Low Emission Vehicle Market (2012 - 2017) - By Degree of Hybridization & Type of Traction Battery Used - Global Forecast, Trends & Analysis

Low emission vehicles are expected to witness good growth as they are being accepted across the globe. Currently, low emission vehicle market is dominated by Full Hybrid Electric Vehicles (FHEVs) and expected to remain as market leader during the forecasted period. The market of North America is expected to be the biggest one for FHEVs. However, our research says that market for PHEVs and BEVs will develop at a faster rate due to governments initiatives to develop charging infrastructure in battery technology. The governments of Europe and China are promoting BEVs due to presence of competitive advantages over the other countries. China can shift to electric vehicle propulsion technology faster than its counterparts due to its ability to heavily invest in its development. Europe is already well equipped when it comes to charging infrastructure for EVs.

The most widely used batteries for low emission vehicle market are lead-acid batteries, Nickel-Cadmium batteries (NiCad), metal hydride batteries (NimH), and lithium ion batteries. Till date, the mass produced FHEV cars have been powered by nickel metal-hydride (NiMH) batteries. However, there are certain noticeable rapid shifts in consumption pattern of batteries used for HEVs. Due to high energy density of lithium ion battery, loads of FHEV manufacturers such as Honda Motors (Japan) and Ford Motors (Germany) will be switching over to the lithium ion battery for FHEV. As an outcome, lithium ion battery is expected to capture the lions share in automotive battery market by 2017.

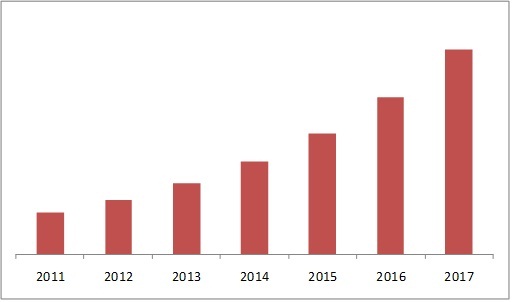

The low emission market was valued $21.13 billion in 2011 and is expected to grow from $27.45 billion in 2012 to $103.13 billion by 2017 at an estimated CAGR of 30.3% from 2012 to 2017. 826.8 thousand low emission vehicle were shipped on a global level for 2011 and the number is expected to reach 3532.1 thousand by 2017, at an estimated CAGR of 27.8% from 2012 to 2017.

For the market of zero emission vehicles, increase in the global price of petroleum-based fuel; rise in the number of initiatives taken by different governments, ever-increasing availability of different HEV models, and continuous development in battery technology are acting as drivers. Lack of support infrastructure, power, performance, and higher cost as compared to ICE-vehicle end-user segments are acting as restraints. Charging infrastructure market and vehicle-to-grid (V2G) technology are the future opportunities for zero emission vehicle market.

Scope of the report

The low emission vehicle market research report categorizes the global market on the basis of degree of hybridization, different types of batteries used in the vehicle, and geographical analysis. Market segmentation also includes forecasting revenue and analyzing trends in this market.

On the basis of degree of hybridization

In this section, global alternative fuel market or HEV market is divided as per the degree of hybridization. Full Hybrid Electric Vehicle (FHEV), Mild Hybrid Electric Vehicle (MHEV), Plug-in Hybrid Electric Vehicle (PHEV), and Pure Electric Vehicle (BEV or EV) are the prominent types of hybrid vehicle. The other hybrid vehicle, i.e. fuel cell vehicle (FCV) is yet to be commercialized.

On the basis of type of battery used

In this section, global alternative fuel market or Hybrid Electric Vehicle market is divided as per the different types of traction batteries used in the vehicle. Lead acid batteries, Nickel-Cadmium batteries (NiCad), metal hydride batteries; especially nickel metal hydride (NimH) and lithium ion batteries are the prominent ones used in HEV market.

On the basis of geography

- North America, Europe, Asia-Pacific, and ROW are covered in the low emission vehicle market report.

- North America is subdivided into U.S and Canada.

- Europe is further divided into U.K., France, Germany, The Netherlands, Spain, and rest of Europe.

- Asia-Pacific is divided into China, Japan, South Korea, and rest of APAC.

- ROW is segmented into Middle East countries, Australia, and South African countries.

Each section will provide market data, market drivers, trends and opportunities, key players, and competitive outlook. Low emission vehicle market report will provide market tables for covering the sub-segments and micro-markets. In addition, the report makes ways for more than 20 company profiles; covering all the sub-segments such as company overview, products & services, financials, strategy, and developments.

Modern HEVs make use of efficiency-improving technologies such as regenerative braking, which converts the vehicle's kinetic energy into electric energy to charge the battery, rather than wasting it as heat energy as conventional brakes do. Some varieties of HEVs use their internal combustion engine to generate electricity by spinning an electrical generator (this combination is known as a motor-generator), to either recharge their batteries or to directly power the electric drive motors. Many Hybrid Electric Vehicles reduce idle emissions by shutting down the ICE at idle and restarting it when needed; this is known as a start-stop system. A hybrid-electric produces less emissions from its ICE than a comparably-sized gasoline car, since an Hybrid Electric Vehicle's gasoline engine is usually smaller than a comparably-sized pure gasoline-burning vehicle (natural gas and propane fuels produce lower emissions) and if not used to directly drive the car, can be geared to run at maximum efficiency, further improving fuel economy.

Companies such as Toyota Motors (Japan), Honda Motors (Japan), Skoda Motors (Germany) and General Motors (U.S.) are the few of the key players in the global hybrid electric vehicle market. Nissan Motors (Japan), Mitsubishi Motors (Japan) and Tesla Motors (U.S.) are the prominent players in global EV market.

There are different environmental or safety-related mandates initiated by governments such as CAFE (U.S.) and EURO standards (Europe). These environmental regulations tend to concentrate on emission control and economy of the fuel. The objective is to optimize the performance of the engine as well as powertrain, which subsequently reduces the fuel consumption and emission. Besides regulatory standards initiated by governments, development in battery technology is also a deciding factor in the success of low emission vehicles. Hybrid Electric Vehicle manufacturers are facing big challenges finding suitable storage solutions for their hybrid electric vehicles. The batteries used for hybrid vehicles (HEV/PHEV/EV) should be inexpensive, small, light, and safe. They should have high power and energy density and should last for good number years without significant degradation. Currently, batteries used for hybrid vehicle do not meet all the criteria at once but lithium ion battery seems to the best option, as far as future is concerned due to its high energy density. Till date, the mass produced FHEV cars have been powered by nickel metal-hydride (NiMH) batteries, but shift in deployment of battery technology is expected due to advancement of technology in lithium ion battery. So significant upgradation and development of the new products for the low emission vehicle market have been the main strategies followed by the key players in this market.

Hybrid Electric Vehicle Market (2011-2017)

Source: MarketsandMarkets Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET CRACKDOWN

1.5.2 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.3 KEY DATA POINTS FROM PRIMARY SOURCES

1.5.4 ASSUMPTIONS MADE FOR LOW EMISSION MARKET REPORT

1.5.5 LIST OF COMPANIES COVERED DURING PRIMARIES

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 MARKET SEGMENTATION

3.3 MARKET DYNAMICS

3.3.1 DRIVERS

3.3.1.1 SIGNIFICANT INCREASE IN THE GLOBAL PRICE OF PETROLEUM BASED FUEL

3.3.1.2 INCREASING GOVERNMENT SUPPORT

3.3.1.3 INCREASING AVAILABILITY OF DIFFERENT HEV MODELS

3.3.1.4 DEVELOPMENT IN BATTERY TECHNOLOGY

3.3.2 RESTRAINTS

3.3.2.1 LACK OF SUPPORT INFRASTRUCTURE

3.3.2.2 LACK OF POWER AND PERFORMANCE

3.3.2.3 HIGHER COST AS COMPARED TO ICE-VEHICLE

3.3.3 OPPORTUNITIES

3.3.3.1 CHARGING INFRASTRUCTURE MARKET

3.3.3.2 VEHICLE TO GRID (V2G) TECHNOLOGY

3.4 WINNING IMPERATIVE

3.4.1 LARGER BATTERY LIFE WITH LIMITED INITIAL AND REPLACEMENT COST

3.5 BURNING ISSUES

3.5.1 OVERALL COST OF OWNERSHIP

3.6 VALUE CHAIN ANALYSIS

3.7 PORTERS FIVE FORCES ANALYSIS

3.7.1 THREAT OF NEW ENTRANTS

3.7.2 THREAT OF PRODUCT SUBSTITUTES

3.7.3 BARGAINING POWER OF SUPPLIERS

3.7.4 BARGAINING POWER OF BUYERS

3.7.5 RIVALRY AMONG EXISTING PLAYERS

4 LOW EMISSION VEHICLE TECHNOLOGY OVERVIEW

4.1 EVOLUTION OF HEV

4.2 FUNCTIONAL CHARACTERISTICS OF HYBRID VEHICLE

4.2.1 PARALLEL HYBRID VEHICLE

4.2.2 SERIES HYBRID CAR

4.2.3 SERIES/PARALLEL HYBRID VEHICLE

4.3 BASIC COMPONENTS OF LOW EMISSION VEHICLE

4.4 LOW EMISSION VEHICLE: ADVANTAGES AND DISADVANTAGES

4.5 INTRODUCTION TO FUEL CELL VEHICLE TECHNOLOGY

4.6 SOLAR POWERED VEHICLE A FUTURISTIC VIEW

5 GLOBAL MARKET, BY THE DEGREE OF HYBRIDIZATION

5.1 INTRODUCTION

5.2 FULL HYBRID ELECTRIC VEHICLE (FHEV)

5.2.1 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET ESTIMATION & FORECAST, BY GEOGRAPHY

5.2.2 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET ESTIMATION & FORECAST, BY BATTERY TYPE

5.3 MILD HYBRID ELECTRIC VEHICLE (MHEV)

5.3.1 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET ESTIMATION & FORECAST, BY GEOGRAPHY

5.3.2 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET ESTIMATION & FORECAST, BY BATTERY TYPES

5.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

5.4.1 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV)MARKET ESTIMATION & FORECAST, BY GEOGRAPHY

5.4.2 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV) MARKET ESTIMATION & FORECAST, BY BATTERY TYPE

5.5 PURE ELECTRIC VEHICLE (BEV OR EV)

5.5.1 PURE ELECTRIC VEHICLE MARKET ESTIMATION & FORECAST, BY GEOGRAPHY

5.5.2 PURE ELECTRIC VEHICLE MARKET ESTIMATION & FORECAST, BY BATTERY TYPES

6 GLOBAL MARKET, BY BATTERY TYPE

6.1 INTRODUCTION

6.2 GLOBAL LEAD ACID BATTERY MARKET USED FOR THE LOW EMISSION VEHICLES

6.2.1 GLOBAL LEAD ACID BATTERY MARKET USED FOR THE LOW EMISSION VEHICLE, ESTIMATION & FORECAST, BY GEOGRAPHY

6.2.2 GLOBAL LEAD ACID BATTERY MARKET USED FOR THE LOW EMISSION VEHICLE, ESTIMATION & FORECAST, BY VEHICLE TYPES

6.3 GLOBAL NICKEL CADMIUM BATTERY MARKET FOR THE LOW EMISSION VEHICLES

6.3.1 NICKEL-CADMIUM BATTERY MARKET FOR LOW EMISSION VEHICLE, ESTIMATION & FORECAST,

BY GEOGRAPHY

6.3.2 GLOBAL NICKEL-CADMIUM BATTERY MARKET FOR THE LOW EMISSION VEHICLE ESTIMATION & FORECAST, BY VEHICLE TYPES

6.4 GLOBAL METAL HYDRIDE BATTERY MARKET USED FOR THE LOW EMISSION VEHICLES

6.4.1 METAL HYDRIDE BATTERY MARKET REVENUE FOR LOW EMISSION VEHICLE, MARKET ESTIMATION & FORECAST, BY GEOGRAPHY

6.4.2 GLOBAL METAL HYDRIDE BATTERY MARKET USED FOR THE LOW EMISSION VEHICLE, MARKET ESTIMATION & FORECAST, BY VEHICLE TYPES

6.5 GLOBAL LITHIUM ION BATTERY MARKET USED FOR THE LOW EMISSION VEHICLES

6.5.1 LITHIUM ION BATTERY MARKET FOR LOW EMISSION VEHICLE, MARKET ESTIMATION & FORECAST,

BY GEOGRAPHY

6.5.2 GLOBAL LITHIUM ION BATTERY MARKET USED FOR THE LOW EMISSION VEHICLE, MARKET ESTIMATION & FORECAST, BY VEHICLE TYPES

7 GEOGRAPHIC ANALYSIS

7.1 NORTH AMERICA

7.1.1 MARKET FORECAST, BY GEOGRAPHY

7.1.2 MARKET FORECAST, BY DEGREE OF HYBRIDIZATION

7.1.3 FORECAST, BY TYPE OF BATTERY USED

7.2 EUROPE

7.2.1 FORECAST, BY GEOGRAPHY

7.2.2 FORECAST, BY DEGREE OF HYBRIDIZATION

7.2.3 FORECAST, BY TYPE OF BATTERY USED

7.3 APAC

7.3.1 FORECAST, BY GEOGRAPHY

7.3.2 MARKET FORECAST, BY DEGREE OF HYBRIDIZATION

7.3.3 MARKET FORECAST, BY TYPE OF BATTERY USED

7.4 ROW

7.4.1 FORECAST, BY DEGREE OF HYBRIDIZATION

7.4.2 FORECAST, BY TYPE OF BATTERY USED

8 COMPETITIVE LANDSCAPE

8.1 OVERVIEW

8.2 COMPARISON OF MAJOR PLAYERS IN HEV MARKET REVENUE WISE

8.3 COMPARISON OF MAJOR PLAYERS IN EV MARKET REVENUE WISE

8.4 COMPETITIVE PROFILES OF THE TOP HEV MANUFACTURER

8.4.1 TOYOTA MOTORS (JAPAN)

8.4.2 HONDA MOTORS (JAPAN)

8.4.3 FORD MOTOR COMPANY (U.S.)

8.5 ANALYST PERSPECTIVES

8.6 RECENT DEVELOPMENTS

8.6.1 NEW PRODUCT DEVELOPMENT

8.6.2 PARTNERSHIP/AGREEMENT/JOINT VENTURE

8.6.3 OTHERS

9 COMPANY PROFILES

9.1 A123 SYSTEMS, INC.

9.1.1 OVERVIEW

9.1.2 PRODUCTS & SERVICES

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 BYD COMPANY LTD

9.2.1 OVERVIEW

9.2.2 PRODUCTS & SERVICES

9.2.3 FINANCIALS

9.2.4 STRATEGY

9.2.5 DEVELOPMENTS

9.3 COBASYS LLC

9.3.1 OVERVIEW

9.3.2 PRODUCTS & SERVICES

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 DAIMLER AG

9.4.1 OVERVIEW

9.4.2 PRODUCTS & SERVICES

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 DELPHI AUTOMOTIVE LLP

9.5.1 OVERVIEW

9.5.2 PRODUCTS & SERVICES

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 DENSO CORPORATION

9.6.1 OVERVIEW

9.6.2 PRODUCTS & SERVICES

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 FORD MOTOR COMPANY

9.7.1 OVERVIEW

9.7.2 PRODUCTS & SERVICES

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 GENERAL MOTORS CO.

9.8.1 OVERVIEW

9.8.2 PRODUCTS & SERVICES

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 HONDA MOTOR CO. LTD.

9.9.1 OVERVIEW

9.9.2 PRODUCTS & SERVICES

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 HONEYWELL INTERNATIONAL INC.

9.10.1 OVERVIEW

9.10.2 PRODUCTS & SERVICES

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 HYUNDAI MOTOR CO. LTD.

9.11.1 OVERVIEW

9.11.2 PRODUCTS & SERVICES

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 ISUZU MOTORS LTD.

9.12.1 OVERVIEW

9.12.2 PRODUCTS & SERVICES

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 KIA MOTORS CORPORATION

9.13.1 OVERVIEW

9.13.2 PRODUCTS & SERVICES

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 MERCEDES-BENZ

9.14.1 OVERVIEW

9.14.2 PRODUCTS & SERVICES

9.14.3 FINANCIALS

9.14.4 STRATEGY

9.14.5 DEVELOPMENTS

9.15 MITSUBISHI MOTORS CORPORATION

9.15.1 OVERVIEW

9.15.2 PRODUCTS & SERVICES

9.15.3 FINANCIALS

9.15.4 STRATEGY

9.15.5 DEVELOPMENTS

9.16 NISSAN MOTOR CO. LTD

9.16.1 OVERVIEW

9.16.2 PRODUCTS & SERVICES

9.16.3 FINANCIALS

9.16.4 STRATEGY

9.16.5 DEVELOPMENTS

9.17 PRIMEARTH EV ENERGY CO. LTD (PANASONIC EV)

9.17.1 OVERVIEW

9.17.2 PRODUCTS & SERVICES

9.17.3 FINANCIALS

9.17.4 STRATEGY

9.17.5 DEVELOPMENTS

9.18 RENAULT S.A

9.18.1 OVERVIEW

9.18.2 PRODUCTS & SERVICES

9.18.3 FINANCIALS

9.18.4 STRATEGY

9.18.5 DEVELOPMENTS

9.19 ROBERT BOSCH GMBH

9.19.1 OVERVIEW

9.19.2 PRODUCTS & SERVICES

9.19.3 FINANCIALS

9.19.4 STRATEGY

9.19.5 DEVELOPMENTS

9.20 SUZUKI MOTOR CORPORATION

9.20.1 OVERVIEW

9.20.2 PRODUCTS & SERVICES

9.20.3 FINANCIALS

9.20.4 STRATEGY

9.20.5 DEVELOPMENTS

9.21 TOYOTA MOTOR CORPORATION

9.21.1 OVERVIEW

9.21.2 PRODUCTS & SERVICES

9.21.3 FINANCIALS

9.21.4 STRATEGY

9.21.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 2 MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2016 (THOUSAND)

TABLE 3 GLOBAL MARKET REVENUE, BY THE DEGREE OF HYBRIDIZATION, 2011 2016 ($BILLION)

TABLE 4 GLOBAL MARKET, UNIT SHIPMENTS, BY THE DEGREE OF HYBRIDIZATION, 2011 2016 (THOUSAND)

TABLE 5 GLOBAL MARKET REVENUE, BY BATTERY TYPE, 2011 2016 ($BILLION)

TABLE 6 GLOBAL MARKET, UNIT SHIPMENTS, BY BATTERY TYPE, 2011 2016 (THOUSAND)

TABLE 7 COMPARISON TABLE OF DIFFERENT TYPES OF LOW EMISSION VEHICLE

TABLE 8 MAKES AND MODELS OF FULL HYBRID ELECTRIC VEHICLE

TABLE 9 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 10 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 11 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET REVENUE, BY BATTERY TYPE, 2011 2017 ($BILLION)

TABLE 12 FULL HYBRID ELECTRIC VEHICLE (FHEV) MARKET, UNIT SHIPMENTS, BY BATTERY TYPE, 2011 2017 (THOUSAND)

TABLE 13 MAKES AND MODELS OF MILD HYBRID ELECTRIC VEHICLE

TABLE 14 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 15 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 16 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET REVENUE, BY BATTERY TYPES, 2011 2017 ($MILLION)

TABLE 17 MILD HYBRID ELECTRIC VEHICLE (MHEV) MARKET, UNIT SHIPMENTS, BY BATTERY TYPES, 2011 2017 (THOUSAND)

TABLE 18 MAKES AND MODELS OF PLUG-IN HYBRID ELECTRIC VEHICLE

TABLE 19 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV) MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 20 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV) MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND UNITS)

TABLE 21 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV) MARKET REVENUE, BY BATTERY TYPE, 2011 2017 ($MILLION)

TABLE 22 PLUG-IN HYBRID ELECTRIC VEHICLE(PHEV) MARKET, UNIT SHIPMENTS, BY BATTERY TYPE, 2011 2017 (THOUSAND UNITS)

TABLE 23 MAKES AND MODELS OF EVS

TABLE 24 PURE ELECTRIC VEHICLE MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 25 PURE ELECTRIC VEHICLE MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 26 PURE ELECTRIC VEHICLE MARKET REVENUE, BY BATTERY TYPES, 2011 2017 ($MILLION)

TABLE 27 PURE ELECTRIC VEHICLE MARKET, UNIT SHIPMENTS, BY BATTERY TYPES, 2011 2017 (THOUSAND)

TABLE 28 LEAD ACID BATTERY MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($MILLION)

TABLE 29 LEAD ACID BATTERY MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 30 GLOBAL LEAD ACID BATTERY MARKET REVENUE, BY VEHICLE TYPES, 2011 2017 ($MILLION)

TABLE 31 GLOBAL LEAD ACID BATTERY MARKET, UNIT SHIPMENTS, BY VEHICLE TYPES, 2011 2017 (THOUSAND UNITS)

TABLE 32 NICKEL-CADMIUM BATTERY MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($MILLION)

TABLE 33 NICKEL CADMIUM BATTERY MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 34 GLOBAL NICKEL CADMIUM BATTERY MARKET REVENUE, BY VEHICLE TYPES, 2011 2017 ($MILLION)

TABLE 35 GLOBAL NICKEL CADMIUM BATTERY MARKET, UNIT SHIPMENTS, BY VEHICLE TYPES, 2011 2017 (THOUSAND)

TABLE 36 METAL HYDRIDE BATTERY MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 37 METAL HYDRIDE BATTERY MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 38 GLOBAL METAL HYDRIDE BATTERY MARKET REVENUE, BY VEHICLE TYPES, 2011 2017 ($BILLION)

TABLE 39 GLOBAL METAL HYDRIDE BATTERY MARKET, UNIT SHIPMENTS, BY VEHICLE TYPES, 2011 2017 (THOUSAND)

TABLE 40 LITHIUM ION BATTERY MARKET REVENUE, BY GEOGRAPHY, 2011 2017 ($BILLION)

TABLE 41 LITHIUM ION BATTERY MARKET, UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2017 (THOUSAND)

TABLE 42 GLOBAL LITHIUM ION BATTERY MARKET REVENUE, BY VEHICLE TYPES, 2011 2017 ($BILLION)

TABLE 43 GLOBAL LITHIUM ION BATTERY MARKET USED, UNIT SHIPMENTS, BY VEHICLE TYPES, 2011 2017 (THOUSAND)

TABLE 44 FEDERAL CREDITS FOR VARIOUS TYPES OF ALTERNATIVE-ENERGY PASSENGER VEHICLES, 2011

TABLE 45 NORTH AMERICA: MARKET REVENUE, BY COUNTRY, 2011 2017 ($BILLION)

TABLE 46 NORTH AMERICA: MARKET, UNIT SHIPMENTS, BY COUNTRY, 2011 2017 (THOUSAND)

TABLE 47 U.S.: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 48 U.S. MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 49 NORTH AMERICA: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 50 NORTH AMERICA: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 51 NORTH AMERICA: MARKET REVENUE, BY TYPES OF BATTERIES USED, 2011 2017 ($BILLION)

TABLE 52 NORTH AMERICA: MARKET, UNIT SHIPMENTS, BY TYPES OF BATTERIES USED, 2011 2017 (THOUSAND)

TABLE 53 EUROPE: MARKET REVENUE, BY COUNTRY, 2011 2017 ($BILLION)

TABLE 54 EUROPE: MARKET, UNIT SHIPMENTS, BY COUNTRY, 2011 2017 (THOUSAND)

TABLE 55 U.K.: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 56 U.K.: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 57 GERMANY: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($MILLION)

TABLE 58 GERMANY: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 59 EUROPE: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 60 EUROPE: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 61 EUROPE: MARKET REVENUE, BY TYPES OF BATTERIES USED, 2011 2017 ($MILLION)

TABLE 62 EUROPE: MARKET, UNIT SHIPMENTS, BY TYPES OF BATTERIES USED, 2011 2017 (THOUSAND)

TABLE 63 APAC: MARKET REVENUE, BY COUNTRY, 2011 2017 ($BILLION)

TABLE 64 APAC: MARKET, UNIT SHIPMENTS, BY COUNTRY, 2011 2017 (THOUSAND)

TABLE 65 JAPAN: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 66 JAPAN: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 67 CHINA: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 68 CHINA: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 69 APAC: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

TABLE 70 APAC: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 71 APAC: MARKET REVENUE, BY TYPES OF BATTERY USED, 2011 2017 ($BILLION)

TABLE 72 APAC: MARKET, UNIT SHIPMENTS, BY TYPES OF BATTERIES USED, 2011 2017 (THOUSAND)

TABLE 73 ROW: MARKET REVENUE, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($MILLION)

TABLE 74 ROW: MARKET, UNIT SHIPMENTS, BY DEGREE OF HYBRIDIZATION, 2011 2017 (THOUSAND)

TABLE 75 ROW: MARKET REVENUE, BY TYPES OF BATTERY USED, 2011 2017 ($MILLION)

TABLE 76 ROW: MARKET, UNIT SHIPMENTS, BY TYPES OF BATTERY USED, 2011 2017 (THOUSAND)

TABLE 77 COMPARISON OF TOP HEV MANUFACTURES, HEV SEGMENT REVENUE ($BILLION)

TABLE 78 COMPARISON OF TOP EV MANUFACTURERS, EV SEGMENT REVENUE ($BILLION)

TABLE 79 NEW PRODUCT DEVELOPMENT

TABLE 80 PARTNERSHIP/AGREEMENT/JOINT VENTURE

TABLE 81 OTHERS

TABLE 82 IMPORTANT FINANCIALS (REVENUE) OF 123 SYSTEMS, 2007 2011 ($MILLION)

TABLE 83 IMPORTANT FINANCIALS (R&D EXPENSES) OF 123 SYSTEMS, 2006 2010 ($MILLION)

TABLE 84 BYD CO. LTD.: OVERALL REVENUE, BY PRODUCT SEGMENTS, 2010 2011 ($MILLION)

TABLE 85 BYD CO. LTD.: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 86 IMPORTANT FINANCIALS OF COBASYS, 2011 ($MILLION)

TABLE 87 DAIMLER AG: OVERALL REVENUE, 2009 2011 ($MILLION)

TABLE 88 REVENUE BY BUSINESS SEGMENT ($MILLION)

TABLE 89 DENSO CORP : OVERALL REVENUE, 2009 2011 ($MILLION)

TABLE 90 FORD MOTOR COMPANY: MARKET REVENUE AND NET INCOME, 2010 2011 ($MILLION)

TABLE 91 GM: MARKET REVENUE AND NET INCOME, BY BUSINESS SEGMENTS, 2010 2011 ($MILLION)

TABLE 92 HONDO MOTOR CO. LTD.: OVERALL REVENUE, BY SEGMENTS, 2010 2011 ($BILLION)

TABLE 93 HONDA MOTORS CO. LTD.: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($BILLION)

TABLE 94 HONEYWELL INTERNATIONAL: OVERALL REVENUE, 2010 2011 ($MILLION)

TABLE 95 HYUNDAI: MARKET REVENUE AND NET INCOME, 2010 2011 ($MILLION)

TABLE 96 ISUZU MOTORS LTD.: OVERALL REVENUE, BY PRODUCT SEGMENTS, 2010 2011 ($BILLION)

TABLE 97 KIA MOTORS CORP : OVERALL REVENUE, 2010 2011 ($BILLION)

TABLE 98 MERCEDES BENZ: MARKET REVENUE, BY BUSINESS SEGMENTS, 2010 2011 ($BILLION)

TABLE 99 MITSUBISHI MOTORS CORP : OVERALL REVENUE, BY SEGMENTS, 2010 2011 ($BILLION)

TABLE 100 MITSUBISHI MOTORS CORP: OVERALL REVENUE, BY GEOGRAPHY, 2010 2011($BILLION)

TABLE 101 NISSAN MOTOR CO. LTD: OVERALL REVENUE, 2010 2011 ($BILLION)

TABLE 102 RENAULT S.A: OVERALL REVENUE, 2009 2011 ($BILLION)

TABLE 103 SUZUKI MOTOR CORP : OVERALL REVENUE, 2009 2011($BILLION)

TABLE 104 TOYOTA MOTOR CORP.: OVERALL REVENUE, 2010 2011 ($BILLION)

TABLE 105 TOYOTA MOTOR CORP.: MARKET REVENUE, BY BUSINESS SEGMENTS, 2010 2011 ($BILLION)

LIST OF FIGURES

FIGURE 1 STAGES IN RESEARCH METHODOLOGY AND THEIR IMPORTANCE

FIGURE 2 MARKET RESEARCH STRATEGY

FIGURE 3 MARKET CRACKDOWN STRATEGY

FIGURE 4 MARKET SEGMENTATION

FIGURE 5 IMPACT ANALYSIS OF DRIVERS

FIGURE 6 IMPACT ANALYSIS FOR RESTRAINT

FIGURE 7 IMPACT ANALYSIS FOR OPPORTUNITIES

FIGURE 8 VALUE CHAIN FOR HEV MARKET

FIGURE 9 PORTERS FIVE FORCES MODEL FOR LOW EMISSION VEHICLE MARKET

FIGURE 10 PARALLEL HYBRID VEHICLE-BASIC ARRANGEMENT

FIGURE 11 SERIES HYBRID VEHICLE-BASIC ARRANGEMENT

FIGURE 12 POWER-SPLIT HYBRIDS VEHICLE-BASIC ARRANGEMENT

FIGURE 13 HYBRID VEHICLE-BASIC ARRANGEMENT

FIGURE 14 EXPECTED UNITS SALE OF FCEVS (2011 2017)

FIGURE 15 FULL HYBRID ELECTRIC VEHICLE (FHEV) REVENUE DISTRIBUTION, BY GEOGRAPHY, 2011 & 2017

FIGURE 16 FULL HYBRID ELECTRIC VEHICLE (FHEV) REVENUE DISTRIBUTION, BY BATTERY TYPE, 2011 & 2017

FIGURE 17 MILD HYBRID ELECTRIC VEHICLE (MHEV) REVENUE DISTRIBUTION, BY GEOGRAPHY, 2011 & 2017

FIGURE 18 MILD HYBRID ELECTRIC VEHICLE (MHEV) REVENUE DISTRIBUTION, BY BATTERY TYPES, 2011 & 2017

FIGURE 19 PLUG IN HYBRID ELECTRIC VEHICLE (PHEV) REVENUE DISTRIBUTION, BY GEOGRAPHY, 2011 & 2017

FIGURE 20 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) REVENUE DISTRIBUTION, BY BATTERY TYPE, 2011 & 2017

FIGURE 21 PURE ELECTRIC VEHICLE REVENUE DISTRIBUTION, BY GEOGRAPHY, 2011 & 2017

FIGURE 22 PURE ELECTRIC VEHICLE REVENUE DISTRIBUTION, BY BATTERY TYPES, 2011 & 2017

FIGURE 23 GLOBAL LEAD ACID BATTERY MARKET USED FOR LOW EMISSION VEHICLE, REVENUE DISTRIBUTION, BY GEOGRAPHY, 2011 & 2017

FIGURE 24 GLOBAL LEAD ACID BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY VEHICLE TYPES, 2011 & 2017

FIGURE 25 NICKEL-CADMIUM BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY GEOGRAPHY, 2011 & 2017

FIGURE 26 GLOBAL NICKEL CADMIUM BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY VEHICLE TYPES, 2011 & 2017

FIGURE 27 LEAD ACID BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY GEOGRAPHY, 2011 & 2017

FIGURE 28 GLOBAL METAL HYDRIDE BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY VEHICLE TYPES, 2011 & 2017

FIGURE 29 LITHIUM ION BATTERY MARKET REVENUE DISTRIBUTION FOR LOW EMISSION VEHICLE, BY GEOGRAPHY, 2011 & 2017

FIGURE 30 GLOBAL LITHIUM ION BATTERY MARKET REVENUE DISTRIBUTION FOR THE LOW EMISSION VEHICLE, BY VEHICLE TYPES, 2011 & 2017

FIGURE 31 NORTH AMERICA: ZERO EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY COUNTRY, 2011 2017 ($BILLION)

FIGURE 32 NORTH AMERICA: LOW EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY DEGREE OF HYBRIDIZATION, 2011 & 2017 ($BILLION)

FIGURE 33 NORTH AMERICA: MARKET REVENUE DISTRIBUTION, BY TYPES OF BATTERIES USED, 2011 & 2017 ($BILLION)

FIGURE 34 EUROPE: LOW EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY COUNTRY, 2011 2017 ($BILLION)

FIGURE 35 EUROPE: MARKET REVENUE DISTRIBUTION, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

FIGURE 36 EUROPE: LOW EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY TYPE OF BATTERY USED, 2011 2017 ($BILLION)

FIGURE 37 APAC: LOW EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY COUNTRY, 2011 2017 ($BILLION)

FIGURE 38 APAC: MARKET REVENUE DISTRIBUTION, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

FIGURE 39 APAC: MARKET REVENUE DISTRIBUTION, BY TYPE OF BATTERY USED, 2011 2017 ($BILLION)

FIGURE 40 ROW : LOW EMISSION VEHICLE MARKET REVENUE DISTRIBUTION, BY DEGREE OF HYBRIDIZATION, 2011 2017 ($BILLION)

FIGURE 41 EUROPE: MARKET REVENUE DISTRIBUTION, BY COUNTRY, 2011 2017 ($BILLION)

FIGURE 42 MARKET SHARE OF MAJOR HEV MANUFACTURERS, 2010 & 2011

FIGURE 43 BYD COMPANY LIMITED: PRODUCT SEGMENTS

FIGURE 44 HONDA MOTOR COMPANY LIMITED: PRODUCT SEGMENT

FIGURE 45 ISUZU MOTORS LTD. PRODUCT SEGMENT

FIGURE 46 KIA MOTORS CORPORATION PRODUCT SEGMENT

FIGURE 47 KEY BRANDS, KIA MOTORS, 2011

FIGURE 48 MERCEDES BENZ PRODUCT SEGMENT

FIGURE 49 MITSUBISHI MOTORS CORPORATION PRODUCT SEGMENT

FIGURE 50 MITSUBISHI MOTORS CORPORATION: BRANDS

FIGURE 51 TOYOTA MOTOR CORPORATION: PRODUCT SEGMENT

Growth opportunities and latent adjacency in Low Emission Vehicle Market