Lead Acid Battery Market by Technology (Basic, Advanced Lead Acid), Type (Stationary, Motive), Construction Method (Flooded, VRLA), End-User (Utilities, Transportation, Industrial, Commercial & Residential), and Region - Global Forecast to 2024

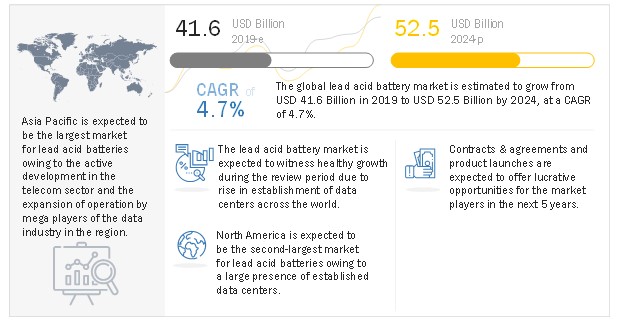

The global lead acid battery market in terms of revenue was estimated to worth $41.6 billion in 2019 and is poised to reach $52.5 billion by 2024 growing at a CAGR of 4.7% during the forecast period.

The factors driving the growth for lead acid battery market is the rapid technological advancements and expansion in the telecom sector. On the contrary, presence of low cost alternatives in the energy storage space and the safety concerns related with the battery usage are identified to restrain the growth of the market, during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Lead acid battery Market Dynamics

Driver: Rapid technological advancements and expansion in the telecom sector

One of the industries that has seen a massive y-o-y growth is the telecom industry. In the times to come, the industry is expected to witness a boom. The competitive wireless telecom industry is all set to experience new levels of challenges, as a new generation of connectivity comes into existence. The telecommunications sector is one of the very few industries experiencing rapid technological development and improvement even during the tough times of recession. This sector continues to be an important force for innovation, growth, and disruption across multiple sectors. The major telecom players in the industry continue to invest in the expansion and development of their processes and operations to capitalize on the increasingly apparent opportunity for bolstered revenue generation streams. Already evaluated in excess of USD 270 billion in the fiscal year 2017, according to numerous industry experts, the reason for the growth of the wireless telecom space is the growth of multiple technological innovations. With several advancements in the communication technology and increasing interconnectivity of devices, the wireless telecom industry is prepared to continue serving as the primary support source for the overarching technology world.

Active technological companies in the market include Surge Holdings, Inc., QUALCOMM, Juniper Networks Inc., and Verizon Communications Inc. The Las Vegas-situated telecom and Fintech software company, Surge Holdings, Inc., announced its market expansion strategy to over 20 million active US veterans, military, and immediate family members recently. On similar lines, the recently concluded Reliance Jio annual general meeting witnessed the company tie-up with Microsoft to bring into existence several data centers in India. These data centers eventually require a central power backup facility; even the UPS used in the systems is of basic lead acid batteries. Thus, with more data centers coming into existence, the usage of this battery is expected to increase considerably.

Restraint: Low-cost alternatives in energy storage space

Until recently, lead acid batteries have been the most cost-effective technology. However, with the rise of alternative battery storage technologies, especially the lithium-ion technology, lead acid batteries are losing out on the cost-effectiveness quotient. Lead acid batteries are witnessing a price drop nearly across all industries. Simultaneously, the Nickel-Metal Hydride (NiMH) battery is a proven and mature technology for hybrid applications. It is used by Original Equipment Manufacturers (OEMs), including Toyota, Honda, and Lexus. The OEMs prefer these batteries for their safety, performance, and longer lifecycle in hybrid applications. Also, along with NiMH batteries, even nickel-cadmium batteries prove to be a cost-efficient solution for battery storage users. They are cheaper and more effective as an alternative to lead acid batteries.

Opportunities: Increase in renewable energy generation target

As per the IEA, renewables are expected to have the fastest growth in the electricity sector, resulting in catering to about 30% of the power demand in 2023, up from 24% in 2017. During this period, renewables are estimated to contribute to more than 70% of the global electricity generation. This growth would be led by solar (both photovoltaics and ground mount modules) followed by wind, hydropower, and bioenergy. Hydropower, however, remains the largest renewable source, catering to about 16% of the global electricity demand by 2023, followed by wind catering to a further 6%, solar Photovoltaics (PV) (4%), and bioenergy (3%). In developing regions such as India, the renewable generation target of 175 GW by 2022, declared in 2018 has now been revised to 217 GW. The additional 45 GW is expected to be contributed to by the floating solar technology. Thus, with the growing generation, the need for energy storage would also increase significantly as the lead acid batteries are installed in the generation grid. At the same time, these batteries are also installed at the substations where the power generated is fed into the main grid. Thus, with the increase in the generation, the implementation of these batteries is also expected to increase significantly.

Challenges: Limited usage capacity of lead acid batteries

Lead acid batteries are expected to have a low useable capacity. It is typically taken into consideration to use just 30–50% of the rated capacity of a typical lead acid battery. This indicates that a 600 Ah battery bank in daily practice provides only, at the maximum, 300 Ah of actual capacity. If one even occasionally drains the batteries more than this, their life would drastically reduce.

These batteries have a limited life cycle. Even if one goes easy on these batteries and is particularly careful to never over drain these cells, the very best deep-cycle lead acid batteries are typically great for 500–1,000 cycles. If one frequently taps into the battery bank, it would mean that the batteries, in this case, may need replacement in less than 2 years of use.

In addition, these batteries waste energy and have major efficiency issues. They waste as much as 15% of the energy put into them via inherent charging, indicating inefficiency. Hence, if one supplies 100 A of power, one would only be storing just 85 Ah. This can be frustrating when using the solar mode of charging when one is trying to squeeze as much efficiency out of every ampere as possible before sunset or gets covered up by clouds.

Basic Lead Acid Battery segment is expected to dominate the Lead Acid Battery market, by technology, during the forecast period

The basic lead acid battery market, by technology, accounts for the highest market share because of its cost-efficiency and overall effectiveness. However, in the next 5 years, the benefits of the advanced lead acid batteries will play a significant role in driving the market figures upward.

The data centres sub-segment is expected to be the largest contributor to the lead acid battery market, by industrial segment, during the forecast period

The lead acid battery market is sub-segmented, by industrial, into data centres, telecom, oil & gas, and others. Others in the industrial segment include construction, metals & mining, chemical & pharmaceutical, and food & beverage industries. Regions such as Asia Pacific is focussing on increasing the number of data centres installed across the countries, due to the growth of the IT sector. Lead acid batteries are expected to be used as a backup power solution in these data centres owing to their functionality across a wide temperature range.

The VRLA segment is expected to be the fastest-growing market during the forecast period

The lead acid battery market, by construction method, is segmented into flooded, and valve regulated lead acid (VRLA) batteries. The VRLA batteries are technologically more advanced and have a longer life cycle with excellent performance levels. They are more cost-effective as compared to lithium-ion and nickel-cadmium batteries and are expected to be the more favoured lead acid battery among its end-users.

The horizontal well is expected to be the largest contributor to the lead acid battery market, by well type, during the forecast period

The lead acid battery market, by well type, is segmented into horizontal well and vertical well. The horizontal well is expected to hold the largest market share in 2021 and have highest growth rate in the forecast period. Improved efficiency obtained from the horizontal well is expected to drive the segment in the forecast period.

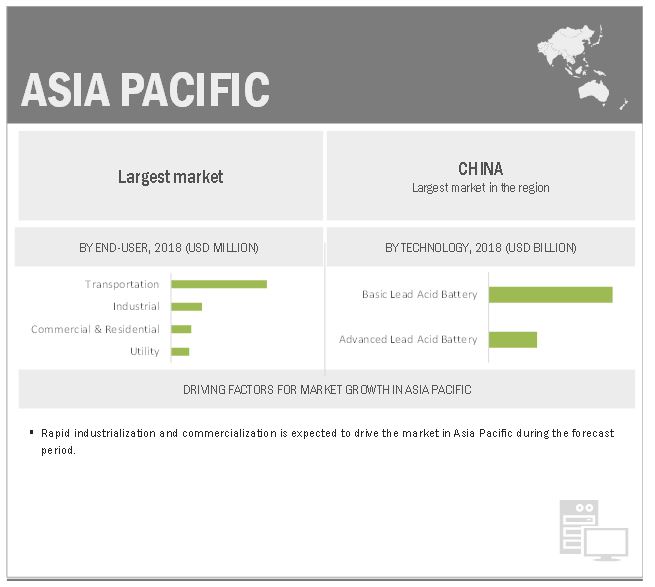

Asia Pacific is expected to be the largest market during the forecast period

In this report, the lead acid battery market has been analysed with respect to five regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. Asia Pacific is estimated to be the largest market from 2019 to 2024. Increasing demand for peak shaving, backup power, grid stability, and renewable energy integration with the main grid has lead to the requirement of cost-effective battery storage solutions. This drives the lead acid battery market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the lead acid battery market are Clarios (US), Chaowei Power (China), Panasonic (Japan), GS Yuasa (Japan) and Hitachi Chemical (Japan). Between 2013 and 2018, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the lead acid battery market.

Recent Developments

- In July 2019, Enersys was appointed Approved Status Vendor for the National PRONTO Association. This enables Enersys to provide its Absorbed Glass Mat (AGM) ODYSSEY batteries to PRONTO warehouse distributor members.

- In March 2019, GS Yuasa opened a new automotive lead acid battery plant in Turkey. The plant will be operated by nci GS Yuasa Akü Sanayi ve Ticaret Anonim ªirketi (“IGYA”) an equity affiliate of the GS Yuasa.

- In June 2018, Enersys entered in a four-year agreement with Navistar to supply ODYSSEY batteries. Under the agreement, Enersys provided ODYSSEY batteries for Original Equipment (OE) and aftermarket replacement batteries for all trucks sold by International Truck dealers under the Fleetrite Platinum Plus brand.

- In June 2018, Exide Industries acquired the Tudor plant of 64,647 sq. m, in Gujarat from Exide Technologies.

- In May 2018, GS Yuasa established a new company called Siam GS Battery Myanmar Limited, in Myanmar. This subsidiary's primary functions include sales, distribution and battery charging, for lead acid battery storage batteries for automotive and household power supply.

Frequently Asked Questions (FAQ):

What is the current size of the lead acid battery market?

The current market size of global lead acid battery market is USD 39.9 billion in 2018.

What is the major drivers for the lead acid battery market?

The factors driving the growth for lead acid battery market is the rapid technological advancements and expansion in the telecom sector.

Which is the fastest-growing region during the forecasted period in lead acid battery market?

Asia Pacific region is expected to grow at the highest CAGR during the forecast period.

Which is the fastest-growing segment, by technology during the forecasted period in lead acid battery market?

The basic lead acid battery segment is expected to grow at the highest CAGR, during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Limitations

1.5 Years Considered for the Study

1.6 Currency

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Scope

2.2 Market Size Estimation

2.2.1 Demand-Side Analysis

2.2.1.1 Calculation

2.2.1.2 Assumptions

2.2.2 Supply Side Analysis

2.2.2.1 Assumptions

2.2.2.2 Calculation

2.2.3 Forecast

2.3 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Lead Acid Battery Market During the Forecast Period

4.2 Market, By Technology

4.3 Market, By Type

4.4 Market, By Construction Method

4.5 Market, By End-User

4.6 Market, By Industrial Segment

4.7 Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Cost-Competitive Energy Storage Solution

5.2.1.2 Rapid Technological Advancements and Expansion in the Telecom Sector

5.2.1.3 Easily Recyclable Compared With Lithium-Ion Batteries

5.2.2 Restraints

5.2.2.1 Low-Cost Alternatives in Energy Storage Space

5.2.2.2 Safety Related to Battery Usage

5.2.3 Opportunities

5.2.3.1 Expanding Data Center Infrastructure

5.2.3.2 Increase in Renewable Energy Generation Target

5.2.4 Challenges

5.2.4.1 Limited Usage Capacity of Lead Acid Batteries

5.2.4.2 Growth of Electric Vehicles

5.3 Supply Chain Analysis

5.3.1 Raw Material Suppliers

5.3.2 Manufacturers

5.3.3 Distributors

5.3.4 End-Users/Engine Manufacturers

6 Market, By Technology (Page No. - 42)

6.1 Introduction

6.2 Basic Lead Acid Battery

6.2.1 Demand for Basic Lead Acid Battery Market is Driven By Its Low Selling Cost

6.3 Advanced Lead Acid Battery

6.3.1 Demand for Advanced Lead Acid Battery is Driven By Its Longer Life Cycle as Compared With Basic Lead Acid Battery

7 Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Stationary

7.2.1 Usage of These Batteries Would Primarily Be in the Commercial & Residential Sectors and Utilities, Which is Expected to Lead to the Growth of the Segment During the Forecast Period

7.3 Motive

7.3.1 Increased Application in the Starting, Lighting, and Ignition (Sli) and Related Transportation Sector is Expected to Boost the Segment During the Forecast Period

8 Market, By Construction Method (Page No. - 50)

8.1 Introduction

8.2 Flooded

8.2.1 The Usage in Static Applications Will Help in the Growth of the Segment During the Forecast Period

8.3 Vrla Battery

8.3.1 Usage of Vrla Batteries in the Motive and Transportation Segments is Expected to Grow During the Forecast Period

9 Market, By End-User (Page No. - 54)

9.1 Introduction

9.2 Utility

9.2.1 Renewable Energy Drives the Need for Market in the Utility Segment

9.3 Transportation

9.3.1 Increasing Need for Efficient Management of Goods and Services in the Transportation Sector has Led to A Rise in the Demand for Lead Acid Batteries

9.4 Industrial

9.4.1 Power Backup in Industrial Applications Creates the Need for Usage of Lead Acid Batteries

9.5 Commercial & Residential

9.5.1 Demand for Advanced Market is Driven By Its Longer Life Cycle as Compared With Basic Lead Acid Battery

10 Market, By Region (Page No. - 59)

10.1 Introduction

10.2 Asia Pacific

10.2.1 By Technology

10.2.2 By Type

10.2.3 By Construction Method

10.2.4 By End-User

10.2.5 By Country

10.2.5.1 China

10.2.5.1.1 The Nation has A Storehouse for Lead to Cater to the Rising Demand for Lead Acid Batteries

10.2.5.2 Japan

10.2.5.2.1 The Country is Investing in the Installation of Lead Acid Batteries in the Marine Industry

10.2.5.3 India

10.2.5.3.1 The Onset of the Electric Vehicle Market Will Provide the Push to the Lead Acid Battery Sales in the Region

10.2.5.4 South Korea

10.2.5.4.1 Major Usage of Lead Acid Batteries Lies in Integrating Renewable Energy to the Existing Grid

10.2.5.5 Rest of Asia Pacific

10.3 Europe

10.3.1 By Technology

10.3.2 By Type

10.3.3 By Construction Method

10.3.4 By End-User

10.3.5 By Country

10.3.5.1 Germany

10.3.5.1.1 Steady Transition in the Usage of Lead Acid Batteries From the Automotive Sector to the Utilities

10.3.5.2 Russia

10.3.5.2.1 Major Developments in the Automobile Manufacturing Category is Expected to Boost Lead Acid Battery Sales

10.3.5.3 UK

10.3.5.3.1 The Nation is Working on the Recycling of Lead Acid Batteries

10.3.5.4 Italy

10.3.5.4.1 Major Projects in the Renewable Space is Expected to Use Lead Acid Batteries

10.3.5.5 Rest of Europe

10.4 North America

10.4.1 By Technology

10.4.2 By Type

10.4.3 By Construction Method

10.4.4 By End-User

10.4.5 By Country

10.4.5.1 US

10.4.5.1.1 Major Usage is Expected to Be in Utilities and Home Systems

10.4.5.2 Canada

10.4.5.2.1 The Nation is Set to Install Lead Acid Batteries for Renewable Integration and Data Centers

10.4.5.3 Mexico

10.4.5.3.1 Lead Acid Batteries are Used in the Metals & Mining Industry

10.5 South America

10.5.1 By Technology

10.5.2 By Type

10.5.3 By Construction Method

10.5.4 By End-User

10.5.5 By Country

10.5.5.1 Brazil

10.5.5.1.1 Brazil to Make Massive Investments in Data Centers and the Telecom Industry

10.5.5.2 Chile

10.5.5.2.1 Chile is Set to Get Its First Major Investment in Data Centers and Hence Boost the Lead Acid Technology in the Country

10.5.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 By Technology

10.6.2 By Type

10.6.3 By Construction Method

10.6.4 By End-User

10.6.5 By Country

10.6.5.1 UAE

10.6.5.1.1 The UAE is Expected to Install Infrastructure to Boost Telecom

10.6.5.2 Saudi Arabia

10.6.5.2.1 Google has Set Eyes on the Country to Build Its Data Infrastructure

10.6.5.3 South Africa

10.6.5.3.1 Renewable Integration is the Major Application Driving the Market in the Country

10.6.5.4 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 90)

11.1 Overview

11.2 Competitive Leadership Mapping, 2018

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic

11.2.4 Emerging

11.3 Market Share Analysis

11.4 Competitive Scenario

11.4.1 New Product Launches

11.4.2 Expansions & Investments

11.4.3 Contracts & Agreements

11.4.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 98)

(Business Overview, Products Offered, Recent Developments & MnM View)*

12.1 Enersys

12.2 Exide Industries

12.3 GS Yuasa

12.4 Clarios

12.5 Panasonic

12.6 Chaowei Power

12.7 Narada Power

12.8 HBL Power Systems

12.9 Crown Battery

12.1 Northstar

12.11 Hitachi Chemical

12.12 Exide Technologies

*Details on Business Overview, Products Offered, Recent Developments & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 134)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (65 Tables)

Table 1 Installation of Lead Acid Batteries in the Transportation Sector Formed the Determining Factor for Deducing the Global Lead Acid Battery Market

Table 2 Global Market Snapshot

Table 3 Upcoming Investments in the Battery Storage Space

Table 4 Cost Comparison of Lead Acid Batteries and Lithium-Ion Batteries

Table 5 Lead Acid Battery Market Size, By Technology, 2017–2024(USD Billion)

Table 6 Basic Lead Acid Market Size, By Region, 2017–2024(USD Billion)

Table 7 Advanced Market Size, By Region, 2017–2024(USD Billion)

Table 8 Market Size, By Type, 2017–2024(USD Billion)

Table 9 Stationary: Market Size, By Region, 2017–2024 (USD Billion)

Table 10 Motive: Market Size, By Region, 2017–2024(USD Billion)

Table 11 Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 12 Flooded: Market Size, By Region, 2017–2024(USD Billion)

Table 13 Vrla: Market Size, By Region, 2017–2024(USD Billion)

Table 14 Market, By End-User, 2018(USD Billion)

Table 15 Utility: Lead Acid Market Size, By End-User, 2017–2024(USD Billion)

Table 16 Transportation: Market Size, By Region, 2017–2024(USD Billion)

Table 17 Market Size, By Industries, 2017–2024(USD Billion)

Table 18 Industrial: Market Size, By Region, 2017–2024(USD Billion)

Table 19 Commercial & Residential: Market Size, By Region, 2017–2024 (USD Billion)

Table 20 Market Size, By Region, 2017–2024(USD Billion)

Table 21 Asia Pacific: Market Size, By Technology, 2017–2024 (USD Billion)

Table 22 Asia Pacific: Market Size, By Type, 2017–2024(USD Billion)

Table 23 Asia Pacific: Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 24 Asia Pacific: Market Size, By End-User, 2017–2024(USD Billion)

Table 25 Asia Pacific: Market Size, By Country, 2017–2024 (USD Billion)

Table 26 China: Market Size, By End-User, 2017–2024(USD Billion)

Table 27 Japan: Market Size, By End-User, 2017–2024(USD Billion)

Table 28 India: Market Size, By End-User, 2017–2024(USD Billion)

Table 29 South Korea: Market Size, By End-User, 2017–2024(USD Billion)

Table 30 Rest of Asia Pacific: Market Size, By End-User, 2017–2024(USD Billion)

Table 31 Europe: Market Size, By Technology, 2017–2024 (USD Billion)

Table 32 Europe: Market Size, By Type, 2017–2024 (USD Billion)

Table 33 Europe: Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 34 Europe: Market Size, By End-User, 2017–2024 (USD Billion)

Table 35 Europe: Market Size, By Country, 2017–2024(USD Billion)

Table 36 Germany: Market Size, By End-User, 2017–2024(USD Billion)

Table 37 Russia: Market Size, By End-User, 2017–2024(USD Billion)

Table 38 UK: Market Size, By End-User, 2017–2024(USD Billion)

Table 39 Italy: Market Size, By End-User, 2017–2024(USD Billion)

Table 40 Rest of Europe: Market Size, By End-User, 2017–2024(USD Billion)

Table 41 North America: Market Size, By Technology, 2017–2024 (USD Billion)

Table 42 North America: Market Size, By Type, 2017–2024 (USD Billion)

Table 43 North America: Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 44 North America: Market Size, By End-User, 2017–2024(USD Billion)

Table 45 North America: Market Size, By Country, 2017–2024(USD Billion)

Table 46 US: Market Size, By End-User, 2017–2024(USD Billion)

Table 47 Canada: Market Size, By End-User, 2017–2024(USD Billion)

Table 48 Mexico: Market Size, By End-User, 2017–2024(USD Billion)

Table 49 South America: Market Size, By Technology, 2017–2024 (USD Billion)

Table 50 South America: Market Size, By Type, 2017–2024 (USD Billion)

Table 51 South America: Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 52 South America: Market Size, By End-User, 2017–2024 (USD Billion)

Table 53 South America: Market Size, By Country, 2017–2024 (USD Billion)

Table 54 Brazil: Market Size, By End-User, 2017–2024 (USD Billion)

Table 55 Chile: Market Size, By End-User, 2017–2024 (USD Billion)

Table 56 Rest of South America: Market Size, By End-User, 2017–2024 (USD Billion)

Table 57 Middle East & Africa: Market Size, By Technology, 2017–2024 (USD Billion)

Table 58 Middle East & Africa: Market Size, By Type, 2017–2024 (USD Billion)

Table 59 Middle East & Africa: Market Size, By Construction Method, 2017–2024 (USD Billion)

Table 60 Middle East & Africa: Market Size, By End-User, 2017–2024 (USD Billion)

Table 61 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Billion)

Table 62 UAE: Market Size, By End-User, 2017–2024 (USD Billion)

Table 63 Saudi Arabia: Market Size, By End-User, 2017–2024 (USD Billion)

Table 64 South Africa: Market Size, By End-User, 2017–2024 (USD Billion)

Table 65 Rest of the Middle East &Africa: Market Size, By End-User, 2017–2024 (USD Billion)

List of Figures (37 Figures)

Figure 1 Lead Acid Battery Market Share of the Leading Players, 2018

Figure 2 Basic Lead Acid Battery Segment is Expected to Dominate the Market, By Technology, From 2019 to 2024

Figure 3 Motive Segment is Expected to Dominate the Market, By Type, From 2019 to 2024

Figure 4 Vrla Segment is Expected to Dominate the Market, By Construction Method, From 2019 to 2024

Figure 5 Transportation Segment is Expected to Dominate the Market, By End-User, From 2019 to 2024

Figure 6 Data Centers is Expected to Dominate the Industrial Market From 2019 to 2024

Figure 7 Asia Pacific Held the Largest Share of the Market in 2018

Figure 8 Growth in the Global Need for A Cost-Competitive Energy Storage Solution Clubbed With Rapid Expansion in Telecom and Data Industries is Expected to Drive the Market

Figure 9 Advanced Lead Acid Battery Segment Dominated the Market, By Technology, in 2018

Figure 10 Motive Segment is Expected to Dominate the Market, By Type, During the Forecast Period

Figure 11 Vrla Battery Segment is Expected to Dominate the Market, By Construction Method, During the Forecast Period

Figure 12 Transportation Segment is Expected to Dominate the Market, By End-User, During the Forecast Period

Figure 13 Data Centers Dominated the Industrial Market in 2018

Figure 14 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Global Increase in the Data Handling Capacity

Figure 17 Market: Supply Chain Analysis

Figure 18 Market, By Technology, 2018

Figure 19 Market (Value), By Type, 2019 & 2024

Figure 20 Market (Value), By Construction Method, 2019 & 2024

Figure 21 Market, By End-User, 2018

Figure 22 Regional Snapshot: Asia Pacific Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Market Size, By Region, 2019–2024

Figure 24 Market Share (Value), By Region, 2024

Figure 25 Asia Pacific: Regional Snapshot

Figure 26 Europe: Regional Snapshot

Figure 27 North America: Regional Snapshot

Figure 28 Key Developments in the Market, January 2016–August 2019

Figure 29 Market (Global) Competitive Leadership Mapping, 2018

Figure 30 Market Share, 2018

Figure 32 Exide Industries: Company Snapshot

Figure 35 Chaowei Power: Company Snapshot

Figure 37 HBL Power Systems: Company Snapshot

This study involved four major activities in estimating the current size of the lead acid battery market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation technique were done to estimate the market size of the segments and corresponding sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as North American Industry Classification System (NAICS)-data, U.S. vehicle registration statistics-data, Battery Association Of Japan-data, International Organization of Motor Vehicle Manufacturers-data, Industrial Technology Research Institute (ITRI) lead usage Industry Publications, several newspaper articles, Statista Industry Journal, Factiva, and, lead acid batteries journal, to identify and collect information useful for a technical, market-oriented, and commercial study of the lead acid battery market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The lead acid battery market comprise several stakeholders such as the companies related to the industry, such as, consulting companies in the battery storage technology sector, government & research organizations, investment organizations, forums, alliances & associations, battery storage solution providers, original equipment manufacturers (OEM), aftermarket solution providers, state & national utility authorities, battery recycle assemblers, Lead acid battery refurbishing companies, dealers & suppliers, and vendors. Its usage characterizes the demand side of this market by end-users like utilities, transportation sector, industries, such as data centers, telecom industries, oil & gas, chemical & pharmaceutical, food & beverage, etc., and the commercial & residential sector. Advancements characterize the supply side in battery manufacturing techniques by OEMs and refurbishing companies, manufacturing basic and advanced lead acid batteries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the lead acid battery market.

Report Objectives

- To define, describe, and forecast the global lead acid battery market by technology, type, construction method, end-user, and region

- To provide detailed information on the major factors influencing the growth of the lead acid battery (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the lead acid battery market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Lead Acid Battery Market