Airborne LiDAR Market by Solution (System & Services), Type (Topographic & Bathymetric (System & Services)), Platform (Fixed Wing Aircraft, Rotary Wing Aircraft & UAVs) and Region - Global Forecast to 2022

The global airborne LiDAR market was valued at USD 971.8 million in 2016, and is expected to reach USD 2,533.7 million by 2022 at a CAGR of 17.32% from 2017 to 2022. The years considered for the study are as follows:Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

2016 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, estimate, segment, and forecast the airborne laser scanning market on the basis of solution, type, and platform

- To forecast the market size of segments with respect to various regions such as North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To identify, analyze, describe, and evaluate key drivers, restraints, opportunities, and challenges impacting the growth of the airborne LiDAR market

- To identify industry trends, market trends, and technology trends currently prevailing in the Airborne laser scanning market

- To provide company profiles of key companies in the airborne LiDAR market based on their product portfolios, market shares, financial positions, and key growth strategies

- To anticipate the degree of competition in the market by identifying key market players

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To track and analyze competitive developments such as contracts, agreements, acquisitions, collaborations, partnerships & joint ventures, and new product launches by key players in the airborne LiDAR market

The global airborne LiDAR market is projected to grow at a CAGR of 17.32% from 2017 to 2022, to reach a market size of USD 2,533.7 million by 2022 from an estimated USD 1,140.1 million in 2017. This growth is attributed to the increasing use of unmanned aerial vehicles in various applications and increasing adoption of LiDAR in engineering and construction applications.

The report segments the airborne laser scanning market on the basis of solutions into system component and industry services. The system component segment covers hardware such as lasers, scanners, interface devices, among others, and software, while the industry services segment includes services provided for end-user industries such as defense & aerospace, transportation & logistics, and oil & gas, among others. The market is also segmented on the basis of type and platform. The type segment covers topographic LiDAR and bathymetric LiDAR while the platform segment covers fixed-wing aircraft, rotary wing aircraft, and UAVs.

Among service end users, the transportation & logistics segment is expected to be the fastest-growing segment. Highway and railway authorities use aerial mapping services provided by different service providers in the airborne laser scanning market. The increase in transportation and logistics activities is fueling the growth of the airborne LiDAR service end users market.

Fixed wing aircraft is the largest segment of the airborne laser scanning market, by platform. It mainly covers fixed wing general aviation aircraft. In the general aviation industry, a large number of light aircraft are designed and built by amateur hobbyists and enthusiasts. The ones manufactured by OEMs are mostly used commercially to survey, photograph, film, and for freight transport, passengers, and sightseeing, as well as personal use. Significant growth in general aviation worldwide and increasing preference for cost-effective air travel for surveys and recreational activities are the primary factors expected to support the growth of the light aircraft market during the forecast period.

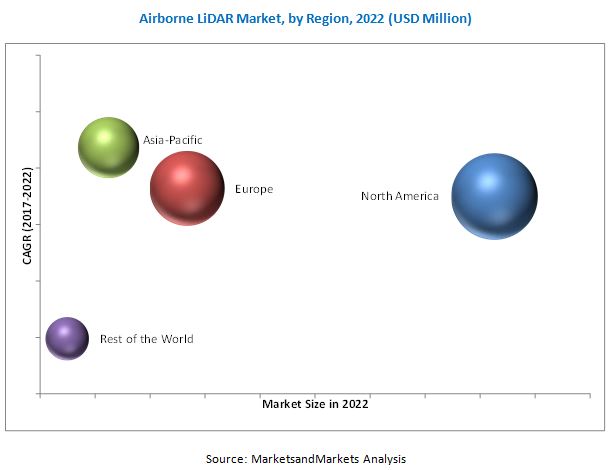

In this report, the airborne laser scanning market has been analyzed with respect to regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate the global airborne LiDAR market during the forecast period, owing to the increasing use of LiDAR in surveying and mapping applications.

Asia Pacific is estimated to be the fastest growing market for airborne LiDAR during 2017 to 2022. The growth of this market can be attributed to the increase in surveying and mapping operations due to the rising infrastructural development, increased focus on agricultural management, and rise in mining activities in the region. China, India, and Japan are the key airborne LiDAR markets in this region. China is the largest airborne LiDAR market in Asia Pacific, due to the rise in surveying and mapping activities in the country. In India, the commercial and government sectors are procuring airborne LiDAR for mapping applications, which is fueling the demand for airborne LiDAR in the country.

LiDAR is a modern and trusted technique employed globally to obtain fast and accurate terrain imagery and models. LiDAR models and imagery are used in a variety of applications across a wide range of industries, including, but not limited to, agriculture, forestry, mining, aerospace & defense, construction, and infrastructure development. Owing to modern technologies and global acceptance, a number of optical and electro-optical/infrared/equipment/services manufacturing companies include airborne laser scanning as a part of their product portfolios. The demand for terrain mapping and imagery across industries has also led to the mushrooming of the demand based LiDAR service industry. However, the lack of awareness among end users is restraining the market growth and technological constraints pose a challenge in the use of LiDAR. However, immense opportunities in GIS applications will positively impact the market growth.

Leading players in the airborne laser scanning market include Saab (Sweden), Teledyne Technologies (US), Leica Geosystems (Switzerland), and FLIR Systems (US), among others. Contracts & agreements was the strategy most commonly adopted by the top players, constituting more than one third of the total developments from 2014 to 2017. It was followed by new product developments, expansions, and mergers & acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Market Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 24)

4 Pemium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Airborne LiDAR Market

4.2 Airborne LiDAR Market, By Solution

4.3 Airborne LiDAR Market: Market Share and CAGR of Top 8 Countries

4.4 Airborne LiDAR Market Segment, By Type

4.5 Asia Pacific Airborne LiDAR Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of LiDAR in Engineering & Construction Applications

5.2.1.2 Increasing Use of Unmanned Aerial Vehicles in Various Applications

5.2.2 Restraints

5.2.2.1 Lack of Awareness Among End Users

5.2.3 Opportunities

5.2.3.1 Immense Opportunities in GIS Applications

5.2.4 Challenges

5.2.4.1 Technological Constraints Pose A Challenge in the Use of LiDAR

6 Industry Trends (Page No. - 34)

6.1 Introduction

6.2 Future Trends

6.3 Technology Trends

6.3.1 Advancements in Mobile LiDAR Software and User Interface

6.3.2 Fusion of LiDAR Data and Images

6.3.3 Geiger-Mode and Single Photon LiDAR

6.4 Patent/ Patent Applications

7 Airborne LiDAR Market, By Solution (Page No. - 37)

7.1 Introduction

7.2 System

7.2.1 Hardware

7.2.1.1 Lasers

7.2.1.2 Scanners

7.2.1.3 Interface Devices

7.2.1.4 Ranging Devices

7.2.1.5 Inertial Measurement Systems

7.2.1.6 Gps/Position Systems

7.2.2 Software

7.3 Services

7.3.1 By Oil & Gas

7.3.2 By Mining

7.3.3 By Defense & Aerospace

7.3.4 By Infrastructure

7.3.5 By Forestry & Agriculture

7.3.6 By Transportation & Logistics

8 Airborne LiDAR Market, By Type (Page No. - 43)

8.1 Introduction

8.2 Topographic LiDAR

8.2.1 Topographic LiDAR, By Solution

8.3 Bathymetric LiDAR

8.3.1 Bathymetric LiDAR Aircraft By Solution

9 Airborne LiDAR Market, By Platform (Page No. - 47)

9.1 Introduction

9.2 Fixed Wing Aircraft

9.2.1 Fixed Wing Aircraft By Solution

9.3 Rotary Wing Aircraft

9.3.1 Rotary Wing Aircraft By Solution

9.4 Unmanned Aerial Vehicle (UAV)

9.4.1 Unmanned Aerial Vehicle By Solution

10 Regional Analysis (Page No. - 51)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Russia

10.3.2 France

10.3.3 Germany

10.3.4 UK

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 South America

10.5.3 Oceanic Countries

11 Competitive Landscape (Page No. - 78)

11.1 Market Ranking of Players, 2016

12 Company Profiles (Page No. - 80)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View)*

12.1 Saab

12.2 Teledyne Technologies

12.3 Leica Geosystems

12.4 Flir Systems

12.5 Fugro

12.6 Velodyne LiDAR

12.7 IGI

12.8 Airborne Imaging

12.9 Dibotics

12.10 Merrick & Company

12.11 Topographic Imaging

12.12 Xactsense

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (74 Tables)

Table 1 Assumptions of the Research Study

Table 2 Government Investments in Infrastructure, 1992 - 2011

Table 3 Innovation and Patent Registrations, 2011-2017

Table 4 Airborne LiDAR Market, By Solution, 2016-2022 (USD Million)

Table 5 System Segment, By Component, 2015–2022 (USD Million)

Table 6 Hardware Subsegment, By Type, 2015–2022 (USD Million)

Table 7 Services, By End Users, 2015–2022 (USD Million)

Table 8 Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 9 Topographic LiDAR Subsegment, By Solution, 2015-2022 (USD Million)

Table 10 Bathymetric LiDAR Subsegment, By Solution, 2015-2022 (USD Million)

Table 11 Airborne LiDARs Market Size, By Platform, 2015-2022 (USD Million)

Table 12 Fixed Wing Aircraft Subsegment, By Solution, 2015-2022 (USD Million)

Table 13 Rotary Wing Aircraft Subsegment, By Solution, 2015-2022 (USD Million)

Table 14 Unmmanned Aerial Vehicle Subsegment, By Solution, 2015-2022 (USD Million)

Table 15 Airborne LiDARs Market, By Region, 2015-2022 (USD Million)

Table 16 North America Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 17 North America Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 18 North America Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 19 North America Airborne LiDARs Market, By Country, 2015-2022 (USD Million)

Table 20 US Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 21 US Airborne LiDARs Market, By Type, 2015-2022 (USD Million)/

Table 22 US Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 23 Canada Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 24 Canada Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 25 Canada Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 26 Europe Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 27 Europe Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 28 Europe Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 29 Europe Airborne LiDARs Market, By Country, 2015-2022 (USD Million)

Table 30 Russia Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 31 Russia Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 32 Russia Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 33 France Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 34 France Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 35 France Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 36 Germany Market, By Solution, 2015-2022 (USD Million)

Table 37 Germany Market, By Type, 2015-2022 (USD Million)

Table 38 Germany Airborne LiDAR Market, By Platform, 2015-2022 (USD Million)

Table 39 UK Market, By Solution, 2015-2022 (USD Million)

Table 40 UK AirborMarket, By Type, 2015-2022 (USD Million)

Table 41 UK Market, By Platform, 2015-2022 (USD Million)

Table 42 Rest of Europe Market, By Solution, 2015-2022 (USD Million)

Table 43 Rest of Europe Market, By Type, 2015-2022 (USD Million)

Table 44 Rest of Europe Market, By Platform, 2015-2022 (USD Million)

Table 45 Asia Pacific Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 46 Asia Pacific Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 47 Asia Pacific Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 48 Asia Pacific Airborne LiDARs Market, By Country, 2015-2022 (USD Million)

Table 49 China Market, By Solution, 2015-2022 (USD Million)

Table 50 China Market, By Type, 2015-2022 (USD Million)

Table 51 China Market, By Platform, 2015-2022 (USD Million)

Table 52 India Market, By Solution, 2015-2022 (USD Million)

Table 53 India Market, By Type, 2015-2022 (USD Million)

Table 54 India Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 55 Japan Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 56 Japan Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 57 Japan Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 58 Rest of Asia Pacific Market, By Solution, 2015-2022 (USD Million)

Table 59 Rest of Asia Pacific Market, By Type, 2015-2022 (USD Million)

Table 60 Rest of Asia Pacific Market, By Platform, 2015-2022 (USD Million)

Table 61 Rest of the World Market, By Solution, 2015-2022 (USD Million)

Table 62 Rest of the World Market, By Type, 2015-2022 (USD Million)

Table 63 Rest of the World Market, By Platform, 2015-2022 (USD Million)

Table 64 Rest of the World Market, By Country, 2015-2022 (USD Million)

Table 65 Middle East & Africa Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 66 Middle East & Africa Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 67 Middle East & Africa Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 68 South America Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 69 South America Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 70 South America Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 71 Oceanic Countries Airborne LiDARs Market, By Solution, 2015-2022 (USD Million)

Table 72 Oceanic Countries Airborne LiDARs Market, By Type, 2015-2022 (USD Million)

Table 73 Oceanic Countries Airborne LiDARs Market, By Platform, 2015-2022 (USD Million)

Table 74 Rank Analysis of Key Players in the Airborne LiDAR Market

List of Figures (27 Figures)

Figure 1 Research Process Flow

Figure 2 Airborne LiDARs Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Based on Solution, the Services Segment is Projected to Lead the Airborne LiDARs Market From 2017 to 2022

Figure 8 Based on Type, the Topographic LiDAR Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Based on Platform, the Unmanned Aerial Vehicles Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 10 North America is Estimated to Account for the Largest Share of the Airborne LiDARs Market in 2017

Figure 11 Increasing Adoption of Airborne LiDAR in Surveying and Imaging Applications is Fuelling the Growth of the Airborne LiDARs Market

Figure 12 Based on Solution, the Services Segment is Projected to Lead the Airborne LiDARs Market From 2017 to 2022

Figure 13 The US is Estimated to Account for the Largest Share of the North American Airborne LiDARs Market in 2017

Figure 14 Based on Type, the Topographic LiDAR Segment is Projected to Lead the Airborne LiDARs Market From 2017 to 2022

Figure 15 The Fixed Wing Aircraft Segment and China are Estimated to Lead the Airborne LiDARs Market in Asia Pacific in 2017

Figure 16 Market Dynamics for Airborne LiDARs Market

Figure 17 Services Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Bathymetric LiDAR Type Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Airborne LiDARs Market, By Platform, 2017 & 2022 (USD Million)

Figure 20 North America is Estimated to Account for the Largest Share of the Airborne LiDAR Market in 2017

Figure 21 North America Airborne LiDAR Market Snapshot

Figure 22 Europe Airborne LiDAR Market Snapshot

Figure 23 Asia Pacific Airborne LiDAR Market Snapshot

Figure 24 Saab AB: Company Snapshot

Figure 25 Teledyne Technologies: Company Snapshot

Figure 26 Flir System: Company Snapshot

Figure 27 Fugro: Company Snapshot

Research Methodology

This research study involved the usage of extensive secondary sources including directories; databases of articles; journals on airborne laser scanning, company newsletters; and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market oriented, and commercial study of the market. Primary sources are several industry experts from core and related industries, OEMs, vendors, suppliers, technology developers, alliances, and organizations. These sources are related to all the segments of the value-chain of this industry.

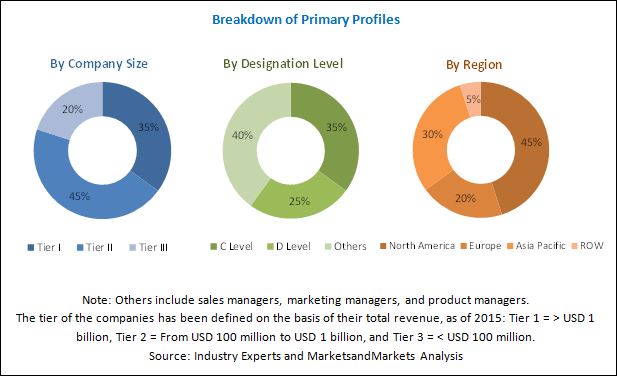

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess prospects. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The airborne laser scanning ecosystem comprises OEMs such as Saab (Sweden), Teledyne Technologies (US), Leica Geosystems (Switzerland), and FLIR Systems (US), among others.

Target Audience:

- Airborne LiDAR Manufacturers

- Advanced Optical Material Manufacturers

- System Integrators

- Potential Investors (Venture Capitalists)

- Research Institutes and Organizations

- Sensor and Radar Manufacturers

- Military Service Providers

- Regulatory Bodies

Scope of the Report:

-

By Solutions

-

System Component

-

Hardware

- Lasers

- Scanner

- Interface Devices

- Ranging Devices

- Inertial Measurement Systems

- GPS/Position Systems

- Software

-

Hardware

-

Industry Services

- Defense & Aerospace

- Infrastructure

- Oil and Gas

- Forestry & Agriculture

- Transportation and Logistics

- Mining Industry

- Others

-

System Component

-

By Type

-

Airborne Topographic LiDAR

- By System

- By Services

-

Airborne Bathymetric LiDAR

- By System

- By Services

-

Airborne Topographic LiDAR

-

By Platform

-

Fixed Wing Aircraft

- By System

- By Services

-

Rotary Wing Aircraft

- By System

- By Services

-

UAVs

- By System

- By Services

-

Fixed Wing Aircraft

-

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Further country-wise breakdown of the Airborne LiDAR market for different regions

Growth opportunities and latent adjacency in Airborne LiDAR Market