System in Package Market by Packaging Technology (2D IC, 2.5D IC, 3D IC), Package Type (BGA, SOP), Packaging Method (Flip Chip, Wire Bond), Device (RF Front-End, RF Amplifier), Application (Consumer Electronics, Communications) - Global Forecast to 2023

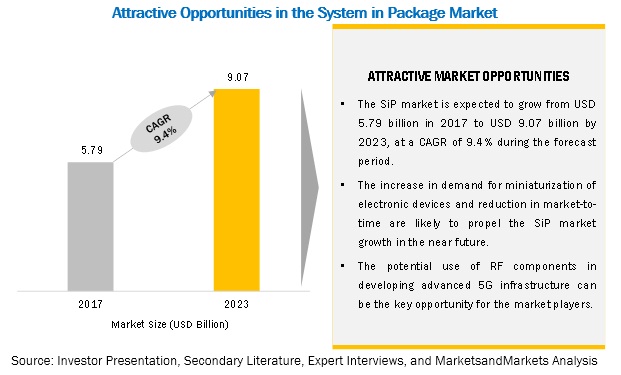

[250 Pages Report] The System in package market is divided on the basis of packaging technology, package type, packaging method, device, application, and geography. The overall SiP market was valued at USD 5.44 billion in 2016 and is expected to reach USD 9.07 billion by 2023, at a CAGR of 9.4% during the forecast period.

By package method, the fan-out wafer level packaging segment is expected to grow at the highest growth rate during the forecast period

The system in package market based on packaging method has been segmented into flip chip (FC), wire bond and die attach (WB and DA), and fan-out wafer level packaging (FOWLP). Intel (US) was the early adopter of flip chip packaging method for packaging of its mainstream CPUs to improve the electrical and thermal performance of the processors. The increasing need for functionalities and reduced package sizes led to the integration of flip chip packaging method in baseband and application processors for mobile platforms. However, FOWLP is a key packaging method used while embedding heterogeneous devices such as baseband processors, RF transceivers, and power management ICs (PMICs). Moreover, the increasing demand for a large number of I/O points for semiconductor devices is expected to generate the demand for FOWLP packaging method.

By device, the RF front-end device holds the largest share of the market

The system in package market for RF front-end packaging method held the largest size in 2016. The rising demand for compact size and high frequency transceivers solutions, in products such as smartphones and tablets, is expected to drive the growth of RF front-end devices.

APAC to account for the largest market size during the forecast period.

The APAC region is expected to hold the largest share of the SiP market during the forecast period. The demand for the SiP technology is more from the consumer electronics sector, particularly for smartphones and tablets. As a result, the presence of big companies in this sector, such as Samsung Electronics (South Korea) and Sony (Japan), is driving the system in package market in APAC.

Market Dynamics

Driver: Growing demand for miniaturization of electronic devices

Rapid R&D and technological advances have created a demand for reliable and compact electronic devices. This has led to the growing demand for miniaturized electronic devices. Many electronic products have become more advanced with the development of semiconductor technology that required the use of IC packaging technology in logic, memory, RF, and sensors to be integrated into small form factors. The SiP offers high-performance and low-power consumption solutions in smaller footprints. Also, the reduction in wire length in SiP helps to enhance the circuit performance and reduce power consumption by controlling the cycle time and energy dissipation. The SiP process facilitates the integration of different multichip modules, such as DRAM and others, together with minimum interference. Thus, the increasing use of IC packaging technology in small form factors for the development of miniaturized electronic devices is driving the growth of this system in package market.

Restraint: Higher level of integration leads to thermal issues

SiP offers highly dense multilevel integration per unit footprint. Though this is attractive for many applications where miniaturization is a concern, it also creates challenges for thermal management. Increased integration leads to high on-chip temperature. During the production of 3D ICs with TSVs, an issue of overheating could be observed. Elevated temperature results drop in threshold voltage and degradation of mobility. The resistance and power dissipation increases as the major part of the component is made up of metal. The wire resistance also increases, resulting in larger interconnect delays. The more pronounced thermal effects in 3D IC are because of higher power densities and greater thermal resistance, along heat dissipation paths. Hence, the growth of the system in package market is hampered because of thermal issues.

Opportunity: Potential use of RF components in developing advanced 5G infrastructure

With the availability of equipment that supports high bandwidth, wireless networks would face heavy congestion over the next five years. This would drive the shift from the existing 3G and 4G LTE technologies to 5G. The aggregate data rates supported by the 5G technology are expected to significantly faster than the existing 3G and 4G data rates, respectively.

By 2021, several major countries such as the US, Japan, South Korea, the UK, Germany, and China are expected to deploy 5G technology. This is expected to significantly increase the number of mobile subscribers, thereby creating a requirement for developing infrastructure that can handle data requests from users. Thus, there would be an upsurge in the requirement of SiP-based RF components to provide increased data rate and improved quality of the received signal during the actual deployment.

However, the use of high-bandwidth RF components, such as front-end module (FEM), power amplifier module (PAM), antenna switch module (ASM), RFID module, and local interconnect network (LIN) transceiver SiP module, in wireless networks would face design challenges such as simulation of multiple chips, passive circuits, and interconnects, all together in a single package. This would, in turn, create an opportunity for SiP-based RF component manufacturers in the development of advanced 5G infrastructure.

Challenge: Effective Supply Chain Management

The supply chain management is a big challenge for the SiP market as “one size fits all” approach is not applicable in the said market. Therefore, the market demands fixed and well-defined supply chain. As SiP is an emerging market, various processes in its supply chain, such as breakdown and traceability of products and services, and logistics are not standardized. The 3D IC packaging industry faces technological challenges; for instance, heterogeneous packaging needs testing of all individual die which may not carried out on a same infrastructure. Also, a single foundry may not able to supply all types of die required in the heterogeneous packaging, which leads to need of multiple suppliers and related logistics.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015–2023 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2023 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Packaging Technology, Package Type, Packaging Method, Application, Device, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

ASE Group (Taiwan), Amkor Technology (US), SPIL (Taiwan), Powertech Technology (Taiwan), UTAC (Global A&T Electronics) (Singapore) |

The research report categorizes the system in package market to forecast the revenues and analyze the trends in each of the following sub-segments:

Please visit 360Quadrants to see the vendor listing of Top 21 Sustainable Packaging Companies, Worldwide 2023

System in Package Market, By Packaging Technology

- 2D IC

- 2.5D IC

- 3D IC

System in Package Market, By Package Type

- Ball Grid Array

- Surface Mount Package

- Pin Grid Array

- Flat Package

- Small Outline Package

System in Package Market, By Packaging Method

- Fan-Out Wafer Level Packaging

- Wire Bond & Die Attach

- Flip Chip

System in Package Market, By Application

- Automotive & Transportation

- Consumer Electronics

- Communication

- Industrial

- Aerospace & Defense

- Healthcare

- Emerging & Others

System in Package Market, By Device

- RF Front-End

- RF Power Amplifier

- Power Management Integrated Circuits

- Baseband Processor

- Application Processor

- Microelectromechanical System

- Others

System in Package Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- RoW

Key Market Players:

ASE Group (Taiwan), Amkor Technology (US), SPIL (Taiwan), Powertech Technology (Taiwan), UTAC (Global A&T Electronics) (Singapore)

ASE Group is the world’s largest independent provider of semiconductor packaging and testing services. The company was founded in 1984 and has its headquarters in Kaohsiung, Taiwan. As of December 2016, the company had a headcount of 66,711 employees. ASE Group’s operational base encompasses production facilities, product development centers, and sales and support offices located in key electronics manufacturing regions such as APAC, Europe, and the US.

Recent Developments:

- In December 2016, Amkor Technology completed the product qualification for its new silicon wafer integrated fan-out technology (SWIFT), the technology used for advanced mobile, networking, and SiP applications. The SWIFT has features of photolithography and thin film dielectrics that bridges the gap between through silicon via (TSV) and traditional wafer- level fan-out (WLFO) packages.

- In March 2016, ASE Group developed SiP solutions for consumer and automotive applications. The company uses technologies such as wire bonding, wafer-level, fan-out, flip-chip, 2.5D/3D, substrates, and embedded IC packaging in SiP to offer an effective solution for IoT.

- In September 2016, SPIL and Hon Hai Precision (Taiwan) signed a letter of intent to form a strategic alliance. Through this, both companies would offer IC wire bonding and wafer level packaging technology for end users.

- In June 2016, ASE Group entered into an agreement with SPIL (Taiwan) to establish a new holding company that is listed in the Taiwan stock exchange and whose American depositary shares are listed in the New York stock exchange. Owing to this, the ASE Group and SPIL have become the wholly owned subsidiaries of HoldCo.

- In May 2016, Amkor Technology collaborated with Cadence (US) to develop packaging assembly design kits (PADK) for silicon-less integrated module (SLIM) and SWIFT packaging technologies. It would help the Amkor Technology’s customer to reduce the SLIM and SWIFT design and verification cycles.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the System in Package market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Market Segmentation

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the System in Package Market

4.2 SiP Market, By Packaging Technology

4.3 Market, By Region and Application

4.4 Market, By Region

4.5 Market Size, By Packaging Method, 2017–2023

4.6 Market, By Package Type

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Value Chain Analysis

5.4 Comparison of Technology

5.5 Benchmarking of SiP and SOC

5.6 Market Trends for SiP

5.7 Market Trends for SOC

6 SiP Market, By Packaging Technology

6.1 Introduction

6.2 2D IC Packaging Technology

6.3 2.5D IC Packaging Technology

6.4 3D IC Packaging Technology

7 SiP Market, By Package Type

7.1 Introduction

7.2 Ball Grid Array (BGA)

7.2.1 Plastic Ball Grid Array (PBGA)

7.2.2 Super Ball Grid Array (SBGA)

7.2.3 Fine Pitch Ball Grid Array (FBGA)

7.2.4 Flip Chip Ball Grid Array (FCBGA)

7.2.5 Others

7.3 Surface Mount Package

7.3.1 Land Grid Array (LGA)

7.3.2 Ceramic Column Grid Array (CCGA)

7.3.3 Others

7.4 Pin Grid Array (PGA)

7.4.1 Flip Chip Pin Grid Array (PGA)

7.4.2 Ceramic Pin Grid Array (CPGA)

7.4.3 Others

7.5 Flat Package (FP)

7.5.1 Quad Flat No-Leads (QFN)

7.5.2 Ultra Thin Quad Flat No-Leads (UTQFN)

7.5.3 Others

7.6 Small Outline Package

7.6.1 Thin Small Outline Package (TSOP)

7.6.2 Thin Shrink Small Outline Package (TSSOP)

7.6.3 Others

8 SiP Market, By Packaging Method (Interconnection Technology)

8.1 Introduction

8.2 Wire Bond and Die Attach

8.3 Flip Chip

8.4 Fan-Out Wafer Level Packaging (FOWLP)

8.5 Comparison of Wire Bond, Flip Chip, and FOWLP Packaging Methods

8.6 Advantages and Limitations of Wire Bond, Flip Chip, and FOWLP Packaging Methods

8.7 Trends in Each Packaging Method

9 SiP Market, By Device

9.1 Introduction

9.2 Power Management Integrated Circuit (PMIC)

9.3 Microelectromechanical Systems (MEMS)

9.4 RF Front-End

9.5 RF Power Amplifier

9.6 Baseband Processor

9.7 Application Processor

9.8 Others

10 SiP Market, By Application

10.1 Introduction

10.2 Consumer Electronics

10.2.1 Communications

10.3 Industrial

10.4 Automotive & Transportation

10.5 Aerospace & Defense

10.6 Healthcare

10.7 Emerging & Others

11 SiP Market, By Geography

11.1 Introduction

11.2 Asia Pacific

11.2.1 China and Taiwan

11.2.2 Japan

11.2.3 South Korea

11.2.4 Rest of APAC

11.3 North America

11.3.1 US

11.3.2 Canada

11.3.3 Mexico

11.4 Europe

11.4.1 Germany

11.4.2 France

11.4.3 Rest of Europe

11.5 Rest of the World (RoW)

11.5.1 Middle East and Africa

11.5.2 South America

12 Competitive Landscape

12.1 Overview

12.2 Ranking Analysis of Market Players

12.3 Competitive Scenario

12.3.1 Battle for the Market Share

12.3.2 Product Launches and Developments

12.3.3 Agreements, Collaborations, Partnerships, and Joint Ventures

12.3.4 Acquisitions and Expansions

13 Company Profiles

(Overview, Service Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and Key Relationships)*

13.1 Amkor Technology

13.2 ASE Group

13.3 Chipbond Technology

13.4 13.4 Chipmos Technologies

13.5 FATC

13.6 13.6 Intel

13.7 JCET

13.8 Powertech Technology

13.9 Samsung Electronics

13.10 Spil

13.11 Texas Instruments

13.12 Unisem

13.13 UTAC (Global A&T Electronics)

*Details on Overview, Service Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and Key Relationships* Might Not Be Captured in Case of Unlisted Companies.

14 Appendix

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (129 Tables)

Table 1 Recent IoT Acquisition

Table 2 System in Package Market, By Packaging Technology, 2015–2023 (USD Million)

Table 3 SiP Market, By Package Type, 2015–2023 (USD Million)

Table 4 SiP Market for BGA, By Package Subtype, 2015–2023 (USD Million)

Table 5 SiP Market for SMT, By Package Subtype, 2015–2023 (USD Million)

Table 6 SiP Market for PGA, By Package Subtype, 2015–2023 (USD Million)

Table 7 SiP Market for FP, By Package Subtype, 2015–2023 (USD Million)

Table 8 SiP Market for Sop, By Package Subtype, 2015–2023 (USD Million)

Table 9 SiP Market, By Packaging Method, 2015–2023 (USD Million)

Table 10 SiP Market for Wire Bond and Die Attach, By Device, 2015–2023 (USD Million)

Table 11 SiP Market for Flip Chip, By Device, 2015–2023 (USD Million)

Table 12 SiP Market for FOWLP, By Device, 2015–2023 (USD Million)

Table 13 SiP Market, By Device, 2015–2023 (Billion Units)

Table 14 SiP Market, By Device, 2015–2023 (USD Million)

Table 15 SiP Market Size for PMIC, By Application, 2015–2023 (USD Million)

Table 16 SiP Market Size for PMIC in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 17 SiP Market Size for PMIC in Communications, By Region, 2015–2023 (USD Million)

Table 18 SiP Market Size for PMIC in Healthcare, By Region, 2015–2023 (USD Million)

Table 19 SiP Market Size for PMIC in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 20 SiP Market Size for PMIC in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 21 SiP Market Size for PMIC in Industrial, By Region, 2015–2023 (USD Million)

Table 22 SiP Market Size for PMIC in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 23 SiP Market Size for PMIC, By Packaging Method, 2015–2023 (USD Million)

Table 24 SiP Market Size for MEMS, By Application, 2015–2023 (USD Million)

Table 25 SiP Market Size for MEMS in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 26 SiP Market Size for MEMS in Healthcare, By Region, 2015–2023 (USD Million)

Table 27 SiP Market Size for MEMS in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 28 SiP Market Size for MEMS in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 29 SiP Market Size for MEMS in Industrial, By Region, 2015–2023 (USD Million)

Table 30 SiP Market Size for MEMS in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 31 SiP Market Size for MEMS, By Packaging Method, 2015–2023 (USD Million)

Table 32 SiP Market Size for RF Front-End, By Application, 2015–2023 (USD Million)

Table 33 SiP Market Size for RF Front-End in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 34 SiP Market Size for RF Front-End in Communications, By Region, 2015–2023 (USD Million)

Table 35 SiP Market Size for RF Front-End in Healthcare, By Region, 2015–2023 (USD Million)

Table 36 SiP Market Size for RF Front-End in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 37 SiP Market Size for RF Front-End in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 38 SiP Market Size for RF Front-End in Industrial, By Region, 2015–2023 (USD Million)

Table 39 SiP Market Size for RF Front-End in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 40 SiP Market Size for RF Front-End, By Packaging Method, 2015–2023 (USD Million)

Table 41 SiP Market Size for RF Power Amplifier, By Application, 2015–2023 (USD Million)

Table 42 SiP Market Size for RF Power Amplifier in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 43 SiP Market Size for RF Power Amplifier in Communications, By Region, 2015–2023 (USD Million)

Table 44 SiP Market Size for RF Power Amplifier in Healthcare, By Region, 2015–2023 (USD Million)

Table 45 SiP Market Size for RF Power Amplifier in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 46 SiP Market Size for RF Power Amplifier in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 47 SiP Market Size for RF Power Amplifier in Industrial, By Region, 2015–2023 (USD Million)

Table 48 SiP Market Size for RF Power Amplifier in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 49 SiP Market Size for RF Power Amplifier, By Packaging Method, 2015–2023 (USD Million)

Table 50 SiP Market Size for Baseband Processor, By Application, 2015–2023 (USD Million)

Table 51 SiP Market Size for Baseband Processor in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 52 SiP Market Size for Baseband Processor in Communications, By Region, 2015–2023 (USD Million)

Table 53 SiP Market Size for Baseband Processor in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 54 SiP Market Size for Baseband Processor in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 55 SiP Market Size for Baseband Processor in Industrial, By Region, 2015–2023 (USD Million)

Table 56 SiP Market Size for Baseband Processor in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 57 SiP Market Size for Baseband Processor, By Packaging Method, 2015–2023 (USD Million)

Table 58 SiP Market Size for Application Processor, By Application, 2015–2023 (USD Million)

Table 59 SiP Market Size for Application Processor in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 60 SiP Market Size for Application Processor in Communications, By Region, 2015–2023 (USD Million)

Table 61 SiP Market Size for Application Processor in Healthcare, By Region, 2015–2023 (USD Million)

Table 62 SiP Market Size for Application Processor in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 63 SiP Market Size for Application Processor in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 64 SiP Market Size for Application Processor, By Packaging Method, 2015–2023 (USD Million)

Table 65 SiP Market Size for Others, By Application, 2015–2023 (USD Million)

Table 66 SiP Market Size for Other Devices in Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 67 SiP Market Size for Other Devices in Communications, By Region, 2015–2023 (USD Million)

Table 68 SiP Market Size for Other Devices in Healthcare, By Region, 2015–2023 (USD Million)

Table 69 SiP Market Size for Other Devices in Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 70 SiP Market Size for Other Devices in Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 71 SiP Market Size for Other Devices in Industrial, By Region, 2015–2023 (USD Million)

Table 72 SiP Market Size for Other Devices in Emerging & Other Applications, By Region, 2015–2023 (USD Million)

Table 73 SiP Market Size for Others, By Packaging Method, 2015–2023 (USD Million)

Table 74 SiP Market, By Application, 2015–2023 (USD Million)

Table 75 SiP Market for Consumer Electronics, By Device, 2015–2023 (USD Million)

Table 76 SiP Market for Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 77 SiP Market for Communications, By Device, 2015–2023 (USD Million)

Table 78 SiP Market for Communications, By Region, 2015–2023 (USD Million)

Table 79 SiP Market for Industrial, By Device, 2015–2023 (USD Million)

Table 80 SiP Market for Industrial, By Region, 2015–2023 (USD Million)

Table 81 SiP Market for Automotive & Transportation, By Device, 2015–2023 (USD Million)

Table 82 SiP Market for Automotive & Transportation, By Region, 2015–2023 (USD Million)

Table 83 SiP Market for Aerospace & Defense, By Device, 2015–2023 (USD Million)

Table 84 SiP Market for Aerospace & Defense, By Region, 2015–2023 (USD Million)

Table 85 SiP Market for Healthcare, By Device, 2015–2023 (USD Million)

Table 86 SiP Market for Healthcare, By Region, 2015–2023 (USD Million)

Table 87 SiP Market for Emerging & Others, By Device, 2015–2023 (USD Million)

Table 88 SiP Market for Emerging & Others, By Region, 2015–2023 (USD Million)

Table 89 SiP Market, By Geography, 2015–2023 (USD Million)

Table 90 System in Package Market Size in APAC, By Country, 2015–2023 (USD Million)

Table 91 SiP Market Size in APAC, By Application, 2015–2023 (USD Million)

Table 92 SiP Market Size in APAC for PMIC, By Application, 2015–2023 (USD Million)

Table 93 SiP Market Size in APAC for MEMS, By Application, 2015–2023 (USD Million)

Table 94 SiP Market Size in APAC for RF Front-End, By Application, 2015–2023 (USD Million)

Table 95 SiP Market Size in APAC for RF Power Amplifier, By Application, 2015–2023 (USD Million)

Table 96 SiP Market Size in APAC for Baseband Processor, By Application, 2015–2023 (USD Million)

Table 97 SiP Market Size in APAC for Application Processor, By Application, 2015–2023 (USD Million)

Table 98 SiP Market Size in APAC for Other Devices, By Application, 2015–2023 (USD Million)

Table 99 SiP Market Size in North America, By Country, 2015–2023 (USD Million)

Table 100 SiP Market Size in North America, By Application, 2015–2023 (USD Million)

Table 101 SiP Market Size in North America for PMIC, By Application, 2015–2023 (USD Million)

Table 102 SiP Market Size in North America for MEMS, By Application, 2015–2023 (USD Million)

Table 103 SiP Market Size in North America for RF Front-End, By Application, 2015–2023 (USD Million)

Table 104 SiP Market Size in North America for RF Power Amplifier, By Application, 2015–2023 (USD Million)

Table 105 SiP Market Size in North America for Baseband Processor, By Application, 2015–2023 (USD Million)

Table 106 SiP Market Size in North America for Application Processor, By Application, 2015–2023 (USD Million)

Table 107 SiP Market Size in North America for Other Devices, By Application, 2015–2023 (USD Million)

Table 108 SiP Market Size in Europe, By Country, 2015–2023 (USD Million)

Table 109 SiP Market Size in Europe, By Application, 2015–2023 (USD Million)

Table 110 SiP Market Size in Europe for PMIC, By Application, 2015–2023 (USD Million)

Table 111 SiP Market Size in Europe for MEMS, By Application, 2015–2023 (USD Million)

Table 112 SiP Market Size in Europe for RF Front-End, By Application, 2015–2023 (USD Million)

Table 113 SiP Market Size in Europe for RF Power Amplifier, By Application, 2015–2023 (USD Million)

Table 114 SiP Market Size in Europe for Baseband Processor, By Application, 2015–2023 (USD Million)

Table 115 SiP Market Size in Europe for Application Processor, By Application, 2015–2023 (USD Million)

Table 116 SiP Market Size in Europe for Other Devices, By Application, 2015–2023 (USD Million)

Table 117 SiP Market Size in RoW, By Country, 2015–2023 (USD Million)

Table 118 SiP Market Size in RoW, By Application, 2015–2023 (USD Million)

Table 119 SiP Market Size in RoW for PMIC, By Application, 2015–2023 (USD Million)

Table 120 SiP Market Size in RoW for MEMS, By Application, 2015–2023 (USD Million)

Table 121 SiP Market Size in RoW for RF Front-End, By Application, 2015–2023 (USD Million)

Table 122 SiP Market Size in RoW for RF Power Amplifier, By Application, 2015–2023 (USD Million)

Table 123 SiP Market Size in RoW for Baseband Processor, By Application, 2015–2023 (USD Million)

Table 124 SiP Market Size in RoW for Application Processor, By Application, 2015–2023 (USD Million)

Table 125 SiP Market Size in RoW for Other Devices, By Application, 2015–2023 (USD Million)

Table 126 Ranking of Top 5 Players in the SiP Market, 2016

Table 127 10 Key Product Launches, Product Developments, and Technology Developments

Table 128 10 Key Agreements, Collaborations, Partnerships, and Joint Ventures

Table 129 5 Key Acquisitions and Expansions

List of Figures (52 Figures)

Figure 1 SiP Market Segmentation

Figure 2 SiP Market: Research Design

Figure 3 Research Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 SiP Market for 3d IC Packaging Technology Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 SiP Market for FOWLP Packaging Method Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 RF Front-End Device Expected to Hold the Largest Size of SiP Market for Packaging Methods in 2017

Figure 10 SiP Market for Healthcare Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 APAC Expected to Hold the Largest Market Share in 2017

Figure 12 Increasing Demand for Miniaturization Along With High-Performance Electronic Devices Drives the Growth of the SiP Market

Figure 13 2D IC Packaging Technology Expected to Hold the Largest Market Size During the Forecast Period

Figure 14 Consumer Electronics Application and RF Front-End Device Expected to Hold the Largest Share of the SiP Market By 2023

Figure 15 System in Package Market in RoW Expected to Grow at the Highest CAGR During 2017–2023

Figure 16 FOWLP Packaging Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 BGA Packaging Expected to Hold the Largest Size of the SiP Market During the Forecast Period

Figure 18 Value Chain Analysis of the SiP Market

Figure 19 SiP Market, By Packaging Technology

Figure 20 SiP Market for 3d IC Packaging Technology Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Structure of 2D IC Packaging Technology

Figure 22 Structure of 2.5D IC Packaging Technology

Figure 23 Structure of 3d IC Packaging Technology

Figure 24 SiP Market, By Package Type

Figure 25 SiP Market for Sop Packaging Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 SiP Market, By Packaging Method

Figure 27 SiP Market for FOWLP Packaging Method Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 SiP Market, By Device

Figure 29 SiP Market for MEMS Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Automotive & Transportation Application Market for MEMS Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 SiP Market, By Application

Figure 32 SiP Market for Healthcare Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 APAC Market for Healthcare Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 SiP Market in APAC Expected to Hold the Largest Size in 2017

Figure 35 APAC: Snapshot of SiP Market

Figure 36 North America: Snapshot of SiP Market

Figure 37 Europe: Snapshot of SiP Market

Figure 38 Companies Adopted Agreements, Collaborations, Partnerships, Joint Ventures as Key Growth Strategies Between January 2013 and October 2017

Figure 39 System in Package Market Evaluation Framework

Figure 40 Amkor Technology: Company Snapshot

Figure 41 ASE Group: Company Snapshot

Figure 42 Chipbond Technology: Company Snapshot

Figure 43 Chipmos Technologies: Company Snapshot

Figure 44 FATC: Company Snapshot

Figure 45 Intel: Company Snapshot

Figure 46 JCET: Company Snapshot

Figure 47 Powertech Technology: Company Snapshot

Figure 48 Samsung Electronics: Company Snapshot

Figure 49 Spil: Company Snapshot

Figure 50 Texas Instruments: Company Snapshot

Figure 51 Unisem: Company Snapshot

Figure 52 UTAC: Company Snapshot

Growth opportunities and latent adjacency in System in Package Market