Floor Adhesive Market by Type (Epoxy, Polyurethane, Acrylic, and Vinyl), Application (Tile & Stone, Carpet, Wood, and Laminate), Technology (Water-based, Solvent-based and Hot-melt based), and Region - Global Forecast to 2028

Updated on : August 22, 2025

Floor Adhesive Market

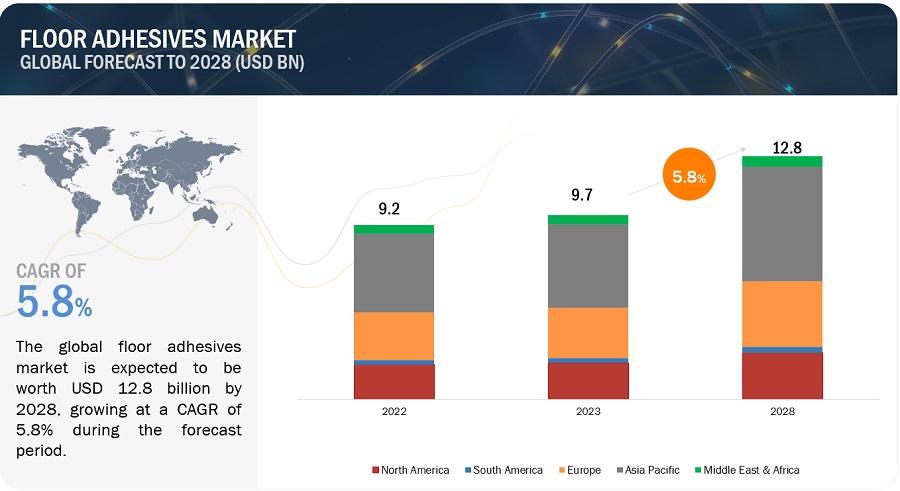

The global floor adhesive market was valued at USD 9.7 billion in 2023 and is projected to reach USD 12.8 billion by 2028, growing at 5.8% cagr from 2023 to 2028. The symbiotic relationship between low VOC and eco-friendly materials and the surge in floor adhesive demand extends further to innovation. Manufacturers are compelled to invest in research and development, spurring the creation of adhesives that not only meet eco-standards but also exhibit enhanced performance attributes, such as quick curing times, robust bonding capabilities, and adaptability to diverse flooring materials.

Floor Adhesive Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Floor Adhesive Market

Floor Adhesive Market Dynamics

Driver: The escalating demand for floor adhesives is intrinsically fueled by the triad of versatility, safety, and ease of application, converging to reshape industry dynamics and elevate the value proposition of adhesive solutions. This strategic confluence reflects a nuanced understanding of evolving construction practices, heightened consumer expectations, and the imperatives of operational efficiency within the modern business landscape.

Versatility stands as a cornerstone of the surging demand for floor adhesives. The adhesive landscape is evolving to meet the multifaceted demands of an array of flooring materials, spanning from traditional hardwood to contemporary luxury vinyl and beyond. Adhesives engineered for diverse substrates and varying installation conditions underscore their adaptability, catering to the distinct requirements of different projects and design visions. This versatility liberates architects, designers, and builders to explore creative possibilities, enabling the realization of intricate patterns, textures, and layouts. As the flooring market embraces a kaleidoscope of materials and design aesthetics, the ability of adhesives to provide a seamless bond across this spectrum propels their indispensability, driving demand upwards.

Safety emerges as a paramount concern that influences adhesive choice and usage. In an era underscored by stringent health and safety standards, adhesives that prioritize the well-being of both installation professionals and occupants gain substantial traction. Low VOC formulations and non-toxic adhesive solutions align with regulatory mandates and resonate with environmentally-conscious consumers, fostering a healthier indoor environment. The absence of hazardous chemicals and noxious fumes during and after application creates a safer and more conducive setting for both installation teams and inhabitants, elevating the market demand for adhesives that champion safety as a foundational attribute.

The strategic facet of ease of application substantiates the demand surge for floor adhesives. In a fast-paced construction landscape, where timelines are critical and operational efficiency is paramount, adhesives that facilitate swift and hassle-free installations gain a competitive edge. Adhesives engineered for seamless application, featuring user-friendly consistency, optimized viscosity, and convenient packaging, streamline the installation process. This efficiency translates into reduced labor costs, minimized downtime, and optimized resource allocation, accentuating their appeal for both small-scale projects and large-scale developments. As stakeholders prioritize seamless execution without compromising on quality, the demand for adhesives that simplify and expedite the installation journey experiences an upward trajectory.

The surging demand for floor adhesives finds its impetus in the intricate interplay of versatility, safety, and ease of application. Adhesive manufacturers that fortify their offerings with these attributes are poised to strategically capitalize on the evolving construction landscape, consumer expectations, and industry imperatives. By aligning adhesive solutions with the demands of modern construction practices and design aspirations, businesses can confidently navigate the ever-evolving floor adhesives market and carve out a commanding market presence.

Restraints: The floor adhesives market is currently facing a notable constraint in the form of escalating raw material prices, which significantly impact the industry's dynamics. The consistent upward trajectory of raw material costs has introduced a complex challenge that reverberates across the value chain, influencing manufacturers, distributors, and end-users.

The rising prices of key raw materials employed in floor adhesive formulations, such as polymers, resins, and additives, have imparted an upward pressure on production costs. Manufacturers find themselves grappling with the delicate balance of maintaining product quality and performance while endeavoring to mitigate the financial strain caused by these price fluctuations. This predicament becomes particularly pronounced as manufacturers aim to provide competitively priced adhesives to their clientele.

Moreover, the amplified raw material costs have a cascading effect on the overall supply chain. Distributors and retailers encounter challenges in managing inventory levels and pricing structures, while end-users, ranging from construction companies to flooring installers, are confronted with higher procurement expenses. This, in turn, has the potential to dampen the demand for floor adhesives, as higher costs might prompt end-users to explore alternative solutions or postpone projects.

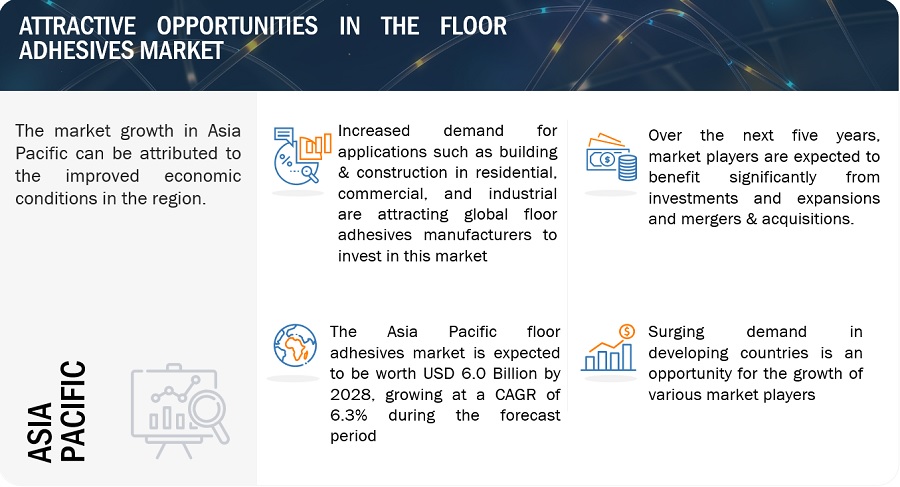

Opportunity: In the dynamic landscape of the floor adhesive industry, a compelling avenue of growth emerges through strategic investments in emerging markets. These nascent economies offer a fertile ground for market expansion, driven by a confluence of factors that align favorably with the unique attributes of floor adhesive products.

Emerging markets, characterized by rapid urbanization, infrastructural development, and burgeoning construction activities, present a reasonable landscape for the floor adhesive sector to thrive. As these markets witness an upswing in residential, commercial, and industrial projects, the demand for reliable and innovative flooring solutions, underpinned by robust adhesives, experiences a proportional rise.

The economic dynamics of emerging markets often position cost-effectiveness as a paramount consideration. Floor adhesive manufacturers, equipped with the ability to offer competitive pricing without compromising on quality, are strategically poised to capture market share and establish brand presence in these regions. Manufacturers can gain a competitive edge by tailoring product offerings to align with the budget constraints and preferences of emerging market consumers.

Challenges: The accelerated pace of industrial activity propelled by globalization has unveiled a strategic window of opportunity for the floor adhesive sector. As economies intertwine, cross-border trade flourishes and industrial enterprises expand their footprint, the demand for reliable and versatile flooring solutions, underpinned by robust adhesives, experiences a noteworthy upsurge.

Globalization has led to the proliferation of manufacturing facilities, warehouses, distribution centers, and commercial spaces across diverse geographies. This surge in industrial infrastructure development necessitates dependable flooring installations that can endure the rigors of heavy machinery, foot traffic, and operational exigencies. Floor adhesives, renowned for their resilient bonding attributes, emerge as a linchpin in ensuring safe and enduring flooring solutions that align with stringent operational requirements.

Furthermore, the seamless adaptability of floor adhesives to various flooring substrates, ranging from concrete to tiles, amplifies their relevance within the global industrial landscape. As facilities cater to specific operational needs, floor adhesives can be tailored to accommodate unique flooring materials, thereby enhancing their versatility and applicability across a spectrum of industrial settings.

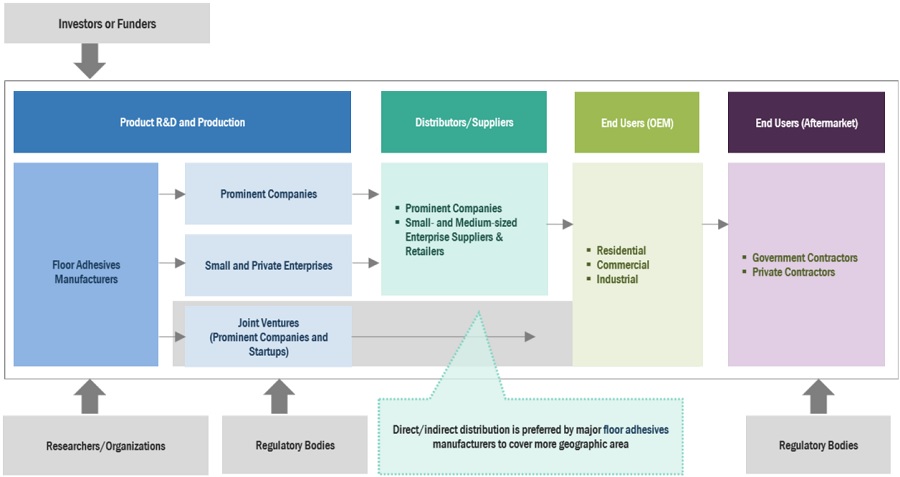

Floor Adhesive Market Ecosystem

Based on application, the carpet floor segment is estimated to account for the highest CAGR in the floor adhesives market

Carpets are extensively utilized as flooring in both residential and business settings. Carpets are a popular choice for a variety of reasons. For instance, carpets provide warmth and insulation, making them suitable for chilly areas or spaces in need of extra coziness. Second, carpets provide a soft and pleasant walking surface, decreasing pressure on the feet and joints. Carpets are therefore an excellent choice for spaces where people spend a lot of time standing or walking. Carpets are also sound-absorbing, making them ideal for locations where noise reduction is sought, such as bedrooms or offices. Carpets also serve as a natural air filter, collecting dust and allergens and therefore improving indoor air quality.

Based on end-use, the commercial segment is estimated to account for one of the highest CAGR in the floor adhesives market

Several credible organizations have reported strong growth in the commercial building business in recent years. The commercial building sector has witnessed consistent development in recent years, according to the National Association of Home Builders (NAHB), with a rising number of projects being performed around the country. The Associated General Contractors of America (AGC) also cites good commercial development trends, citing increased demand for new office spaces, retail centers, and industrial facilities. Furthermore, industry organizations such as the American Institute of Architects (AIA) and the Construction Industry Institute (CII) have been researching and accumulating data to analyze commercial construction growth.

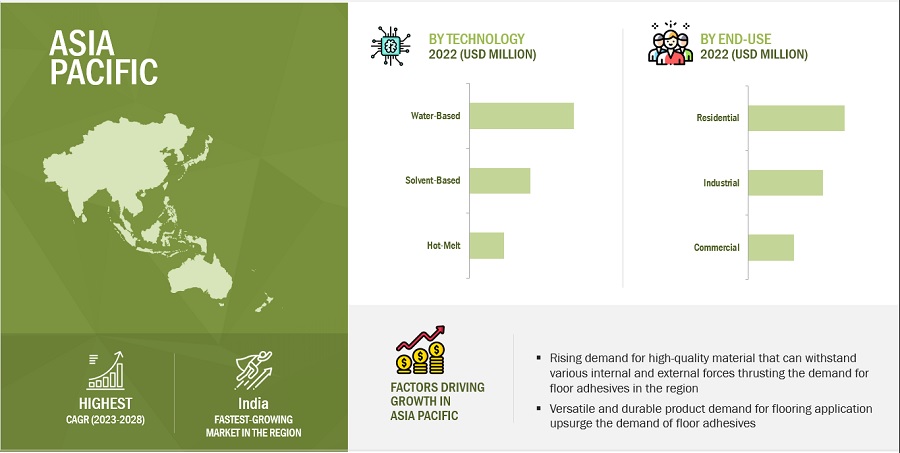

The Asia Pacific market is projected to contribute one of the largest shares of the floor adhesives market industry.

The Asia Pacific market for floor adhesives is being driven by technological advancements in the building industry. China is predicted to be Asia Pacific's largest consumer of floor adhesive, with the largest market share in terms of both value and volume. Despite its small size, South Korea has showed positive demand, which is expected to continue in the future. During the projected period, the Chinese floor adhesives market is predicted to grow at a quick 7.2% CAGR.

To know about the assumptions considered for the study, download the pdf brochure

Floor Adhesive Market Industry Players

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Dow Inc (US), Wacker Chemie AG (Germany), and Pidilite Industries Limited (India) are the key players operating in the global market.

Read More: Floor Adhesive Companies

Floor Adhesive Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 9.7 billion |

|

Revenue Forecast in 2028 |

USD 12.8 billion |

|

CAGR |

5.8% |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Technology, By Resin Type, By End-Use Industry, By Application, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Dow Inc (US), Wacker Chemie AG (Germany), and Pidilite Industries Limited (India) |

Based on technology, the floor adhesive market has been segmented as follows:

- Water-Based

- Solvent-Based

- Hot-Melt

Based on resin types, the floor adhesive market industry has been segmented as follows:

- Epoxy

- Polyurethane

- Acrylic

- Vinyl

- Others

Based on the end-use industry, the floor adhesive market has been segmented as follows:

- Residential

- Commercial

- Industrial

Based on the application, the floor adhesive market has been segmented as follows:

- Tile & Stone Floor

- Wood Floor

- Carpet Floor

- Laminate Floor

- Others

Based on the region, the floor adhesive market industry has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the floor adhesives market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the floor adhesives market?

US, UK, Canada, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the floor adhesives market during 2023-2028?

The CAGR is expected to record 5.8% from 2023-2028

Does this report cover the different resin type of the floor adhesives market?

Yes, the report covers the different resin type of floor adhesives.

Does this report cover the different technology of floor adhesives?

Yes, the report covers different technology of floor adhesives. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of building and construction sector- Impact of low VOCs and eco-friendly floor adhesives- Versatility, safety, and ease of applicationRESTRAINTS- Escalating raw material pricesOPPORTUNITIES- Investments in emerging markets- Increased industrial activity due to globalizationCHALLENGES- Supply chain disruption and increased compliance

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- 5.5 SUPPLY CHAIN ANALYSIS

- 6.1 INTRODUCTION

-

6.2 EPOXYCHEMICAL AND HEAT RESISTANCE TO FUEL DEMAND FOR EPOXY RESINS

-

6.3 POLYURETHANEHIGH DEMAND FROM BUILDING & CONSTRUCTION APPLICATIONS TO DRIVE MARKET

-

6.4 ACRYLICINCREASING DEMAND FROM FLOORING INDUSTRY TO DRIVE MARKET

-

6.5 VINYLHIGH DEMAND FROM CONSTRUCTION SECTOR TO FUEL MARKET

- 6.6 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 WATER-BASEDINCREASE IN NEW INFRASTRUCTURE PROJECTS TO DRIVE DEMAND FOR WATER-BASED ADHESIVES

-

7.3 SOLVENT-BASEDHIGH POLYMER STABILITY TO FUEL DEMAND FOR SOLVENT-BASED ADHESIVES

-

7.4 HOT-MELTCOST-EFFECTIVENESS AND EASY INTEGRATION TO BOOST DEMAND FOR HOT-MELT ADHESIVES

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALENERGY EFFICIENCY AND LOW MAINTENANCE TO DRIVE MARKET

-

8.3 COMMERCIALINCREASE IN PRIVATE SECTOR INVESTMENTS TO BOOST MARKET

-

8.4 INDUSTRIALSURGE IN MULTISTOREY WAREHOUSES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 TILE & STONEMOISTURE AND TEMPERATURE RESISTANCE TO FUEL DEMAND FOR STONE ADHESIVES

-

9.3 WOODWIDE USE IN RESIDENTIAL AND COMMERCIAL SECTORS TO DRIVE MARKET

-

9.4 CARPETINTRICATE DESIGNS AND SOFT TEXTURE TO DRIVE MARKET

-

9.5 LAMINATERESISTANCE TO STAINS AND SCRATCHES TO BOOST DEMAND FOR LAMINATE FLOORING

- 9.6 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- Increasing private residential and nonresidential constructions to boost marketCANADA- Investments in industrial infrastructure to boost marketMEXICO- New constructions in residential segment to drive market

-

10.3 EUROPERECESSION IMPACTGERMANY- Rising demand for floor adhesives from residential sector to drive marketFRANCE- Development of affordable houses and renewable energy infrastructure to fuel marketUK- Growth of construction sector to boost marketRUSSIA- Population growth to drive demand for floor adhesivesITALY- New project finance rules and investment policies to drive marketTURKEY- Rapid urbanization and increasing purchasing power to fuel marketSPAIN- Resurgence in residential and commercial developments to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACTCHINA- Increase in foreign investments to drive marketINDIA- Affordable housing initiatives to fuel demand for floor adhesivesJAPAN- Government investments in commercial and reconstruction segments to drive marketSOUTH KOREA- Strategic resilience and adaptive measures to boost marketINDONESIA- Increasing customer awareness about esthetics and functionalities to drive marketVIETNAM- Expansion of local companies to drive marketMALAYSIA- Positive economic outlook and new investments to drive marketREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Expansion of manufacturing companies to drive marketARGENTINA- Improved economic conditions to drive demand for floor adhesivesREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Mega housing projects to boost demand for wooden adhesivesSOUTH AFRICA- Rapid urbanization to drive marketUAE- Establishment of new infrastructure to boost marketREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.3 MARKET RANKING ANALYSIS

-

11.4 REVENUE ANALYSISMARKET EVALUATION

- 11.5 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSHENKEL AG & CO. KGAA- Business overview- Products offered- Recent developments- MnM viewH.B. FULLER COMPANY- Business overview- Products offered- Recent developments- MnM viewSIKA AG- Business overview- Products offered- Recent developments- MnM viewARKEMA (BOSTIK)- Business overview- Products offered- Recent developments- MnM viewDOW, INC.- Business overview- Products offered- Recent developments- MnM viewPIDILITE INDUSTRIES LTD.- Business overview- Products offeredWACKER CHEMIE AG- Business overview- Products offered- Recent developmentsASHLAND- Business overview- Products offeredFORBO GROUP- Business overview- Products offeredLATICRETE INTERNATIONAL, INC.- Business overview- Products offered

-

12.2 OTHER PLAYERSMAPEI S.P.A.- Company overview- Products offeredARDEX GMBH- Company overview- Products offeredAKZONOBEL N.V.- Company overview- Products offeredSELENA FM S.A.- Company overview- Products offered3M- Company overview- Products offeredSTAUFF- Company overview- Products offeredINTERFACE, INC.- Company overview- Products offered- Recent developmentsTERRACO HOLDINGS LTD.- Company overview- Products offeredSAKSHI CHEM SCIENCES- Company overview- Products offeredNEXUS ADHESIVES- Company overview- Products offeredJOWAT SE- Company overview- Products offeredFRANKLIN INTERNATIONAL- Company overview- Products offeredASTRAL ADHESIVES- Company overview- Products offeredGEKKO FLOORING ADHESIVES- Company overview- Products offeredQ.E.P. CO., INC.- Company overview- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 FLOOR ADHESIVES MARKET SNAPSHOT

- TABLE 2 FLOOR ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE (2020–2027)

- TABLE 4 FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 5 FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 6 FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 7 FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 8 EPOXY: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 9 EPOXY: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 10 EPOXY: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 11 EPOXY: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 12 POLYURETHANE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 13 POLYURETHANE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 POLYURETHANE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 15 POLYURETHANE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 16 ACRYLIC: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 17 ACRYLIC: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 ACRYLIC: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 19 ACRYLIC: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 20 VINYL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 21 VINYL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 VINYL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 23 VINYL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 OTHER TYPES: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 25 OTHER TYPES: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OTHER TYPES: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 27 OTHER TYPES: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 29 FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 30 FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 31 FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 32 WATER-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 33 WATER-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 WATER-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 35 WATER-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 SOLVENT-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 37 SOLVENT-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SOLVENT-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 39 SOLVENT-BASED: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 HOT-MELT: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 41 HOT-MELT: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 HOT-MELT: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 43 HOT-MELT: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 45 FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 46 FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 47 FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 48 RESIDENTIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 49 RESIDENTIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 RESIDENTIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 51 RESIDENTIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 COMMERCIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 53 COMMERCIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 COMMERCIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 55 COMMERCIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 INDUSTRIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 57 INDUSTRIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 INDUSTRIAL: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 59 INDUSTRIAL: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 60 FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 61 FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 63 FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 64 TILE & STONE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 65 TILE & STONE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 TILE & STONE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 67 TILE & STONE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 68 WOOD: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 69 WOOD: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 WOOD: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 71 WOOD: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 72 CARPET: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 73 CARPET: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 CARPET: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 75 CARPET: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 76 LAMINATE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 77 LAMINATE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 LAMINATE: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 79 LAMINATE: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 80 OTHER APPLICATIONS: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 81 OTHER APPLICATIONS: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 OTHER APPLICATIONS: FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 83 OTHER APPLICATIONS: FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 84 FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 85 FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 FLOOR ADHESIVES MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 87 FLOOR ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 88 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 91 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 92 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 95 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 96 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 99 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 100 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 103 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 104 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 107 NORTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 108 US: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 109 US: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 110 US: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 111 US: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 112 CANADA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 113 CANADA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 115 CANADA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 116 MEXICO: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 117 MEXICO: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 118 MEXICO: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 119 MEXICO: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 120 EUROPE: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 121 EUROPE: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 123 EUROPE: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 124 EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 125 EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 127 EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 128 EUROPE: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 129 EUROPE: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 131 EUROPE: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 132 EUROPE: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 133 EUROPE: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 EUROPE: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 135 EUROPE: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 136 EUROPE: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 137 EUROPE: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 EUROPE: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 139 EUROPE: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 140 GERMANY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 141 GERMANY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 GERMANY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 143 GERMANY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 144 FRANCE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 145 FRANCE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 146 FRANCE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 147 FRANCE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 148 UK: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 149 UK: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 150 UK: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 151 UK: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 152 RUSSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 153 RUSSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 154 RUSSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 155 RUSSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 156 ITALY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 157 ITALY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 158 ITALY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 159 ITALY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 160 TURKEY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 161 TURKEY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 162 TURKEY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 163 TURKEY: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 164 SPAIN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 165 SPAIN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 166 SPAIN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 167 SPAIN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 168 REST OF EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 169 REST OF EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 171 REST OF EUROPE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 172 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 175 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 176 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 179 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 180 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 183 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 184 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 187 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 188 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 191 ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 192 CHINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 193 CHINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 194 CHINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 195 CHINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 196 INDIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 197 INDIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 198 INDIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 199 INDIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 200 JAPAN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 201 JAPAN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 202 JAPAN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 203 JAPAN: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 204 SOUTH KOREA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 205 SOUTH KOREA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 206 SOUTH KOREA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 207 SOUTH KOREA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 208 INDONESIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 209 INDONESIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 210 INDONESIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 211 INDONESIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 212 VIETNAM: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 213 VIETNAM: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 214 VIETNAM: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 215 VIETNAM: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 216 MALAYSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 217 MALAYSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 218 MALAYSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 219 MALAYSIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 220 REST OF ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 223 REST OF ASIA PACIFIC: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 224 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 226 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 227 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 228 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 229 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 230 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 231 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 232 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 234 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 235 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 236 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 237 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 238 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 239 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 240 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 241 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 242 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 243 SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 244 BRAZIL: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 245 BRAZIL: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 246 BRAZIL: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 247 BRAZIL: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 248 ARGENTINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 249 ARGENTINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 250 ARGENTINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 251 ARGENTINA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 252 REST OF SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 253 REST OF SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 254 REST OF SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 255 REST OF SOUTH AMERICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2021–2022 (KILOTON)

- TABLE 259 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 263 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY END USE, 2021–2022 (KILOTON)

- TABLE 267 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY END USE, 2023–2028 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2021–2022 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 275 MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 276 SAUDI ARABIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 277 SAUDI ARABIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 278 SAUDI ARABIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 279 SAUDI ARABIA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 280 SOUTH AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 281 SOUTH AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 282 SOUTH AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 283 SOUTH AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 284 UAE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 285 UAE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 286 UAE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 287 UAE: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 288 REST OF MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2021–2022 (KILOTON)

- TABLE 291 REST OF MIDDLE EAST & AFRICA: FLOOR ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 292 STRATEGIES ADOPTED BY KEY FLOOR ADHESIVE MARKET PLAYERS (2017–2023)

- TABLE 293 COMPANY INDUSTRY FOOTPRINT

- TABLE 294 COMPANY REGION FOOTPRINT

- TABLE 295 COMPANY FOOTPRINT

- TABLE 296 FLOOR ADHESIVES MARKET: PRODUCT LAUNCHES, 2017–2023

- TABLE 297 FLOOR ADHESIVES MARKET: DEALS, 2017–2023

- TABLE 298 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 299 HENKEL AG: DEALS

- TABLE 300 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 301 H.B. FULLER COMPANY: DEALS

- TABLE 302 SIKA AG: COMPANY OVERVIEW

- TABLE 303 SIKA AG: PRODUCT LAUNCHES

- TABLE 304 SIKA AG: DEALS

- TABLE 305 ARKEMA (BOSTIK): COMPANY OVERVIEW

- TABLE 306 ARKEMA (BOSTIK): DEALS

- TABLE 307 DOW, INC.: COMPANY OVERVIEW

- TABLE 308 DOW, INC.: DEALS

- TABLE 309 PIDILITE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 310 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 311 WACKER CHEMIE AG: DEALS

- TABLE 312 ASHLAND: COMPANY OVERVIEW

- TABLE 313 FORBO GROUP: COMPANY OVERVIEW

- TABLE 314 LATICRETE INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 315 INTERFACE, INC.: DEALS

- FIGURE 1 FLOOR ADHESIVES: MARKET SEGMENTATION

- FIGURE 2 FLOOR ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 FLOOR ADHESIVES MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 FLOOR ADHESIVES MARKET SIZE ESTIMATION, BY TECHNOLOGY

- FIGURE 8 FLOOR ADHESIVES MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF FLOOR ADHESIVES MARKET

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 11 FLOOR ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 12 EPOXY FLOOR ADHESIVE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 WATER-BASED TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 TILE & STONE TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 RESIDENTIAL TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 HIGH DEMAND FROM RESIDENTIAL END-USE INDUSTRY IN EMERGING ECONOMIES TO DRIVE MARKET

- FIGURE 18 EPOXY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 RESIDENTIAL AND CHINA RECORDED HIGHEST GROWTH IN 2022

- FIGURE 20 EMERGING ECONOMIES TO GROW FASTER THAN DEVELOPED COUNTRIES

- FIGURE 21 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: FLOOR ADHESIVES MARKET

- FIGURE 24 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 25 FLOOR ADHESIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 EPOXY TO LEAD FLOOR ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 27 WATER-BASED SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 28 RESIDENTIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 TILE & STONE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO BE LARGEST FLOOR ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: FLOOR ADHESIVES MARKET SNAPSHOT

- FIGURE 32 EUROPE: FLOOR ADHESIVES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: FLOOR ADHESIVES MARKET SNAPSHOT

- FIGURE 34 ARGENTINA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 35 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 36 FLOOR ADHESIVES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 MARKET RANKING ANALYSIS, 2022

- FIGURE 38 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 39 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 40 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 41 SIKA AG: COMPANY SNAPSHOT

- FIGURE 42 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- FIGURE 43 DOW, INC.: COMPANY SNAPSHOT

- FIGURE 44 PIDILITE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 45 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 46 ASHLAND: COMPANY SNAPSHOT

- FIGURE 47 FORBO GROUP: COMPANY SNAPSHOT

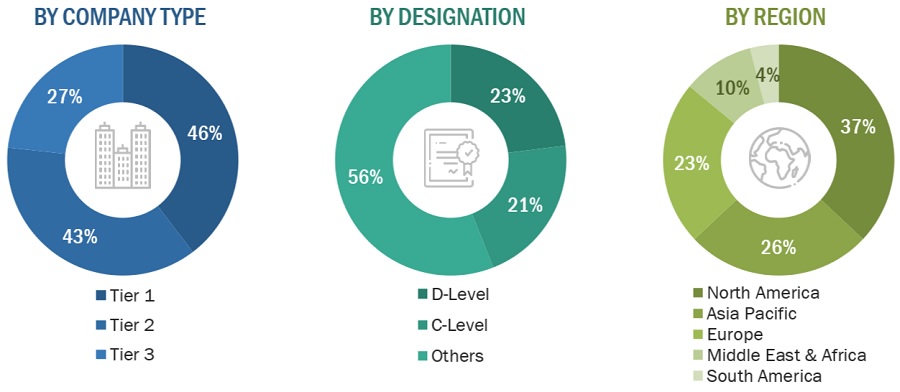

The study involved four major activities in estimating the current size of the floor adhesives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering floor adhesives information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the floor adhesives industry, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the floor adhesives market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from floor adhesives vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, resin type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using floor adhesives were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of floor adhesives and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

Sika AG |

Director |

|

Dow Inc |

Project Manager |

|

Henkel AG & KGaA |

Individual Industry Expert |

|

H.B Fuller |

Director |

Market Size Estimation

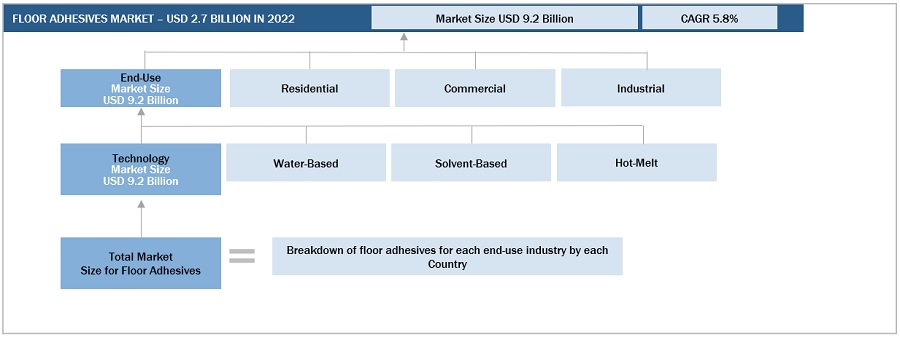

The research methodology used to estimate the size of the floor adhesives market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of floor adhesives.

Global Floor Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Floor Adhesives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Floor adhesive, also referred to as flooring adhesive or floor glue, is a specialized adhesive used for securely bonding various types of flooring materials to a subfloor or underlayment. Its primary function is to provide stability and durability to flooring installations, making it an essential component in residential, commercial, and industrial settings. This adhesive is particularly valuable for ensuring the steadfast attachment of flooring materials like vinyl, carpet, hardwood, tile, and more, preventing undesirable shifting or lifting over time.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the floor adhesives market based on technology, resin type, application, end-use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the floor adhesives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the floor adhesives market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the floor adhesives Market

Growth opportunities and latent adjacency in Floor Adhesive Market