Hosted PBX Market by Offering (Solution and Services), Application (Unified Communication & Collaboration, Mobility, Contact Center), Vertical (BFSI, Retail & eCommerce, Manufacturing, Healthcare & Life Sciences) and Region - Global forecast to 2028

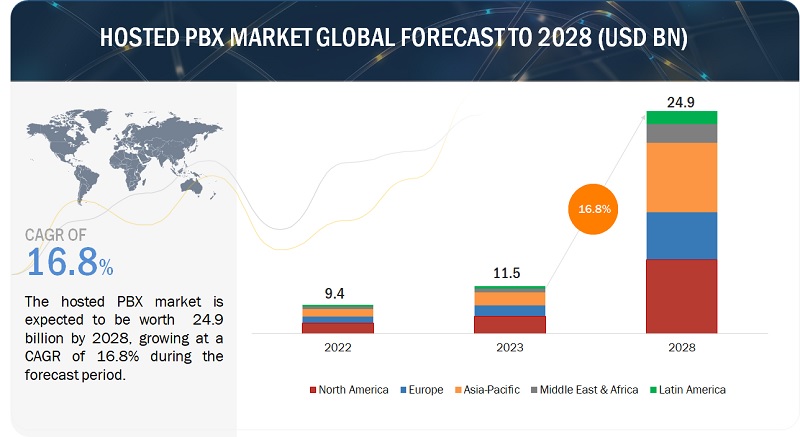

The global hosted PBX market size was estimated at USD 11.5 billion in 2023 and is projected to reach USD 24.9 billion by 2028, growing at a CAGR of 16.8% from 2023 to 2028. The exponential growth of the hosted PBX market is significantly propelled by its role in facilitating the paradigm shift toward remote work. Hosted PBX serves as a critical driver for this transformation by providing robust support for distributed workforces. As businesses increasingly embrace remote work models, hosted PBX emerges as the linchpin that enables employees to seamlessly access essential communication tools from any location. The inherent flexibility of hosted PBX proves indispensable for organizations navigating the challenges and opportunities presented by distributed or remote workforces. This capability addresses the evolving dynamics of the modern workplace, allowing businesses to transcend geographical constraints and fostering a collaborative environment irrespective of physical boundaries. The ability of hosted PBX to empower remote work not only enhances operational efficiency but also aligns with the changing preferences and needs of today's workforce. Consequently, the market for hosted PBX experiences substantial growth as businesses recognize its pivotal role in adapting to the flexible and decentralized nature of contemporary work arrangements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Hosted PBX Market Dynamics

Driver: Rising demand for enterprise mobility

The escalating demand for enterprise mobility, spurred by the surge in remote work and the essential need for business agility, has become a driving force behind the adoption of hosted PBX systems. In response to the evolving landscape of work, where employees are increasingly operating from diverse locations, hosted PBX emerges as a pivotal solution offering accessibility and flexibility. The system seamlessly supports remote workforces, enabling employees to engage in business communications effortlessly from any device with an internet connection. This adaptability not only ensures business continuity but also enhances mobile workforce productivity by providing mobile apps that facilitate efficient call management and voicemail access on smartphones. Moreover, the scalability and flexibility inherent in hosted PBX systems allow businesses to effortlessly adjust their communication infrastructure, catering to fluctuating workforce sizes and dynamic business requirements without the burden of upfront investments in hardware and software.

Beyond meeting the immediate needs of remote work, the adoption of hosted PBX is also driven by its ability to optimize costs. By eliminating the necessity for businesses to invest in, install, and maintain their own hardware and software, hosted PBX systems lead to significant cost savings. This cost-effectiveness is further underscored by the liberation of IT resources, allowing them to be allocated to critical tasks. Additionally, the integration capabilities of hosted PBX with various business applications foster enhanced collaboration among employees, creating a productive and efficient work environment. In conclusion, the rising demand for enterprise mobility has propelled the adoption of hosted PBX systems, offering a transformative solution that aligns with the dynamic needs of modern businesses in an increasingly mobile and agile work environment.

Restraint: Compatibility and Interoperability issues

Compatibility and interoperability issues emerge as significant restraints in the hosted PBX market, hindering seamless integration with existing enterprise systems. Many businesses already operate diverse communication and collaboration tools, and the challenge lies in ensuring that hosted PBX solutions align harmoniously with these varied platforms. The complexity arises when different vendors and technologies are involved, leading to compatibility issues that may impede the smooth functioning of hosted PBX systems within the broader IT infrastructure. Interoperability challenges also arise when attempting to integrate hosted PBX with legacy systems or specialized applications that may not readily support modern cloud-based communication solutions. Incompatibility between different versions of software, hardware, or communication protocols can further exacerbate these issues, making it challenging for organizations to achieve a cohesive and integrated communication environment. The lack of standardized protocols across various communication platforms and the evolving nature of technology contribute to these compatibility and interoperability concerns. Overcoming these challenges requires concerted efforts from service providers, vendors, and businesses to establish and adhere to industry standards, ensuring a more seamless integration of hosted PBX within the existing technology landscape. As organizations strive for unified and streamlined communication solutions, addressing compatibility and interoperability issues will be crucial for the widespread acceptance and successful implementation of hosted PBX systems.

Opportunity: WebRTC and 5G networks enhancing real-time communication

WebRTC, as an open-source project, stands as a pivotal driver in transforming real-time multimedia applications, offering a plug-in-free environment for voice calling, video chat, and file sharing within web browsers. This technology goes beyond traditional installations, allowing seamless integration into web applications, including Customer Relationship Management (CRM), thereby cultivating a more customer-centric experience. Through the deployment of a WebRTC gateway, telephony services, hosted PBX solutions, and cloud services are supported, enabling end-users to access SIP-based hosted PBX solutions and communicate with call centers directly within their primary web interface. Vendors benefit from cost efficiencies and improved user experiences by integrating video, messaging, and voice features seamlessly into any web-based service, granting users on-the-go access to communication services without specialized applications. In parallel, the advent of 5G networks brings a distinct dimension to real-time communication. The fifth generation of wireless technology promises higher data speeds, lower latency, and increased capacity, presenting a unique opportunity for enhancing hosted PBX systems. The convergence of WebRTC and 5G networks introduces a symbiotic relationship, where the efficiencies of WebRTC align with the advanced capabilities of 5G. This convergence opens new horizons for innovative applications and services, fostering a more responsive and immersive communication experience. Independently, WebRTC and 5G networks stand as powerful catalysts, each contributing to the evolution of real-time communication, and together, they present a formidable opportunity for advancing the capabilities and reach of hosted PBX solutions in the dynamic landscape of modern communication technologies.

Challenge: Growing concerns over Quality of Service (QoS)

The growing concerns over Quality of Service (QoS) present a significant challenge for hosted PBX systems. hosted PBX relies on internet connectivity to deliver voice and data services, and as the demand for high-quality communication increases, ensuring consistent and reliable QoS becomes paramount. The inherent dependency on network conditions is one technical aspect contributing to this challenge. hosted PBX systems are susceptible to latency, jitter, and packet loss, which can degrade voice quality and cause disruptions during calls. Implementing robust Quality of Service mechanisms, such as traffic prioritization and bandwidth management, is crucial to mitigate these issues. Optimizing codecs and employing error correction techniques are technical strategies that can enhance the overall QoS in hosted PBX environments. Furthermore, scalability introduces another layer of technical complexity in maintaining QoS for hosted PBX. As the number of users and concurrent calls increases, the network must efficiently handle the additional load without compromising performance. Advanced load balancing techniques, efficient routing algorithms, and redundant infrastructure are essential technical measures to manage scalability challenges. Monitoring and proactive management tools that provide real-time insights into network performance and call quality parameters become indispensable to address and rectify QoS issues promptly. In essence, a comprehensive and technically sound approach encompassing network optimization, traffic management , and scalability measures is essential to alleviate the growing concerns over Quality of Service in hosted PBX system.

Hosted PBX Market Ecosystem

Prominent players in this market include well-established, financially stable hosted PBX solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include RingCentral (US), AT&T (US), and Verizon (US) and so on.

"By application, Unified Communication and Collaboration segment to hold the largest market size during the forecast period.

The seamless integration of Unified Communications and Collaboration (UC&C) tools within hosted PBX solutions is a driving force behind the market's growth, enhancing collaboration and communication efficiency. hosted PBX providers commonly integrate a spectrum of tools and platforms, including video conferencing applications such as Zoom and Microsoft Teams, messaging platforms like Slack or Microsoft Teams chat, and file-sharing services such as Dropbox or Google Drive. By unifying access to these diverse communication channels, businesses can streamline workflows, enabling team members to collaborate in real time, regardless of geographical locations. This integration not only simplifies the user experience but also provides a consolidated environment where voice, video, messaging, and file sharing seamlessly converge. The ability to incorporate these widely used and essential collaboration tools positions hosted PBX solutions as indispensable for businesses seeking a comprehensive, integrated, and efficient communication infrastructure.

“Healthcare & life sciences segment is expected to have the fastest growth rate during the forecast period.”

Integrating automated communication capabilities within hosted PBX systems is a pivotal driver propelling the market's growth, particularly within the healthcare sector. hosted PBX empowers healthcare organizations to implement automated appointment reminders and scheduling systems, representing a transformative shift in patient engagement strategies. This feature not only enhances operational efficiency by reducing the administrative burden associated with manual appointment reminders but also plays a crucial role in mitigating no-show rates, a persistent challenge in healthcare settings. By leveraging automated communication, healthcare providers can proactively reach out to patients, offering timely reminders and facilitating convenient scheduling processes. This streamlines the patient experience and contributes significantly to better patient care management. The positive impact on appointment adherence fosters improved resource utilization within healthcare facilities. As a result, the integration of automated communication features into hosted PBX solutions aligns seamlessly with the evolving needs of healthcare organizations, positioning hosted PBX as an indispensable tool in driving operational excellence and patient satisfaction in the broader landscape of healthcare communication solutions.

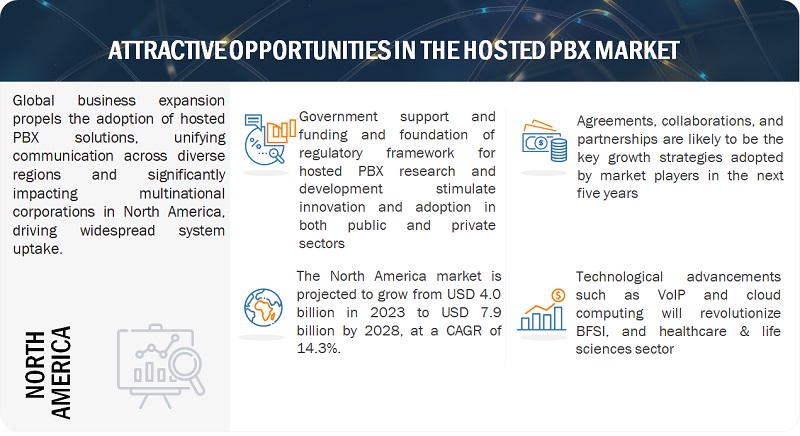

“North America to have the largest market size during the forecast period.”

The expansive and reliable presence of high-speed internet infrastructure throughout North America serves as a pivotal driver for the burgeoning growth of the hosted PBX market in the region. The robust availability of broadband plays a fundamental role in facilitating the seamless operation of cloud-based communication solutions, such as hosted PBX, thereby significantly enhancing the overall user experience. This widespread accessibility to high-speed internet ensures that businesses and individuals alike can harness the full potential of advanced communication technologies, contributing to the adoption and expansion of hosted PBX services. As North America continues to maintain a strong and pervasive broadband network, it establishes a solid foundation for the sustained growth and widespread integration of hosted PBX solutions, fostering a dynamic and thriving market landscape in the region.

Market Players:

The major players in the hosted PBX market are AT&T (US) , Verizon Communications (US), Cisco Systems (US), BT Group (US), RingCentral (US), Comcast Corporation (US), 8x8 (US), Sangoma Technologies (US), Lumen Technologies (US), Nextiva (US), Fusion Connect (US), Avaya (US), Mitel Networks (US), Lingo Telecom (US), TPx Communications (US), Telesystem (US), Ozonotel Communications (India), OneConnect (US), InterGlobe Communications (US), CloudTalk (US), Datavo (US), Nexge Technologies (US), NovoLink Communications (US), 3CX (Cpryus), AstraQom International (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their hosted PBX market footprint.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments Covered |

By offering (solution, services), application type (unified communication and collaboration, mobility, call center, other applications), vertical, and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

AT&T (US), Verizon Communications (US), Cisco Systems (US), BT Group (US), RingCentral (US), Comcast Corporation (US), 8x8 (US), Sangoma Technologies (US), Lumen Technologies (US), Nextiva (US), Fusion Connect (US), Avaya (US), Mitel Networks (US), Lingo Telecom (US), TPx Communications (US), Telesystem (US), Ozonotel Communications (India), OneConnect (US), InterGlobe Communications (US), CloudTalk (US), Datavo (US), Nexge Technologies (US), NovoLink Communications (US), 3CX (Cpryus), AstraQom International (US). |

This research report categorizes the hosted PBX market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

- Solution

-

Services

-

Professional Services

- Deployment & Integration

- Training, Support & Maintenance

- Managed Services

-

Professional Services

Based on application:

- Unified communication and collaboration

- Mobility

- Call center

- Other applications (application integration, analytics & reporting)

Based on Enterprise

- Banking, Financial Services, & Insurance (BFSI)

- Retail & eCommerce

- Healthcare & Life Sciences

- Manufacturing

- Telecom

- IT & ITeS

- Travel & hospitality

- Government & Public Sector

- Education

- Other Verticals (transportation & logistics and real estate)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- RestLatin of America

Recent Developments

- In October 2023, BT Group and Ring Central expanded its partnership to accelerate the adoption of cloud-based communications the support the digital transformation of businesses across the UK.

- In June 2023, Cisco and AT&T have collaborated to support businesses in expanding connectivity for an increasingly mobile-centric workforce. They have introduced innovative solutions to improve connectivity and revolutionize communication for hybrid work environments.

- In April 2022, Lumen Technologies partnered with Alianza, Inc. Under this collaboration, Lumen will leverage Alianza's cloud communications platform to enhance its voice services portfolio. This strategic alliance aims to offer customers robust and flexible business communication capabilities from any location.

- In January 2021, 8x8 and Verint Systems partnered to bring integrated cloud workforce management applications and cloud contact center to mid-market and enterprise businesses worldwide.

Frequently Asked Questions (FAQ):

What is the definition of the hosted PBX market?

The hosted Private Branch Exchange (PBX) market refers to the segment of the telecommunications industry that focuses on the delivery of cloud-based phone system solutions to businesses. In a hosted PBX model, the traditional on-premises PBX hardware and infrastructure are replaced by a cloud-based service provided by a third-party vendor. This cloud-based solution enables businesses to access and manage their telecommunication services, such as voice, video, messaging, and other collaboration features, over the internet. hosted PBX offers a range of benefits, including cost savings, scalability, and flexibility, as it eliminates the need for businesses to invest in and maintain physical phone system equipment on-site. Instead, the service provider manages and maintains the infrastructure remotely, ensuring that businesses can efficiently communicate and collaborate without the burden of handling the technical aspects of their telephony system.

What is the market size of the hosted PBX market?

The hosted PBX market is estimated at USD 11.46 billion in 2023 to USD 24.92 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 16.8 % from 2023 to 2028.

What are the major drivers in the hosted PBX market?

The major drivers in the hosted PBX market are the rising demand for enterprise mobility and the advancements in VoIP technology.

Who are the key companies operating in the hosted PBX market?

The key companies operating in the hosted PBX market are AT&T (US), Verizon Communications (US), Cisco Systems (US), BT Group (US), RingCentral (US), Comcast Corporation (US), 8x8 (US), Sangoma Technologies (US), Lumen Technologies (US), Nextiva (US), Fusion Connect (US), Avaya (US), Mitel Networks (US), Lingo Telecom (US), TPx Communications (US), Telesystem (US), Ozonotel Communications (India), OneConnect (US), InterGlobe Communications (US), CloudTalk (US), Datavo (US), Nexge Technologies (US), NovoLink Communications (US), 3CX (Cpryus), AstraQom International (US).

What are the key technology trends prevailing in the hosted PBX market?

The key technology trends in hosted PBX include VoIP, Virtualization, Cloud computing, Unified Communications. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for enterprise mobility- Advancements in VoIP technology- Increasing adoption of Unified Communication-as-a-Service (UCaaS)- Shift of organizations from capital expenditure (CAPEX) model to operating expense (OPEX) modelRESTRAINTS- Security and privacy concerns- Compatibility and interoperability issuesOPPORTUNITIES- WebRTC and 5G networks enhancing real-time communication- Upsurge in remote learningCHALLENGES- Growing concerns over Quality of Service (QoS)

-

5.3 BRIEF HISTORY OF HOSTED PBX TECHNOLOGY1990–20002001–20102011–20202021–PRESENT

-

5.4 ECOSYSTEM/MARKET MAP

-

5.5 CASE STUDY ANALYSISCASE STUDY 1: BREKEKE PBX MT EDITION SIMPLIFIED MULTI-TENANCY FOR COST-EFFECTIVE CUSTOMIZED TELEPHONYCASE STUDY 2: XORCOM’S SOLUTION HELPED IN UPGRADING ATTON EL TESORO HOTEL’S IP TELEPHONY SYSTEMCASE STUDY 3: VIRTUALPBX 300 PLAN TRANSFORMED TSELLC’S WORK DISTRIBUTION MODELCASE STUDY 4: VIRTUALPBX DASH PROVIDED MIND & MILL WITH SCALABLE AND EFFICIENT PHONE SYSTEM

-

5.6 VALUE CHAIN ANALYSISSERVICE PROVIDERSSOFTWARE/APPLICATION PROVIDERSINFRASTRUCTURE PROVIDERSCHANNEL PARTNERSEND-USE DEVICES

-

5.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Virtualization- VoIP- Cloud Computing- Unified Communications (UC)- Session Initiation Protocol (SIP)COMPLEMENTARY TECHNOLOGIES- Natural Language Processing (NLP)- Edge Computing- Interactive Voice Response (IVR)ADJACENT TECHNOLOGIES- 5G- Mobility

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY BILLING CYCLEINDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY FEATURE

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES & EVENTS, 2023–2024

-

5.15 BEST PRACTICES IN HOSTED PBX MARKETNETWORK ASSESSMENTQUALITY OF SERVICE (QOS) CONFIGURATIONSECURITY MEASURESREDUNDANCY AND HIGH AVAILABILITYBANDWIDTH MONITORING AND MANAGEMENTCODEC SELECTIONREGULAR BACKUPSEMPLOYEE TRAININGVOIP-COMPATIBLE HARDWAREREGULAR SYSTEM UPDATESMONITORING AND ANALYTICSSCALABILITY PLANNING

-

5.16 CURRENT AND EMERGING BUSINESS MODELSSUBSCRIPTION MODELCONSUMPTION-BASED MODELTIERED MODELFREEMIUM MODELWHITE-LABEL MODELHYBRID AND MULTI-CLOUD MODELSMANAGED SERVICES AND OUTSOURCINGPAY-AS-YOU-GROW

- 5.17 HOSTED PBX TOOLS, FRAMEWORKS, AND TECHNIQUES

-

5.18 FUTURE LANDSCAPE OF HOSTED PBX MARKETSHORT-TERM ROADMAP (2023–2025)MID-TERM ROADMAP (2026–2028)LONG-TERM ROADMAP (2029–2030)

-

5.19 HOSTED PBX ARCHITECTUREHOSTED PBX PROVIDERVOIP PHONEINTERNET

- 5.20 COMPARISON OF HOSTED PBX AND TRADITIONAL PBX

-

6.1 INTRODUCTIONOFFERINGS: MARKET DRIVERS

-

6.2 SOLUTIONNEED TO ENHANCE EFFICIENCY AND IMPROVE CUSTOMER EXPERIENCE AND ORGANIZATIONAL RESPONSIVENESS TO DRIVE MARKET

-

6.3 SERVICESPROFESSIONAL SERVICES- Deployment & Integration- Training, Support, and MaintenanceMANAGED SERVICES- Focus on streamlining and optimizing communication systems to fuel demand for hosted PBX managed services

-

7.1 INTRODUCTIONAPPLICATIONS: MARKET DRIVERS

-

7.2 UNIFIED COMMUNICATION & COLLABORATIONREAL-TIME COMMUNICATION- Availability of real-time communication tools and technologies to propel marketFILE SHARING- Need for simplifying and enhancing collaborative efforts to drive marketREMOTE COLLABORATION- Increased flexibility and responsiveness of hosted PBX systems to drive its use for remote collaborationFAX-ON-DEMAND- Need for rapid document exchanges and enhanced workflow to boost demand for fax-on-demand UC&C

-

7.3 MOBILITYNEED TO ENSURE SEAMLESS COMMUNICATION ACROSS DIVERSE LOCATIONS TO BOOST DEMAND FOR HOSTED PBX SOLUTIONS

-

7.4 CONTACT CENTERVIRTUAL ASSISTANCE & SUPPORT- Need for deploying automated systems to cater to routine customer queries and support needs to drive marketCALL ROUTING & QUEUEING- Need for management of incoming calls during peak hours to fuel demand for hosted PBX systems for call routing and queueingCALL RECORDING & MONITORING- Need for ensuring compliance adherence, quality assurance, and dispute resolution to boost demand for hosted PBX systems for call recording and monitoring

- 7.5 OTHER APPLICATIONS

-

8.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

8.2 BFSINEED FOR IMPROVED CUSTOMER SERVICE THROUGH STREAMLINED COMMUNICATION PROCESSES AND ENHANCED OPERATIONAL EFFICIENCY AND COST SAVINGS TO DRIVE MARKETUSE CASES- Customer Support and Service Center- Multi-location Connectivity

-

8.3 MANUFACTURINGFOCUS ON IMPROVED RESOURCE PLANNING AND STREAMLINED WORKFLOW TO DRIVE MARKETUSE CASES- Supply Chain Coordination- Remote Troubleshooting

-

8.4 RETAIL & ECOMMERCEHOSTED PBX TO SIMPLIFY COMMUNICATION PROCESSES AND ENSURE CUSTOMER INQUIRIES ARE HANDLED TIMELY AND ACCURATELYUSE CASES- Order Management and Support- Returns and Exchanges Coordination

-

8.5 HEALTHCARE & LIFE SCIENCESNEED FOR IMPROVING PATIENT ENGAGEMENT, AUTOMATED APPOINTMENT SCHEDULING, INTELLIGENT CALL ROUTING, AND PRIORITIZATION OF EMERGENCY CALLS TO DRIVE MARKETUSE CASES- Automated Appointment Scheduling- Virtual Health Assistants

-

8.6 IT & ITESSHIFT FROM TRADITIONAL, COMPLEX CONTACT CENTER SETUPS TO DIGITALIZED VOICE SOLUTIONS AND ADOPTION OF ‘WFH’ MODEL TO DRIVE MARKETUSE CASES- Smart Outbound Call Connectivity- Flexible Deployment Options

-

8.7 EDUCATIONHOSTED PBX TO ENABLE SEAMLESS BROADCASTING THROUGH CAMPUSES AND HELP ADMINISTRATORS MANAGE CONFIGURATIONS FROM ANYWHEREUSE CASES- Zoned Public Announcements- Dialing Restrictions for Classroom Phone

-

8.8 GOVERNMENT & PUBLIC SECTORDELIVERY OF MULTILINGUAL ANNOUNCEMENTS AND RELIABLE COMMUNICATION INFRASTRUCTURE DURING EMERGENCY SITUATIONS TO DRIVE MARKETUSE CASES- Secure and Reliable Communication During Disasters- Integration with Safety Measures and Alerts

-

8.9 TELECOMNEED FOR COST-SAVINGS, IMPROVED VOIP TECHNOLOGY, AND SEAMLESS INTEGRATION WITH VARIOUS ENDPOINTS TO PROPEL MARKETUSE CASES- Competitive Total Cost of Ownership- Rapid Installation and Maintenance

-

8.10 TRAVEL & HOSPITALITYVIRTUAL VOICE ASSISTANCE AND SEAMLESS CHECK-IN AND CHECK-OUT MECHANISMS TO FUEL DEMAND FOR HOSTED PBXUSE CASES- Virtual Voice Assistant for Guest Inquiries- Real-time Room Booking and Reservations

-

8.11 OTHER VERTICALSUSE CASES- GPS-enabled Routing and Tracking- Mobile Accessibility for On-the-Go Operation- Automated Property Updates via SMS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- High level of technological awareness and presence of several CSPs to drive marketCANADA- Cloud Adoption Strategy, cloud-friendly policies, burgeoning VoIP sector, and improved communication infrastructure to propel market

-

9.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- High demand for flexible and scalable communication services and presence of major players to drive marketGERMANY- Strong connectivity infrastructure, shift toward remote work, and initiatives such as ‘Cloud Strategy’ to drive marketITALY- Implementation of strategic initiatives and ‘Cloud-First’ policy, regulatory support, and digitalization strategies to propel marketFRANCE- Telecommunication initiatives, government support, and strategic investments to fuel demand for hosted PBX solutionsSPAIN- National Cloud Services Strategy for Public Administrations to prioritize use of cloud technologies in public administrationsREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Robust existing infrastructure, presence of many vendors, and stable economy to drive marketINDIA- Implementation of ‘Digital India’ initiative and other strategic policies to boost demand for hosted PBX solutionsJAPAN- Government's focus on technological advancements and popularity of UCC solutions to propel marketAUSTRALIA & NEW ZEALAND- Rise in remote and hybrid work models and businesses prioritizing collaborative technologies to drive marketSOUTH KOREA- Presence of tech giants and investment from major companies to fuel demand for hosted PBX solutionsSOUTHEAST ASIA- Focus on digital transformation, cloud adoption, and improvement of government ICT infrastructure to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC COUNTRIES- UAE- KSA- Rest of GCC CountriesSOUTH AFRICA- Advancements in cloud and developments by major players to fuel demand for hosted PBX solutionsREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rising spending on IT & telecommunications sector and focus on ‘National Strategy for Connected Schools’ to drive marketMEXICO- Improved connectivity and government’s collaboration with major players to fuel demand for hosted PBX marketREST OF LATIN AMERICA

- 10.1 INTRODUCTION

-

10.2 KEY PLAYER STRATEGIES/RIGHT TO WINOVERVIEW OF STRATEGIES ADOPTED BY KEY HOSTED PBX PROVIDERS

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

10.8 HOSTED PBX PRODUCT BENCHMARKINGPROMINENT HOSTED PBX- AT&T Office@Hand- RingCentral Cloud PBX Phone system- 3CX Phone System- Nextiva Cloud PBX

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY HOSTED PBX PROVIDERS

-

11.1 KEY PLAYERSAT&T INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERIZON COMMUNICATIONS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO SYSTEMS INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBT GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRINGCENTRAL, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMCAST CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments8X8, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSANGOMA TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsLUMEN TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsNEXTIVA, INC.FUSION CONNECT, INC.AVAYAMITEL NETWORKS CORPORATIONTPX COMMUNICATIONSTELESYSTEM

-

11.2 START-UPS/SMESOZONETEL COMMUNICATIONSLINGO TELECOM, LLCONECONNECTINTERGLOBE COMMUNICATIONS, INC.CLOUDTALKDATAVONEXGE TECHNOLOGIESNOVOLINK COMMUNICATIONS, INC.3CXASTRAQOM

-

12.1 INTRODUCTION TO ADJACENT MARKETSUNIFIED COMMUNICATION AND COLLABORATION MARKET- Market definition- Market overview- Unified Communication and Collaboration market, by component- Unified Communication and Collaboration market, by deployment mode- Unified Communication and Collaboration market, by vertical- Unified Communication and Collaboration market, by regionCOMMUNICATION PLATFORM-AS-A-SERVICE MARKET- Market overview- Communication platform-as-a-service market, by component- Communication platform-as-a-service market, by vertical- Communication platform-as-a-service market, by region

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 RISK ASSESSMENT

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 HOSTED PBX MARKET: ECOSYSTEM

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY BILLING CYCLE (USD)

- TABLE 10 INDICATIVE PRICING ANALYSIS OF HOSTED PBX SOLUTIONS, BY FEATURE (USD)

- TABLE 11 HOSTED PBX MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 15 HOSTED PBX MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 16 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 17 SOLUTION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 SOLUTION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 HOSTED PBX MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 22 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 HOSTED PBX MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 34 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 UNIFIED COMMUNICATION & COLLABORATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 UNIFIED COMMUNICATION & COLLABORATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MOBILITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 MOBILITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 CONTACT CENTER: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 CONTACT CENTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 HOSTED PBX MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 44 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 45 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 RETAIL & ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 IT & ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 OTHER VERTICALS: HOSTED PBX MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 HOSTED PBX MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: HOSTED PBX MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 79 US: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 80 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 81 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 83 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 84 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 85 US: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 88 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 90 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 93 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 94 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 96 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 98 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 100 EUROPE: HOSTED PBX MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 112 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 113 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 114 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 115 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 116 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 117 UK: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 118 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 120 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 121 ITALY: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 122 ITALY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 123 ITALY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 124 ITALY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 125 ITALY: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 126 ITALY: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 127 ITALY: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 128 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 ITALY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 130 ITALY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HOSTED PBX MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 CHINA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 144 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 145 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 146 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 147 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 148 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 150 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 152 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HOSTED PBX MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 KSA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 168 KSA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 KSA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 170 KSA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 171 KSA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 172 KSA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 173 KSA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 174 KSA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 KSA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 176 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: HOSTED PBX MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 189 BRAZIL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 190 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 191 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 192 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 194 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 195 BRAZIL: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 196 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 198 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 199 MARKET: DEGREE OF COMPETITION

- TABLE 200 OVERALL COMPANY FOOTPRINT

- TABLE 201 OFFERING FOOTPRINT

- TABLE 202 APPLICATION FOOTPRINT

- TABLE 203 REGION FOOTPRINT

- TABLE 204 DETAILED LIST OF START-UPS/SMES

- TABLE 205 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 206 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 207 MARKET: PRODUCT LAUNCHES, JANUARY 2021–DECEMBER 2023

- TABLE 208 MARKET: DEALS, JANUARY 2021–SEPTEMBER 2023

- TABLE 209 COMPARATIVE ANALYSIS OF PROMINENT HOSTED PBX VENDORS

- TABLE 210 AT&T INC: COMPANY OVERVIEW

- TABLE 211 AT&T INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 AT&T INC: DEALS

- TABLE 213 VERIZON COMMUNICATIONS INC.: COMPANY OVERVIEW

- TABLE 214 VERIZON COMMUNICATIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 VERIZON COMMUNICATIONS INC.: DEALS

- TABLE 216 CISCO SYSTEMS INC: COMPANY OVERVIEW

- TABLE 217 CISCO SYSTEMS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 CISCO SYSTEMS INC: PRODUCT LAUNCHES/UPDATES

- TABLE 219 CISCO SYSTEMS INC: DEALS

- TABLE 220 BT GROUP: COMPANY OVERVIEW

- TABLE 221 BT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 BT GROUP: PRODUCT LAUNCHES/UPDATES

- TABLE 223 BT GROUP: DEALS

- TABLE 224 RINGCENTRAL, INC.: COMPANY OVERVIEW

- TABLE 225 RINGCENTRAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 RINGCENTRAL, INC.: PRODUCT LAUNCHES/UPDATES

- TABLE 227 RINGCENTRAL, INC.: DEALS

- TABLE 228 COMCAST CORPORATION: COMPANY OVERVIEW

- TABLE 229 COMCAST CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 COMCAST CORPORATION: DEALS

- TABLE 231 8X8, INC.: COMPANY OVERVIEW

- TABLE 232 8X8, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 8X8, INC.: DEALS

- TABLE 234 SANGOMA TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 235 SANGOMA TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 236 SANGOMA TECHNOLOGIES CORPORATION: DEALS

- TABLE 237 LUMEN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 238 LUMEN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 LUMEN TECHNOLOGIES: DEALS

- TABLE 240 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 241 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 242 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 243 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 244 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 245 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 246 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 247 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 248 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 249 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 250 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 251 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 252 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 253 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 254 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 255 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 256 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 257 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 258 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 259 COMMUNICATION PLATFORM-AS-A-SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 HOSTED PBX MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 HOSTED PBX MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REGIONAL SPENDING OF HOSTED PBX MARKET

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 8 HOSTED PBX MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 9 HOSTED PBX MARKET: REGIONAL SNAPSHOT

- FIGURE 10 INCREASING DEMAND FOR ENTERPRISE MOBILITY TO DRIVE MARKET

- FIGURE 11 HOSTED PBX MARKET: SEGMENTS WITH SIGNIFICANT GROWTH RATE IN 2023

- FIGURE 12 UNIFIED COMMUNICATION AND COLLABORATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 SERVICES SEGMENT TO ACCOUNT FOR HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SOLUTIONS AND BFSI SEGMENTS TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HOSTED PBX MARKET

- FIGURE 17 BRIEF HISTORY OF HOSTED PBX TECHNOLOGY

- FIGURE 18 HOSTED PBX: ECOSYSTEM

- FIGURE 19 HOSTED PBX MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 LIST OF MAJOR PATENTS

- FIGURE 21 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY BILLING CYCLE

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 CONTACT CENTER SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 32 HOSTED PBX MARKET SHARE ANALYSIS, 2022

- FIGURE 33 MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 34 HOSTED PBX MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 35 VALUATION AND FINANCIAL METRICS OF KEY HOSTED PBX VENDORS

- FIGURE 36 AT&T INC: COMPANY SNAPSHOT

- FIGURE 37 VERIZON COMMUNICATIONS INC.: COMPANY SNAPSHOT

- FIGURE 38 CISCO SYSTEMS INC: COMPANY SNAPSHOT

- FIGURE 39 BT GROUP: COMPANY SNAPSHOT

- FIGURE 40 RINGCENTRAL, INC.: COMPANY SNAPSHOT

- FIGURE 41 COMCAST CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 8X8, INC.: COMPANY SNAPSHOT

- FIGURE 43 SANGOMA TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

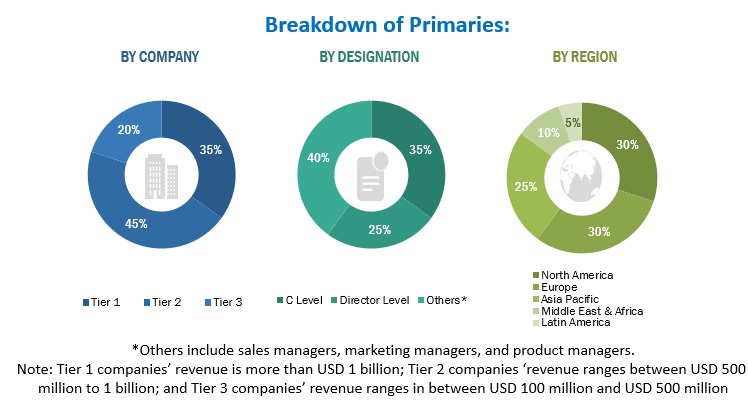

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the hosted PBX market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering hosted PBX solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the hosted PBX market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as International Journal of Innovative Science and Research Technology (IJIS), Xaas Journal, International Journal of Wireless and Mobile Computing (IJWMC) have been referred to for identifying and collecting information for this study on the market. The secondary sources included annual reports, press releases investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from hosted PBX solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using hosted PBX solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of hosted PBX solutions which would impact the overall hosted PBX market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the hosted PBX market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of hosted PBX offerings.

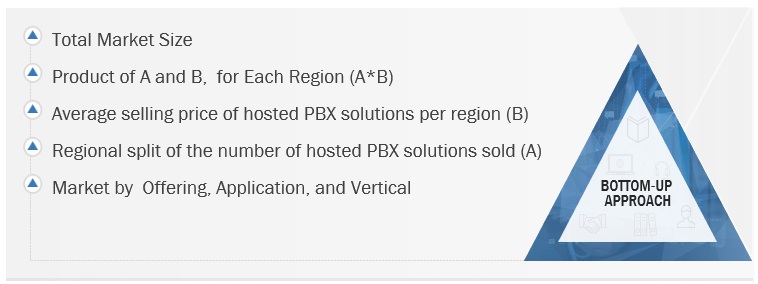

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hosted PBX market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Hosted PBX Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Hosted PBX Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the hosted PBX market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The hosted PBX (Private Branch Exchange) market is a segment within the telecommunications industry that revolves around the delivery of cloud-based communication solutions for businesses. In the traditional sense, a PBX system manages an organization's internal phone network, facilitating seamless communication among employees. hosted PBX, however, introduces a transformative paradigm by outsourcing the entire telephony infrastructure to third-party service providers. In this model, the PBX system is not housed on-site but is instead hosted in the cloud. This cloud-based approach enables businesses to access a comprehensive suite of telecommunication features without the need for significant upfront investments in physical hardware. Companies subscribing to hosted PBX services can enjoy a wide range of functionalities, including voicemail, call forwarding, conferencing, and more, all of which are scalable and customizable to meet specific organizational needs. The market has gained momentum due to its inherent advantages, such as cost-effectiveness, scalability, and flexibility, making it particularly appealing to businesses of various sizes and industries. hosted PBX providers handle the complexities of maintenance, updates, and upgrades, reducing the burden on in-house IT teams and ensuring that organizations have access to the latest features and security enhancements. As businesses increasingly seek modern, streamlined communication solutions, the hosted PBX market continues to play a pivotal role in reshaping how organizations approach and manage their telecommunication infrastructure.

Key Stakeholders

- Hosted PBX providers

- Government organizations, forums, alliances, and associations

- Consulting service providers

- Value-added resellers (VARs)

- End users

- System integrators

- Research organizations

- Consulting companies

Report Objectives

- To determine and forecast the global hosted PBX market by offering (solution, services), application type (unified communication and collaboration, mobility, call center), vertical, and region from 2023 to 2038, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the hosted PBX market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hosted PBX Market