9.3 Insurance Companies

9.4 Other Financial Institutions

10 Regional Analysis (Page No. - 82)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific (APAC)

10.5 Middle East & Africa (MEA)

10.6 Latin America

11 Competitive Landscape (Page No. - 106)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches

11.2.2 Partnerships, Agreements, and Collaborations

11.2.3 Mergers and Acquisitions

11.2.4 Expansions

12 Company Profiles (Page No. - 115)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Cisco Systems, Inc.

12.2 Computer Sciences Corporation

12.3 EMC Corporation

12.4 Honeywell International, Inc.

12.5 IBM Corporation

12.6 Booz Allen Hamilton, Inc.

12.7 Mcafee, Inc. (Intel Security Group)

12.8 Sophos Group PLC.

12.9 Symantec Corporation

12.10 Trend Micro Incorporated

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

13 Appendix (Page No. - 158)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (89 Tables)

Table 1 BFSI Security Market Size and Growth 20142021 (USD Billion)

Table 2 Innovation Spotlight: Latest Cyber Security Innovations

Table 3 Market Size, By Security Type, 2014-2021 (USD Million)

Table 4 Physical Security: Market, By Region, 2014-2021 (USD Million)

Table 5 Information Security: Market, By Region, 2014-2021 (USD Million)

Table 6 BFSI Physical Security Market, By Type, 20142021 (USD Million)

Table 7 BFSI Physical Security Market, By System and Component, 20142021 (USD Million)

Table 8 System & Component: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 9 Video Surveillance: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 10 Access Control: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 11 Intrusion & Fire Detection: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 12 Physical Security Information Management: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 13 BFSI Physical Security Market, By Service, 20142021 (USD Million)

Table 14 Services: BFSI Physical Security Market Size , By Region, 20142021 (USD Million)

Table 15 System Integration: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 16 Maintenance & Support: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 17 Design & Consulting: BFSI Physical Security Market, By Region, 20142021 (USD Million)

Table 18 BFSI Security Market Size, By Information Security Type, 20142021 (USD Million)

Table 19 Market for Information Security, By Solution, 20142021 (USD Million)

Table 20 Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 21 Identity & Access Management: Market for Information Security Solutions, By Region, 20142021 (USD Million)

Table 22 Risk & Compliance Management: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 23 Encryption: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 24 Disaster Recovery: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 25 Unified Threat Management: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 26 Firewall: BFSI Security Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 27 Ddos Mitigation: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 28 Security & Vulnerability Management: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 29 IDS/IPS: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 30 Data Loss Protection: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 31 Antivirus & Anti-Malware: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 32 Web Filtering: BFSI Security Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 33 Other Solution: Market for Information Security Solution, By Region, 20142021 (USD Million)

Table 34 BFSI Information Security Market, By Services, 20142021 (USD Million)

Table 35 Market for Information Security Services, By Region, 20142021 (USD Million)

Table 36 Consulting: Market for Information Security Services, By Region, 20142021 (USD Million)

Table 37 Design & Integration: Market for Information Security Services, By Region, 20142021 (USD Million)

Table 38 Risk & Threat Assessment: Market for Information Security Services, By Region, 20142021 (USD Million)

Table 39 Managed Security Services: BFSI Security Market for Information Security Services, By Region, 20142021 (USD Million)

Table 40 Training & Education Services: Market for Information Security, By Region, 20142021 (USD Million)

Table 41 Market Size, By Sub-Vertical, 20142021 (USD Million)

Table 42 Banking: Market Size, By Region, 20142021 (USD Million)

Table 43 Insurance Companies: Market Size, By Region, 20142021 (USD Million)

Table 44 Other Financial Institutions: BFSI Security Market Size, By Region, 20142021 (USD Million)

Table 45 Market Size, By Region, 20142021 (USD Million)

Table 46 North America: Market, By Type, 20142021 (USD Million)

Table 47 North America: Market, By Physical Security, 20142021 (USD Million)

Table 48 North America: BFSI Physical Security Market, By System & Component, 20142021 (USD Million)

Table 49 North America: BFSI Physical Security Market, By Services, 20142021 (USD Million)

Table 50 North America: BFSI Security Market, By Information Security, 20142021 (USD Million)

Table 51 North America: BFSI Information Security Market, By System & Component, 20142021 (USD Million)

Table 52 North America: BFSI Information Security Market, By Services, 20142021 (USD Million)

Table 53 North America: Market, By Sub-Vertical, 20142021 (USD Million)

Table 54 Europe: Market, By Type, 20142020 (USD Million)

Table 55 Europe: BFSI Security Market, By Physical Security, 20142021 (USD Million)

Table 56 Europe: BFSI Physical Security Market, By System & Component, 20142021 (USD Million)

Table 57 Europe: BFSI Physical Security Market, By Service, 20142021 (USD Million)

Table 58 Europe: Market, By Information Security, 20142021 (USD Million)

Table 59 Europe: BFSI Information Security Market, By System and Component, 20142021 (USD Million)

Table 60 Europe: BFSI Information Security Market, By Service, 20142021 (USD Million)

Table 61 Europe: Market, By Sub-Vertical, 20142021 (USD Million)

Table 62 Asia-Pacific: Market, By Type, 20142021 (USD Million)

Table 63 Asia-Pacific: Market, By Physical Security, 20142021 (USD Million)

Table 64 Asia-Pacific: BFSI Physical Security Market, By System & Component, 20142021 (USD Million)

Table 65 Asia-Pacific: BFSI Physical Security Market, By Service, 20142021 (USD Million)

Table 66 Asia-Pacific: BFSI Security Market, By Information Security, 20142021 (USD Million)

Table 67 Asia-Pacific: BFSI Information Security Market, By System & Component, 20142021 (USD Million)

Table 68 Asia-Pacific: BFSI Information Security Market, By Service, 20142021 (USD Million)

Table 69 Asia-Pacific: Market, By Sub-Vertical, 20142021 (USD Million)

Table 70 Middle East & Africa: Market, By Type, 20142021 (USD Million)

Table 71 Middle East & Africa: Market, By Physical Security, 20142021 (USD Million)

Table 72 Middle East & Africa: BFSI Physical Security Market, By System & Component, 20142021 (USD Million)

Table 73 Middle East & Africa: BFSI Physical Security Market, By Service, 20142021 (USD Million)

Table 74 Middle East & Africa: Market, By Information Security, 20142021 (USD Million)

Table 75 Middle East & Africa: BFSI Information Security Market, By System & Component, 20142021 (USD Million)

Table 76 Middle East & Africa: BFSI Information Security Market, By Service, 20142021 (USD Million)

Table 77 Middle East & Africa: BFSI Security Market, By Sub-Vertical, 20142021 (USD Million)

Table 78 Latin America: Market, By Type, 20142021 (USD Million)

Table 79 Latin America: Market, By Physical Security, 20142021 (USD Million)

Table 80 Latin America: BFSI Physical Security Market, By System & Component, 20142021 (USD Million)

Table 81 Latin America: BFSI Physical Security Market, By Services, 20142021 (USD Million)

Table 82 Latin America: Market, By Information Security, 20142021 (USD Million)

Table 83 Latin America: BFSI Information Security Market, By System & Component, 20142021 (USD Million)

Table 84 Latin America: BFSI Information Security Market, By Service, 20142021 (USD Million)

Table 85 Latin America: Market, By Sub-Vertical, 20142021 (USD Million)

Table 86 New Product Launches, 20132016

Table 87 Partnerships, Agreements, and Collaborations, 20142016

Table 88 Mergers and Acquisitions, 20132015

Table 89 Expansions, 20132015

List of Figures (41 Figurs)

Figure 1 BFSI Security Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Research Methodology: Data Triangulation

Figure 5 Physical Security Segment Expected to Be the Fastest-Growing Segment of Market From 2016 to 2021

Figure 6 Market in Asia-Pacific Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Increasing Demand for Physical Security Solutions Expected to Fuel the Growth of BFSI Security Market During the Forecast Period

Figure 8 Insurance Vertical Expected to Witness Highest Growth During the Forecast Period

Figure 9 Physical Security Information Management Segment Expected to Be the Fastest-Growing Segment of Market During the Forecast Period

Figure 10 Market Segmentation: By Type

Figure 11 BFSI Physical Security Market Segmentation: By System & Component

Figure 12 BFSI Physical Security Market Segmentation: By Services

Figure 13 BFSI Information Security Market Segmentation: By System & Component

Figure 14 BFSI Information Security Market Segmentation: By Services

Figure 15 Market Segmentation: By Sub-Vertical

Figure 16 BFSI Security Market Segmentation: By Region

Figure 17 Global Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Physical Security Segment is Expected to Account for the Largest Share of the Market in 2016

Figure 19 System & Component Segment is Expected to Account for A Major Share of the BFSI Physical Security Market During the Forecast Period

Figure 20 Solution Expected to Contribute A Larger Share to the BFSI Information Security Segment From 2016 to 2021

Figure 21 Banking is Expected to Dominate the BFSI Security Market During the Forecast Period

Figure 22 Asia-Pacific: an Attractive Destination for the Market, 20162021

Figure 23 Market, By Region, 2016 & 2021 (USD Million)

Figure 24 North American Market: Snapshot

Figure 25 Asia-Pacific Market: Snapshot

Figure 26 Companies Adopted New Product Launches as A Key Growth Strategy During 20132016

Figure 27 Market Evaluation Framework

Figure 28 Cisco Systems, Inc.: Company Snapshot

Figure 29 Cisco Systems, Inc.: SWOT Analysis

Figure 30 Computer Sciences Corporation: Company Snapshot

Figure 31 Computer Sciences Corporation: SWOT Analysis

Figure 32 EMC Corporation: Company Snapshot

Figure 33 EMC Corporation: SWOT Analysis

Figure 34 Honeywell International, Inc.: Company Snapshot

Figure 35 Honeywell International, Inc.: SWOT Analysis

Figure 36 IBM Corporation: Company Snapshot

Figure 37 IBM Corporation: SWOT Analysis

Figure 38 Booz Allen Hamilton, Inc.: Company Snapshot

Figure 39 Sophos Group PLC.: Company Snapshot

Figure 40 Symantec Corporation: Company Snapshot

Figure 41 Trend Micro Incorporated: Company Snapshot

Growth opportunities and latent adjacency in BFSI Security Market