Inertial Measurement Unit Market Size, Share, Trends & Growth Analysis by Component (Accelerometer, Gyroscope, Magnetometer, Others), Grade (Marine, Navigation, Tactical, Space, Commercial), Technology (MO, RLG, FOG, MEMS, Others), Platform, End User, and Region - Global Forecast

Updated on : Oct 22, 2024

Inertial Measurement Unit Market Size & Share:

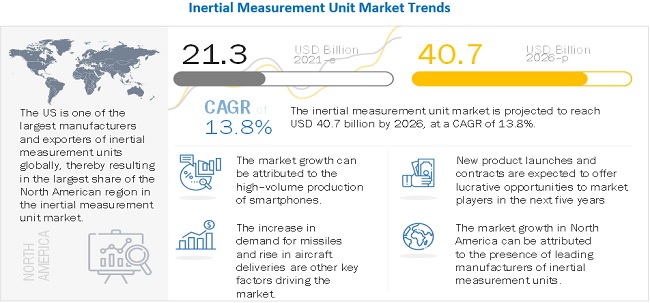

The Inertial Measurement Unit Market is estimated to be USD 21.3 billion in 2021 and is projected to reach USD 40.7 billion by 2026, growing at a CAGR of 13.8% during the forecast period. The growth of this market is mainly driven by the high–volume production of smartphones, increase in demand for missiles and rise in aircraft deliveries. The Inertial Measurement Unit (IMU) market is experiencing robust growth, driven by increasing demand across industries such as aerospace, defense, automotive, and consumer electronics. Technological advancements in sensors, gyroscopes, and accelerometers are enhancing the accuracy and efficiency of IMUs, making them essential for applications like navigation, motion tracking, and stabilization. The rise of autonomous vehicles, drones, and robotics is further propelling market expansion. Additionally, the integration of IMUs with other technologies such as GPS and artificial intelligence is creating new opportunities, while improving overall system performance and reliability.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Inertial Measurement Unit Market

The inertial measurement unit market includes major players General Electric (US), Honeywell (US), Bosch (Germany), Safran (France), and Northrop Grumman (US). These players have spread their business across various countries including North America, Europe, Asia Pacific, Middle East, and Rest of the World. COVID-19 has impacted their businesses as well.

Inertial Measurement Unit Market Dynamics

Drivers: High volume production of smartphones

The increase in new smartphones sales and shipments across the globe is one of the key factors driving the growth of the IMU market. According to International Data Corporation (IDC), the shipment volume of smartphones reached 1,292.2 million units in 2020. The demand for smartphones is strong in the largest markets such as China, the US, Brazil, Japan, etc. The penetration of smartphones is increasing significantly in countries with a high gross population such as India, Nigeria, and Pakistan, and will fuel the growth of the smartphones market during the forecast period. Additionally, many smartphones include inertial measurement units that normally include a gyro sensor, accelerometer, and magnetometer. The IMUs installed in smartphones enable them to measure the gait, tremor, and movement characteristics of humans. Therefore, increasing shipment of smartphones is driving the growth of the inertial measurement unit market.

Opportunities: Booming VR and AR technologies

AR is a technology that uses the existing environment to overlay new information on top of it, whereas VR provides the user with a virtual environment with the help of hardware and software equipped in a computing device. It also provides a fully immersive environment where the user can interact with objects similar to those in the real world. AR is used to enhance the visual experience using virtual tools such as graphics, digital images, and simulations to add a new layer of interaction with the real environment. VR can create a virtual world with computer-generated and machine-driven reality. IMU is a key component used to measure speed, orientation, and specific gravity or acceleration to augment VR into the real world. Increasing product launches is also driving the growth of the market. For instance, in 2018, Bosch Sensortec launched the BMI085, a 6-axis high-performance IMU. It includes a 3-axis 16-bit MEMS acceleration sensor and a 3-axis 16-bit MEMS gyroscope in a single package. The BMI085 provides responsive motion sensors, enhanced precision, robustness, and reduced time lag. This makes the device ideal for high-performance AR/VR applications

Challenges: Error propagation

Stable platform IMUs depend on various mechanical parts inter-connected to each other with different joints for their functioning. These joints need to be frictionless to avoid any measurement error. With continued usage and wear and tear, the errors caused due to friction increase, which, in turn, hampers the performance of these systems. Apart from friction, there are a few computational errors that are induced as a result of noise and drifts. For instance, MEMS inertial sensors encompass very tiny mechanical components weighing in micrograms. These parts are so light that they occasionally fail to react to small changes with respect to orientation. Thus, friction and drifts induce a measurement error, which gets propagated in the long run.

Increasing need to measure angular velocity in three dimensions is expected to fuel the growth of the gyroscope segment in the inertial measurement unit market during the forecast period.

The gyroscope segment is estimated to lead the market during the forecast period, with a share of 57% in 2021. Gyroscopes are used in various devices to calculate their actual velocity until these devices stabilize and provide the measurement of the angular velocity proportional to the external torque applied. They are used in different types of aircraft. Gyroscopes find application in the defense sector. They are also used in various industrial applications. Gyroscopes are extensively used in the consumer electronics and automotive industries. They are widely used in smartphones, owing to their orientation and rotation measurement capabilities.

The MEMS segment is projected to witness the highest CAGR during the forecast period.

Based on technology, the MEMS segment is projected to be the highest CAGR rate for the inertial measurement unit market during the forecast period. These small, lightweight systems have an advantage over other types of IMUs due to their less weight and comparatively higher accuracy with a compact size. MEMS-based IMUs are expected to replace FOG IMUs in tactical grade performance applications in the coming years.

The commercial grade segment is projected to witness the highest CAGR during the forecast period.

Based on the grade, the commercial grade segment is projected to grow at the highest CAGR rate for the inertial measurement unit market during the forecast period. Commercial grade IMUs include consumer grade IMUs and enterprise-grade IMUs. Consumer grade IMUs are used for low-end applications such as phones, tablets, automobile airbag systems, etc., while enterprise-grade IMUs are used in small UAVs.

Inertial Measurement Unit Market Segmental Analysis

The satellites/space vehicles segment is projected to witness the highest CAGR during the forecast period

Based on platform, the satellites/space vehicles segment is projected to grow at the highest CAGR rate for the inertial measurement unit market during the forecast period. They are used for television broadcasting, telephones, satellite-based navigation, and weather forecasting and are equipped with sophisticated satellite telescopes for space research. They are also used for search and rescue missions as well as monitoring ocean, wind currents, forest fires, oil spills, airborne pollution.

The commercial segment is projected to witness the highest CAGR during the forecast period.

Based on the end user, the commercial segment is projected to grow at the highest CAGR rate for the inertial measurement unit market during the forecast period. IMUs serve as orientation sensors in many consumer products. Low-cost IMUs have enabled the proliferation of the consumer drone industry. They are also frequently used in the sports industry, like in technique training, and animation applications.

Regional Analysis - Inertial Measurement Unit Market

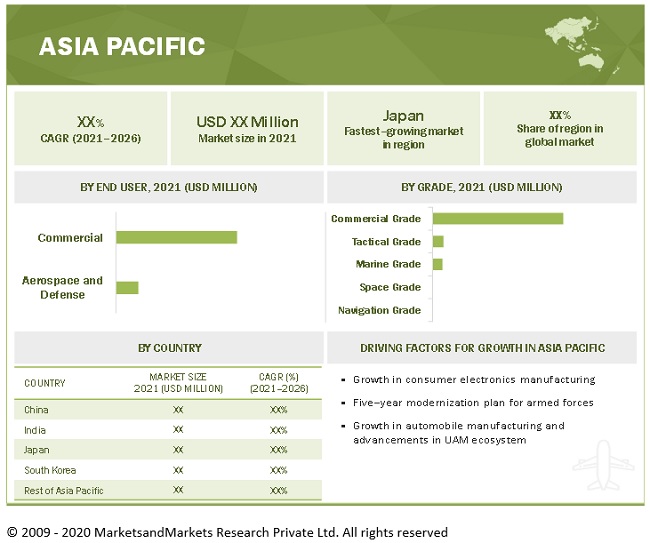

The Asia Pacific market is projected to contribute the largest share from 2021 to 2026

The majority of the Asia Pacific IMU market is accounted for by consumer electronic products. In addition, according to the Shipbuilders' Association of Japan, Asia Pacific accounts for a 96% share of the global merchant shipbuilding industry. As per OICA, car manufacturers in China and Japan alone constituted 42.8% of the global car production in 2020. Asia Pacific has a monopoly in industries such as consumer electronics, marine, and automobiles.

To know about the assumptions considered for the study, download the pdf brochure

Top Inertial Measurement Unit Companies - Key Market Players

The inertial measurement unit market is dominated by a few globally established players such as General Electric (US), Honeywell (US), Bosch (Germany), Safran (France), and Northrop Grumman (US).

Scope of the Inertial Measurement Unit Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 21.3 billion by 2021 |

|

Projected Market Size |

USD 40.7 billion by 2026 |

|

CAGR |

13.8% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, By Technology, By Grade, By Platform, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

General Electric (US), Honeywell (US), Bosch (Germany), Safran (France), and Northrop Grumman (US) |

The study categorizes the inertial measurement unit based on component, technology, grade, platform, end user, and by region.

By Component

- Accelerometers

- Gyroscopes

- Magnetometers

- Other sensors

By Technology

- Mechanical Gyro

- Ring Laser Gyro

- Fiber Optic Gyro

- MEMs

- Others

By Grade

- Marine Grade

- Navigation Grade

- Tactical Grade

- Space Grade

- Commercial Grade

By Platform

- Aircraft

- Missiles

- Satellites/Space Vehicles

- Marine Vessels

- Military Vehicles

- Unmanned Aerial Vehicles (UAVs)

- Unmanned Ground Vehicles (UGVs)

- Unmanned Marine Vehicles (UMVs)

- Consumer Electronics

- Automotive

- Survey Equipment

- Advanced Air Mobility

By End User

- Aerospace and Defense

- Commercial

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In June 2021, Safran Electronics & Defense, a long-standing leader in inertia, unveiled Geonyx M, its first amphibious inertial navigation system, designed for and with marine commandos. Geonyx M reaps the advantages of technologies and feedback from other Safran Electronics & Defense product ranges, including Geonyx (land vehicles), Argonyx (surface vessels), and Black-Onyx (submarines). This legacy enables it to deliver a true breakthrough in terms of performance, reliability, precision, and robustness.

- In April 2021, Pipistrel selected Honeywell’s next-generation Attitude Heading Reference System and Air Data Module for its Nuuva V300 cargo unmanned aerial vehicle (UAV). The technologies provide critical navigation and motion-sensing data and will work in tandem with Honeywell’s Compact Fly-By-Wire system onboard the aircraft.

- In February 2021, Northrop Grumman Corporation provided key navigation and critical components to support NASA Jet Propulsion Laboratory’s Perseverance Rover. The Perseverance Rover utilizes Northrop Grumman’s LN-200S inertial measurement unit (IMU) to provide attitude and acceleration information for guidance, as well as pressurant tanks for the Rover’s Gas Dust Removal Tool (GDRT) and propellant tanks for the Rover’s controlled descent element.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the inertial measurement unit market?

The inertial measurement unit market is expected to grow substantially. The growth of this market is mainly driven by high–volume production of smartphones, increase in demand for missiles and rise in aircraft deliveries.

What are the key sustainability strategies adopted by leading players operating in the inertial measurement unit market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the inertial measurement unit market. The major players include General Electric (US), Honeywell (US), Bosch (Germany), Safran (France), and Northrop Grumman (US), these players have adopted various strategies, such as acquisitions, contracts, new product launches, and partnerships & agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the inertial measurement unit market?

MEMS are used for a wide range of automotive applications, including vehicle dynamic control, rollover detection, anti-theft systems, electronic parking brake systems, and vehicle navigation systems. They are also being integrated with motorcycles for applications such as traction control, wheelie control, launch control, corner sensitive ABS, and slide control, among others. Robert Bosch GmbH (Germany) is a pioneer in the automotive MEMS segment.

Silicon Sensing Systems Limited (UK) is a manufacturer of reliable, affordable, and high integrity MEMS inertial sensors and systems. In July 2021, the company launched the DMU41 silicon MEMS (micro-electro-mechanical systems) inertial measurement unit (IMU) and the compact standalone single-axis CRH03 gyroscope.

Who are the key players and innovators in the ecosystem of the inertial measurement unit market?

The key players in the inertial measurement unit market include General Electric (US), Honeywell (US), Bosch (Germany), Safran (France), and Northrop Grumman (US).

Which region is expected to hold the highest market share in the inertial measurement unit market?

Inertial measurement unit market in Asai Pacific is projected to hold the highest market share during the forecast period. North America accounted for the largest share of 53.5% of the inertial measurement unit market and is expected to grow at a CAGR of 15.6% during the forecast period. The majority of the Asia Pacific IMU market is accounted for by consumer electronic products. Asia Pacific has a monopoly in industries such as consumer electronics, marine, and automobiles. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

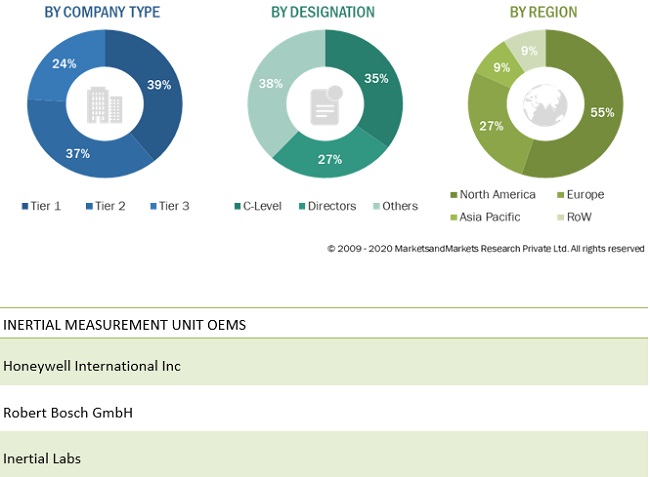

The research study involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg, and Factiva to identify and collect information relevant to the inertial measurement unit market. Primary sources include industry experts from the inertial measurement unit market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the inertial measurement unit market as well as to assess the growth prospects of the market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from inertial measurement unit manufacturers; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, product, end user, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using inertial measurement unit were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of inertial measurement unit and future outlook of their business which will affect the overall market.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

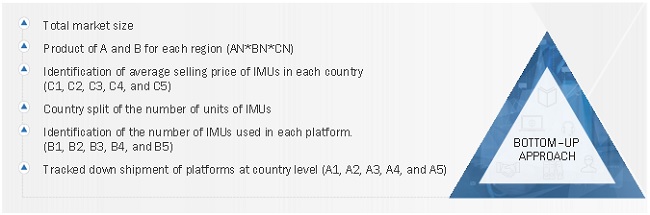

Both top-down and bottom-up approaches were used to estimate and validate the total size of the inertial measurement unit market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Inertial Measurement Unit Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the inertial measurement unit market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends. Along with this, the market size was validated using the top-down and bottom-up approaches.

Navigating the Inertial Measurement Unit (IMU) Market: Exploring IMU Sensors, MEMS IMUs, and IMU Modules

The Inertial Measurement Unit (IMU) is a critical component in many navigation, guidance, and stabilization systems. IMUs use various types of sensors, including accelerometers, gyroscopes, and magnetometers, to measure the orientation and velocity of a moving object. The global IMU market is experiencing significant growth due to advancements in sensor technology and the increasing demand for accurate and reliable navigation systems. In this blog, we will explore the IMU market and the different types of IMU sensors, including MEMS IMUs and IMU modules.

IMU sensors are the core components of IMUs. They are used to measure the motion and position of an object in real time. Accelerometers are used to measure linear acceleration, while gyroscopes are used to measure rotational motion. Magnetometers are used to measure the orientation of the object relative to the Earth's magnetic field. These sensors work together to provide a precise measurement of the object's orientation and velocity.

MEMS IMUs are a type of IMU that uses Micro-Electro-Mechanical System (MEMS) technology to manufacture sensors on a micro-scale. MEMS IMUs are small, lightweight, and low-power, making them ideal for use in mobile and handheld devices such as smartphones, tablets, and drones. MEMS IMUs have revolutionized the navigation and motion sensing industries by providing accurate and affordable sensors that can be integrated into a wide range of applications.

IMU modules are complete IMU systems that include multiple sensors, processing electronics, and software. These modules are designed to simplify the integration of IMUs into larger systems, such as unmanned aerial vehicles (UAVs), autonomous vehicles, and robotics. IMU modules are available in a variety of form factors and with various performance specifications, making them suitable for a wide range of applications.

The global IMU market is expected to continue to grow in the coming years due to increasing demand for accurate and reliable navigation systems in a variety of industries. According to a report by MarketsandMarkets, the IMU market is expected to reach $21.74 billion by 2023, with a compound annual growth rate of 6.2% from 2018 to 2023.

North America is expected to be the largest market for IMUs, followed by Asia Pacific and Europe. The growth in these regions can be attributed to the increasing demand for navigation and motion sensing systems in industries such as aerospace and defense, automotive, and consumer electronics.

Challenges:

- Increasing competition from emerging technologies that offer similar or improved performance, such as LiDAR and computer vision systems.

- Maintaining accuracy and reliability in harsh environments, such as high temperatures, vibrations, and electromagnetic interference.

- Addressing the challenge of sensor fusion and data processing, as IMUs typically require integration with other sensors and algorithms to provide accurate motion sensing and navigation.

- Maintaining affordability and accessibility for a wider range of applications and industries.

Opportunities:

- Growing demand for accurate and reliable navigation systems in the automotive, aerospace, and defense industries, as well as in consumer electronics and robotics.

- Advancements in MEMS and other sensor technologies, enable the development of smaller, lighter, and more power-efficient IMUs.

- Integration with emerging technologies such as autonomous vehicles, drones, and augmented/virtual reality systems.

- Increasing adoption of IMUs in healthcare, sports, and entertainment industries for applications such as motion tracking and analysis.

Report Objectives

- To define, describe, segment, and forecast the inertial measurement unit market based on component, technology, grade, platform and end user.

- To forecast the size of various segments of the inertial measurement unit market based on five regions—North America, Europe, Asia Pacific, and Rest of the World¯along with major countries in each region.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze technological advancements and product launches in the market

- To analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To provide a detailed competitive landscape of the market, along with market share analysis of key players

- To strategically profile key players and comprehensively analyze their market position in terms of shares and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the inertial measurement unit market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in inertial measurement unit market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inertial Measurement Unit Market