Fillings and Toppings Market by Type (Syrups, Pastes, and Variegates, Creams, Fondants), Application (Confectionery Products, Bakery Products), Flavor (Fruits, Chocolates, Vanilla), Form (Solid, Liquid) and Raw Material - Global Forecasts to 2027

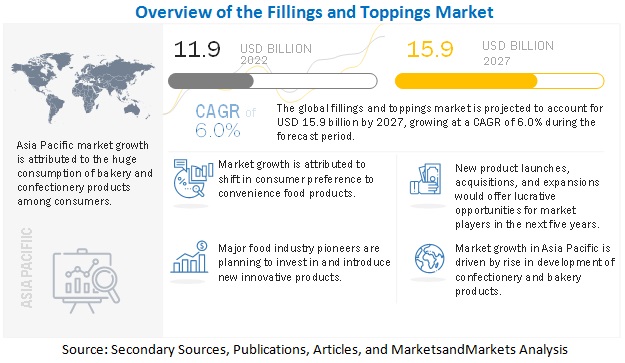

[215 Pages Report] The global fillings and toppings market is predicted to generate USD 15.9 billion revenue by 2027. The global fillings and toppings market has been driven by factors such as rising demand for premium and healthier products among the consumers, rising consumer awareness about health, and evolving busy lifestyles of the consumers. Owing to the high growth of the fillings and toppings market, various manufacturers and investors are investing in the expansion of the fillings and toppings industry. For instance, Cloetta, a Swedish confectionery, and the nuts company is currently planning to launch to build a new manufacturing plant in the Netherland. Hence, the expansion of confectionery industries in the region will further enhance the demand for fillings and toppings.

To know about the assumptions considered for the study, Request for Free Sample Report

Fillings and Toppings Market Growth Dynamics

Drivers: Rapidly growing confectionery and bakery industries

The global confectionery and bakery industries are expected to grow at high rates in developing nations. Adoption of western dietary habits has changed the consumers eating preferences and has played a major role in the growth of fillings and toppings in the Asia Pacific. Confectionery is building on premiumization in a market that is mature but continuing to grow modestly. Despite rising concerns around sugar intake, consumers continue to demand every day and more indulgent treats. Moreover, fillings form an integral part of cakes and pastries. They enhance the sensory characteristics, while also providing a characteristic taste to cakes and pastries. They are also used in viennoiseries such as puff pastries and pieces of bread.

Restraints: Stringent Adherence due to international quality standards and regulations

The ingredients used in the manufacturing of fillings and toppings for bakery, confectionery, and convenience food products are subjected to rigorous health and safety checks based on the governmental regulations in each country. Standards set by agencies for the classification and usage levels differ from respective authoritative bodies and pose a serious problem to companies for streamlining product developments. Also, the industry will continue to be burdened by government rules, for instance, the Environmental Protection Agency and the Food and Drug Administration are continually inspecting bakeries' operations and establishing new restrictions that raise production expenses and thus, affecting the growth of the bakery industry in the market.

Opportunities: The baking and confectionery industry’s growth potential in developing economies

The increased income has changed the living standards and employment rates in these regions, leading to a change in lifestyle with hectic work schedules. Eating habits have been shifting from regular meals to fast food and convenience foods, which is providing an impetus to fillings and toppings in these markets. Developing markets offer higher potential for greater market penetration, while in developed markets, innovation in new flavors and healthy ingredients drive the market growth.

Challenges: Health consciousness among consumers in developed countries

In the US and developed European countries such as Germany, U.K., France, and Italy, health consciousness among consumers is one of the major factors restraining the demand for fillings and toppings in the market. In Europe, the rising level of obesity found in infants and young adults is a significant issue, wherein the European Union is promoting the consumption of fruits and vegetables, which has a positive impact on the juice concentrates market in Europe. For instance, Germany is very health conscious and is one of the leading markets for bakery products, globally. The rising health consciousness among consumers has been driving the market growth for healthy foods in the country. This has adversely affected the demand for cakes, pastries, and other bakery snack products.

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 11.9 billion |

|

Market size value in 2027 |

USD 15.9 billion |

|

Number of Pages |

215 Pages Report |

|

Market size estimation |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

|

|

Regions covered |

|

|

Companies studied |

|

By type, fruits and nuts is the second fastest growing segment in the global fillings and toppings market.

Fruits and nuts that are largely used as inclusions or for a topping purpose are mainly in dried or processed form. Nuts in fillings and toppings are largely used for puddings, crumbles, dessert cakes, and ice creams. There are many nut pies such as dried apricot and walnut tart, mixed nut toffee tart, and chocolate peanut butter tart which are used in dessert. Callebaut (Switzerland) provides a homogeneous hazelnut paste that is used for flavoring fillings. With the increasing demand for plant-based products, the market for fruits and nuts is expected to grow at the fastest rate during the forecast period.

By raw material, cocoa is the second fastest growing segment in the global fillings and toppings market.

Cocoa is largely used as a raw material for the manufacturing of semi-sweet or bittersweet chocolate. Bakery and confectionery are the key application industries for cocoa. Cocoa is used for a wide range of other applications, which also include cereals, dry mixes, ice cream, desserts, beverages and dairy. Furthermore, cocoa powder and chocolate syrups serve as a filling ingredient in the preparation of various beverages and drinks. Hence. Increasing the demand for cocoa as a raw material in the forecast period.

By flavor, the vanilla segment is projected to grow progressively during the forecasted period.

The vanilla flavor is one of the most popular ice cream flavors in the world. It has different flavor profiles such as natural vanilla flavor, beany vanilla flavor, buttery vanilla flavor, milky vanilla flavor, and many more, which provide different fillings and toppings choices for different food products. In Germany, people prefer buttery vanilla flavor as compared to any vanilla flavor in France. Vanilla offers different types of cake fillings such as vanilla mousse, vanilla custard, vanilla pudding, and vanilla cream. Vanilla cream toppings are offered for vanilla flavor in various desserts and drinks, hence increasing the demand for the vanilla flavor segment in the forecast period.

By application, the beverages segment has a progressive growth in the global market over the foreseeable future.

Beverages, soy isolates are used in liquid whipped toppings, pre-whipped toppings, sour cream dressings, and coffee whiteners. Soy concentrates and isolates are also used as a source of protein in instant beverages. It helps in enhancing the texture, taste, and visual characteristics of food products. Hot chocolate, café mocha, and frappes drinks are topped with fat-coated honeycomb, mini mallows, milk chocolate curls (blossoms), and caramel fudge. Toppings add value to both, hot and cold beverages. Cream toppings are gaining popularity for gourmet coffees, milkshakes, specialty cappuccinos, lattes, and teas, hence increasing the demand for fillings and toppings.

By form, the liquid segment is anticipated to be the fastest growing segment in the fillings and toppings market over the foreseeable future.

The liquid form is used in accordance with the requirement of applications such as ice creams, cakes, yogurt, pastries, chocolates, and beverages. The ingredients used to manufacture fillings and toppings play an important role in the final form. For instance, fruit syrups and chocolate syrups in a specific proportion results in the formation of a solid fillings and toppings form, which is suitable for use in the preparation of bakery and confectionery products. Moreover, with an increasing demand for diversified food with artisanal fillings in the confectionery industry is driving the market for the liquid form segment.

By region, Europe was the largest regional market for the fillings and toppings industry

To know about the assumptions considered for the study, download the pdf brochure

Europe accounted for the largest share in the global market; however, it is expected to grow at a slow rate during the forecast period. It remains one of the important markets for fillings and toppings companies due to its size. The European market is led by countries such as Germany, the U.K., France, and Italy. Changing consumer trends, such as the rising level of health consciousness, which has compelled consumers to pay more attention to their diet, have reformed the overall bakery industry in the country. Expanding product ranges to include healthier products helped companies grow with the changing preference of consumers. Moreover, In developed economies such as Germany, childhood obesity and juvenile diabetes cases are increasing. Such factors have led health-conscious consumers to increasingly select for healthier food products that contain calorie content in the prescribed range. This has resulted in chocolate and bakery manufacturers using fruits and nuts as fillings and toppings for their products.

Fillings and Toppings Market Key Players:

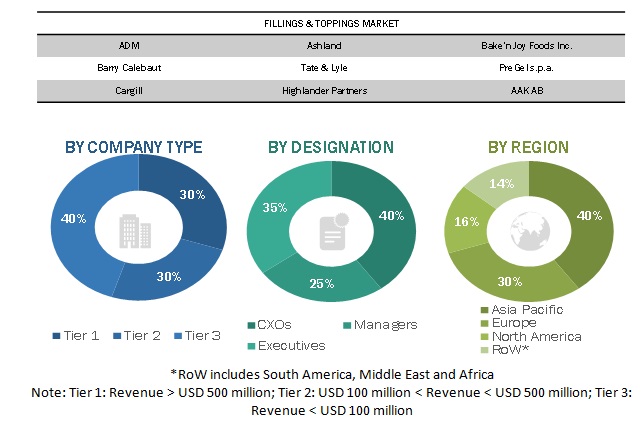

Key players in this market include ADM (US), Barry Callebaut (Switzerland), Tate and Lyle (US), AGRANA Beteiligungs-AG (Austria), and Associated British Foods plc (UK).

Target Audience:

- Food and Beverage manufacturers and formulators

- Bakery products manufacturers

- Confectionery products manufacturers

- Bakery organizations and associations

- Marketing directors

- Product Innovation directors

- Key executives from various key companies and organizations in the fillings and toppings market

Fillings and Toppings Market Report Scope:

In this report the fillings and toppings market segment is based on type, application, form, flavor, raw material, and region.

Market By Type

- Fondants

- Creams

- Syrups, Pastes, and Variegates

- Sprinkles

- Fruits and nuts

Market By Application

- Bakery Products

- Confectionery Products

- Dairy Products and Frozen Desserts

- Beverages

- Convenience Food

Market By Flavor

- Fruits

- Chocolates

- Vanilla

- Nuts

- Caramel

- Other Flavors

Market By Form

- Solid

- Liquid

- Gel

- Foam

Market By Raw Material

- Hydrocolloids

- Starches

- Dairy Ingredients

- Fruits

- Sweeteners

- Cocoa

- Other Raw Materials

Market By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- MEA

- Africa

Recent Developments

- In April 2022, Barry Callebaut (Switzerland), expanded its North American presence by building a new specialty chocolate factory in Ontario, Canada with a production capacity of over 50,000 tonnes. It will focus on manufacturing sugar-free chocolate, as well as high protein and other specialty products, reflecting the market trends. The investment in Ontario fits the Group's strategy to continuously nurture its global footprint, locating production close to its customers.

- In August 2021, Bake’n Joy Foods, Inc. (US) Bake’n Joy announced the acquisition of LandM Baking, expanding industry reach in terms of product category and distribution.

- In November 2021, Cargill (US) had expanded its Asian manufacturing facilities with a key investment of $35 million expansion of its production facility in Port Klang, Malaysia, for specialty fats within confectionery. The expansion is aimed to significantly expand the overall product portfolio.

Frequently Asked Questions (FAQ):

Which are the major fillings and toppings segments considered in this study?

All the major fillings and toppings are segmented in various segments such as application, flavor, form, raw material, and type.

I am interested in the Asia Pacific market for the raw material segment. Is the customization available for the same? What would all information be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects, including market size, forecast, market dynamics, company profiles, and competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific (Thailand, the Philippines, Australia and New Zealand, Malaysia, Singapore, and Vietnam)

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the fillings and toppings market?

Global fillings and toppings market is characterized by the following drivers:

- Evolving consumer lifestyles in developing countries

There has been a significant change in the food consumption pattern of consumers. Ready-to-eat or convenience food products are largely demanded over homemade food products. The increasing number of nuclear families, working women, and favorably changing economic conditions in developing regions have led to an increasing trend of dining outside, particularly in urban and semi-urban areas. The use of fillings and toppings by food manufacturers for enhancing the taste, texture, aesthetic appeal, flavor, and color of food and beverage products is expected to drive the demand in the market.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, MnM view to elaborate analyst view on the company. Some of the key players in the market include ADM (US), Barry Callebaut (Switzerland), Tate and Lyle (US), AGRANA Beteiligungs-AG (Austria), Associated British Foods plc (UK), Cargill (US), AAK AB (Sweden), Ashland (US), Highlander Partners (US), and Zentis GmbH and Co. KG (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FILLINGS AND TOPPINGS MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 INCLUSIONS AND EXCLUSIONS

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 FILLINGS AND TOPPINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1: BOTTOM-UP (FILLINGS AND TOPPINGS MARKET, BY REGION)

2.2.2 APPROACH 2: TOP-DOWN (GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 35)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 4 FILLINGS AND TOPPINGS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 5 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 6 MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET, BY FLAVOR, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET, BY RAW MATERIAL, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 10 SHIFTING CONSUMER PREFERENCE TO CONVENIENCE FOOD PROPELLING FILLINGS AND TOPPINGS MARKET

4.2 NORTH AMERICA: MARKET FOR FILLINGS AND TOPPINGS, BY TYPE AND COUNTRY

FIGURE 11 US AND SYRUPS, PASTES, AND VARIEGATES SEGMENTS ACCOUNTED FOR A SIGNIFICANT MARKET SHARE IN 2021

4.3 FILLINGS AND TOPPINGS MARKET, BY TYPE

FIGURE 12 SYRUPS, PASTES, AND VARIEGATES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 MARKET FOR FILLINGS AND TOPPINGS, BY FLAVOR

FIGURE 13 FRUITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MARKET FOR FILLINGS AND TOPPINGS, BY APPLICATION AND REGION

FIGURE 14 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 MARKET FOR FILLINGS AND TOPPINGS, BY RAW MATERIAL

FIGURE 15 SWEETENERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 MARKET DYNAMICS

FIGURE 16 RAPID GROWTH OF FAST-FOOD INDUSTRY TO FUEL GLOBAL FILLINGS AND TOPPINGS MARKET GROWTH IN FUTURE

5.1.1 DRIVERS

5.1.1.1 Rapidly growing confectionery and bakery industries

5.1.1.2 Evolving consumer lifestyle

5.1.2 RESTRAINTS

5.1.2.1 Volatile raw material pricing trends

5.1.2.2 Adherence to international quality standards and regulations

5.1.3 OPPORTUNITIES

5.1.3.1 Growth potential in developing nations

5.1.3.2 Rising middle-class population presenting attractive opportunities for filling and topping products

5.1.4 CHALLENGES

5.1.4.1 Rising trends for clean-label products

5.1.4.2 Health-conscious consumers in developed countries

6 INDUSTRY TRENDS (Page No. - 50)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND DEVELOPMENT

6.2.2 SOURCING OF RAW MATERIALS

6.2.3 MANUFACTURING, PACKAGING, AND STORAGE

6.2.4 DISTRIBUTION, MARKETING, AND SALES

6.2.5 END USERS

6.3 MARKET MAP AND ECOSYSTEM: FILLINGS AND TOPPINGS MARKET

6.3.1 DEMAND SIDE

6.3.2 SUPPLY SIDE

FIGURE 18 FILLINGS AND TOPPINGS MARKET: MARKET MAP

TABLE 3 MARKET FOR FILLINGS AND TOPPINGS: SUPPLY CHAIN (ECOSYSTEM)

6.4 PATENT ANALYSIS

FIGURE 19 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

FIGURE 20 TOP TEN INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 21 TOP TEN APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 4 PATENTS PERTAINING TO FILLINGS AND TOPPINGS 2019–2021

6.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 FILLINGS AND TOPPINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.5.1 INTENSITY OF COMPETITIVE RIVALRY

6.5.2 BARGAINING POWER OF SUPPLIERS

6.5.3 BARGAINING POWER OF BUYERS

6.5.4 THREAT OF NEW ENTRANTS

6.5.5 THREAT OF SUBSTITUTES

7 REGULATORY FRAMEWORK (Page No. - 59)

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 US

7.2.2 CANADA

7.3 EUROPE

7.3.1 EUROPEAN UNION

7.3.2 UK

7.3.3 ITALY

7.4 ASIA PACIFIC

7.4.1 INDIA

7.4.2 CHINA

7.4.3 AUSTRALIA AND NEW ZEALAND

8 FILLINGS AND TOPPINGS MARKET, BY TYPE (Page No. - 64)

8.1 INTRODUCTION

FIGURE 22 SYRUPS, PASTES, AND VARIEGATES TO DOMINATE GLOBAL MARKET IN 2022

TABLE 6 FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 7 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.2 SYRUPS, PASTES, AND VARIEGATES

8.2.1 INCREASING CONSUMER PREFERENCES FOR HEALTHIER OPTIONS

TABLE 8 SYRUPS, PASTES, AND VARIEGATES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 9 SYRUPS, PASTES, AND VARIEGATES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 CREAMS

8.3.1 GROWING CONSUMER PREFERENCES FOR HIGH-QUALITY PRODUCTS

TABLE 10 CREAMS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 11 CREAMS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 FONDANTS

8.4.1 MANUFACTURERS PREFER RAW MATERIALS WITH VERSATILE APPLICATIONS

TABLE 12 FONDANTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 13 FONDANTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.5 FRUITS AND NUTS

8.5.1 NEED FOR SMOOTH TEXTURE PROPELS DEMAND FOR FRUIT FILLINGS

TABLE 14 FRUITS AND NUTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 15 FRUITS AND NUTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.6 SPRINKLES

8.6.1 RISING DEMAND BY CONSUMERS FOR SWEET BAKED GOODS BOOSTS MARKET GROWTH

TABLE 16 SPRINKLES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 17 SPRINKLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 FILLINGS AND TOPPINGS MARKET, BY APPLICATION (Page No. - 72)

9.1 INTRODUCTION

FIGURE 23 CONFECTIONERY PRODUCTS SEGMENT TO DOMINATE GLOBAL MARKET IN 2022

TABLE 18 FILLINGS AND TOPPINGS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 19 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 CONFECTIONERY PRODUCTS

9.2.1 GROWING USE OF NATURAL INGREDIENTS IN CONFECTIONS BOOSTS DEMAND FOR CONFECTIONERY PRODUCTS

TABLE 20 CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 BAKERY PRODUCTS

9.3.1 INCREASING CONSUMER TASTE PREFERENCES FOR FRUIT FLAVORS

FIGURE 24 BAKERY PRODUCTS TURNOVER IN EUROPE (2015–2019)

TABLE 22 BAKERY PRODUCTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 BAKERY PRODUCTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 DAIRY PRODUCTS AND FROZEN DESSERTS

9.4.1 INCREASED DEMAND FOR FLAVORED DAIRY PRODUCTS

TABLE 24 DAIRY PRODUCTS AND FROZEN DESSERTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 DAIRY PRODUCTS AND FROZEN DESSERTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 CONVENIENCE FOOD

9.5.1 GROWING DEMAND FOR CONVENIENCE FOOD COMPELS MANUFACTURERS TO LAUNCH INNOVATIVE SOLUTIONS

TABLE 26 CONVENIENCE FOOD MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 27 CONVENIENCE FOOD MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 BEVERAGES

9.6.1 GROWING CONSUMER DEMAND FOR BEVERAGES WITH ENHANCED TEXTURE AND TASTE

TABLE 28 BEVERAGES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 BEVERAGES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 FILLINGS AND TOPPINGS MARKET, BY FLAVOR (Page No. - 81)

10.1 INTRODUCTION

FIGURE 25 FRUITS SEGMENT ACCOUNTS FOR LARGEST MARKET SHARE IN 2022

TABLE 30 FILLINGS AND TOPPINGS MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 31 MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

10.2 FRUITS

10.2.1 RISING CONSUMER DEMAND FOR BOTANICALS INCREASES NEED FOR FRUIT-FLAVORED FILLINGS AND TOPPINGS

TABLE 32 FRUITS FLAVOR MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 FRUITS FLAVOR MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 CHOCOLATES

10.3.1 GROWING DEMAND FOR PREMIUM CHOCOLATE PRODUCTS

TABLE 34 CHOCOLATES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 CHOCOLATES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 VANILLA

10.4.1 GROWING CONSUMER DEMAND FOR AUTHENTIC, NATURAL, AND DELICIOUS FLAVORS

TABLE 36 VANILLA MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 VANILLA MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 NUTS

10.5.1 RISING DEMAND FROM FLEXITARIANS FOR PLANT-BASED PROTEINS BOOSTS MARKET GROWTH

TABLE 38 NUTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 NUTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.6 CARAMEL

10.6.1 CONSUMERS LOOKOUT FOR NEW FLAVOR COMBINATIONS

TABLE 40 CARAMEL MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 41 CARAMEL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHER FLAVORS

10.7.1 RISING DEMAND FOR COFFEE AND HERBAL FLAVORS

TABLE 42 OTHER FLAVORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 OTHER FLAVORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 FILLINGS AND TOPPINGS MARKET, BY FORM (Page No. - 90)

11.1 INTRODUCTION

FIGURE 26 SOLID SEGMENT TO DOMINATE GLOBAL MARKET IN 2022

TABLE 44 FILLINGS AND TOPPINGS MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 45 MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

11.2 SOLID

11.2.1 RISING CONSUMER INCLINATION TOWARD BAKERY AND CONFECTIONERY PRODUCTS

TABLE 46 SOLID MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 47 SOLID MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.3 LIQUID

11.3.1 RISING HOME EVENTS OR GATHERINGS BOOST MARKET GROWTH

TABLE 48 LIQUID MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 LIQUID MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.4 GEL

11.4.1 GROWING CONSUMER COMFORT WITH BAKERY AND PASTRY PRODUCTS

TABLE 50 GEL MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 GEL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.5 FOAM

11.5.1 RISING CONSUMER PREFERENCES FOR FLAVORSOME DESSERTS

TABLE 52 FOAM MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 53 FOAM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12 FILLINGS AND TOPPINGS MARKET, BY RAW MATERIAL (Page No. - 97)

12.1 INTRODUCTION

FIGURE 27 SWEETENERS SEGMENT TO DOMINATE GLOBAL MARKET IN 2022

TABLE 54 FILLINGS AND TOPPINGS MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 55 MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

12.2 HYDROCOLLOIDS

12.2.1 INCREASING USE OF ADDITIVES TO IMPROVE TEXTURE

TABLE 56 HYDROCOLLOIDS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 57 HYDROCOLLOIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3 STARCHES

12.3.1 INCREASING USE OF STARCH IN FOOD AND BEVERAGE INGREDIENTS

TABLE 58 STARCHES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 59 STARCHES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.4 DAIRY INGREDIENTS

12.4.1 GROWING CONSUMER INCLINATION TOWARD NUTRIENT-RICH PRODUCTS

TABLE 60 DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.5 FRUITS

12.5.1 FRESH-FLAVORED, HEALTH-BENEFICIAL FRUITS BOOST DEMAND AS RAW MATERIALS

TABLE 62 FRUITS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 FRUITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.6 SWEETENERS

12.6.1 RISING DEMAND FOR ADDITIVES EXTENDS SHELF LIFE OF PRODUCTS

12.6.2 NATURAL SWEETENERS

12.6.3 ARTIFICIAL SWEETENERS

TABLE 64 SWEETENERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 65 SWEETENERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.7 COCOA

12.7.1 HEALTH-CONSCIOUS CONSUMERS INCLINE TOWARD CLEAN LABELING

TABLE 66 COCOA MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 67 COCOA MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.8 OTHER RAW MATERIALS

12.8.1 RAPIDLY GROWING CAFE OUTLETS INCREASED DEMAND FOR COFFEE

TABLE 68 OTHER RAW MATERIALS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 69 OTHER RAW MATERIALS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

13 FILLINGS AND TOPPINGS MARKET, BY FUNCTIONALITY (Page No. - 108)

13.1 INTRODUCTION

13.2 GLAZING

TABLE 70 GLAZING AGENTS USED IN FOOD AND BEVERAGES INDUSTRY

13.3 STABILIZING

TABLE 71 STABILIZING AGENTS USED IN FOOD AND BEVERAGES INDUSTRY

13.4 VISCOSITY

13.5 FLAVOR ENHANCING

13.6 TEXTURIZING

TABLE 72 TEXTURIZING AGENTS USED IN FOOD AND BEVERAGES INDUSTRY

14 FILLINGS AND TOPPINGS MARKET, BY REGION (Page No. - 112)

14.1 INTRODUCTION

FIGURE 28 REGIONAL SNAPSHOT: INDIA SHOWS FASTEST GROWTH RATE (2022–2027)

TABLE 73 FILLINGS AND TOPPINGS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 74 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

TABLE 75 NORTH AMERICA: FILLINGS AND TOPPINGS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

14.2.1 US

14.2.1.1 Rising demand for premium quality products from health-conscious consumers

TABLE 87 US: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 88 US: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.2.2 CANADA

14.2.2.1 Changing dietary patterns of consumers and growing demand for innovative products

TABLE 89 CANADA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.2.3 MEXICO

14.2.3.1 Increased sale of packaged food products boosts demand for fillings and toppings

TABLE 91 MEXICO: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 92 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

FIGURE 29 EUROPEAN FILLINGS AND TOPPINGS MARKET SNAPSHOT: GERMANY ACCOUNTED FOR LARGEST SHARE IN 2022

TABLE 93 EUROPE: FILLINGS AND TOPPINGS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

14.3.1 UK

14.3.1.1 Increasing demand for luxury goods boosts fillings and toppings market

TABLE 105 UK: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 106 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.2 GERMANY

14.3.2.1 Changing lifestyle of consumers increased demand for convenience food

TABLE 107 GERMANY: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.3 ITALY

14.3.3.1 Changing food habits and rising consumption of fast foods increased demand for fillings and toppings

TABLE 109 ITALY: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 110 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.4 FRANCE

14.3.4.1 High demand for confectionery and bakery products in French households boosts market growth

TABLE 111 FRANCE: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 112 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.5 REST OF EUROPE

14.3.5.1 Growing demand for fillings and toppings in food and beverages

TABLE 113 REST OF THE EUROPE: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 REST OF THE EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC FILLINGS AND TOPPINGS MARKET SNAPSHOT: CHINA ACCOUNTING FOR LARGEST SHARE IN 2022

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

14.4.1 CHINA

14.4.1.1 Growing demand for bread and other products affects fillings and toppings market

TABLE 127 CHINA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 128 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.2 JAPAN

14.4.2.1 Immense growth in processed food industry increased demand for fillings and toppings

TABLE 129 JAPAN: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 130 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.3 INDIA

14.4.3.1 Rising demand for bakery products boosts fillings and toppings market

TABLE 131 INDIA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 132 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.4 AUSTRALIA AND NEW ZEALAND

14.4.4.1 Growing demand for healthier and plant-based products

TABLE 133 AUSTRALIA AND NEW ZEALAND: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 134 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.5 REST OF ASIA PACIFIC

14.4.5.1 Rising demand for aesthetically appealing products drives market growth

TABLE 135 REST OF ASIA PACIFIC: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5 SOUTH AMERICA

TABLE 137 SOUTH AMERICA: FILLINGS AND TOPPINGS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 138 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 140 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 142 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 SOUTH AMERICA: MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

TABLE 147 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 148 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Rising consumption of artisanal bakery products to surge demand for high-quality baking ingredients

TABLE 149 BRAZIL: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 150 BRAZIL: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5.2 ARGENTINA

14.5.2.1 Gradual increase in purchasing power of Argentinians to boost consumption of convenience food

TABLE 151 ARGENTINA: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 152 ARGENTINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5.3 REST OF SOUTH AMERICA

14.5.3.1 Growing demand for natural ingredients in products

TABLE 153 REST OF SOUTH AMERICA: MARKET FOR FILLINGS AND TOPPINGS SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 154 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.6 REST OF THE WORLD

TABLE 155 REST OF THE WORLD: FILLINGS AND TOPPINGS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 156 REST OF THE WORLD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 157 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 158 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 159 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 160 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 REST OF THE WORLD: MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 162 REST OF THE WORLD: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 163 REST OF THE WORLD: MARKET SIZE, BY FLAVOR, 2019–2021 (USD MILLION)

TABLE 164 REST OF THE WORLD: MARKET SIZE, BY FLAVOR, 2022–2027 (USD MILLION)

TABLE 165 REST OF THE WORLD: MARKET SIZE, BY RAW MATERIAL, 2019–2021 (USD MILLION)

TABLE 166 REST OF THE WORLD: MARKET SIZE, BY RAW MATERIAL, 2022–2027 (USD MILLION)

14.6.1 AFRICA

14.6.1.1 Expanding confectionery industry propels demand for fillings and toppings

TABLE 167 AFRICA: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 168 AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.6.2 MIDDLE EAST

14.6.2.1 Growing market for convenience food and confectionery products

TABLE 169 MIDDLE EAST: FILLINGS AND TOPPINGS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 162)

15.1 OVERVIEW

15.2 MARKET SHARE ANALYSIS, 2021

TABLE 171 FILLINGS AND TOPPINGS MARKET SHARE ANALYSIS, 2021

15.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 31 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

15.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

15.4.1 STARS

15.4.2 PERVASIVE PLAYERS

15.4.3 EMERGING LEADERS

15.4.4 PARTICIPANTS

FIGURE 32 MARKET FOR FILLINGS AND TOPPINGS: COMPANY EVALUATION QUADRANT FOR PLAYERS (2021)

15.5 COMPETITIVE SCENARIO

15.5.1 DEALS

TABLE 172 MARKET FOR FILLINGS AND TOPPINGS: DEALS, 2019–2022

15.5.2 OTHER DEVELOPMENTS

TABLE 173 MARKET: OTHER DEVELOPMENTS, 2019–2022

16 COMPANY PROFILES (Page No. - 169)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

16.1 ADM

TABLE 174 ADM: BUSINESS OVERVIEW

FIGURE 33 ADM: COMPANY SNAPSHOT

TABLE 175 ADM: DEALS

16.2 BARRY CALLEBAUT

TABLE 176 BARRY CALLEBAUT: BUSINESS OVERVIEW

FIGURE 34 BARRY CALLEBAUT: COMPANY SNAPSHOT

TABLE 177 BARRY CALLEBAUT: DEALS

TABLE 178 BARRY CALLEBAUT: OTHERS

16.3 TATE & LYLE PLC

TABLE 179 TATE & LYLE PLC: BUSINESS OVERVIEW

FIGURE 35 TATE & LYLE PLC: COMPANY SNAPSHOT

TABLE 180 TATE & LYLE PLC: DEALS

TABLE 181 TATE & LYLE PLC: OTHERS

16.4 AGRANA BETEILIGUNGS-AG

TABLE 182 AGRANA BETEILIGUNGS-AG: BUSINESS OVERVIEW

FIGURE 36 AGRANA BETEILIGUNGS-AG: COMPANY SNAPSHOT

16.5 ASSOCIATED BRITISH FOODS PLC

TABLE 183 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 37 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

16.6 CARGILL

TABLE 184 CARGILL: BUSINESS OVERVIEW

FIGURE 38 CARGILL: COMPANY SNAPSHOT

TABLE 185 CARGILL: OTHERS

16.7 AAK AB

TABLE 186 AAK AB: BUSINESS OVERVIEW

FIGURE 39 AAK AB: COMPANY SNAPSHOT

16.8 ASHLAND

TABLE 187 ASHLAND: BUSINESS OVERVIEW

FIGURE 40 ASHLAND: COMPANY SNAPSHOT

16.9 HIGHLANDER PARTNERS LP.

TABLE 188 HIGHLANDER PARTNERS LP: BUSINESS OVERVIEW

TABLE 189 HIGHLANDER PARTNERS LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 190 HIGHLANDER PARTNERS LP: DEALS

16.10 ZENTIS GMBH & CO. KG

TABLE 191 ZENTIS GMBH & CO. KG: BUSINESS OVERVIEW

16.10.2 PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 ZENTIS GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.11 HANAN PRODUCTS CO., INC

TABLE 193 HANAN PRODUCTS CO., INC: BUSINESS OVERVIEW

TABLE 194 HANAN PRODUCTS CO., INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.12 BAKE’N JOY FOODS, INC

TABLE 195 BAKE’N JOY FOODS, INC: BUSINESS OVERVIEW

TABLE 196 BAKE’N JOY FOODS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 197 BAKE’N JOY FOODS, INC: DEALS

16.13 PREGEL SPA

TABLE 198 PREGEL SPA: BUSINESS OVERVIEW

TABLE 199 PREGEL SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

17 ADJACENT AND RELATED MARKETS (Page No. - 203)

17.1 INTRODUCTION

TABLE 200 MARKETS ADJACENT TO FILLINGS AND TOPPINGS MARKET

17.2 LIMITATIONS

17.3 CARAMEL INGREDIENTS MARKET

17.3.1 MARKET DEFINITION

17.3.2 MARKET OVERVIEW

TABLE 201 CARAMEL INGREDIENTS MARKET, BY TYPE, 2014–2021 (KT)

17.4 CONFECTIONERY INGREDIENTS MARKET

17.4.1 MARKET DEFINITION

17.4.2 MARKET OVERVIEW

TABLE 202 CONFECTIONERY INGREDIENTS MARKET, BY APPLICATION, 2014–2021 (USD MILLION)

18 APPENDIX (Page No. - 206)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

The study involved four major activities in estimating the fillings and toppings market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as food additive associations and organizations such as the FDA, EFSA, USDA, and FSANZ and associations and industry bodies [World Health Organization (WHO), Institute of Food and Agricultural Sciences (IFAS)] were referred to identify and collect information for this study. These secondary sources included annual reports, web releases and investor presentations of companies, news articles, journals, and paid databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of bakery products manufacturers, confectionery product manufacturers, bakers, and bakery associations and organizations. The supply side is characterized by the presence of fillings and toppings manufacturers and service providers, marketing directors, research officers and quality control officers, product innovation directors and key executives from various key companies and organizations operating in fillings and toppings market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the fillings and toppings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the fillings and toppings market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the fillings and toppings market, with respect to its type, application, form, flavor, raw material, and regional markets, from 2022 to 2027

- To describe and forecast the global market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of fillings and toppings market

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions and investments, product launches and approvals, mergers and acquisitions, and agreements in the fillings and toppings market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific fillings and toppings market, by key country

- Further breakdown of the Rest of the European fillings and toppings market, by key country

- Further breakdown of the Rest of South America fillings and toppings market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fillings and Toppings Market