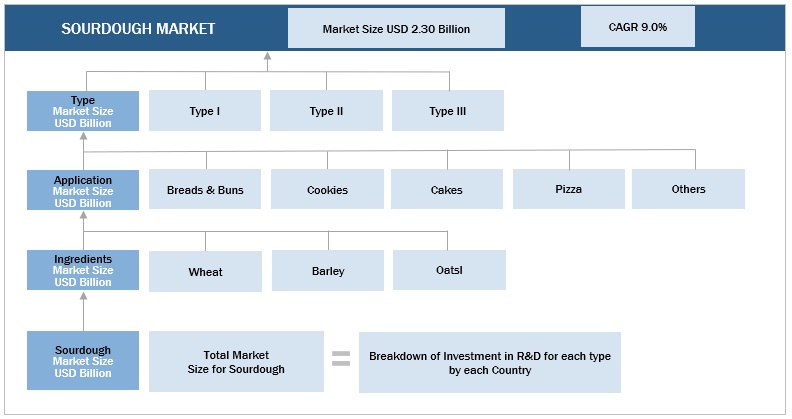

Sourdough Market by Type (Type I, Type II, and Type III), Application (Bread & Buns, Cookies, Cakes, Pizza), Ingredients (Wheat, Barley, and Oats), and Region (North America, Europe, APAC, South America, RoW) - Global Forecast to 2029

Sourdough Market Overview

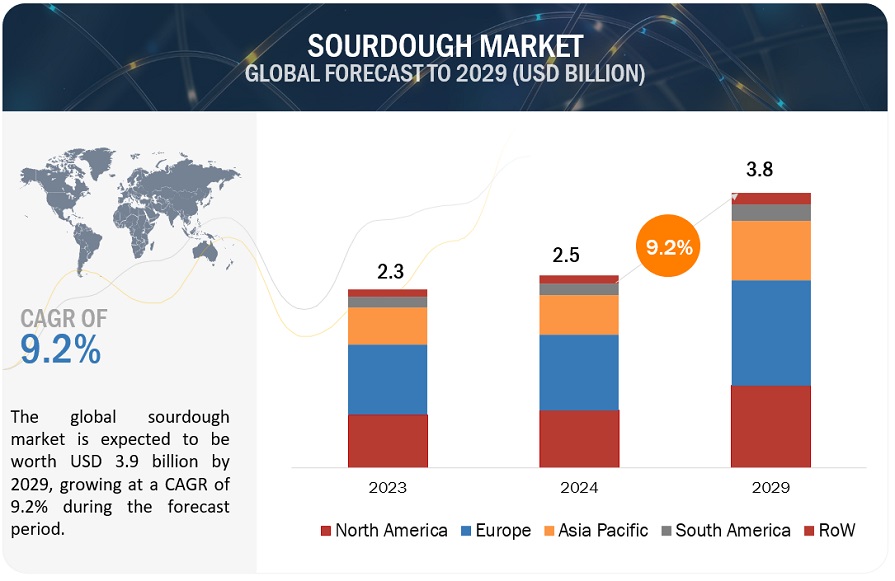

The global Sourdough Market is on a trajectory of prominent growth, with an estimated value projected to reach USD 3.8 billion by 2029 from the 2024 valuation of USD 2.5 billion, displaying a promising Compound Annual Growth Rate (CAGR) of 9.2%. Scientific research continues to highlight the benefits of sourdough, especially, increased nutritional benefits, distinct flavor, and lack of food additives. The re-emergence of artisan bread-making, fueled by the growing interest in traditional baking techniques particularly in the developed economies such as North America and Europe, is contributing to the growth of the sourdough market. The growing appreciation for artisanal sourdough bread and the recognition of its unique qualities have inspired home bakers worldwide, fostering an increased interest in sourdough and propelling its market growth.

The popularity of sourdough bread has increased in recent years, due to its distinctive fermentation process, resulting in increased digestibility and reduced gluten level. Consequently, this has further attracted health-conscious customers and individuals who have mild reactions to gluten. The market is responding to this trend with an increased demand for sourdough products, which are now being adopted by different types of companies so that they can accommodate the changing tastes of their customers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Sourdough Market Dynamics

Driver: Rising health awareness among consumers

The recent SPINS report published in 2022 states that consumer preferences have shifted significantly towards "better-for-you" products, with a focus on health and wellness. This change is evident as 77% of shoppers now consider sustainability a crucial factor in their product choices, marking an 8% increase from the previous year. Consumers are increasingly conscious of their ecological footprint, adopting eco-friendly practices in their shopping, consumption, and disposal habits. These shifting consumer behaviors and preferences directly relate to the sourdough market. The increased demand for "better-for-you" products and the emphasis on health and wellness will drive more people toward healthier bread alternatives like sourdough. The significant health benefits, such as improved gut health, management of blood sugar, reduced risk of heart diseases, and reduced gluten content through fermentation, make it a sought-after choice among health-conscious consumers. Additionally, the growing popularity of environment-friendly and locally sourced foods supports sourdough's position as an environmentally friendly bread option. As the new generation of consumers becomes more educated, open-minded, and willing to explore different products, they will likely embrace sourdough's unique taste and artisanal appeal and promote the growth of the sourdough market in the coming years.

Restraint: Limited shelf life and product inconsistency

Problems like limited shelf life and product inconsistency present significant challenges to the growth of the sourdough market. It is naturally fermented and has a shorter shelf life compared to commercially baked bread that contains preservatives. Sourdough lacks artificial additives, hence it is tasty and healthy but not long-lasting. Because of this short shelf life, distribution and storage can be problematic, since retailers and end-users must handle inventory cautiously. Maintaining quality and taste at a consistent level can be difficult with natural fermentation which is affected by temperature variations and humidity. Slight deviations in the fermentation process can thus have far-reaching consequences for the customer satisfaction levels as well as brand loyalty given that these determine whether consumers come back for more or not. Consequently, addressing such problems as manufacturing inconsistency alongside managing limited shelf-life are some of the challenges that businesses face when operating within the sourdough marketplace.

Opportunity: Increasing demand for innovation and product diversification

Surging research in food technology can be used as an avenue for enhancing functional and bioactive ingredients, with the potential to enhance human health and deal with nutrition security. The breakthroughs in this research are directed at nutritional deficiencies, underutilized crop optimization, and improvement of nutrient bioavailability.

The sourdough market could be among the beneficiaries of such technologies. The incorporation of functional and bioactive ingredients into sourdough products would give them better nutritional value and more health benefits. Moreover, improvements in preservation techniques could lengthen the lifespan of sourdough resulting in its widespread availability. The incorporation of innovative flavors, textures and speciality ingredients such as gluten-free or organic alternatives has the ability to attract new customers and drive the growth of the sourdough market.

Challenge: Increasing price sensitivity and market penetration

Sourdough products are often positioned at a higher price than conventional bread due to longer fermentation times, specialized ingredients, and unique artisanal production methods. This increased price can act as a barrier for price-sensitive consumers, prominently in low-income regions where affordability is a key consideration. Price sensitivity can limit the accessibility and affordability of sourdough products to a niche segment of consumers who are willing to pay a premium, hindering the market’s potential for broader growth.

Despite the rising popularity of sourdough, it faces challenges in penetrating mainstream markets where traditional varieties dominate due to their widespread availability, lower price points, and established consumer preferences. On the other hand, sourdough may be perceived as a specialty or niche product, limiting its presence in mainstream supermarkets and retail outlets. This limited market penetration constrains the reach and exposure of sourdough products to a broader consumer base.

SOURDOUGH MARKET ECOSYSTEM

The demand side of the sourdough market ecosystem encompasses consumers and food establishments which collectively contribute to the increasing demand for sourdough products. Whereas, the supply side of the sourdough market consists of a wide range of producers, suppliers, and distributors working together to cater the growing demand for sourdough products while maintaining quality, authenticity, and sustainability.

In the type segment, the market for type III is projected to grow at the highest CAGR during the forecast period.

Type III sourdough is prepared by dehydrating sourdough which is acquired through traditional fermentation or by incorporating starter cultures. The dehydration process can be achieved through freeze-drying, spray drying, or drying in a fluidized bed reactor. It is essential to note that the microorganisms present in the dough must be resistant to drying. Type III sourdough offers several advantages over other types, including extended shelf life, reduced volume, and ease of handling, transportation, and storage. The extended shelf life and convenient handling and storage of sourdough are anticipated to propel the growth of the type III sourdough market.

In the application segment, bread and buns dominated the market during the study period.

The application of sourdough in bread and buns has revolutionized the bakery industry, presenting a flourishing opportunity in the global sourdough market. Consumption trends have taken hold globally for healthier and natural food alternatives; thus, sourdough has experienced remarkable growth in the global market. It has attracted established bakeries to supplement their products and several startups and entrepreneurs who opened the market to various sourdough-based bread and buns to meet varied consumer tastes and preferences. As bread is considered the staple food in developed nations, the growing population supporting the rising demand for bread and buns coupled with the heightened health awareness among consumers is augmenting the usage of sourdough in bread and bun production and propelling the growth of the market.

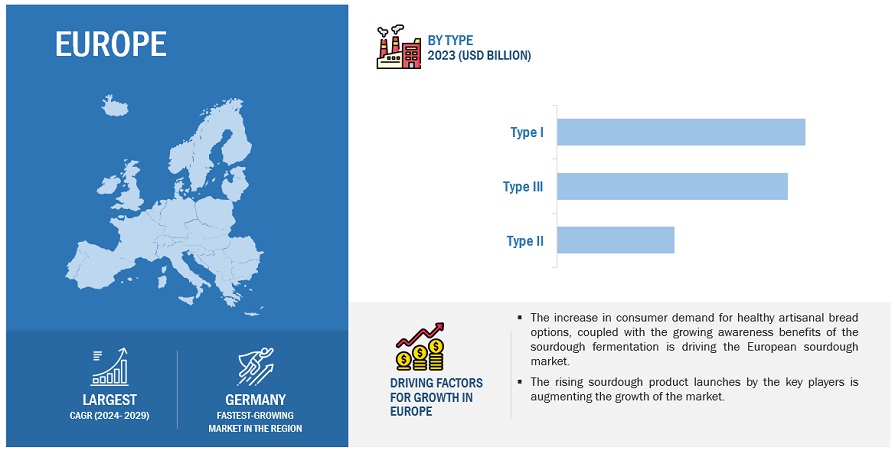

The sourdough market in the European region is dominating during the study period.

The high per capita consumption of bread and bakery products in Europe, averaging 57 Kg, showcases the region's strong preference for bread and bakery products. To cate to the increased demand the bakery market in Europe has shown growth in both sales and product launches, after several years of negative growth, indicating a positive trajectory for the industry. With the bakery market in Europe experiencing continuous growth and a surge in consumption, there is a rising demand for healthier and authentic alternatives like sourdough. Moreover, increasing growth in the market value and volume of cakes, pastries, and sweet goods, which aligns with sourdough's artisanal and gourmet appeal, further augments the potential for sourdough's expansion in Europe. As consumers continue to seek diverse and high-quality bakery products, sourdough's premium and authentic reputation positions it advantageously in the European bakery industry. The region's prominent role as both an exporter and importer of bakery products indicates a dynamic market environment, offering ample opportunities for the growth and global reach of sourdough offerings and proliferating the growth of the sourdough market.

Key Market Players

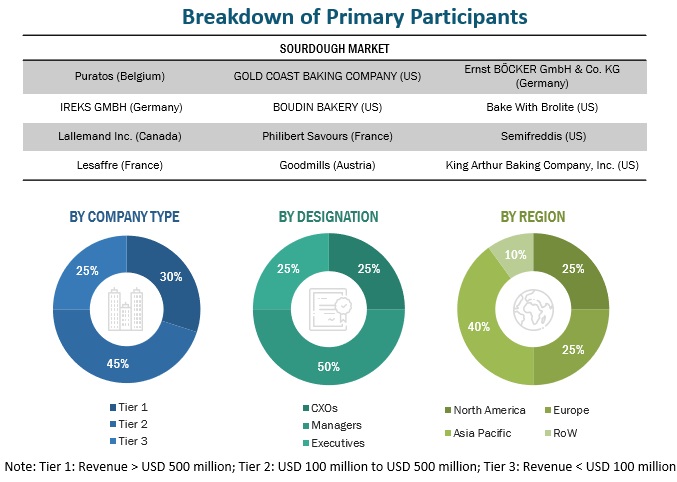

The key players in the sourdough market include Puratos (Belgium), AB Mauri (United Kingdom), IREKS GmbH (Germany), Lallemand (Canada), Lesaffre (France), Boudin Bakery (US), Goodmills (Australia), and Bake With Brolite (US). These market participants are increasing their market presence via product launches. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

Ingredients, Type, Application, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

Target Audience

- Sourdough Manufacturers

- Bread and Bakery Products Manufacturers

- Related government authorities, commercial research & development (R&D) institutions.

- Venture capitalists and investors.

- Technology and raw material providers to sourdough companies.

Government agricultural departments and regulatory bodies such as the US Department of Agriculture (USDA), the Food and Drug Administration (FDA) in the United States, and the European Food Safety Authority (EFSA) in Europe,

Sourdough Market Segmentation:

By Type

- Type I

- Type II

- Type III

By Ingredient

- Wheat

- Barley

- Oats

By Application

- Breads & Buns

- Cookies

- Cakes

- Pizza

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In May 2024, Puratos launched “Sapore Lavida” which is a first completely traceable sourdough produced at its Belgium facility. It is produced with wholewheat flour acquired through regenerative agriculture techniques to cater to the growing demand for sustainability. This launch also signifies the start of the ongoing partnership between Puratos and various farming cooperatives, which are formed to gather key insights into regenerative agriculture to aid in enhancing the sustainability of the wider bakery industry.

- In May 2024, AB Mauri launched three new Aromafer sourdough pastes in the UK market. Through this launch has company has expanded its wide portfolio of sourdough ingredients to cater to the growing demand of consumers.

- In September 2023, Lesafffre Nordic launched a new product range named Zavarka which is scalded to produce a distinctive taste profile. The company launched 3 products under this namely Zavarka Oat, Zavarka Barley, and Zavarka Wheat. Through this, Lesafrre aims to strengthen its presence in the Nordic region.

Key Questions Addressed by the Report

What is the current size of the sourdough market?

The sourdough market is valued at USD 2.5 billion in 2024 and is expected to grow to USD 3.8 billion by 2029, reflecting a CAGR of 9.2%.

What factors are driving the growth of the sourdough market?

Key growth drivers include increasing awareness of the health benefits of sourdough, such as improved digestibility and lower glycemic index compared to regular bread. The growing preference for clean-label and fermented foods, along with the artisanal baking trend, is also boosting market demand.

Which types of sourdough products are most popular?

Sourdough bread remains the most dominant category, followed by sourdough pizza bases, rolls, and pastries. Innovations like gluten-free sourdough and ready-to-bake mixes are also gaining traction among health-conscious and convenience-driven consumers.

Who are the key players in the global sourdough market?

The market features a mix of artisan bakeries, specialty food producers, and large bakery manufacturers. Leading companies include Puratos, Lesaffre, Lantmännen Unibake, and IREKS, alongside numerous local craft bakers worldwide.

How is the sourdough market segmented?

The market is typically segmented by product type (bread, rolls, pastries, pizza bases, etc.), distribution channel (supermarkets, artisan bakeries, online retail, foodservice), and region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

What are the major challenges facing the sourdough market?

Challenges include the relatively longer fermentation time compared to conventional bread, higher production costs, and the need for specialized baking expertise. Additionally, maintaining product consistency at large scale can be complex.

Which regions are leading the sourdough market?

Europe holds a significant share due to its long-standing tradition of artisanal breadmaking, with Germany, France, and the UK as key markets. North America is experiencing rapid growth as consumer awareness of sourdough’s health benefits increases. Asia-Pacific is an emerging market with rising interest in Western-style bakery goods.

What are the emerging trends in the sourdough market?

Notable trends include the rise of gluten-free and wholegrain sourdough products, increased use of ancient grains like spelt and rye, and the integration of sourdough into snacks and non-traditional applications. Online sales and subscription bakery services are also expanding.

How is technology influencing sourdough production?

Advancements in fermentation control, starter culture development, and automation are helping bakers achieve consistent quality while scaling up production. Freeze-dried sourdough starters are also making commercial production more efficient.

What is the future outlook for the sourdough market?

The market is expected to continue growing over the next decade, supported by health and wellness trends, premiumization in bakery products, and consumer appetite for authentic, flavorful bread. Increased innovation and regional product adaptations will likely drive further expansion.

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising health awareness among consumers- Popularity of authentic and artisanal food trends- Increasing demand for gluten-free productsRESTRAINTS- Limited shelf life and product inconsistencyOPPORTUNITIES- Demand for innovation and product diversification- Culinary exploration and changing taste preferencesCHALLENGES- Rising price sensitivity and market penetration- Intricate and time-consuming sourdough fermentation

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGBAKINGPACKAGINGMARKETING AND SALES

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.5 REGULATORY FRAMEWORK

-

6.6 NORTH AMERICAUS- Food and Drug Administration (FDA)- United States Department of Agriculture (USDA)- State and Local Health Departments- Occupational Safety and Health Administration (OSHA)CANADAMEXICO

-

6.7 EUROPEAN UNION (EU)GERMANYFRANCEUKITALYSPAIN

-

6.8 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALAND

-

6.9 SOUTH AMERICABRAZILARGENTINA

-

6.10 PATENT ANALYSIS

- 6.11 TRADE ANALYSIS

-

6.12 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS

-

6.13 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

6.14 TECHNOLOGY ANALYSIS3D BREAD QUALITY X-RAYSDIGITAL HUMIDITY SENSORS

-

6.15 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.17 KEY CONFERENCES & EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 WHEATHEALTH BENEFITS OFFERED BY WHEAT TO DRIVE DEMAND FOR WHEAT SOURDOUGH

-

7.3 BARLEYABILITY OF BARLEY SOURDOUGH TO RETARD STALING PROCESS AND INHIBIT MOLD GROWTH TO PROPEL DEMAND

-

7.4 OATSNUTRITIONAL ADVANTAGES AND EXCEPTIONAL NUTTY TASTE OF OATS SOURDOUGH TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 TYPE IINCREASING APPLICATION OF TYPE I SOURDOUGH IN ARTISANAL BAKERIES TO DRIVE GROWTH

-

8.3 TYPE IIUNIQUE ORGANOLEPTIC PROPERTIES OF TYPE II SOURDOUGH TO PROPEL MARKET

-

8.4 TYPE IIIEXTENDED SHELF-LIFE AND CONVENIENT HANDLING AND STORAGE OF TYPE III SOURDOUGH TO PROPEL GROWTH

- 9.1 INTRODUCTION

-

9.2 BREAD & BUNSCONSUMER PREFERENCE FOR CLEAN-LABEL NATURAL FOOD PRODUCTS TO DRIVE DEMAND

-

9.3 COOKIESRISING DEMAND FOR NUTRITIOUS COOKIES TO DRIVE MARKET

-

9.4 CAKESINCREASED PREFERENCE FOR FLAVORFUL, TENDER CAKES TO PROPEL MARKET

-

9.5 PIZZASDEMAND FOR ARTISANAL AND PREMIUM PIZZA OPTIONS TO DRIVE MARKET EXPANSION

- 9.6 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Expanding bakery sector to encourage market growthCANADA- Increased prevalence of celiac diseases to drive growthMEXICO- Increase in demand for biodegradable plastics in various food packaging applications to drive growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rising consumption of bread to boost market expansionFRANCE- Rapid growth of bakery sector to offer favorable market opportunitiesUK- Growing popularity of ready-to-eat food products to drive demandITALY- Increasing number of artisanal bakeries to foster market growthSPAIN- Country’s culinary heritage and deeply rooted gastronomic culture to drive preference for sourdoughREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- High demand for convenient food options to drive growthINDIA- Presence of numerous small-scale and industrial bakeries to drive demandJAPAN- Remarkable surge in demand for bread to drive marketAUSTRALIA & NEW ZEALAND- Increase in healthy and sustainable food choices among consumers to drive demandREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Growth of bread and bakery market to spur market expansionARGENTINA- Government initiatives to subsidize flour mills to boost demandREST OF SOUTH AMERICA

-

10.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTMIDDLE EAST- Thriving bakery sector to drive growthAFRICA- Ability of sourdough bread to suit diverse regional tastes and flour preferences to drive growth

- 11.1 OVERVIEW

- 11.2 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 11.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 11.5 MARKET SHARE ANALYSIS

-

11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSPRODUCT FOOTPRINT FOR KEY PLAYERS

-

11.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES

-

12.1 KEY PLAYERSPURATOS- Business overview- Products offered- Recent developments- MnM viewIREKS GMBH- Business overview- Products offered- MnM viewLALLEMAND INC.- Business overview- Products offered- MnM viewLESAFFRE- Business overview- Products offered- MnM viewGOODMILLS- Business overview- Products offered- MnM viewGOLD COAST BAKING COMPANY- Business overview- Products offered- MnM viewBOUDIN BAKERY- Business overview- Products offered- MnM viewPHILIBERT SAVOURS- Business overview- Products offered- MnM viewERNST BÖCKER GMBH & CO. KG- Business overview- Products offered- Recent developments- MnM viewBAKE WITH BROLITE- Business overview- Products offered- MnM viewSEMIFREDDI’S- Business overview- Products offered- MnM viewKING ARTHUR BAKING COMPANY, INC.- Business overview- Products offered- MnM viewDR. SUWELACK- Business overview- Products offered- Recent developments- MnM viewCULTURES FOR HEALTH- Business overview- Products offered- MnM viewLA BREA BAKERY- Business overview- Products offered- MnM view

-

12.2 STARTUPS/SMESITALMILLPOILÂNETHE ACME BREAD COMPANYTHE SOURDOUGH COMPANYTHEOBROMA

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 STARTER CULTURES MARKETMARKET DEFINITIONMARKET OVERVIEWSTARTER CULTURES MARKET, BY FORMSTARTER CULTURES MARKET, BY REGION

-

13.4 BAKERY PREMIXES MARKETMARKET DEFINITIONMARKET OVERVIEWBAKERY PREMIXES MARKET, BY TYPEBAKERY PREMIXES MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 SOURDOUGH MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO SOURDOUGH MARKET, 2013–2022

- TABLE 9 IMPORT VALUE OF SOURDOUGH FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF SOURDOUGH FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 11 WHEAT: SOURDOUGH MARKET, BY REGION, 2020–2022 (USD PER TON)

- TABLE 12 BARLEY: SOURDOUGH MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 13 OATS: SOURDOUGH MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 14 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 15 PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 17 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 18 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 19 SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 20 SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 21 SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 22 SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 23 WHEAT: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 WHEAT: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 WHEAT: SOURDOUGH MARKET, BY REGION, 2019–2022 (KT)

- TABLE 26 WHEAT: SOURDOUGH MARKET, BY REGION, 2023–2028 (KT)

- TABLE 27 BARLEY: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 BARLEY: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 BARLEY: SOURDOUGH MARKET, BY REGION, 2019–2022 (KT)

- TABLE 30 BARLEY: SOURDOUGH MARKET, BY REGION, 2023–2028 (KT)

- TABLE 31 OATS: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 OATS: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 OATS: SOURDOUGH MARKET, BY REGION, 2019–2022 (KT)

- TABLE 34 OATS: SOURDOUGH MARKET, BY REGION, 2023–2028 (KT)

- TABLE 35 SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 TYPE I: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 TYPE I: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 TYPE II: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 TYPE II: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 TYPE III: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 TYPE III: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 BREAD & BUNS: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 BREAD & BUNS: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 COOKIES: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 COOKIES: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 CAKES: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 CAKES: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 PIZZAS: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 PIZZAS: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OTHER APPLICATIONS: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 OTHER APPLICATIONS: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 SOURDOUGH MARKET, BY REGION, 2019–2022 (KT)

- TABLE 58 SOURDOUGH MARKET, BY REGION, 2023–2028 (KT)

- TABLE 59 NORTH AMERICA: SOURDOUGH MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: SOURDOUGH MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 US: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 68 US: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 69 US: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 70 US: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 71 CANADA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 72 CANADA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 74 CANADA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 75 MEXICO: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 76 MEXICO: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 77 MEXICO: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 78 MEXICO: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 79 EUROPE: SOURDOUGH MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: SOURDOUGH MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 GERMANY: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 88 GERMANY: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 89 GERMANY: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 90 GERMANY: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 91 FRANCE: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 92 FRANCE: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 93 FRANCE: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 94 FRANCE: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 95 UK: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 96 UK: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 97 UK: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 98 UK: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 99 ITALY: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 100 ITALY: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 101 ITALY: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 102 ITALY: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 103 SPAIN: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 104 SPAIN: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 105 SPAIN: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 106 SPAIN: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 107 REST OF EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 110 REST OF EUROPE: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 111 ASIA PACIFIC: SOURDOUGH MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SOURDOUGH MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 120 CHINA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 122 CHINA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 123 INDIA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 124 INDIA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 126 INDIA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 127 JAPAN: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 128 JAPAN: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 129 JAPAN: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 130 JAPAN: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 131 AUSTRALIA & NEW ZEALAND: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 134 AUSTRALIA & NEW ZEALAND: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 135 REST OF ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 138 REST OF ASIA PACIFIC: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 139 SOUTH AMERICA: SOURDOUGH MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 SOUTH AMERICA: SOURDOUGH MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 144 SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 146 SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 147 SOUTH AMERICA: SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 148 SOUTH AMERICA: SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 BRAZIL: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 150 BRAZIL: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 151 BRAZIL: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 152 BRAZIL: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 153 ARGENTINA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 154 ARGENTINA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 155 ARGENTINA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 156 ARGENTINA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 157 REST OF SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 158 REST OF SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 160 REST OF SOUTH AMERICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 161 ROW: SOURDOUGH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 162 ROW: SOURDOUGH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 ROW: SOURDOUGH MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 164 ROW: SOURDOUGH MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 ROW: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 166 ROW: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 167 ROW: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 168 ROW: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 169 ROW: SOURDOUGH MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 170 ROW: SOURDOUGH MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 174 MIDDLE EAST: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 175 AFRICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (USD MILLION)

- TABLE 176 AFRICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (USD MILLION)

- TABLE 177 AFRICA: SOURDOUGH MARKET, BY INGREDIENT, 2019–2022 (KT)

- TABLE 178 AFRICA: SOURDOUGH MARKET, BY INGREDIENT, 2023–2028 (KT)

- TABLE 179 REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD BILLION)

- TABLE 180 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 181 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 182 SOURDOUGH MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS, BY TYPE

- TABLE 183 SOURDOUGH MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS, BY APPLICATION

- TABLE 184 SOURDOUGH MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS, BY INGREDIENT

- TABLE 185 SOURDOUGH MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 186 SOURDOUGH MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 187 SOURDOUGH MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 188 SOURDOUGH MARKET: PRODUCT LAUNCHES, 2022

- TABLE 189 SOURDOUGH MARKET: DEALS, 2021

- TABLE 190 PURATOS: BUSINESS OVERVIEW

- TABLE 191 PURATOS: PRODUCTS OFFERED

- TABLE 192 PURATOS: DEALS

- TABLE 193 IREKS GMBH: BUSINESS OVERVIEW

- TABLE 194 IREKS GMBH: PRODUCTS OFFERED

- TABLE 195 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 196 LALLEMAND INC.: PRODUCTS OFFERED

- TABLE 197 LESAFFRE: BUSINESS OVERVIEW

- TABLE 198 LESAFFRE: PRODUCTS OFFERED

- TABLE 199 GOODMILLS: BUSINESS OVERVIEW

- TABLE 200 GOODMILLS: PRODUCTS OFFERED

- TABLE 201 GOLD COAST BAKING COMPANY: BUSINESS OVERVIEW

- TABLE 202 GOLD COAST BAKING COMPANY: PRODUCTS OFFERED

- TABLE 203 BOUDIN BAKERY: BUSINESS OVERVIEW

- TABLE 204 BOUDIN BAKERY: PRODUCTS OFFERED

- TABLE 205 PHILIBERT SAVOURS: BUSINESS OVERVIEW

- TABLE 206 PHILIBERT SAVOURS: PRODUCTS OFFERED

- TABLE 207 ERNST BÖCKER GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 208 ERNST BÖCKER GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 209 ERNST BÖCKER GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 210 BAKE WITH BROLITE: BUSINESS OVERVIEW

- TABLE 211 BAKE WITH BROLITE: PRODUCTS OFFERED

- TABLE 212 SEMIFREDDI’S: BUSINESS OVERVIEW

- TABLE 213 SEMIFREDDI’S: PRODUCTS OFFERED

- TABLE 214 KING ARTHUR BAKING COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 215 KING ARTHUR BAKING COMPANY, INC.: PRODUCTS OFFERED

- TABLE 216 DR. SUWELACK: BUSINESS OVERVIEW

- TABLE 217 DR. SUWELACK: PRODUCTS OFFERED

- TABLE 218 DR. SUWELACK: PRODUCT LAUNCHES

- TABLE 219 CULTURES FOR HEALTH: BUSINESS OVERVIEW

- TABLE 220 CULTURES FOR HEALTH: PRODUCTS OFFERED

- TABLE 221 LA BREA BAKERY: BUSINESS OVERVIEW

- TABLE 222 LA BREA BAKERY: PRODUCTS OFFERED

- TABLE 223 STARTER CULTURES MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 224 STARTER CULTURES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 225 STARTER CULTURES MARKET, BY FORM, 2017–2021 (KT)

- TABLE 226 STARTER CULTURES MARKET, BY FORM, 2022–2027 (KT)

- TABLE 227 STARTER CULTURES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 228 STARTER CULTURES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 229 BAKERY PREMIXES MARKET, BY TYPE, 2017–2025 (USD THOUSAND)

- TABLE 230 BAKERY PREMIXES MARKET, BY TYPE, 2017–2025 (KT)

- TABLE 231 BAKERY PREMIXES MARKET, BY REGION, 2017–2025 (USD THOUSAND)

- TABLE 232 BAKERY PREMIXES MARKET, BY REGION, 2017–2025 (KT)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- FIGURE 3 KEY ECONOMIES BASED ON GROSS DOMESTIC PRODUCT, 2019–2021 (USD TRILLION)

- FIGURE 4 DATA TRIANGULATION AND MARKET BREAKDOWN

- FIGURE 5 RECESSION MACROINDICATORS

- FIGURE 6 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 7 GLOBAL GROSS DOMESTIC PRODUCT, 2011–2021 (USD TRILLION)

- FIGURE 8 RECESSION INDICATORS AND THEIR IMPACT ON SOURDOUGH MARKET

- FIGURE 9 GLOBAL SOURDOUGH MARKET: CURRENT FORECAST VS. RECESSION FORECAST

- FIGURE 10 SOURDOUGH MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 SOURDOUGH MARKET, BY INGREDIENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 SOURDOUGH MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 SOURDOUGH MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 14 POPULARITY OF ARTISANAL BAKING TRENDS AND RISING HEALTH AWARENESS AMONG CONSUMERS TO DRIVE GROWTH

- FIGURE 15 CHINA TO ACHIEVE FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 TYPE I SEGMENT AND GERMANY TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 17 BREAD & BUNS SEGMENT AND EUROPE TO ACCOUNT FOR SIGNIFICANT SHARE BY 2028

- FIGURE 18 TYPE I SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 BREAD & BUNS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 20 WHEAT SEGMENT TO LEAD MARKET BY 2028

- FIGURE 21 REVENUE SHARE OF US BAKERY PRODUCTS, 2021

- FIGURE 22 SOURDOUGH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 REVENUE SHIFT ANALYSIS

- FIGURE 25 PATENTS GRANTED GLOBALLY, 2013–2022

- FIGURE 26 MAJOR PATENTS GRANTED, BY REGION

- FIGURE 27 ECOSYSTEM MAP

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 29 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 30 SOURDOUGH MARKET, BY INGREDIENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 SOURDOUGH MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 SOURDOUGH MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC SOURDOUGH MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: SOURDOUGH MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICAN SOURDOUGH MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 36 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 37 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 38 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Sourdough market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Sourdough market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of sourdough. On the demand side, key opinion leaders, executives, and CEOs of companies in the Sourdough industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Sourdough market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

Sourdough Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Sourdough market size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Sourdough market size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Sourdough Market Definition

A sourdough is a form of dough fermented by yeast and lactic acid bacteria (LAB) that is used as sponge dough in bread production. The creation, maintenance, and usage of a complex and varied starter culture are essential components of the ancient technique of creating sourdough bread. Around the world, sourdough starter cultures are used to make bread on both a small-scale (artisanal) and large-scale (commercial) basis. While there is a lot of scientific research on sourdough, neither the scientific community nor the bread industry has standardized methods for using sourdough starters, and there aren't many suggestions for where sourdough research should go in the future.

Stakeholders

- Raw material suppliers

- Traders, distributors, and manufacturers & suppliers of bakery fillings

- Bakery product manufacturers

- Government and research organizations

- Trade associations and industry bodies

-

Government authorities

- American Bakers Association (ABA)

- Specialty Food Association (SFA)

- Baking Association of Canada (BAC)

- International Dairy Deli Bakery Association (IDDBA)

- Brazilian Manufacturers Association of Biscuits, Pasta and Industrialized Breads & Cakes (ABIMAPI)

- Craft Bakers Association (CBA)

- European Commission

- European Food Safety Authority (EFSA)

Sourdough Market Report Objectives

- To define, segment, and project the global market for Sourdough on the basis of type, application, ingredients, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the Sourdough market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European Sourdough market, by key country

- Further breakdown of the Rest of the Asia Pacific market, by key country

- Further breakdown of the Rest of South America market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Sourdough Market