Fiber Optics Gyroscope Market by Sensing Axis (1, 2, and 3), Device (Gyrocompass, Inertial Measurement Unit, Inertial Navigation System, and Attitude Heading Reference System), Application, and Geography - Global Forecast to 2022

The fiber optics gyroscope market size is expected to reach USD 1,037.0 Million by 2022, at a CAGR of 3.61% between 2016 and 2022. The fiber optics gyroscope market is majorly driven by the increasing defense expenditure globally. Moreover, the overall fiber optics gyroscope market is driven by factors such as the huge demand for remotely operated vehicles guidance and growing adoption of automation in industries and homes. For this study, the base year considered is 2015 and the market forecast provided is between 2016 and 2022.

The fiber optics gyroscope market is expected to be worth USD 1,037.0 Million by 2022, at a CAGR of 3.61% between 2016 and 2022. Fiber optics gyroscopes are widely used for remotely operated vehicle guidance and industrial applications. Fiber optics gyroscope is used in the navigation system and measurement units for navigation and controlling devices. Factors such as the rising demand for unmanned vehicles and growing industrialization could generate significant opportunities for this market in the near future.

In 2015, the defense and homeland security applications accounted for the largest share of the fiber optics gyroscope market, followed by the aeronautics and aviation application. The market for the remotely operated vehicle guidance is expected to grow at a high rate between 2016 and 2022. Fiber optics gyroscope is used to control and navigate the devices in these applications. In the aeronautics and aviation application, the demand for fiber optics gyroscope would grow because of the increasing demand of inertial navigation system and inertial measurement units for navigating spacecraft and aircrafts. This factor is expected to boost the demand for fiber optics gyroscope in these applications.

The fiber optics gyroscope market has also been segmented on the basis of sensing axis into 1 axis, 2 axes, and 3 axes. Of all the available sensing axis, the market for 3-axis fiber optics gyroscopes held the largest share in 2015 and the same trend is expected to continue by 2022 owing to the growing level of integration. Manufacturers are working towards integrating several functionalities in one system to reduce the number of components per device and to reduce the size and weight of the overall product. 3-Axis fiber optics gyroscopes are highly suitable for such integration.

Inertial navigation systems are expected to experience a high growth between 2016 and 2002. The use of the inertial navigation system in various applications such as defense, aeronautics and aviation, and remotely operated vehicles is expected to grow the fiber optics gyroscope market in the near future.

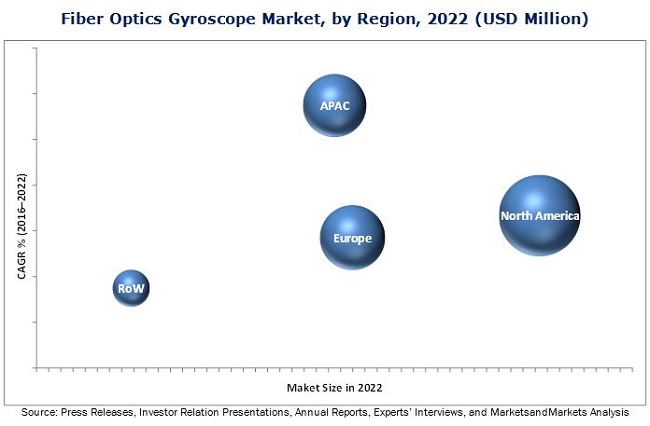

North America is expected to hold the largest share of the fiber optics gyroscope market in 2022. Presence of major players, increasing investments toward the development of advanced sensors, and increasing expenditure in defense sectors by the U.S. are driving the growth of the fiber optics gyroscope market in North America.

The key restraining factors in the fiber optics gyroscope market is the highly complex manufacturing process and demanding cycle time as well as the capital-intensive applications in this market. EMCORE Corporation (U.S.) designs and manufactures optical chips, components, systems and subsystems for the broadband and specialty fiber optics gyroscope market. The company provides advanced fiber optics gyroscope and navigation systems to the U.S. The company focuses on innovative products development strategies to strengthen its position in the fiber optics gyroscope market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Share Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Fiber Optic Gyroscope Market, 2016–2022 (USD Million)

4.2 Market, By Device

4.3 Market, By Application

4.4 Market Share of 3 Major Applications Across Regions in 2015

4.5 Market: Defense & Homeland Security and Aeronautics & Aviation Applications (2015)

4.6 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Sensing Axis

5.2.2 By Device

5.2.3 By Application

5.2.4 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Adoption of Automation in Industries and Homes

5.3.1.2 Increasing Defense Expenditure Globally

5.3.2 Restraints

5.3.2.1 Growing Demand for Advanced Microelectromechanical Systems Gyroscopes

5.3.2.2 Highly Complex and Time-Consuming Manufacturing Process

5.3.3 Opportunities

5.3.3.1 Growing Demand of Remotely Operated Vehicles

5.3.3.2 Use of Fiber Optic Gyroscope for Measurement While Drilling (MWD) Processes in the Oil Industry

5.3.4 Challenges

5.3.4.1 High Investment and Low Cost-Benefit Ratio

6 Industry Analysis (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Model

6.4.1 Intensity of Competitive Rivalry

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Threat of New Entrants

7 Fiber Optic Gyroscope Market, By Sensing Axis (Page No. - 50)

7.1 Introduction

7.2 1-Axis

7.3 2-Axis

7.4 3-Axis

8 Fiber Optic Gyroscope Market, By Device (Page No. - 55)

8.1 Introduction

8.2 Gyrocompass

8.3 Inertial Measurement Unit

8.4 Inertial Navigation System

8.5 Attitude Heading Reference System

9 Fiber Optic Gyroscope Market, By Application (Page No. - 59)

9.1 Introduction

9.2 Tactical Grade Applications

9.3 Remotely Operated Vehicle Guidance

9.3.1 Unmanned Underwater Vehicle

9.3.2 Unmanned Aerial Vehicle

9.3.3 Unmanned Ground Vehicle

9.4 Aeronautics and Aviation

9.5 Robotics

9.6 Defense and Homeland Security

9.7 Industrial

10 Geographical Analysis (Page No. - 80)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Market Ranking Analysis: Fiber Optic Gyroscope Market

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Contracts

11.3.3 Expansions

12 Company Profiles (Page No. - 110)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Emcore Corporation

12.3 Honeywell International, Inc.

12.4 Colibrys Ltd.

12.5 KVH Industries, Inc.

12.6 Northrop Grumman Litef GmbH

12.7 Nedaero Components

12.8 Ixblue SAS

12.9 Fizoptika Corp.

12.10 Optolink LLC

12.11 AL Cielo Inertial Solutions Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 132)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (66 Tables)

Table 1 Key Industry Trends in the Fiber Optic Gyroscope Market

Table 2 Porter’s Five Forces Analysis: Threat of Substitutes is Expected to Have the Lowest Impact on the Overall Fog Market

Table 3 Fiber Optic Gyroscope Market, By Sensing Axis, 2014–2022 (USD Million)

Table 4 1-Axis Fiber Optic Gyroscope Market, By Application, 2014–2022 (USD Million)

Table 5 2-Axis Fiber Optic Gyroscope Market, By Application, 2014–2022 (USD Million)

Table 6 3-Axis Fiber Optic Gyroscope Market, By Application, 2014–2022 (USD Million)

Table 7 Fiber Optic Gyroscope Market Size, By Device, 2014–2022 (USD Million)

Table 8 Market, By Application, 2014–2022 (USD Million)

Table 9 Market for Tactical Grade Applications, By Region, 2014–2022 (USD Million)

Table 10 Market for Tactical Grade Applications in North America, By Country, 2014–2022 (USD Million)

Table 11 Market for Tactical Grade Applications in Europe, By Country, 2014–2022 (USD Thousand)

Table 12 Market for Tactical Grade Applications in APAC, By Country, 2014–2022 (USD Thousand)

Table 13 Market for Tactical Grade Applications in RoW, By Region, 2014–2022 (USD Thousand)

Table 14 Market Size for Remotely Operated Vehicle Guidance Application, By Region, 2014–2022 (USD Million)

Table 15 Market for Remotely Operated Vehicle Guidance Application in North America, By Country, 2014–2022 (USD Million)

Table 16 Market for Remotely Operated Vehicle Guidance Application in Europe, By Country, 2014–2022 (USD Thousand)

Table 17 Market for Remotely Operated Vehicle Guidance Application in APAC, By Country, 2014–2022 (USD Thousand)

Table 18 Market for Remotely Operated Vehicle Guidance Application in RoW, By Region, 2014–2022 (USD Thousand)

Table 19 Market for Remotely Operated Vehicle Guidance, By Type, 2014–2022 (USD Million)

Table 20 Market for Aeronautics and Aviation Application, By Region, 2014–2022 (USD Million)

Table 21 Market for Aeronautics and Aviation Application in North America, By Country, 2014–2022 (USD Million)

Table 22 Market for Aeronautics and Aviation Application in Europe, By Country, 2014–2022 (USD Million)

Table 23 Market for Aeronautics and Aviation Application in APAC, By Country, 2014–2022 (USD Million)

Table 24 Market for Aeronautics and Aviation Application in RoW, By Region, 2014–2022 (USD Million)

Table 25 Market for Robotics Application, By Region, 2014–2022 (USD Million)

Table 26 Market for Robotics Application in North America, By Country, 2014–2022 (USD Thousand)

Table 27 Market for Robotics Application in Europe, By Country, 2014–2022 (USD Thousand)

Table 28 Market for Robotics Application in APAC, By Country, 2014–2022 (USD Thousand)

Table 29 Market for Robotics Application in RoW, By Region, 2014–2022 (USD Thousand)

Table 30 Market for Defense and Homeland Security Application, By Region, 2014–2022 (USD Million)

Table 31 Market for Defense and Homeland Security Application in North America, By Country, 2014–2022 (USD Million)

Table 32 Market for Defense and Homeland Security Application in Europe, By Country, 2014–2022 (USD Million)

Table 33 Market for Defense and Homeland Security Application in APAC, By Country, 2014–2022 (USD Million)

Table 34 Market for Defense and Homeland Security Application in RoW, By Region, 2014–2022 (USD Million)

Table 35 Market for Industrial Application, By Region, 2014–2022 (USD Million)

Table 36 Market for Industrial Application in North America, By Country, 2014–2022 (USD Million)

Table 37 Market for Industrial Application in Europe, By Country, 2014–2022 (USD Million)

Table 38 Market for Industrial Application in APAC, By Country, 2014–2022 (USD Million)

Table 39 Market for Industrial Application in RoW, By Region, 2014–2022 (USD Thousand)

Table 40 Market Size, By Region, 2014–2022 (USD Million)

Table 41 Market in North America, By Application, 2014–2022 (USD Million)

Table 42 Market in North America, By Country, 2014–2022 (USD Million)

Table 43 Market in U.S., By Application, 2014–2022 (USD Million)

Table 44 Market in Canada, By Application, 2014–2022 (USD Million)

Table 45 Market in Mexico, By Application, 2014–2022 (USD Million)

Table 46 Market in Europe, By Application, 2014–2022 (USD Million)

Table 47 Market in Europe, By Country, 2014–2022 (USD Million)

Table 48 Market in U.K., By Application, 2014–2022 (USD Million)

Table 49 Market in Germany, By Application, 2014–2022 (USD Million)

Table 50 Market in France, By Application, 2014–2022 (USD Million)

Table 51 Market in Rest of Europe, By Application, 2014–2022 (USD Thousand)

Table 52 Market in APAC, By Application, 2014–2022 (USD Million)

Table 53 Market in APAC, By Country, 2014–2022 (USD Million)

Table 54 Market in China, By Application, 2014–2022 (USD Million)

Table 55 Market in Japan, By Application, 2014–2022 (USD Million)

Table 56 Market in India, By Application, 2014–2022 (USD Thousand)

Table 57 Market in South Korea, By Application, 2014–2022 (USD Million)

Table 58 Market in Rest of APAC, By Application, 2014–2022 (USD Thousand)

Table 59 Market in RoW, By Application, 2014–2022 (USD Million)

Table 60 Market in RoW, By Region, 2014–2022 (USD Million)

Table 61 Market in Middle East and Africa, By Application, 2014–2022 (USD Thousand)

Table 62 Market in South America, By Application, 2014–2022 (USD Thousand)

Table 63 Market Ranking of the Top 5 Players in the Fiber Optic Gyroscopes Market in 2015

Table 64 New Product Launches, 2013–2016

Table 65 Contracts, 2016

Table 66 Expansions, 2014

List of Figures (56 Figures)

Figure 1 Fiber Optic Gyroscope Market Segmentation

Figure 2 Fiber Optic Gyroscope Market: Research Design

Figure 3 Process Flow

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Fiber Optic Gyroscope Market, 2014–2022 (USD Million)

Figure 9 Fiber Optic Gyroscope Market Share, By Sensing Axis (2015 vs 2022)

Figure 10 Inertial Navigation Systems to Hold the Largest Size of the Fog Market By 2022

Figure 11 Remotely Operated Vehicle Guidance Expected to Witness the Highest Growth Rate Between 2016 and 2022

Figure 12 North America Held the Largest Share of the Fog Market in 2015

Figure 13 Attractive Opportunities for the Fiber Optic Gyroscope Market

Figure 14 Fiber Optic Gyroscope Market for Inertial Navigation System to Grow at the Highest CAGR Between 2016 and 2022

Figure 15 Defense & Homeland Security Application Expected to Dominate the Fiber Optic Gyroscope Market Till 2022

Figure 16 Defense & Homeland Security Application Held the Largest Share of the Fiber Optic Gyroscope Market in North America in 2015

Figure 17 Defense & Homeland Security and Aeronautics & Aviation to Grow at the Highest CAGR in APAC During the Forecast Period

Figure 18 China is Expected to Emerge as the Fastest-Growing Market for Fiber Optic Gyroscope Between 2016 and 2022

Figure 19 Fiber Optic Gyroscope Market Segmentation, By Geography

Figure 20 Growing Demand of Fiber Optic Gyroscopes for Navigation and Guidance Applications Would Drive the Growth of the Fog Market

Figure 21 Defense Expenditure By Top 10 Countries in 2015

Figure 22 Value Chain Analysis (2016): Maximum Value Added Between the Original Equipment Manufacturing and System Integration Phases

Figure 23 Porter’s Five Forces Analysis, 2016

Figure 24 Fiber Optic Gyroscope (Fog) Market: Porter’s Five Forces Analysis

Figure 25 Fog Market: Intensity of Competitive Rivalry

Figure 26 Fog Market: Threat of Substitutes

Figure 27 Fog Market: Bargaining Power of Buyers

Figure 28 Fog Market: Bargaining Power of Suppliers

Figure 29 Fog Market: Threat of New Entrants

Figure 30 3-Axis Fiber Optic Gyroscope Market Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 31 Defense and Homeland Security Application Segment Expected to Hold the Largest Share of the Fog Market By 2022

Figure 32 Fiber Optic Gyroscope Market for Inertial Navigation System Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 33 Fog Market for Remotely Operated Vehicle Guidance Application Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 34 Fiber Optic Gyroscope Market for Remotely Operated Vehicle Guidance Application in APAC Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 35 APAC Expected to Grow at the Highest CAGR for Aeronautics and Aviation Application Between 2016 and 2022

Figure 36 North America Held the Largest Size of the Fog Market for the Robotics Application in 2015

Figure 37 APAC Expected to Grow at the Highest Rate for the Defense and Homeland Security Application Between 2016 and 2022

Figure 38 Geographic Snapshot: Asia-Pacific to Witness the Highest Growth Rate for the Fog Market Between 2016 and 2022

Figure 39 Fiber Optic Gyroscope Market in China Estimated to Grow at the Highest Rate Between 2016 and 2022

Figure 40 Snapshot of Market in North America

Figure 41 Snapshot of Market in Europe

Figure 42 Snapshot of Market in Asia-Pacific

Figure 43 Companies Adopted New Product Launches as the Key Growth Strategy Between 2013 and 2016

Figure 44 Market Evaluation Framework: New Product Launches Fueled the Growth of the Fog Market Between 2014 and 2016

Figure 45 Battle for Market Share: New Product Launches Was the Key Strategy Adopted By Key Players in the Fog Market

Figure 46 Geographic Revenue Mix of Leading Players

Figure 47 Emcore Corporation: Company Snapshot

Figure 48 Emcore Corporation: SWOT Analysis

Figure 49 Honeywell International, Inc.: Company Snapshot

Figure 50 Honeywell International, Inc.: SWOT Analysis

Figure 51 Colibrys Ltd.: Company Snapshot

Figure 52 Colibrys Ltd.: SWOT Analysis

Figure 53 KVH Industries, Inc.: Company Snapshot

Figure 54 KVH Industries, Inc.: SWOT Analysis

Figure 55 Northrop Grumman Litef GmbH: Company Snapshot

Figure 56 Northrop Grumman Litef GmbH: SWOT Analysis

This report provides a detailed analysis of the fiber optics gyroscope market based on sensing axis, device, application, and geography for four main regions North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW). The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges). The main driver for fiber optics gyroscope market is the growing use of remotely operated vehicle in various industries such as defense, aeronautics, and others. The report also profiles the key players and comprehensively analyzes their market ranking and core competencies along with detailing the competitive landscape for market leaders.

To estimate the size of the fiber optics gyroscope market, top-down and bottom-up approaches have been used. This research study involves an extensive usage of secondary sources, directories, and paid databases such as Factiva and OneSource to identify and collect information useful to study the technical, market-oriented, and commercial aspects of fiber optics gyroscope.

The research methodology is explained below.

- This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- High-growth segments have been identified to analyze opportunities in the overall fiber optics gyroscope market

- Competitive developments such as contracts, agreement and acquisitions, new product developments, and research and development (R&D) in the overall fiber optics gyroscope market have been analyzed.

- All the percentage splits and breakdown of the market segments are analyzed on the basis of secondary and primary research.

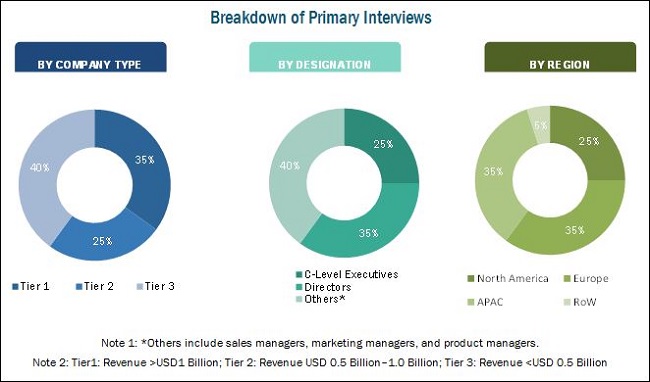

The following figure depicts the breakdown of the primaries on the basis of company type, designation, and region conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

This report provides valuable insights regarding the ecosystem of the fiber optics gyroscope market such as component manufacturers (EMCORE Corporation (U.S.) and Honeywell International, Inc. (U.S.)); system/device providers (iXBlue SAS (France), Fizoptika Corp. (Russia), and KVH Industries, Inc. (U.S.)); and application areas (Colibrys Ltd. (Switzerland)). This study answers several questions of stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs)

- Integrated device manufacturers (IDMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Solution providers

- Intellectual property (IP) core and licensing providers

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and regulatory bodies

“The study answers several questions of the target audiences, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.”

Scope of the Report:

This research report categorizes the overall fiber optics gyroscope market on the basis of sensing axis, device, application, and geography.

By Sensing Axis

- 1-axis

- 2-axis

- 3-axis

By Device

- Gyrocompass

- Inertial Measurement Unit

- Inertial Navigation System

- Attitude Heading Reference System

By Application

- Tactical Grade Applications

- Remotely Operated Vehicle Guidance

- Aeronautics And Aviation

- Robotics

- Defense And Homeland Security

- Industrial

By Geography

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- France

- U.K.

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, The Netherlands, and Sweden)

-

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

-

Rest of the World (RoW)

- Middle East and Africa

- Latin America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fiber Optics Gyroscope Market

I would like to understand the global market size and the major application areas of the market of Fiber Optic Gyroscopes. Can you help me with the same?

I am interesting in buying a market research on inertial navigation and gyrocompass for naval or maritime small carrier like UUV, UAV, USV. Could you provide me with the scope of your report?