Polyglycolic Acid Market by Form (Fibers, Films, Others), End-use industry (Medical, Oil & Gas, Packaging) and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America)-Global Forecast to 2024

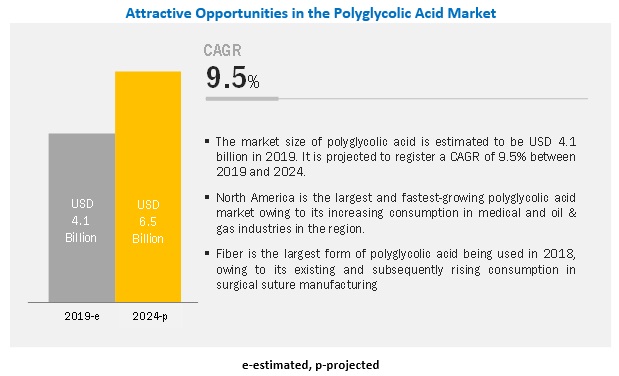

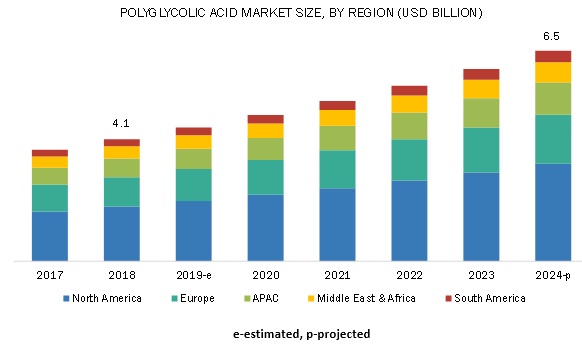

[117 Pages Report] The polyglycolic acid market size is estimated at USD 4.1 billion in 2019 and is projected to reach USD 6.5 billion by 2024, at a CAGR of 9.5%. The polyglycolic acid industry is driven majorly by its huge consumption in the medical industry, along with its increasing demand in the packaging industry.

Fiber form is estimated to lead the overall polyglycolic acid market during the forecast period.

Fiber form leads to the overall polyglycolic acid market. The fibrous form of polyglycolic acid is majorly obtained through ring-opening polymerization of the cyclic dimers of glycolic acid. The current demand for fiber form of polyglycolic acid is majorly supported by its huge consumption in the medical industry in the formation of absorbable surgical sutures. Surgical suture made up of polyglycolic acid is widely used for surgical procedures and therapeutic treatments in the field of ophthalmic, gynecological and obstetric, orthopedic, urological and other departments of the medical industry.

Medical is estimated to be the largest end-use industry of polyglycolic acid.

Medical is the largest end-use industry of polyglycolic acid in 2018. The huge preference and acceptance of polyglycolic acid in the field of transluminal coronary angioplasty, hysterectomy, total mastectomy, and other surgeries under the medical industry is expected to drive the demand for polyglycolic acid during the forecast period. Apart from the medical industry, oil & gas is also a significant consumer of polyglycolic acid, which is the second-largest as well as the fastest-growing end-use industry for polyglycolic acid. The increasing demand for polyglycolic acid in biodegradable frac ball and plug manufacturing is the primary factor driving the market demand.

North America is projected to be the largest polyglycolic acid market.

North America is estimated to be the largest polyglycolic acid market during the forecast period. US, Canada, and Mexico are the major markets for polyglycolic acid in the North America region, with the US being the largest. The presence of significant old age population along with an increase in the number of cardiac, orthopedic and hysterectomy surgeries in the region is expected to drive the demand for polyglycolic acid in North America. The increasing medical tourism in a significant part of the area will further support the polyglycolic acid market growth.

Key Market Players

Kureha Corporation (Japan), Corbion (Netherlands), Shenzhen Polymtek Biomaterial Co, .Ltd. (China), BMG Incorporated (JAPAN), Huizhou Foryou Medical Devices Co., Ltd. (China), Teleflex Incorporated (US) are the key players operating in the polyglycolic acid market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion and joint ventures are the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for polyglycolic acid from emerging economies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

|

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD), Volume (ton) |

|

Segments |

Form, End-use Industry and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

Kureha Corporation (Japan), Corbion (Netherlands), Shenzhen Polymtek Biomaterial Co, .Ltd. (China), BMG Incorporated (JAPAN), Huizhou Foryou Medical Devices Co., Ltd. (China), Teleflex Incorporated (US) Total 6 major players are the manufactures and rest 14 are suppliers and end users of polyglycolic acid. |

This research report categorizes the polyglycolic acid market based on form, end-use industry, and region.

By Form:

- Fibers

- Films

- Others (Plate, Rod, and Composites)

By End-use Industry:

- Medical

- Oil & Gas

- Packaging

- Others (Civil Engineering, Agriculture, and Filter)

By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In September 2016, Kureha Corporation and JGC Corporation formed entered a joint venture (70% Kureha America Inc., and 30% JGC Corporation) and created a new company under the name Kureha Energy Solutions LLC. This new company was formed to market the companys PGA downhole tools, which are used in the oil & gas applications.

- In February 2015, Teleflex Incorporated expanded the manufacturing infrastructure and production capabilities for bioresorbable sutures, fibers, and resins at its Mansfield, Massachusetts facility. With this expansion, the company has developed the production and cleanroom areas along with the launch of a new customer support center, and additional areas for research and development activities. The expansion has benefited the companys Bondekฎ Plus (polyglycolic acid) coated suture as well as the manufacturing of specialized yarns of polyglycolic acid (PGA), poly-L-lactide (PLLA), and polyglycolic acid-co-poly-L-lactic acid (PGLA).

Critical questions the report answers:

- What are the upcoming hot bets for the polyglycolic acid market?

- What are the market dynamics for the different grades of polyglycolic acid?

- What are the market dynamics for different applications of polyglycolic acid?

- Who are the major manufacturers of polyglycolic acid?

- What are the significant factors which will impact market growth during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.2.2 Breakdown Of Primary Interviews

2.3 Secondary Data

2.3.1 Key Data From Secondary Sources

2.4 Base Number Calculation

2.4.1 Supply Side Approach

2.4.2 Demand Side Approach

2.5 Market Size Estimation

2.5.1 Market Size Estimation Methodology: Bottom-Up Approach

2.5.2 Market Size Estimation Methodology: Top-Down Approach

2.6 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Polyglycolic Acid Market

4.2 Polyglycolic Acid Market in North America, By Form and Country, 2018

4.3 Polyglycolic Acid Market, By End-Use Industry

4.4 Polyglycolic Acid Market, By Region

5 Market Business Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for PGA in Biomedical Application

5.2.1.2 Growing Biodegradable Polymer Demand in the Packaging Industry

5.2.2 Restraints

5.2.2.1 Huge Cost of Production

5.2.3 Opportunities

5.2.3.1 Growing PGA Application in Shale Gas Extraction

5.2.4 Challenges

5.2.4.1 Availability of Substitutes

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Contribution of Healthcare to Gdp

6 Glycolic Acid Market, By Form (Page No. - 36)

6.1 Introduction

6.1.1 Fiber

6.1.1.1 Fiber Form Pgas Offer Superior Elasticity and Strength Than Other Braided Structures

6.1.2 Film

6.1.2.1 PGA in Film Form is Used in the Packaging Materials of Food, Electronics, and Medical

6.1.3 Others

6.1.3.1 Plate

6.1.3.2 Composites

6.1.3.3 Rod

7 Polyglycolic Acid Market, By End-Use Industry (Page No. - 42)

7.1 Introduction

7.1.1 Medical

7.1.1.1 Unmatched Compatibility and Unique Properties of PGA are Increasing Its Demand in Various Applications in This Industry

7.1.2 Oil & Gas

7.1.2.1 Increasing Demand for Biodegradable Frac Balls and Plugs is Likely to Influence the Polyglycolic Acid Market Positively

7.1.3 Packaging

7.1.3.1 Increasing Bioplastic Demand in Packaging Industry is Expected to Drive the Market

7.1.4 Others

8 Polyglycolic Acid Market, By Region (Page No. - 48)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Risk of Cardiovascular and Other Non-Communicable Diseases is Expected to Spur the PGA Demand

8.2.2 Canada

8.2.2.1 Increasing Cardio-Related Surgeries are Leading to the Market Growth

8.2.3 Mexico

8.2.3.1 Rising Need for Varied Surgical Procedures in the Country Will Positively Influence the PGA Demand

8.3 Europe

8.3.1 Germany

8.3.1.1 Presence of A Major Healthcare Industry Will Drive the PGA Demand in the Country

8.3.2 UK

8.3.2.1 Increasing Risk of Cardio Vascular Diseases is Likely to Boost the Demand for PGA

8.3.3 Italy

8.3.3.1 Rising Demand for Effective and Efficient Surgical Procedures Will Drive the Market in the Country

8.3.4 France

8.3.4.1 Increasing Surgical Procedures in the Country is Likely to Increase the Demand for PGA

8.3.5 Spain

8.3.5.1 Increasing Consumption of PGA is Witnesses in Healthcare and Packaging Industries in the Country

8.3.6 Russia

8.3.6.1 Increasing Government Initiatives in the Healthcare Industry Will Drive the PGA Demand

8.3.7 Turkey

8.3.7.1 High Demand for PGA is Witnessed Due to the Increasing Risk of Non-Communicable Diseases Owing Rising Elderly Population in the Country

8.3.8 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 Increasing Risk of Diseases Owing to Prominent Old Age Population of the Country is Expected to Drive the PGA Demand

8.4.2 Japan

8.4.2.1 Presence of Prominent PGA Manufacturers Along With Increasing Demand From Healthcare Industry Will to Drive the Market

8.4.3 India

8.4.3.1 Rapidly Growing Cardiovascular Diseases is Expected to Drive the PGA Demand

8.4.4 South Korea

8.4.4.1 Increasing Demand for Surgical Procedures With Rising Old Age Population to Boost PGA Demand

8.4.5 Australia

8.4.5.1 Growing Rate of Non-Communicable Diseases Will Lead to High Demand for PGA

8.4.6 Indonesia

8.4.6.1 Expected Rise in Surgical Treatment Owing to Rising Old Age Population and Cosmetic Surgery are Likely to Drive the Polyglycolic Acid Market

8.4.7 Rest of APAC

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Growing Healthcare Industry of the Country is Likely to Influence the PGA Demand Positively

8.5.2 UAE

8.5.2.1 The Presence of Major Natural Gas Reserve Along With Growing Healthcare Sector is Expected to Drive PGA Demand

8.5.3 Rest of the Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Rising Incidences of Non-Communicable Diseases are Expected to Drive the PGA Demand

8.6.2 Argentina

8.6.2.1 Increasing Health Risk is Expected to Drive PGA Demand in Surgical Suture Application in the Country

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 93)

9.1 Introduction

9.2 Market Ranking of PGA Manufacturers

9.3 Competitive Situation and Trends

9.3.1 Expansion

9.3.2 Joint Venture

10 Company Profiles (Page No. - 95)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Kureha Corporation

10.2 Corbion

10.3 BMG Incorporated

10.4 Teleflex Incorporated

10.5 Foryou Medical

10.6 Shenzhen Polymtek Biomaterial Co., Ltd.

10.7 Additional Company Profiles

10.7.1 End-Users Of Pga

10.7.1.1 Advanced Medical Solutions Group PLC

10.7.1.2 Hu-Friedy Mfg. Co., LLC

10.7.1.3 Unisur Lifecare Pvt. Ltd.

10.7.1.4 Lotus Surgicals

10.7.1.5 Orion Sutures India Pvt. Ltd

10.7.1.6 Futura Surgicare Pvt. Ltd

10.7.1.7 LUX Sutures

10.7.1.8 Katsan Surgical Sutures

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 110)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (118 Tables)

Table 1 USD Per Capita Healthcare Spending, 2017 and 2018

Table 2 Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 3 Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 4 Polyglycolic Fibers Market Size, By Region, 20172024 (USD Million)

Table 5 Polyglycolic Fibers Market Size, By Region, 20172024 (Ton)

Table 6 Polyglycolic Films Market Size, By Region, 20172024 (USD Million)

Table 7 Polyglycolic Films Market Size, By Region, 20172024 (Ton)

Table 8 Other Polyglycolic Acid Forms Market Size, By Region, 20172024 (USD Million)

Table 9 Other Polyglycolic Acid Forms Market Size, By Region, 20172024 (Ton)

Table 10 Glycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 11 Polyglycolic Acid Market Size in Medical Industry, By Region, 20172024 (USD Million)

Table 12 Polyglycolic Acid Market Size in Oil & Gas Industry, By Region, 20172024 (USD Million)

Table 13 Polyglycolic Acid Market Size in Packaging Industry, By Region, 20172024 (USD Million)

Table 14 Polyglycolic Acid Market Size in Other End-Use Industries, By Region, 20172024 (USD Million)

Table 15 Polyglycolic Acid Market Size, By Region, 20172024 (USD Million)

Table 16 Polyglycolic Acid Market Size, By Region, 20172024 (Ton)

Table 17 Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 18 Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 19 Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 20 North America: Polyglycolic Acid Market Size, By Country, 20172024 (USD Million)

Table 21 North America: Polyglycolic Acid Market Size, By Country, 20172024 (Ton)

Table 22 North America: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 23 North America: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 24 North America: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 25 US: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 26 US: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 27 US: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 28 Canada: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 29 Canada: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 30 Canada: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 31 Mexico: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 32 Mexico: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 33 Mexico: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 34 Europe: Polyglycolic Acid Market Size, By Country, 20172024 (USD Million)

Table 35 Europe: Polyglycolic Acid Market Size, By Country, 20172024 (Ton)

Table 36 Europe: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 37 Europe: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 38 Europe: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 39 Germany: Polyglycolic Acid Market Size, By Form,20172024 (USD Million)

Table 40 Germany: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 41 Germany: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 42 UK: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 43 UK: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 44 UK: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 45 Italy: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 46 Italy: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 47 Italy: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 48 France: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 49 France: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 50 France: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 51 Spain: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 52 Spain: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 53 Spain: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 54 Russia: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 55 Russia: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 56 Russia: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 57 Turkey: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 58 Turkey: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 59 Turkey: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 60 Rest of Europe: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 61 Rest of Europe: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 62 Rest of Europe: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 63 APAC: Polyglycolic Acid Market Size, By Country, 20172024 (USD Million)

Table 64 APAC: Polyglycolic Acid Market Size, By Country, 20172024 (Ton)

Table 65 APAC: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 66 APAC: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 67 APAC: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 68 China: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 69 China: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 70 China: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 71 Japan: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 72 Japan: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 73 Japan: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 74 India: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 75 India: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 76 India: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 77 South Korea: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 78 South Korea: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 79 South Korea: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 80 Australia: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 81 Australia: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 82 Australia: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 83 Indonesia: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 84 Indonesia: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 85 Indonesia: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 86 Rest of APAC: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 87 Rest of APAC: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 88 Rest of APAC: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 89 Middle East & Africa: Polyglycolic Acid Market Size, By Country, 20172024 (USD Million)

Table 90 Middle East & Africa: Polyglycolic Acid Market Size, By Country, 20172024 (Ton)

Table 91 Middle East & Africa: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 92 Middle East & Africa: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 93 Middle East & Africa: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 94 Saudi Arabia: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 95 Saudi Arabia: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 96 Saudi Arabia: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 97 UAE: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 98 UAE: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 99 UAE: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 100 Rest of the Middle East & Africa: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 101 Rest of the Middle East & Africa: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 102 Rest of the Middle East & Africa: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 103 South America: Polyglycolic Acid Market Size, By Country, 20172024 (USD Million)

Table 104 South America: Polyglycolic Acid Market Size, By Country, 20172024 (Kiloton)

Table 105 South America: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 106 South America: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 107 South America: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 108 Brazil: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 109 Brazil: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 110 Brazil: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 111 Argentina: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 112 Argentina: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 113 Argentina: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 114 Rest of South America: Polyglycolic Acid Market Size, By Form, 20172024 (USD Million)

Table 115 Rest of South America: Polyglycolic Acid Market Size, By Form, 20172024 (Ton)

Table 116 Rest of South America: Polyglycolic Acid Market Size, By End-Use Industry, 20172024 (USD Million)

Table 117 Expansion, 20142019

Table 118 Joint Venture, 20142019

List of Figures (26 Figures)

Figure 1 Fiber Form Accounted for the Largest Market Share in 2018

Figure 2 Medical to Be the Largest End-Use Industry in the Polyglycolic Acid Market in Terms of Value

Figure 3 North America Was the Largest Polyglycolic Acid Market in 2018

Figure 4 Growing Medical Industry to Drive the Market Growth During the Forecast Period

Figure 5 Us Was the Leading Market and Fibers the Largest Form in North America in 2018

Figure 6 Medical End-Use Industry is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 7 Polyglycolic Acid Market to Register the Highest Growth in North America

Figure 8 Drivers, Restraints, Opportunities, and Challenges Governing the Polyglycolic Acid Market

Figure 9 Polyglycolic Acid Market: Porters Five Forces Analysis

Figure 10 Fiber to Be the Largest Form of the PGA

Figure 11 North America to Be the Largest Market for Polyglycolic Acid Fibers

Figure 12 Medical Industry to Dominate the Polyglycolic Acid Market

Figure 13 North America to Be the Largest Market in the Medical End-Use Industry

Figure 14 Polyglycolic Acid Market Regional Snapshot

Figure 15 North America: Polyglycolic Acid Market Snapshot

Figure 16 Europe: Polyglycolic Acid Market Snapshot

Figure 17 APAC: Polyglycolic Acid Market

Figure 18 Middle East & Africa: Polyglycolic Acid Market Snapshot

Figure 19 South America: Polyglycolic Acid Market Snapshot

Figure 20 Market Ranking of Key Players in 2018

Figure 21 Kureha Corporation: Company Snapshot

Figure 22 Kureha Corporation: SWOT Analysis

Figure 23 Corbion: Company Snapshot

Figure 24 Corbion: SWOT Analysis

Figure 25 Teleflex Incorporated: Company Snapshot

Figure 26 Teleflex Incorporated: : SWOT Analysis

The study involved four major activities in estimating the current market size for polyglycolic acid. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

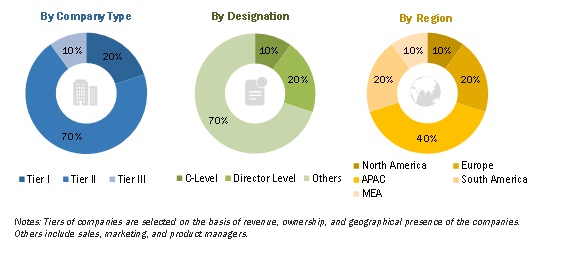

The polyglycolic acid market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the medical industry as well as oil & gas and packaging industries. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the polyglycolic acid market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and forecast the global polyglycolic acid market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the polyglycolic acid market based on form and end-use industry

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansion and joint venture in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the polyglycolic acid market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Polyglycolic Acid Market