Carpets & Rugs Market by Type (Tufted, Woven, Needle-punched, Knotted), Material (Nylon, Polyester, Polypropylene), End-use Sector (Residential, Non-residential, Automotive & Transportation), and Region - Global Forecast to 2022

[193 Pages Report] The global carpets & rugs market was valued at USD 88.24 billion in 2016, and is projected to reach USD 112.69 billion by 2022, at a CAGR of 4.2%. The base year considered for the study is 2016, with the market size projected from 2017 to 2022. The primary objective of the study is to define, segment, and project the carpets & rugs market size on the basis of type, material, end-use sector, and region. The study also aims at strategically analyzing micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market. It also provides detailed information about the main factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). In addition to this, the study analyzes competitive developments such as acquisitions, expansions, and research & development activities in the carpets & rugs market.

Market Dynamics

Drivers

- Rise in the number of renovation & remodeling activities

- Growing interest of consumers toward interior decoration

- Rapid urbanization & globalization

Restraints

- High prices of raw materials

Opportunities

- Rise in the number of construction activities in the developing economies

- Growing importance of organized retailing

Challenges

- Disposal of wastes

Rise in the number of renovation & remodeling activities drives the demand for carpets & Rugs at a large scale

Carpets & rugs are used for their aesthetic appeal and functional properties, which include slip resistance and thermal insulation to the floor. In addition to covering floors and further improving the overall appeal of home or office decor, carpets & rugs offer a protective layer to floors. In regions with mostly cold climate, carpets & rugs are used for keeping the floor from getting too cold. A few decades ago, the demand for carpets & rugs was the highest in developed economies. However, this trend has changed in the last few years, with consumers spending more money on bringing about aesthetic improvements to their homes or office spaces. This demand, to some extent, has also been driven by the easing economic crisis, which has led to a renewed demand for carpets & rugs. Moreover, the rising disposable income of consumers, especially in developing nations, is likely to encourage the growth of the market.

The following are the major objectives of the study.

- To define, segment, and project the carpets & rugs market on the basis of type, material, end-use sector, and region

- To project the size of the market and its sub segments in terms of value and volume, with respect to the five main regions (along with their respective key countries), namely, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and industry trends)

- To strategically analyze the micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for the stakeholders and provide a competitive landscape of the market leaders

- To analyze the competitive developments such as acquisitions, expansions, and new product launches in the carpets & rugs market

- To strategically profile the key players and comprehensively analyze their core competencies

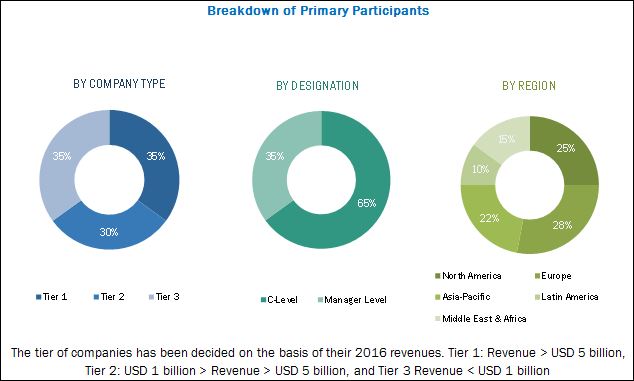

The research methodology used to estimate and forecast the market size included the top-down approach. The total market size for carpets & rugs was calculated; accordingly, weightages in terms of percentage were assigned to different sectors in each of the segments, which were done on the basis of extensive primary interviews and secondary research such as Central Carpets Industries Associations (CCIA), Carpet Export Promotion Counsil (CEPC), European Carpet & Rug Association (ECRA), and Flooring Industry Associations. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The market ecosystem involves various stakeholders in the carpets & rugs market. It starts with raw material suppliers such as Mohawk Industries, Inc. (U.S.), Shaw Industries Group (U.S.), Lowes Companies, Inc. (U.S.), Taekett S.A. (France), and Home Depot, Inc. (U.S.) that are the manufacturing companies of the carpets & rugs. The next level in the chain involves the assembly team that is monitored by manufacturers such as Interface, Inc. (U.S.), Dixie Group, Inc. (U.S.), Orientals Weavers Company for Carpets (Egypt), Tai Ping Carpets International Limited (China), and Victoria PLC (U.K.). It is followed by the marketing and sales of the finished products, which is only possible if an efficient distribution channel is developed. Finally, the end products are distributed to the consumers.

Major Market Developments

- In December 2016, Shaw Industries Group, Inc. (U.S.) constructed a new carpet tile manufacturing facility in Adairsville, Georgia with USD 85.0 million. This expansion helped the company to expand its geographical reach and enhance its production capacity.

- In September 2015, Victoria PLC acquired Interfloor Group Limited (U.K.), which is one of the leading manufacturers of carpet underlay and related accessories for USD 72.2 million. This acquisition aimed at expanding the companys geographical reach and enhance its product portfolio.

Target audience

- Raw material suppliers

- Manufacturers of carpets & rugs

- Importers and exporters of carpets & rugs

- Traders, distributors, and suppliers of carpets & rugs

- Logistics partners

- Market research & consulting firms

- Regulatory bodies and government

Scope of the report

This research report categorizes the carpets & rugs market based type, material, end-use sector, and region.

Based on type, the market has been segmented as follows:

- Tufted

- Woven

- Needle-punched

- Knotted

- Others (Needle-felt, knitted, hooked, and braided)

Based on material, the market has been segmented as follows:

- Nylon

- Polyster

- Polypropylene

- Others (Wool, triexta, acrylic, and silk)

Based on end-use sector, the market has been segmented as follows:

- Residential

- Non-residential

- Automotive & transportation

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the market for different recycled product types

Geographic Analysis

- Further analysis of carpets & rugs market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

MarketsandMarkets projects that the size of the carpets & rugs market will grow from USD 91.60 billion in 2017 to USD 112.69 billion by 2022, at an estimated CAGR of 4.2%. The carpets & rugs market is expected to witness a high growth due to factors such as an increase in middle-class population, growth in demand from the residential and non-residential sectors, and increase in the renovation & remodeling activities.

Carpets & rugs are used to cover residential and non-residential floors, which include offices, educational institutions, healthcare facilities, hotels, recreation centers, and retails outlets in order to decorate and enhance the appearance of the interior space. Carpets & rugs can be both machine-made and handmade. They are made of materials such as nylon, polypropylene, polyester, wool, cotton, jute, and silk. Handmade carpets & rugs are considered more durable and long-lasting compared to machine-made ones; these can be manufactured at a faster rate than handmade carpets & rugs. The growing interest of consumers in home dιcor, the booming housing construction sector, rise in renovation & remodeling activities, and rapid urbanization & globalization are among the factors contributing to the growth of this market worldwide.

This report has been segmented on the basis of type, material, end-use sector, and region. On the basis of type, the tufted segment, which is projected to be the fastest-growing market during the forecast period, accounted for the largest share in 2016. Tufted carpets are treated with stain-resistant chemicals to increase the longevity of the carpet fibers. These carpets are used for wall-to-wall carpeting and are ideal for rooms with heavy furniture and high footfall.

On the basis of material, the nylon segment accounted for the largest share in 2016 and is projected to grow at the second-highest CAGR during the forecast period. This growth can be attributed to nylons good resilience, stain and abrasion resistance, good yarn memory to hold twist, ability to hide soil, and superior cleaning efficacy. Due to its high strength, carpets manufactured from nylon fiber are used in areas with heavy foot traffic, mainly for industrial and commercial carpeting. The polypropylene segment is projected to grow at the highest rate in the carpets & rugs market during the forecast period.

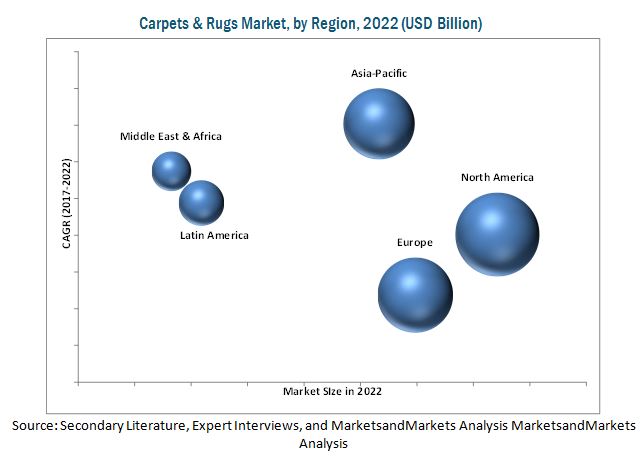

In 2016, the North American region accounted for the largest share in the total market for carpets & rugs, in terms of value, followed by Europe and Asia-Pacific, owing to manufacturers focus on developing low-cost options for carpets & rugs. The Asia-Pacific market is projected to register the highest growth during the forecast period; this is attributed to the increase in construction activities in countries such as China, Japan, India, and Indonesia; this, in turn, is expected to lead to the growth of the carpets & rugs market. The carpets & rugs market in the North American region is developed and matured; the markets in the U.S. and Canada are projected to grow the highest rates from 2017 to 2022.

Under the end-use sector, the residential sector is projected to grow at the highest rate, as carpets are mainly used as floor covering. In this sector, it is used for its enhancement of the aesthetic appeal of a room and sound & thermal insulation. Carpets are available in a wide range of colors and textures to suit all decors. The demand from this sector is supported by increased investment in new housing constructions and home renovation projects such as the replacement of worn or out-of-style carpets and rugs, which is also driven by increase in disposable income. Factors such as moderate cost, ease of installation, and favorable aesthetics are to spur the demand for carpets and rugs in newly built houses.

The global carpets & rugs market is dominated by players such as Mohawk Industries, Inc. (U.S.), Shaw Industries Group (U.S.), Lowes Companies, Inc. (U.S.), Taekett S.A. (France), Home Depot, Inc. (U.S.), Interface, Inc. (U.S.), Dixie Group, Inc. (U.S.), Orientals Weavers Company for Carpets (Egypt), Tai Ping Carpets International Limited (China), and Victoria PLC (U.K.). These players adopted various strategies such as acquisitions and expansions to cater to the needs of the carpets & rugs market.

Critical questions the report answers:

- What is the political, social, economic, and technological scenario currently prevailing in different regions and their impact on the demand for carpets & rugs?

- What are the major trends evident in the global carpets & rugs market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Developing Economies to Register High Growth in Demand for Carpets & Rugs

4.2 Carpets & Rugs Market, By Type & Region

4.3 Asia-Pacific: Carpets & Rugs Market, By Material

4.4 Market, By End-Use Sector & Region, 2017

4.5 Asia-Pacific: Carpet & Rugs Market, By Type & Country

4.6 Market: Regional Snapshot

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in the Number of Renovation & Remodeling Activities

5.2.1.2 Growing Interest of Consumers Toward Interior Decoration

5.2.1.3 Rapid Urbanization & Globalization

5.2.2 Restraints

5.2.2.1 High Prices of Raw Materials

5.2.3 Opportunities

5.2.3.1 Rise in the Number of Construction Activities in the Developing Economies

5.2.3.2 Growing Importance of Organized Retailing

5.2.4 Challenges

5.2.4.1 Disposal of Wastes

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Prominent Companies

6.2.2 Small & Medium Enterprises

6.3 Macro Economic Indicator

6.3.1 Rising Population

6.3.2 Increase in Middle-Class Population, 20092030

6.3.3 Developing Economics, GDP (Purchasing Power Parity), 2015

6.3.4 GDP & Contribution to the Construction Industry, By Country

7 Carpets & Rugs Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Tufted

7.3 Woven

7.4 Needle-Punched

7.5 Knotted

7.6 Others

8 Carpets & Rugs Market, By Material (Page No. - 58)

8.1 Introduction

8.2 Nylon

8.3 Polyester

8.4 Polypropylene

8.5 Others

9 Carpets & Rugs Market, By End-Use Sector (Page No. - 62)

9.1 Introduction

9.2 Residential

9.3 Non-Residential

9.4 Automotive & Transportation

10 Carpets & Rugs Market, By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 North America: Carpets & Rugs Market, By Country

10.2.2 North America: Market, By Type

10.2.3 North America: Market, By Material

10.2.4 North America: Market, By End-Use Sector

10.2.5 U.S.

10.2.5.1 U.S.: Carpets & Rugs Market, By Type

10.2.5.2 U.S.: Market, By End-Use Sector

10.2.6 Canada

10.2.6.1 Canada: Carpets & Rugs Market, By Type

10.2.6.2 Canada: Market, By End-Use Sector

10.2.7 Mexico

10.2.7.1 Mexico: Carpets & Rugs Market, By Type

10.2.7.2 Mexico: Market, By End-Use Sector

10.3 Europe

10.3.1 Europe: Carpets & Rugs Market, By Country

10.3.2 Europe: Market, By Type

10.3.3 Europe: Market, By Material

10.3.4 Europe: Market, By End-Use Sector

10.3.5 Germany

10.3.5.1 Germany: Carpets & Rugs Market, By Type

10.3.5.2 Germany: Market, By End-Use Sector

10.3.6 U.K.

10.3.6.1 U.K.: Carpets & Rugs Market, By Type

10.3.6.2 U.K.: Market, By End-Use Sector

10.3.7 France

10.3.7.1 France: Carpets & Rugs Market, By Type

10.3.7.2 France: Market, By End-Use Sector

10.3.8 Spain

10.3.8.1 Spain: Carpets & Rugs Market, By Type

10.3.8.2 Spain: Market, By End-Use Sector

10.3.9 Italy

10.3.9.1 Italy: Carpets & Rugs Market, By Type

10.3.9.2 Italy: Market, By End-Use Sector

10.3.10 Rest of Europe

10.3.10.1 Rest of Europe: Carpets & Rugs Market, By Type

10.3.10.2 Rest of Europe: Market, By End-Use Sector

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Carpets & Rugs Market, By Country

10.4.2 Asia-Pacific: Market, By Type

10.4.3 Asia-Pacific: Market, By Material

10.4.4 Asia-Pacific: Market, By End-Use Sector

10.4.5 China

10.4.5.1 China: Carpets & Rugs Market, By Type

10.4.5.2 China: Market, By End-Use Sector

10.4.6 India

10.4.6.1 India: Carpets & Rugs Market, By Type

10.4.6.2 India: Market, By End-Use Sector

10.4.7 Japan

10.4.7.1 Japan: Carpets & Rugs Market, By Type

10.4.7.2 Japan: Market, By End-Use Sector

10.4.8 Australia

10.4.8.1 Australia: Carpets & Rugs Market, By Type

10.4.8.2 Australia: Market, By End-Use Sector

10.4.9 Indonesia

10.4.9.1 Indonesia: Carpets & Rugs Market, By Type

10.4.9.2 Indonesia : Market, By End-Use Sector

10.4.10 Rest of Asia-Pacific

10.4.10.1 Rest of Asia-Pacific: Carpets & Rugs Market, By Type

10.4.10.2 Rest of Asia-Pacific: Market, By End-Use Sector

10.5 Middle East & Africa (MEA)

10.5.1 Middle East & Africa: Carpets & Rugs Market, By Country

10.5.2 Middle East & Africa: Market, By Type

10.5.3 Middle East & Africa: Market, By Material

10.5.4 Middle East & Africa: Market, By End-Use Sector

10.5.5 Turkey

10.5.5.1 Turkey: Carpets & Rugs Market, By Type

10.5.5.2 Turkey: Market, By End-Use Sector

10.5.6 Saudi Arabia

10.5.6.1 Saudi Arabia: Carpets & Rugs Market, By Type

10.5.6.2 Saudi Arabia: Market, By End-Use Sector

10.5.7 UAE

10.5.7.1 UAE: Carpets & Rugs Market, By Type

10.5.7.2 UAE: Market, By End-Use Sector

10.5.8 South Africa

10.5.8.1 South Africa: Carpets & Rugs Market, By Type

10.5.8.2 South Africa: Market, By End-Use Sector

10.5.9 Egypt

10.5.9.1 Egypt: Carpets & Rugs Market, By Type

10.5.9.2 Egypt: Market, By End-Use Sector

10.5.10 Rest of Middle East & Africa

10.5.10.1 Rest of Middle East & Africa: Carpets & Rugs Market, By Type

10.5.10.2 Rest of Middle East & Africa: Market, By End-Use Sector

10.6 South America

10.6.1 South America: Carpets & Rugs Market, By Country

10.6.2 South America: Market, By Type

10.6.3 South America: Market, By Material

10.6.4 South America: Market, By End-Use Sector

10.6.5 Brazil

10.6.5.1 Brazil: Carpets & Rugs Market, By Type

10.6.5.2 Brazil: Market, By End-Use Sector

10.6.6 Argentina

10.6.6.1 Argentina: Carpets & Rugs Market, By Type

10.6.6.2 Argentina: Market, By End-Use Sector

10.6.7 Rest of South America

10.6.7.1 Rest of South America: Carpets & Rugs Market, By Type

10.6.7.2 Rest of South America: Market, By End-Use Sector

11 Competitive Landscape (Page No. - 142)

11.1 Introduction

11.2 Competitive Leadership Mapping, 2016

11.2.1 Dynamic Differentiators

11.2.2 Innovators

11.2.3 Visionary Leaders

11.2.4 Emerging Companies

11.3 Competitive Benchmarking

11.3.1 Product Offerings

11.3.2 Business Strategy

11.4 Market Ranking of Key Players

11.4.1 Mohawk Industries, Inc.

11.4.2 Shaw Industries Group

11.4.3 Lowes Company, Inc.

11.4.4 Tarkett S.A.

11.4.5 Home Depot, Inc.

12 Company Profiles (Page No. - 149)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Mohawk Industries Inc.

12.2 Shaw Industries Group, Inc.

12.3 Tarkett S.A.

12.4 Lowes Companies, Inc.

12.5 Interface Inc.

12.6 Dixie Group, Inc.

12.7 Oriental Weavers Company for Carpet.

12.8 Tai Ping Carpets International Limited

12.9 Victoria PLC

12.10 The Home Depot, Inc.

12.11 Additional Companies

12.11.1 Mannington Mills, Inc.

12.11.2 Beaulieu International Group

12.11.3 Ikea Group

12.11.4 Engineered Floors LLC

12.11.5 Royalty Carpet Mills, Inc.

12.11.6 Stark Carpet Corp.

12.11.7 Invista

12.11.8 Milliken & Company

12.11.9 Kraus Carpet Mills Ltd.

12.11.10 Couristan, Inc.

12.11.11 ABBey Carpet & Floor

12.11.12 Axminster Carpets Ltd

12.11.13 Floor Coverings International

12.11.14 Avalanche Flooring, Inc.

12.11.15 Foamex International Inc

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 186)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (156 Tables)

Table 1 World Urbanization Trends, 19902050

Table 2 North America: GDP, By Country, 20152022 (USD Billion)

Table 3 North America: Contribution to the Construction Industry, By Country, 20142021 (USD Billion)

Table 4 Europe: GDP, By Country, 20152022 (USD Billion)

Table 5 Europe: Contribution to the Construction Industry, By Country, 20142021 (USD Billion)

Table 6 Asia-Pacific: GDP, By Country, 20152022 (USD Billion)

Table 7 Asia-Pacific: Contribution to the Construction Industry, By Country, 20142021 (USD Billion)

Table 8 Middle East & Africa: GDP, By Country, 20152022 (USD Billion)

Table 9 Middle East & Africa: Contribution to the Construction Industry, By Country, 20142021 (USD Billion)

Table 10 South America: GDP, By Country, 20152022 (USD Billion)

Table 11 South America: Contribution to the Construction Industry, By Country, 20142021 (USD Billion)

Table 12 Carpets & Rugs Market Size, By Type, 20152022 (USD Billion)

Table 13 Market Size, By Type, 20152022 (Billion Square Feet)

Table 14 Market Size, By Material, 20152022 (USD Billion)

Table 15 Market Size, By Material, 20152022 (Billion Square Feet)

Table 16 Market Size, By End-Use Sector, 20152022 (USD Billion)

Table 17 Market Size, By End-Use Sector, 20152022 (Billion Square Feet)

Table 18 Market Size, By Region, 20152022 (USD Million)

Table 19 Market Size, By Region, 20152022 (Million Square Feet)

Table 20 North America: Carpets & Rugs Market Size, By Country, 20152022 (USD Million)

Table 21 North America: Carpets & Rugs Market Size, By Country, 20152022 (Million Square Feet)

Table 22 North America: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 23 North America: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 24 North America: Carpets & Rugs Market Size, By Material, 20152022 (USD Million)

Table 25 North America: Carpets & Rugs Market Size, By Material, 20152022 (Million Square Feet)

Table 26 North America: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 27 North America: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 28 U.S.: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 29 U.S.: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 30 U.S.: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 31 U.S.: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 32 Canada: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 33 Canada: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 34 Canada: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 35 Canada: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 36 Mexico: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 37 Mexico: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 38 Mexico: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 39 Mexico: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 40 Europe: Carpets & Rugs Market Size, By Country, 20152022 (USD Million)

Table 41 Europe: Carpets & Rugs Market Size, By Country, 20152022 (Million Square Feet)

Table 42 Europe: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 43 Europe: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 44 Europe: Carpets & Rugs Market Size, By Material, 20152022 (USD Million)

Table 45 Europe: Carpets & Rugs Market Size, By Material, 20152022 (Million Square Feet)

Table 46 Europe: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 47 Europe: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 48 Germany: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 49 Germany: By Market Size, By Type, 20152022 (Million Square Feet)

Table 50 Germany: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 51 Germany: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 52 U.K.: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 53 U.K.: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 54 U.K.: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 55 U.K.: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 56 France: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 57 France: By Market Size, By Type, 20152022 (Million Square Feet)

Table 58 France: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 59 France: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 60 Spain: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 61 Spain: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 62 Spain: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 63 Spain: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 64 Italy: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 65 Italy: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 66 Italy: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 67 Italy: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 68 Rest of Europe: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 69 Rest of Europe: By Market Size, By Type, 20152022 (Million Square Feet)

Table 70 Rest of Europe: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 71 Rest of Europe: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 72 Asia-Pacific: Carpets & Rugs Market Size, By Country, 20152022 (USD Million)

Table 73 Asia-Pacific: By Market Size, By Country, 20152022 (Million Square Feet)

Table 74 Asia-Pacific: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 75 Asia-Pacific: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 76 Asia-Pacific: Carpets & Rugs Market Size, By Material, 20152022 (USD Million)

Table 77 Asia-Pacific: Carpets & Rugs Market Size, By Material, 20152022 (Million Square Feet)

Table 78 Asia-Pacific: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 79 Asia-Pacific: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 80 China: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 81 China: By Market Size, By Type, 20152022 (Million Square Feet)

Table 82 China: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 83 China: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 84 India: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 85 India: Carpets & Rugs Market Size, By Type, 20152022 (Million Square Feet)

Table 86 India: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (USD Million)

Table 87 India: Carpets & Rugs Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 88 Japan: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 89 Japan: By Market Size, By Type, 20152022 (Million Square Feet)

Table 90 Japan: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 91 Japan: ByMarket Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 92 Australia: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 93 Australia: By Market Size, By Type, 20152022 (Million Square Feet)

Table 94 Australia: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 95 Australia: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 96 Indonesia: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 97 Indonesia: By Market Size, By Type, 20152022 (Million Square Feet)

Table 98 Indonesia: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 99 Indonesia: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 100 Rest of Asia-Pacific: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 101 Rest of Asia-Pacific: By Market Size, By Type, 20152022 (Million Square Feet)

Table 102 Rest of Asia-Pacific: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 103 Rest of Asia-Pacific: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 104 Middle East & Africa: Carpets & Rugs Market Size, By Country, 20152022 (USD Million)

Table 105 Middle East & Africa: By Market Size, By Country, 20152022 (Million Square Feet)

Table 106 Middle East & Africa: By Market Size, By Type, 20152022 (USD Million)

Table 107 Middle East & Africa: By Market Size, By Type, 20152022 (Million Square Feet)

Table 108 Middle East & Africa: By Market Size, By Material, 20152022 (USD Million)

Table 109 Middle East & Africa: By Market Size, By Material, 20152022 (Million Square Feet)

Table 110 Middle East & Africa: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 111 Middle East & Africa: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 112 Turkey: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 113 Turkey: By Market Size, By Type, 20152022 (Million Square Feet)

Table 114 Turkey: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 115 Turkey: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 116 Saudi Arabia: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 117 Saudi Arabia: By Market Size, By Type, 20152022 (Million Square Feet)

Table 118 Saudi Arabia: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 119 Saudi Arabia: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 120 UAE: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 121 UAE: By Market Size, By Type, 20152022 (Million Square Feet)

Table 122 UAE: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 123 UAE: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 124 South Africa: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 125 South Africa: By Market Size, By Type, 20152022 (Million Square Feet)

Table 126 South Africa: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 127 South Africa: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 128 Egypt: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 129 Egypt: By Market Size, By Type, 20152022 (Million Square Feet)

Table 130 Egypt: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 131 Egypt: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 132 Rest of Middle East & Africa: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 133 Rest of Middle East & Africa: By Market Size, By Type, 20152022 (Million Square Feet)

Table 134 Rest of Middle East & Africa: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 135 Rest of Middle East & Africa: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 136 South America: Carpets & Rugs Market Size, By Country, 20152022 (USD Million)

Table 137 South America: By Market Size, By Country, 20152022 (Million Square Feet)

Table 138 South America: By Market Size, By Type, 20152022 (USD Million)

Table 139 South America: By Market Size, By Type, 20152022 (Million Square Feet)

Table 140 South America: By Market Size, By Material, 20152022 (USD Million)

Table 141 South America: By Market Size, By Material, 20152022 (Million Square Feet)

Table 142 South America: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 143 South America: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 144 Brazil: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 145 Brazil: By Market Size, By Type, 20152022 (Million Square Feet)

Table 146 Brazil: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 147 Brazil: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 148 Argentina: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 149 Argentina: By Market Size, By Type, 20152022 (Million Square Feet)

Table 150 Argentina: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 151 Argentina: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 152 Rest of South America: Carpets & Rugs Market Size, By Type, 20152022 (USD Million)

Table 153 Rest of South America: By Market Size, By Type, 20152022 (Million Square Feet)

Table 154 Rest of South America: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 155 Rest of South America: By Market Size, By End-Use Sector, 20152022 (Million Square Feet)

Table 156 Market Ranking, 2016

List of Figures (33 Figures)

Figure 1 Carpets & Rugs Market: Segmentation

Figure 2 Carpets & Rugs Market, By Region

Figure 3 Global Carpets & Rugs Market: Research Design

Figure 4 Breakdown of Primaries

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Global Carpets & Rugs Market: Data Triangulation Methodology

Figure 8 Tufted Carpets & Rugs Projected to Remain the Largest Segment, By Material, Through 2022

Figure 9 Polypropylene Segment to Register the Highest Growth Rate During the Forecast Period

Figure 10 Residential Sector to Dominate the Demand for Carpet & Rugs Through 2022

Figure 11 North America Was the Largest Market for Carpets & Rugs in 2016

Figure 12 Rise in Construction in Developing Economies Offer Attractive Opportunities in the Carpets & Rugs Market

Figure 13 Tufted Segment to Lead the Global Market Through 2022

Figure 14 Ploypropylene Segment to Grow at the Highest Rate During the Forecast Period in Asia-Pacific

Figure 15 Residential Segment to Dominate the Carpets & Rugs Market in 2017

Figure 16 Tufted Carpets & Rugs Captured the Largest Share in the Asia-Pacific Market, in 2016

Figure 17 Market in China is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 18 Carpets & Rugs Market Dynamics

Figure 19 Carpets & Rugs Market: Supply Chain Analysis

Figure 20 Projected GDP Per Capita, By Country

Figure 21 Geographical Snapshot (20172022): Market in China Projected to Grow at the Highest Rate, in Terms of Value

Figure 22 North American Carpets & Rugs Market Snapshot: U.S. Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 23 Asia-Pacific Carpets & Rugs Market Snapshot: China is Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 24 Carpets & Rugs Market: Dive Chart

Figure 25 Mohawk Industries, Inc.: Company Snapshot

Figure 26 Tarkett S.A.: Company Snapshot

Figure 27 Lowes Companies, Inc.: Company Snapshot

Figure 28 Interface Inc.: Company Snapshot

Figure 29 Dixie Group, Inc.: Company Snapshot

Figure 30 Orientals Weavers Company for Carpets: Company Snapshot

Figure 31 Tai Ping Carpets International Limited: Company Snapshot

Figure 32 Victoria PLC: Company Snapshot

Figure 33 The Home Depot, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Carpets & Rugs Market