Pipe Coatings Market by Surface (Internal and External), type (Fusion Bonded Epoxy, Thermoplastic, Bituminous, Concrete), End-Use Industry (Oil & Gas, Water & Waste Water, Chemical Processing, Mining, and Agriculture), & Region - Global Forecast to 2026

Updated on : September 03, 2025

Pipe Coatings Market

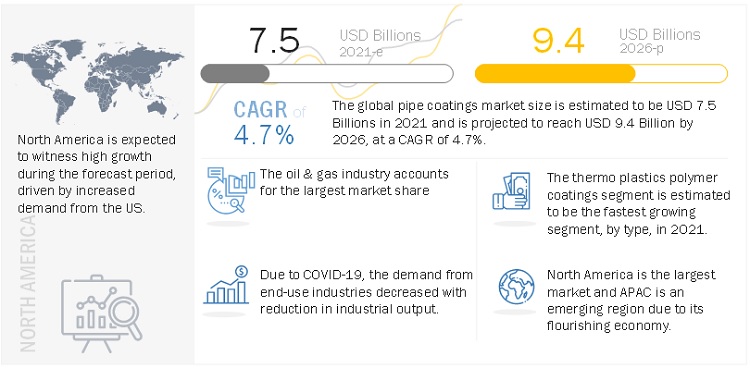

The global pipe coatings market was valued at USD 7.5 billion in 2021 and is projected to reach USD 9.4 billion by 2026, growing at 4.7% cagr from 2021 to 2026. The increase in usage of coating in pipeline to prevent corrosion driving the growth of the pipe coating market. Moreover, the coatings having a longer life and better protective properties are chosen for the pipelines,the above mentioned properties is also expected to drive the growth of the market in the near future.

Global Pipe Coatings Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Pipe Coatings Market Dynamics

DRIVERS: Growth in the oil & gas and infrastructure industries

The global demand for oil & gas is expected to increase soon. The increasing energy demand drives the demand for oil & gas due to the high depletion of energy and higher technological developments. Hence, the oil & gas industry is expected to drive the pipeline market, which is, in turn, expected to facilitate the growth of the pipe coatings market. The market is also expected to grow in emerging economies. As the emerging countries of APAC and South America become more engaged in the manufacturing sector, the regions’ infrastructure is being upgraded to facilitate trade

According to a recent study, the global infrastructure spending in APAC is expected to grow by approximately 48%, by 2025. APAC’s infrastructure market is expected to reach USD 5.3 trillion by 2025. Hence, the growth in the pipeline market is a huge driver for the pipe coatings market. In addition, in South America, the demand for gas is driving the pipeline market, thereby fueling the growth of the pipe coatings market.

According to IEA, the demand for the oil market collapsed in 2020 from 2019. In 2020, the projected demand was recorded at 9mb/d. However, in the absence of rapid policy intervention and behavioral changes by 2026, the projected consumption of global oil will reach 104.1 mb/d. The producer of the Middle Eastern region will be responsible for half of the increases largely from their present shut down capacity.

RESTRAINT: High content of volatile organic compounds (VOCs) in pipe coatings

The various solvent-based coatings used in pipes, currently, have a high VOC content. These VOCs and HAPS (Hazardous Air Pollutant Sources) components present in the coatings pose a threat to the environment. High VOC released into the atmosphere pose health hazards and cause pollution and contributes to the greenhouse effect. Adopting low-solvent or non-solvent coatings often demands high capital investment for new equipment, enhanced surface preparation requirements for better wetting and flow, and more technical experience and training on the application. End users must pay extra initially to compensate for the additional costs in comparison to the cost associated with conventional solvent-based systems. The use of solvent-based coatings is expected to witness limited growth in the future due to the implementation of stringent regulations on VOC emissions.

OPPORTUNITIES: Mobile coating technology

Mobile coating technology, also known as innovative portable coating technology, involves providing coating services at the location of the project site. It enhances project streamlining to significantly reduce transportation and handling costs and the time taken to complete the coating. This technology is used for pipe coatings and lining needed for external anti-corrosion, mechanical protection, thermal insulation, and buoyancy control. This technology can reduce the repair costs incurred for transportation and handling damages and allow the pipeline constructors to operate more efficiently. The installation of a mobile coating facility is easy and has the same production capacity as that of a fixed plant. For this type of facility, companies can hire local technicians and train them so that they achieve the same output as that of a fixed plant without losing their productivity, quality, and cost-effectiveness.

CHALLENGES: Unfavorable weather conditions and harsh terrains

New pipelines built in terrains, such as rocky soil, mountains, steep slopes, rivers, and roads with wet, frozen, or silty/clay trench materials, present new challenges for coatings providers, particularly in unfavorable weather conditions. In many remote areas, the pipelines are installed during extremely cold conditions. These areas have less infrastructure development and offer less support for the operation of the pipeline. In addition, as new and larger diameter pipelines are constructed in remote areas, where harsh terrains and climates are often unfavorable, pipeline integrity is a concern. Corrosion protection is the focus of the pipeline integrity effort. However, mechanical protection also needs to be addressed to ensure the integrity of the corrosion protection. Mechanical protection methods commonly used worldwide are sand bedding & padding, mechanical bedding & padding, rock shield materials, and extra-thick anti-corrosion coatings. However, these methods have limitations. For example, sand bedding & padding is not suitable with frozen material and in extremely cold conditions. It becomes impractical to use for steep slopes and river and road crossings. These factors pose a challenge to the pipeline coaters and thereby to the growth of the market.

External Coating is estimated to lead the pipe coatings market in 2020

The market for external coatings is projected to be the larger and the faster-growing surface in the pipe coatings market. External corrosion is the major cause of the deterioration of the buried transmission pipelines. The installation of pipelines is costly; hence, external surface coatings play an important role in protecting these pipelines from corrosion and extending their lifespans.

Thermoplastic polymer coatings is estimated to be the leading the pipe coatings type

Thermoplastic polymer coatings are the most used type of pipe coatings. Thermoplastic polymer coatings was the largest segment in terms of value in 2020 compared to the other types of pipe coatings. The high demand for thermoplastic polymer coatings is attributed to its excellent properties and a broad spectrum of applications in various end-use industries. Thermoplastic polymer coatings are expected to rise significantly in the pipe coatings market during the forecast period.

Oil & gas is the largest end-use industry of pipe coatings.

Oil & gas is the largest end-use industry of pipe coatings. The rapid growth in the oil & gas segment drives the market of pipe coatings globally. Furthermore, properties, including superior resistance to corrosion, abrasion, and protection from chemical attacks, are expected to drive the demand for these coatings. Significant development of the pipe coatings market in all the regions can be attributed to the increased use of pipe coatings in municipal water supply, oil & gas, industrial, chemical processing, among other end-use industries.

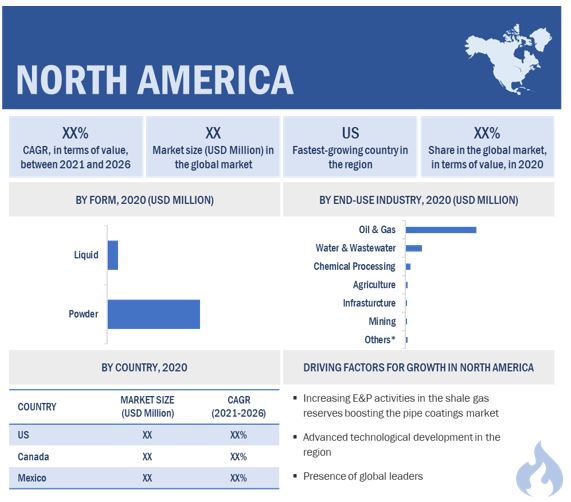

North America is projected to account for the largest share of the pipe coatings market during the forecast period

North America accounted for the largest market share followed by APAC and Europe. The growth of APAC can be attributed to the rapidly increasing demand for pipe coatings from end-use industries, especially water & wastewater treatment and oil & gas. Furthermore, the demand for pipe coatings is mainly triggered by growing demand from oil & gas, among other end-use industries. The Alaska LNG Project is a planned liquefied natural gas export facility near Nikiski, Alaska. It is regarded as one of the largest natural gas development projects in the world. The project, which is expected to cost between 45 USD billion and 65 USD billion, will involve the building of an LNG plant, storage facility, and shipping port, as well as a 1,287-kilometer pipeline from the North Slope to the LNG facility and a gas treatment plant. This way the development in demand for chemical processing and oil & gas, as well as the growing use of pipe coatings in construction, energy, and sewage industries, are the key factors expected to drive the demand for pipe coatings during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Pipe Coatings Market Players

The pipe coating market is dominated by a few globally established players such as PPG Industries, Inc. (US), Akzo Nobel N. V. (Netherlands), The Sherwin-Williams Company (US), ShawCor (Canada), and Axalta Coating Systems Ltd. (US), among others.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Pipe Coatings Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Sq. Meter) |

|

Segments covered |

By Type, By form, End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

PPG Industries (US), Akzo Nobel N. V. (Netherlands), The Sherwin-Williams Company (US), ShawCor (Canada), and Axalta Coating Systems Ltd. (US are the top 5 manufacturers are covered in the pipe coatings market. |

This research report categorizes the pipe coatings market based on resin type, backing material, end-use industry, and region.

Pipe coatings market, By Type

- Thermoplastic Polymer Coatings

- Fusion Bonded Epoxy Coating

- Bituminous

- Concrete

- Others

Pipe coatings market, By Form

- Liquid

- Powder

Pipe coatings market, By End Use Industry

- Oil & Gas

- Water and Waste Water

- Chemical Processing

- Mining

- Agriculture

- Others

Pipe coatings market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In 2019, Axalta Coating Systems Ltd. acquired Capital Paints LLC (UAE), which specializes in architectural powder coatings. This acquisition is done to provide better support and technical services to local customers in the oil & gas and architectural segments while also helping the company enter the markets in the Middle Eastern region.

- In 2019, The Sherwin Williams company acquired 2 European coating companies. This acquisition would strengthen the performance coatings of the group, which provides new technologies and a larger worldwide platform.

- In July 2019, Arkema acquired Arrmaz (US), a surfactant for crop nutrition, mining, and infrastructure markets. The acquisition will help to further boost the group’s profile.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the pipe coatings market?

The major drivers influencing the growth of pipe coatings are Increase in oil and gas industry to strengthen the infrastructure.

What are the major challenges in the pipe coatings market?

The major challenges in pipe coatings market are the implementation of stringent regulatory policies and intense competition in the market posing challenge to new entrants.

What are the different applications of pipe coatings?

Pipe coatings s find their applications in various end-use industries such as oil and gas, water and wastewater, chemical processing are among others. The applications of these have been constantly increasing owing to constant innovation.

What is the impact of COVID-19 pandemic on the pipe coatings market?

Owing to the COVID-19 pandemic, there has been a mixed impact on the pipe coatings market across the globe. Various industries such as oil and gas, water and wastewater, chemical processing have witnessed significant slump due to lockdowns.

What are the industry trends in pipe coatings market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for pipe coatings and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 PIPE COATINGS MARKET SEGMENTATION

1.4 REGIONS COVERED

FIGURE 2 PIPE COATING MARKET REGION SEGMENTATION

1.5 PIPE COATINGS MARKET: INCLUSIONS AND EXCLUSIONS

1.6 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

1.8 UNIT CONSIDERED

1.9 STAKEHOLDERS

1.10 LIMITATIONS

1.11 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 3 PIPE COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

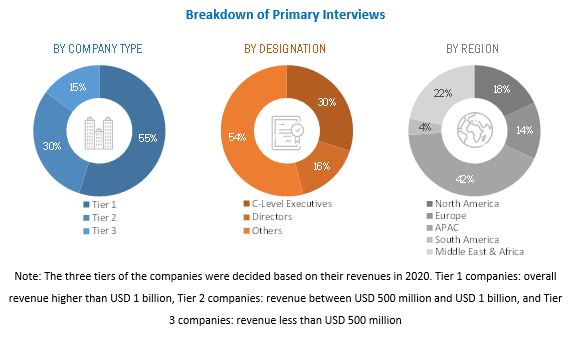

2.1.2.3 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 MARKET SIZE ESTIMATION

2.1.4 SUPPLY SIDE

FIGURE 5 APPROACH 1: BOTTOM-UP- SUPPLY-SIDE ANALYSIS/PRODUCTION

2.1.5 ESTIMATING THE PIPE COATINGS MARKET SIZE FROM THE KEY PLAYERS’ MARKET SHARE

FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.1.6 DEMAND-SIDE

2.1.6.1 Assessing the overall market size from the powder coatings market

FIGURE 7 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.2 DATA TRIANGULATION

FIGURE 8 PIPE COATINGS MARKET: DATA TRIANGULATION

2.3 ASSUMPTIONS

2.4 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 THERMOPLASTIC POLYMER SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SEGMENT IN 2021

FIGURE 11 POWDER COATINGS ESTIMATED TO BE A LARGER SEGMENT OF THE PIPE COATINGS MARKET IN 2021

FIGURE 12 OIL & GAS ESTIMATED TO BE THE LARGEST END-USE INDUSTRY IN THE PIPE COATING MARKET IN 2021

FIGURE 13 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 SIGNIFICANT OPPORTUNITIES IN THE PIPE COATINGS MARKET

FIGURE 14 OIL & GAS SEGMENT, BY END-USE INDUSTRY, EXPECTED TO DRIVE THE DEMAND FOR PIPE COATINGS DURING THE FORECAST PERIOD

4.2 NORTH AMERICA: PIPE COATINGS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 15 FUSION BONDED EPOXY COATINGS SEGMENT AND THE US MARKET ACCOUNTED FOR HIGHER SHARES IN 2020

4.3 PIPE COATINGS MARKET, BY END-USE INDUSTRY

FIGURE 16 WATER & WASTEWATER SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE PIPE COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in the oil & gas and infrastructure industries

5.2.1.2 Growing technological advancements

5.2.2 RESTRAINTS

5.2.2.1 High content of volatile organic compounds (VOCs) in pipe coatings

5.2.3 OPPORTUNITIES

5.2.3.1 Mobile coating technology

5.2.4 CHALLENGES

5.2.4.1 Unfavorable weather conditions and harsh terrains

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 RANGE SCENARIO

FIGURE 19 RANGE SCENARIO OF PIPE COATINGS MARKET

5.5 YC-YCC DRIVERS

FIGURE 20 YC-YCC DRIVERS

5.6 TARIFF AND REGULATORY ANALYSIS

5.6.1 REGULATIONS

5.7 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 21 PIPE COATINGS MARKET: ECOSYSTEM

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN OF PIPE COATING MARKET

TABLE 1 PIPE COATINGS MARKET: ECOSYSTEM

5.8.1 PROMINENT COMPANIES

5.8.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.9 PRICING ANALYSIS

FIGURE 23 PIPE COATING MARKET PRICE, BY END-USE INDUSTRY

5.9.1 THERMOPLASTIC POLYMER COATINGS

5.9.2 FUSION BONDED EPOXY COATINGS

5.9.3 CONCRETE COATINGS

5.9.4 BITUMINOUS COATINGS

5.9.5 OTHERS

5.10 TECHNOLOGY ANALYSIS

5.10.1 POWDER COATINGS

5.10.2 LIQUID COATINGS

5.10.3 BENEFICIAL EFFECTS

5.11 IMPACT OF COVID-19 PANDEMIC

TABLE 2 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021 (PERCENTAGE)

5.12 IMPACT OF COVID-19 ON THE PIPE COATINGS MARKET

5.13 PIPE COATINGS PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

5.13.4 GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 24 GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 25 PUBLICATION TRENDS - LAST 10 YEARS

5.13.5 INSIGHT

FIGURE 26 JURISDICTION ANALYSIS

5.13.6 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP COMPANIES/APPLICANTS

5.13.6.1 List of Patents by Valspar Sourcing Inc.

5.13.6.2 List of Patents by Rhodia Operations

5.13.6.3 List of Patents by Borealis Ag

5.13.6.4 List of Patents by 3M Innovative Properties Company

5.13.6.5 List of Patents by Acergy France Sa

5.13.7 TOP 10 PATENT OWNERS (US) IN THE LAST 10 YEARS

5.14 CASE STUDY

6 PIPE COATINGS MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 28 THERMOSETTING POLYMER COATINGS SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

TABLE 3 PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 4 PIPE COATING MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 5 PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 6 PIPE COATING MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

6.2 THERMOPLASTIC POLYMER COATINGS

6.2.1 HIGH DEMAND FROM SEWAGE, IRRIGATION, INFRASTRUCTURE, MINING, AND CHEMICAL PROCESSING APPLICATIONS

6.2.2 POLYETHYLENE (PE) COATINGS

6.2.3 POLYPROPYLENE (PP) COATINGS

6.2.4 POLYURETHANE (PU) COATINGS

TABLE 7 THERMOPLASTIC POLYMER COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 8 THERMOPLASTIC POLYMER COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 THERMOPLASTIC POLYMER COATINGS MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 10 THERMOPLASTIC POLYMER COATINGS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.3 FUSION BONDED EPOXY (FBE) COATINGS

6.3.1 INCREASING USE OF FUSION BONDED EPOXY COATINGS IN THE OIL & GAS INDUSTRY

TABLE 11 FUSION BONDED EPOXY COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 12 FUSION BONDED EPOXY COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 FUSION BONDED EPOXY COATINGS MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 14 FUSION BONDED EPOXY COATINGS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.4 CONCRETE COATINGS

6.4.1 OFFSHORE PIPELINES FOR TRANSPORTATION, EXPLORATION, PRODUCTION, AND DISTRIBUTION ACTIVITIES

TABLE 15 CONCRETE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 16 CONCRETE COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 CONCRETE COATINGS MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 18 CONCRETE COATINGS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.5 BITUMINOUS COATINGS

6.5.1 THE USE OF BITUMINOUS COATINGS IN THE DEVELOPING COUNTRIES OF APAC DUE TO THEIR EASY AVAILABILITY AND LOWER COST

TABLE 19 BITUMINOUS COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 20 BITUMINOUS COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 BITUMINOUS COATINGS MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 22 BITUMINOUS COATINGS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.6 OTHERS

TABLE 23 OTHER TYPES MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 24 OTHER TYPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 OTHER TYPES MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 26 OTHER TYPES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7 PIPE COATINGS MARKET, BY FORM (Page No. - 90)

7.1 INTRODUCTION

FIGURE 29 POWDER COATINGS TO BE A FASTER-GROWING SEGMENT

TABLE 27 PIPE COATINGS MARKET SIZE, BY FORM, 2016–2018 (USD MILLION)

TABLE 28 PIPE COATING MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

7.2 POWDER COATINGS

7.2.1 ENVIRONMENTAL FRIENDLINESS AND LOWER COST OF USING POWDER COATINGS

TABLE 29 POWDER COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 30 POWDER COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 LIQUID COATINGS

7.3.1 INCREASE IN THE NUMBER OF PIPELINES DUE TO INCREASED INDUSTRIALIZATION AND OFFSHORE RESERVES

TABLE 31 LIQUID COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 32 LIQUID COATINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 PIPE COATINGS MARKET, BY SURFACE (Page No. - 95)

8.1 INTRODUCTION

FIGURE 30 EXTERNAL SURFACE TO BE A FASTER-GROWING SEGMENT

TABLE 33 PIPE COATINGS MARKET SIZE, BY SURFACE, 2016–2018 (USD MILLION)

TABLE 34 PIPE COATING MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

8.2 INTERNAL SURFACE

8.2.1 IMPROVED FLOW CHARACTERISTICS AND CORROSION PROTECTION TO BOOST THE MARKET

TABLE 35 INTERNAL SURFACE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 36 INTERNAL SURFACE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 EXTERNAL SURFACE

8.3.1 PROTECTION OF PIPES AGAINST CORROSION IN THE OIL & GAS INDUSTRY

TABLE 37 EXTERNAL SURFACE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 38 EXTERNAL SURFACE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 PIPE COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 100)

9.1 INTRODUCTION

FIGURE 31 OIL & GAS TO BE THE LARGEST END-USE INDUSTRY FOR PIPE COATINGS

TABLE 39 PIPE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 40 PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2 OIL & GAS INDUSTRY

9.2.1 MASSIVE ECONOMIC EXPANSIONS AND GROWING ENERGY & POWER (E&P) ACTIVITIES IN DEVELOPING COUNTRIES

TABLE 41 OIL & GAS: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 42 OIL & GAS: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 WATER & WASTEWATER TREATMENT

9.3.1 INCREASING CONCERN FOR WATER CONSERVATION AND DISPOSAL OF WASTEWATER

TABLE 43 WATER & WASTEWATER TREATMENT: PIPE COATINGS MARKET SIZE FOR, BY REGION, 2016–2018(USD MILLION)

TABLE 44 WATER & WASTEWATER TREATMENT: PIPE COATINGS MARKET SIZE FOR, BY REGION, 2019–2026 (USD MILLION)

9.4 CHEMICAL PROCESSING

9.4.1 GROWING DEMAND FOR CHEMICALS AND INCREASING INFRASTRUCTURE DEVELOPMENTS

TABLE 45 CHEMICAL PROCESSING: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 46 CHEMICAL PROCESSING: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 MINING

9.5.1 INCREASING MINING ACTIVITIES IN APAC TO BOOST THE MARKET FOR PIPE COATINGS

TABLE 47 MINING: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 48 MINING: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.6 AGRICULTURE

9.6.1 PROTECTION OF PIPES FROM CORROSION IN THE AGRICULTURE INDUSTRY TO BOOST THE DEMAND FOR PIPE COATINGS

TABLE 49 AGRICULTURE: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 50 AGRICULTURE: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.7 INFRASTRUCTURE

9.7.1 INCREASING URBANIZATION AND GOVERNMENT AND CONSUMER SPENDING

TABLE 51 INFRASTRUCTURE: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 52 INFRASTRUCTURE: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.8 OTHERS

TABLE 53 OTHER END-USE INDUSTRIES: PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 54 OTHER END-USE INDUSTRIES: PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 PIPE COATINGS MARKET, BY REGION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 32 CHINA TO BE THE FASTEST-GROWING PIPE COATINGS MARKET GLOBALLY

TABLE 55 PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 56 PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 57 PIPE COATINGS MARKET SIZE, BY REGION, 2016–2018 (KILOTON)

TABLE 58 PIPE COATING MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

10.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: PIPE COATINGS MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY SURFACE, 2016–2018 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2018 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 72 NORTH AMERICA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing E&P activities in the shale gas reserves boosting the pipe coatings market

TABLE 73 US: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 74 US: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 US: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 76 US: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 77 US: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 78 US: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Extensive oil & gas reserves along with the ongoing E&P activities expected to boost the pipe coatings market

TABLE 79 CANADA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 82 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 83 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 84 CANADA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Extensive E&P activities in the oil & gas industry in the country

TABLE 85 MEXICO: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 86 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 MEXICO: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 88 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 89 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 90 MEXICO: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3 APAC

FIGURE 34 APAC: PIPE COATINGS MARKET SNAPSHOT

TABLE 91 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 92 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 93 APAC: MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

TABLE 94 APAC: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 95 APAC: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 96 APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 APAC: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 98 APAC: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 99 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 100 APAC: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.1 CHINA

10.3.1.1 Rising demand for durable and high strength pipes

TABLE 101 CHINA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 102 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 CHINA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 104 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 105 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 106 CHINA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.2 JAPAN

10.3.2.1 Growth in the oil & gas, water & wastewater treatment, and chemical processing industries

TABLE 107 JAPAN: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 108 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 JAPAN: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 110 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 111 JAPAN MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 112 JAPAN PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.3 INDIA

10.3.3.1 Growing economy, increasing population, and ongoing exploration

TABLE 113 INDIA: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 114 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 INDIA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 116 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 117 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 118 INDIA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.4 SOUTH KOREA

10.3.4.1 Growing infrastructural developments

TABLE 119 SOUTH KOREA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 120 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 SOUTH KOREA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 122 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 123 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 124 SOUTH KOREA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.5 INDONESIA

10.3.5.1 Increasing demand for pipelines for wastewater disposal and sewage treatment

TABLE 125 INDONESIA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 126 INDONESIA: MARKET SIZE, BY TYPE,2019–2026 (USD MILLION)

TABLE 127 INDONESIA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 128 INDONESIA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 129 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 130 INDONESIA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.6 REST OF APAC

TABLE 131 REST OF APAC : PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 132 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 REST OF APAC: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 134 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 135 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018(USD MILLION)

TABLE 136 REST OF APAC: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.4 MIDDLE EAST & AFRICA

TABLE 137 MIDDLE EAST & AFRICA : PIPE COATINGS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA : MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 141 MIDDLE EAST & AFRICA : MARKET SIZE, BY SURFACE, 2016–2018 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA : MARKET SIZE, BY FORM, 2016–2018 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE 2016–2018 (KILOTON)

TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 149 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY 2016–2018 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.4.1 UAE

10.4.1.1 High demand from the oil & gas industry driving the growth of the pipe coatings market

TABLE 151 UAE: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 152 UAE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 UAE: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 154 UAE: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 155 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 156 UAE: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.4.2 SAUDI ARABIA

10.4.2.1 Large oil reserves increase the demand for pipelines, boosting the pipe coatings market

TABLE 157 SAUDI ARABIA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 158 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 160 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 161 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 162 SAUDI ARABIA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.4.3 REST OF MIDDLE EAST & AFRICA

TABLE 163 REST OF MIDDLE EAST & AFRICA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 166 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 167 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY,2016–2018 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST & AFRICA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5 EUROPE

TABLE 169 EUROPE: PIPE COATINGS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 170 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 171 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 172 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 173 EUROPE: MARKET SIZE, BY SURFACE, 2016–2018 (USD MILLION)

TABLE 174 EUROPE: MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

TABLE 175 EUROPE: MARKET SIZE, BY FORM, 2016–2018 (USD MILLION)

TABLE 176 EUROPE: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 177 EUROPE: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 178 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 EUROPE: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 180 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 181 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 182 EUROPE: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.1 GERMANY

10.5.1.1 Large chemical processing industries drive the growth of the pipe coatings market

TABLE 183 GERMANY: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 184 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 GERMANY: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 186 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 187 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 188 GERMANY: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.2 UK

10.5.2.1 Increasing demand for oil & gas drives the growth of pipe coatings

TABLE 189 UK: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 190 UK: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 UK: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 192 UK: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 193 UK: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 194 UK: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.3 FRANCE

10.5.3.1 Growing chemical industry

TABLE 195 FRANCE: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 196 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 197 FRANCE: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 198 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 199 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 200 FRANCE: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.4 SPAIN

10.5.4.1 Increasing demand in oil & gas and water & wastewater treatment industries

TABLE 201 SPAIN: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 202 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 203 SPAIN: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 204 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 205 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 206 SPAIN: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.5 ITALY

10.5.5.1 Increasing demand for anti-corrosion pipelines in the oil & gas industry

TABLE 207 ITALY: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 208 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 209 ITALY: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 210 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 211 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 212 ITALY: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.6 RUSSIA

10.5.6.1 Rising demand for large diameter pipes in the oil & gas industry

TABLE 213 RUSSIA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 214 RUSSIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 215 RUSSIA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 216 RUSSIA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 217 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 218 RUSSIA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.7 TURKEY

10.5.7.1 Growth in construction and use of pipe coatings in sewage

TABLE 219 TURKEY: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 220 TURKEY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 TURKEY: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 222 TURKEY: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 223 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 224 TURKEY: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 225 REST OF EUROPE: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 226 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 227 REST OF EUROPE: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 228 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 229 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 230 REST OF EUROPE: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 231 SOUTH AMERICA: PIPE COATINGS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 232 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 233 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 234 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 235 SOUTH AMERICA: MARKET SIZE, BY SURFACE, 2016–2018 (USD MILLION)

TABLE 236 SOUTH AMERICA: MARKET SIZE, BY SURFACE, 2019–2026 (USD MILLION)

TABLE 237 SOUTH AMERICA: MARKET SIZE, BY FORM, 2016–2018 (USD MILLION)

TABLE 238 SOUTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 239 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 240 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 241 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 242 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 243 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 244 SOUTH AMERICA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Easy availability of raw materials expected to fuel the growth of the pipe coatings market

TABLE 245 BRAZIL: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 246 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 247 BRAZIL: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 248 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 249 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 250 BRAZIL: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Favorable oil & gas industry outlook facilitating the growth of pipe coatings market

TABLE 251 ARGENTINA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 252 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 253 ARGENTINA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 254 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 255 ARGENTINA: MARKET SIZE, BY END USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 256 ARGENTINA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 257 REST OF SOUTH AMERICA: PIPE COATINGS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 258 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 259 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 260 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 261 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 262 REST OF SOUTH AMERICA: PIPE COATING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 214)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 MARKET RANKING

FIGURE 35 MARKET RANKING ANALYSIS FOR THE PIPE COATINGS MARKET

11.4 COMPETITIVE EVALUATION QUADRANT (TIER 1)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

FIGURE 36 COMPANY EVALUATION MATRIX FOR PIPE COATING MARKET, 2020

11.4.4 STRENGTH OF PRODUCT PORTFOLIO

11.5 KEY MARKET DEVELOPMENTS

11.5.1 AGREEMENTS, 2019

TABLE 263 COMPANIES ADOPTED THIS STRATEGY TO LEVERAGE FAVORABLE GEOGRAPHICAL LOCATIONS AND INNOVATIVE TECHNOLOGIES. JOINT VENTURES PROVIDE OPPORTUNITIES TO GAIN NEW CAPACITY AND EXPERTISE.

11.5.2 MERGERS & ACQUISITIONS, 2018-2021

12 COMPANY PROFILE (Page No. - 220)

(Business Overview, Products Offered, Recent Developments, Winning Imperatives, MNM View, Key Strengths, Strategies & Choices Made, Weakness & Competitive Threats, Impact of COVID-19, COVID-19 Measures Adopted)*

12.1 PPG INDUSTRIES, INC.

TABLE 264 PPG INDUSTRIES, INC.: BUSINESS OVERVIEW

FIGURE 37 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 38 PPG INDUSTRIES, INC.: WIINING IMPERATIVES

FIGURE 39 PPG INDUSTRIES, INC.: COVID-19 IMPACT

12.2 AKZO NOBEL N. V.

TABLE 265 AKZO NOBEL N. V.: BUSINESS OVERVIEW

FIGURE 40 AKZO NOBEL N. V.: COMPANY SNAPSHOT

FIGURE 41 AKZO NOBEL N. V.: WINNING IMPERATIVES

FIGURE 42 AKZO NOBEL N. V.: COVID-19 IMPACT

12.3 SHAWCOR LTD.

TABLE 266 SHAWCORE.: BUSINESS OVERVIEW

FIGURE 43 SHAWCOR LTD..: COMPANY SNAPSHOT

FIGURE 44 SHAWCOR LTD..: WINNING IMPERATIVES

FIGURE 45 SHAWCOR LTD..: WINNING IMPERATIVES

12.4 3M COMPANY

TABLE 267 3M.: BUSINESS OVERVIEW

FIGURE 46 3M: COMPANY SNAPSHOT

FIGURE 47 3M: WINNING IMPERATIVE

FIGURE 48 3M: COVID-19 IMPACT

12.5 THE SHERWIN-WILLIAMS COMPANY

TABLE 268 SHERWIN-WILLIAMS COMPANY.: BUSINESS OVERVIEW

FIGURE 49 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 50 THE SHERWIN-WILLIAMS COMPANY: WINNING IMPERATIVES

FIGURE 51 THE SHERWIN-WILLIAMS COMPANY: COVID-19 IMPACT

12.6 AXALTA COATING SYSTEMS

TABLE 269 AXALTA.: BUSINESS OVERVIEW

FIGURE 52 AXALTA COATING SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 53 AXALTA COATING SYSTEMS LTD.: WINNING IMPERATIVE

FIGURE 54 AXALTA COATING SYSTEMS LTD.: COVID-19 IMPACT

12.7 ARKEMA S.A

TABLE 270 ARKEMA.: BUSINESS OVERVIEW

FIGURE 55 ARKEMA S.A: COMPANY SNAPSHOT

FIGURE 56 ARKEMA S.A: WINNING IMPERATIVES

FIGURE 57 ARKEMA S.A: WINNING IMPERATIVES

12.8 WASCO ENERGY GROUP OF COMPANIES

TABLE 271 WASCO ENERGY GROUP OF COMPNAIES.: BUSINESS OVERVIEW

12.9 SPECIALTY POLYMER COATINGS

TABLE 272 SPECIALITY POLYMER COATING.: BUSINESS OVERVIEW

12.1 SEAL FOR LIFE

TABLE 273 SEAL FOR LIFE.: BUSINESS OVERVIEW

12.11 ALLAN EDWARDS

TABLE 274 ALLAN EDWARDS.: BUSINESS OVERVIEW

12.12 CELANESE CORPORATION

TABLE 275 CELANESE CORPORATION.: BUSINESS OVERVIEW

12.13 TENARIS

TABLE 276 TANARIS.: BUSINESS OVERVIEW

12.14 WINN & COALES (DENSO) LTD.

TABLE 277 WINN & COALES (DENOS) LTD. : BUSINESS OVERVIEW

12.15 AEGION CORPORATION

TABLE 278 AEGION CORPORATION.: BUSINESS OVERVIEW

12.16 EUPEC PIPECOATINGS FRANCE SA

TABLE 279 EUPEC PPECOATINGS FRANCE SA.: BUSINESS OVERVIEW

12.17 L.B. FOSTER COMPANY

TABLE 280 L.B FOSTER.: BUSINESS OVERVIEW

12.18 THE ARABIAN PIPECOATING COMPANY LTD.

TABLE 281 THE ARABIAN PIPECOATING COMPANY LTD.: BUSINESS OVERVIEW

12.19 HEMPEL A/S

TABLE 282 HEMPEL A/S.: BUSINESS OVERVIEW

12.20 PERMA-PIPE INC

TABLE 283 PREMA PIPE INC.: BUSINESS OVERVIEW

*Business Overview, Products Offered, Recent Developments, Winning Imperatives, MNM View, Key Strengths, Strategies & Choices Made, Weakness & Competitive Threats, Impact of COVID-19, COVID-19 Measures Adopted might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 265)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global pipe coatings market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand regarding end-use industries, application areas, and countries was comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of pipe coatings market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the pipe coatings market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect this study's pipe coatings market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the pipe coatings market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the pipe coatings market industry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global pipe coatings market size. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- In terms of value, the industry's supply chain and market size were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the pipe coatings market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the pipe coatings market in terms of value and volume based on type, end-use industry, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the pipe coatings marketmarket

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the pipe coatings market report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further breakdown of the Rest of the APAC pipe coatings market into more nations not covered in the study

- Further breakdown of Rest of Europe pipe coatings market into more nations not covered in the study

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pipe Coatings Market

Company share in North America market

Global anti-corrosive materials by type, technology and potential targets for strategic alliance

Pipe coating market and insights on increasing demand and new technology.

Market data for global Pipe market focusing on Netherlands, Germany, Poland, France, and UK

Piping application/end-user in Polyurethane market

Report title not mentioned

Incomplete

Information on Pipeline coating market

Construction chemicals market