Glycolic Acid Market by Grade (Cosmetic, Technical), Application (Personal Care & Dermatology, Industrial, Household) and Region (Asia Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2027

Updated on : September 02, 2025

Glycolic Acid Market

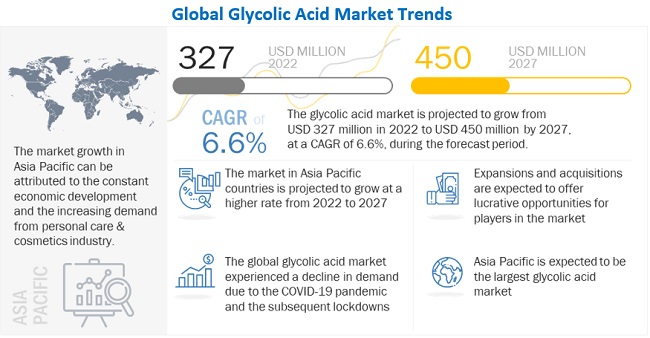

The global glycolic acid market was valued at USD 327 million in 2022 and is projected to reach USD 450 million by 2027, growing at 6.6% cagr from 2022 to 2027. Glycolic acid is a type of alpha hydroxyl acid (AHA) derived from natural or synthetic routes. It is widely used in differing purities for chemical peels, anti-aging creams, hair care, skincare creams, and other applications. Owing to the increasing demand from end-use applications, it is expected that the global glycolic acid market will have a significant potential for growth in near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Glycolic Acid Market Dynamics

Driver: Growing demand for glycolic acid in cosmetics industry

The growing demand for glycolic acid in the cosmetic industry and personal care products, specifically as a preferred ingredient in anti-aging, anti-pollution, and over-the-counter skin care products, will continue driving the market. Its unmatched ability to quickly and effectively penetrate the skin, owing to its small molecular structure, helps to fight many negative effects of pollution and other anti-aging problems by cleansing and exfoliating the dead skin layers. The use of glycolic acid in anti-aging and anti-pollution skincare creams, facial cleansers, gels, and scrubs reduces acne breakouts, hyperpigmentation, fine lines, scars, and other age-related skin marks or spots. Apart from these factors, the increasing demand for glycolic acid-based over-the-counter skin care products (creams, toners, and masks) and the growing market for keratolytic agents due to increasing dermatological conditions are further expected to drive the glycolic acid market. Glycolic acid is the most commonly used keratolytic agent to treat skin conditions, owing to its ability to soften keratin, the key structural component of the skin. The growing popularity of natural personal and cosmetic products is also among the key drivers of the glycolic acid market.

Restraint: Glycolic acid-based cosmetic products cause skin problems

Glycolic acid is a water-based alpha hydroxy acid, most used as a chemical ingredient in the formulation of different cosmetics and personal care products. The organic nature and high exfoliation property of glycolic acid make it a preferred ingredient for skincare and haircare products. However, skin damage can be a major disadvantage or restraint for market growth. Glycolic acid is generally recommended to be used with a layer of sunscreen cream and in accurate proportion, failing to do so can cause severe skin damage and other problems. Stinging and burning of skin are the most common issues related to the use of glycolic acid, irrespective of its concentration. In addition, temporary and/or longer-lasting redness, crusting, scabbing, dryness, flaking, and peeling of the skin are some of the major issues faced by users, based on the concentration of glycolic acid used in the product. Apart from these, change in skin color is also one of the rare but serious issues related to its usage. The skin may temporarily have a shade lighter or darker in this case. These issues may arise if the concentration of glycolic acid is too high, or if it remains on the skin for too long. As glycolic acid has properties to exfoliate the topmost layers of dead skin and penetrate deep inside the skin layer, its precise concentration is of utmost importance. It is generally found in concentrations from 5 to 30%; with higher concentrations, the solution becomes more potent. Thus, while using the glycolic acid solution as an ingredient in cosmetic products, the manufacturer needs to focus on the concentration of the solution.

Opportunity: Growing demand for biodegradable polymers to increase glycolic acid consumption

Biodegradable polymers are used to provide temporary support to the body with the ability to breakdown within a limited period. Polyglycolic acid, prepared through ring polymerization of glycolide, a diester of glycolic acid, is the most common biodegradable polymer used in the medical industry. Excellent degradation behavior and low toxicity are some of the major factors making it an ideal biodegradable polymer for biomedical devices and tissue engineering applications. The expected huge demand for polyglycolic acid-based biodegradable polymers, especially in resorbable sutures, surgical fixation devices, and drug delivery devices, will provide major opportunities to glycolic acid manufacturers. The Chemours Company, a leading player in the glycolic acid market, has already catered to the market demand for biodegradable polymers with the launch of its new glycolic acid under the brand name Glypure. Resorbable polymer sutures are expecting a huge demand, owing to increasing use in surgical procedures related to the nervous system, respiratory system, and cardiovascular system.

Challenges: Stringent regulations regarding usage of glycolic acid

Glycolic acid is one of the most regulated industries. Regulations regarding the usage of glycolic acid differ with different applications, and complying with each of them is a major challenge for manufacturers of glycolic acid-based products. For example, glycolic acid has to be registered with the Center for Food Safety and Applied Nutrition (CFSAN), a branch of the US Food & Drug Administration, to be used in cosmetic and personal care products. For veterinary hygiene disinfectants and food & feed area disinfectant applications, glycolic acid has to be registered with European Chemical Authority (ECHA). In addition, this alpha hydroxy acid (glycolic acid) has also to comply with Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) and the United States Environmental Protection Agency (EPA) to be used in different industrial and household applications. Thus, due to the compliance requirement of all these regulations, the production process of glycolic acid requires additional time. This factor acts as a major challenge for glycolic acid manufacturers as well as its users.

Cosmetic grade is the fasted growing grade segment of the glycolic acid market

On the basis of grade, the market is segmented into cosmetic grade and technical grade. Because of its high transparency, which is similar to that of glass, amorphous PET is utilized in the manufacture of bottles and packaging. The cosmetic grade glycolic acid is an aqueous solution or crystalline powder with a concentration ranging from 10–99% purity level. It is a highly used and preferred grade of glycolic acid due to its unmatched and excellent performance in the field of anti-aging and anti-pollution skin treatments. The use of cosmetic grade glycolic acid in different skincare creams and lotions as an active ingredient helps in reducing the effects of fine lines, irregular pigmentation, age spots, and enlarged pores., it is also highly used in skin peel products due to its supreme quality of exfoliating the stratum corneum (the outer layer of skin), which helps in dead skin removal and rejuvenation.

Personal Care & Dermatology is the largest application segment of the glycolic acid market

The personal care & dermatology application segment led the market in terms of both value and volume. It is used in various personal care & dermatology applications owing to its superb exfoliation and hydration properties. Its small molecules help the solution to deeply penetrate the skin and treat it from within, which makes it ideal for skin care creams for acne removal, hyperpigmentation, anti-aging, and anti-pollution. Glycolic acid is used in chemical peels, moisturizers, shampoos, and other products.

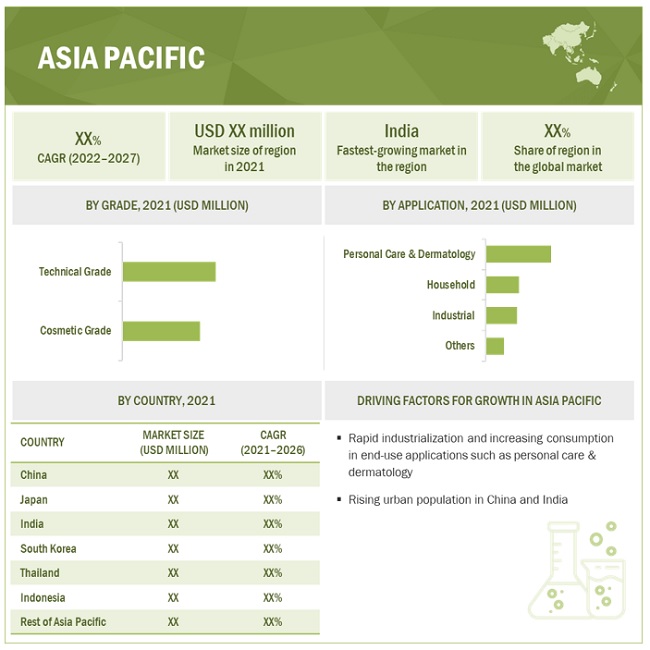

Asia Pacific is the largest market for glycolic acid market

The Asia Pacific region is projected to be the largest market, in terms of value. Asia Pacific is also expected to grow at the highest CAGR during the forecast period. The increasing per capita spending on cosmetic products, along with the huge demand for effective and innovative skincare and haircare products, will drive the glycolic acid market. There is huge consumption of glycolic acid in anti-aging products owing to the growing old age population in China, Japan, South Korea, and other countries will positively impact the market.

To know about the assumptions considered for the study, download the pdf brochure

Glycolic Acid Market Ecosystem

Glycolic Acid Market Players

The Chemours Company (US), China Petrochemical Corporation (China), CABB Group GmbH (Germany), Zhonglan Industry Co., Ltd. (China), Water Chemical Co., Ltd (China) are the key players operating in the glycolic acid market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, and new product development are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to glycolic acid from emerging economies.

Glycolic Acid Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Purity, Grade, Application and Region |

|

Regions |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies |

The Chemours Company (US), China Petrochemical Corporation (China), CABB Group GmbH (Germany), Zhonglan Industry Co., Ltd. (China), Water Chemical Co., Ltd (China) |

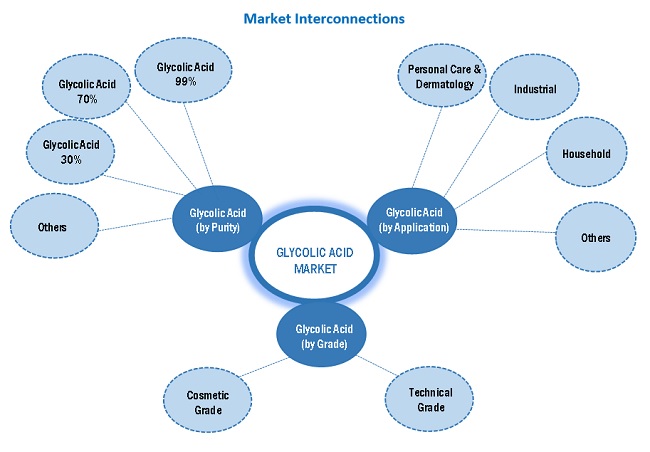

This research report categorizes the glycolic acid market based on Purity, Grade, Application and Region.

By Grade:

- Cosmetic Grade

- Technical Grade

By Application:

- Personal Care & Dermatology

- Industrial

- Household

- Others

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In July 2019, Hefei TNJ Chemical Industry Co., Ltd expanded its market in Cosmetics materials in Seoul, South Korea.

- In November 2021, The Chemours Company launched a new glycolic acid product under the brand name Glyclean D. The new product is used as a disinfectant for various household and institutional cleaning applications.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the glycolic acid market?

Rise in demand for glycolic acid from emerging economies and growing demand from personal care & dermatology, industrial and household applications are hot bets for the market.

What are the market dynamics for the different grades of glycolic acid?

On the basis of grade, the market is segmented into cosmetic grade and technical grade. They are used in anti-aging creams, industrial cleaners, and medical sutures.

What are the market dynamics for the different applications of glycolic acid?

On the basis of application, the market is segmented into personal care & dermatology, industrial household, and others. The personal care & dermatology application segment led the market in terms of both value and volume. There is increasing demand for glycolic acid as a keratolytic agent for treating dermatological diseases.

Who are the major manufacturers of the glycolic acid market?

The Chemours Company (US), China Petrochemical Corporation (China), CABB Group GmbH (Germany), Zhonglan Industry Co., Ltd. (China), Water Chemical Co., Ltd (China) are the key players operating in the glycolic acid market.

What are the major factors which will impact market growth during the forecast period?

Stringent regulations will be a restraint to the growth of the market during the forecast period. Regulations regarding the usage of glycolic acid differ with different applications, and complying with each of them is a major challenge for manufacturers of glycolic acid-based products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 GLYCOLIC ACID MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.3.2 REGIONAL SCOPE

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 GLYCOLIC ACID MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 7 GLYCOLIC ACID MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 TECHNICAL GRADE TO BE LARGER MARKET DURING FORECAST PERIOD

FIGURE 9 PERSONAL CARE & DERMATOLOGY TO BE FASTEST-GROWING APPLICATION SEGMENT

FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING GLYCOLIC ACID MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ASIA PACIFIC TO SHOW HIGHER GROWTH RATE DUE TO CONSTANT ECONOMIC DEVELOPMENT AND INCREASING END-USE APPLICATIONS

FIGURE 11 INCREASING DEMAND FROM PERSONAL CARE & COSMETICS INDUSTRY TO DRIVE DEMAND FOR GLYCOLIC ACID

4.2 GLYCOLIC ACID MARKET, BY GRADE

FIGURE 12 COSMETIC GRADE TO BE FASTER-GROWING SEGMENT

4.3 GLYCOLIC ACID MARKET, BY APPLICATION

FIGURE 13 PERSONAL CARE & DERMATOLOGY APPLICATION SEGMENT TO LEAD GLYCOLIC ACID MARKET

4.4 GLYCOLIC ACID MARKET, BY REGION AND APPLICATION

FIGURE 14 ASIA PACIFIC AND PERSONAL CARE & DERMATOLOGY LED THEIR RESPECTIVE SEGMENTS IN GLYCOLIC ACID MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GLYCOLIC ACID MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for glycolic acid in cosmetics industry

5.2.1.2 Increasing glycolic acid consumption in varied applications

5.2.2 RESTRAINTS

5.2.2.1 Glycolic acid-based cosmetic products cause skin problems

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for biodegradable polymers to increase glycolic acid consumption

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations regarding usage of glycolic acid

6 INDUSTRY TRENDS (Page No. - 46)

6.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 GLYCOLIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 1 GLYCOLIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 THREAT OF NEW ENTRANTS

6.1.3 THREAT OF SUBSTITUTES

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 MACROECONOMIC INDICATORS

6.3 PERSONAL CARE SECTOR REVENUE

TABLE 2 TRENDS AND FORECAST OF PERSONAL CARE SECTOR REVENUE, 2017–2023 (USD MILLION)

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 17 GLYCOLIC ACID, SUPPLY CHAIN

6.4.1 RAW MATERIAL MANUFACTURERS

6.4.1.1 Prominent companies

6.4.1.2 Small & medium-sized enterprises

6.4.2 APPLICATION INDUSTRIES

6.5 ECOSYSTEM MAPPING

FIGURE 18 GLYCOLIC ACID MARKET: ECOSYSTEM MAP

6.6 TECHNOLOGY ANALYSIS

6.7 CASE STUDY ANALYSIS

6.8 PRICING ANALYSIS

TABLE 3 AVERAGE PRICE OF GLYCOLIC ACID (USD/KG)

6.9 TRADE ANALYSIS

TABLE 4 IMPORT TRADE DATA FOR GLYCEROL, CRUDE; GLYCEROL WATERS AND GLYCEROL IYES (USD MILLION)

TABLE 5 EXPORT TRADE DATA FOR GLYCEROL, CRUDE; GLYCEROL WATERS, AND GLYCEROL IYES (USD MILLION)

6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 19 GLYCOLIC ACID MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

6.11 PATENT ANALYSIS

6.11.1 INTRODUCTION

6.11.2 METHODOLOGY

6.11.3 DOCUMENT TYPE

TABLE 6 TOTAL NUMBER OF PATENTS

FIGURE 20 TOTAL NUMBER OF PATENTS

6.11.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 21 NUMBER OF PATENTS YEAR-WISE, FROM 2011 TO 2021

6.11.5 INSIGHTS

6.11.6 LEGAL STATUS OF PATENTS

FIGURE 22 PATENT ANALYSIS, BY LEGAL STATUS

6.11.7 JURISDICTION ANALYSIS

FIGURE 23 TOP JURISDICTION – BY DOCUMENT

6.11.8 TOP COMPANIES/APPLICANTS

FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

6.11.8.1 List of patents

TABLE 7 LIST OF PATENTS BY KUREHA CORPORATION

TABLE 8 LIST OF PATENTS BY METABOLIC EXPLORER SA

TABLE 9 LIST OF PATENTS BY DUPONT

6.11.8.2 Top 10 patent owners (US) in last 10 years

TABLE 10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 11 GLYCOLIC ACID MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.13 TARIFF AND REGULATIONS: REGULATORY ANALYSIS

6.13.1 OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION (OSHA) STANDARDS FOR CEMENT AND CONCRETE

6.13.2 EUROPEAN UNION STANDARDS FOR GLYCOLIC ACID

6.13.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

7 GLYCOLIC ACID MARKET, BY PURITY (Page No. - 64)

7.1 INTRODUCTION

7.2 GLYCOLIC ACID 99%

7.2.1 HUGE DEMAND FOR GLYCOLIC ACID 99% IN MEDICAL APPLICATION TO BOOST MARKET GROWTH

7.3 GLYCOLIC ACID 70%

7.3.1 INCREASING USE IN DERMATOLOGY AND INDUSTRIAL CLEANING APPLICATIONS

7.4 GLYCOLIC ACID 30%

7.4.1 DEMAND FOR GLYCOLIC ACID 30% FOR SKIN PEEL APPLICATION TO INCREASE

7.5 OTHERS

7.5.1 GLYCOLIC ACID 60%

7.5.2 GLYCOLIC ACID 57%

8 GLYCOLIC ACID MARKET, BY GRADE (Page No. - 66)

8.1 INTRODUCTION

FIGURE 25 TECHNICAL GRADE TO LEAD GLYCOLIC ACID MARKET

TABLE 13 GLYCOLIC ACID MARKET SIZE, BY GRADE, 2016–2019 (USD MILLION)

TABLE 14 GLYCOLIC ACID MARKET SIZE, BY GRADE, 2016–2019 (KILOTON)

TABLE 15 GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 16 GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

8.2 COSMETIC GRADE

8.2.1 DEMAND FOR SKINCARE CREAMS OWING TO ADVERSE CLIMATIC CONDITIONS AND GROWING OLD AGE POPULATION DRIVING SEGMENT

8.3 TECHNICAL GRADE

8.3.1 INCREASING CONSUMPTION OF GLYCOLIC ACID IN INDUSTRIAL CLEANING APPLICATION IS DRIVING SEGMENT

9 GLYCOLIC ACID MARKET, BY APPLICATION (Page No. - 70)

9.1 INTRODUCTION

FIGURE 26 PERSONAL CARE & DERMATOLOGY APPLICATION TO LEAD GLYCOLIC ACID MARKET

TABLE 17 GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 18 GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 19 GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 20 GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9.2 PERSONAL CARE & DERMATOLOGY

9.2.1 GROWING DEMAND FOR ANTI-AGING AND ANTI-POLLUTION PRODUCTS TO DRIVE MARKET

TABLE 21 GLYCOLIC ACID MARKET SIZE IN PERSONAL CARE & DERMATOLOGY, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 GLYCOLIC ACID MARKET SIZE IN PERSONAL CARE & DERMATOLOGY, BY REGION, 2020–2027 (KILOTON)

9.3 INDUSTRIAL

9.3.1 CONSUMPTION OF GLYCOLIC ACID INCREASING IN INDUSTRIAL CLEANING APPLICATION

TABLE 23 GLYCOLIC ACID MARKET SIZE IN INDUSTRIAL, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 GLYCOLIC ACID MARKET SIZE IN INDUSTRIAL, BY REGION, 2020–2027 (KILOTON)

9.4 HOUSEHOLD

9.4.1 DEMAND FOR EFFECTIVE AND EFFICIENT HOUSEHOLD CLEANERS WITH ANTIMICROBIAL PROPERTIES DRIVING MARKET

TABLE 25 GLYCOLIC ACID MARKET SIZE IN HOUSEHOLD, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 GLYCOLIC ACID MARKET SIZE IN HOUSEHOLD, BY REGION, 2020–2027 (KILOTON)

9.5 OTHERS

9.5.1 DYEING & TANNING

9.5.2 ADHESIVE

9.5.3 AGRICULTURE

9.5.4 MEDICAL

9.5.5 FOOD

TABLE 27 GLYCOLIC ACID MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 GLYCOLIC ACID MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (KILOTON)

10 GLYCOLIC ACID MARKET, BY REGION (Page No. - 78)

10.1 INTRODUCTION

FIGURE 27 REGIONAL SNAPSHOT: ASIA PACIFIC TO BE FASTEST-GROWING MARKET

TABLE 29 GLYCOLIC ACID MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 GLYCOLIC ACID MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: GLYCOLIC ACID MARKET SNAPSHOT

TABLE 31 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 33 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 35 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 36 ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.1 CHINA

10.2.1.1 Significant government support and presence of strong manufacturing base to accelerate demand for glycolic acid

TABLE 37 CHINA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 38 CHINA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 39 CHINA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 40 CHINA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.2 JAPAN

10.2.2.1 Presence of major cosmetic and manufacturing industries driving glycolic acid market

TABLE 41 JAPAN: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 42 JAPAN: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 43 JAPAN: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 JAPAN: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.3 INDIA

10.2.3.1 Significantly growing economy to influence end-use industries of glycolic acid

TABLE 45 INDIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 46 INDIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 47 INDIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 48 INDIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.4 SOUTH KOREA

10.2.4.1 Rising demand from industrial sectors to boost growth

TABLE 49 SOUTH KOREA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 50 SOUTH KOREA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 51 SOUTH KOREA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 52 SOUTH KOREA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.5 THAILAND

10.2.5.1 Growing industrial and personal care industries will increase demand for glycolic acid

TABLE 53 THAILAND: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 54 THAILAND: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 55 THAILAND: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 THAILAND: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.6 INDONESIA

10.2.6.1 Presence of major cosmetics and beauty products market significantly driving glycolic acid market

TABLE 57 INDONESIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 58 INDONESIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 59 INDONESIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 INDONESIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.7 REST OF ASIA PACIFIC

TABLE 61 REST OF ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 62 REST OF ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 63 REST OF ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 REST OF ASIA PACIFIC: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA: GLYCOLIC ACID MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 67 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 69 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.1 US

10.3.1.1 Technical grade accounts for larger share of overall market in US

TABLE 71 US: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 72 US: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 73 US: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 US: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.2 CANADA

10.3.2.1 Personal care & dermatology is fastest-growing application in Canada

TABLE 75 CANADA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 76 CANADA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 77 CANADA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 CANADA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.3 MEXICO

10.3.3.1 Presence of prominent cosmetics industry to augment demand for glycolic acid

TABLE 79 MEXICO: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 80 MEXICO: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 81 MEXICO: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 MEXICO: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4 EUROPE

TABLE 83 EUROPE: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 EUROPE: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 85 EUROPE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 87 EUROPE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 EUROPE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.1 GERMANY

10.4.1.1 Large cosmetic market will positively impact glycolic acid market growth

TABLE 89 GERMANY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 90 GERMANY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 91 GERMANY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 GERMANY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.2 ITALY

10.4.2.1 High consumption of glycolic acid witnessed in beauty & personal care and manufacturing industries

TABLE 93 ITALY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 94 ITALY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 95 ITALY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 ITALY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.3 FRANCE

10.4.3.1 Personal care & dermatology is largest and fastest-growing application of glycolic acid

TABLE 97 FRANCE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 98 FRANCE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 99 FRANCE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 FRANCE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.4 SPAIN

10.4.4.1 Growing beauty & personal care industry will drive glycolic acid market

TABLE 101 SPAIN: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 102 SPAIN: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 103 SPAIN: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 SPAIN: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.5 UK

10.4.5.1 Increasing awareness about skincare products will drive glycolic acid market

TABLE 105 UK: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 106 UK: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 107 UK: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 UK: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.6 RUSSIA

10.4.6.1 Russia witnessing strong demand for different skincare products

TABLE 109 RUSSIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 110 RUSSIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 111 RUSSIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 RUSSIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.7 REST OF EUROPE

TABLE 113 REST OF EUROPE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 115 REST OF EUROPE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 117 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 119 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 121 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.1 SAUDI ARABIA

10.5.1.1 Saudi Arabia to lead glycolic acid market in the region

TABLE 123 SAUDI ARABIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 124 SAUDI ARABIA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 125 SAUDI ARABIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 SAUDI ARABIA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.2 UAE

10.5.2.1 Growing cosmetic & personal care sector will drive glycolic acid market

TABLE 127 UAE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 128 UAE: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 129 UAE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 130 UAE: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.3 SOUTH AFRICA

10.5.3.1 Presence of personal care, industrial manufacturing, textile industries propelling market growth

TABLE 131 SOUTH AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 132 SOUTH AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 133 SOUTH AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 134 SOUTH AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.4 TURKEY

10.5.4.1 Presence of strong industrial sector to increase demand for glycolic acid

TABLE 135 TURKEY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 136 TURKEY: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 137 TURKEY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 138 TURKEY: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 139 REST OF MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 140 REST OF MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 141 REST OF MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 142 REST OF MIDDLE EAST & AFRICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6 SOUTH AMERICA

TABLE 143 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 144 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 145 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 146 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 147 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 148 SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Strong industrial sector significantly influencing market for glycolic acid

TABLE 149 BRAZIL: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 150 BRAZIL: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 151 BRAZIL: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 BRAZIL: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.2 ARGENTINA

10.6.2.1 Strong manufacturing and industrial sectors to drive glycolic acid market

TABLE 153 ARGENTINA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 154 ARGENTINA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 155 ARGENTINA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 156 ARGENTINA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.3 REST OF SOUTH AMERICA

TABLE 157 REST OF SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 158 REST OF SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 159 REST OF SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 160 REST OF SOUTH AMERICA: GLYCOLIC ACID MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 127)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 30 NEW PRODUCT DEVELOPMENT AND EXPANSION STRATEGIES ADOPTED BY GLYCOLIC ACID MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 31 RANKING OF TOP FIVE PLAYERS IN GLYCOLIC ACID MARKET, 2021

11.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 161 GLYCOLIC ACID MARKET: DEGREE OF COMPETITION

FIGURE 32 GLYCOLIC ACID MARKET SHARE, BY COMPANY (2021)

11.3.2.1 The Chemours Company

11.3.2.2 CABB Group GmbH

11.3.2.3 China Petrochemical Corporation

11.3.2.4 Water Chemical Co., Ltd

11.3.2.5 Zhonglan Industry Co., Ltd.

11.4 COMPANY EVALUATION QUADRANT (TIER 1)

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 33 GLYCOLIC ACID MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 34 START-UP/SMES EVALUATION QUADRANT FOR GLYCOLIC ACID MARKET

11.6 COMPETITIVE BENCHMARKING

TABLE 162 GLYCOLIC ACID MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 163 GLYCOLIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 DEALS

TABLE 164 GLYCOLIC ACID MARKET: DEALS (2019 TO 2021)

11.7.2 OTHER DEVELOPMENTS

TABLE 165 GLYCOLIC ACID MARKET: NEW PRODUCT LAUNCHES (2019 TO 2021)

12 COMPANY PROFILES (Page No. - 137)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1.1 THE CHEMOURS COMPANY

TABLE 166 THE CHEMOURS COMPANY: BUSINESS OVERVIEW

FIGURE 35 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

TABLE 167 THE CHEMOURS COMPANY: NEW PRODUCT LAUNCH

12.1.2 CABB GROUP GMBH

TABLE 168 CABB GROUP GMBH: BUSINESS OVERVIEW

12.1.3 CHINA PETROCHEMICAL CORPORATION

TABLE 169 CHINA PETROCHEMICAL CORPORATION: BUSINESS OVERVIEW

FIGURE 36 CHINA PETROCHEMICAL CORPORATION: COMPANY SNAPSHOT

12.1.4 WATER CHEMICAL CO., LTD

TABLE 170 WATER CHEMICAL CO., LTD: BUSINESS OVERVIEW

12.1.5 ZHONGLAN INDUSTRY CO., LTD.

TABLE 171 ZHONGLAN INDUSTRY CO., LTD.: BUSINESS OVERVIEW

12.1.6 SHANDONG XINHUA PHARMACEUTICAL CO. LTD.

TABLE 172 SHANDONG XINHUA PHARMACEUTICAL CO. LTD.: BUSINESS OVERVIEW

FIGURE 37 SHANDONG XINHUA PHARMACEUTICAL CO. LTD.: COMPANY SNAPSHOT

12.1.7 PHIBRO ANIMAL HEALTH CORP.

TABLE 173 PHIBRO ANIMAL HEALTH CORP.: BUSINESS OVERVIEW

FIGURE 38 PHIBRO ANIMAL HEALTH CORP.: COMPANY SNAPSHOT

12.1.8 HEBEI CHENGXIN CO., LTD.

TABLE 174 HEBEI CHENGXIN CO., LTD.: BUSINESS OVERVIEW

12.1.9 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

TABLE 175 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: BUSINESS OVERVIEW

TABLE 176 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: DEAL

12.1.10 AVID ORGANICS

TABLE 177 AVID ORGANICS: BUSINESS OVERVIEW

12.2 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

12.2.1 JIAXING JLIGHT CHEMICALS CO., LTD.

TABLE 178 JIAXING JLIGHT CHEMICALS CO., LTD: BUSINESS OVERVIEW

12.2.2 WUHAN BIOCAR BIO-PHARM CO., LTD.

TABLE 179 WUHAN BIOCAR BIO-PHARM CO., LTD.: BUSINESS OVERVIEW

12.2.3 XINJI CITY TAIDA SINOPEC CO., LTD.

TABLE 180 XINJI CITY TAIDA SINOPEC CO., LTD.: BUSINESS OVERVIEW

12.2.4 CROSSCHEM LP

TABLE 181 CROSSCHEM LP: BUSINESS OVERVIEW

12.2.5 SANCAIINDUSTRY

TABLE 182 SANCAIINDUSTRY: BUSINESS OVERVIEW

12.2.6 MEHUL DYE CHEM INDUSTRIES

TABLE 183 MEHUL DYE CHEM INDUSTRIES: BUSINESS OVERVIEW

12.2.7 SIDDHARTH CHLOROCHEM

TABLE 184 SIDDHARTH CHLOROCHEM: BUSINESS OVERVIEW

12.2.8 HANGZHOU LINGRUI CHEMICAL CO., LTD.

TABLE 185 HANGZHOU LINGRUI CHEMICAL CO., LTD.: BUSINESS OVERVIEW

12.2.9 CANGZHOU GOLDLION CHEMICALS CO., LTD

TABLE 186 CANGZHOU GOLDLION CHEMICALS CO., LTD: BUSINESS OVERVIEW

12.2.10 VELOCITY CHEMICALS LTD.

TABLE 187 VELOCITY CHEMICALS LTD.: BUSINESS OVERVIEW

12.2.11 ACTIZA PHARMACEUTICAL PVT. LTD.

TABLE 188 ACTIZA PHARMACEUTICAL PVT. LTD.: BUSINESS OVERVIEW

12.2.12 KUREHA CORPORATION

TABLE 189 KUREHA CORPORATION: BUSINESS OVERVIEW

12.2.13 MERCK KGAA

TABLE 190 MERCK KGAA: BUSINESS OVERVIEW

12.2.14 SAANVI CORP

TABLE 191 SAANVI CORP: BUSINESS OVERVIEW

12.2.15 SIMCOQC

TABLE 192 SIMCOQC: BUSINESS OVERVIEW

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 164)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

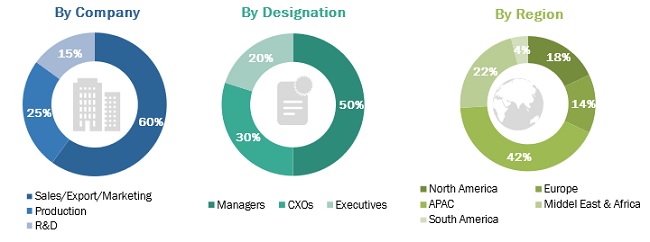

The study involved four major activities in estimating the current market size for the glycolic acid market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Glycolic Acid Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Glycolic Acid Market Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as pharmaceuticals, personal care, and other companies of the customer/end users who are using glycolic acid were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of glycolic acid and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Glycolic Acid Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the glycolic acid market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Glycolic Acid Market Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Glycolic Acid Market Report Objectives

- To define, describe, and forecast the global glycolic acid market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the glycolic acid market based on grade and application.

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Glycolic Acid Market Report Available Customizations

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Glycolic Acid Market