Fiber Optics Market by Fiber Type (Glass, Plastic), Cable Type (Single-mode, Multi-mode), Deployment (Underground, Underwater, Aerial), Application (Communication, and non-communication) and Region – Global Forecast to 2029

Fiber Optics Market Summary

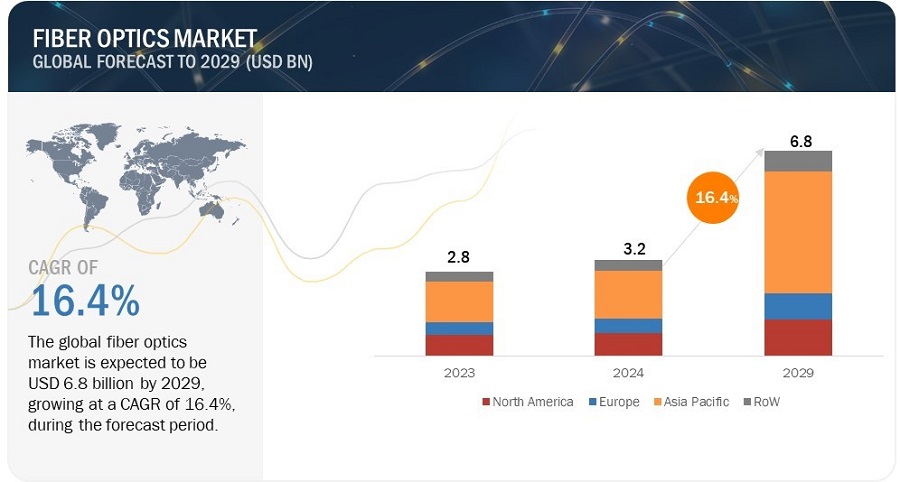

The global Fiber Optics Market was valued at USD 3.2 billion in 2024 and is projected to grow from USD 3.6 billion in 2025 to USD 6.8 billion by 2029, at a CAGR of 16.4% during the forecast period. This remarkable growth trajectory is driven by the increasing deployment of 5G communication networks, which heavily rely on fiber optics for high-speed data transmission. Additionally, the proliferation of data centers globally and the rising demand for high bandwidth are significant contributors to this upward trend. Despite challenges such as installation in challenging terrains and high costs, the market's potential is bolstered by innovations in technology and government initiatives prioritizing fiber optic connectivity.

Key Takeaways:

• The global Fiber Optics Market was valued at USD 3.2 billion in 2024 and is projected to grow from USD 3.6 billion in 2025 to USD 6.8 billion by 2029, at a CAGR of 16.4% during the forecast period.

• By Technology: The market benefits from advancements in glass optical fibers, which are favored for their high performance in extreme conditions, and plastic optical fibers, suitable for industrial and automotive applications.

• By Application: The communications sector, particularly telecom, is a major driver, leveraging fiber optics for cost efficiency and superior bandwidth over traditional copper cables.

• By Deployment Type: The rapid development of telecom infrastructure is fueling underground optic fiber deployment, while the rise of over-the-top media services is increasing the demand for aerial fiber optics.

• By Region: ASIA PACIFIC is expected to grow fastest at 3.8% CAGR, propelled by significant government initiatives and investments in fiber optic infrastructure.

• Market Dynamics: Despite being prone to physical damage and transmission loss, the fiber optics market is thriving due to the surging demand for high performance and reliable data transmission solutions.

• Ecosystem Dynamics: The market is witnessing a shift with fiber optics replacing traditional copper cables, driven by the need for lightweight, EMI-resistant solutions.

In conclusion, the fiber optics market is on a robust growth path, driven by technological advancements and strategic investments in infrastructure. The increasing shift towards 5G networks and the rising need for high bandwidth data transmission create promising opportunities for expansion. As the market evolves, addressing challenges in installation and costs will be crucial to harnessing its full potential.

The growing penetration of 5G across developed and developing economies is expected to bring opportunities for fiber optics vendors. 5G infrastructure is dependent on optical fiber communication. These optical fibers can transfer data at high transmission rates from one location to another. Government initiatives in developing countries are working to prioritize fiber optic connectivity. For example, out of ~1.5 billion people in Africa, only 350 million have internet coverage. Less than 10% of these connections are with fiber networks. The government in the region is now focusing on deploying fiber networks to improve healthcare and education, among other services.

Fiber Optics Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

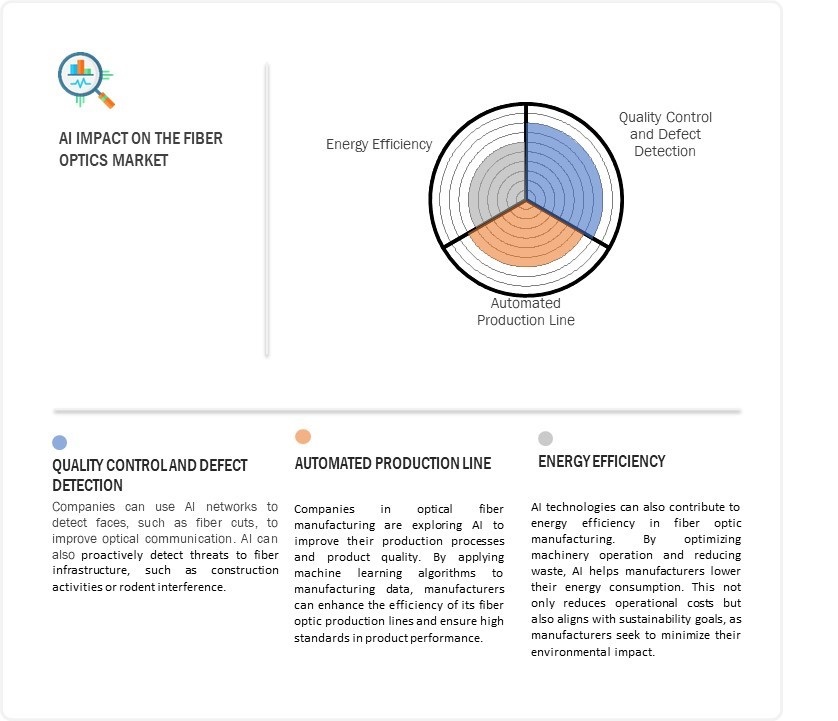

Impact of AI on the Fiber Optics Market

Fiber Optics Market Trends & Dynamics

Driver: Rising number of data center facilities worldwide

The rising deployment of data center facilities worldwide is expected to drive the growth of the fiber optics market. Data centers require high bandwidth, wide-area coverage, low power consumption, and end-to-end connectivity between two facilities. Fiber optics plays a significant role in connecting two or more data centers located thousands of kilometers apart; they help transmit large volumes of data over long distances with low latency and higher transmission rates. The data is directly transmitted using light pulses across a fiber optics network, which further helps reduce the power consumption in data centers.

Restraint: Probe to physical damage and transmission loss

Fiber optics are prone to transmission losses and are expensive are fragile. They are so small that they can be easily damaged during renovation or relink. Fiber optic networks are also prone to fiber fuse, as too much light can damage the fiber cable quickly. Any material wrapped around the cable can also cut off the transmission. The fiber optic cables are delicate, they need robust and protective sheathing to suit the environment where they are installed.

Opportunity: Rising demand for fiber optics as replacement of copper cables

Fiber optics technology was invented mainly to replace the copper cables. As copper cables are heavy and bulky, they are difficult to manage physically. Furthermore, electromagnetic interference (EMI) limits copper’s performance and reliability because of the nature of electrical signals. In optical communications, fiber optics and shielded end casings are used, which help provide immunity to electromagnetic and radio-frequency interference. Moreover, the weight of fiber optics solutions is very low compared with copper cables. Therefore, there are fewer chances of switch ports being damaged. In addition, they require less maintenance and have better server utilization. With the increasing network traffic, customers are adding transmission bandwidth to existing optical networks or purchasing and deploying additional systems to address bandwidth demands. This is further expected to support the fiber optics market growth in the near future.

Challenge: Installing fiber optics networks in difficult terrains and high cost of installation

Underground fiber optic cables are placed mainly on highways and city streets. Planning a fiber route becomes difficult in an area where a new building or commercial site comes without authorization. Several Mobile Network Operators (MNOs) have noted more complex requests for information reduction use, allowance for discovery, unreasonable charges for using return order wire (ROW), unsolicited requests for redress, and the installation of resources across expensive and time-consuming municipal boundaries.

Fiber Optics Market Map:

Glass segment to have the highest share of fiber optics market by 2029

The glass segment is expected to have the highest market share of the fiber optics market by 2029. The segment is expected to grow at the second-highest rate during the forecast period. Glass optical fiber has a huge numerical aperture compared to plastic, allowing more light rays into the system. The transfer range of single-mode fiber is in the range of 200–2,200 nm. The efficient performance of glass fiber optics in adverse environments with high temperatures and corrosive chemicals, and their ability to transmit both visible and infrared light are significant factors for the growth of this segment.

Single-mode segment is expected to account for the high market share from 2024 to 2029.

Single-mode segment is expected to account for a high market share during the forecast period. A single-mode fiber optic cable is 9 µm in diameter. This mode of fiber optic cables can carry signals at a much greater speed and over longer distances than multi-mode fibers. Single-mode fiber optics cable dominance is mainly due to their increased demand from long-distance transmission applications. Telecom companies typically use single-mode fibers for long-distance and high-bandwidth requirements. They are also used by Cable Antenna Television (CATV) companies, as well as colleges and universities.

The underground segment is projected to hold significant share in the fiber optics market during the forecast period.

Underwater deployment is a process where fiber optics are installed in subsea or submarine optical cable networks. Underwater or submarine fiber optic cables are laid on ocean beds to connect various regions and continents for communication applications. The surge in the global demand for increased bandwidth and the rise in telecom subscriptions and internet connections worldwide are the major factors driving the underwater deployment of optical fibers.

Market for non-communication application segment to grow significantly throughout the forecast period

Non-communication applications include the use of fiber optics in sensors and fiber optic lighting. Sensors is the largest application of fiber optics in the non-communication segment. The demand from various industries such as oil & gas, aerospace, military, and automotive mainly drives the demand for fiber optics in this segment. Fiber optics possess unique characteristics of illumination and glowing when a ray of light is passed through them. These optics are witnessing high adoption in lighting applications across museums, art galleries, and pools.

Fiber optics market in China is expected to dominate in 2029

China is expected to have a dominating market share in the Asia Pacific region in 2029. It has built about 500 AI-powered smart cities in the country. The rise in the number of smart cities is further expected to increase the demand for applications like smart utilities, smart transportation, smart buildings, and communication infrastructure—that invariably require fiber optic solutions. Also, rapid commercialization of 5G services across China, South Korea, and Japan is expected to create significant opportunities for the fiber optics market in the region.

Fiber Optics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Fiber Optics - Key Market Players

Key players in the fiber optics companies are Corning Incorporated (US), Prysmian Group (Italy), Sumitomo Electric Industries, Ltd. (Japan), Yangtze Optical Fibre and Cable Joint Stock Limited Company (China), Fujikura Ltd. (Japan), Hengtong Group Co., Ltd. (China), Furukawa Electric Co. Ltd. (Japan), LEONI Fiber Optics GmbH (Germany), LS Cable & System Ltd. (South Korea), and Proterial Cable America Inc. (US).

Scope of the Fiber Optics Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 3.2 billion in 2024 |

| Projected Market Size | USD 6.8 billion by 2029 |

|

Fiber Optics Market Growth Rate

|

at a CAGR of 16.4% |

|

Market size available for years |

2020–2029 |

|

Base year |

2023 |

|

Forecast period |

2024–2029 |

|

Segments covered |

Fiber Type, Cable Type, Deployment, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Corning Incorporated (US), Sumitomo Electric Industries, Ltd. (Japan), Prysmian Group (Italy),Yangtze Optical Fibre and Cable Joint Stock Limited Company (China) and Fujikura Ltd. (Japan), LEONI (Germany), LS Cable & System Ltd. (South Korea), Hengtong Group Co., Ltd. (China), Furukawa Electric Co. Ltd. (Japan), Optical Cable Corporation (US), LS Cable & System Ltd. (South Korea), Proterial Cable America Inc., (US), Coherent Corporation (US), Finolex Cables Ltd. (India), CommScope Holding Company, Inc. (US), Sterlite Technologies Limited (India), ZTT (China), FiberHome Telecommunication Technologies Co., Ltd. (China), Aksh Optifibre (India), Art Photonics GmbH (Germany), RPG Cables (India), Nestor Cables (Finland), Orbis Oy (Finland), Birla Cable Ltd. (India), Belden Inc. (US), and Fiber Mountain (US) players have been covered. |

Fiber Optics Market Highlights

This research report categorizes the fiber optics market based on fiber type, cable type, deployment, application, and region.

|

Segment |

Subsegment |

|

By Fiber Type : |

|

|

By Cable Type : |

|

|

By Deployment : |

|

|

By Application : |

|

|

By Region: |

|

Recent Developments

- In April 2024, Prysmian Group will acquire Warren & Brown Technologies. The acquisition will help Prysmian Group to strengthen its enterprise solutions for the telecommunication market.

- In June 2023, Corning Incorporated announced a joint venture with SGD Pharma to open a new glass tube facility in India. This joint venture is expected to boost pharmaceutical manufacturing in India and allow SGD Pharma to use Corning's innovative Velocity Vial technology.

- In June 2023, Corning Incorporated announced a joint venture with SGD Pharma to open a new glass tube facility in India. This joint venture boosts pharmaceutical manufacturing in India and allows SGD Pharma to use Corning's innovative Velocity Vial technology.

- In September 2023, Sumitomo Electric Industries, Ltd. realized the world’s first mass production of ultra-low loss, multi-core fiber “2C Z-PLUS Fiber ULL”.

Key Questions Addressed in Report:

What is the total CAGR expected to be recorded for the fiber optics market during 2024-2029?

The fiber optics market is expected to record a CAGR of 16.4% from 2024 to 2029.

What are the significant opportunities in the fiber optics market?

A 5G network requires high-bandwidth fiber optic cables for secure and reliable data transfers. Subsequently, expanding telecommunication infrastructure across developing countries are expected to drive the fiber optics market in the near future.

Which deployment has the largest size in the fiber optics market?

Aerial deployment is expected to have the largest market size during the forecast period.

Which application has the largest size in the fiber optics market?

Communication application is expected to have the larger market size during the forecast period.

Which cable type has the highest growth in the fiber optics market?

Single-mode is expected to have the highest market growth during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing internet penetration and data traffic- Rising number of data center facilities worldwide- Surging demand for high bandwidthRESTRAINTS- Prone to physical damage and transmission lossOPPORTUNITIES- Increasing deployment of 5G communication networks- Rising demand for fiber optics due to high performance and reliability- Increasing penetration of Fiber to the XCHALLENGES- Installing fiber optic networks in hard-to-reach terrains and high cost of installation

-

5.3 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Plastic Optical Fibers- Glass Optical Fibers- Nanf Hollow-Core FibberCOMPLEMENTARY TECHNOLOGIES- Digital Signal ProcessorADJACENT TECHNOLOGIES- Wireless Communication

- 5.4 IMPACT OF AI ON FIBER OPTICS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PRICING ANALYSISAVERAGE INDICATIVE SELLING PRICE OF FIBER OPTICSAVERAGE INDICATIVE SELLING PRICE OF FIBER OPTICS, BY REGIONAVERAGE SELLING PRICES OF FIBER OPTIC PRODUCTS OFFERED BY KEY PLAYERS FOR TOP-THREE APPLICATIONS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 ECOSYSTEM ANALYSIS

- 5.9 INVESTMENT AND FUNDING SCENARIO

-

5.10 PATENT ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIO (HS CODE 9001)EXPORT SCENARIO (HS CODE 9001)

-

5.12 TARIFF AND REGULATORY LANDSCAPETARIFFS RELATED TO OPTICAL FIBER, OPTICAL FIBER BUNDLES, AND CABLES OF VOICE (9001)

-

5.13 REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS- International Organization for Standardization (ISO)/ International Electrotechnical Commission (IEC)- ITU standardsGOVERNMENT REGULATIONS- US- Europe- China- India

- 5.14 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.15 CASE STUDY ANALYSISALMA TELECOM UPGRADED ITS NETWORK USING FTTP SOLUTION OFFERED BY CORNING INCORPORATEDBALDWIN CITY ACHIEVED HIGH-SPEED BROADBAND CONNECTIVITY USING CORNING’S FLEXNAP SYSTEMCOMMSCOPE HELPED E-FIBER COMMERCIALIZE FTTX NETWORKS IN NETHERLANDS

-

5.16 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 GLASSHIGH PERFORMANCE IN EXTREME CONDITIONS TO DRIVE MARKET

-

6.3 PLASTICSUITABILITY FOR INDUSTRIAL AND AUTOMOTIVE LIGHTING APPLICATIONS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 SINGLE-MODELONG-DISTANCE AND HIGH-BANDWIDTH TELECOMMUNICATION REQUIREMENTS TO DRIVE MARKET

-

7.3 MULTI-MODEGROWING DEMAND FOR UNLIMITED BANDWIDTH CAPACITY TO BOOST DEMAND

- 8.1 INTRODUCTION

-

8.2 COMMUNICATIONTELECOM- Cost efficiency and higher bandwidth and speed than copper to drive demandPREMISES- Expansion of LAN and data centers to drive marketUTILITY- Growth of power industry to drive marketCABLE ANTENNA TELEVISION- Shifting consumer preference toward high-definition content to drive market growthINDUSTRIAL- Proliferation of smart factories across developed economies to fuel demand for fiber opticsMILITARY- Increase in military budgets worldwide to create market growth opportunitiesOTHER COMMUNICATION APPLICATIONS

-

8.3 NON-COMMUNICATIONSENSORS- Use of fiber optics in distributed sensing applications to support market growthFIBER OPTIC LIGHTING- Growing demand from museum displays, pools, and star field ceilings to drive market

- 9.1 INTRODUCTION

-

9.2 UNDERGROUNDRAPID DEVELOPMENT OF TELECOM INFRASTRUCTURE TO FUEL UNDERGROUND OPTIC FIBER DEPLOYMENT

-

9.3 UNDERWATERINCREASING INSTALLATION OF SUBMARINE OPTICAL FIBER CABLES TO PROPEL MARKET GROWTH

-

9.4 AERIALRISING PENETRATION OF OVER-THE-TOP MEDIA SERVICES TO INCREASE AERIAL DEPLOYMENT OF FIBER OPTICS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Extensive penetration of smart home technology products to drive marketCANADA- Growing investments in network infrastructure to drive marketMEXICO- Increasing internet penetration to boost marketMACROECONOMIC OUTLOOK FOR NORTH AMERICA

-

10.3 EUROPEGERMANY- Gigabit Strategy to strengthen FTTH network to favor market growthUK- Presence of telecom service providers to augment market growthFRANCE- Favorable government initiatives to drive marketITALY- Increasing adoption of FTTH broadband to offer opportunities for fiber optics providersSPAIN- Rapid commercialization of 5G communication services to foster market growthREST OF EUROPEMACROECONOMIC OUTLOOK FOR EUROPE

-

10.4 ASIA PACIFICCHINA- Substantial investments by telecom operators in deployment of 5G base stations to drive marketINDIA- Government initiatives to increase broadband connectivity across rural areas to support fiber optics market expansionJAPAN- Presence of prominent fiber optics manufacturers to drive marketSOUTH KOREA- Proliferation of smart factories to boost marketREST OF ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFIC

-

10.5 ROWLATIN AMERICA- Rising deployment of fiber optic solutions across Brazil, Argentina, and Chile to foster market growthGCC COUNTRIES- Advancement in 5G technology to drive marketREST OF MIDDLE EAST & AFRICAMACROECONOMIC OUTLOOK FOR ROW

- 11.1 OVERVIEW

- 11.2 KEY STRENGTHS/RIGHT TO WIN, 2020–2023

- 11.3 REVENUE ANALYSIS, 2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: (KEY PLAYERS), 2023- Company footprint- Fiber type footprint- Cable type footprint- Deployment type footprint- Application footprint- Region footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES- Detailed list of key startups/SMEs

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSCORNING INCORPORATED- Business overview- Products offered- Recent developments- MnM viewPRYSMIAN GROUP- Business overview- Products offered- Recent developments- MnM viewSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products offered- Recent developments- MnM viewYANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY- Business overview- Products offered- Recent developments- MnM viewFUJIKURA LTD.- Business overview- Products offered- Recent developments- MnM viewHENGTONG GROUP CO., LTD.- Business overview- Products offered- Recent developmentsFURUKAWA ELECTRIC CO., LTD.- Business overview- Products offered- Recent developmentsLEONI FIBER OPTICS GMBH- Business overview- Products offered- Recent developmentsLS CABLE & SYSTEM LTD.- Business overview- Products offered- Recent developmentsPROTERIAL CABLE AMERICA INC.- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSCOHERENT CORPORATIONOPTICAL CABLE CORPORATIONFINOLEX CABLES LTD.COMMSCOPE HOLDING COMPANYSTERLITE TECHNOLOGIES LTDZTTFIBERHOMEAKSH OPTIFIBREART PHOTONICS GMBHRPG CABLES (A DIVISION OF KEC INTERNATIONAL LIMITED)NESTOR CABLESORBIS OYBIRLA CABLE LTD.BELDEN INC.FIBRE MOUNTAIN

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 2 FIBER OPTICS MARKET: RISK ASSESSMENT

- TABLE 3 AVERAGE SELLING PRICE ANALYSIS OF FIBER OPTIC PRODUCTS OFFERED BY MARKET PLAYERS FOR TOP-THREE APPLICATIONS

- TABLE 4 FIBER OPTICS MARKET: ECOSYSTEM

- TABLE 5 FIBER OPTICS MARKET: KEY PATENTS, 2020–2024

- TABLE 6 MFN TARIFF IMPOSED BY FEW COUNTRIES ON US ON EXPORT OF PRODUCTS WITH HS CODE 9001

- TABLE 7 MFN TARIFF IMPOSED BY FEW COUNTRIES ON CHINA ON EXPORT OF PRODUCTS WITH HS CODE 9001

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 FIBER OPTICS MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 13 FIBER OPTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (USD MILLION)

- TABLE 17 FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (USD MILLION)

- TABLE 18 FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 19 FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 20 GLASS FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 21 GLASS FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 22 GLASS FIBER OPTICS MARKET, BY REGION, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 23 GLASS FIBER OPTICS MARKET, BY REGION, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 24 PLASTIC FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 25 PLASTIC FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 26 PLASTIC FIBER OPTICS MARKET, BY REGION, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 27 PLASTIC FIBER OPTICS MARKET, BY REGION, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 28 FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (USD MILLION)

- TABLE 29 FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (USD MILLION)

- TABLE 30 FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 31 FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 32 SINGLE-MODE FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 33 SINGLE-MODE FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 SINGLE-MODE FIBER OPTICS MARKET, BY REGION, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 35 SINGLE-MODE FIBER OPTICS MARKET, BY REGION, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 36 MULTI-MODE FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 37 MULTI-MODE FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 MULTI-MODE FIBER OPTICS MARKET, BY REGION, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 39 MULTI-MODE FIBER OPTICS MARKET, BY REGION, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 40 FIBER OPTICS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 41 FIBER OPTICS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 42 COMMUNICATION: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 43 COMMUNICATION: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 44 TELECOM: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 45 TELECOM: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 46 PREMISES: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 47 PREMISES: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 48 UTILITY: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 49 UTILITY: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 50 CATV: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 51 CATV: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 52 INDUSTRIAL: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 53 INDUSTRIAL: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 54 MILITARY: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 MILITARY: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 OTHER COMMUNICATION APPLICATIONS: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 57 OTHER COMMUNICATION APPLICATIONS: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 NON-COMMUNICATION APPLICATIONS: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 59 NON-COMMUNICATION APPLICATIONS: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 60 SENSORS: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 SENSORS: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 FIBER OPTIC LIGHTING: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 63 FIBER OPTIC LIGHTING: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 64 FIBER OPTICS MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 65 FIBER OPTICS MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 66 UNDERGROUND DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 UNDERGROUND DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 UNDERWATER DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 UNDERWATER DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 AERIAL DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 71 AERIAL DEPLOYMENT: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 72 FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 FIBER OPTICS MARKET, BY REGION, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 75 FIBER OPTICS MARKET, BY REGION, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 76 NORTH AMERICA: FIBER OPTICS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: FIBER OPTICS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 81 NORTH AMERICA: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 82 NORTH AMERICA: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 85 NORTH AMERICA: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 86 NORTH AMERICA: FIBER OPTICS MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: FIBER OPTICS MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: FIBER OPTICS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: FIBER OPTICS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 90 EUROPE: FIBER OPTICS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 91 EUROPE: FIBER OPTICS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 92 EUROPE: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (USD MILLION)

- TABLE 93 EUROPE: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (USD MILLION)

- TABLE 94 EUROPE: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 95 EUROPE: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 96 EUROPE: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (USD MILLION)

- TABLE 97 EUROPE: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (USD MILLION)

- TABLE 98 EUROPE: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 99 EUROPE: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 100 EUROPE: FIBER OPTICS MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 101 EUROPE: FIBER OPTICS MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 102 EUROPE: FIBER OPTICS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 103 EUROPE: FIBER OPTICS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: FIBER OPTICS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: FIBER OPTICS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 109 ASIA PACIFIC: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 110 ASIA PACIFIC: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 113 ASIA PACIFIC: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 114 ASIA PACIFIC: FIBER OPTICS MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: FIBER OPTICS MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: FIBER OPTICS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: FIBER OPTICS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 118 ROW: FIBER OPTICS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 119 ROW: FIBER OPTICS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 120 ROW: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (USD MILLION)

- TABLE 121 ROW: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (USD MILLION)

- TABLE 122 ROW: FIBER OPTICS MARKET, BY FIBER TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 123 ROW: FIBER OPTICS MARKET, BY FIBER TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 124 ROW: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (USD MILLION)

- TABLE 125 ROW: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (USD MILLION)

- TABLE 126 ROW: FIBER OPTICS MARKET, BY CABLE TYPE, 2020–2023 (MILLION FIBER KILOMETER)

- TABLE 127 ROW: FIBER OPTICS MARKET, BY CABLE TYPE, 2024–2029 (MILLION FIBER KILOMETER)

- TABLE 128 ROW: FIBER OPTICS MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 129 ROW: FIBER OPTICS MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 130 ROW: FIBER OPTICS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 131 ROW: FIBER OPTICS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 132 FIBER OPTICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 133 FIBER OPTICS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 134 FIBER OPTICS MARKET: FIBER TYPE FOOTPRINT

- TABLE 135 FIBER OPTICS MARKET: CABLE TYPE FOOTPRINT

- TABLE 136 FIBER OPTICS MARKET: DEPLOYMENT TYPE FOOTPRINT

- TABLE 137 FIBER OPTICS MARKET: APPLICATION FOOTPRINT

- TABLE 138 FIBER OPTICS MARKET: REGION FOOTPRINT

- TABLE 139 FIBER OPTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 140 FIBER OPTICS MARKET: KEY STARTUPS/SMES

- TABLE 141 FIBER OPTICS MARKET: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 142 FIBER OPTICS MARKET: DEALS, JANUARY 2019–JULY 2024

- TABLE 143 FIBER OPTICS MARKET: EXPANSIONS, JANUARY 2019–JULY 2024

- TABLE 144 FIBER OPTICS MARKET: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 145 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 146 CORNING INCORPORATED: PRODUCT OFFERED

- TABLE 147 CORNING INCORPORATED: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 148 CORNING INCORPORATED: DEALS, JANUARY 2019–JULY 2024

- TABLE 149 CORNING INCORPORATED: EXPANSIONS, JANUARY 2019–JULY 2024

- TABLE 150 PRYSMIAN GROUP: COMPANY OVERVIEW

- TABLE 151 PRYSMIAN GROUP: PRODUCTS OFFERED

- TABLE 152 PRYSMIAN GROUP: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 153 PRYSMIAN GROUP: DEALS, JANUARY 2019–JULY 2024

- TABLE 154 PRYSMIAN GROUP: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 155 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 156 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 157 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 158 SUMITOMO ELECTRIC INDUSTRIES, LTD.: DEALS, JANUARY 2019–JULY 2024

- TABLE 159 SUMITOMO ELECTRIC INDUSTRIES: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 160 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: COMPANY OVERVIEW

- TABLE 161 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: PRODUCTS OFFERED

- TABLE 162 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 163 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: DEALS, JANUARY 2019–JULY 2024

- TABLE 164 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: EXPANSIONS, JANUARY 2019–JULY 2024

- TABLE 165 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 166 FUJIKURA LTD.: COMPANY OVERVIEW

- TABLE 167 FUJIKURA LTD.: PRODUCTS OFFERED

- TABLE 168 FUJIKURA LTD.: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 169 FUJIKURA LTD.: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 170 HENGTONG GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 171 HENGTONG GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 172 HENGTONG GROUP CO., LTD.: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 173 HENGTONG GROUP CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 174 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 175 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 176 FURUKAWA ELECTRIC CO., LTD.: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 177 FURUKAWA ELECTRIC CO., LTD.: DEALS, JANUARY 2019–JULY 2024

- TABLE 178 FURUKAWA ELECTRIC CO. LTD.: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 179 LEONI FIBER OPTICS GMBH: COMPANY OVERVIEW

- TABLE 180 LEONI FIBER OPTICS GMBH: PRODUCTS OFFERED

- TABLE 181 LEONI FIBER OPTICS GMBH: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 182 LEONI FIBER OPTICS GMBH: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 183 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- TABLE 184 LS CABLE & SYSTEM LTD.: PRODUCTS OFFERED

- TABLE 185 LS CABLE & SYSTEM LTD.: PRODUCT LAUNCHES, JANUARY 2019–JULY 2024

- TABLE 186 LS CABLE & SYSTEM LTD.: DEALS, JANUARY 2019–JULY 2024

- TABLE 187 LS CABLE & SYSTEM LTD.: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- TABLE 188 PROTERIAL CABLE AMERICA INC.: COMPANY OVERVIEW

- TABLE 189 PROTERIAL CABLE AMERICA INC.: PRODUCTS OFFERED

- TABLE 190 PROTERIAL CABLE AMERICA INC.: DEALS, JANUARY 2019–JULY 2024

- TABLE 191 PROTERIAL CABLE AMERICA INC.: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2024

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FIBER OPTICS MARKET ESTIMATION: PROCESS FLOW

- FIGURE 3 FIBER OPTICS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 FIBER OPTICS MARKET: DATA TRIANGULATION

- FIGURE 7 GLASS FIBER TYPE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 SINGLE-MODE CABLE TYPE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 AERIAL DEPLOYMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 TELECOM WAS LARGEST SEGMENT OF FIBER OPTICS MARKET IN 2023

- FIGURE 11 FIBER OPTICS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 12 RISING ADOPTION OF FIBER OPTICS IN 5G AND FTTX NETWORKS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 13 GLASS FIBER TYPE TO DOMINATE FIBER OPTICS MARKET, DURING FORECAST PERIOD

- FIGURE 14 SINGLE-MODE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 AERIAL DEPLOYMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF FIBER OPTICS MARKET IN 2024

- FIGURE 16 GLASS FIBER AND ASIA PACIFIC HELD LARGEST SHARES OF FIBER OPTICS MARKET IN 2023

- FIGURE 17 TELECOM APPLICATION TO LEAD COMMUNICATION SEGMENT OF FIBER OPTICS MARKET DURING FORECAST PERIOD

- FIGURE 18 FIBER OPTICS MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FIBER OPTICS MARKET

- FIGURE 20 GLOBAL INTERNET PENETRATION RATE TILL JANUARY 2024, BY REGION

- FIGURE 21 ANALYSIS OF IMPACT OF DRIVERS ON FIBER OPTICS MARKET

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON FIBER OPTICS MARKET

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON FIBER OPTICS MARKET

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON FIBER OPTICS MARKET

- FIGURE 25 AI IMPACT ON FIBER OPTICS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE INDICATIVE SELLING PRICE ANALYSIS OF FIBER OPTICS, 2020–2029 (USD)

- FIGURE 28 AVERAGE INDICATIVE SELLING PRICE ANALYSIS OF FIBER OPTICS, BY REGION, 2020–2029 (USD)

- FIGURE 29 AVERAGE SELLING PRICES OF FIBER OPTIC PRODUCTS OFFERED BY KEY PLAYERS FOR TOP-THREE APPLICATIONS

- FIGURE 30 FIBER OPTICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 FIBER OPTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 FIBER OPTICS FUNDING, BY REGION, 2023

- FIGURE 33 FIBER OPTICS: PATENT ANALYSIS 2014 TO 2024

- FIGURE 34 IMPORT DATA FOR HS CODE 9001, BY COUNTRY, 2019–2023

- FIGURE 35 EXPORT DATA FOR HS CODE 9001, BY COUNTRY, 2019–2023

- FIGURE 36 FIBER OPTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE APPLICATIONS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP-THREE APPLICATIONS

- FIGURE 39 PLASTIC SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 SINGLE-MODE CABLE TYPE TO DOMINATE FIBER OPTICS MARKET DURING FORECAST PERIOD

- FIGURE 41 COMMUNICATION SEGMENT TO DOMINATE FIBER OPTICS MARKET DURING FORECAST PERIOD

- FIGURE 42 AERIAL DEPLOYMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: FIBER OPTICS MARKET SNAPSHOT

- FIGURE 45 EUROPE: FIBER OPTICS MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: FIBER OPTICS MARKET SNAPSHOT

- FIGURE 47 FIBER OPTICS MARKET: REVENUE ANALYSIS OF FIBER OPTICS FOR TOP FIVE PLAYERS, 2019–2023

- FIGURE 48 FIBER OPTICS MARKET SHARE ANALYSIS, 2023

- FIGURE 49 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- FIGURE 50 ENTERPRISE VALUE/EBITDA OF KEY VENDORS, 2024

- FIGURE 51 TOP TRENDING BRANDS/PRODUCTS

- FIGURE 52 FIBER OPTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 FIBER OPTICS MARKET: COMPANY FOOTPRINT

- FIGURE 54 FIBER OPTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 56 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 57 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 58 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY: COMPANY SNAPSHOT

- FIGURE 59 FUJIKURA LTD.: COMPANY SNAPSHOT

- FIGURE 60 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

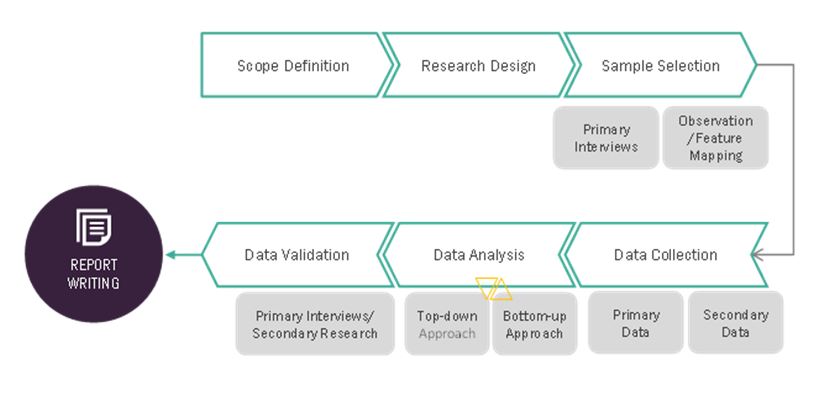

The study involved four major activities in estimating the size for fiber optics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors were referred to. Secondary research was done to obtain key information about the market’s supply chain, the value chain of the market, the pool of key market players, market segmentation according to industry trends, region, and developments from both market and technology perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

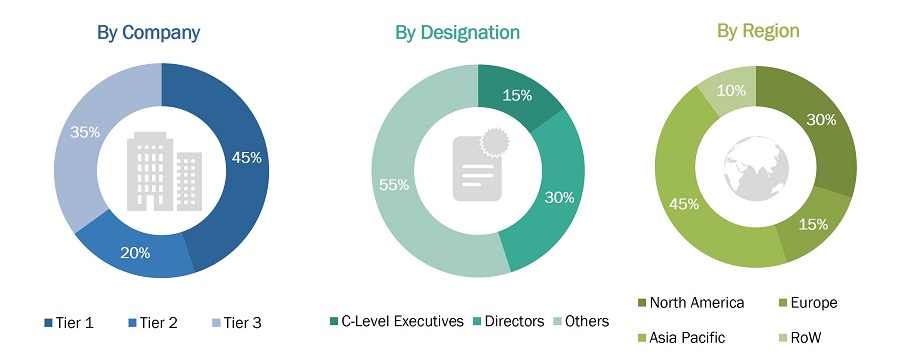

Primary Research

Extensive primary research has been conducted after understanding and analyzing the fiber optics market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, we have implemented both the top-down and bottom-up approaches to estimate and validate the size of the fiber optics market and various other dependent submarkets. The key players in the fiber optics market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players and interviews with experts (such as CEOs, COOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures given below show the market size estimation process from supply side employed for this study.

Fiber Optics Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A fiber optic is a flexible, transparent fiber made of extruded glass (silica) or plastic, which can function as a “light pipe” to transmit light by the process of total internal reflection. Fiber optics includes a transparent core surrounded by a transparent cladding material with a lower index of refraction, through which the light travels by total internal reflection. This phenomenon causes the fiber to act as a waveguide.

Key Stakeholders

- Raw material suppliers

- Fiber optics manufacturers

- Suppliers and distributors

- Manufacturers of cables and other fiber optic components

- Technology standards organizations, forums, alliances, and associations

- Government agencies, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startups

- End users from the telecom, datacenter, utility, premises, military, industrial, and other end-users

Report Objectives

- To define, describe, segment, and forecast the size of the fiber optics market, by fiber type, cable type, deployment, application, and region, in terms of value

- To define, describe, segment, and forecast the size of the fiber optics market, by fiber type, cable type, and region, in terms of volume

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the fiber optics market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the fiber optics ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market position in terms of ranking and core competencies2, and provide information about the competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the fiber optics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fiber Optics Market

OFC market in India, with import volume, and consumption trends

Detailed information on the fiber optic market

Interested in fiber optics market and forecast for India and other major countries

An idea about the cost evolution (decrease or increase) of the fiber optics cable in parallel with the attractive opportunities between 2016 and 2021.

Want to get information of optic cables market and the trends

General information on Fiber Optics Market

General information on company profiles and major developments associated

General information on optic fiber sensors, and polymer optic fibers.

Specific information on Market share, designs and technology in TPU market

Optical cable market with analysis of raw material, chines makret and major companies operating along with technology utilized to produce these cables

Specific information required for optical fiber and replacement of copper cable with optical fiber. Need analysis on replacement potential of optical fibers.

Market data on global Optical fiber market

Detailed report on european fiber optics market, value chain analysis, competitive landscape, etc.

Fiber to the x Market