Chocolate Flavors Market by Application (Confectionery, Dairy & Hot Drinks, Bakery Products, Frozen Products, Convenience Products, Others) & Region (North America, Europe, Asia-Pacific, Latin America, Rest of the World) - Global Trends & Forecast to 2019

Chocolate flavors are known for their high cocoa content. They are typically sweet, usually brown, and used as flavoring ingredients in various food & beverage preparations. It also offers the advantage of a nutritional profile with health benefits such potential to lower blood pressure & cholesterol and reduce the risk of strokes. They are used extensively in baked food, dairy products, snacks, confectionery, and drinks.

The market is segmented according to its usage in various applications and in different regions. The applications include bakery, dairy, beverages, confectionery, and functional food. The market is driven by increasing sustainable cocoa farming practices, cocoa production and supply chain, growing economies, high seasonal & festive demands, technological advancements, and growing health and nutrition awareness.

This report provides a detailed analysis of the chocolate flavors market, which includes market dynamics such as drivers, restraints, opportunities, and challenges faced by key players. The market size includes a geographic segmentation of the chocolate flavors market, which includes North America, Europe, Asia-Pacific, Latin America and Rest of the World (RoW). The market is further segmented on the basis of the key countries in these regions.

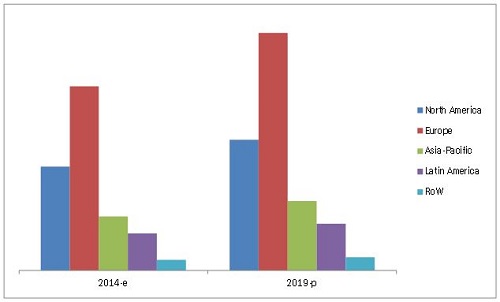

Chocolate Flavors Market Size, by Region, 2014 ($Thousand)

Source: Company Website, Company Annual Reports, FAO, ICCO, COMTRADE, and MarketsandMarkets Analysis

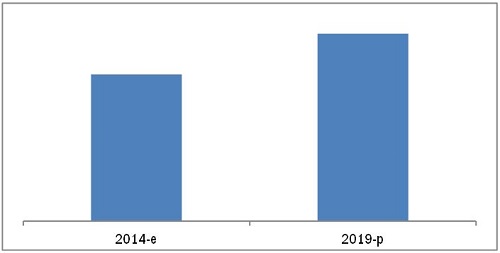

The chocolate flavors market is projected to grow at a CAGR of 5.0% to reach a value of more than $350 million by 2019. Key players in this market prefer strategic acquisitions and expansions to expand their global network and their chocolate flavors business segment in new geographies.

This report provides qualitative analyses of the leading players in the market. It also enumerates the development strategies preferred by leading market players. The market dynamics in terms of market drivers, restraints, opportunities, and challenges are discussed in detail in the report.

Key players such as Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), Barry Callebaut AG (Switzerland), Olam International Limited (Singapore), and International Flavors & Fragrances, Inc. (U.S.) have been profiled in the report.

Scope of the Report

This report focuses on the chocolate flavors market, which is segmented on the basis of application and region.

On the basis of application, the market has been segmented as follows:

- Bakery products

- Dairy & hot drinks

- Confectionery

- Frozen products

- Convenience foods

- Others

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

This report on chocolate flavors has been classified on the basis applications and regions. The consumption of chocolate flavors increased with the increase in seasonal & festive demand, demand for functional foods due to health benefits of cocoa & chocolate products, improved cocoa supply chain, and technological advancements. Europe is the largest and the fastest growing market for chocolate flavors. The market is also projected to grow in emerging economies such as Southeast Asia, Latin America, and Africa, with key manufacturers investing in the development of cocoa and chocolate products. The increasing disposable income and rising middle-class population is a key driver for the market.

Chocolate Flavors Market Size, 2014 vs. 2019 ($Thousand)

E Estimated; P - Projected

Source: Company Website & Publications, FAO, Investor Presentations, COMTRADE, and MarketsandMarkets Analysis

The market for chocolate flavors is projected to be valued at more than $350 million by 2019, growing at a CAGR of 5.0% from 2014 to 2019. The market in Europe is projected to grow at the highest CAGR during the review period.

The chocolate flavors market is fragmented, with key companies driving the growth by opting for strategic acquisitions, investments, and innovative product offerings. This report provides qualitative analysis of the prominent market players and their preferred development strategies. Key players such as Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), and Barry Callebaut AG (Switzerland) have been profiled in the report.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Chocolate Flavors Market, By Application

1.3.2 Chocolate Flavors Market, By Region

1.3.3 Periodization Considered for the Chocolate Flavors Market

1.4 Base Currency Considered for the Chocolate Flavors Market

1.5 Packaging Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Developing Economies

2.2.2.2 Growing Middle-Class Population, 20092030

2.2.3 Supply-Side Analysis

2.2.3.1 Cocoa Production

2.2.3.2 Investment Projects

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions of the Research Study

2.6.2 Limitations of the Research Study

3 Executive Summary

3.1 Overview

3.1.1 Evolution

3.2 Chocolate Flavors

3.3 Europe is the Fastest-Growing Market for Chocolate Flavor Applications

3.4 Food Application of Chocolate Flavors

3.5 Key Players in the Chocolate Flavors Market

4 Premium Insights

4.1 Opportunities in Chocolate Flavors Market

4.2 U.S. to Be the Largest Chocolate Flavors Market in 2014

4.3 Life Cycle Analysis: Chocolate Flavors Market, By Region

4.4 Chocolate Flavors Market, By Region, 2014 vs. 2019

4.5 Europe Was the Largest Chocolate Flavors Market, 2013

4.6 Developed vs. Emerging Chocolate Flavors Market, 2014 vs. 2019

4.7 Chocolate Flavors Market, By Application, 2013

4.8 Asia-Pacific: Chocolate Flavors Market, 2013

4.9 Competitive Landscape in Chocolate Flavors Market, 20112013

5 Industry Analysis

5.1 Introduction

5.2 Supply Chain Analysis

5.2.1 Growers

5.2.2 Intermediaries

5.2.3 Cocoa Processors

5.2.4 End-Product Manufacturers

5.2.5 Retailers

5.2.6 Organizations & Regulatory Bodies

5.3 Value Chain Analysis

5.4 Industry Insights

5.4.1 International Cocoa Organization

5.4.1.1 Sps Africa

5.4.1.2 Integrated Management of Cocoa Pests and Pathogens

5.4.1.3 Capacity Building on Price Risk Management Strategy for Cocoa Smallholder Farmers in Africa

5.4.2 Porters Five Forces Analysis

5.4.2.1 Intensity of Competitive Rivalry

5.4.2.2 Bargaining Power of Suppliers

5.4.2.3 Bargaining Power of Buyers

5.4.2.4 Threat of Substitutes

5.4.2.5 Threat of New Entrants

5.5 Pest Analysis

5.5.1 Political Factors

5.5.1.1 Civil Wars & Election Protests in the Ivory Coast

5.5.2 Economic Factors

5.5.2.1 Unpredictable Economic Condition of Ivory Coast

5.5.2.2 Lack of Infrastructure in Developing Countries

5.5.3 Social Factors

5.5.3.1 Child & Forced Labor

5.5.3.2 Challenges Faced By Farmers in Cocoa-Producing Countries

5.5.4 Technological Factors

6 Market Overview

6.1 Introduction

6.1.1 Global Cocoa Production

6.1.2 Varieties of Cocoa

6.1.2.1 Criollo

6.1.2.2 Forastero

6.1.2.3 Trinitario

6.1.3 Global Cocoa Prices

6.1.4 Cocoa Processing

6.2 Market Segmentation

6.2.1 Chocolate Flavors Market, By Application

6.2.2 Chocolate Flavors Market, By Region

6.3 Market Dynamics

6.3.1 Drivers

6.3.1.1 Health Benefits of Chocolate

6.3.1.2 Large Number of Applications

6.3.2 Restraints

6.3.2.1 Highly Unstable Economies in Cocoa-Producing Countries

6.3.2.2 Excess Dependence on West African Countries for Cocoa Supply

6.3.3 Opportunities

6.3.3.1 Organic & Fairtrade Chocolates

6.3.3.2 Penetration in Emerging Countries

6.3.3.3 Application in Functional Food & Pharmaceutical Products

6.3.4 Challenge

6.3.4.1 Changing Consumer Preferences

7 Key Brands

7.1 Introduction

7.1.1 Archer Daniels Midland Company

7.1.1.1 Ambrosia

7.1.1.2 Merckens

7.1.1.3 Dezaan

7.1.2 Cargill, Incorporated

7.1.2.1 Wilbur Chocolate

7.1.2.2 Peters Chocolate

7.1.2.3 Gerkens Cocoa

7.1.3 Olam International Limited

7.1.3.1 MACAO

7.1.4 Barry Callebaut AG

7.1.4.1 Bensdorp (Barry Callebaut)

8 Chocolate Flavors Market, By Application

8.1 Introduction

8.2 Confectionery

8.3 Dairy & Hot Drinks

8.4 Bakery Products

8.5 Frozen Products

8.6 Convenience Products

8.7 Other Food Products

9 Chocolate Flavors Market, By Region

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Spain

9.3.5 Italy

9.3.6 Belgium

9.3.7 the Netherlands

9.3.8 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 South Korea

9.4.5 Southeast Asia

9.4.6 Rest of Asia-Pacific

9.5 Latin America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of Latin America

9.6 Rest of the World (ROW)

9.6.1 South Africa

9.6.2 The Middle East

9.6.3 Rest of Africa

10 Competitive Landscape

10.1 Overview

10.2 Chocolate Flavors Market Share Analysis (2013)

10.3 Competitive Situation & Trends

10.4 Chocolate Flavor Market Developments (20102015*)

10.5 Expansions & Investments

10.6 Agreements, Partnerships, Joint Ventures & Collaborations

10.7 Acquisitions

10.8 New Product Launches

11 Company Profiles

11.1 Introduction

11.2 Archer Daniels Midland Company

11.2.1 Business Overview

11.2.2 Products

11.2.3 Key Strategies

11.2.4 Recent Developments

11.2.5 SWOT Analysis

11.2.6 MNM View

11.3 Barry Callebaut

11.3.1 Business Overview

11.3.2 Products

11.3.3 Key Strategies

11.3.4 Recent Developments

11.3.5 SWOT Analysis

11.3.6 MNM View

11.4 Blommer Chocolate Company

11.4.1 Business Overview

11.4.2 Products

11.4.3 Key Strategies

11.4.4 Recent Developments

11.4.5 MNM View

11.5 Cargill, Incorporated

11.5.1 Business Overview

11.5.2 Products

11.5.3 Key Strategies

11.5.4 Recent Developments

11.5.5 SWOT Analysis

11.5.6 MNM View

11.6 CEMOI Group

11.6.1 Business Overview

11.6.2 Products

11.6.3 Key Strategies

11.6.4 Recent Developments

11.6.5 MNM View

11.7 Frutarom Industries Ltd.

11.7.1 Business Overview

11.7.2 Products

11.7.3 Key Strategy

11.7.4 Recent Developments

11.7.5 MNM View

11.8 Givaudan S.A.

11.8.1 Business Overview

11.8.2 Products

11.8.3 Key Strategies

11.8.4 Recent Developments

11.8.5 SWOT Analysis

11.9 International Flavors & Fragrances Inc.

11.9.1 Business Overview

11.9.2 Products

11.9.3 Key Strategies

11.9.4 Developments

11.9.5 SWOT Analysis

11.9.6 MNM View

11.10 Olam International Ltd.

11.10.1 Business Overview

11.10.2 Products

11.10.3 Key Strategies

11.10.4 Recent Developments

11.10.5 SWOT Analysis

11.10.6 MNM View

11.11 Puratos Group

11.11.1 Business Overview

11.11.2 Products

11.11.3 Key Strategies

11.11.4 Recent Developments

11.11.5 SWOT Analysis

11.11.6 MNM View

12 Appendix

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Available Customizations

12.4 Related Reports

List of Tables (84 Tables)

Table 1 U.S. Tolerance Limit for Pesticide Residue in Cocoa Beans (Cacao Beans)

Table 2 Health Benefits of Chocolate Drive the Market Growth

Table 3 Nutrient Content of Different Chocolate Forms/100g

Table 4 Growth of Application Market

Table 5 Unstable Economic Conditions Affect the Market Growth

Table 6 Organic & Fairtrade Chocolate Offer Growth Opportunities in the Market

Table 7 Type of Cocoa and Its Food Application

Table 8 Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 9 Chocolate Flavors Market Size, By Application, 20122019 ($Thousand)

Table 10 Chocolate Flavors Market Size in Confectionery, By Region, 20122019 (MT)

Table 11 Chocolate Flavors Market Size in Confectionery, By Region, 20122019 ($Thousand)

Table 12 Chocolate Flavors Market Size in Dairy & Hot Drinks, By Region, 20122019 (MT)

Table 13 Chocolate Flavors Market Size in Dairy & Hot Drinks, By Region, 20122019 ($Thousand)

Table 14 Chocolate Flavors Market Size in Bakery Products, By Region, 20122019 (MT)

Table 15 Chocolate Flavors Market Size in Bakery Products, By Region, 20122019 ($Thousand)

Table 16 Chocolate Flavors Market Size in Frozen Products, By Region, 20122019 (MT)

Table 17 Chocolate Flavors Market Size in Frozen Products, By Region, 20122019 ($Thousand)

Table 18 Chocolate Flavors Market Size in Convenience Foods, By Region, 20122019 (MT)

Table 19 Chocolate Flavors Market Size in Convenience Foods, By Region, 20122019 ($Thousand)

Table 20 Chocolate Flavors Market Size in Other Food Products, By Region, 20122019 (MT)

Table 21 Chocolate Flavors Market Size in Other Food Products, By Region, 20122019 ($Thousand)

Table 22 Factors That Can Influence Cocoa Prices in Next Five Years

Table 23 Chocolate Flavors Market Size, By Region, 20122019 (MT)

Table 24 Chocolate Flavors Market Size, By Region, 20122019 ($Thousand)

Table 25 North America: Chocolate Flavors Market Size, By Country, 20122019 (MT)

Table 26 North America: Market Size, By Country, 20122019 ($Thousand)

Table 27 U.S.: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 28 U.S.: Market Size, By Application, 20122019 ($Thousand)

Table 29 Canada: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 30 Canada: Market Size, By Application, 20122019 ($Thousand)

Table 31 Mexico: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 32 Mexico: Market Size, By Application, 20122019 ($Thousand)

Table 33 Europe: Chocolate Flavors Market Size, By Country, 20122019 (MT)

Table 34 Europe: Market Size, By Country, 20122019 ($Thousand)

Table 35 Germany: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 36 Germany: Market Size, By Application, 20122019 ($Thousand)

Table 37 France: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 38 France: Market Size, By Application, 20122019 ($Thousand)

Table 39 U.K.: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 40 U.K.: Market Size, By Application, 20122019 ($Thousand)

Table 41 Spain: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 42 Spain: Market Size, By Application, 20122019 ($Thousand)

Table 43 Italy: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 44 Italy: Market Size, By Application, 20122019 ($Thousand)

Table 45 Belgium: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 46 Belgium: Market Size, By Application, 20122019 ($Thousand)

Table 47 The Netherlands: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 48 The Netherlands: Market Size, By Application, 20122019 ($Thousand)

Table 49 Rest of Europe: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 50 Rest of Europe: Market Size, By Application, 20122019 ($Thousand)

Table 51 Asia-Pacific: Chocolate Flavors Market Size, By Country, 20122019 (MT)

Table 52 Asia-Pacific: Market Size, By Country, 20122019 ($Thousand)

Table 53 China: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 54 China: Market Size, By Application, 20122019 ($Thousand)

Table 55 Japan: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 56 Japan: Market Size, By Application, 20122019 ($Thousand)

Table 57 India: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 58 India: Market Size, By Application, 20122019 ($Thousand)

Table 59 South Korea: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 60 South Korea: Market Size, By Application, 20122019 ($Thousand)

Table 61 Southeast Asia: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 62 Southeast Asia: Market Size, By Application, 20122019 ($Thousand)

Table 63 Rest of Asia-Pacific: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 64 Rest of Asia-Pacific: Market Size, By Application, 20122019 ($Thousand)

Table 65 Latin America: Chocolate Flavors Market Size, By Country, 20122019 (MT)

Table 66 Latin America: Market Size, By Country, 20122019 ($Thousand)

Table 67 Brazil: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 68 Brazil: Market Size, By Application, 20122019 ($Thousand)

Table 69 Argentina: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 70 Argentina: Market Size, By Application, 20122019 ($Thousand)

Table 71 Rest of Latin America: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 72 Rest of Latin America: Market Size, By Application, 20122019 ($Thousand)

Table 73 ROW: Chocolate Flavors Market Size, By Country, 20122019 (MT)

Table 74 ROW: Market Size, By Country, 20122019 ($Thousand)

Table 75 South Africa: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 76 South Africa: Market Size, By Application, 20122019 ($Thousand)

Table 77 The Middle East: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 78 The Middle East: Market Size, By Application, 20122019 ($Thousand)

Table 79 Rest of Africa: Chocolate Flavors Market Size, By Application, 20122019 (MT)

Table 80 Rest of Africa: Market Size, By Application, 20122019 ($Thousand)

Table 81 Expansions & Investments, 20112014

Table 82 Agreements, Partnerships, Joint Ventures & Collaborations, 2010-2014

Table 83 Acquisitions, 20132015

Table 84 New Product Launches, 2011-2014

List of Figures (67 Figures)

Figure 1 Chocolate Flavors Market: Research Design

Figure 2 Factors Influencing the Cocoa & Chocolate Industry

Figure 3 Top 5 Economies Based on GDP (PPP) Are U.S., China, India, Japan, & Germany

Figure 4 Middle-Class Population in Asia-Pacific is Projected to Grow & Account for the Largest Share in the Global Market By 2030

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Assumption of the Research Study

Figure 9 Limitations of the Research Study

Figure 10 Evolution of the Cocoa & Chocolate Industry

Figure 11 Chocolate Flavors Market Share (Value), Geographical Overview, 2014

Figure 12 Market in Europe to Grow at the Highest Rate

Figure 13 Chocolate Flavors Market Snapshot (2014 vs. 2019): Application in Dairy & Hot Drinks to Drive Market Growth

Figure 14 Share of Leading Companies in Chocolate Flavors Market, 2013

Figure 15 Demand for New Flavors & Innovative Products Present Attractive Growth Opportunities for Chocolate Flavors Market

Figure 16 U.S. Estimated to Be the Largest Market, 2014

Figure 17 Chocolate Flavors Market is in the Growth Phase, 2014

Figure 18 European Market is Projected to Record High Growth Between 2014 & 2019

Figure 19 Dairy & Hot Drinks Was the Largest Application Segment of Chocolate Flavors Market in Europe, 2013

Figure 20 The Market in China is Projected to Grow at the Highest CAGR

Figure 21 Dairy & Hot Drinks Was the Largest Application Segment in the Market, 2013

Figure 22 Japan Accounted for the Largest Share in the Asia-Pacific Chocolate Flavors Market, 2013

Figure 23 Key Companies Accounted for More Than 50% Share in the Chocolate Flavors Market

Figure 24 Cocoa & Chocolate Market: Manufacturer & Distribution Channels

Figure 25 Value Chain Analysis of Cocoa & Chocolate Market

Figure 26 Porters Five Forces Analysis

Figure 27 Global Cocoa Production, By Region, 2014

Figure 28 Cocoa Prices 2009-2014 (000 USD/MT)

Figure 29 Cocoa Processing

Figure 30 Chocolate Flavors Market, By Application

Figure 31 Chocolate Flavors Market, By Region

Figure 32 ORAC Value of High-Flavanol Containing Foods

Figure 33 Europe Drives the Market Growth for Confectionery Segment

Figure 34 Innovative Products Launched By Coffeehouses Drives the Market Growth

Figure 35 Market for Bakery Products is Driven By E-Retailing & Changing Consumer Eating Preferences

Figure 36 Growth Opportunities in Frozen Products Segment is Driven By Increase in Number of Working Women

Figure 37 Fluctuating Cocoa Prices, 19602014

Figure 38 Emerging Countries to Show High Market Growth Potential in the Coming Five Years

Figure 39 Presence of Key Cocoa & Chocolate Players Drives the Market in North America

Figure 40 European Market Drives the Chocolate Flavors Application in Food

Figure 41 Economic Development is Expected to Drive the Asia-Pacific Market Growth

Figure 42 Brazil: A Key Market in Latin America

Figure 43 Globalization Has Significant Impact on Development of the Market

Figure 44 Key Companies Preferred Expansion & Investment Which Will Have A Significant Impact on the Market Development

Figure 45 Barry Callebaut Grew at the Highest CAGR Between 2011 & 2013

Figure 46 ADM & Cargill Dominated the Chocolate Flavors Market in 2013

Figure 47 Maximum Developments Were Recorded in 2014

Figure 48 Barry Callebaut Was the Most Active Company in the Chocolate Flavors Market Between 2010 & 2014

Figure 49 Barry Callebaut Adopted All Strategies to Expand Its Global Reach & Maintain Its Market Position Between 2010 & 2015

Figure 50 Geographic Revenue Mix of Top 4 Chocolate Flavors Manufacturers

Figure 51 Company Snapshot: Archer Daniels Midland Company

Figure 52 SWOT Analysis: Archer Daniels Midland Company

Figure 53 Company Snapshot: Barry Callebaut

Figure 54 SWOT Analysis: Barry Callebaut

Figure 55 Company Snapshot: Blommer Chocolate Company

Figure 56 Company Snapshot: Cargill, Incorporated

Figure 57 SWOT Analysis: Cargill, Incorporated

Figure 58 Company Snapshot: CEMOI Group

Figure 59 Company Snapshot: Frutarom Industries Ltd.

Figure 60 Company Snapshot: Givuadan S.A.

Figure 61 SWOT Analysis: Givaudan S.A.

Figure 62 Company Snapshot: International Flavors & Fragrances Inc.

Figure 63 SWOT Analysis: International Flavors & Fragrances Inc.

Figure 64 Company Snapshot: Olam International Ltd.

Figure 65 SWOT Analysis: Olam International Ltd.

Figure 66 Company Snapshot: Puratos Group

Figure 67 SWOT Analysis: Puratos Group

Growth opportunities and latent adjacency in Chocolate Flavors Market