Industrial Floor Coating Market by Resin Type, Flooring Material (Concrete, Mortar, Terrazzo), Coating Component, Technology, End-use Sector (Manufacturing, Aviation & Transportation, Food Processing, Science & Technology), Region - Global Forecast to 2024

Updated on : April 17, 2024

Industrial Floor Coating Market

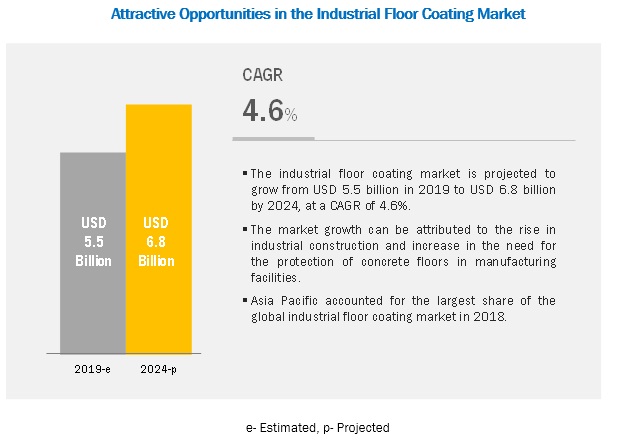

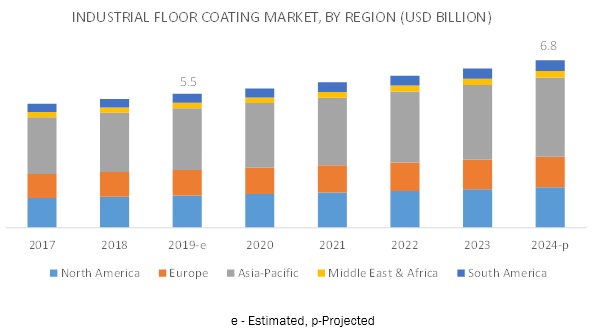

The Global Industrial Floor Coating Market was valued at USD 5.5 billion in 2019 and is projected to reach USD 6.8 billion by 2024, growing at 4.6% cagr from 2019 to 2024. The demand for industrial floor coatings can be attributed to the high growth of industrial and commercial construction industries across the globe. Factors such as rapid industrialization and growing manufacturing industries across the globe are driving the demand for industrial floor coating.

In terms of value and volume, the epoxy segment is projected to lead the industrial floor coating market from 2019 to 2024.

Based on resin type, the epoxy segment is projected to be the fastest-growing market. The dominant market position of epoxy can be attributed to its superior properties, such as high adhesion, impact resistance, flexibility, and resistance to chemicals and solvents. Furthermore, this segment is also projected to be the fastest-growing segment in the global industrial floor coating market.

In terms of value and volume, the concrete segment of the industrial floor coating industry is projected to grow at the highest CAGR during the forecast period.

By flooring material, the concrete segment is projected to be the fastest-growing segment in the industrial floor coating market. Factors such as lower cost of concrete, its superior durability, and its tensile strength make it the widely used material for the construction of industrial floors.

In terms of value and volume, the manufacturing segment of the industrial floor coating industry is projected to be the largest market.

By end-use sector, the manufacturing segment is projected to be the largest segment in the industrial floor coating market. This dominant market position is attributed to the exponential growth of the manufacturing industry globally. With the boost in manufacturing activities, the number of production plants has also gone up, which has created an opportunity for the application of industrial floor coating in these facilities.

In terms of both value as well as volume, the Asia Pacific region is estimated to account for the highest share in the global industrial floor coating market during the forecast period

The Asia Pacific region accounted for the largest market share in 2018. The increase in demand in the region for protective coatings can be largely attributed to the growing industrial, infrastructural & construction, marine, and automotive industries. Besides, there are less stringent norms and standards for safety and environmental compliance, along with the easy availability of cheap labor, which is attracting the major players across diverse industries to set up production facilities in these countries. These factors help to further accelerate the demand for industrial floor coating in the region.

Industrial Floor Coating Market Players

Key players, such as PPG Industries, Inc. (US), AkzoNobel N.V. (The Netherlands), The Sherwin-Williams Company (US), BASF SE (Germany), and RPM International Inc. (US), have adopted these strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the industrial floor coating market.

PPG Industries is a key global manufacturer and supplier of specialty materials, paints, optical products, and coatings. It caters to a huge customer base in various markets, such as consumer products, industrial, construction markets, and transportation. The company is financially and strategically well placed and has a strong customer base. It gives high importance to research and developmental activities. It aims to expand its existing distribution network to serve the customers better. Further, it also aims to innovate and expand its existing product portfolio for industrial and performance coatings.

Industrial Floor Coating Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019

|

USD 5.5 billion |

|

Revenue Forecast in 2024 |

USD 6.8 billion |

|

CAGR |

4.6% |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD Billion) and Volume (KT) |

|

Segments covered |

Resin Type, Flooring Material, Component Type, Technology, End-use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies covered |

PPG Industries, Inc. (US), AkzoNobel N.V. (The Netherlands), The Sherwin-Williams Company (US), BASF SE (Germany), RPM International Inc. (US), 3M Company (US), The Daw Group (The Netherlands), The Lubrizol Corporation (US), Asian Paints PPG Pvt. Ltd. (India), Axalta Coating Systems Ltd. (US), and The Dow Chemical Company (US) |

This research report categorizes the industrial floor coating market based on resin type, flooring material, component type, technology, end-use industry, and region.

On the basis of resin type:

- Epoxy

- Polyurethane

- Hybrid

- Others (alkyd and acrylic)

On the basis of flooring material

- Concrete

- Mortar

- Terrazzo

- Others (asphalt and previously coated)

On the basis of coating component

- One-component

- Two-component

- Three-component

- Four-component

- Five-component

On the basis of technology

- Water-borne

- Solvent-borne

On the basis of end-use sector

- Manufacturing

- Aviation & transportation

- Food processing

- Science & technology

- Others (car parks, hospitality, healthcare, and fire & public safety sectors)

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2019, AkzoNobel acquired Mauvilac Industries Limited (Africa), a manufacturer of paint and coating. This initiative includes the acquisition of Mauvilac Industries’ local manufacturing facility, four concept stores, and a strong distribution network. This strategic initiative is expected to strengthen AkzoNobel’s footprint in Sub-Saharan African markets.

- In October 2019, AkzoNobel introduced a new range of powder coating ‘Interpon Redox,’ which is an ideal solution for corrosion protection. This powder coating may be used to all array of surfaces, substrates, and environments (such as cable cars, window frames, wind turbines, and chemical plants).

- In July 2019, AkzoNobel invested USD 4 million (3 million Euros) in Changzhou powder coatings plant in China, with an aim to enhance its production facilities as well as supply chain. Furthermore, the company invested in adding three new production lines at the same plant in China.

Key Questions Addressed by the Report:

- What are the global trends in the industrial floor coating market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different resin types of industrial floor coating?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for industrial floor coating?

- Who are the major players in the industrial floor coating market globally?

Frequently Asked Questions (FAQ):

What are the advantages of floor coatings in industrial applications?

What are the factors influencing the growth of industrial floor coating market?

What are the different technologies used in industrial floor coatings?

What are the different resin types used in industrial floor coatings?

What are the different flooring materials for industrial floor coatings?

What are the different end-use of industrial floor coating?

What is the biggest restraint for industrial floor coating market?

What are the government regulations being imposed on the industrial floor coating market?

How is the industrial floor coating market aligned?

Who are the major manufacturers for industrial floor coatings?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.3.2 Regional Scope

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Research: Supply Side Analysis

2.3 Primary Research: Demand Side Analysis

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-DoWn Approach

2.5 Secondary Data

2.5.1 Key Data From Secondary Sources

2.6 Primary Data

2.7 Research Assumptions & Limitations

2.7.1 Assumptions

2.7.2 Limitations

3 Executive Summary (Page No. - 29)

3.1 Introduction

4 Premium Insights (Page No. - 33)

4.1 Emerging Economies to Witness A Relatively Higher Demand for Industrial Floor Coating

4.2 Asia Pacific: Industrial Floor Coating Market, By Resin Type & Country

4.3 Industrial Floor Coating Market, By Resin Type

4.4 Industrial Floor Coating Market, By Flooring Material

4.5 Industrial Floor Coating Market, By End-Use Sector

4.6 Industrial Floor Coating Market, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand to Protect Concrete Floors in Industrial and Commercial Facilities

5.2.1.2 Rapidly Increasing Industrialization in Developing Countries

5.2.2 Restraints

5.2.2.1 High Prices of Raw Materials and Energy

5.2.3 Opportunities

5.2.3.1 Increase in Industrial and Commercial Constructions

5.2.3.2 Rise in Demand for Bio-Based Floor Coatings

5.2.4 Challenges

5.2.4.1 Stringent Environmental Regulations Enforced By Governments

6 Industrial Floor Coating Market, By Resin Type (Page No. - 40)

6.1 Introduction

6.1.1 Industrial Floor Coating Market, By Resin Type

6.1.1.1 Epoxy Segment Accounted to Be the Majorly Consumed Resin Type in the Industrial Floor Coating Market

6.2 Epoxy

6.3 Polyurethane

6.4 Hybrid

6.5 Others

7 Industrial Floor Coating Market, By Flooring Material (Page No. - 44)

7.1 Introduction

7.1.1 Industrial Floor Coating Market, By Flooring Material

7.1.1.1 The Concrete Segment Accounted to Be the Most Consumed Flooring Material in the Industrial Floor Coating Market

7.2 Concrete

7.3 Mortar

7.4 Terrazzo

7.5 Others

8 Industrial Floor Coating Market, By Component Type (Page No. - 48)

8.1 Introduction

8.2 One-Component

8.3 Two-Component

8.4 Three-Component

8.5 Four-Component

8.6 Five-Component

9 Industrial Floor Coating Market, By Technology (Page No. - 51)

9.1 Introduction

9.2 Water-Borne

9.3 Solvent-Borne

10 Industrial Floor Coating Market, By End-Use Sector (Page No. - 53)

10.1 Introduction

10.1.1 Industrial Floor Coating Market, By End-Use Sector

10.1.1.1 Food Processing Segment to Be the Fastest-Growing End-Use Sector in the Industrial Floor Coating Market

10.2 Manufacturing

10.3 Aviation & Transportation

10.4 Food Processing

10.5 Science & Technology

10.6 Others

11 Industrial Floor Coating Market, By Region (Page No. - 58)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.1.1 China to Be the Largest Market for Industrial Floor Coating in Asia Pacific

11.2.2 Japan

11.2.2.1 Japan to Be the Third-Fastest-Growing Country in the Asia Pacific Industrial Floor Coating Market

11.2.3 India

11.2.3.1 India is Projected to Witness the Second-Highest Growth in the Asia Pacific Market

11.2.4 Australia

11.2.4.1 Growth in the Consumer Goods and Food Processing Industries is Expected to Boost the Australian Industrial Floor Coating Market

11.2.5 South Korea

11.2.5.1 Government Sustenance to Promote Technology and Manufacturing Activities Accelerating the Growth of the South Korean Industrial Floor Coating Market

11.2.6 Rest of Asia Pacific

11.2.6.1 Growing Manufacturing and Aerospace Industries to Drive the Industrial Floor Coating Market in Rest of Asia Pacific

11.3 North America

11.3.1 US

11.3.1.1 Epoxy Segment, By Resin Type, to Witness Higher Consumption in the US By 2024

11.3.2 Canada

11.3.2.1 Food Processing Segment, By End Use, to Grow at A Higher CAGR, in Terms of Both Volume and Value, in Canada

11.3.3 Mexico

11.3.3.1 Food Processing Sector to Witness High Growth, in Terms of Volume, in Mexico By 2024

11.4 Europe

11.4.1 Germany

11.4.1.1 The Food Processing Sector is Projected to Record A Higher Growth in Germany

11.4.2 UK

11.4.2.1 The Epoxy Segment in the UK is Projected to Witness A Higher Demand By 2024

11.4.3 France

11.4.3.1 The Food Processing Sector is Projected to Grow at A Higher Rate in France

11.4.4 Russia

11.4.4.1 Increase in Growth in the Manufacturing Sector to Boost the Demand for Industrial Floor Coating in Russia

11.4.5 Spain

11.4.5.1 Growth in the Food Processing Industry to Accelerate the Consumption of Industrial Floor Coatings in Spain

11.4.6 Rest of Europe

11.4.6.1 The Epoxy Segment is Projected to Record A Higher Growth in the Rest of Europe Market By 2024

11.5 Middle East & Africa

11.5.1 UAE

11.5.1.1 The UAE is Projected to Be the Fastest-Growing Country-Level Market in the Middle East & Africa for Industrial Floor Coatings

11.5.2 Saudi Arabia

11.5.2.1 Saudi Arabia to Be the Second-Fastest-Growing Market in the Middle East & Africa, in Terms of Value

11.5.3 South Africa

11.5.3.1 Manufacturing Segment to Lead the South African Industrial Floor Coating Market, in Terms of Value

11.5.4 Turkey

11.5.4.1 Turkey to Be the Largest Market for Industrial Floor Coatings in the Middle East & Africa

11.5.5 Rest of the Middle East & Africa

11.5.5.1 Rest of the Middle East & Africa Projected to Have A High Potential for Growth in the Industrial Floor Coating Market

11.6 South America

11.6.1 Brazil

11.6.1.1 Brazil to Account for the Largest Share in the South American Industrial Floor Coating Market

11.6.2 Argentina

11.6.2.1 Increase in Government Expenditure on Industrial Construction is Projected to Drive the Industrial Floor Coating Market in Argentina

11.6.3 Rest of South America

11.6.3.1 The Epoxy Segment is Projected to Remain the Largest Consumed Resin in Rest of South America

12 Competitive Landscape (Page No. - 124)

12.1 Overview

12.2 Competitive Scenario

12.2.1 Acquisition

12.2.2 Expansion and Investment

12.2.3 New Product Development

12.2.4 Divestiture and Partnership

12.3 Microquadrant for Industrial Floor Coating Manufacturer

12.4 Industrial Floor Coating Market (Global) Competitive Leadership Mapping, 2019

12.4.1 Strength of Product Portfolio

12.4.2 Business Strategy Excellence

13 Company Profiles (Page No. - 133)

13.1 PPG Industries, Inc.

13.1.1 Business Overview

13.1.2 Financial Assessment

13.1.3 Operational Assessment

13.1.4 Products Offered

13.1.5 Recent Developments

13.1.6 SWOT Analysis

13.1.7 Current Focus and Strategies

13.1.8 Threat From Competition

13.1.9 Right to Win

13.2 Akzonobel N.V.

13.2.1 Business Overview

13.2.2 Financial Assessment

13.2.3 Operational Assessment

13.2.4 Products Offered

13.2.5 Recent Developments

13.2.6 SWOT Analysis

13.2.7 Current Focus and Strategies

13.2.8 Threats From Competition

13.2.9 Right to Win

13.3 The Sherwin-Williams Company

13.3.1 Business Overview

13.3.2 Financial Assessment

13.3.3 Operational Assessment

13.3.4 Products Offered

13.3.5 Recent Developments

13.3.6 SWOT Analysis

13.3.7 Current Focus and Strategies

13.3.8 Threat From Competition

13.3.9 Right to Win

13.4 BASF SE

13.4.1 Business Overview

13.4.2 Financial Assessment

13.4.3 Operational Assessment

13.4.4 Products Offered

13.4.5 Recent Developments

13.4.6 SWOT Analysis

13.4.7 Current Focus and Strategies

13.4.8 Threat From Competition

13.4.9 Right to Win

13.5 RPM International Inc.

13.5.1 Business Overview

13.5.2 Financial Assessment

13.5.3 Operational Assessment

13.5.4 Products Offered

13.5.5 Recent Developments

13.5.6 SWOT Analysis

13.5.7 Current Focus and Strategies

13.5.8 Threat From Competition

13.5.9 Right to Win

13.6 3M Company

13.6.1 Business Overview

13.6.2 Financial Assessment

13.6.3 Operational Assessment

13.6.4 Product Offered

13.6.5 Right to Win

13.7 Koninklijke DSM N.V. (DSM)

13.7.1 Business Overview

13.7.2 Financial Assessment

13.7.3 Operational Assessment

13.7.4 Products Offered

13.7.5 Right to Win

13.8 Axalta Coating Systems Ltd.

13.8.1 Business Overview

13.8.2 Financial Assessment

13.8.3 Operational Assessment

13.8.4 Products Offered

13.8.5 Recent Developments

13.8.6 Right to Win

13.9 The DoW Chemical Company

13.9.1 Business Overview

13.9.2 Financial Assessment

13.9.3 Operational Assessment

13.9.4 Products Offered

13.9.5 Right to Win

13.10 The DaW Group

13.10.1 Business Overview

13.10.2 Operational Assessment

13.10.3 Products Offered

13.10.4 Right to Win

13.11 The Lubrizol Corporation

13.11.1 Business Overview

13.11.2 Financial Assessment

13.11.3 Operational Assessment

13.11.4 Product Offered

13.12 Asian Paints PPG Pvt. Limited

13.12.1 Business Overview

13.12.2 Operational Assessment

13.12.3 Product Offered

13.13 Other Players

13.13.1 CPC Floor Coatings

13.13.2 Ardex Group

13.13.3 Conren Ltd.

13.13.4 Mc-Bauchemie Muller GmbH & Co. KG

13.13.5 Armorpoxy

13.13.6 Polycote

13.13.7 A&I Coatings

13.13.8 Florock Polymer Flooring

13.13.9 Plexi-Chemie Inc.

13.13.10 Nora System, Inc.

13.13.11 Maris Polymers

13.13.12 Grand Polycoats

13.13.13 Milliken & Company

13.13.14 Michelman Inc.

13.13.15 Tambour

13.13.16 Pro Maintenance Inc.

13.13.17 Himfloor Sas

13.13.18 Remmers (UK) Ltd.

13.13.19 Rica Resine Srl

13.13.20 Apurva India Private Limited

14 Appendix (Page No. - 180)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (157 Tables)

Table 1 Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 2 Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 3 Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 4 Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 5 Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 6 Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 7 Industrial Floor Coating Market Size, By Region, 2017–2024 (USD Million)

Table 8 Industrial Floor Coating Market Size, By Region, 2017–2024 (Kt)

Table 9 Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 10 Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 11 Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 12 Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 13 Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 14 Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 15 Asia Pacific: Industrial Floor Coating Market Size, By Country, 2017–2024 (USD Million)

Table 16 Asia Pacific: Industrial Floor Coating Market Size, By Country, 2017–2024 (Kt)

Table 17 Asia Pacific: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 18 Asia Pacific: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 19 Asia Pacific: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 20 Asia Pacific: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 21 Asia Pacific: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 22 Asia Pacific: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 23 China: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 24 China: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 25 China: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 26 China: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 27 Japan: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 28 Japan: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 29 Japan: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 30 Japan: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 31 India: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 32 India: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 33 India: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 34 India: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 35 Australia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 36 Australia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 37 Australia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 38 Australia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 39 South Korea: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 40 South Korea: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 41 South Korea: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 42 South Korea: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 43 Rest of Asia Pacific: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 44 Rest of Asia Pacific: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 45 Rest of Asia Pacific: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 46 Rest of Asia Pacific: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 47 North America: Industrial Floor Coating Market Size, By Country, 2017–2024 (USD Million)

Table 48 North America: Industrial Floor Coating Market Size, By Country, 2017–2024 (Kt)

Table 49 North America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 50 North America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 51 North America: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 52 North America: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 53 North America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 54 North America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 55 US: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 56 US: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 57 US: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 58 US: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 59 Canada: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 60 Canada: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 61 Canada: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 62 Canada: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 63 Mexico: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 64 Mexico: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 65 Mexico: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 66 Mexico: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 67 Europe: Industrial Floor Coating Market Size, By Country, 2017–2024 (USD Million)

Table 68 Europe: Industrial Floor Coating Market Size, By Country, 2017–2024 (Kt)

Table 69 Europe: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 70 Europe: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 71 Europe: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 72 Europe: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 73 Europe: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 74 Europe: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 75 Germany: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 76 Germany: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 77 Germany: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 78 Germany: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 79 UK: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 80 UK: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 81 UK: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 82 UK: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 83 France: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 84 France: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 85 France: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 86 France: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 87 Russia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 88 Russia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 89 Russia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 90 Russia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 91 Spain: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 92 Spain: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 93 Spain: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 94 Spain: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 95 Rest of Europe: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 96 Rest of Europe: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 97 Rest of Europe: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 98 Rest of Europe: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 99 Middle East & Africa: Industrial Floor Coating Market Size, By Country, 2017–2024 (USD Million)

Table 100 Middle East & Africa: Industrial Floor Coating Market Size, By Country, 2017–2024 (Kt)

Table 101 Middle East & Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 102 Middle East & Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 103 Middle East & Africa: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 104 Middle East & Africa: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 105 Middle East & Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 106 Middle East & Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 107 UAE: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 108 UAE: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 109 UAE: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 110 UAE: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 111 Saudi Arabia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 112 Saudi Arabia: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 113 Saudi Arabia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 114 Saudi Arabia: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 115 South Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 116 South Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 117 South Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 118 South Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 119 Turkey: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 120 Turkey: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 121 Turkey: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 122 Turkey: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 123 Rest of the Middle East & Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 124 Rest of the Middle East & Africa: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 125 Rest of the Middle East & Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 126 Rest of the Middle East & Africa: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 127 South America: Industrial Floor Coating Market Size, By Country, 2017–2024 (USD Million)

Table 128 South America: Industrial Floor Coating Market Size, By Country, 2017–2024 (Kt)

Table 129 South America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 130 South America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 131 South America: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (USD Million)

Table 132 South America: Industrial Floor Coating Market Size, By Flooring Material, 2017–2024 (Kt)

Table 133 South America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 134 South America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 135 Brazil: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 136 Brazil: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 137 Brazil: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 138 Brazil: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 139 Argentina: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 140 Argentina: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 141 Argentina: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 142 Argentina: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 143 Rest of South America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (USD Million)

Table 144 Rest of South America: Industrial Floor Coating Market Size, By Resin Type, 2017–2024 (Kt)

Table 145 Rest of South America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 146 Rest of South America: Industrial Floor Coating Market Size, By End-Use Sector, 2017–2024 (Kt)

Table 147 Acquisition

Table 148 Expansion and Investment

Table 149 New Product Development

Table 150 Divestiture and Partnership

Table 151 Net Sales of the Business Segments for the Year Ended December 31, 2018 (USD Million)

Table 152 Major Manufacturing Site Locations (Industrial Coating)

Table 153 Revenue From Functional Materials & Solutions (Divisions)

Table 154 Revenue From the Business Segments

Table 155 Performance Coating Segment’s Revenue By End-Market (%) in 2018

Table 156 Performance Coating Segment’s Revenue By Geography (%) in 2018

Table 157 Number of Production Sites (As of December 31, 2018)

List of Figures (46 Figures)

Figure 1 Industrial Floor Coating Market Segmentation

Figure 2 Industrial Floor Coating Market, By Region

Figure 3 Industrial Floor Coating Market: Research Design

Figure 4 Research Methodology- Supply Side Analysis (Approach 1)

Figure 5 Research Methodology- Demand Side Analysis (Approach 2)

Figure 6 Industrial Floor Coating Market: Bottom-Up Approach

Figure 7 Industrial Floor Coating Market: Top-DoWn Approach

Figure 8 Epoxy Segment Accounted for the Largest Share in the Industrial Floor Coating Market, in Terms of Value, in 2018

Figure 9 Concrete Segment Projected to Grow at the Highest CAGR in the Industrial Floor Coating Market During the Forecast Period

Figure 10 Food Processing Projected to Be the Fastest-Growing End-Use Sector in the Industrial Floor Coating Market During the Forecast Period

Figure 11 Asia Pacific LED the Industrial Floor Coating Market in 2018

Figure 12 Emerging Economies Offer Attractive Opportunities in the Industrial Floor Coating Market During the Forecast Period

Figure 13 China Was the Largest Market for Industrial Floor Coating in Asia Pacific in 2018

Figure 14 the Epoxy Segment is Projected to Lead the Industrial Floor Coating Market During the Forecast Period

Figure 15 The Concrete Segment is Projected to Be the Fastest-Growing Flooring Material in the Industrial Floor Coating Market

Figure 16 The Manufacturing Segment is to Be the Fastest-Growing End-Use Application in the Industrial Floor Coating Market During the Forecast Period

Figure 17 The Industrial Floor Coating Market in Australia is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 18 Industrial Floor Coating Market Dynamics

Figure 19 Industrial Floor Coating Market Size, By Resin Type, 2019 vs. 2024 (USD Million)

Figure 20 Industrial Floor Coating Market Size, By Flooring Material, 2019 vs. 2024 (USD Million)

Figure 21 Industrial Floor Coating Market Size, By End-Use Sector, 2019 vs. 2024 (USD Million)

Figure 22 Regional Snapshot: Australia is Projected to Be the Fastest-Growing Country-Level Market During the Forecast Period

Figure 23 Asia Pacific: Industrial Floor Coating Market Snapshot

Figure 24 Companies Undertook Acquisition as A Key Growth Strategy Between 2016 and 2019

Figure 25 PPG Industries, Inc.: Company Snapshot

Figure 26 PPG Industries, Inc.: SWOT Analysis

Figure 27 Winning Imperatives: PPG Industries, Inc.

Figure 28 Akzonobel N.V.: Company Snapshot

Figure 29 Akzonobel N.V.: SWOT Analysis

Figure 30 Winning Imperatives: Akzonobel N.V.

Figure 31 The Sherwin-Williams Company: Company Snapshot

Figure 32 The Sherwin-Williams Company: SWOT Analysis

Figure 33 Winning Imperatives: the Sherwin-Williams Company

Figure 34 BASF SE: Company Snapshot

Figure 35 BASF SE: SWOT Analysis

Figure 36 Winning Imperatives: BASF SE

Figure 37 RPM International Inc.: Company Snapshot

Figure 38 RPM International Inc.: SWOT Analysis

Figure 39 Winning Imperatives

Figure 40 3M Company: Company Snapshot

Figure 41 Koninklijke DSM N.V. (DSM): Company Snapshot

Figure 42 Axalta Coating Systems Ltd.: Company Snapshot

Figure 43 The DoW Chemical Company: Company Snapshot

Figure 44 The DaW Group: Company Snapshot

Figure 45 The Lubrizol Corporation: Company Snapshot

Figure 46 Asian Paints PPG Pvt. Limited: Company Snapshot

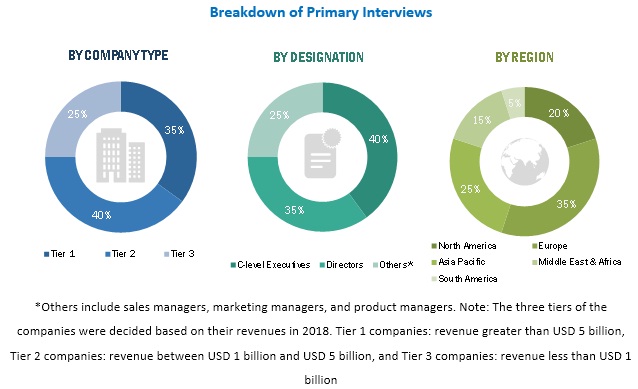

The study involved four major activities for estimating the current global size of the industrial floor coating market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial floor coating through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the industrial floor coating market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the industrial floor coating market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the industrial floor coating market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the industrial floor coating industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the industrial floor coating market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the industrial floor coating market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the industrial floor coating market in terms of value and volume based on resin type, flooring material, component type, technology, end-use sector, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, investments, acquisitions, partnerships, and divestitures in the industrial floor coating market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the industrial floor coating report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the industrial floor coating market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Industrial Floor Coating Market