Food Extrusion Market by Extruder (Single Screw, Twin Screw, and Contra Twin Screw), Process (Cold and Hot), Product Type (Savory Snacks, Breakfast Cereals, Bread, Flours & Starches, and Textured Protein), and Region - Global Forecast to 2026

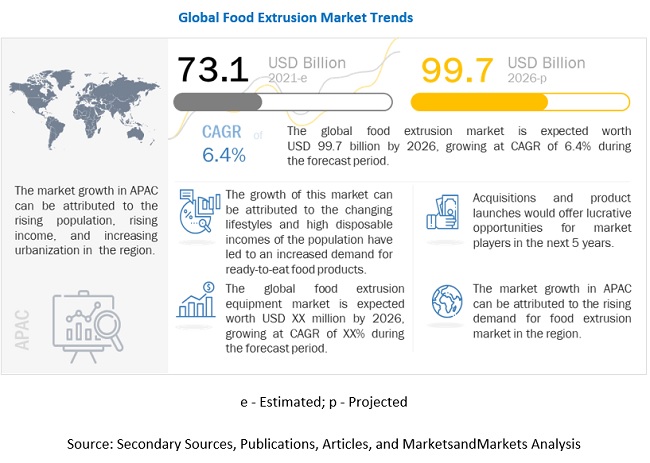

The global food extrusion market, valued at USD 73.1 billion in 2021, is anticipated to reach to USD 99.7 billion by 2026, with a projected compound annual growth rate (CAGR) of 6.4% during the forecast period. Innovative and flexibly designed processing and packaging systems are the prerequisites for manufacturers to keep pace with the trends in the food industry that may arise from operation cost and consumer spending. Advanced automated food processing equipment enables high-volume production of better-quality products with a longer shelf life.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Global Food Extrusion Market

European and North American regions are highly driven by technology and diverse food applications, contributing to the growth of the food extrusion market. The processed food industry is also witnessing significant growth in developing regions such as China, India, Japan, and Australia. With the outbreak of COVID-19, the customers’ desire for healthy, convenient, and premium products has increased, which is further expected to drive the growth of nutritious, high-fiber extruded foods and functional additives.

Market Dynamics

Drivers: Increase in demand for processed product types

The food extrusion market is primarily driven by the growth of the processed food industry. The changing lifestyles and high disposable incomes of the population have led to an increased demand for ready-to-eat product types as they help save time and effort. Additionally, the demand for processed product types from the urban population of developing economies is expected to subsequently drive the demand for food extrusion equipment. The rising per capita income and the increasing trend of snacking between meals are also fueling the demand for extruded product types. Consumer preferences in emerging economies such as China, India, Brazil, and the Middle East have gradually transitioned from traditional homemade breakfasts and snacking meals to ready-to-eat products over the last couple of decades.

Restraints: Volatility of raw material prices

Changes in climatic conditions across the globe have reduced the production of raw materials, such as potatoes, corn, and tapioca. Snack pellet manufacturers suffer a shortage of raw material supply and are unable to meet the rising demand. Due to the volatility factor, the prices of other raw materials, such as wheat and vegetable oil, vary by more than 40%, along with the fluctuation of natural gas by more than 25%. In addition to this, the high price of snack pellet ingredients, such as binding agents and savory flavors, also act as a restraint. Due to a hike in the pricing of raw materials used for snack pellets, manufacturers are experiencing a declining trend in their profit margins.

Opportunities: New product developments and launches of extruded product types

Over the past few years, the processed food industry has witnessed several activities—the emergence of new players, the expansion of snacks portfolio through continuous product innovation, aggressive marketing campaigns to establish a supplier-consumer relationship, and a shift in consumption patterns with the increasing demand for convenience foods. With the increase in disposable incomes, the demand for branded snacks is expected to increase. Additionally, the rising health consciousness owing to sedentary lifestyles and the increasing incidences of lifestyle diseases in developed and developing countries have resulted in the demand for “healthy” snacks. This demand is only expected to increase in the future and presents lucrative opportunities for both existing as well as new players.

Challenges: Operational complexity during food processing

The viscosity, screw speed, temperature, and pressure, along with the complexity of the mathematical descriptions of the process are closely interrelated. These dynamics present a challenge for accurate dynamic modeling of the extrusion process. Also, there are several load variables for viscosity regulations, depending on the choice of the manipulation variable, which may present disturbances. Also, extra caution needs to be taken while processing functional products as there may be a loss of nutrients in the ingredients during processing.

Breakfast cereals are popular as they are convenient and provide nutritional benefits as well.

They can be available in two types, i.e., ready-to-eat cold and hot cereals. The products may be sweetened according to the market demands and incorporate typical breakfast components, such as cocoa, honey, and malt. A further modification involves granola/muesli mixes, which mainly consist of extruded products together with pieces of nuts and raisins. Almost any cereal can be cooked using an extruder, but the number of functional cereals is limited to corn, wheat, and rice. The ready-to-eat cereals are usually cooked and modified by flaking, toasting, puffing, shredding, or extruding.

Single screw extruder has uniform expansion of raw materials

A single screw extruder consists of a live bin, feeding screw, preconditioning cylinder, extruder barrel, die, and knife. It uses one single screw in the barrel of the extruder to transport and shape multiple ingredients into a uniform product type by forcing the ingredient mix through a shaped die to produce a uniform shape. Single screw extruders typically consist of three zones: feeding zone, kneading zone, and cooling zone. In contrast to twin screw extruders, single screw extruders have poor mixing ability, owing to which the materials are required to be pre-mixed or preconditioned.

The hot extrusion segment, by process type is projected to be the fastest-growing during the forecast period.

Hot extrusion or extrusion-cooking of raw food materials deal with the extrusion of ground material at baro-thermal conditions. With the help of the shear energy exerted by the rotating screw and additional heating of the barrel, the food material is heated to its melting point. In this process, the changed rheological status of the food is conveyed under high pressure through a die or a series of dies, and the product expands to its final shape. This results in very different physical and chemical properties of the extrudates compared to those of the raw materials used.

To know about the assumptions considered for the study, download the pdf brochure

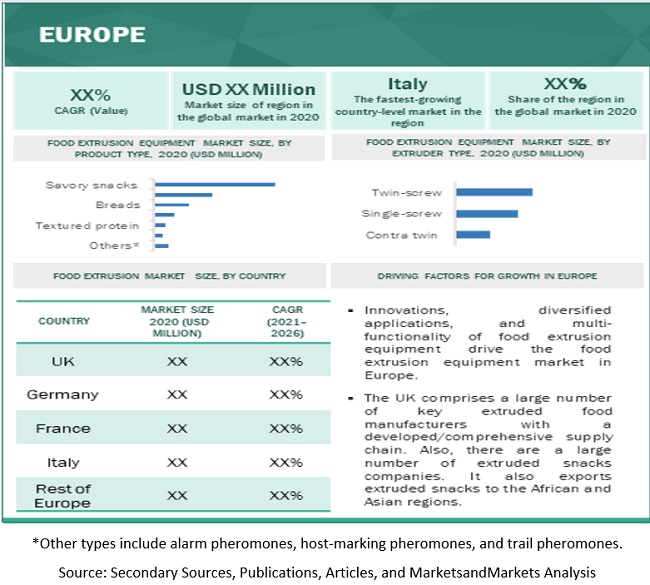

The European region dominated the food extrusion market.

The presence of a developed snack food market offers the European food extrusion market a prominent consumer base with opportunistic growth prospects. The growth of the food industry in this region is estimated to be driven by increasing consumption of processed product types in the Eastern & Southeastern European countries. Increasing consumption of snack product types in this region has also compelled manufacturers to source extruded snack products from other parts of the world for an uninterrupted supply of raw materials, as domestic production is not sufficient to meet the demand from the food industry of Europe.

Key Market Players

The key service providers in this market include Bühler (Switzerland), Akron Tool & Die (US), Baker Perkins (UK), Coperion (Germany), GEA (Germany), KAHL Group (Germany), Triott Group (Netherlands), Flexicon (US), Groupe Legris Industries (Belgium), The Bonnot Company (US), American Extrusion International (US), Shandong Light M&E Co., Ltd (China), Snactek (India), Doering systems, inc. (US), PacMoore (US), Egan Food Technologies (US), Schaaf Technologie GmbH (Germany), Wenger Manufacturing, Inc. (US), Brabender GmbH & Co. KG (Germany), and Jinan Darin Machinery Co., Ltd., (China).

Scope of the report

|

Report Metric |

Details |

|

Market Size Forecast 2026 |

USD 99.7 billion |

|

Market Size at 2021 |

USD 73.1 billion |

|

Estimated CAGR |

6.4 % |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2015-2026 |

|

Historical Base Year |

2020 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Europe |

|

Leading Manufacturers In Food Extrusion Market |

|

Food Extrusion Market:

This research report categorizes the food extrusion market, based on product types, extruder, process and regions.

By product type

- Savory snacks

- Breakfast cereals

- Breads

- Flours & Starches

- Textured protein

- Functional ingredients

- Other product types

By extruder

- Single screw extruder

- Twin screw extruder

- Contra-twin screw extruder

By process

- Cold extrusion

- Hot extrusion

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Target Audience

- Extrusion machinery, technology, and equipment manufacturers and suppliers

- Extruded product type manufacturers, suppliers, and distributors

- Extrusion machinery spare part suppliers and distributors

- Extruded food raw material suppliers and distributors

- Regulatory and research organizations

- Food and agriculture organizations, such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), and Food Standards Australia New Zealand (FSANZ)

- Associations and industry bodies, such as the Extrusion Trade Associations and European Snacks Association

- Government agencies and NGOs

- Food safety agencies

Recent Developments

- In July 2021, Flexicon Corporation Pty Ltd doubled the size of its manufacturing and sales operation. It will ensure the company’s growth in Asia.

- In April 2021, Givaudan and Bühler jointly opened the APAC Protein Innovation Centre. It is located at the Givaudan Woodlands site in Singapore. The Protein Innovation Centre jointly runs being supported by experts from both companies. It is connected to a vast network of R&D innovation centers in Switzerland, and other key hubs across the region helps in plant-based product development on a global scale. This helps the company in achieving a vision of a collaborative and sustainable future of food.

- In October 2019, Coperion provided ZSK 32 Mc18 extruder to DJK Corporation for research and development. It will provide Coperion ZSK 32 Mc18 that can be equipped with ZS-B side feeders, with the Feed Enhancement Technology FET, which optimizes the material intake capacity, as well as with a ZS-EG side devolatilization unit. https://www.coperion.com/en/news-media/newsroom/2019/djk-expands-test-lab-in-japan-with-extruder

- In September 2017, GEA acquired Pavan SPA. It is a growth strategy that will help GEA expand its area of activities in food processing.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food extrusion market?

Europe account largest share in the food extrusion market. The food extrusion market in this region is highly fragmented and consists of a large number of companies, most of which are small to medium in scale. The European Snack Association (ESA) supports the savory snacks industry in Europe by providing technical expertise and information about the European Union (EU) policy.

What is the current size of the global food extrusion market?

The global food extrusion market is valued at USD 68.1 Billion in 2020 and is estimated to be valued at USD 73.1 billion in 2021.

Which are the key players in the market, and how intense is the competition?

Players such as Bühler, Akron Tool & Die, Baker Perkins, Coperion, GEA lead the market because of their innovative products and usage of different distribution channels to meet the demands of consumers. These factors are projected to contribute to the growth of the market.

What is the COVID-19 impact on the food extrusion market?

European and North American regions are highly driven by technology and diverse food applications, contributing to the growth of the food extrusion market. The processed food industry is also witnessing significant growth in developing regions such as China, India, Japan, and Australia. With the outbreak of COVID-19, the customers’ desire for healthy, convenient, and premium products has increased, which is further expected to drive the growth of nutritious, high-fiber extruded foods and functional additives. The food extrusion industry is claimed to aid food hunger and facilitate improving eating characteristics that will fuel the market. .

Can I download the PDF of market research report of Food Extrusion Market?

The latest and updated Nov 2022 market research report for Food Extrusion Market can be accessed on MarketsandMarkets.com. It contains Market forecast, estimated CAGR, key trends and it is updated in Nov 2022. TnC apply.

How much will Food Extrusion Market grow in 2023 and beyond?

The Food Extrusion Market is projected to reach USD 99.7 billion by 2026, recording a CAGR of 6.4% during the forecast period. It is estimated to be valued at USD 73.1 billion in 2021.

Which are the upcoming trends, opportunities in the Food Extrusion Market?

The food extrusion market is primarily driven by the growth of the processed food industry. The changing lifestyles and high disposable incomes of the population have led to an increased demand for ready-to-eat product types as they help save time and effort. Additionally, the demand for processed product types from the urban population of developing economies is expected to subsequently drive the demand for food extrusion equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 FOOD EXTRUSION: GEOGRAPHIC SEGMENTATION

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2020

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 FOOD EXTRUSION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

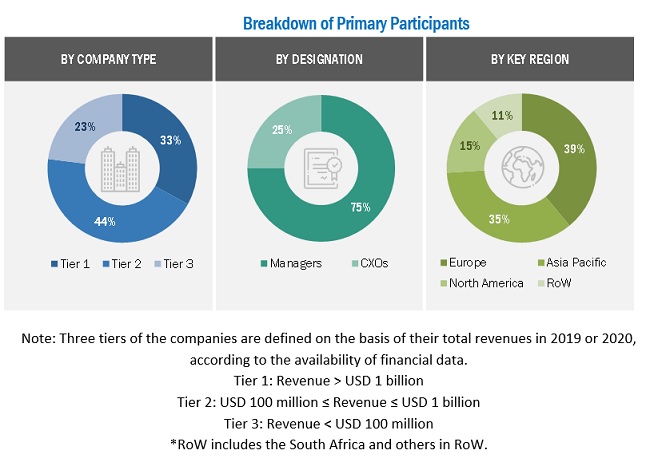

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 FOOD EXTRUSION MARKET SIZE ESTIMATION – SUPPLY SIDE (1/2)

FIGURE 6 MARKET SIZE ESTIMATION – SUPPLY SIDE (2/2)

FIGURE 7 MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 8 FOOD EXTRUSION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.3.1 MARKET SIZE ESTIMATION: SUPPLY SIDE

2.3.2 MARKET SIZE ESTIMATION: DEMAND SIDE

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 11 COVID-19: GLOBAL PROPAGATION

FIGURE 12 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 13 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 14 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 15 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 16 SAVORY SNACKS SEGMENT TO DOMINATE THE GLOBAL MARKET THROUGH 2026 IN TERMS OF VALUE

FIGURE 17 TWIN SCREW EXTRUDERS SEGMENT TO DOMINATE THE FOOD EXTRUSION EQUIPMENT MARKET THROUGH 2026 IN TERMS OF VALUE

FIGURE 18 FOOD EXTRUSION EQUIPMENT MARKET, BY PROCESS, 2021 VS. 2026

FIGURE 19 EUROPE TO DOMINATE THE GLOBAL MARKET IN 2020 IN TERMS OF VALUE

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 20 FOOD EXTRUSION MARKET BY PRODUCT TYPE: AN EMERGING MARKET WITH PROMISING GROWTH POTENTIAL

4.2 FOOD EXTRUSION MARKET GROWTH RATE, BY KEY COUNTRY

FIGURE 21 ITALY TO GROW AT THE HIGHEST RATE IN THE GLOBAL MARKET FROM 2021 TO 2026 IN TERMS OF VALUE

4.3 ASIA PACIFIC FOOD EXTRUSION MARKET SHARE, BY PRODUCT TYPE AND COUNTRY, IN TERMS OF VALUE

FIGURE 22 SAVORY SNACKS SEGMENT TO DOMINATE THE ASIA PACIFIC MARKET IN 2020

4.4 FOOD EXTRUSION EQUIPMENT MARKET, BY EXTRUDER

FIGURE 23 SHARE OF EXTRUDERS IN THE FOOD EXTRUSION EQUIPMENT MARKET, BY REGION, 2020, IN TERMS OF VALUE

4.5 FOOD EXTRUSION EQUIPMENT MARKET, BY COUNTRY, IN TERMS OF VALUE

FIGURE 24 DEVELOPING COUNTRIES TO RECORD THE HIGHEST GROWTH RATES DURING THE FORECAST PERIOD

5 FOOD EXTRUSION MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MACRO INDICATORS

5.3 VALUE CHAIN ANALYSIS

5.3.1 INPUT MARKET

5.3.2 FOOD MARKET

5.3.3 PROCESSING MARKET

5.3.4 DISTRIBUTION

FIGURE 25 VALUE CHAIN ANALYSIS: PROCESSORS ADD 5% TO 7% TO THE PRICE OF THE END PRODUCTS

5.4 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: FOOD EXTRUSION MARKET DYNAMICS

5.4.1 DRIVERS

5.4.1.1 Increase in demand for processed product types

5.4.1.2 Increase in innovations in the global market

5.4.1.3 Trend of veganism to boost the food extrusion market

FIGURE 27 DIETS FOLLOWED BY CONSUMERS IN 2020

5.4.2 RESTRAINTS

5.4.2.1 Volatility of raw material prices

5.4.2.2 Stringent food regulations

5.4.3 OPPORTUNITIES

5.4.3.1 New product developments and launches of extruded product types

5.4.3.2 Government initiatives and investments to expand the processed food sector

5.4.3.3 Changing taste preferences can be sufficed with various emerging applications of extrusion

5.4.4 CHALLENGES

5.4.4.1 Operational complexity during food processing

5.4.4.2 Processing challenges with the combination of healthier products with ancient grains

5.5 IMPACT OF COVID-19 ON THE MARKET DYNAMICS

6 FOOD EXTRUSION MARKET, BY PRODUCT TYPE (Page No. - 63)

6.1 INTRODUCTION

FIGURE 28 SAVORY SNACKS SEGMENT TO DOMINATE THE GLOBAL MARKET THROUGH 2026 IN TERMS OF VALUE

TABLE 2 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 3 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

6.2 COVID-19 IMPACT ON FOOD EXTRUSION MARKET, BY PRODUCT TYPE

6.2.1 REALISTIC SCENARIO

TABLE 4 COVID-19 IMPACT ON THE GLOBAL MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

6.2.2 OPTIMISTIC SCENARIO

TABLE 5 COVID-19 IMPACT ON THE GLOBAL MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

6.2.3 PESSIMISTIC SCENARIO

TABLE 6 COVID-19 IMPACT ON THE GLOBAL MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

6.3 SAVORY SNACKS

TABLE 7 SAVORY SNACKS: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 8 SAVORY SNACKS: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 9 SAVORY SNACKS: MARKET, BY REGION, 2015–2020 (KT)

TABLE 10 SAVORY SNACKS: MARKET, BY REGION, 2021–2026 (KT)

6.4 BREAKFAST CEREALS

TABLE 11 BREAKFAST CEREALS: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 12 BREAKFAST CEREALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 13 BREAKFAST CEREALS: MARKET, BY REGION, 2015–2020 (KT)

TABLE 14 BREAKFAST CEREALS: MARKET, BY REGION, 2021–2026 (KT)

6.5 BREAD

TABLE 15 BREADS: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 16 BREADS: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 BREADS: MARKET, BY REGION, 2015–2020 (KT)

TABLE 18 BREADS: MARKET, BY REGION, 2021–2026 (KT)

6.6 FLOURS & STARCHES

TABLE 19 FLOURS & STARCHES: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 20 FLOURS & STARCHES: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 FLOURS & STARCHES: MARKET, BY REGION, 2015–2020 (KT)

TABLE 22 FLOURS & STARCHES: MARKET, BY REGION, 2021–2026 (KT)

6.7 TEXTURED PROTEIN

TABLE 23 TEXTURED PROTEIN: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 24 TEXTURED PROTEIN: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 TEXTURED PROTEIN: MARKET, BY REGION, 2015–2020 (KT)

TABLE 26 TEXTURED PROTEIN: MARKET, BY REGION, 2021–2026 (KT)

6.8 FUNCTIONAL INGREDIENTS

TABLE 27 FUNCTIONAL INGREDIENTS: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 FUNCTIONAL INGREDIENTS: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 FUNCTIONAL INGREDIENTS: MARKET, BY REGION, 2015–2020 (KT)

TABLE 30 FUNCTIONAL INGREDIENTS: MARKET, BY REGION, 2021–2026 (KT)

6.9 OTHER PRODUCT TYPES

TABLE 31 OTHER PRODUCT TYPES: FOOD EXTRUSION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 32 OTHERS PRODUCT TYPES: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 OTHER PRODUCT TYPES: MARKET, BY REGION, 2015–2020 (KT)

TABLE 34 OTHER PRODUCT TYPES: MARKET, BY REGION, 2021–2026 (KT)

7 FOOD EXTRUSION EQUIPMENT MARKET, BY EXTRUDER (Page No. - 78)

7.1 INTRODUCTION

FIGURE 29 TWIN SCREW EXTRUDERS SEGMENT TO DOMINATE THE FOOD EXTRUSION EQUIPMENT MARKET THROUGH 2026 IN TERMS OF VALUE

TABLE 35 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 36 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON FOOD EXTRUSION MARKET, BY EXTRUDER

7.2.1 REALISTIC SCENARIO

TABLE 37 COVID-19 IMPACT ON THE FOOD EXTRUSION EQUIPMENT MARKET, BY EXTRUDER, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

7.2.2 OPTIMISTIC SCENARIO

TABLE 38 COVID-19 IMPACT ON THE FOOD EXTRUSION EQUIPMENT MARKET, BY EXTRUDER, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

7.2.3 PESSIMISTIC SCENARIO

TABLE 39 COVID-19 IMPACT ON THE FOOD EXTRUSION EQUIPMENT MARKET, BY EXTRUDER, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

7.3 SINGLE SCREW EXTRUDERS

TABLE 40 SINGLE SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 SINGLE SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 TWIN SCREW EXTRUDERS

TABLE 42 TWIN SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 43 TWIN SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 CONTRA TWIN SCREW EXTRUDERS

TABLE 44 CONTRA TWIN SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 CONTRA TWIN SCREW EXTRUDERS: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 FOOD EXTRUSION EQUIPMENT MARKET, BY PROCESS (Page No. - 85)

8.1 INTRODUCTION

FIGURE 30 HOT EXTRUSION SEGMENT TO DOMINATE THE FOOD EXTRUSION EQUIPMENT MARKET THROUGH 2026 IN TERMS OF VALUE

TABLE 46 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 47 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

8.2 COLD EXTRUSION

TABLE 48 COLD EXTRUSION: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 COLD EXTRUSION: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 HOT EXTRUSION

TABLE 50 HOT EXTRUSION: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 51 HOT EXTRUSION: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 FOOD EXTRUSION MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 31 INDIA IS PROJECTED TO GROW AT THE HIGHEST RATE IN THE GLOBAL MARKET FROM 2021 TO 2026, IN TERMS OF VALUE

TABLE 52 FOOD EXTRUSION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 MARKET SIZE, BY REGION, 2015–2020 (KT)

TABLE 55 MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 56 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 57 FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON THE FOOD EXTRUSION MARKET, BY REGION

9.2.1 REALISTIC SCENARIO

TABLE 58 COVID-19 IMPACT ON THE GLOBAL MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

9.2.2 OPTIMISTIC SCENARIO

TABLE 59 COVID-19 IMPACT ON THE GLOBAL MARKET, BY REGION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

9.2.3 PESSIMISTIC SCENARIO

TABLE 60 COVID-19 IMPACT ON THE GLOBAL MARKET, BY REGION, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

9.3 NORTH AMERICA

TABLE 61 NORTH AMERICA: FOOD EXTRUSION MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (KT)

TABLE 64 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 65 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 70 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 71 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.3.1 US

TABLE 75 US: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 76 US: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 77 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 78 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 79 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 80 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 81 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 82 US: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.3.2 CANADA

TABLE 83 CANADA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 84 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 85 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 86 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 87 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 88 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 89 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 90 CANADA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.3.3 MEXICO

TABLE 91 MEXICO: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 92 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 93 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 94 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 95 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 96 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 97 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 98 MEXICO: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4 EUROPE

FIGURE 32 EUROPE: MARKET SNAPSHOT

TABLE 99 EUROPE: FOOD EXTRUSION MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 101 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 102 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 103 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (KT)

TABLE 104 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 105 EUROPE: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 108 EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 109 EUROPE: FOOD EXTRUSION MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4.1 UK

TABLE 113 UK: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 114 UK: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 115 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020(KT)

TABLE 116 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 117 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 118 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 119 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 120 UK: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4.2 GERMANY

TABLE 121 GERMANY: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 123 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020(KT)

TABLE 124 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 125 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 126 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 127 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 128 GERMANY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4.3 FRANCE

TABLE 129 FRANCE: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 131 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020(KT)

TABLE 132 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 133 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 134 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 135 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 136 FRANCE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4.4 ITALY

TABLE 137 ITALY: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 138 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 139 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020(KT)

TABLE 140 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 141 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 142 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 143 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 144 ITALY: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.4.5 REST OF EUROPE

TABLE 145 REST OF EUROPE: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 147 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020(KT)

TABLE 148 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 149 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 150 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 151 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 152 REST OF EUROPE: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 153 ASIA PACIFIC: FOOD EXTRUSION MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (KT)

TABLE 156 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 157 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 158 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 159 ASIA PACIFIC: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 163 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 164 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 165 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 166 ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5.1 CHINA

TABLE 167 CHINA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 169 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 170 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 171 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 172 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 173 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 174 CHINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5.2 INDIA

TABLE 175 INDIA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 176 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 177 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 178 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 179 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 180 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 181 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 182 INDIA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5.3 JAPAN

TABLE 183 JAPAN: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 184 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 185 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 186 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 187 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 188 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 189 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 190 JAPAN: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5.4 AUSTRALIA & NEW ZEALAND

TABLE 191 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 192 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 193 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 194 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 195 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 196 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.5.5 REST OF ASIA PACIFIC

TABLE 199 REST OF ASIA PACIFIC: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 202 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 203 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.6 REST OF THE WORLD (ROW)

TABLE 207 ROW: FOOD EXTRUSION MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 208 ROW: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 209 ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 210 ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 211 ROW: FOOD EXTRUSION MARKET SIZE, BY COUNTRY, 2015–2020 (KT)

TABLE 212 ROW: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 213 ROW: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 214 ROW: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 215 ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 216 ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 217 ROW: FOOD EXTRUSION MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 218 ROW: MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 219 ROW: MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 220 ROW: MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.6.1 BRAZIL

TABLE 221 BRAZIL: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 222 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 223 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 224 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 225 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 226 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 227 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 228 BRAZIL: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.6.2 ARGENTINA

TABLE 229 ARGENTINA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 230 ARGENTINA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 231 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 232 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 233 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 234 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 235 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 236 ARGENTINA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.6.3 SOUTH AFRICA

TABLE 237 SOUTH AFRICA: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 238 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 239 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 240 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 241 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 242 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 243 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 244 SOUTH AFRICA: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

9.6.4 OTHERS IN ROW

TABLE 245 OTHERS IN ROW: FOOD EXTRUSION MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 246 OTHERS IN ROW: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 247 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 248 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

TABLE 249 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2015–2020 (USD MILLION)

TABLE 250 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY EXTRUDER, 2021–2026 (USD MILLION)

TABLE 251 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 252 OTHERS IN ROW: FOOD EXTRUSION EQUIPMENT MARKET SIZE, BY PROCESS, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 179)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS

TABLE 253 FOOD EXTRUSION MARKET: DEGREE OF COMPETITION (COMPETITIVE)

10.3 KEY PLAYER STRATEGIES

10.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2020

FIGURE 34 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANT

FIGURE 35 FOOD EXTRUSION MARKET: COMPANY EVALUATION QUADRANT, 2020

10.5.5 PRODUCT FOOTPRINT

TABLE 254 COMPANY APPLICATION FOOTPRINT

TABLE 255 COMPANY REGION FOOTPRINT

TABLE 256 COMPANY PROCESS FOOTPRINT

TABLE 257 OVERALL COMPANY FOOTPRINT

10.6 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 36 FOOD EXTRUSION MARKET: COMPANY EVALUATION QUADRANT, 2020

10.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

10.7.1 PRODUCT LAUNCHES

TABLE 258 PRODUCT LAUNCHES, 2017–2021

10.7.2 DEALS

TABLE 259 DEALS, 2017–2019

10.7.3 OTHERS

TABLE 260 EXPANSIONS, 2021

11 COMPANY PROFILES (Page No. - 192)

(Business overview, Products offered, Recent developments & MnM View)*

11.1 KEY PLAYERS

11.1.1 BÜHLER

TABLE 261 BÜHLER: BUSINESS OVERVIEW

FIGURE 37 BÜHLER: COMPANY SNAPSHOT

TABLE 262 BÜHLER: PRODUCTS OFFERED

TABLE 263 FOOD EXTRUSION MARKET: PRODUCT LAUNCHES, JUNE 2019

TABLE 264 MARKET: OTHERS, APRIL 2021

11.1.2 AKRON TOOL & DIE

TABLE 265 AKRON TOOL & DIE: BUSINESS OVERVIEW

TABLE 266 AKRON TOOL & DIE: PRODUCTS OFFERED

11.1.3 BAKER PERKINS

TABLE 267 BAKER PERKINS: BUSINESS OVERVIEW

TABLE 268 BAKER PERKINS: PRODUCTS OFFERED

TABLE 269 FOOD EXTRUSION MARKET: PRODUCT LAUNCHES, FEBRUARY 2017- MAY 2017

11.1.4 COPERION

TABLE 270 COPERION: BUSINESS OVERVIEW

TABLE 271 COPERION: PRODUCTS OFFERED

TABLE 272 FOOD EXTRUSION MARKET: PRODUCT LAUNCHES, DECEMBER 2020

TABLE 273 FOOD EXTRUSION MARKET: DEALS, OCTOBER 2019

11.1.5 GEA

TABLE 274 GEA: BUSINESS OVERVIEW

FIGURE 38 GEA: COMPANY SNAPSHOT

TABLE 275 GEA: PRODUCTS OFFERED

TABLE 276 GEA: PRODUCT LAUNCHES, AUGUST 2021

TABLE 277 GEA: DEALS, SEPTEMBER 2017

11.1.6 KAHL GROUP

TABLE 278 KAHL GROUP: BUSINESS OVERVIEW

TABLE 279 KAHL GROUP: PRODUCTS OFFERED

11.1.7 TRIOTT GROUP

TABLE 280 TRIOTT GROUP: BUSINESS OVERVIEW

TABLE 281 TRIOTT GROUP: PRODUCTS OFFERED

11.1.8 THREE-TEC GMBH

TABLE 282 THREE-TEC GMBH: BUSINESS OVERVIEW

TABLE 283 THREE-TEC GMBH: PRODUCTS OFFERED

11.1.9 GROUPE LEGRIS INDUSTRIES

TABLE 284 GROUPE LEGRIS INDUSTRIES: BUSINESS OVERVIEW

FIGURE 39 GROUPE LEGRIS INDUSTRIES: COMPANY SNAPSHOT

TABLE 285 GROUPE LEGRIS INDUSTRIES: PRODUCTS OFFERED

11.1.10 THE BONNOT COMPANY

TABLE 286 THE BONNOT COMPANY: BUSINESS OVERVIEW

TABLE 287 THE BONNOT COMPANY: PRODUCTS OFFERED

11.1.11 AMERICAN EXTRUSION INTERNATIONAL

TABLE 288 AMERICAN EXTRUSION INTERNATIONAL: BUSINESS OVERVIEW

TABLE 289 AMERICAN EXTRUSION INTERNATIONAL: PRODUCTS OFFERED

11.1.12 SHANDONG LIGHT M&E CO., LTD

TABLE 290 SHANDONG LIGHT M&E CO., LTD: BUSINESS OVERVIEW

TABLE 291 SHANDONG LIGHT M&E CO., LTD: PRODUCTS OFFERED

11.1.13 SNACKTEK

TABLE 292 SNACTECK.: BUSINESS OVERVIEW

TABLE 293 SNACKTEK: PRODUCTS OFFERED

11.1.14 DOERING SYSTEMS, INC.

TABLE 294 DOERING SYSTEMS, INC.: BUSINESS OVERVIEW

TABLE 295 DOERING SYSTEMS, INC.: PRODUCTS OFFERED

11.1.15 PACMOORE

TABLE 296 PACMOORE: BUSINESS OVERVIEW

TABLE 297 PACMOORE: PRODUCTS OFFERED

11.1.16 EGAN FOOD TECHNOLOGIES

TABLE 298 EGAN FOOD TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 299 EGAN FOOD TECHNOLOGIES: PRODUCTS OFFERED

11.1.17 SCHAAF TECHNOLOGIE GMBH

TABLE 300 SCHAAF TECHNOLOGIE GMBH: BUSINESS OVERVIEW

TABLE 301 SCHAAF TECHNOLOGIE GMBH: PRODUCTS OFFERED

11.1.18 WENGER MANUFACTURING, INC

TABLE 302 WENGER MANUFACTURING, INC: BUSINESS OVERVIEW

TABLE 303 WENGER MANUFACTURING, INC.: PRODUCTS OFFERED

11.1.19 BARBENDER GMBH & CO. KG

TABLE 304 BARBENDER GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 305 BARBENDER GMBH & CO. KG: PRODUCTS OFFERED

11.1.20 JINAN DARIN MACHINERY CO., LTD.,

TABLE 306 JINAN DARIN MACHINERY CO., LTD., BUSINESS OVERVIEW

TABLE 307 JINAN DARIN MACHINERY CO., LTD.,: PRODUCTS OFFERED

11.1.21 HENAN HIWANT INTERNATIONAL CO., LTD

11.1.22 DEMACO

11.1.23 CARUGIL

11.1.24 SUNPRING EXTRUSION

11.1.25 SHANDONG LIGHT M&E CO., LTD

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 230)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 SAVORY INGREDIENTS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 SAVORY INGREDIENTS MARKET, BY APPLICATION

TABLE 308 SAVORY INGREDIENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 309 SAVORY INGREDIENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

12.3.4 SAVORY INGREDIENTS MARKET, BY REGION

TABLE 310 SAVORY INGREDIENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 311 SAVORY INGREDIENTS MARKET SIZE, BY REGION, 2018–2025 (KT)

12.4 FOOD ROBOTICS MARKET

12.4.1 LIMITATIONS

12.4.2 MARKET DEFINITION

12.4.3 MARKET OVERVIEW

12.4.4 FOOD ROBOTICS MARKET, BY APPLICATION

TABLE 312 FOOD ROBOTICS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

12.4.5 FOOD ROBOTICS MARKET, BY REGION

TABLE 313 FOOD ROBOTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

13 APPENDIX (Page No. - 237)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the market size for food extrusion market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers, certified publications, articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation, according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The food extrusion market comprises several stakeholders, such as food raw material suppliers, extruded food processors, extrusion technology and equipment suppliers, extrusion machine manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the food industry and growth in population. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the food & beverage industry. The primary sources from the supply side include research institutions involved in R&D to introduce new technologies, key opinion leaders, distributors, extrusion machine manufacturers & suppliers, and extruded product type manufacturers and distributors.

To know about the assumptions considered for the study, download the pdf brochure

Food Extrusion Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food extrusion market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The approach aided in understanding the trend of food applications for which food extrusion was adopted at a country level. These were individually added up for each country to arrive at the global and regional market size and CAGR.

- All macroeconomic and microeconomic factors, such as the consumption of processed food and retail sales of ready-to-eat foods that affect the growth of the food extrusion market, were considered while estimating the market size.

- The market size, regional, and segmental market shares so obtained were validated with key primary respondents in the food extrusion market.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed wherever applicable. The data for extruded product types and extrusion machines were separately calculated by studying various factors and trends from both demand and supply sides in the food extrusion industry. The market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for food extrusion on the basis of process, extruder, product type, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food extrusion market

- The food extrusion market indicates the market size for extruded product types and the food extrusion equipment market for extruders and process

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for food extrusion into the UK, and Greece

- Further breakdown of the Rest of Asia Pacific market for food extrusion into South Korea, Thailand, and Indonesia

- Further breakdown of the Rest of South America market for food extrusion into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for food extrusion into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Extrusion Market