Confectionery Ingredients Market by Type (Cocoa & Chocolate, Dairy Ingredients, Hydrocolloids, Emulsifiers, Malts, Oils & Shortenings, Starches & Derivatives, Flavors), Application (Chocolate, Sugar Confectionery, Gums), Form - Global Forecast to 2021

The confectionery ingredients market is projected to reach USD 76.81 Billion by 2021, at a CAGR of 6.2% from 2016 to 2021. The objectives of the study are to define, segment, and measure the confectionery ingredients market with respect to its type, application, source, form, and key regional market. It also includes factors influencing the growth of the market, strategic analysis of the micro markets, analysis of the opportunities for stakeholders, details of the competitive landscape, and strategic profiling of the key players with respect to their market share and core competencies.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

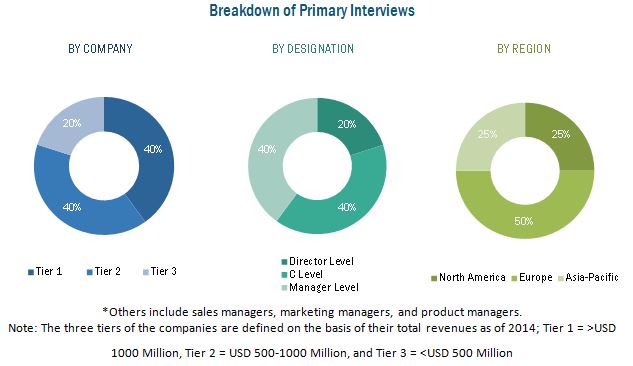

This report includes estimations of market sizes for value (USD billion). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the confectionery ingredients market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research (FAO, Bloomberg, Factiva, companies’ annual reports), and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The various contributors involved in the value chain of Confectionery ingredients include Confectionery ingredients manufacturers such as Barry Callebaut (Switzerland), Olam International (Singapore), Cargill, Incorporated (U.S.), Archer Daniels Midland Company (U.S.), Ingredion Incorporated (U.S.), and E. I. du Pont de Nemours and Company (U.S.); government bodies & regulatory associations such as United States Department of Agriculture (USDA), FDA (Food and Drug Administration), FSSA (Food Safety and Standards Authority), EFSA (European Food Safety Authority); distributors such as Koninklijke DSM N.V. (Netherlands), Kerry Group plc (Ireland), and Tate & Lyle PLC (U.K.); and end uses such as chocolates, sugar confectionaries, gums, and other industries which include fillings , coatings , caramel, aerated confectionery , spreads, cereal bars.

Target Audience

- Confectionery ingredients manufacturers

- Confectionery ingredients suppliers

- Research institutions

- Government bodies

- Distributors

- End users (industries) (chocolate manufacturers, sugar confectioners, gum manufacturing)

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

On the basis of Type, the confectionery ingredients market has been segmented as follows:

- Cocoa & chocolate

- Dairy ingredients

- Hydrocolloids

- Emulsifiers

- Malts

- Oils & shortenings

- Starches & derivatives

- Sweeteners

- Flavors

- Others (food color additives & flavors, functional systems, fruits & vegetables)

On the basis of Application, the confectionery ingredients market has been segmented as follows:

- Chocolate

- Sugar confectionery

- Gum

- Others (fillings, coatings, caramel, aerated confectionery, spreads, and cereal bars)

On the basis of Source, the confectionery ingredients market has been segmented as follows:

- Synthetic

- Natural

On the basis of Form, the confectionery ingredients market has been segmented as follows:

- Dry

- Liquid

On the basis of Region, the confectionery ingredients market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of other applications of confectionery ingredients

Regional Analysis

- Further breakdown of the Rest of the World confectionery ingredients market into Middle Eastern countries

- Further breakdown of the Rest of Asia-Pacific confectionery ingredients market into other Asian countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The market for confectionery ingredients is projected to reach USD 76.81 Billion by 2021, at a CAGR of 6.2% from 2016 to 2021. The confectionery ingredients market is driven by growing industrialization, large-scale adoption of confectionery ingredients for various applications in diverse industries including chocolate, sugar confectionery, gums, and other industries such as fillings, coatings, caramel, aerated confectionery, spreads, and cereal bars. Also, owing to the factors such as changing consumer lifestyles, R&D and innovations to strengthen the confectionery ingredients market, increasing demand for natural ingredients due to increasing consumer awareness, and health benefits of chocolates result in the growth of the confectionery ingredients market.

The confectionery ingredients market has been segmented on the basis of type into cocoa & chocolate, dairy ingredients, hydrocolloids, emulsifiers, malts, oils & shortenings, starches & derivatives, sweeteners, flavors, and others, which include food color additives & flavors, functional systems and fruits & vegetables. The cocoa & chocolate segment dominated the confectionery ingredients market, owing to the increasing producers’ demand as it is commercially viable, abundant demand for chocolate, diverse application dimensions not only in confectionery but also in baking industry and development of food technology and food processing.

Based on application, the confectionery ingredients market has been segmented into chocolate, sugar confectionery, gums, and other applications such as fillings, coatings, caramel, aerated confectionery, spreads, and cereal bars. The chocolate segment dominated the confectionery ingredients market as there is an abundant demand for chocolates, owing to the health benefits attached to it, changing lifestyles coupled with evolving eating habits, consumers’ preference for convenience food and high purchasing power of consumers.

Based on source, the confectionery ingredients market has been segmented into natural and synthetic. The synthetic segment dominated the confectionery ingredients market due to confectionery ingredients manufacturers’ reliance on this source, owing to its functional benefits and the cost efficiencies involved.

The market has also been segmented on the basis of form into dry and liquid. The dry form dominated the confectionery ingredients market due to its functional benefits and operational efficiencies attached to it. It is also projected to grow at the highest CAGR from 2016 to 2021.

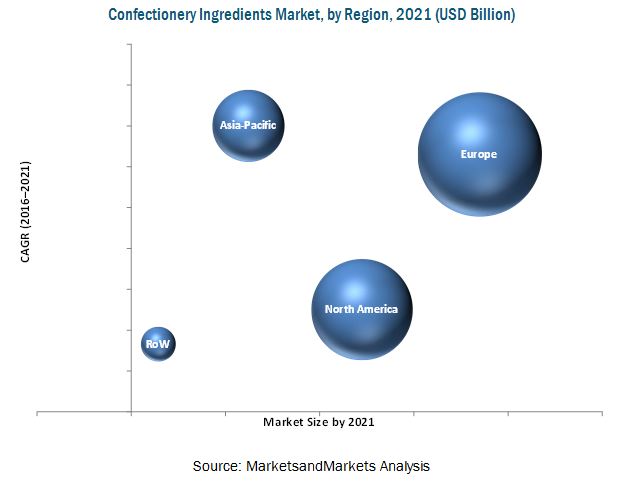

On the basis of region, the confectionery ingredients market has been segmented into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW). Europe dominated the global confectionery ingredients market due to the developed industries in this region. Asia-Pacific is projected to be the fastest-growing region due to the continuous increase in demand for confectionery ingredients, owing to the suitable climate and operational benefits from confectionery ingredients, along with increase in disposable income, grow in purchasing power and industrialization especially in countries such as China and India. Ease of doing business, and broad application spectrum are also some of the prominent factors that are driving the demand for confectionery ingredients in the Asia-Pacific economies.

Adherence to the international quality standards and regulations for confectionery ingredient products, volatile cocoa prices, and ambiguity over the consumption of trans-fatty acids & health issues related to it are the factors which restrain the market.

The confectionery ingredients market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted expansions and investments as their preferred growth strategies. Key players in this market include Cargill, Incorporated (U.S.), Archer Daniels Midland Company (U.S.), Olam International (Singapore), Barry Callebaut (Switzerland), E. I. du Pont de Nemours and Company (U.S.), Koninklijke DSM N.V. (Netherlands), and Kerry Group plc (Ireland). Other players such as Arla Foods (Denmark), Tate & Lyle PLC (U.K.), Ingredion Incorporated (U.S.), and AarhusKarlshamn (Sweden) also have a strong presence in the global confectionery ingredients market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Developing Economies and Per Capita Consumption of Confectionery

2.3.2.2 Growing Middle-Class Population

2.3.3 Supply-Side Analysis

2.3.3.1 Raw Material Suppliers: Cocoa Producers

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 34)

3.1 Overview of the Confectionery Ingredients Market

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in the Confectionery Ingredients Market

4.2 Asia-Pacific Region Shows Promising Growth for the Confectionery Ingredients Market Until 2021

4.3 Europe Held Largest Share in the Confectionery Ingredients Market (KT)

4.4 Asia-Pacific Economies Such as India and China Projected to Grow at the Highest CAGR; U.S. Market for Confectionery Ingredients to Remain Dominant (USD Million)

4.5 Europe Dominated the Confectionery Ingredients Market Across All Types of Ingredients in 2015, in Terms of Volume

4.6 Confectionery Ingredients Market Attractiveness Across Regions

4.7 Product Life Cycle

4.8 Year on Year Growth Outlook

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Changing Consumer Lifestyles

5.3.1.2 Health Benefits of Chocolates

5.3.1.3 Large Number of Confectionery Applications

5.3.1.4 R&D and Innovations to Strengthen the Confectionery Ingredients Market

5.3.1.5 Increasing Demand for Natural Ingredients Due to Increasing Consumer Awareness

5.3.2 Restraints

5.3.2.1 Adherence to International Quality Standards and Regulations for Confectionery Ingredient Products

5.3.2.2 Volatile Cocoa Prices

5.3.2.3 Ambiguity Over the Consumption of Trans-Fatty Acids and Its Related Health Issues

5.3.3 Opportunities

5.3.3.1 Emerging Applications of Confectionery Ingredient

5.3.3.2 Product Innovation to Reflect Changes in Consumer Behavior

5.3.3.3 Increasing Consumption of Confectionery Goods in Developed and Developing Countries

5.3.3.4 Seasonal and Festive Related Demand

5.3.4 Challenges

5.3.4.1 Growing Substitution of Confectionery Goods

5.3.4.2 Consumer Perception Towards ‘Chocolate-Flavored Products’ and Chocolate Products

5.3.4.3 Demand for Clean Label Products From Consumers

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users (Chocolate Manufacturers/Confectioners/Food Industry/Retail Customers/Governments/Researchers)

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Confectionery Ingredients Market, By Type (Page No. - 62)

7.1 Introduction

7.2 Cocoa & Chocolate

7.3 Dairy Ingredients

7.4 Hydrocolloids

7.5 Emulsifiers

7.6 Malts

7.7 Oils & Shortenings

7.8 Starch & Derivatives

7.9 Sweeteners

7.10 Flavors

7.11 Others

8 Confectionery Ingredients Market, By Source (Page No. - 81)

8.1 Introduction

8.2 Synthetic

8.3 Natural

9 Confectionery Ingredients Market, By Form (Page No. - 88)

9.1 Introduction

9.2 Dry Form

9.3 Liquid Form

10 Confectionery Ingredients Market, By Application (Page No. - 94)

10.1 Introduction

10.2 Chocolate

10.3 Sugar Confectionery

10.4 Gum

10.5 Others

11 Confectionery Ingredients Market, By Region (Page No. - 104)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 France

11.3.3 Germany

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Australia

11.4.4 Japan

11.4.5 Rest of Asia Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Chile

11.5.4 Middle East

11.5.5 Africa

12 Confectionery Ingredients Market, Branding Overview (Page No. - 135)

12.1 Introduction

12.1.1 Cornsweet

12.1.2 Novalipid

12.1.3 Coroli

12.1.4 Jeltec

12.1.5 Fibersol-2

12.1.6 Choc-A-Like

12.1.7 Kerrylac;

12.1.8 Resistamyl

12.1.9 Elastigel

12.1.10 Tasteva

13 Competitive Landscape (Page No. - 137)

13.1 Overview

13.2 Competitive Situation & Trends

13.3 Expansions & Investments

13.4 Acquisitions

13.5 New Product Launches

13.6 Collaborations, Agreements, Joint Ventures & Partnerships

14 Company Profiles (Page No. - 144)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

14.1 Introduction

14.1.1 Geographic Revenue Mix

14.2 Cargill, Incorporated

14.3 Archer Daniels Midland Company

14.4 Olam International Ltd.

14.5 Barry Callebaut

14.6 E. I. Du Pont De Nemours and Company

14.7 Koninklijke DSM N.V.

14.8 Kerry Group PLC

14.9 Arla Foods

14.10 Tate & Lyle PLC

14.11 Ingredion Incorporated

14.12 Aarhuskarlshamn (AAK)

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 185)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 More Company Developments

15.3.1 Expansions & Investments

15.3.2 Acquisitions

15.3.3 New Product Launches

15.3.4 Collaborations, Agreements, Joint Ventures & Partnerships

15.4 Introducing RT: Real Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (95 Tables)

Table 1 Healthy Food Product Consumption, By Attribute & Region in 2014

Table 2 Confectionery Ingredients Market Size, By Type, 2014-2021 (USD Million)

Table 3 Market Size For Confectionery Ingredients, By Type, 2014-2021 (KT)

Table 4 Cocoa & Chocolate Market Size, By Region, 2014-2021 (USD Million )

Table 5 Cocoa & Chocolate Market Size, By Region, 2014-2021 (KT)

Table 6 Dairy Ingredients Market Size, By Region, 2014-2021 (USD Million)

Table 7 Dairy Ingredients Market Size, By Region, 2014-2021 (KT)

Table 8 Hydrocolloids Market Size, By Region, 2014-2021 (USD Million)

Table 9 Hydrocolloids Market Size, By Region, 2014-2021 (KT)

Table 10 Emulsifiers Market Size, By Region, 2014-2021 (USD Million)

Table 11 Emulsifiers Market Size, By Region, 2014-2021 (KT)

Table 12 Malts Market Size, By Region, 2014-2021 (USD Million)

Table 13 Malts Market Size, By Region, 2014-2021 (KT)

Table 14 Oils & Shortenings Market Size, By Region, 2014-2021 (USD Million)

Table 15 Oils & Shortenings Market Size, By Region, 2014-2021 (KT)

Table 16 Starch & Derivatives Market Size, By Region, 2014-2021 (USD Million)

Table 17 Starch & Derivatives Market Size, By Region, 2014-2021 (KT)

Table 18 Sweeteners Market Size, By Region, 2014-2021 (USD Million)

Table 19 Sweeteners Market Size, By Region, 2014-2021 (KT)

Table 20 Flavors Market Size, By Region, 2014-2021 (USD Million)

Table 21 Flavors Market Size, By Region, 2014-2021 (KT)

Table 22 Other Confectionery Ingredients Market Size, By Region, 2014-2021 (USD Million)

Table 23 Other Confectionery Ingredients Market Size, By Region, 2014-2021 (KT)

Table 24 Market Size For Confectionery Ingredients, By Source, 2014–2021 (USD Million)

Table 25 Market Size For Confectionery Ingredients, By Source, 2016–2021 (KT)

Table 26 Market Size For Synthetic Confectionery Ingredients, By Region, 2014–2021 (USD Million)

Table 27 Market Size For Synthetic Confectionery Ingredients, By Region, 2014–2021 (KT)

Table 28 Market Size For Natural Confectionery Ingredients, By Region, 2014–2021 (USD Million)

Table 29 Market Size For Natural Confectionery Ingredients, By Region, 2014–2021 (KT)

Table 30 Market Size For Confectionery Ingredients, By Form, 2014–2021 (USD Million)

Table 31 Market Size For Confectionery Ingredients, By Form, 2014–2021 (KT)

Table 32 Market Size For Dry Confectionery Ingredients, By Region, 2014–2021 (USD Million)

Table 33 Market Size For Dry Confectionery Ingredients, By Region, 2014–2021 (KT)

Table 34 Liquid Form Market Size, By Region, 2014–2021 (USD Million)

Table 35 Market Size For Liquid Confectionery Ingredients, By Region, 2014–2021 (KT)

Table 36 Market Size For Confectionery Ingredients, By Application, 2014–2021 (USD Million)

Table 37 Market Size For Confectionery Ingredients, By Application, 2014–2021 (KT)

Table 38 Chocolate Confectionery Market Size, By Region, 2014–2021 (USD Million)

Table 39 Chocolate Confectionery Market Size, By Region, 2014–2021 (KT)

Table 40 Sugar Confectionery Market Size, By Region, 2014–2021 (USD Million)

Table 41 Sugar Confectionery Market Size, By Region, 2014–2021 (KT)

Table 42 Gum Market Size, By Region, 2014–2021 (USD Million)

Table 43 Gum Market Size, By Region, 2014–2021 (KT)

Table 44 Other Applications Market Size, By Region, 2014–2021 (USD Million)

Table 45 Other Applications Market Size, By Region, 2014–2021 (KT)

Table 46 Market Size For Confectionery Ingredients, By Region, 2014–2021 (USD Million)

Table 47 Confectionery Ingredients Market Size, By Region, 2014–2021 (KT)

Table 48 North America: Confectionery Ingredients Market Size, By Country, 2014–2021 (USD Million)

Table 49 North America: Market Size For Confectionery Ingredients, By Country, 2014–2021 (KT)

Table 50 North America: Market Size For Confectionery Ingredients, By Type, 2014–2021 (USD Million)

Table 51 North America: Market Size For Confectionery Ingredients, By Type, 2014–2021 (KT)

Table 52 North America: Market Size For Confectionery Ingredients, By Application, 2014–2021 (USD Million)

Table 53 North America: Market Size For Confectionery Ingredients, By Application, 2014–2021 (KT)

Table 54 North America: Market Size For Confectionery Ingredients, By Form, 2014–2021 (USD Million)

Table 55 North America: Market Size For Confectionery Ingredients, By Form, 2014–2021 (KT)

Table 56 North America: Market Size For Confectionery Ingredients, By Source, 2014–2021 (USD Million)

Table 57 North America: Confectionery Ingredients Market Size, By Source, 2014–2021 (KT)

Table 58 Europe: Confectionery Ingredients Market Size, By Country, 2014–2021 (USD Million)

Table 59 Europe: Market Size For Confectionery Ingredients, By Country, 2014–2021 (KT)

Table 60 Europe: Market Size For Confectionery Ingredients, By Type, 2014–2021 (USD Million)

Table 61 Europe: Market Size For Confectionery Ingredients, By Type, 2014-2021 (KT)

Table 62 Europe: Market Size For Confectionery Ingredients, By Application, 2014–2021 (USD Million)

Table 63 Europe: Market Size For Confectionery Ingredients, By Application, 2014–2021 (KT)

Table 64 Europe: Market Size For Confectionery Ingredients, By Form, 2014–2021 (USD Million)

Table 65 Europe: Market Size For Confectionery Ingredients, By Form, 2014–2021 (KT)

Table 66 Europe: Market Size For Confectionery Ingredients, By Source, 2014–2021 (USD Million)

Table 67 Europe: Confectionery Ingredients Market Size, By Source, 2014–2021 (KT)

Table 68 Asia-Pacific: Confectionery Ingredients Market Size, By Country, 2014–2021 (USD Million)

Table 69 Asia-Pacific: Market Size For Confectionery Ingredients, By Country, 2014–2021(KT)

Table 70 Asia-Pacific: Market Size For Confectionery Ingredients, By Type, 2014–2021 (USD Million)

Table 71 Asia-Pacific: Market Size For Confectionery Ingredients, By Type, 2014–2021 (KT)

Table 72 Asia-Pacific: Market Size For Confectionery Ingredients, By Application, 2014–2021 (USD Million)

Table 73 Asia-Pacific: Market Size For Confectionery Ingredients, By Application, 2014–2021 (KT)

Table 74 Asia-Pacific: Market Size For Confectionery Ingredients, By Source, 2014–2021(USD Million)

Table 75 Asia-Pacific: Market Size For Confectionery Ingredients, By Source, 2014–2021 (KT)

Table 76 Asia-Pacific: Market Size For Confectionery Ingredients, By Form, 2014–2021 (USD Million)

Table 77 Asia-Pacific: Confectionery Ingredients Market Size, By Form, 2014–2021(KT)

Table 78 RoW: Confectionery Ingredients Market Size, By Country/Region, 2014–2021 (USD Million)

Table 79 RoW: Market Size For Confectionery Ingredients, By Country/Region, 2014–2021 (KT)

Table 80 RoW: Market Size For Confectionery Ingredients, By Type, 2014-2021 (USD Million)

Table 81 RoW: Market Size For Confectionery Ingredients, By Type, 2014-2021 (KT)

Table 82 RoW: Market Size For Confectionery Ingredients, By Application, 2014-2021 (USD Million)

Table 83 RoW: Market Size For Confectionery Ingredients, By Application, 2014-2021 (KT)

Table 84 RoW: Market Size For Confectionery Ingredients, By Form, 2014-2021 (USD Million)

Table 85 RoW: Market Size For Confectionery Ingredients, By Form, 2014-2021 (KT)

Table 86 RoW: Market Size For Confectionery Ingredients, By Source, 2014-2021 (USD Million)

Table 87 RoW: Market Size For Confectionery Ingredients, By Source, 2014-2021 (KT)

Table 88 Expansions & Investments, 2010-2015

Table 89 Mergers & Acquisitions, 2010-2015

Table 90 New Product Launches, 2010–2016

Table 91 Collaborations, Agreements, Joint Ventures & Partnerships, 2010–2016

Table 92 Expansions & Investments, 2011–2016

Table 93 Acquisitions, 2011–2016

Table 94 New Product/Development Launches, 2011–2016

Table 95 Collaborations, Agreements, Joint Ventures & Partnerships , 2011–2016

List of Figures (79 Figures)

Figure 1 Confectionery Ingredients Market Segmentation

Figure 2 Confectionery Ingredients Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 GDP (PPP) of Top Economies, 2015

Figure 5 Consumption of Confectionery (Kg Per Capita)

Figure 6 Middle-Class Population in the Asia-Pacific Region Projected to Account for the Largest Share in the Global Market By 2030

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Market Breakdown & Data Triangulation

Figure 10 Confectionery Ingredients Market Growth Trend (2016 vs 2021)

Figure 11 Chocolate Confectionery Dominated the Market For Confectionery Ingredients, By Application

Figure 12 Asia-Pacific is Projected to Be the Fastest-Growing Market for Confectionery Ingredients From 2016 to 2021

Figure 13 Cocoa & Chocolate Segment to Dominate the Global Confectionery Ingredients Market, By Type, 2016–2021

Figure 14 Confectionery Ingredients Market, By Source, 2016 vs 2021 (USD Million)

Figure 15 Major Players Adopted Expansion & Investments as the Key Strategy From 2011 to 2016

Figure 16 Confectionery Ingredients: an Emerging Market With Promising Growth Potential, 2016–2021 (USD Million)

Figure 17 Asia-Pacific Projected to Grow at the Highest Rate From 2016 to 2021

Figure 18 The Cocoa & Chocolate Segment Accounted for the Largest Share in the European Market in 2015 (KT)

Figure 19 Indian Market is Projected to Grow at the Highest Rate From 2016 to 2021

Figure 20 Confectionery Ingredients Market Size, By Type , 2015 (KT)

Figure 21 Asia-Pacific Confectionery Ingredients Market to Grow at the Highest Rate From 2016 to 2021

Figure 22 Europe to Hit Maturity Phase in the Confectionery Ingredients Market

Figure 23 Europe & North America Market are Expected to Grow at A Decreasing Rate

Figure 24 Confectionery Ingredients Market Segmentation

Figure 25 Changing Lifestyles and Eating Habits Drive the Growth of the Confectionery Ingredients Market

Figure 26 Value Chain Analysis: Major Value is Added During Manufacturing & Material Sourcing

Figure 27 Supply Chain: Multi-Model Distribution System Followed By Prominent Players

Figure 28 New Product Launch is the Key Strategy for Industry Players

Figure 29 Porter’s Five Forces Analysis

Figure 30 Confectionery Ingredients Market Size for Cocoa & Chocolate, By Region, 2016 & 2021 (USD Million)

Figure 31 Confectionery Ingredients Market Size for Dairy Ingredients, By Region, 2016 & 2021 (USD Million)

Figure 32 Confectionery Ingredients Market Size for Hydrocolloids, By Region, 2016 & 2021 (USD Million)

Figure 33 Confectionery Ingredients Market Size for Emulsifiers, By Region, 2016 & 2021 (USD Million)

Figure 34 Confectionery Ingredients Market Size for Malts, By Region, 2016 & 2021 (USD Million)

Figure 35 Confectionery Ingredients Market Size for Oils & Shortenings, By Region, 2016 & 2021 (USD Million)

Figure 36 Confectionery Ingredients Market Size for Starch & Derivatives, By Region, 2016 & 2021 (USD Million)

Figure 37 Confectionery Ingredients Market Size for Sweeteners, By Region, 2016 & 2021 (USD Million)

Figure 38 Confectionery Ingredients Market Size for Flavors, By Region, 2016 & 2021 (USD Million)

Figure 39 Other Confectionery Ingredients Market Size, By Region, 2016 & 2021 (USD Million)

Figure 40 Market For Confectionery Ingredients, By Source

Figure 41 Synthetic Segment Projected to Account for the Higher Share in Terms of Value

Figure 42 Synthetic Confectionery Ingredients Market in Asia-Pacific is Projected to Grow at the Highest Rate From 2016 to 2021 in Terms of Value

Figure 43 Europe is Projected to Lead the Natural Segment of Confectionery Ingredients Market in Terms of Value

Figure 44 Rising Presence of Manufacturers in Natural Ingredients

Figure 45 Market For Confectionery Ingredients, By Form

Figure 46 Dry Form Segment Projected to Account for the Larger Share in Terms of Value Through 2021

Figure 47 Dry Confectionery Ingredients Market in Asia-Pacific is Projected to Grow at the Highest Rate From 2016 to 2021 in Terms of Value

Figure 48 Europe is Projected to Lead the Liquid Form of Confectionery Ingredients Through 2021

Figure 49 Market For Confectionery Ingredients, By Application

Figure 50 Chocolate Confectionery is Projected to Account for the Highest Share Through 2021 in Terms of Value

Figure 51 Europe is Projected to Dominate the Gums Market Through 2021 in Terms of Volume

Figure 52 Market For Confectionery Ingredients: Geographic Snapshot, 2016–2021

Figure 53 North America: Confectionery Ingredients Market Snapshot

Figure 54 Europe: Confectionery Ingredients Market, 2014–2021

Figure 55 Switzerland Had the Highest Per Capita Confectionery Consumption in 2015

Figure 56 Asia-Pacific: Market Size For Confectionery Ingredients, By Country, 2015-2021

Figure 57 Expansions & Investments: Current Approach of Leading Confectionery Ingredients Market Players

Figure 58 Portfolio Strengthening Through Developments

Figure 59 Share of Collaborations, Agreements, Joint Ventures & Partnerships in Total Developments

Figure 60 Expansions & Investments: the Key Growth Strategies, 2010–2016

Figure 61 Geographic Revenue Mix of Top Five Market Players

Figure 62 Cargill, Incorporated: Company Snapshot

Figure 63 Cargill, Incorporated: SWOT Analysis

Figure 64 Archer Daniels Midland Company: Company Snapshot

Figure 65 Archer Daniels Midland Company: SWOT Analysis

Figure 66 Olam International Ltd.: Company Snapshot

Figure 67 Olam International Ltd.: SWOT Analysis

Figure 68 Barry Callebaut: Company Snapshot

Figure 69 Barry Callebaut: SWOT Analysis

Figure 70 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 71 E. I Du Pont De Nemours and Company: SWOT Analysis

Figure 72 Koninklijke DSM N.V.: Company Snapshot

Figure 73 Koninklijke DSM N.V.: SWOT Analysis

Figure 74 Kerry Group PLC: Company Snapshot

Figure 75 Kerry Group PLC: SWOT Analysis

Figure 76 Arla Foods: Company Snapshot

Figure 77 Tate & Lyle PLC: Company Snapshot

Figure 78 Ingredion Incorporated: Company Snapshot

Figure 79 Aarhuskarlshamn : Company Snapshot

Growth opportunities and latent adjacency in Confectionery Ingredients Market