Milk Protein Market by Type (MPC, MPI, MPH, Casein & Caseinates, WPC, WPI), Livestock (Cow, Buffalo, Goat), Form (Dry, Liquid), Application (Sports Nutrition, Infant Formula, Dairy Products), and Region - Global Forecast to 2022

[162 Pages Report] Milk Protein Market categorizes the Global Market by Type (MPC, MPI, MPH, Casein & Caseinates, WPC, WPI), Livestock (Cow, Buffalo, Goat), Form (Dry, Liquid), Application (Sports Nutrition, Infant Formula, Dairy Products) and Region. The global market is estimated to be valued at USD 9.78 Billion in 2017, and is projected to grow at a CAGR of 6.5% during the forecast period of 2017–2022.

The years considered for the study are as follows:

- Historical year: 2015

- Base year: 2016

- Estimated year: 2017

- Projected year: 2022

- Forecast period: 2017–2022

Objectives of the study are as follows:

- To define, segment, and measure the milk protein market based on type, application, livestock, form, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders

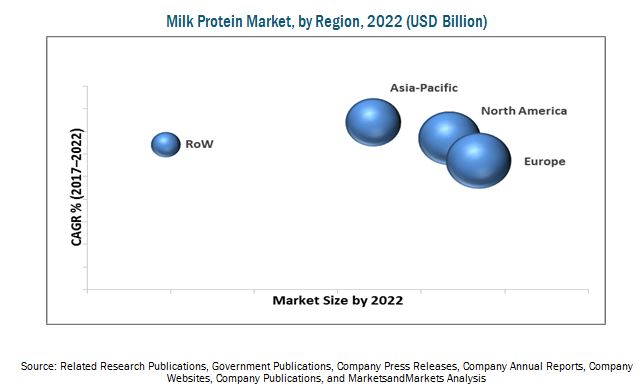

- To project the size of the market, in terms value (USD million), in the four main regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To project the market size, in terms value (USD million) and volume (KT) on the basis of key milk protein, by type

- To analyze opportunities in the market for stakeholders and study the details of a competitive landscape, to be provided to the key market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To track and analyze the competitive developments such as new product launches, acquisitions, expansions and investments, agreements, and joint ventures in the market

Research Methodology

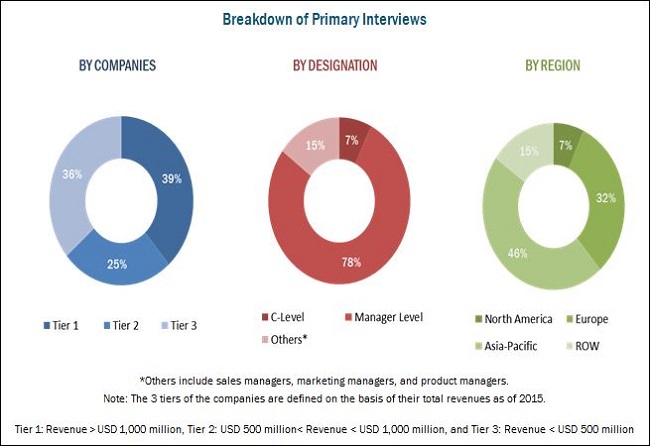

This report includes estimations of market sizes in terms of value (USD billion) and volume (kilo tons). Both top-down and bottom-up approaches have been used to estimate and validate the size of the milk protein market and of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources the Food and Agriculture Organization (FAO), the European Food Safety Authority (EFSA), American Dairy Products Institute (ADPI), and the Food and Drug Administration (FDA) to identify and collect information useful for this technical, market-oriented, and commercial study of the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of milk protein include raw material suppliers, manufacturers, wholesalers/distributors, retailers, and end users. Major manufacturing companies develop their in-house R&D centers for research and innovation activities to support their manufacturing units and to successfully introduce new products in the market.

The market is dominated by key players such as Lactalis Ingredients (France), Fonterra Co-operative Group (New Zealand), FrieslandCampina (Netherlands), Arla Foods (Denmark), and Saputo Ingredients (Canada). Other market players include Glanbia PLC (Ireland), Kerry Group plc (Ireland), Havero Hoogwewt Group (Netherlands), Sachsenmilch Leppersdorf GmbH (Germany), and AMCO Protein (U.S.).

Target Audience:

- Milk protein importers and exporters

- Dairy manufacturers and processors

-

Secondary sources, which include the following:

- The Food and Agriculture Organization (FAO) and the International Dairy Food Association(IDFA)

- The European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA)

- Food safety agencies

-

End applications, which include the following:

- Bakery products, confectionery products, and convenience foods

- Dairy products

Scope of theReport

Based on Type, the market has been segmented as follows:

- Milk protein concentrates

- Milk protein isolates

- Milk protein hydrolysates

- Whey protein concentrates

- Whey protein isolates

- Casein & caseinates

- Others (include whey protein hydrolysates, milk and whey peptides, dairy protein fractions, colostrums, and alpha lactalbumin)

Based on Livestock, the market has been segmented as follows:

- Cow

- Buffalo

- Goat

Based on Application, the market has been segmented as follows:

- Infant formula

- Sports nutrition

- Dairy products

- Others (include dry mixes, functional food, confectionary products)

Based on Form, the market has been segmented as follows:

- Dry

- Liquid

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

- Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of other food application in the market

Regional Analysis

- Further breakdown of the Rest of Europe milk protein market into Spain, the Netherlands, Denmark, Belgium, and Russia

- Further breakdown of the Rest of Asia-Pacific milk protein market into Indonesia, South Korea, Malaysia, Singapore, Thailand, and Vietnam

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The milk protein market is projected to grow at a CAGR of 6.5%, in terms of value, from 2017 to reach a projected value of USD 13.38 Billion by 2022. The multifunctional nature of milk protein, ease of incorporation in a wide range of applications, increase in demand for high protein food, and increase in consumption of premium products are the factors driving the global market. Increase in awareness with regard to the importance of high nutritional food and its rising applications among the global population, fuels the demand for milk protein.

The global market has been segmented by type into casein & caseinates, milk protein concentrates, milk protein isolates, milk protein hydrolysates, whey protein concentrates, whey protein isolates, and others. The whey protein concentrates segment has emerged as the most widely used milk protein owing to their multifunctional properties and their vast applications in bakery products, confectionery products, infant formula, clinical nutrition, dairy products, and sports nutrition.

Based on livestock, cow milk is estimated to have the largest market share in 2017. The global demand for milk protein from cow’s milk is higher than other milk producing livestock. Factors such as increased cattle farming, developed milk supply services, developments in storage and refrigeration, large scale production of cow’s milk globally compared to that of other livestock are drivers for cows to be the main source for the milk protein market.

The global market has been segmented on the basis of application into infant formula, sports nutrition, dairy products, and others. Milk protein is gaining importance in the infant formula segment with an increase in importance toward infant nutrition and growth in concerns regarding lactose intolerance among infants, which drive the demand for low-lactose, high protein infant nutrition.

Europe is estimated to be the largest share in terms of value, in the global milk protein market, in 2017. Positive knowledge of segments create a platform for innovative applications of milk protein, and tapping the emerging markets in China, India, Australia, and New Zealand leads to growth opportunities in Asia-Pacific.

Growth in awareness with regard to dairy substitutes such as plant and soy protein and fluctuations in supply of raw materials, that is, milk, restrains the total market for milk protein.

The leading players that dominated the milk protein market include Groupe Lactalis (France), Fonterra Co-Operative Group (New Zealand), FrieslandCampina (Netherlands), Arla Foods (Denmark), and Saputo Incorporated (Canada).

The key players have been exploring the market in new regions by adopting acquisitions, expansions, investments, new product launches, agreements, and joint ventures as their preferred strategies. Key players have been investing in intensive R&D activities and also adopting expansions and acquisitions as a mode to enhance their product offerings and capture a larger market share, thus increasing the demand for milk protein.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered for the Study

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries, By Company Type, Designation & Region

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in this Market

4.2 Milk Protein Market Size, By Application

4.3 Europe: Milk Protein Market, By Type and By Country

4.4 Milk Protein Market: Major Countries

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Insights

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Livestock

5.3.3 By Application

5.3.4 By Product Form

5.3.5 By Product Functionality (Qualitative)

5.3.6 By Processing Method (Qualitative)

5.3.7 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Awareness About Health & Wellness

5.4.1.2 Increase in Demand for Nutrition-Based Products in Sports Nutrition, Infant Formulas, and Clinical Nutrition

5.4.1.3 Increase in Demand for High-Protein Food in the Confectionery and Bakery Industry

5.4.2 Restraints

5.4.2.1 Alternatives Such as Plant Protein

5.4.3 Opportunities

5.4.3.1 Emerging Markets are New Growth Frontiers

5.4.3.2 Functional Potential of Milk Protein in New Products

5.4.4 Challenges

5.4.4.1 Fluctuation in Prices of Raw Materials Leading to Uncertainty in the Market

5.4.4.2 Increase in Cases of Lactose Intolerance and Allergies

5.4.4.3 Approval From Various Regulatory Bodies

5.5 Supply Chain Analysis

6 Regulatory Framework (Page No. - 46)

6.1 Introduction

6.2 North America

6.2.1 U.S.

6.2.1.1 U.S. Food and Drug Administration Inspection Guide

6.2.1.2 Regulation for Receiving Raw Milk

6.2.1.3 Regulation for Milk Processing

6.2.2 Canada

6.2.3 Mexico

6.3 Europe

6.3.1 European Food Safety Authority

6.4 Asia-Pacific

6.4.1 Japan

6.4.2 China

6.4.3 India

6.4.4 Australia & New Zealand

6.5 Rest of the World (RoW)

6.5.1 Israel

6.5.2 Brazil

7 Milk Protein Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Whey Protein Concentrates

7.3 Whey Protein Isolates

7.4 Casein & Caseinates

7.5 Milk Protein Concentrates

7.6 Milk Protein Isolates

7.7 Milk Protein Hydrolysates

7.8 Other Milk Protein

8 Milk Protein Market, By Livestock (Page No. - 61)

8.1 Introduction

8.2 Cow

8.3 Buffalo

8.4 Goat

9 Milk Protein Market, By Application (Page No. - 68)

9.1 Introduction

9.2 Infant Formula

9.3 Sports Nutrition

9.4 Dairy Products

9.5 Others

10 Milk Protein Market, By Form (Page No. - 77)

10.1 Introduction

10.2 Dry Form

10.3 Liquid Form

11 Milk Protein Market, By Brand (Page No. - 82)

11.1 Introduction

11.2 Prolacta

11.3 Sureprotein

11.4 Lacprodan

11.5 Solmiko

11.6 Germanprot

11.7 Germanmicell

11.8 Solago

11.9 Hyfoama, Versawship, and Hygel

11.10 Ultranor

11.11 Hyprol

11.12 Provon

11.13 Avonlac & Thermax

11.14 Refit

11.15 Excellion

11.16 Hiprotal

11.17 Pronativ

12 Milk Protein Market, By Functionality (Page No. - 86)

12.1 Introduction

12.2 Emulsification, Foaming, and Thickening

12.3 Color/Flavor Development

12.4 Gelation

12.5 Heat Stability

13 Milk Protein Market, By Processing Method (Page No. - 88)

13.1 Introduction

13.2 Pasteurization

13.3 Creaming and Homogenization

13.4 Filtration

13.5 Drying

13.6 Spray Drying

14 Milk Protein Market, By Region (Page No. - 90)

14.1 Introduction

14.2 North America

14.2.1 U.S.

14.2.2 Canada

14.2.3 Mexico

14.3 Europe

14.3.1 U.K.

14.3.2 France

14.3.3 Germany

14.3.4 Rest of Europe

14.4 Asia Pacific

14.4.1 China

14.4.2 India

14.4.3 Australia & New Zealand

14.4.4 Rest of Asia-Pacific

14.5 Rest of the World (RoW)

14.5.1 Latin America

14.5.2 Middle East

15 Competitive Landscape (Page No. - 111)

15.1 Overview

15.2 Competitive Situation & Trends

15.2.1 Expansions & Investments

15.2.2 Acquisitions

15.2.3 New Product Launches

15.2.4 Agreements & Joint Ventures

15.3 Industry Insights

16 Company Profiles (Page No. - 122)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

16.1 Introduction

16.2 Lactalis Ingredients

16.3 Fonterra Co-Operative Group

16.4 Frieslandcampina

16.5 Arla Foods

16.6 Saputo Ingredients

16.7 Glanbia PLC

16.8 Kerry Group

16.9 Havero Hoogwewt

16.10 Sachsenmilch Leppersdorf GmbH

16.11 Amco Protein

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

17 Appendix (Page No. - 151)

17.1 Insights of Industry Experts

17.2 Discussion Guide

17.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.4 Introducing RT: Real-Time Market Intelligence

17.5 Available Customizations

17.6 Related Reports

17.7 Author Details

List of Tables (77 Tables)

Table 1 Definitions & Regulations for Milk Protein Products

Table 2 Milk Protein Market Size, By Type, 2015–2022 (USD Million)

Table 3 Market Size , By Type, 2015–2022 (KT)

Table 4 Whey Protein Concentrates Market Size, By Region, 2015–2022 (USD Million)

Table 5 Whey Protein Concentrate Market Size, By Region, 2015–2022 (KT)

Table 6 Whey Protein Isolates Market Size, By Region, 2015–2022 (USD Million)

Table 7 Whey Protein Isolates Market Size, By Region, 2015–2022 (KT)

Table 8 Casein & Caseinates Market Size, By Region, 2015–2022 (USD Million)

Table 9 Casein & Caseinates Market Size, By Region, 2015–2022 (KT)

Table 10 Milk Protein Concentrates Market Size, By Region, 2015–2022 (USD Million)

Table 11 Milk Protein Concentrates Market Size, By Region, 2015–2022 (KT)

Table 12 Milk Protein Isolates Market Size, By Region, 2015–2022 (USD Million)

Table 13 Milk Protein Isolates Market Size, By Region, 2015–2022 (KT)

Table 14 Milk Protein Hydrolysates Market Size, By Region, 2015–2022 (USD Million)

Table 15 Milk Protein Hydrolysates Market Size, By Region, 2015–2022 (KT)

Table 16 Other: Milk Protein Market Size, By Region, 2015–2022 (USD Million)

Table 17 Other: Market Size, By Region, 2015–2022 (KT)

Table 18 By Market Size, By Livestock, 2015–2022 (USD Million)

Table 19 Market Size, By Livestock, 2015–2022 (KT)

Table 20 Cow: Milk Protein Market Size, By Region, 2015–2022 (USD Million)

Table 21 Cow: Market Size, By Region, 2015–2022 (KT)

Table 22 Buffalo: Milk Protein Market Size, By Region, 2015–2022 (USD Million)

Table 23 Buffalo: Market Size, By Region, 2015–2022 (KT)

Table 24 Goat: Milk Protein Market Size, By Region, 2015–2022 (USD Million)

Table 25 Goat: Market Size, By Region, 2015–2022 (KT)

Table 26 By Market Size , By Application, 2015–2022 (USD Million)

Table 27 Milk Protein Market Size , By Application, 2015–2022 (KT)

Table 28 Market Size in Infant Formula, By Region, 2015–2022 (KT)

Table 29 By Market Size in Sports Nutrition, By Region, 2015–2022 (KT)

Table 30 By Market Size in Dairy Products, By Region, 2015–2022 (KT)

Table 31 Milk Protein Market Size in Other Applications, By Region, 2015–2022 (KT)

Table 32 Market Size, By Form, 2015–2022 (USD Million)

Table 33 Market Size , By Type, 2015–2022 (KT)

Table 34 Milk Protein: Dry Form Market Size , By Region, 2015–2022 (USD Million)

Table 35 Milk Protein: Dry Form Market Size, By Region, 2015–2022 (KT)

Table 36 Milk Protein: Liquid Form Market Size, By Region, 2015–2022 (USD Million)

Table 37 Milk Protein: Liquid Form Market Size, By Region, 2015–2022 (KT)

Table 38 Milk Protein Market Size, By Region, 2015–2022 (USD Million)

Table 39 Market Size, By Region, 2015–2022 (KT)

Table 40 North America: Milk Protein Market Size, By Type, 2015–2022 (USD Million)

Table 41 North America: By Market Size, By Type, 2015–2022 (KT)

Table 42 North America: By Market Size, By Application, 2015–2022 (KT)

Table 43 North America: By Market Size, By Livestock, 2015–2022 (USD Million)

Table 44 North America: Milk Protein Market Size, By Livestock, 2015–2022 (KT)

Table 45 North America: By Market Size, By Form, 2015–2022 (USD Million)

Table 46 North America: Market, By Form, 2015–2022 (KT)

Table 47 North America: Market Size, By Country, 2015–2022 (KT)

Table 48 Europe: By Market, By Type, 2015–2022, (USD Million)

Table 49 Europe: Milk Protein Market, By Type, 2015–2022, (KT)

Table 50 Europe: Market, By Application, 2015–2022 (KT)

Table 51 Europe: By Market, By Livestock, 2015–2022 (USD Million)

Table 52 Europe: Market, By Livestock, 2015–2022 (KT)

Table 53 Europe: By Market, By Form, 2015–2022 (USD Million)

Table 54 Europe: By Market, By Form, 2015–2022 (KT)

Table 55 Europe: Market Size, By Country, 2015–2022 (KT)

Table 56 Asia-Pacific: Milk Protein Market, By Type, 2015-2022 (USD Million)

Table 57 Asia-Pacific: Market, By Type, 2015-2022 (KT)

Table 58 Asia-Pacific: Market, By Application, 2015-2022 (KT)

Table 59 Asia-Pacific: Market, By Livestock, 2015-2022 (USD Million)

Table 60 Asia-Pacific: Market, By Livestock, 2015-2022 (KT)

Table 61 Asia-Pacific: Market, By Form, 2015-2022 (USD Million)

Table 62 Asia-Pacific: Market, By Form, 2015-2022 (KT)

Table 63 Asia-Pacific: Market Size, By Country, 2015–2022 (KT)

Table 64 RoW: Milk Protein Market Size, By Type, 2015-2022 (USD Million)

Table 65 RoW: Market Size, By Type, 2015-2022 (KT)

Table 66 RoW: Market Size, By Application, 2015-2022 (KT)

Table 67 RoW: Market Size, By Livestock, 2015-2022 (USD Million)

Table 68 RoW: Market Size, By Livestock, 2015-2022 (KT)

Table 69 RoW: Market Size, By Form, 2015-2022 (USD Million)

Table 70 RoW: Market Size, By Form, 2015-2022 (KT)

Table 71 RoW: Market Size, By Region, 2015-2022 (KT)

Table 72 Global Milk Protein Manufacturing Company Rankings, 2016

Table 73 Expansions & Investments, 2012–2016

Table 74 Acquisitions, 2012–2016

Table 75 New Product Development, 2012-2016

Table 76 Agreements & Joint Ventures, 2012–2016

Table 77 Investments to Expand Production Capabilities is the Most Prevailing Strategic Trend in the Milk Protein Industry

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Milk Protein Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation & Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 Sports Nutrition Segment is Estimated to Dominate the Milk Proteins Market in 2017

Figure 9 Whey Protein Concentrates is Estimated to Dominate the Milk Proteins Market in 2017

Figure 10 Europe Dominated the Market in 2016

Figure 11 Expansions & Investments and Acquisitions: the Key Strategies, 2012–2016

Figure 12 Emerging Markets to Driver Growth in the Market During the Forecast Period

Figure 13 Sports Nutrition Segment to Continue Dominating the Market Through 2022

Figure 14 Whey Protein Concentrates Accounted for the Largest Share in the European Milk Protein Market in 2016

Figure 15 Milk Protein Market Growth Rate, By Country, 2017–2022

Figure 16 Milk Protein Market Size, By Top Countries, 2017 vs 2022 (USD Million)

Figure 17 Milk Protein Market in the Asia-Pacific Region is Experiencing High Growth

Figure 18 Milk Protein Market, By Type

Figure 19 Market, By Livestock

Figure 20 Market, By Application

Figure 21 Market, By Product Form

Figure 22 Market, By Product Functionality

Figure 23 Market, By Processing Method

Figure 24 Market, By Region

Figure 25 Milk Protein Market: Drivers, Restraints, Opportunities, and Challenges

Figure 26 Raw Material Suppliers are Vital Components of the Supply Chain

Figure 27 Whey Protein Concentrates Segment to Dominate the Market Through 2022 (KT)

Figure 28 Cow Segment to Dominate the Market Through 2022

Figure 29 Cow Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 30 Sports Nutrition Segment to Dominate the Market Through 2022 (USD Million)

Figure 31 Infant Formula Market Size, By Region, 2017 vs 2022 (KT)

Figure 32 Sports Nutrition Market Size, By Region, 2017 vs 2022 (KT)

Figure 33 Dairy Products Market Size, By Region, 2017 vs 2022 (KT)

Figure 34 Other Applications Market Size, By Region, 2017 vs 2022 (KT)

Figure 35 Dry Form of Milk Protein to Dominate the Market Through 2022 (KT)

Figure 36 Europe: Milk Protein Market Snapshot

Figure 37 Asia-Pacific Milk Protein Market Snapshot

Figure 38 Key Companies Preferred Strategies Such as Expansions & Investments, Agreements & Joint Ventures, New Product Launches, and Acquisitions Over the Last Five Years

Figure 39 Expansions Fueled Growth & Widened the Geographic Presence

Figure 40 Expansions & Investments: the Key Strategies, 2012—2016

Figure 41 Geographical Revenue Mix of Top Five Players

Figure 42 Groupe Lactalis: Company Snapshot

Figure 43 Groupe Lactalis: SWOT Analysis

Figure 44 Fonterra Co-Operative Group: Company Snapshot

Figure 45 Fonterra Co-Operative Group: SWOT Analysis

Figure 46 Frieslandcampina: Company Snapshot

Figure 47 Frieslandcampina: SWOT Analysis

Figure 48 Arla Foods: Company Snapshot

Figure 49 Arla Foods: SWOT Analysis

Figure 50 Saputo Inc.: Company Snapshot

Figure 51 Saputo Inc: SWOT Analysis

Figure 52 Glanbia PLC: Company Snapshot

Figure 53 Kerry Group: Company Snapshot

Growth opportunities and latent adjacency in Milk Protein Market